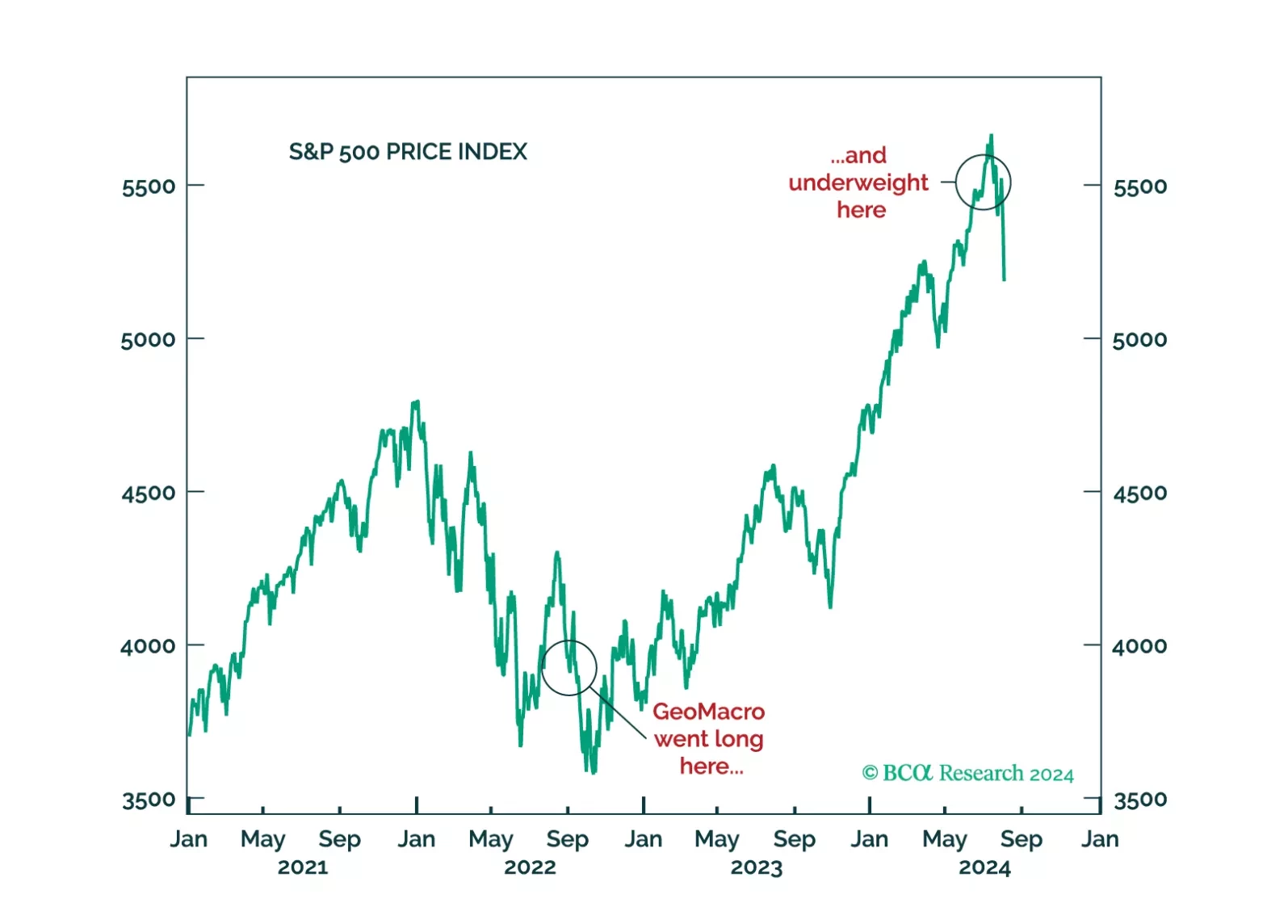

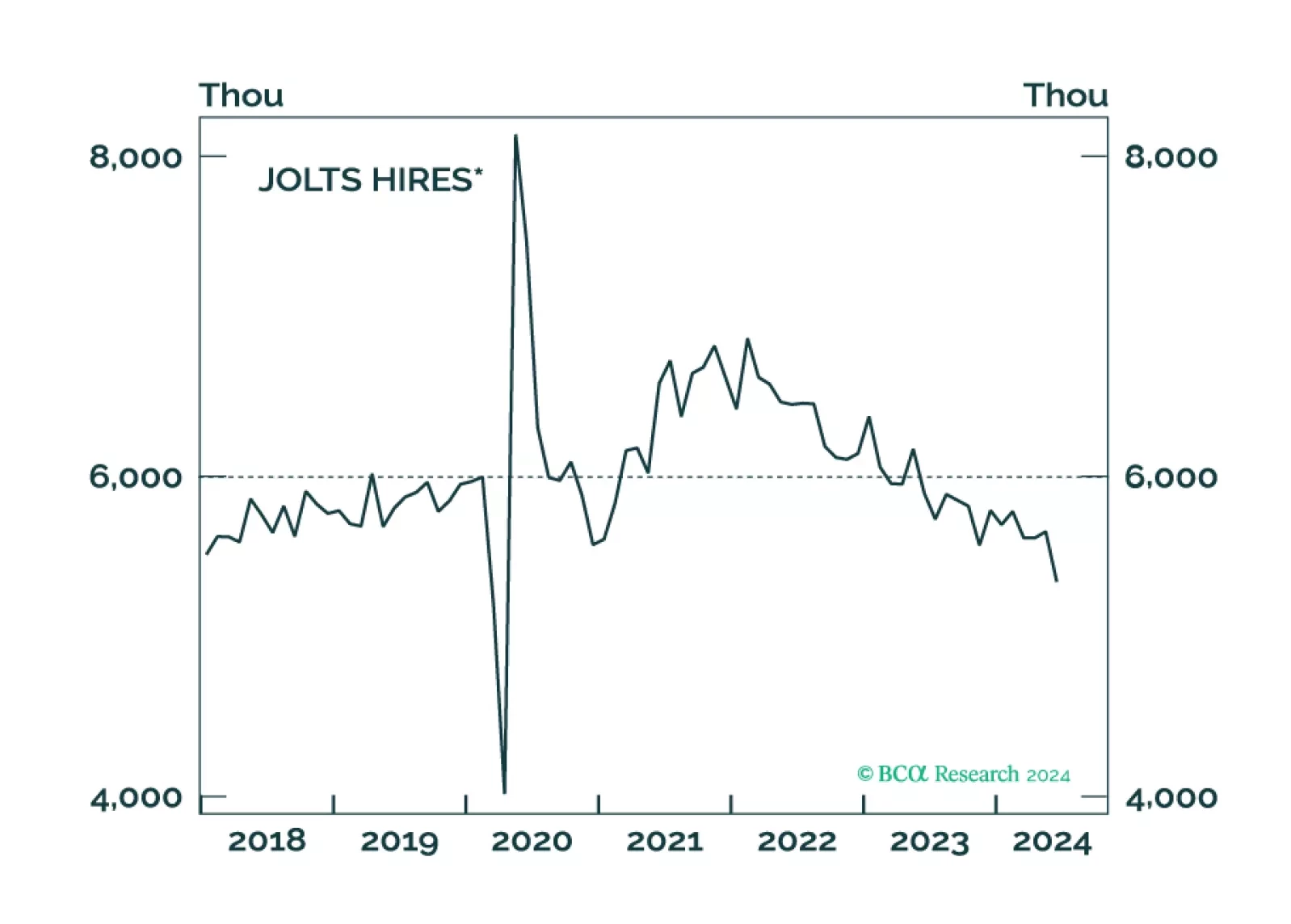

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…

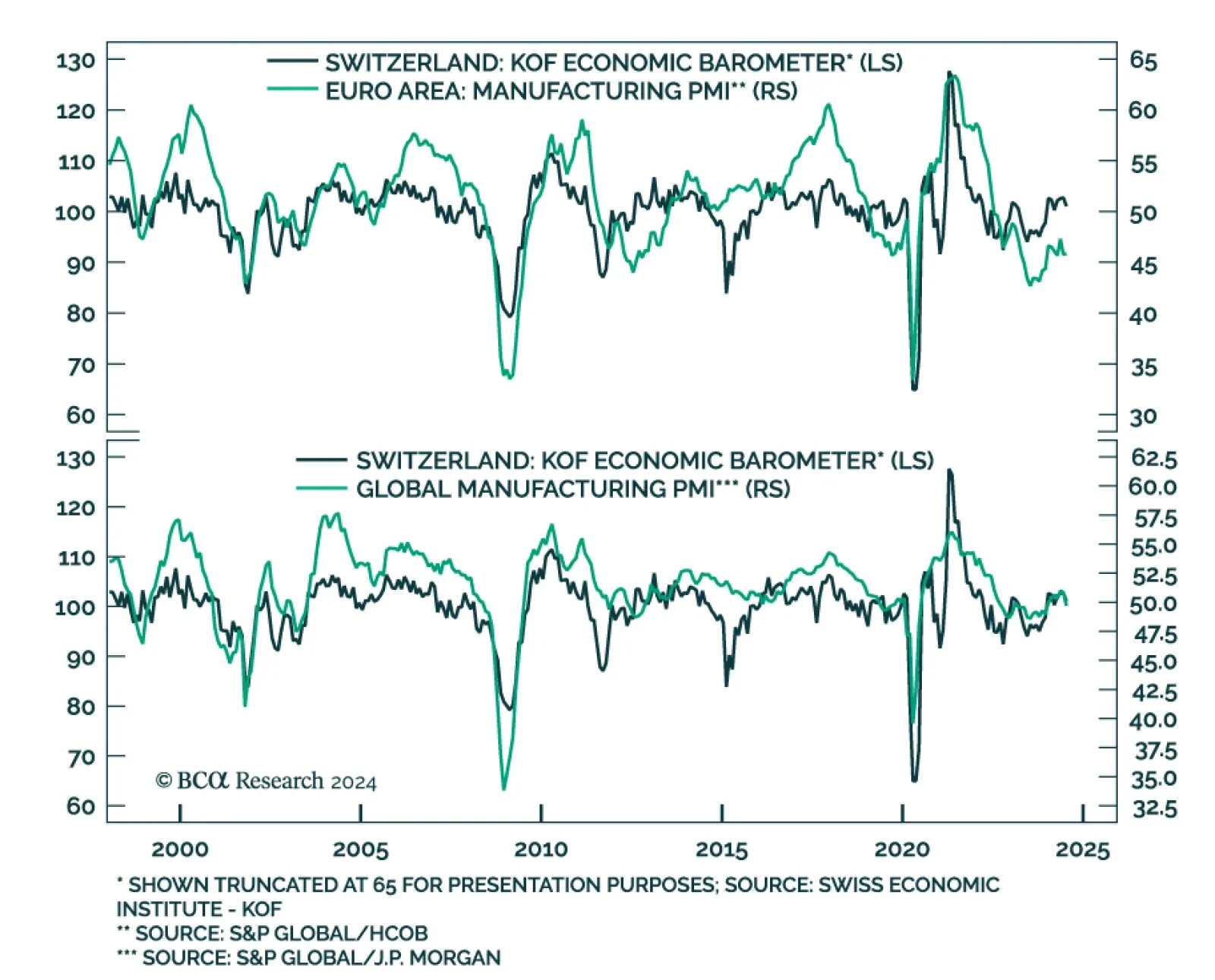

US economic news has stolen the spotlight in the past several days but economic developments in the rest of the world have also been uninspiring. The JPM Global Manufacturing PMI dipped into contraction territory in July,…

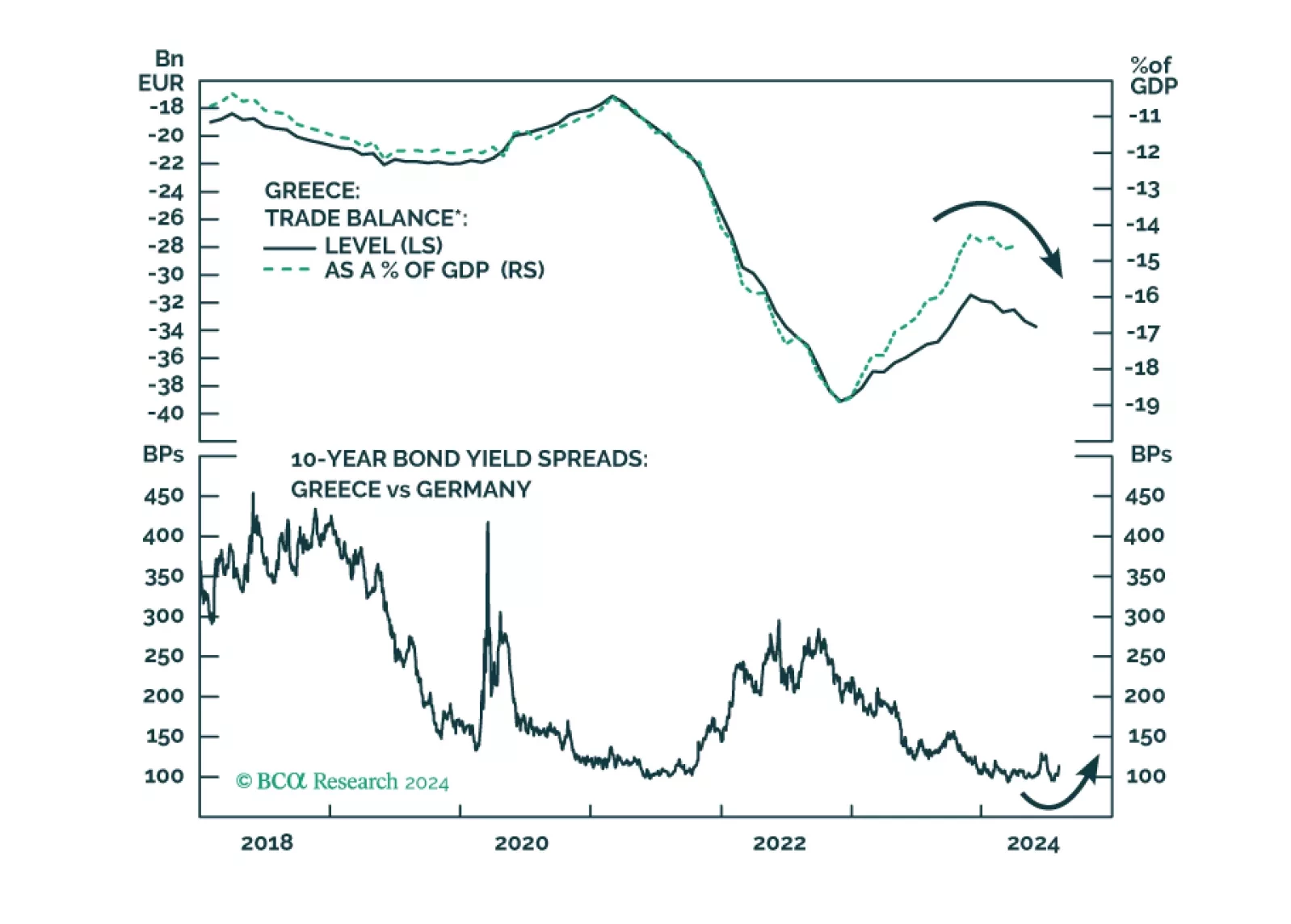

Absolute return investors should be tactically cautious on Greek assets. Dedicated EM equity portfolios, however, should overweight Greek stocks.

Our Portfolio Allocation Summary for August 2024.

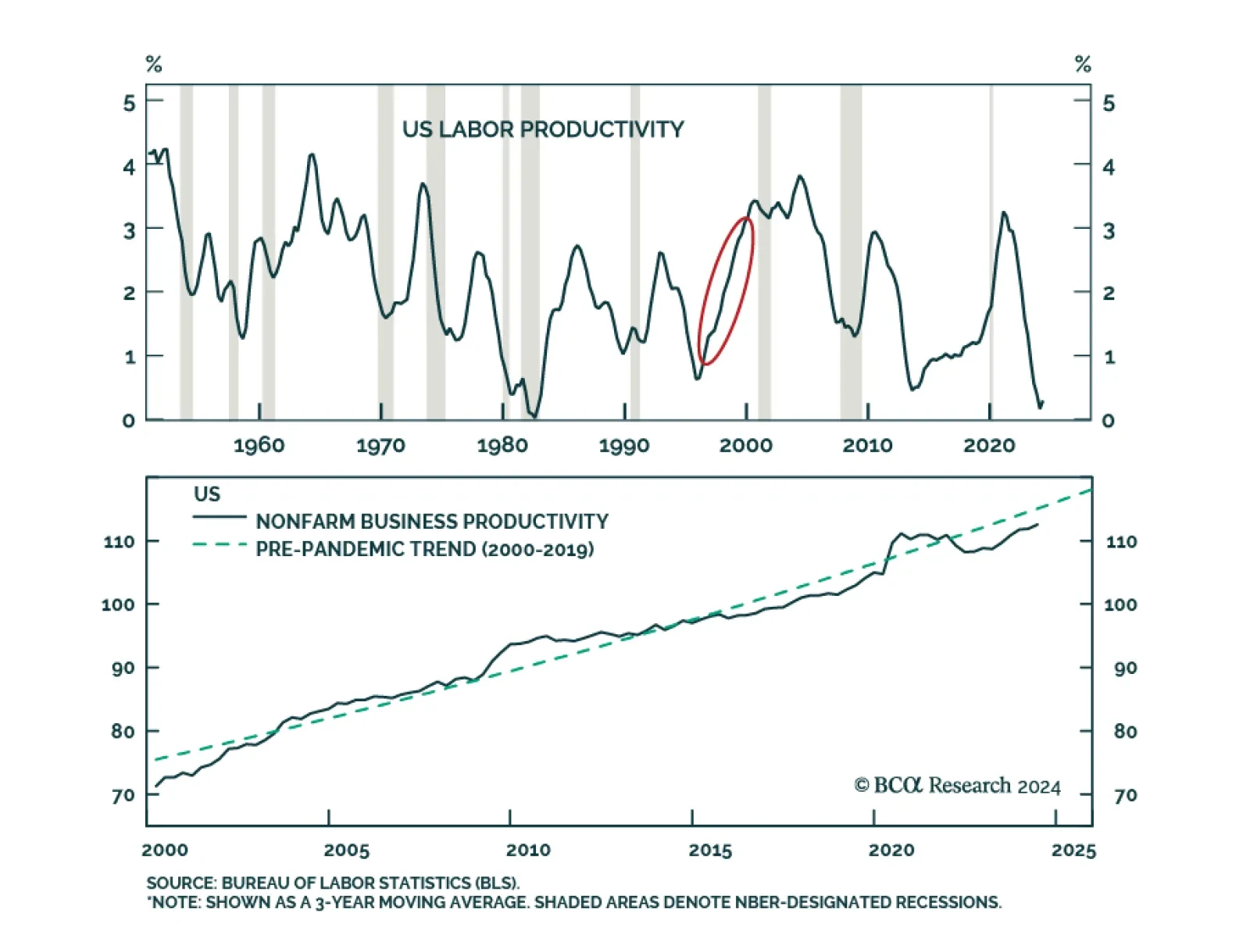

We have previously highlighted that an upside surprise in China’s fiscal stimulus as well as an AI-triggered jump in US productivity could potentially prolong the expansion, and constitute two key risks to our recession…

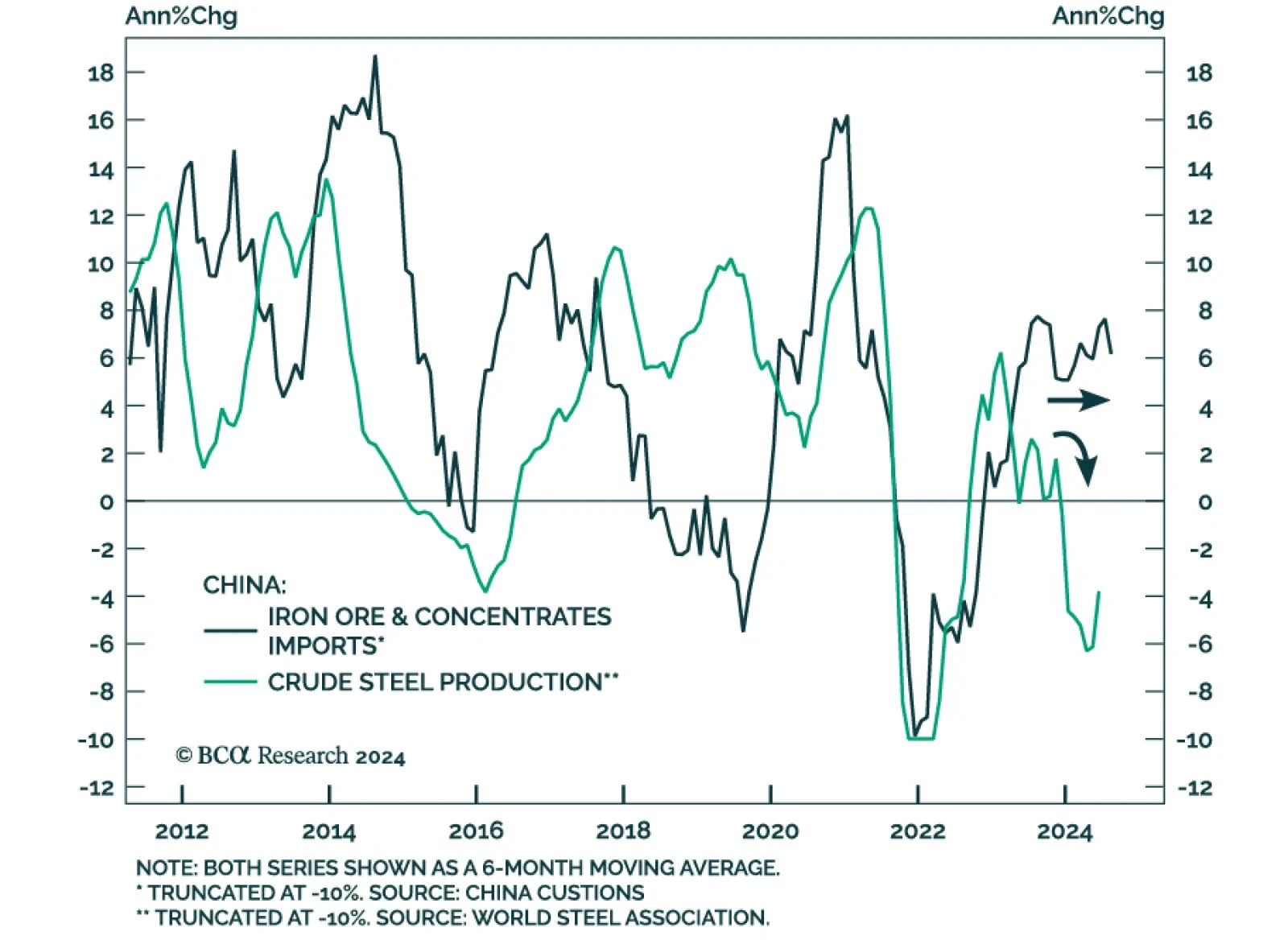

According to BCA Research’s Commodity & Energy Strategy service, robust iron ore imports are sending a false signal about steel demand. Instead, these supplies are being used to restock inventories. By the end of…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

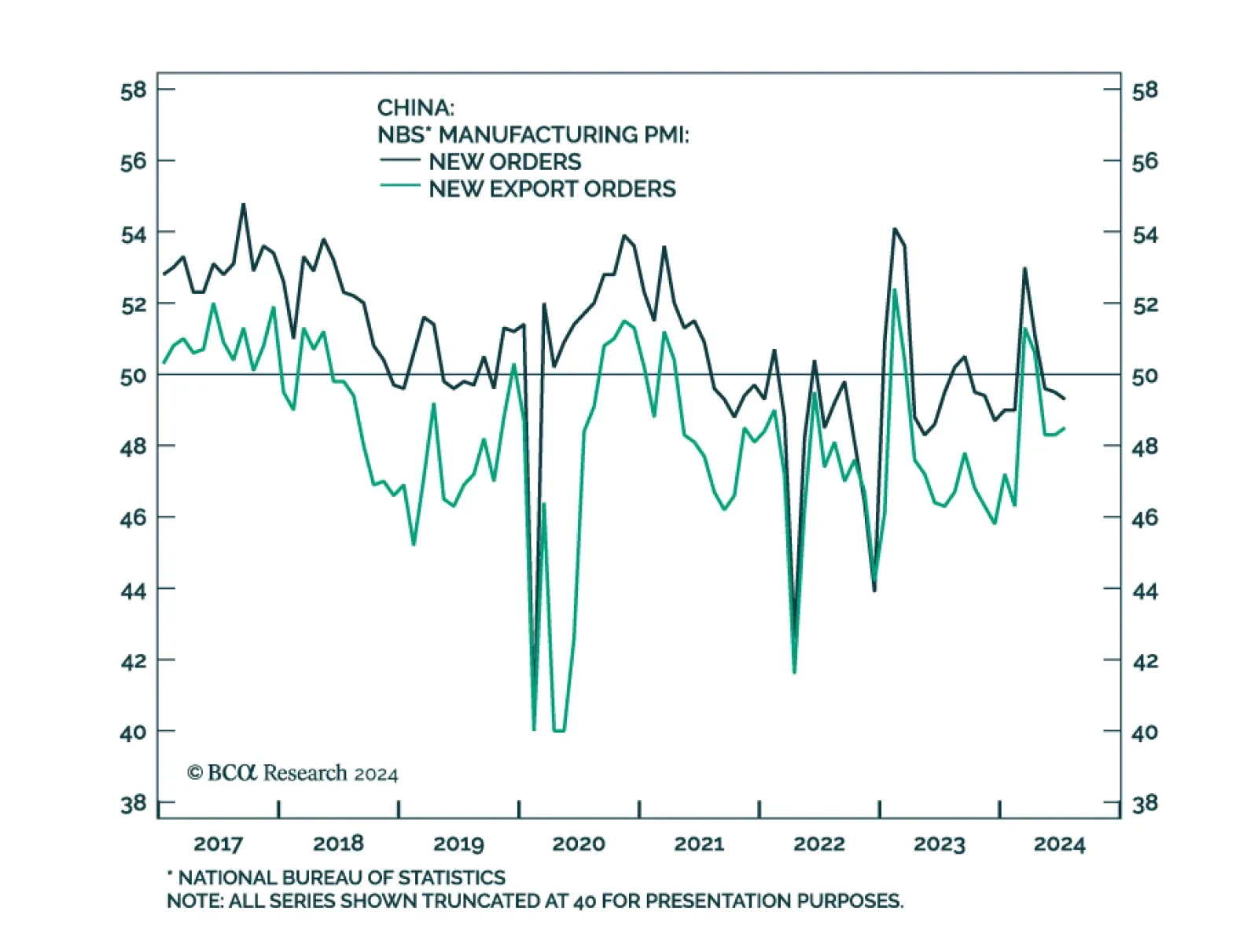

China’s NBS manufacturing PMI declined further in July, from 49.5 to 49.4, marking a third consecutive month of contraction. New orders and new export orders underscored continued weakness in both domestic and foreign…

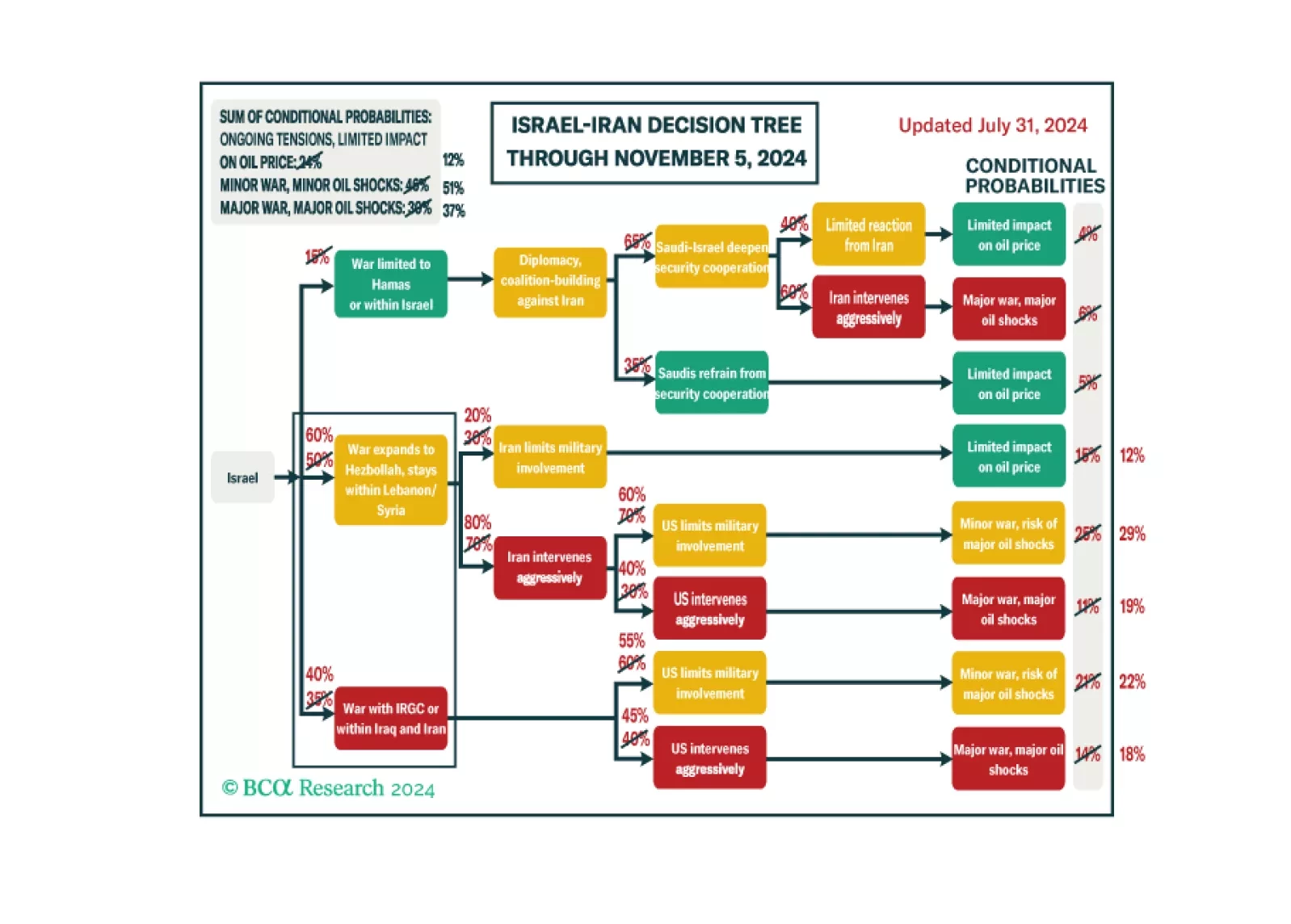

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…