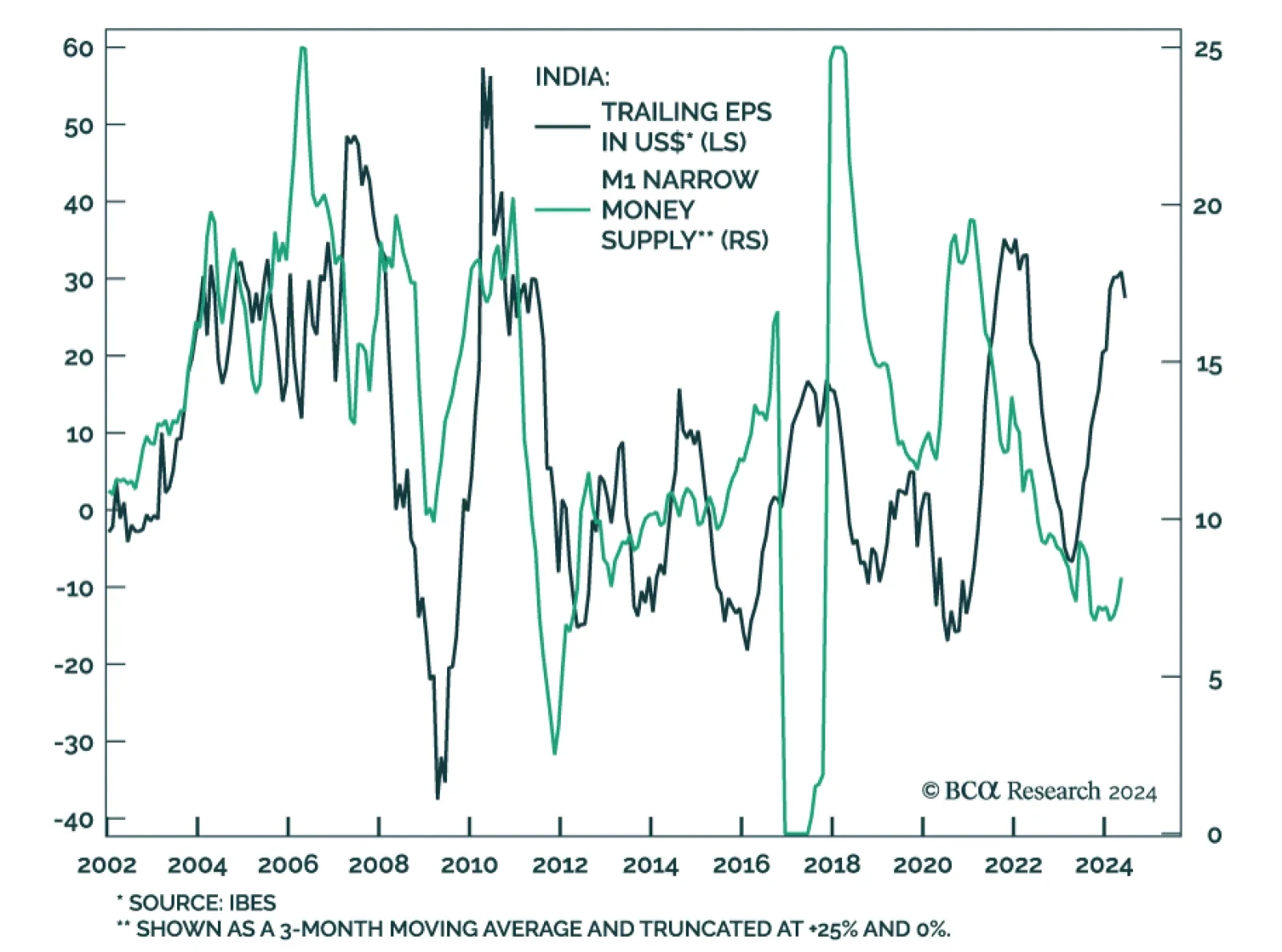

Our colleagues from the Emerging Markets Strategy team argue that investors should brace for a significant correction in Indian stocks in the coming months. They posit that the pillar of Indian corporations' sustained profit…

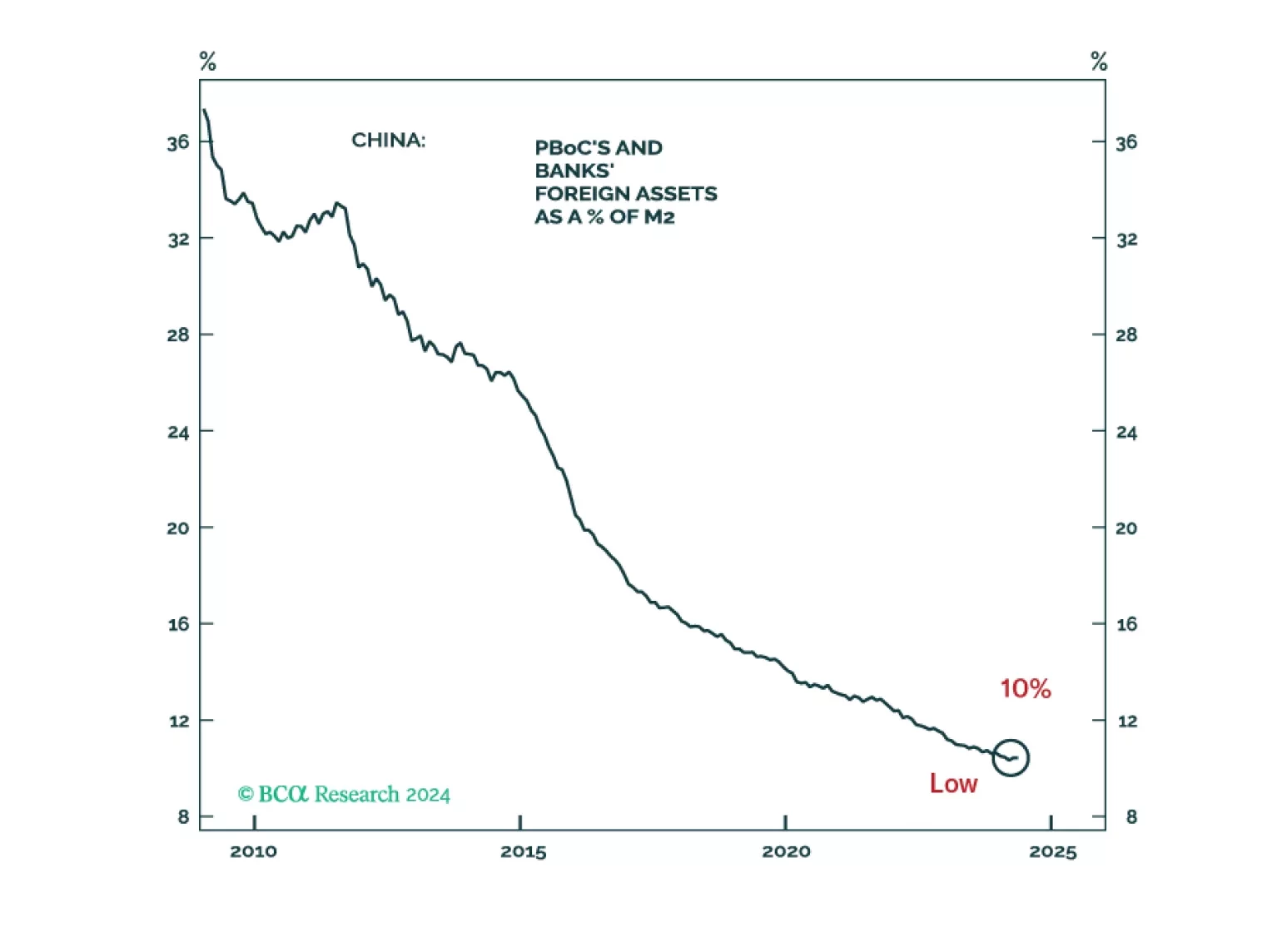

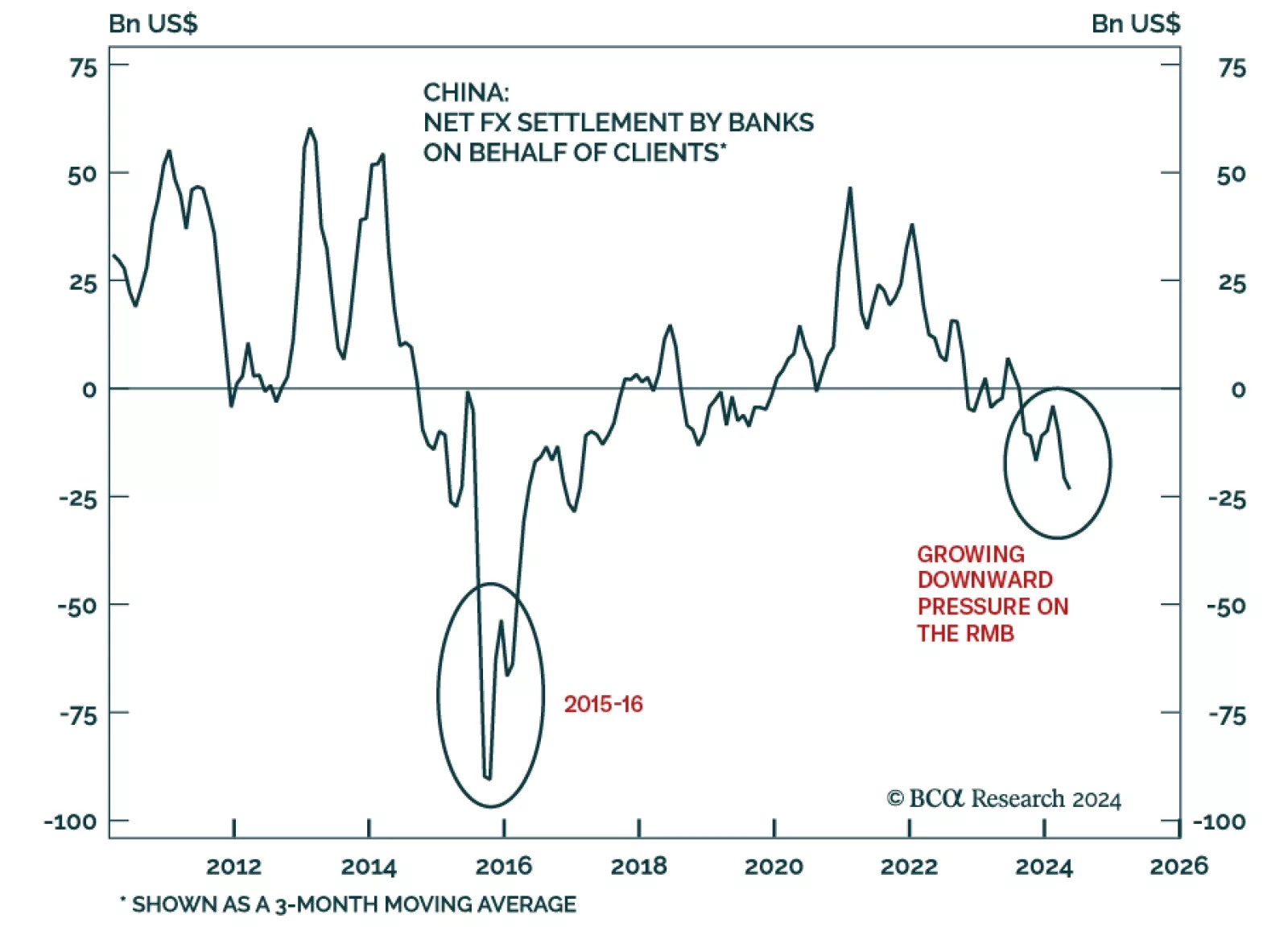

The Chinese currency has been under considerable depreciation pressure due to capital outflows. Additionally, the economy is grappling with debt deflation and a balance sheet recession, conditions that typically call for lower…

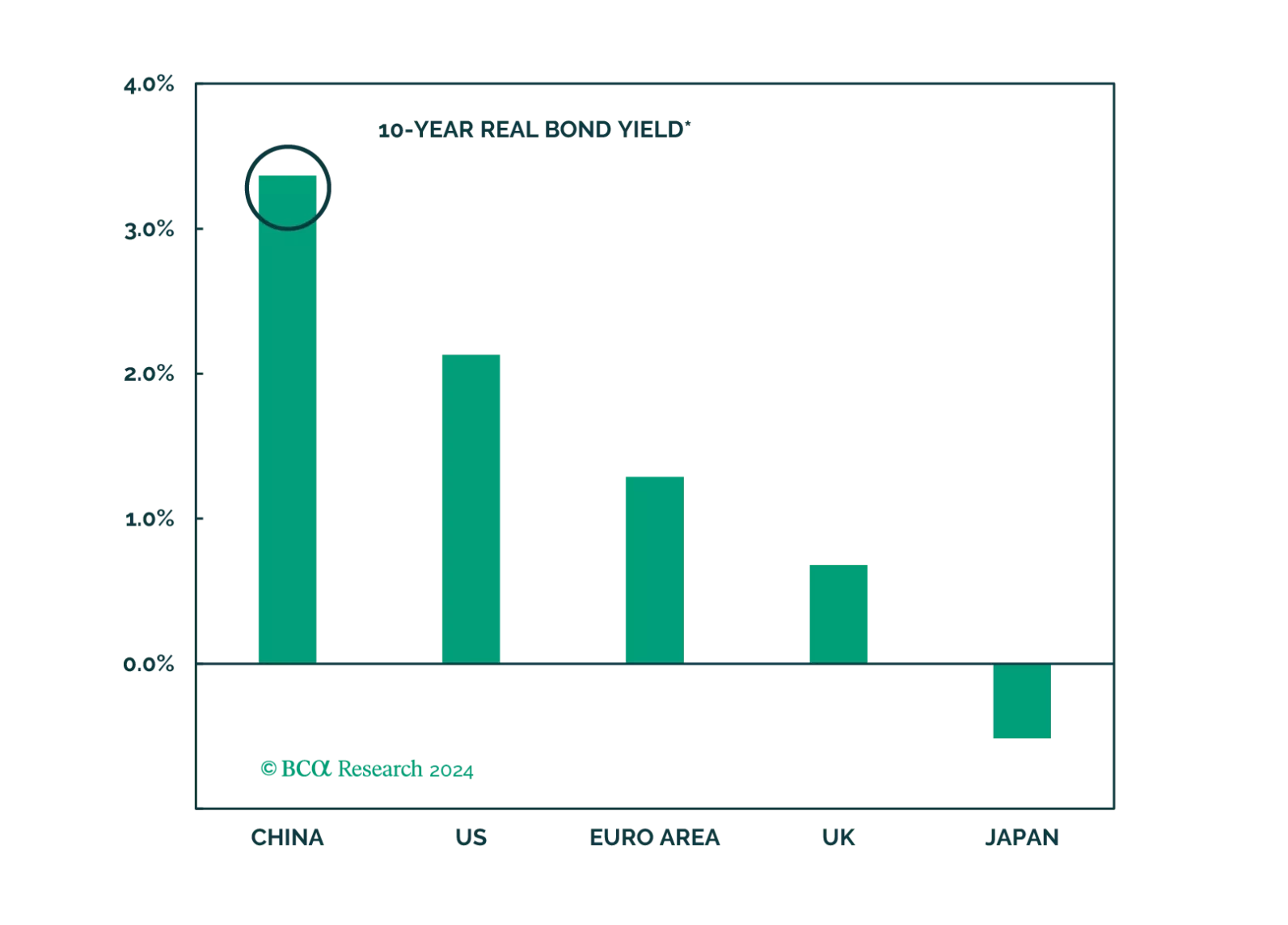

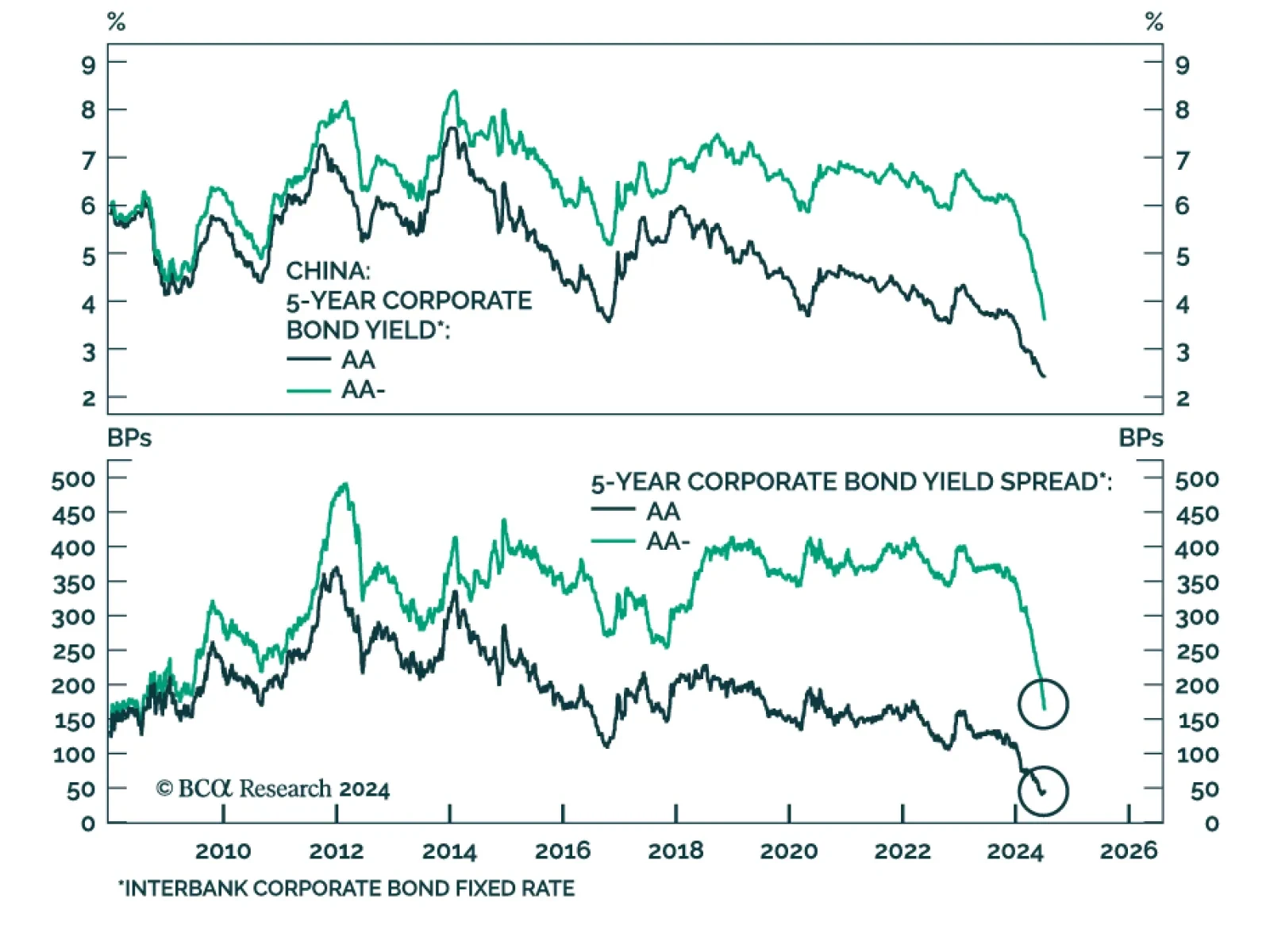

According to BCA Research’s China Investment Strategy service, onshore bonds are vulnerable to an investor sentiment reversal. Chinese 10-year government bond yields will likely trend lower to below 2% over the next 12…

The PBoC appears increasingly uncomfortable with the rapid decline in the Chinese government bond yields. While the PBoC will succeed in temporarily curbing investors’ enthusiasm for bonds, the central bank will be unwilling to raise…

Our Portfolio Allocation Summary for July 2024.

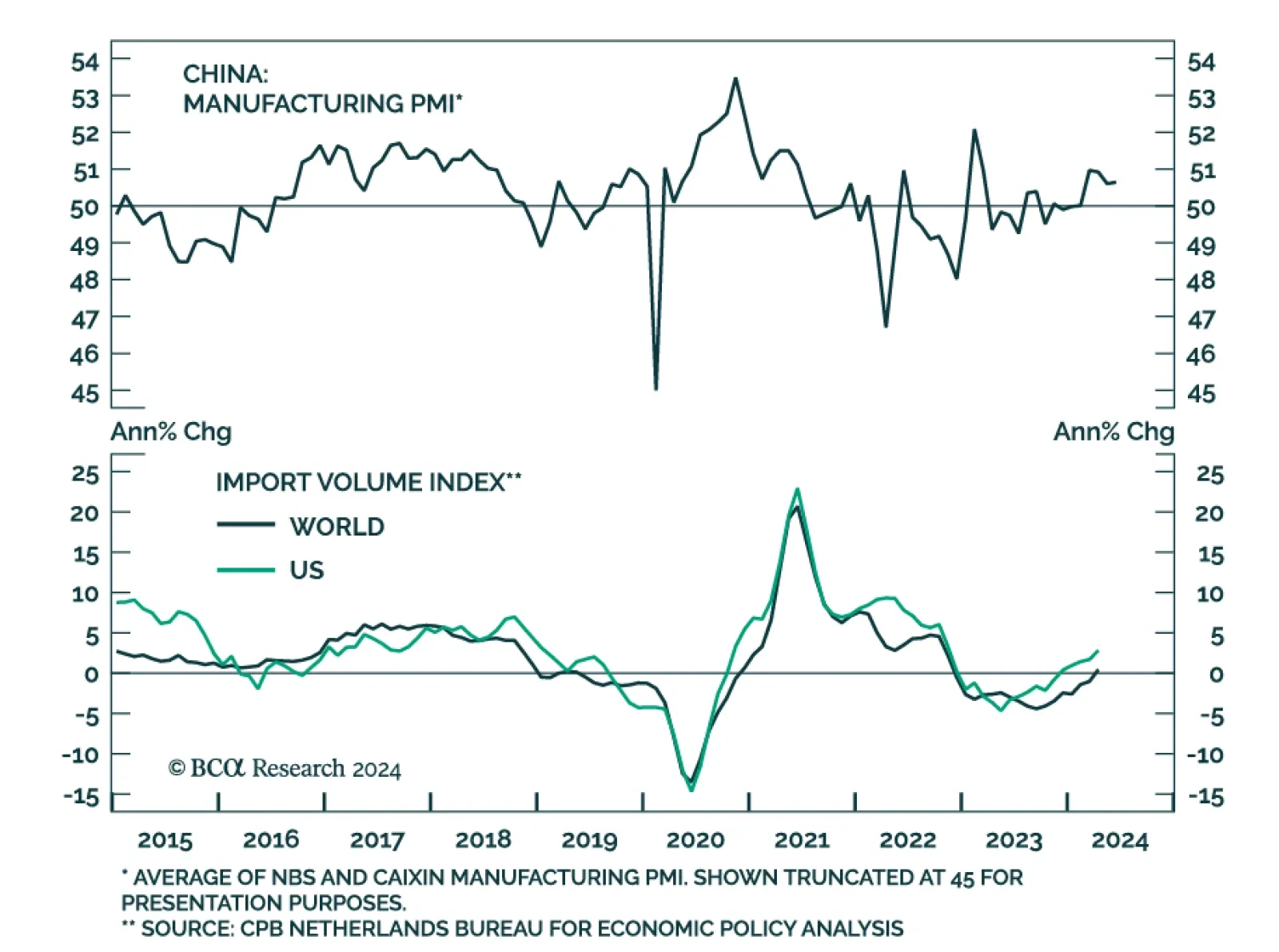

Chinese manufacturing PMIs remained mostly stable in June. The Caixin PMI ticked 0.1 point higher to 51.8 while the NBS measure remained at 49.5. Both leading gauges of Chinese manufacturing activity are thus sending seemingly…

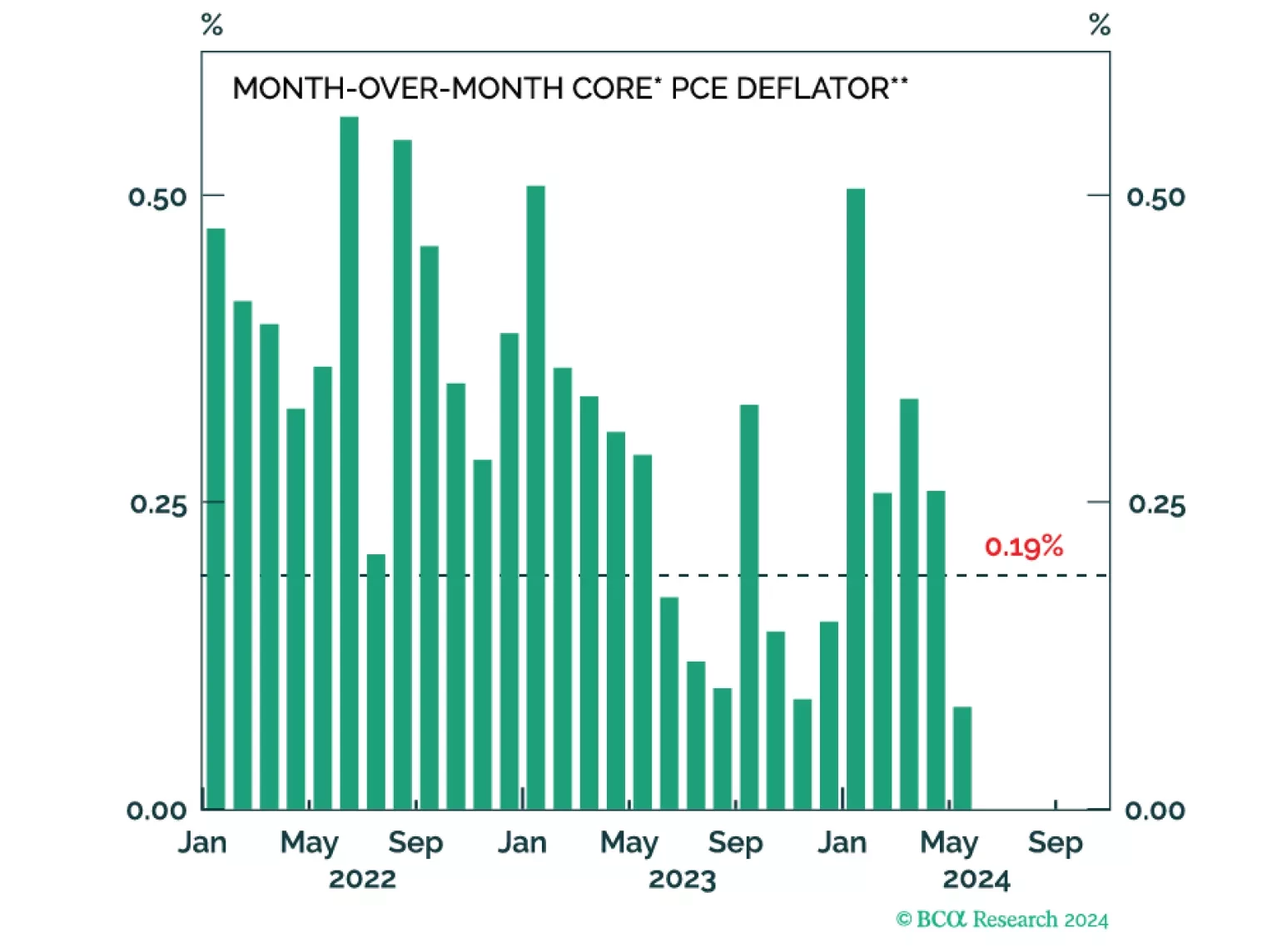

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

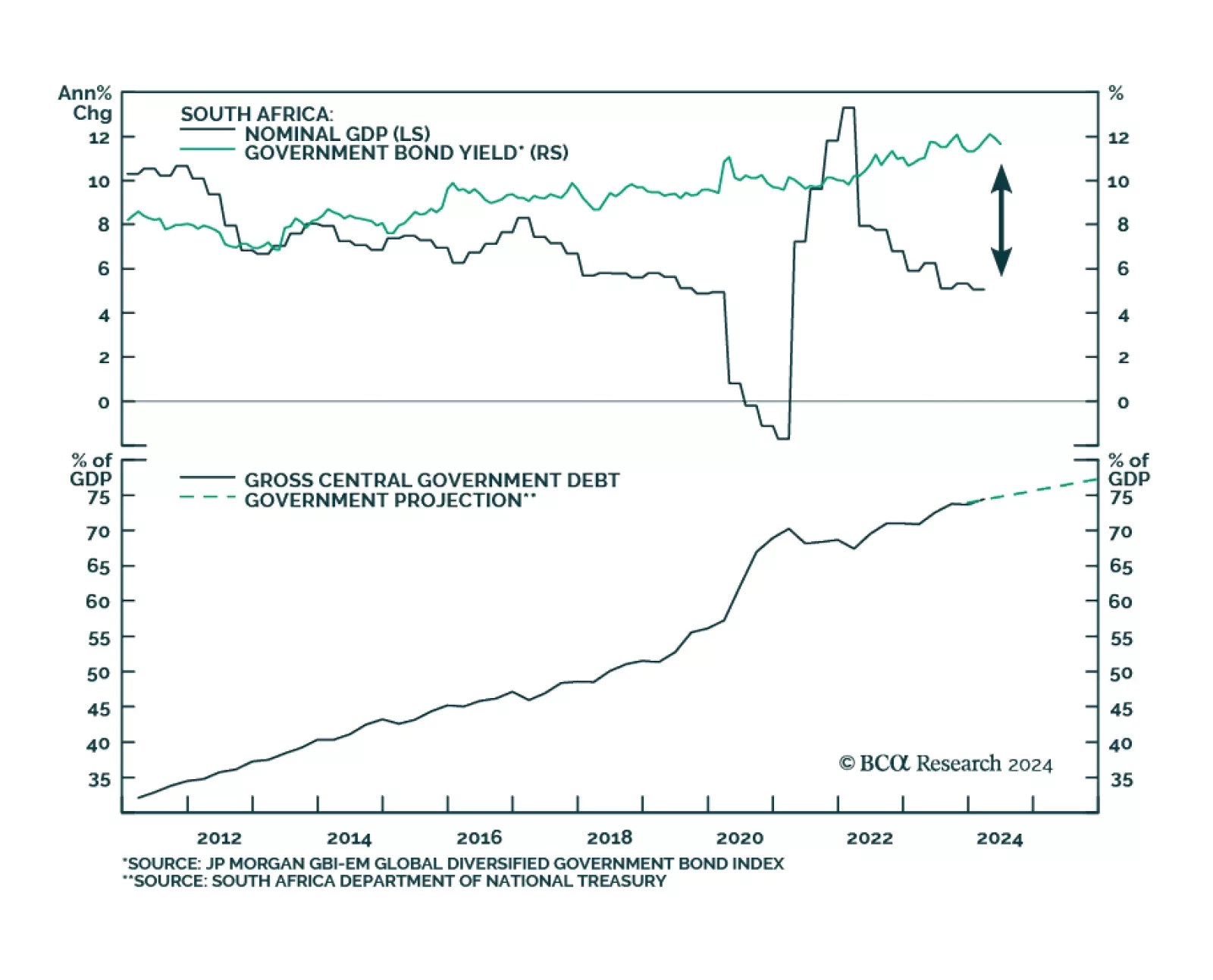

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

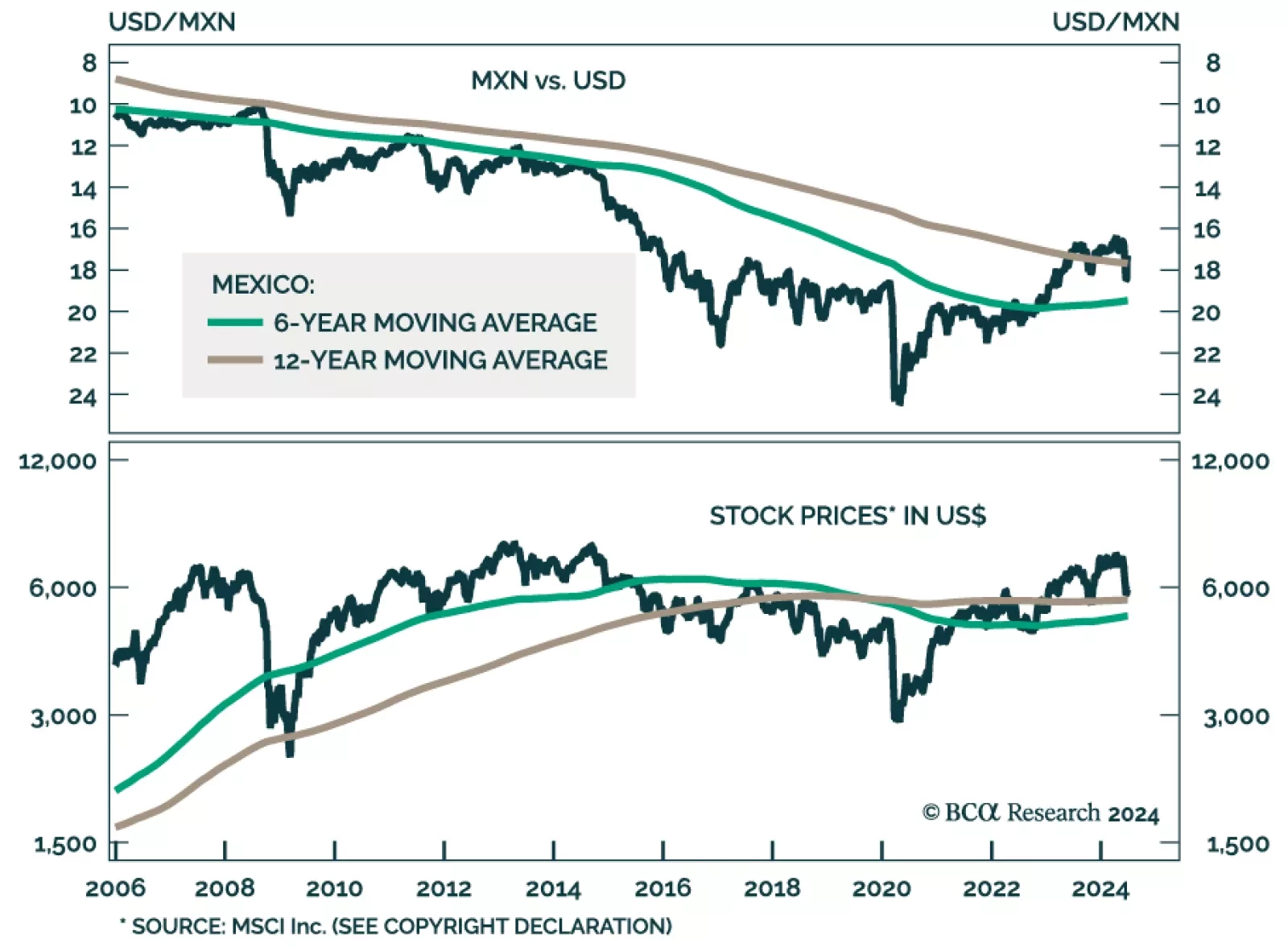

Mexico has gone from investor darling to massive underperformer within the EM space in the past month. In the eyes of our Emerging Markets Strategy team, the near-term outlook for Mexican risk assets remains poor in absolute…