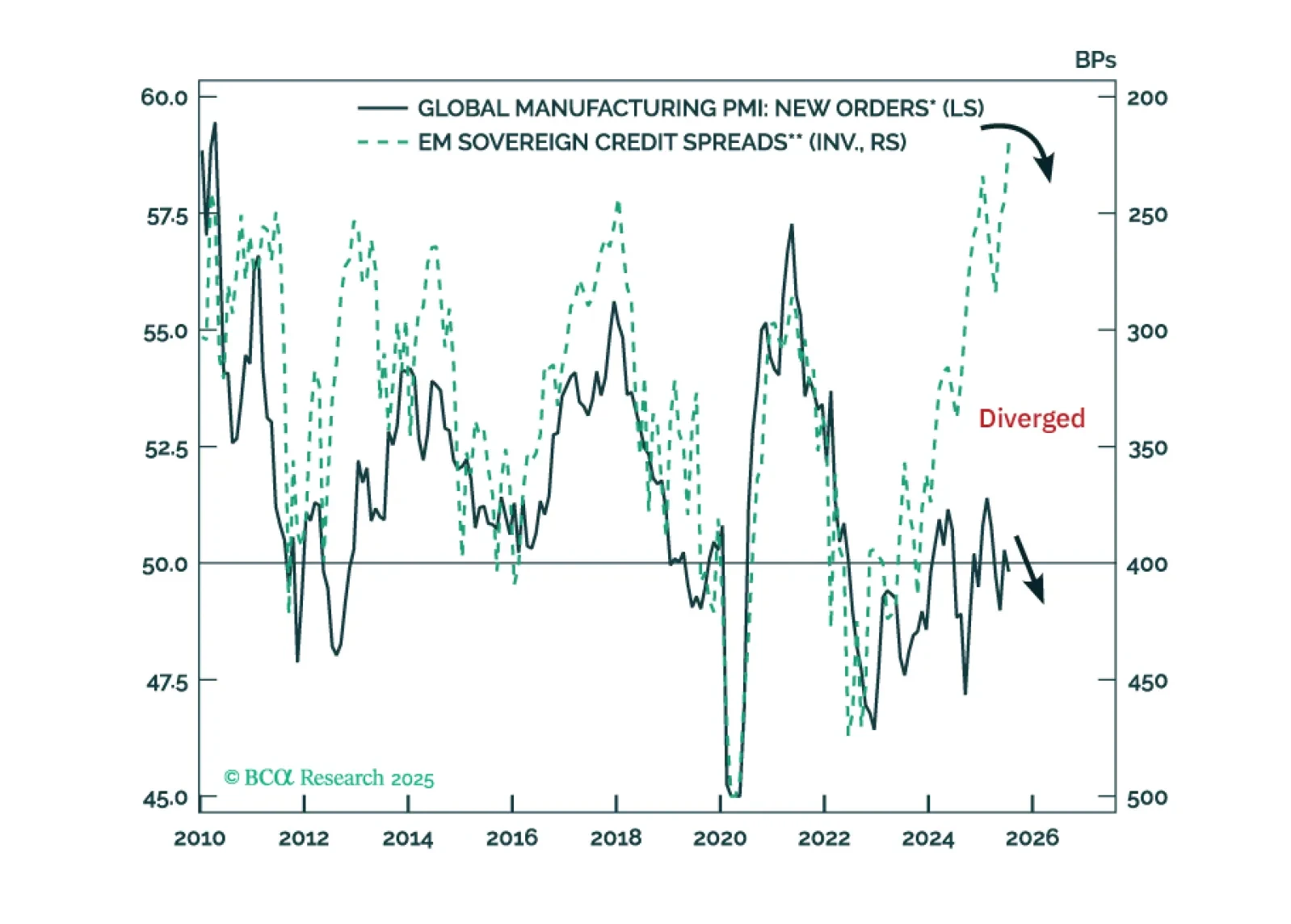

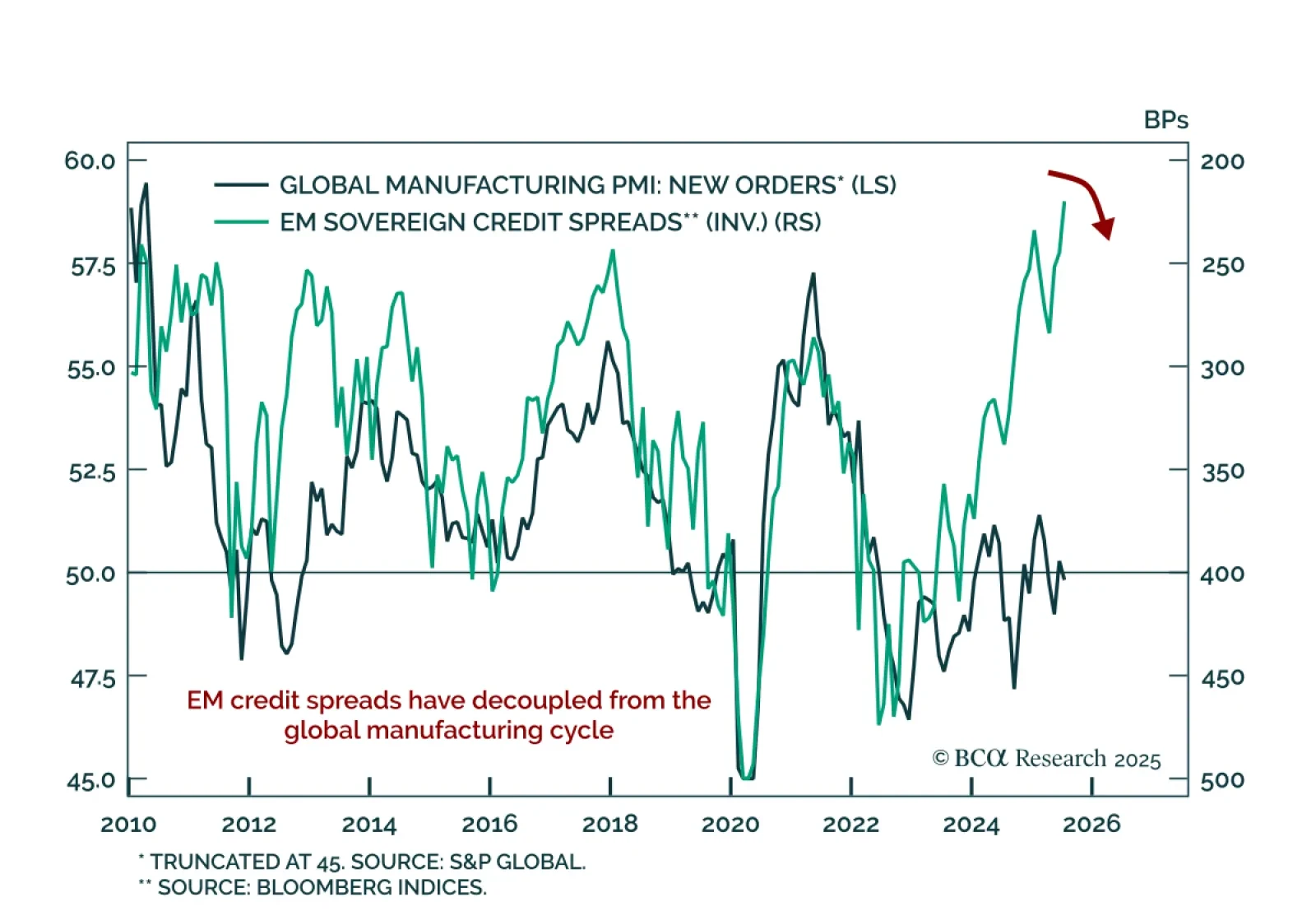

Our Emerging Markets strategists expect EM sovereign and corporate credit spreads to widen as global trade slows and domestic demand weakens, despite a softer US dollar. USD depreciation alone will not drive a sustained rally in EM…

EM sovereign and corporate credit spreads are set to widen. Within a global credit portfolio, maintain a neutral allocation to EM credit markets versus US corporate credit. Favor EM local currency bonds over EM USD bonds.

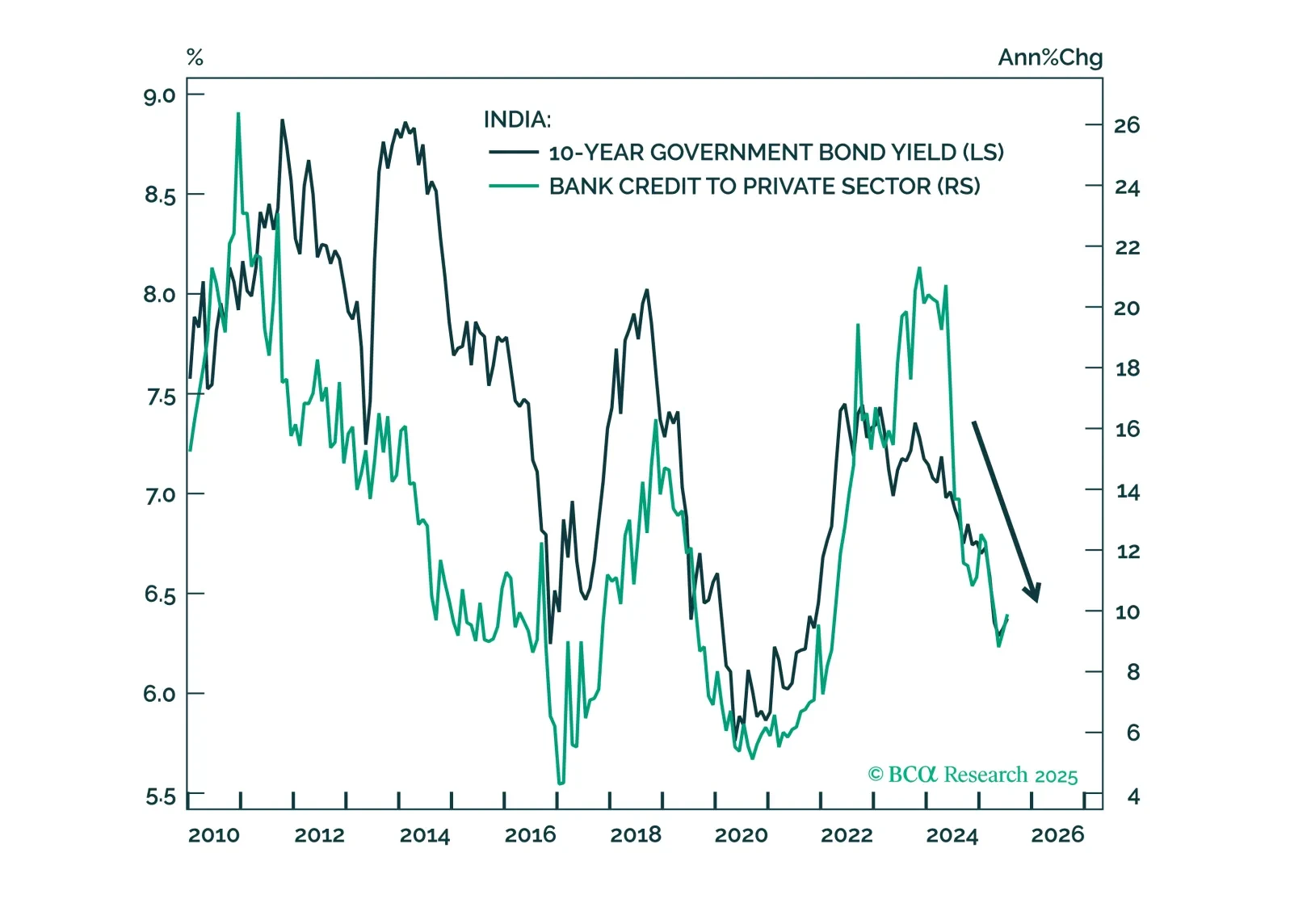

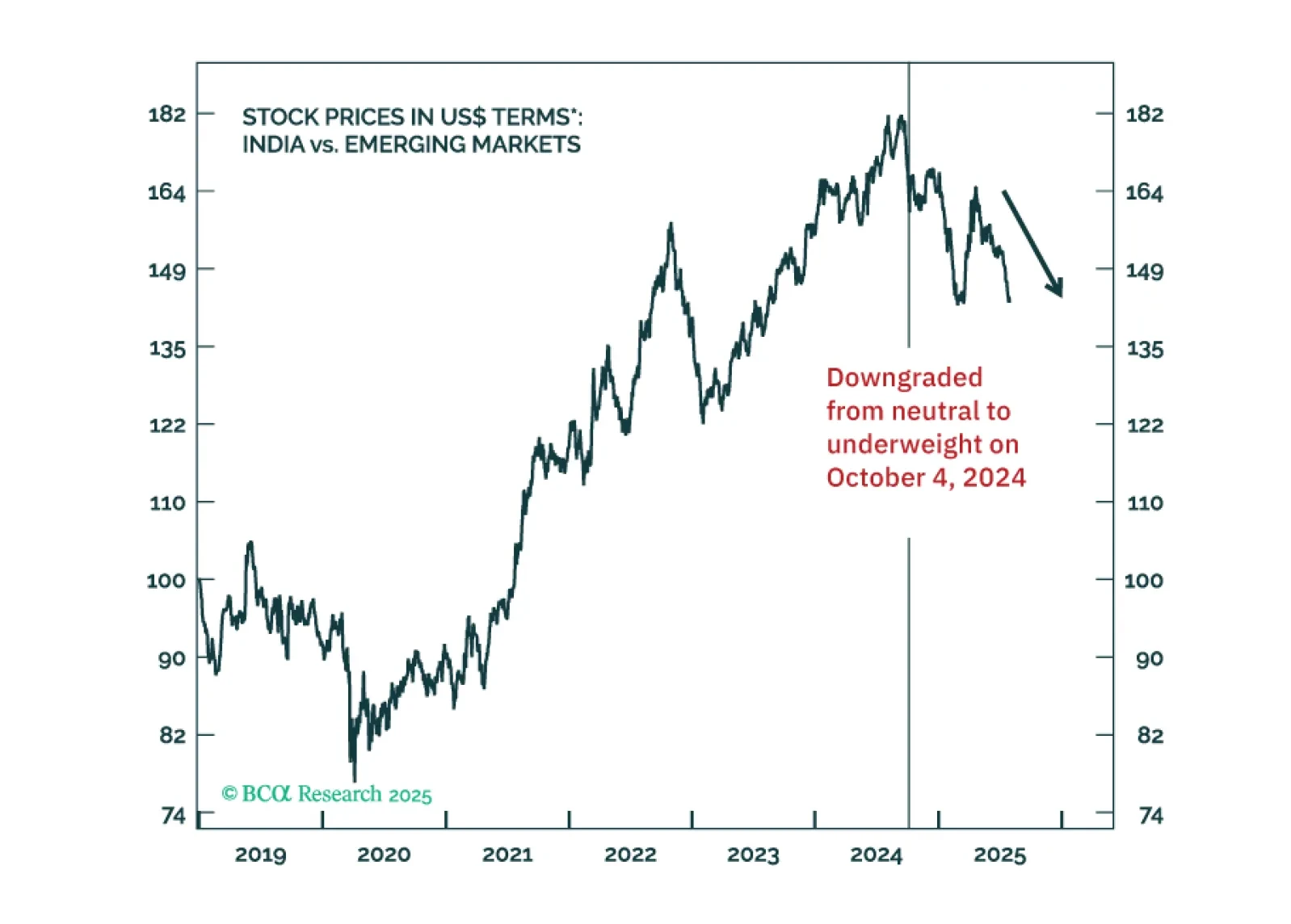

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

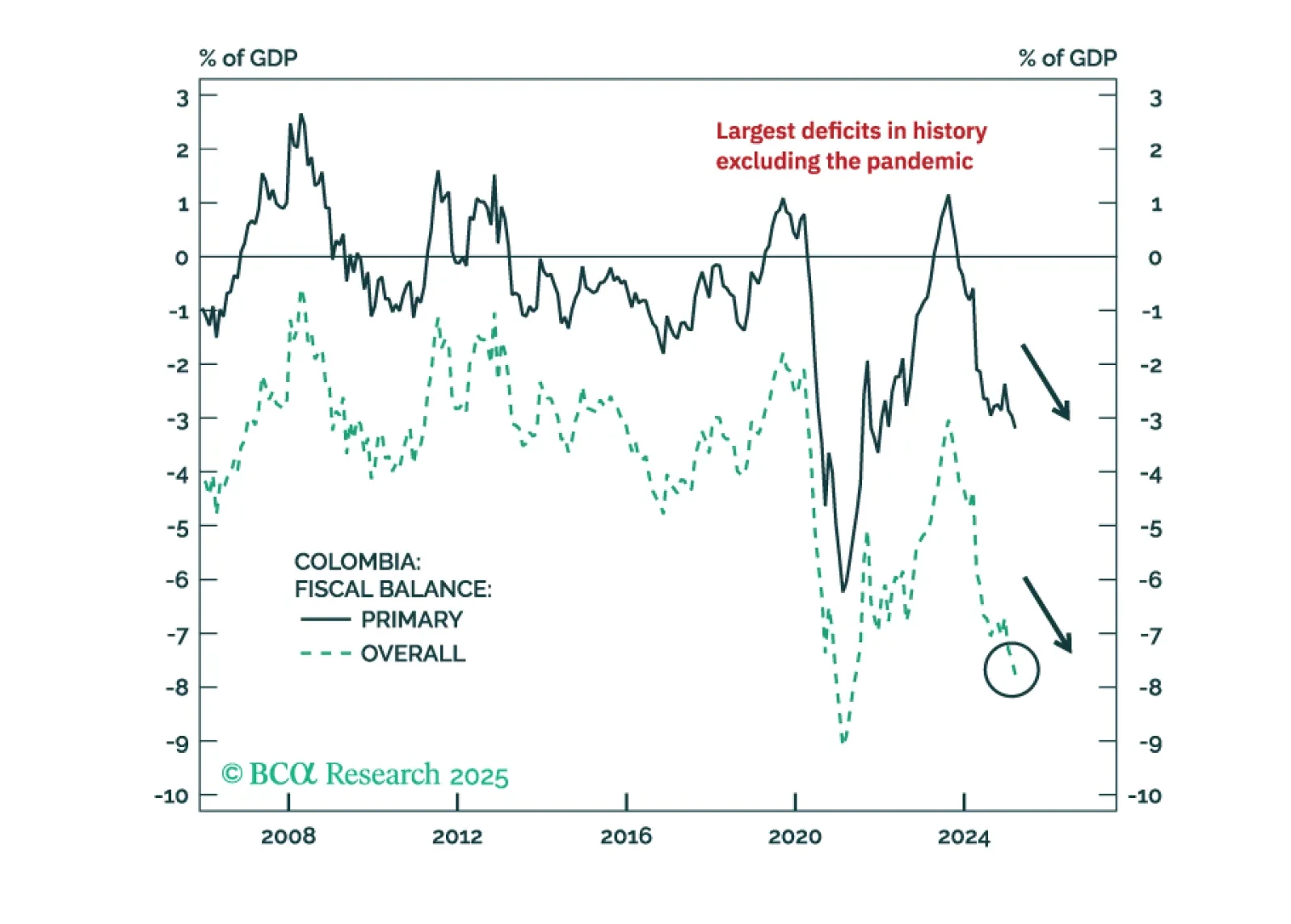

Colombian markets will be torn between expectations of future orthodox policies and the reality of a worsening macro backdrop in the next 12 months. To balance risks, we are upgrading Colombian equities, local bonds, and sovereign…

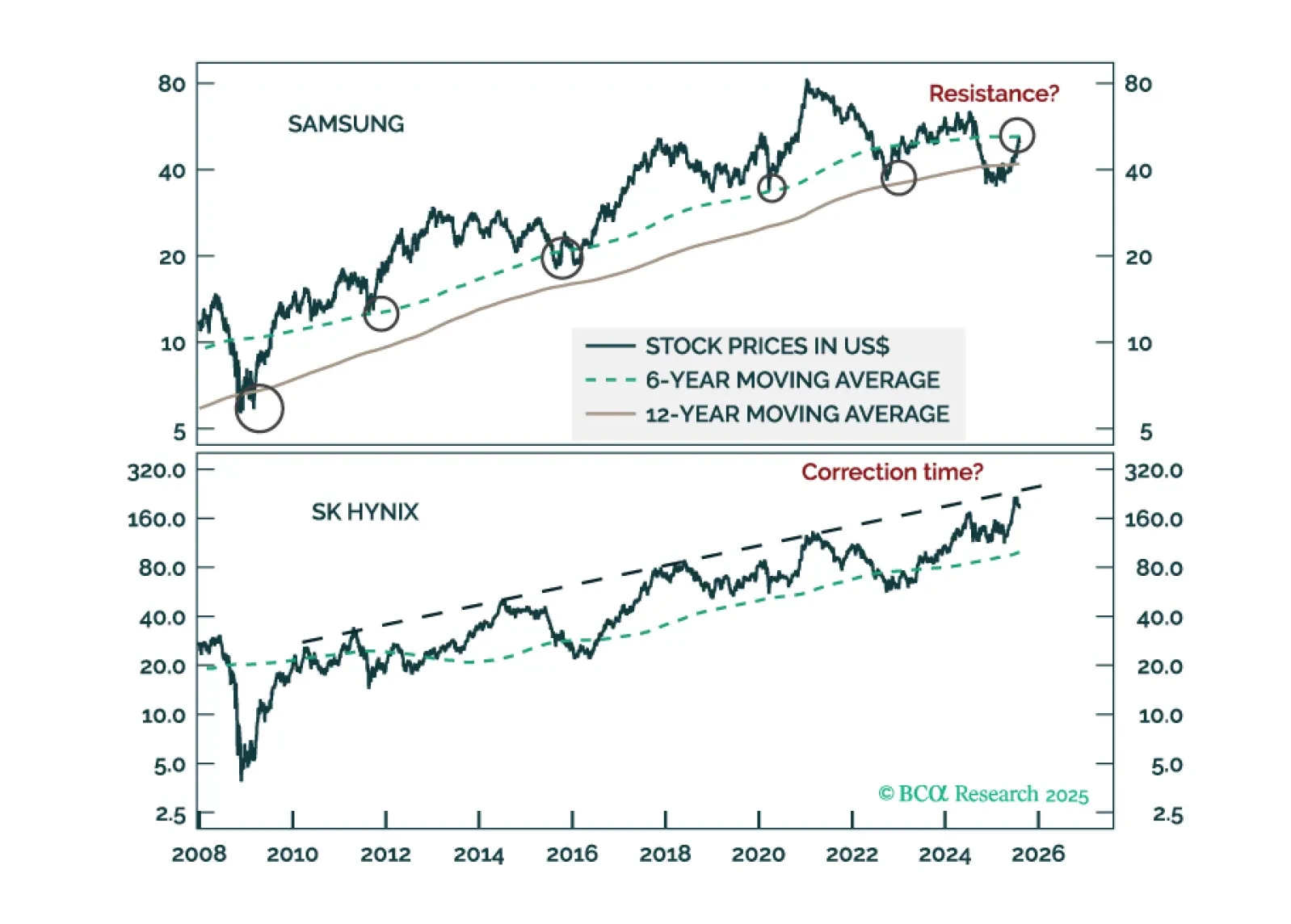

Our Emerging Markets strategists recommend downgrading Korean equities from overweight to neutral and staying long 10-year Korean bonds, currency unhedged. A deflationary shock from shrinking exports will ripple through the Korean…

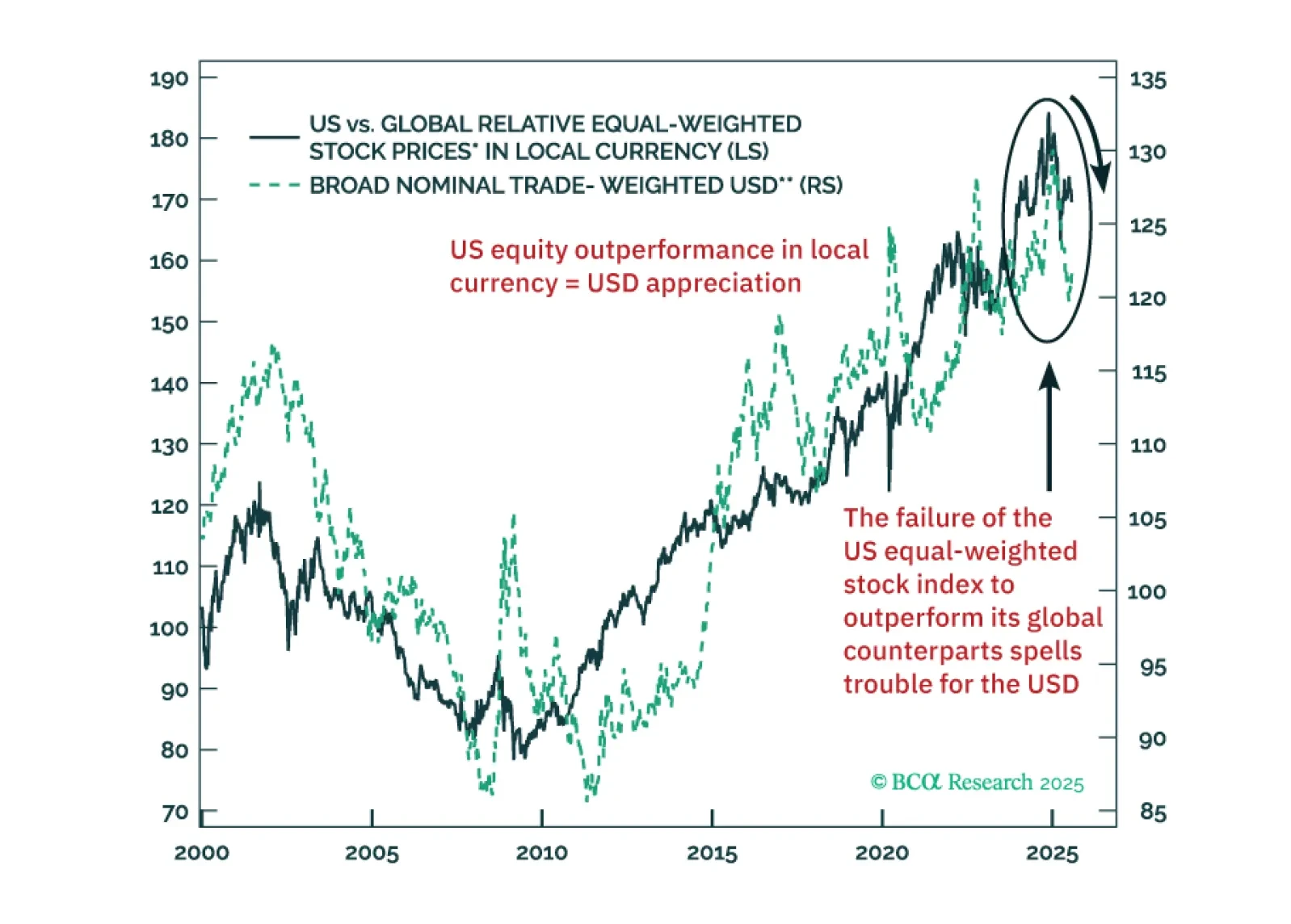

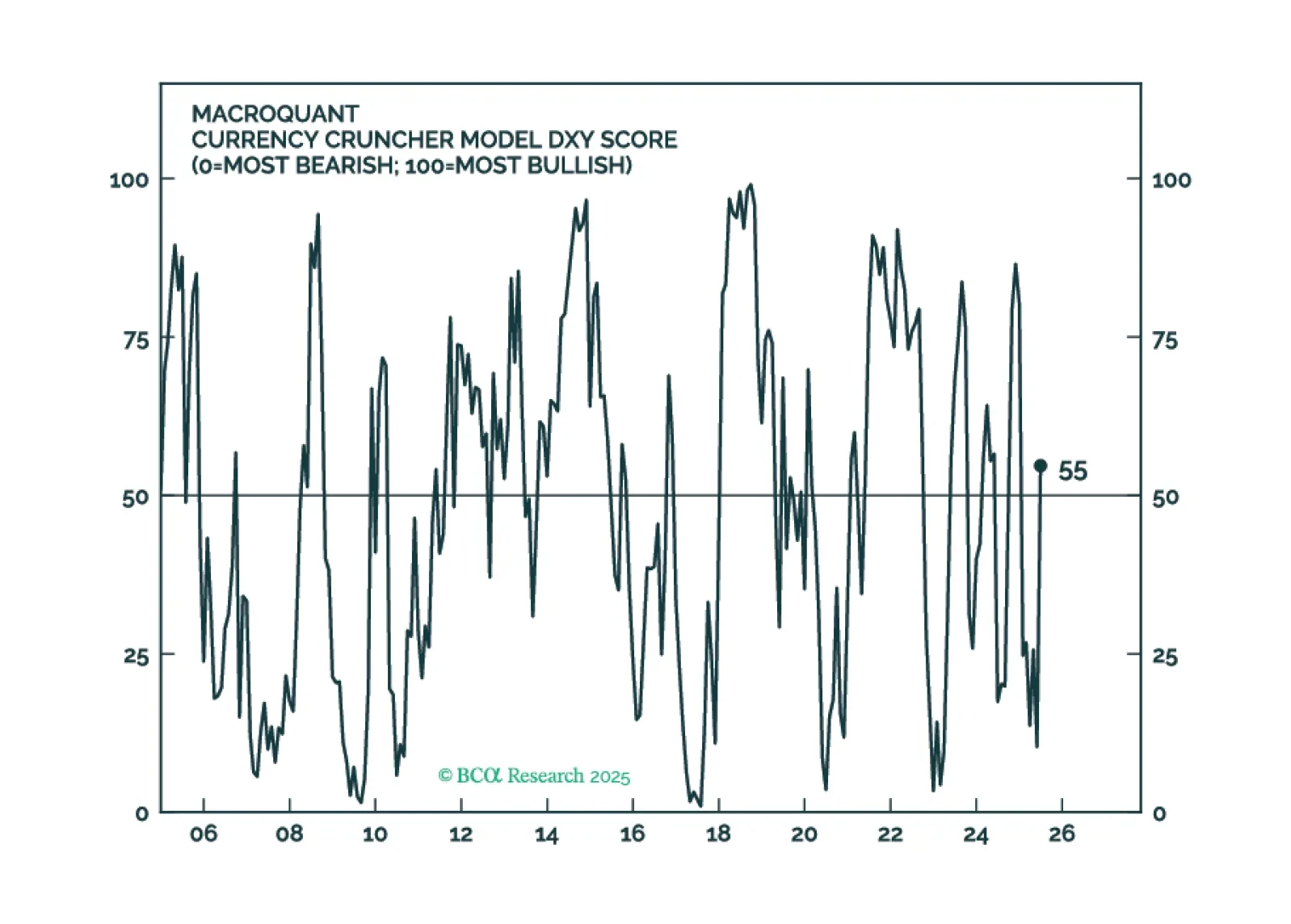

US TMT stocks have been delivering miraculous profit performance. Yet, outside US large tech, global equity fundamentals and technicals are troublesome. A near-term USD rebound should be faded.

Our Portfolio Allocation Summary for August 2025.

A deflationary shock from shrinking exports will ripple throughout the Korean economy. We are downgrading the KOSPI from overweight to neutral and reiterating a long position in 10-year domestic bonds, currency unhedged.

A high US tariff and the lingering uncertainties on the US-India trade deal will hurt investors sentiment. This and contracting corporate profits will push share prices lower. Stay underweight Indian stocks.

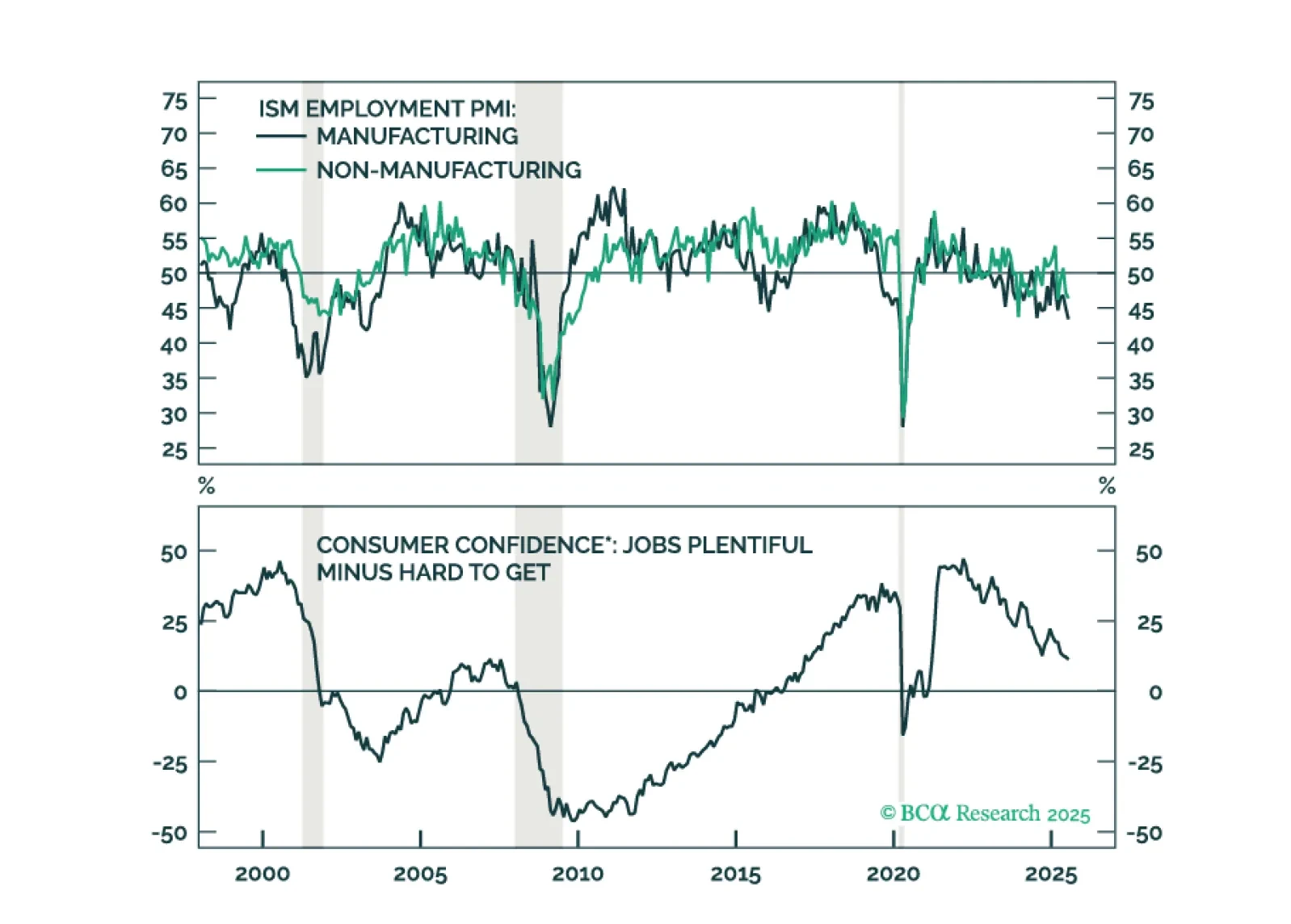

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.