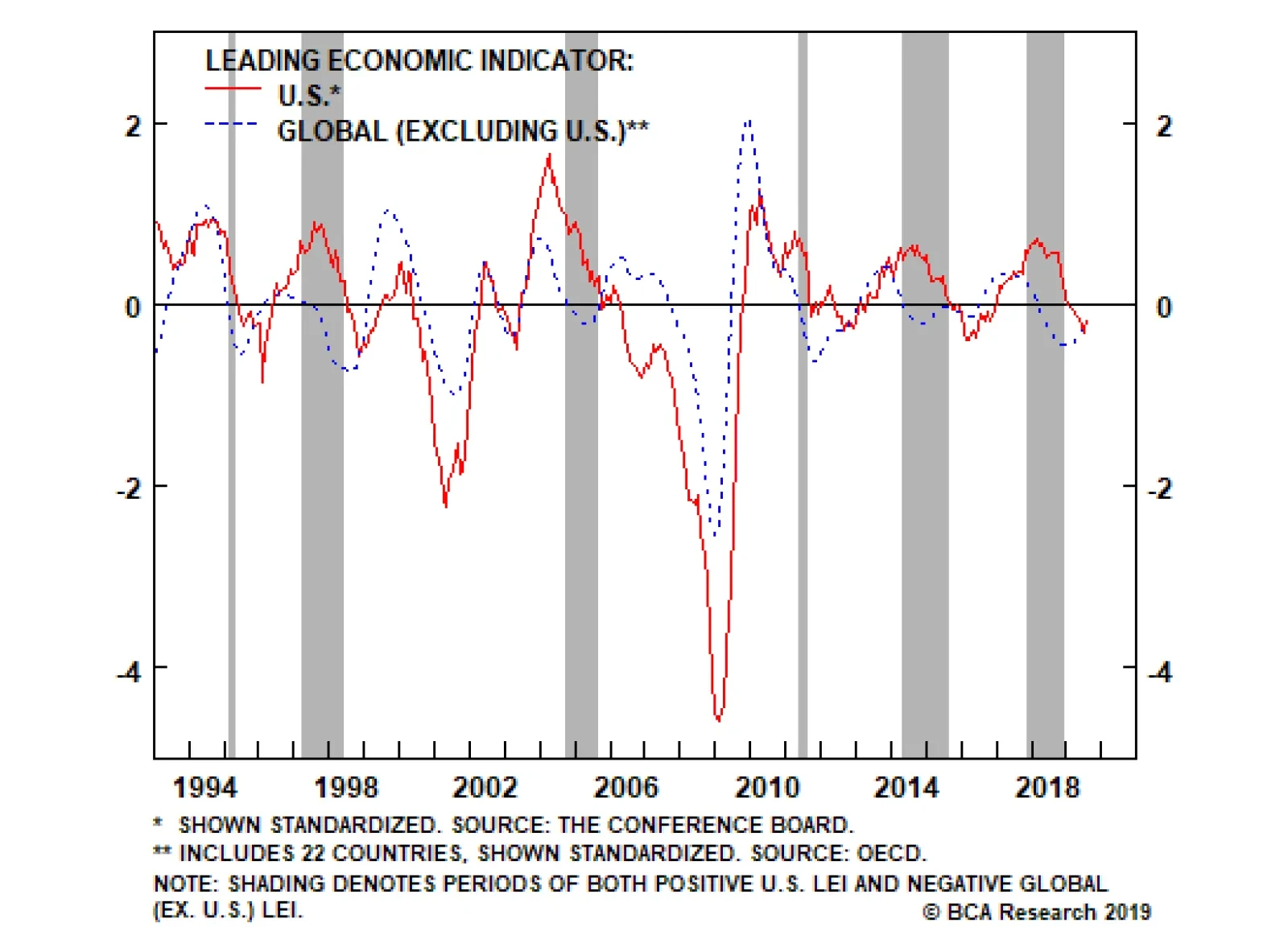

The United States is insulated from global trade, but only to a point – it cannot escape a global recession should one develop, given that its economy is still closely linked to the rest of the world. With global and U.S.…

Analyses on the Philippines, Colombia and Argentina are available below. Highlights Global growth conditions, especially outside the U.S., remain bond friendly. Nevertheless, U.S. bonds are overbought and technical factors might…

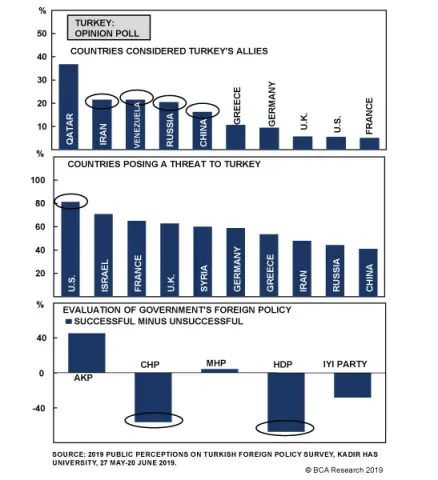

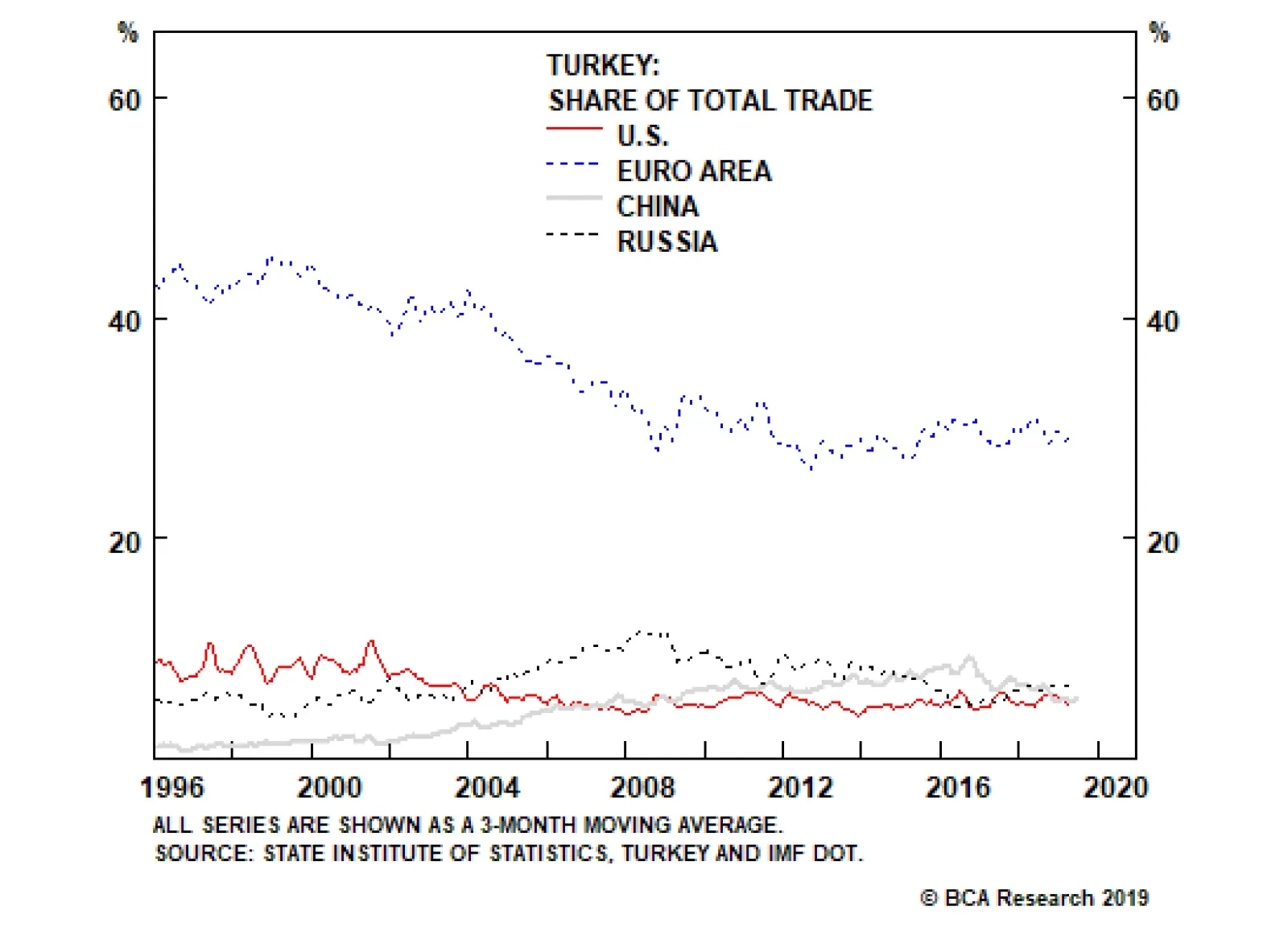

For several years Erdogan has attempted to distract the populace from the country’s economic slide by adopting an aggressive foreign policy, particularly toward the West. The immediate cause is Syria, where Turkey has…

Various forces are creating a tug-of-war on the U.S.-Turkey relationship. First, the U.S. Congress is ready to impose sanctions over the S400s and Trump is under pressure to punish Turkey for undermining NATO and dealing with the…

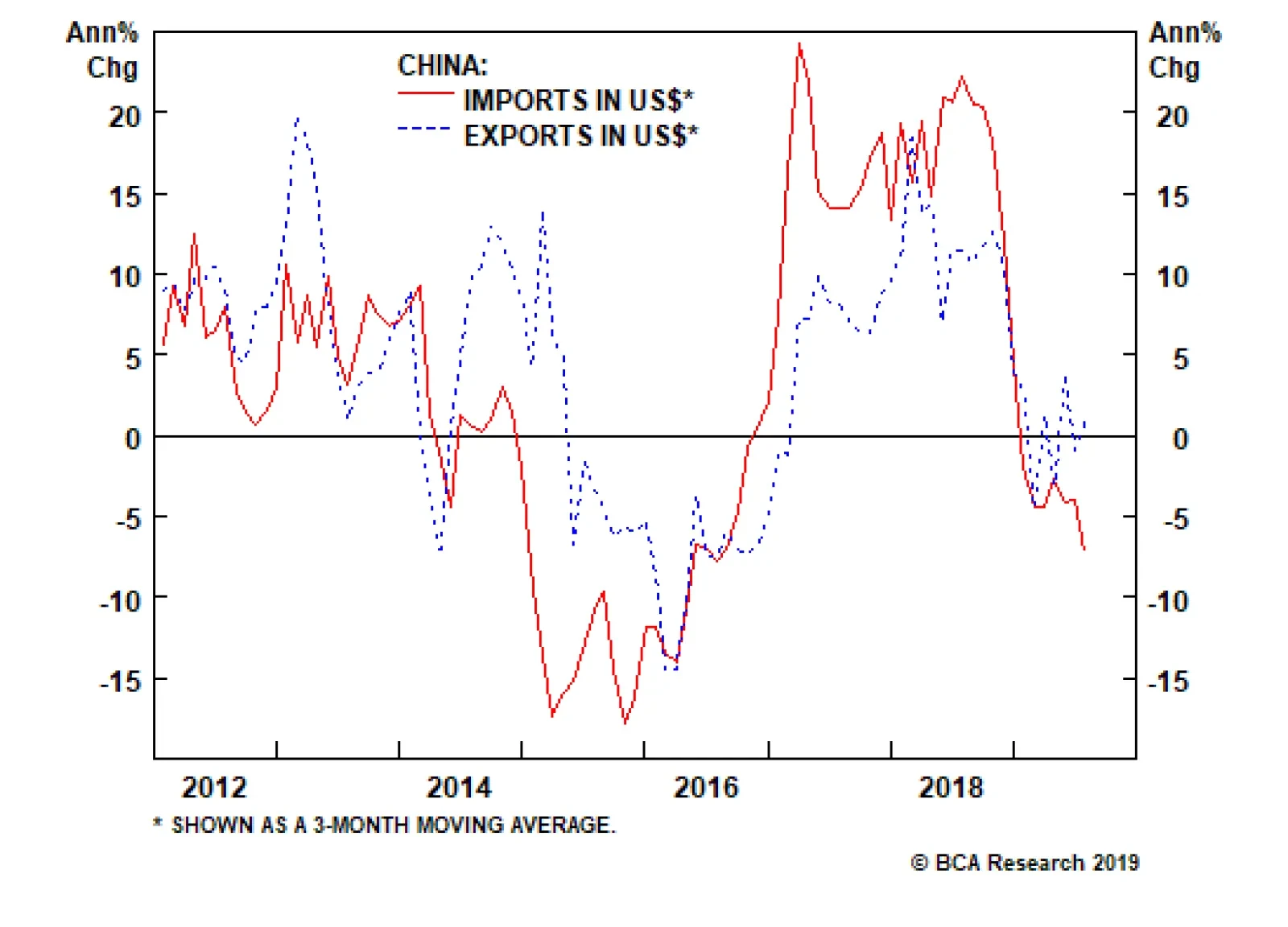

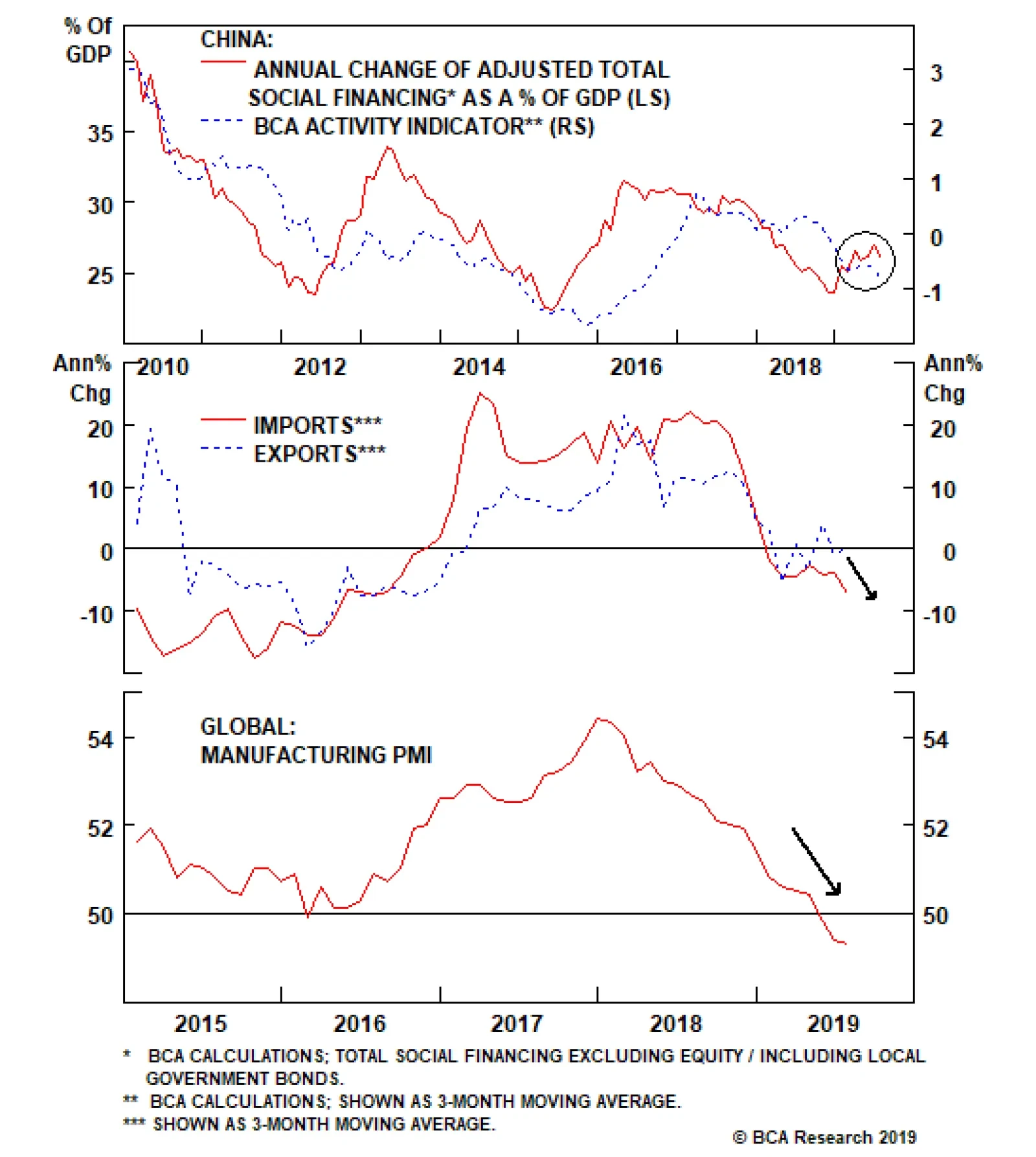

The media and many investors seem to be solely focused on the impact of U.S. tariffs against imports from China. Yet, these tariffs have not been the primary cause of the ongoing global manufacturing and trade recessions. The…

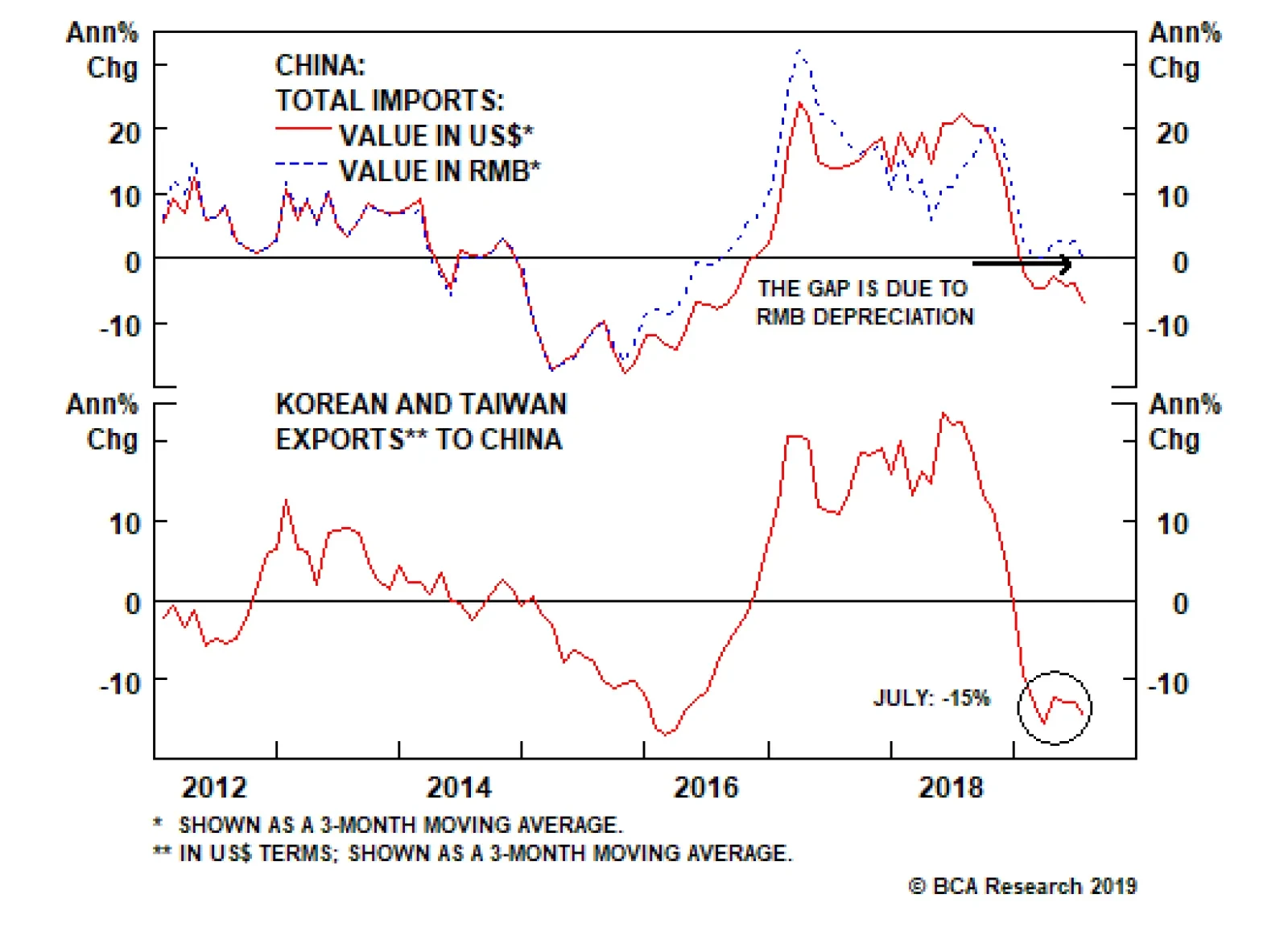

The recent RMB depreciation will likely intensify the Chinese import contraction, as the same amount of yuan will buy less goods priced in U.S. dollars. Since the majority of goods and commodities procured by mainland companies…

Highlights The current global trade downtrend has primarily been due to a contraction in Chinese imports. The latter reflects weakness in China's domestic demand in general and capital spending in particular. The current global…

Scenario 1 (Bullish): Effects of Stimulus – Impact of Tariff Shock > 0 Scenario 2 (Bearish): Effects of Stimulus – Impact of Tariff Shock ≤ 0 In scenario 1, the impact of China’s reflationary efforts…