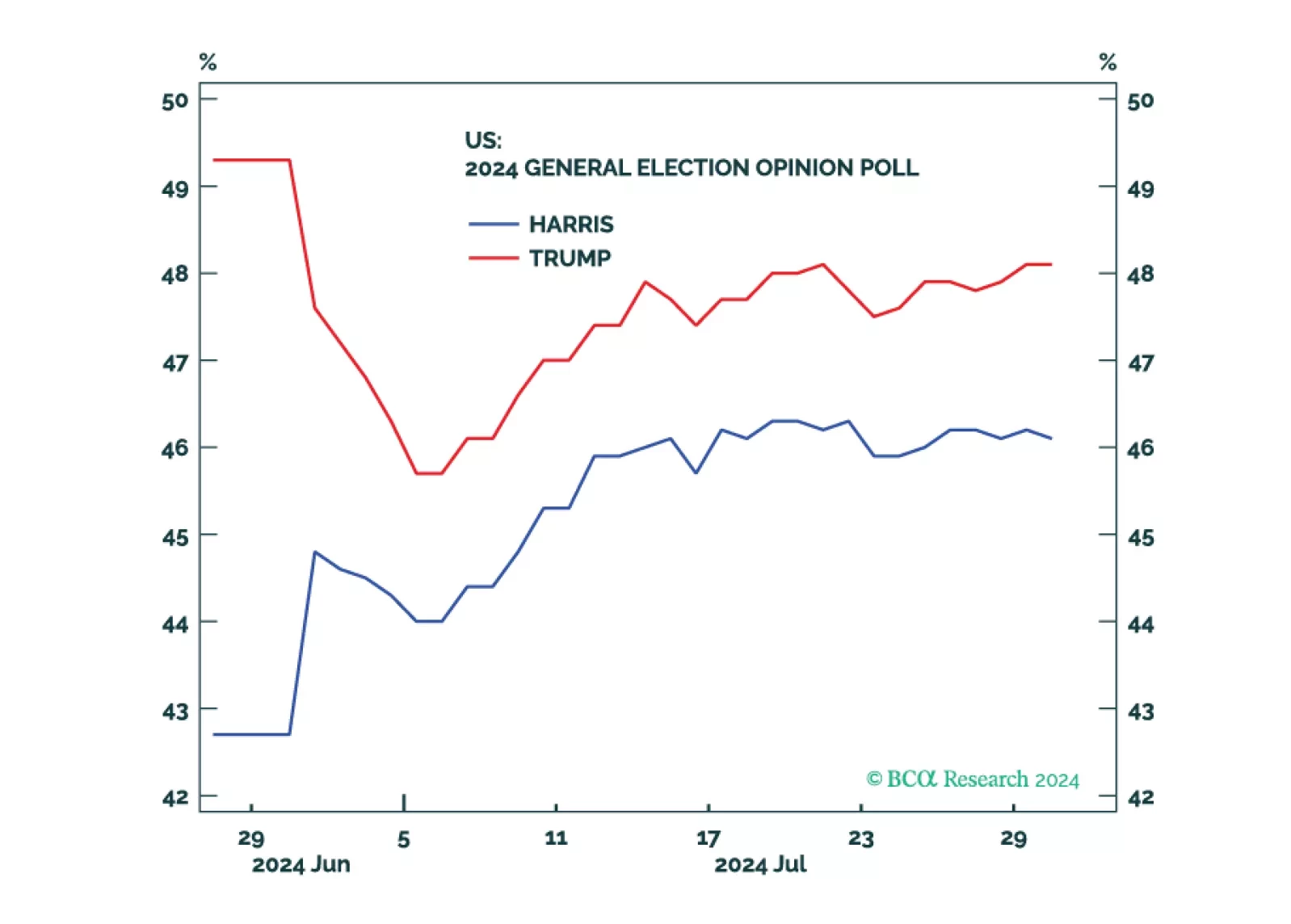

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

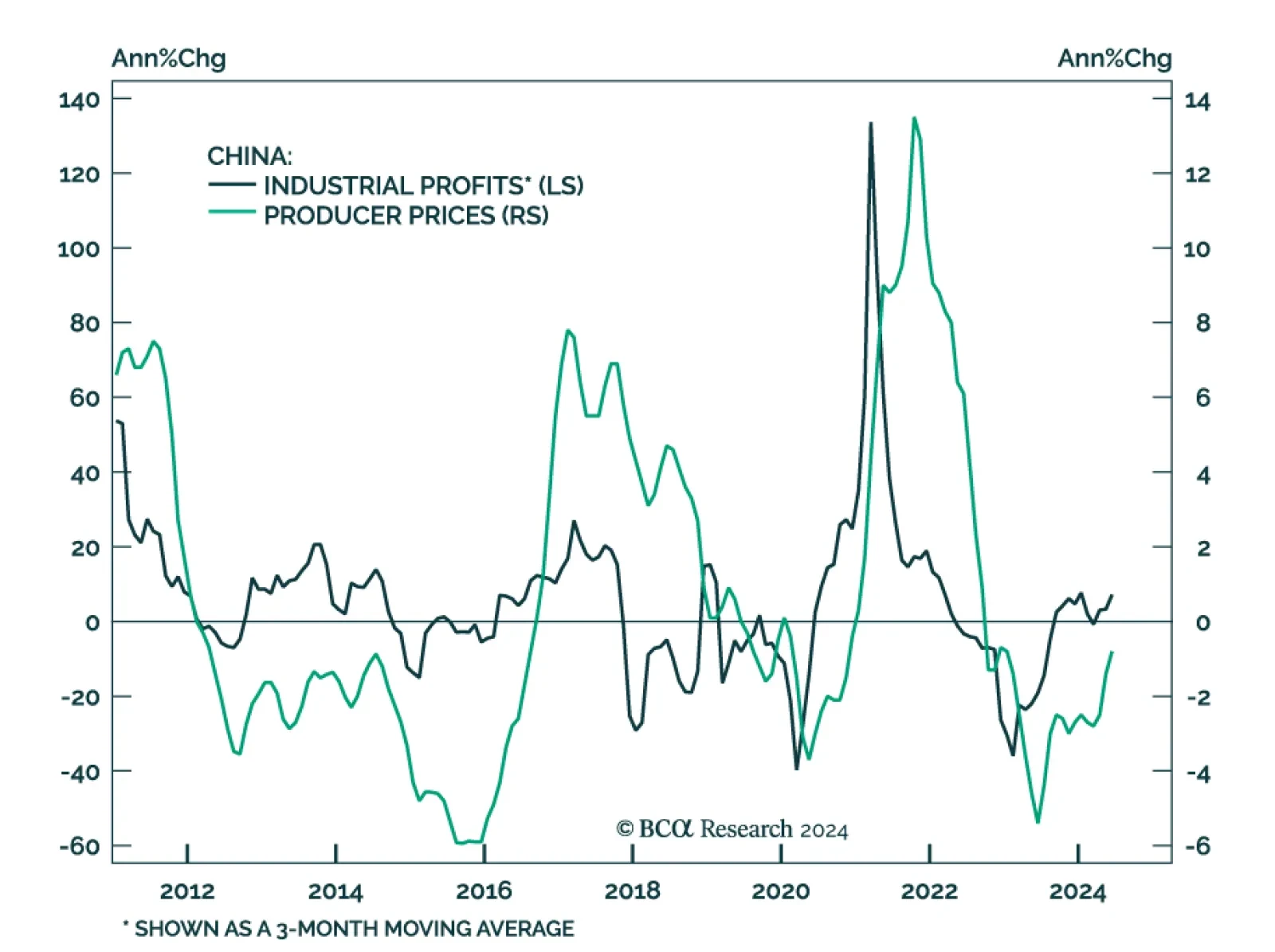

Chinese industrial profits growth accelerated in June, rising from 0.7% y/y to 3.6%. Profits expanded at 3.5% in the first half of 2024, compared to 3.4% in the first half of 2023, and suggest that China’s manufacturing…

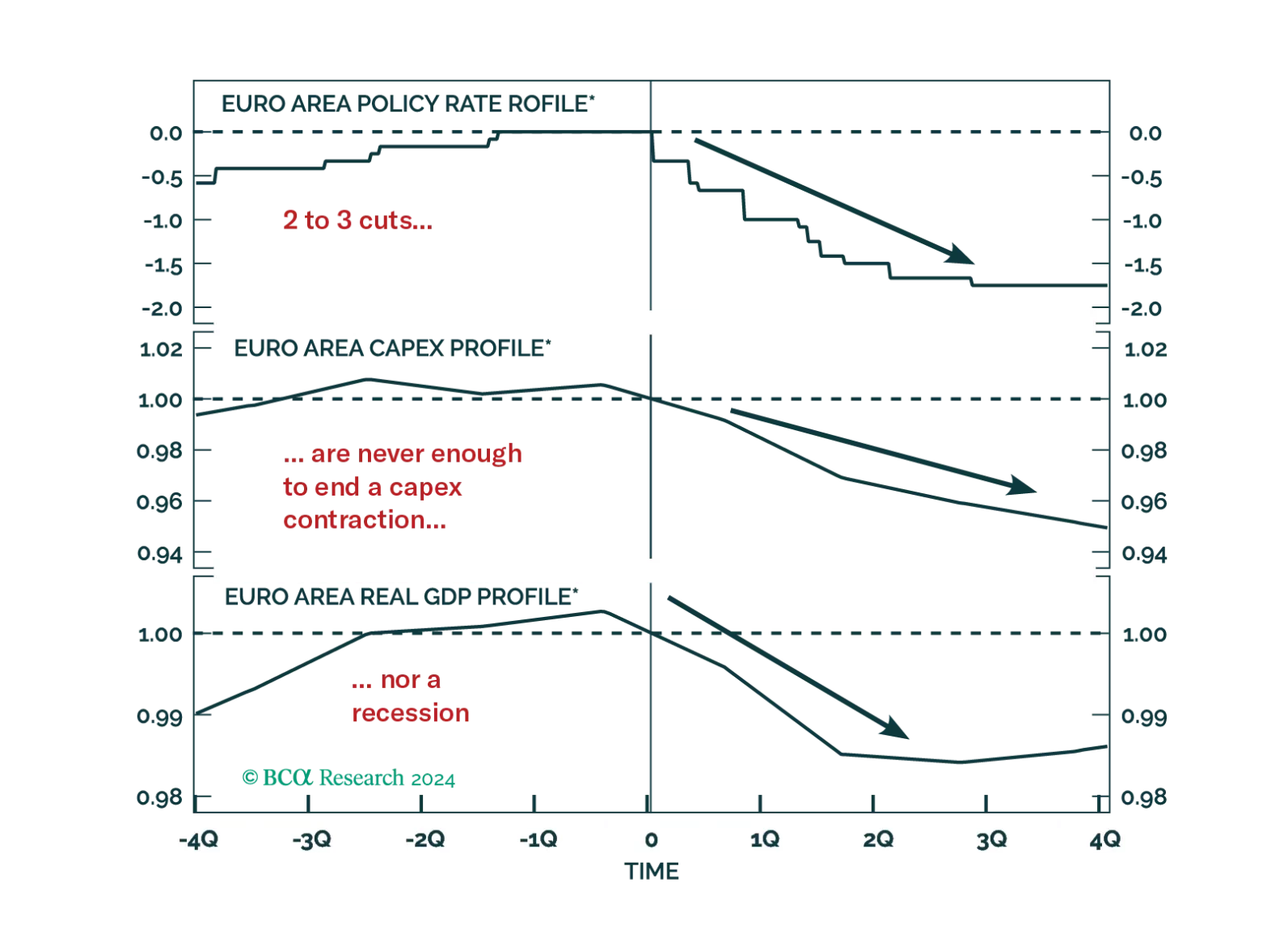

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

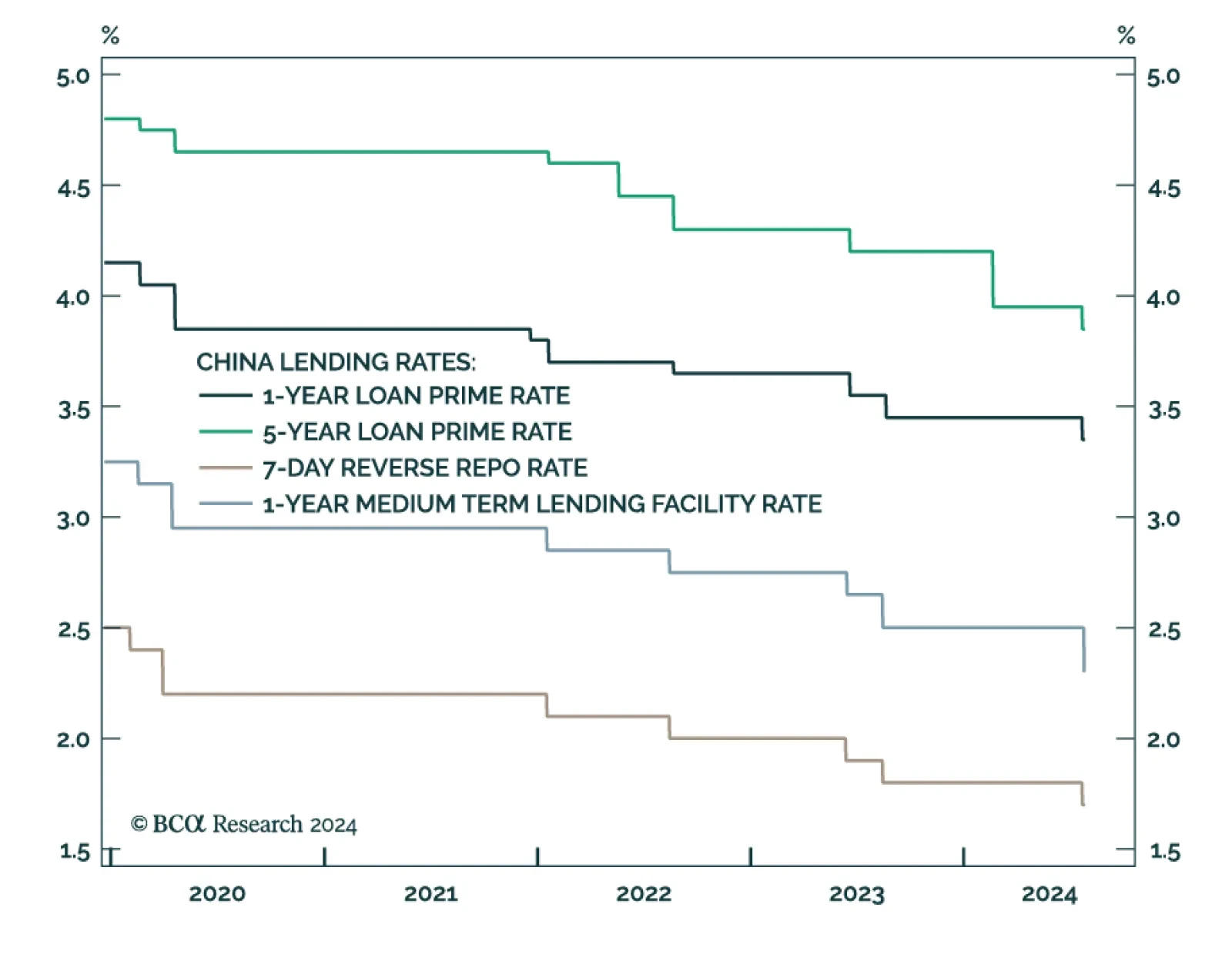

Just a few days after unexpectedly lowering three key borrowing rates by 10 basis points (bps), the PBoC cut the 1-year medium-term lending facility rate by 20 bps, from 2.50% to 2.30%. While the earlier cut lowered the…

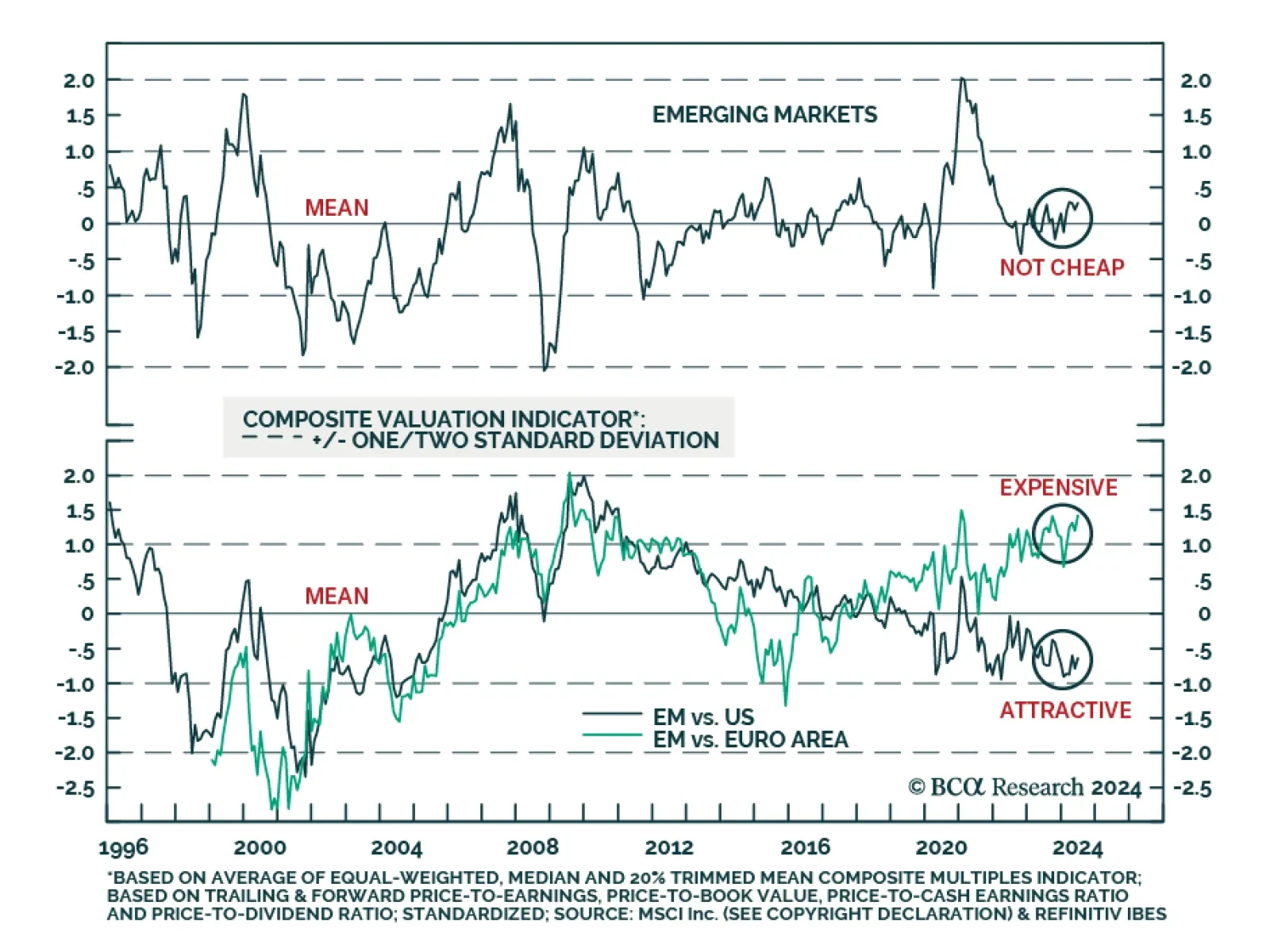

In US dollar terms, the MSCI Emerging Market index has been flat over the past 15 years, dramatically underperforming the S&P 500 and Euro Area equities. The root cause is fundamental; EM earnings per share (EPS) growth has…

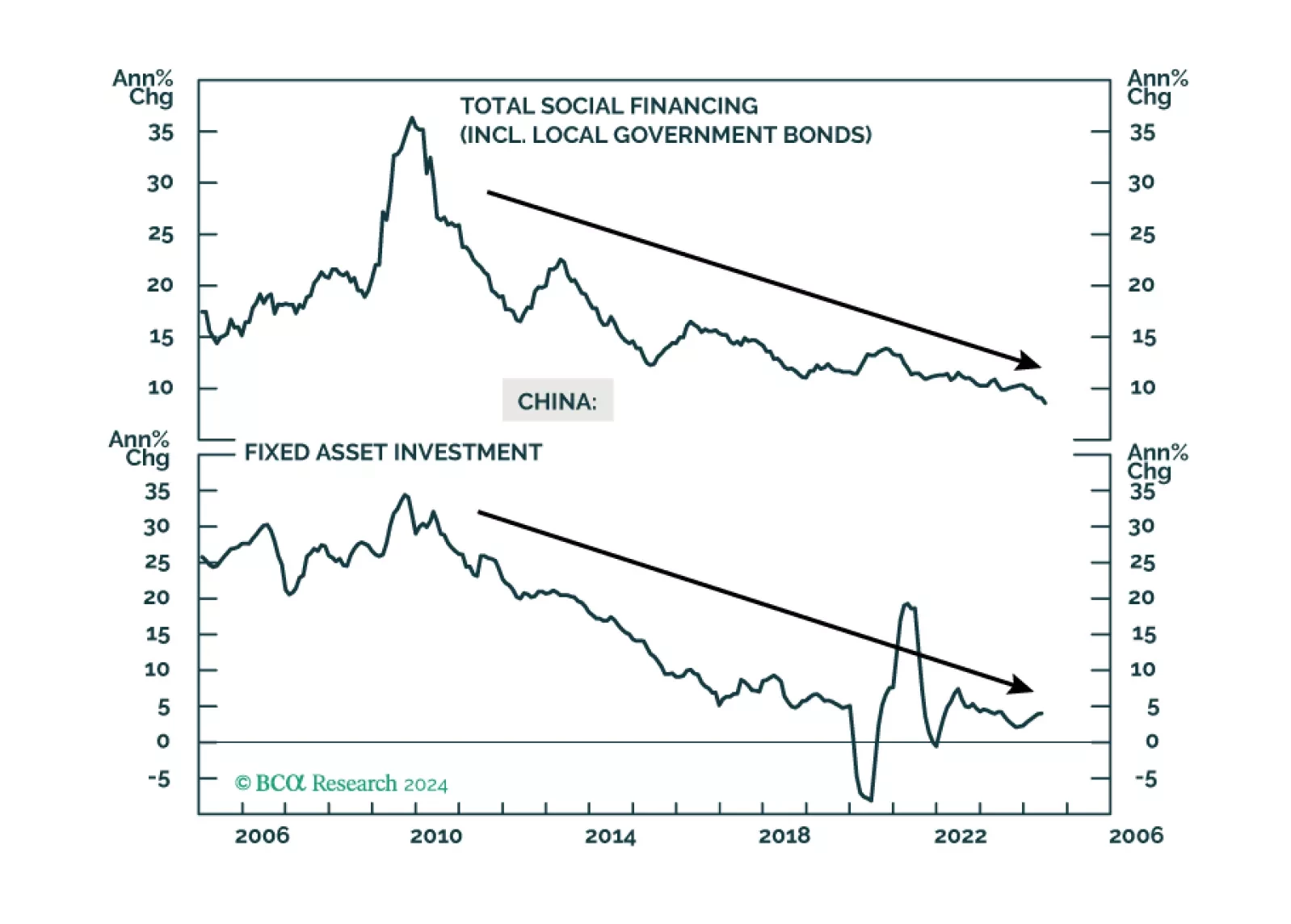

This report provides our framework for interpreting the messages from last week’s Third Plenum, and the potential implications for the economy and investors.

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

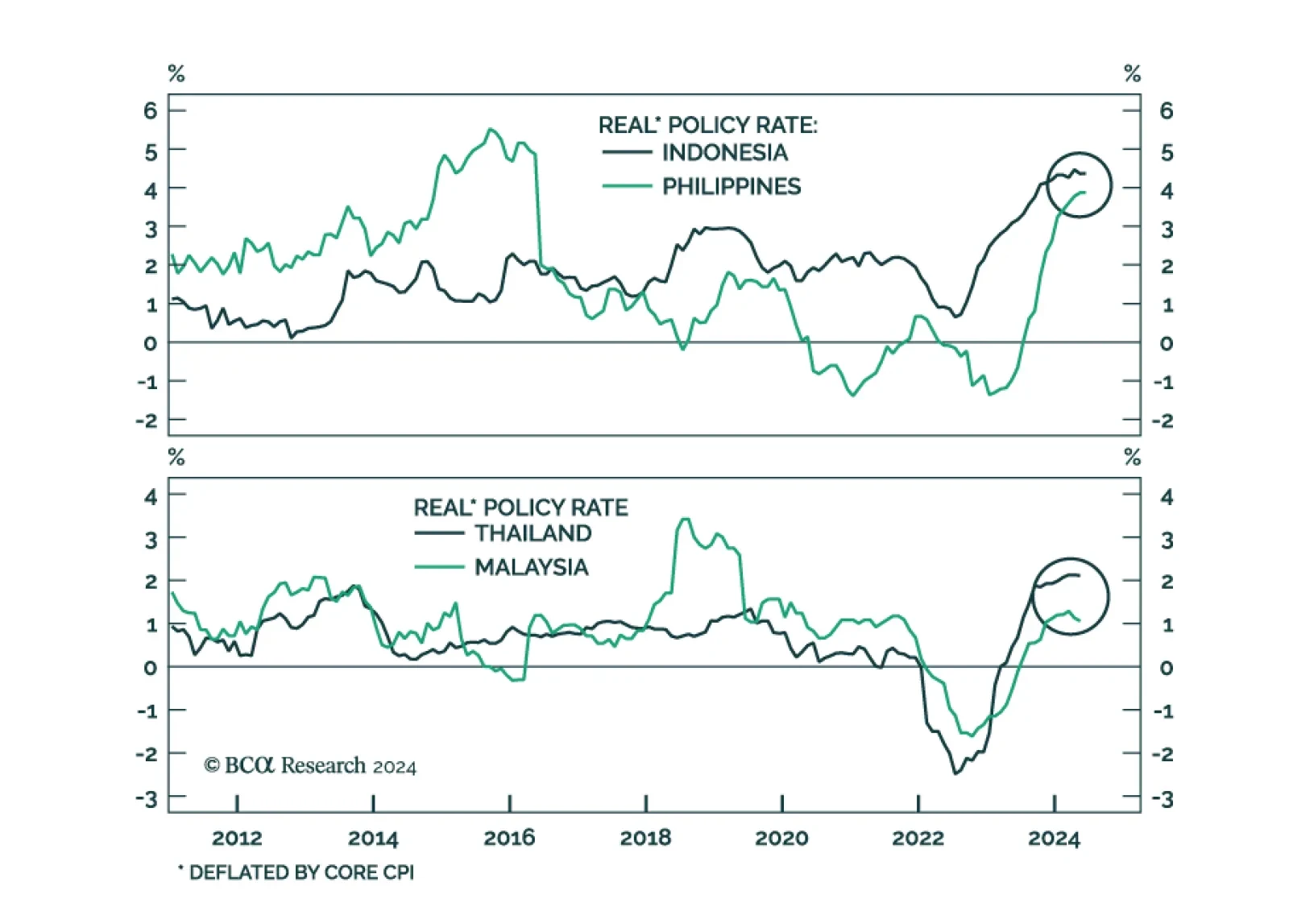

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

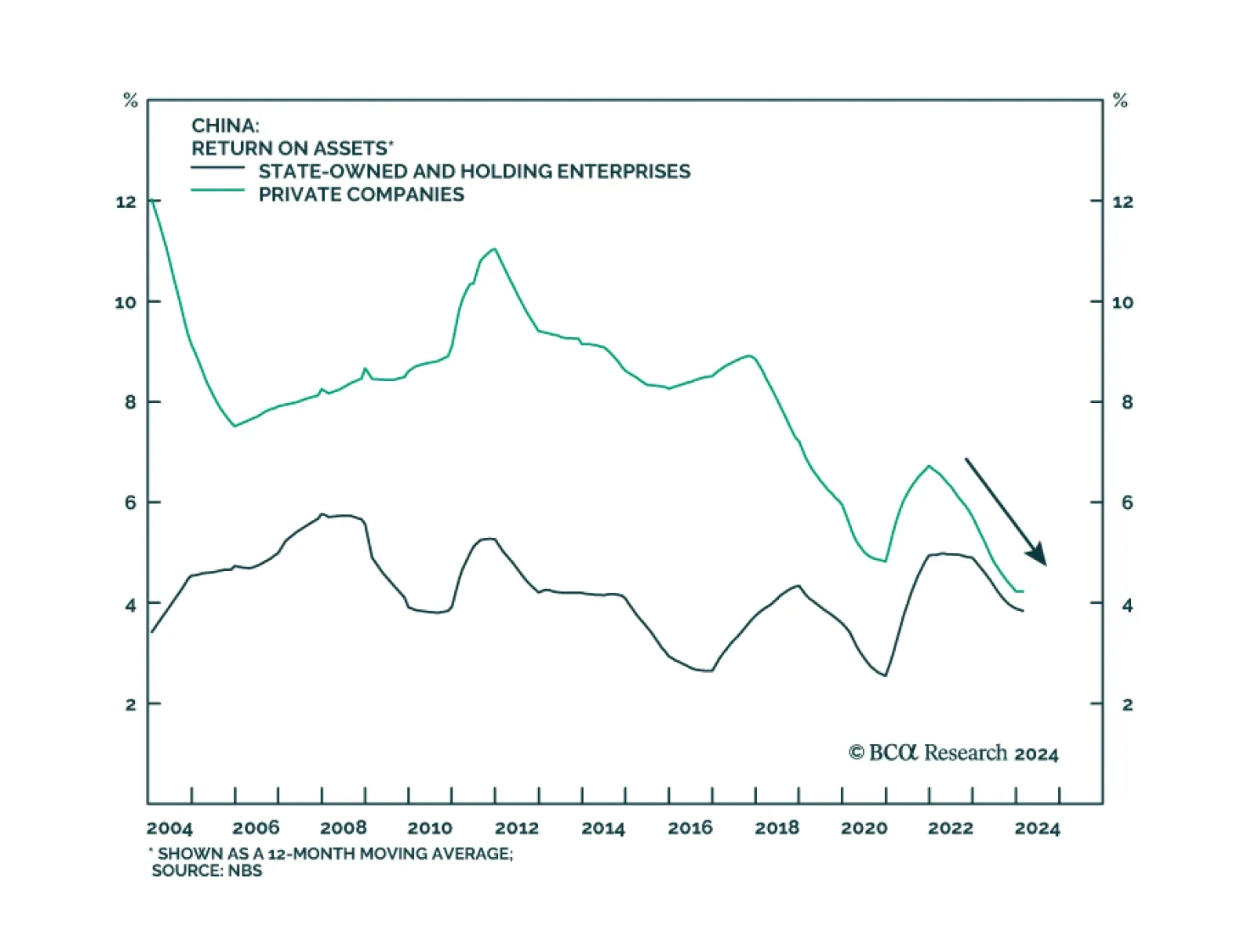

Though hope springs eternal among global investors for big-bang stimulus from Beijing, the closely watched Third Plenum adjourned without any specific prescriptions to reverse China’s economic slump. The communiqu…