Highlights Trump is now clearly retreating from policies that harm the economy and reduce his reelection chances. Geopolitical risks are abating for the first time since May – a boon for financial markets amid global policy…

Please note that this abbreviated weekly report complements today’s Special Report titled China’s Foreign Debt, And A Secret Weapon published in collaboration with BCA’s China Investment Strategy service. Feature A…

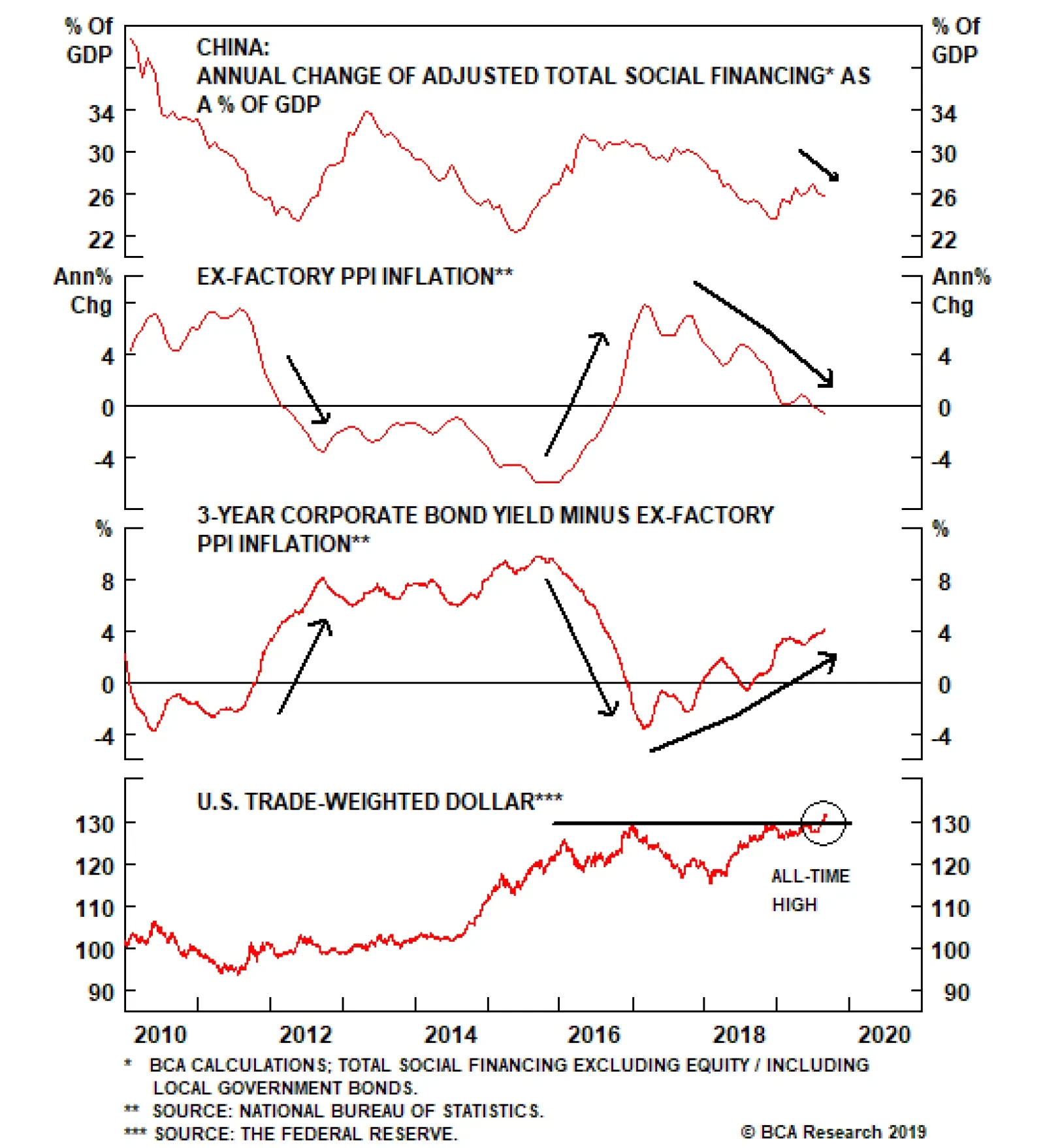

China’s August Total Social Financing improved relative to July, rising from CNY1.01 trillion to CNY1.95 trillion, and beating expectations of CNY1.605 trillion. The positives end there. The annual growth rate of Total…

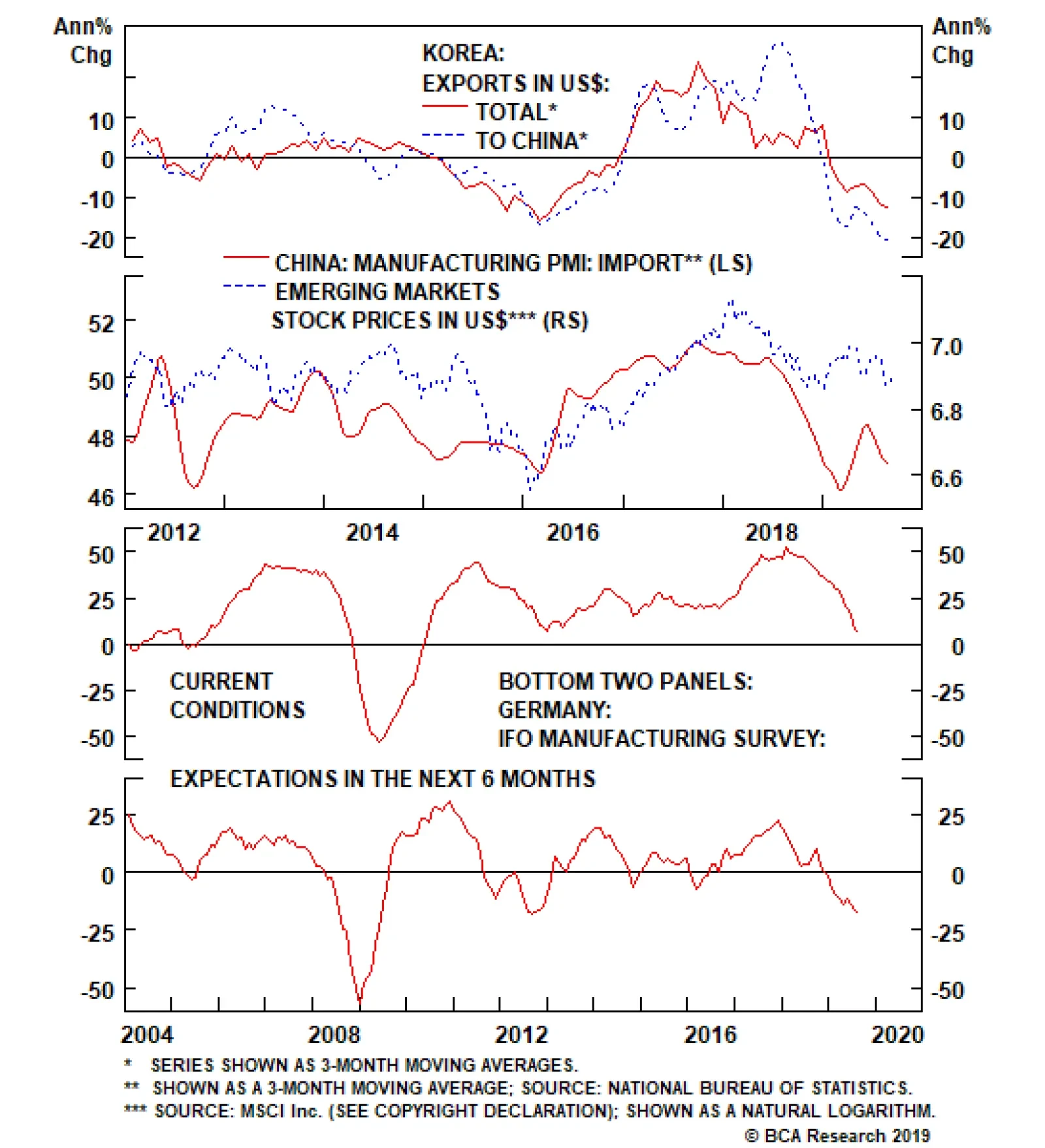

China, rather than the U.S. has been the epicenter of the global slowdown. Hence, a major rally in global cyclical equities and EM risk assets hinges on a recovery in the Chinese business cycle. Even though Caixin’s PMI for…

Share prices of growth companies, defensive equity sectors and credit markets are at risk because of expensive valuations and crowded investor positioning. In other words, they could sell off even if a global recession is avoided…

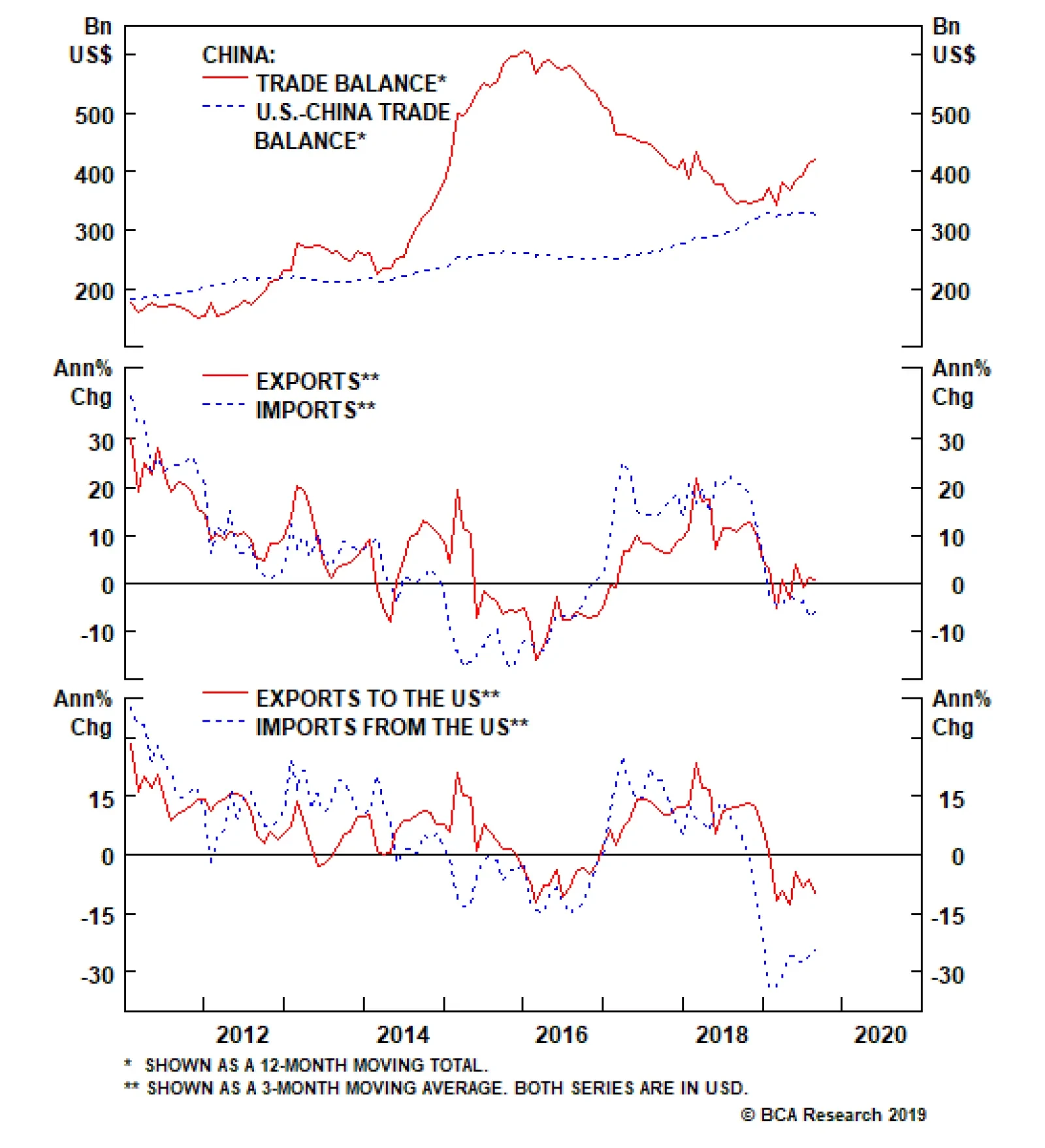

Chinese August trade numbers were soft. In USD-terms, Chinese exports contracted 1% annually, and imports, 5.6%. A weak yuan softened the blow. In RMB-terms, exports decelerated from a 10.3% annual growth to 2.6% and imports…

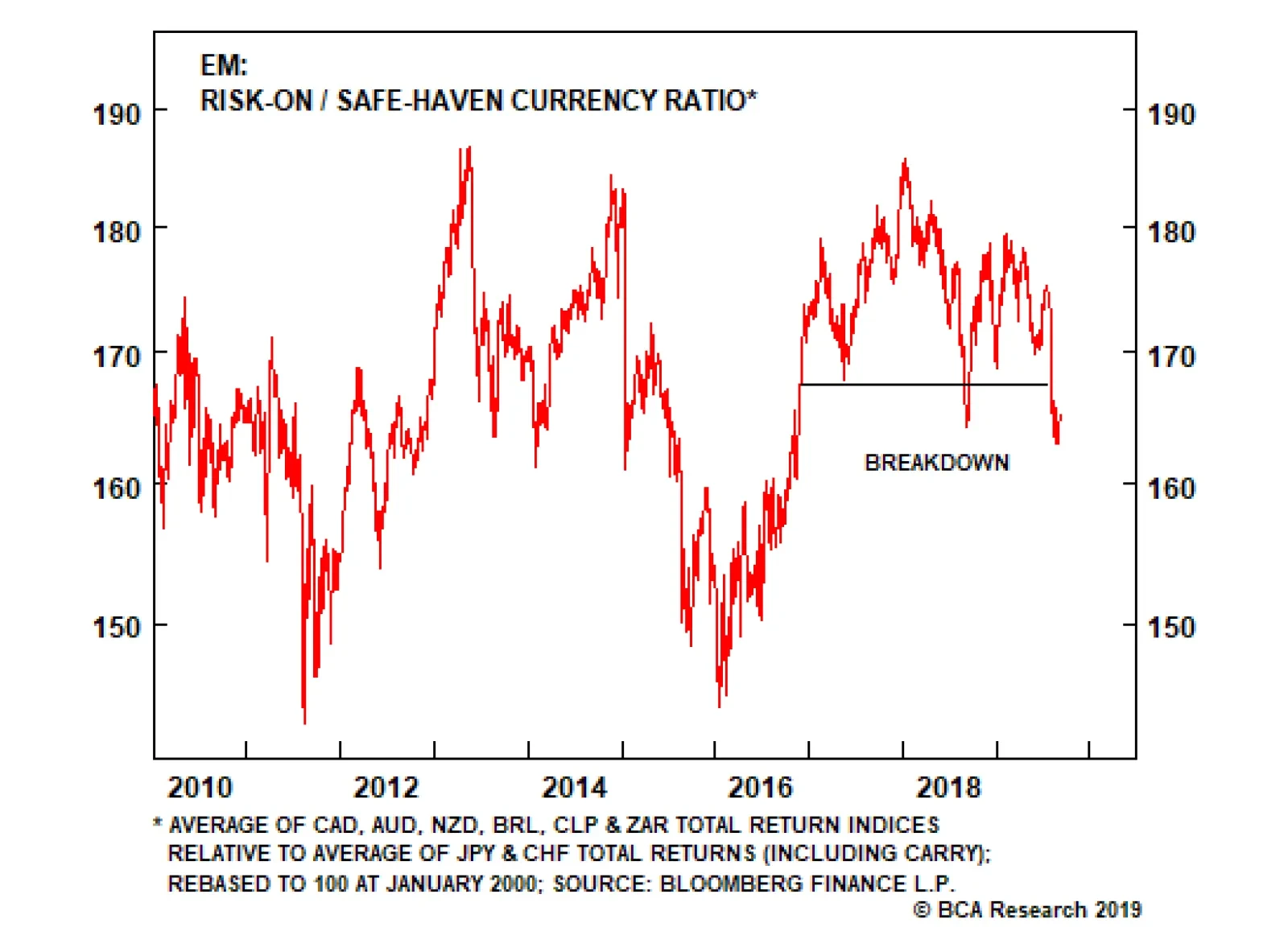

Highlights The lingering global manufacturing recession and the substantial drop in U.S. bond yields have been behind the decoupling between both EM stocks and the S&P 500, and cyclical and defensive equities. Neither the most…

Highlights Coincident measures of economic activity suggest that China’s economy continued to slow in July. The August manufacturing PMIs were positive, but they more likely reflect tariff front-running activity than a genuine…

Highlights While a self-fulfilling crisis of confidence that plunges the global economy into recession cannot be excluded, it is far from our base case. Provided the trade war does not spiral out of control, it is highly likely that…