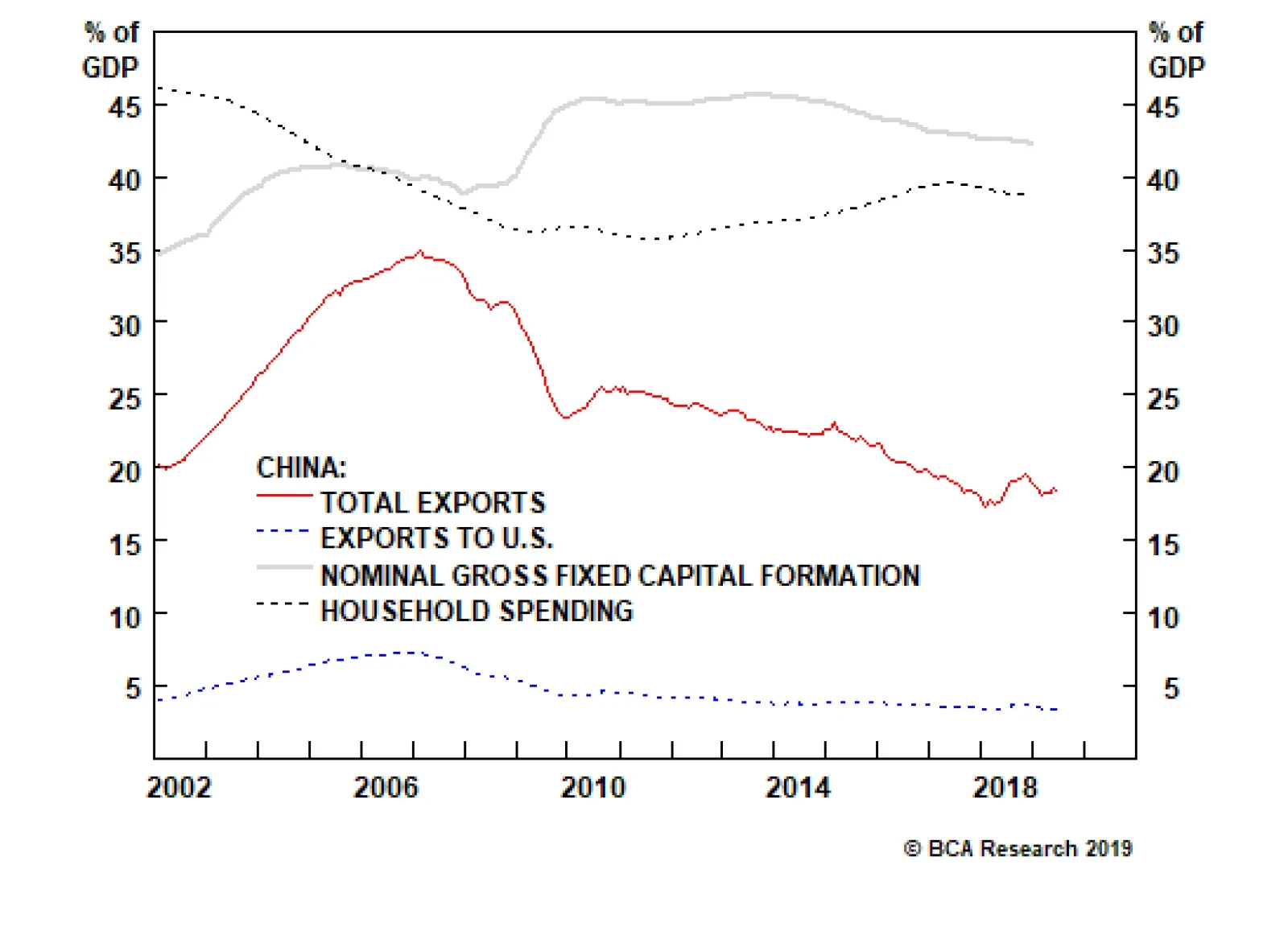

If and when deleveraging does transpire in China, the household income growth rate will decelerate, resulting in weaker spending growth. It will be impossible for the mainland economy to undertake even mild deleveraging and…

Highlights Four ghosts of 2016 are knocking at the door: Brexit, Trump, Brazil, Italy. President Trump and U.S. trade policy are keeping uncertainty high. Upgrade the odds of a no-deal Brexit to about 33%. Expect limited stimulus…

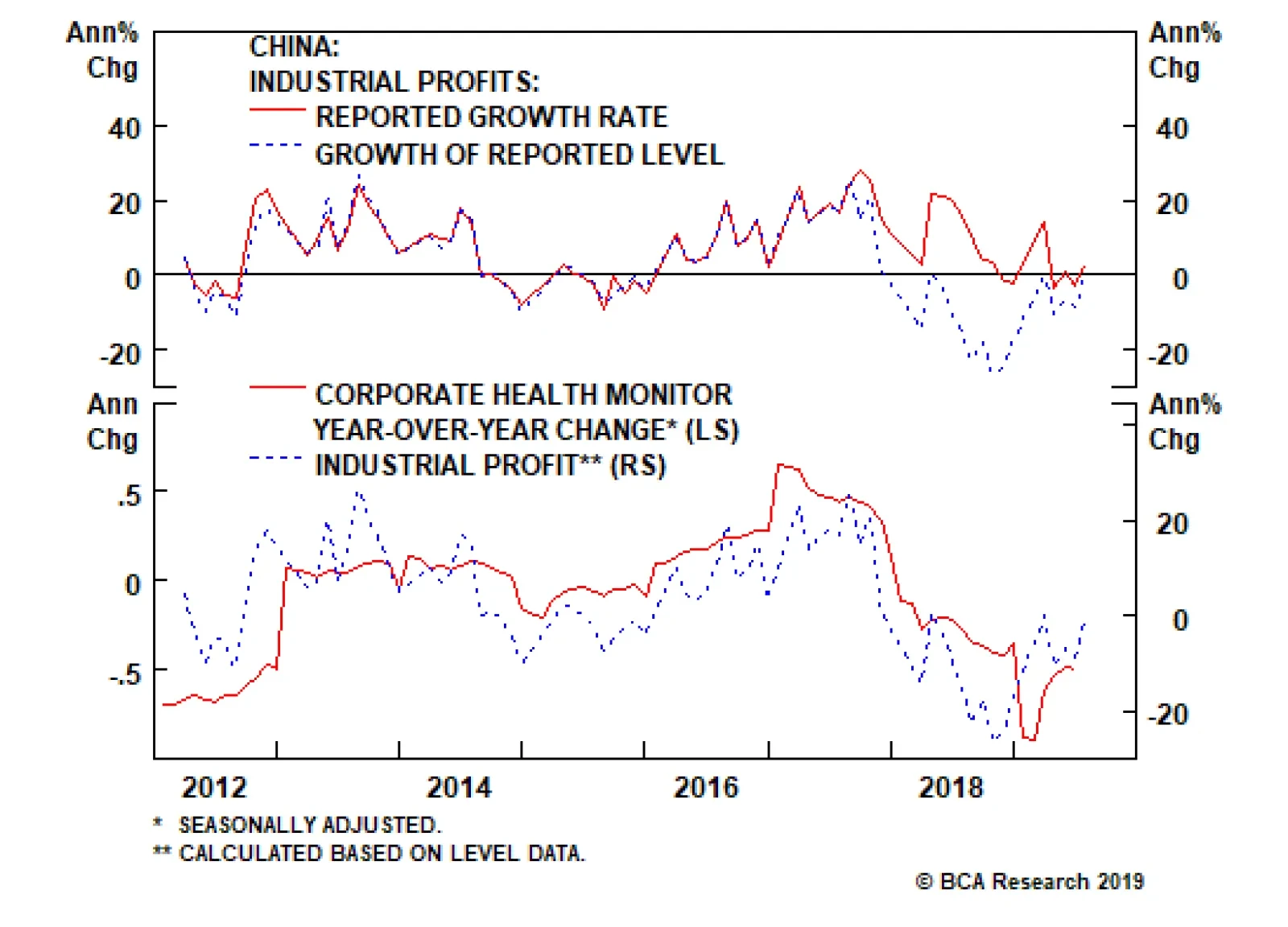

According to the official reported growth rate, Chinese industrial profit growth ticked back up into positive territory in July, after having fallen into modestly negative territory earlier this year. However, market participants…

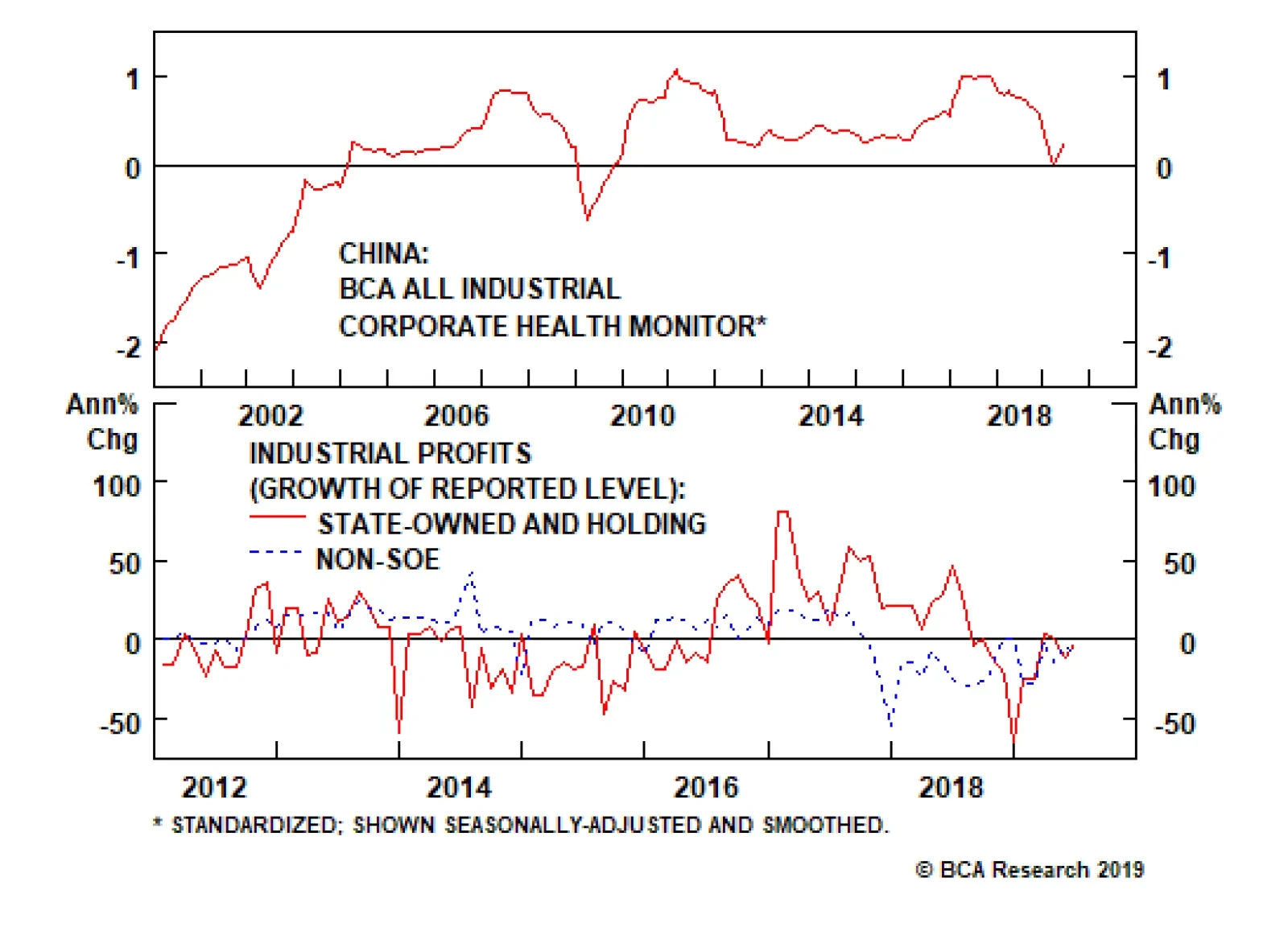

The deterioration in China’s profit growth and corporate health has the following implications: The deceleration in profit growth has caused a meaningful deterioration in corporate health, even if our Corporate Health…

Highlights The U.S.-Sino trade war is taking a dangerous turn, but the U.S. should avoid a recession until 2022. Global growth will bottom in early 2020. The Fed is set to cut rates two to three times in the next year. Safe-haven…

Away from the Sino-U.S. trade-war headlines – and the remarkable commodity price volatility they produce – apparent steel consumption in China is up 9.5% y/y in the first seven months of this year. This is being spurred by…

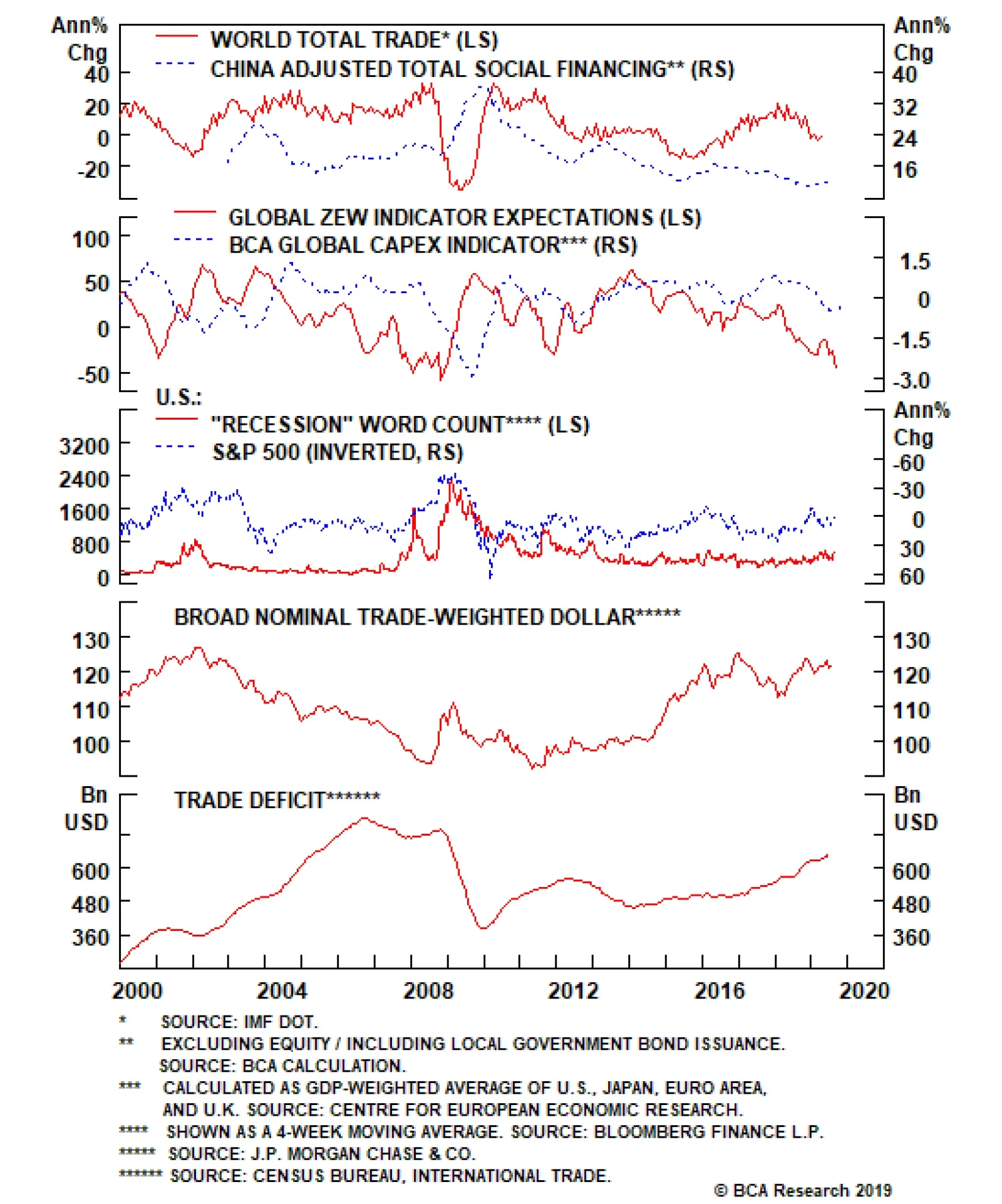

Trump’s predicament suggests that he will have to adjust his policies. Global trade, capital spending, and sentiment have deteriorated significantly since the last escalation-and-delay episode with China in May and June.…