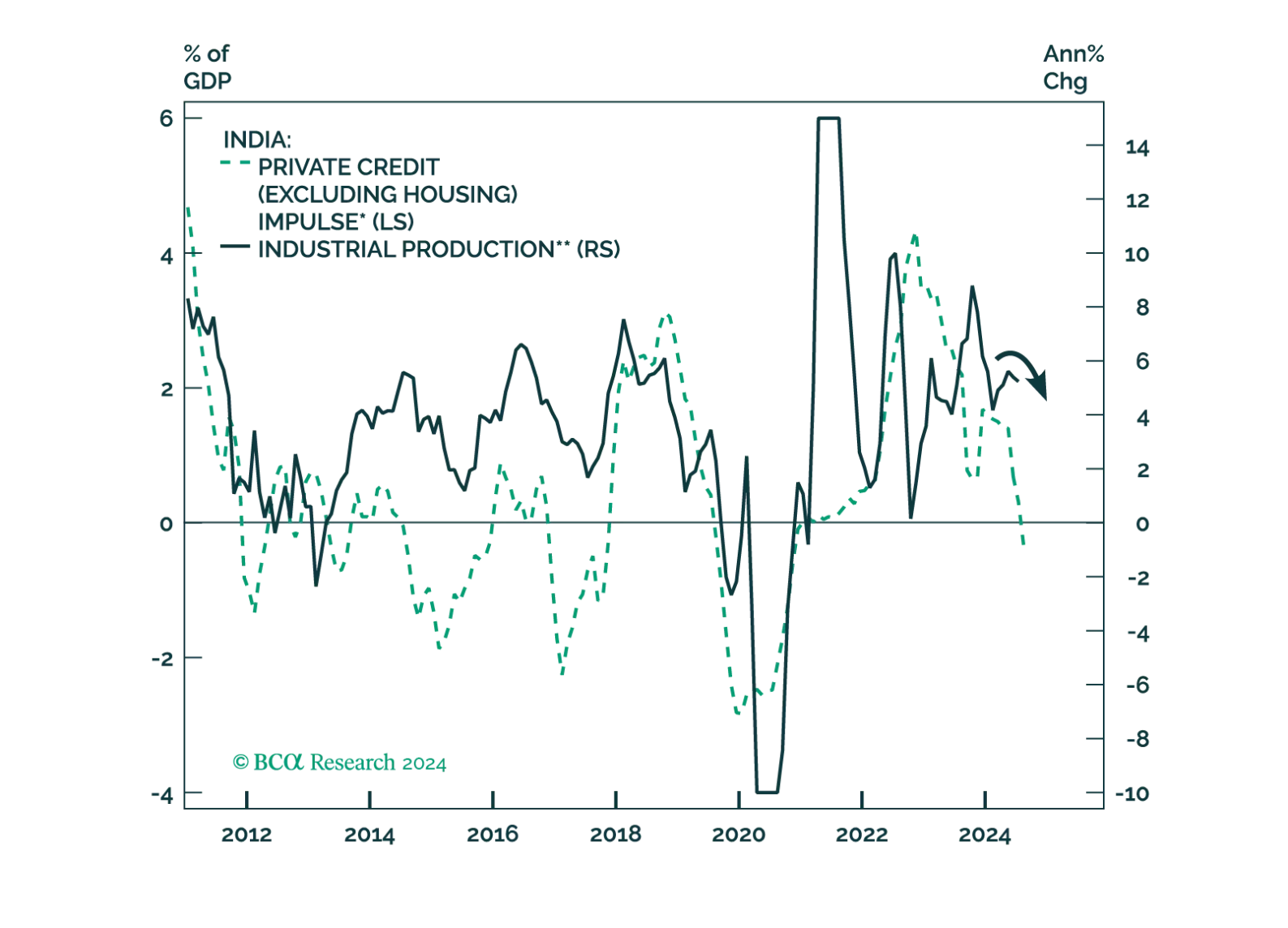

India’s credit impulse has turned negative. Government spending is contracting. The country’s growth will remain subdued; and both drivers of stock prices – profits and multiples – are headed lower at a time when equity valuations…

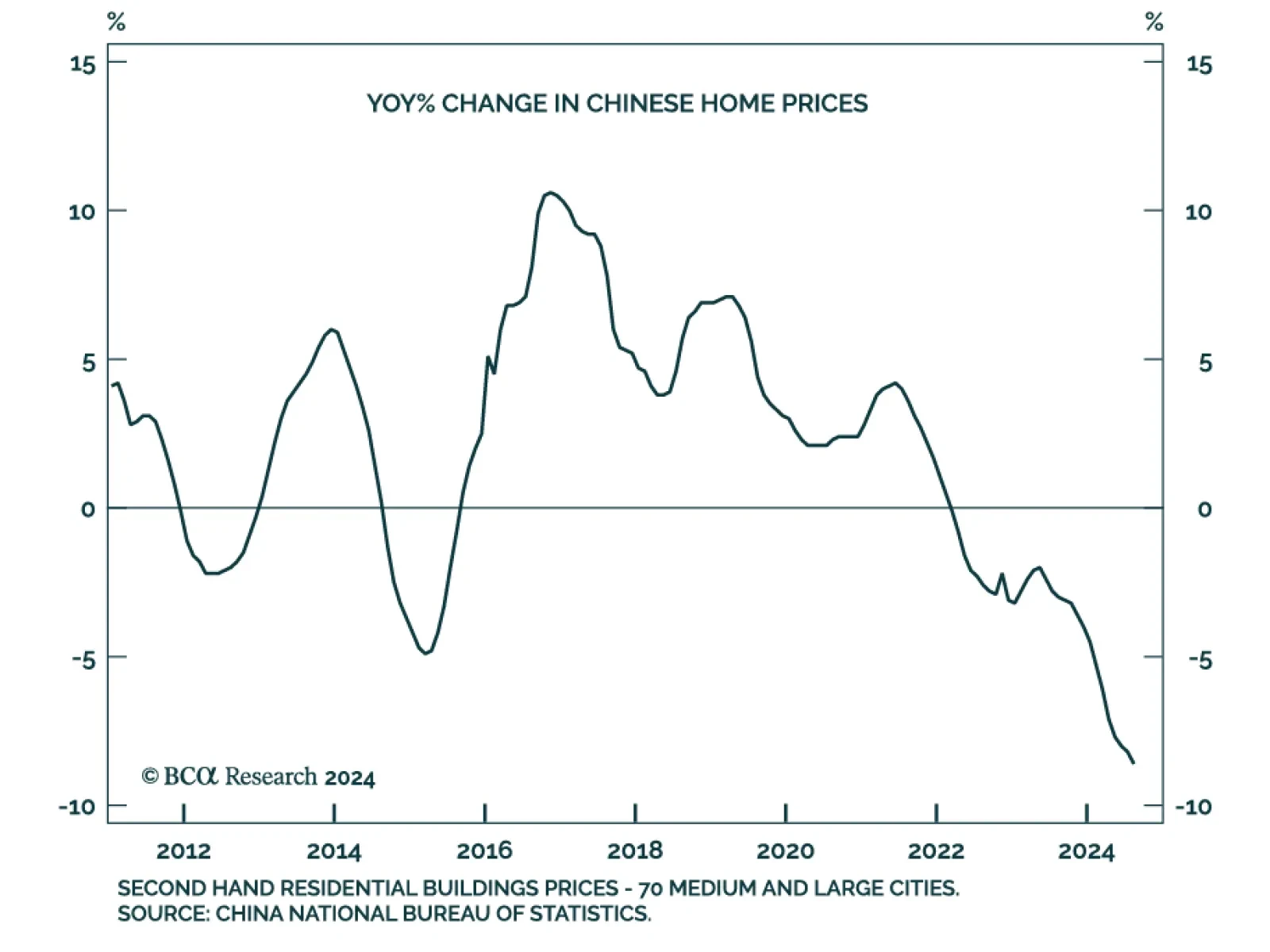

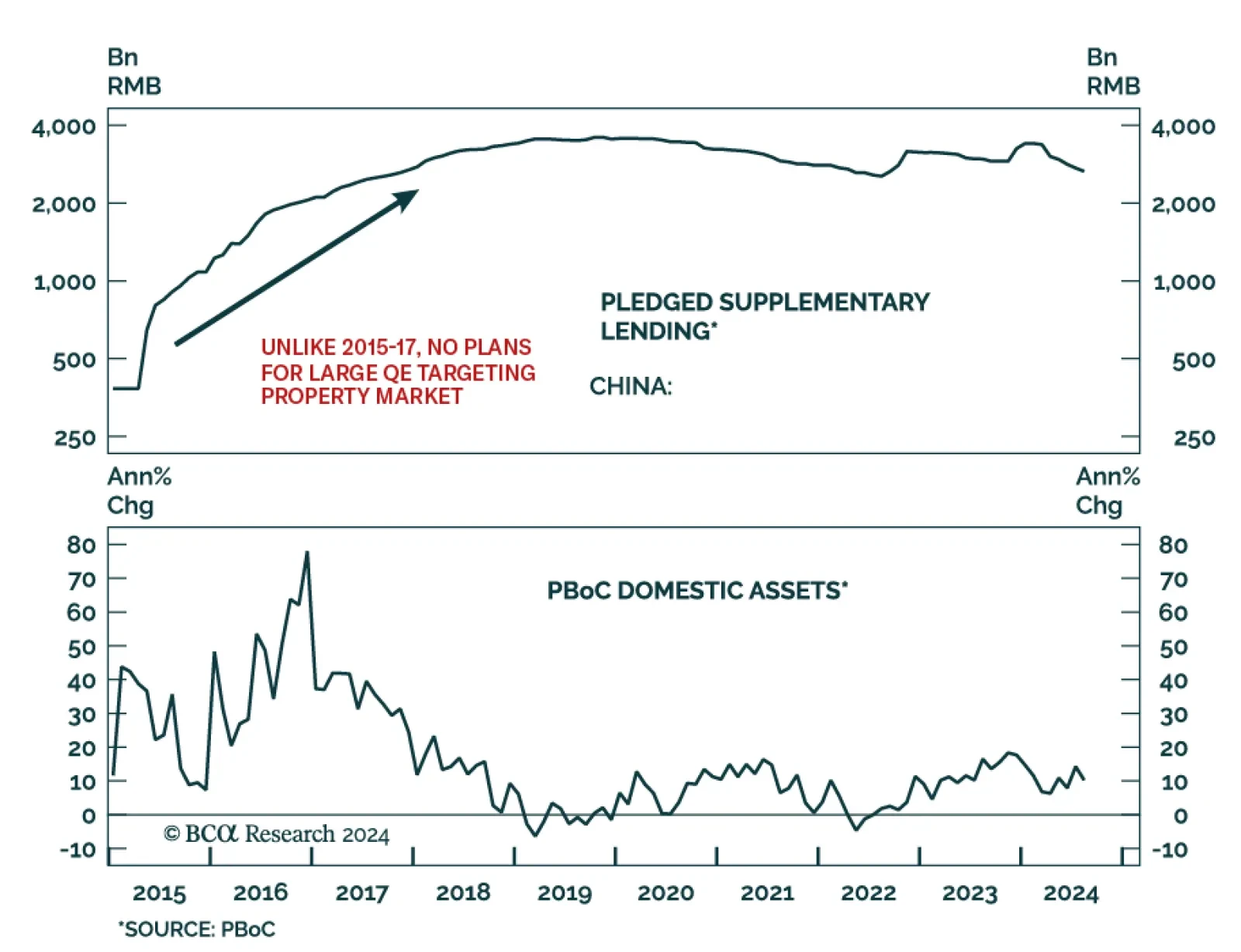

According to BCA Research’s Counterpoint service, absent the multi-decade housing and construction boom, China will be unable to generate the monster credit impulses that it did through 2000-20. While the credit…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

Our Portfolio Allocation Summary for October 2024.

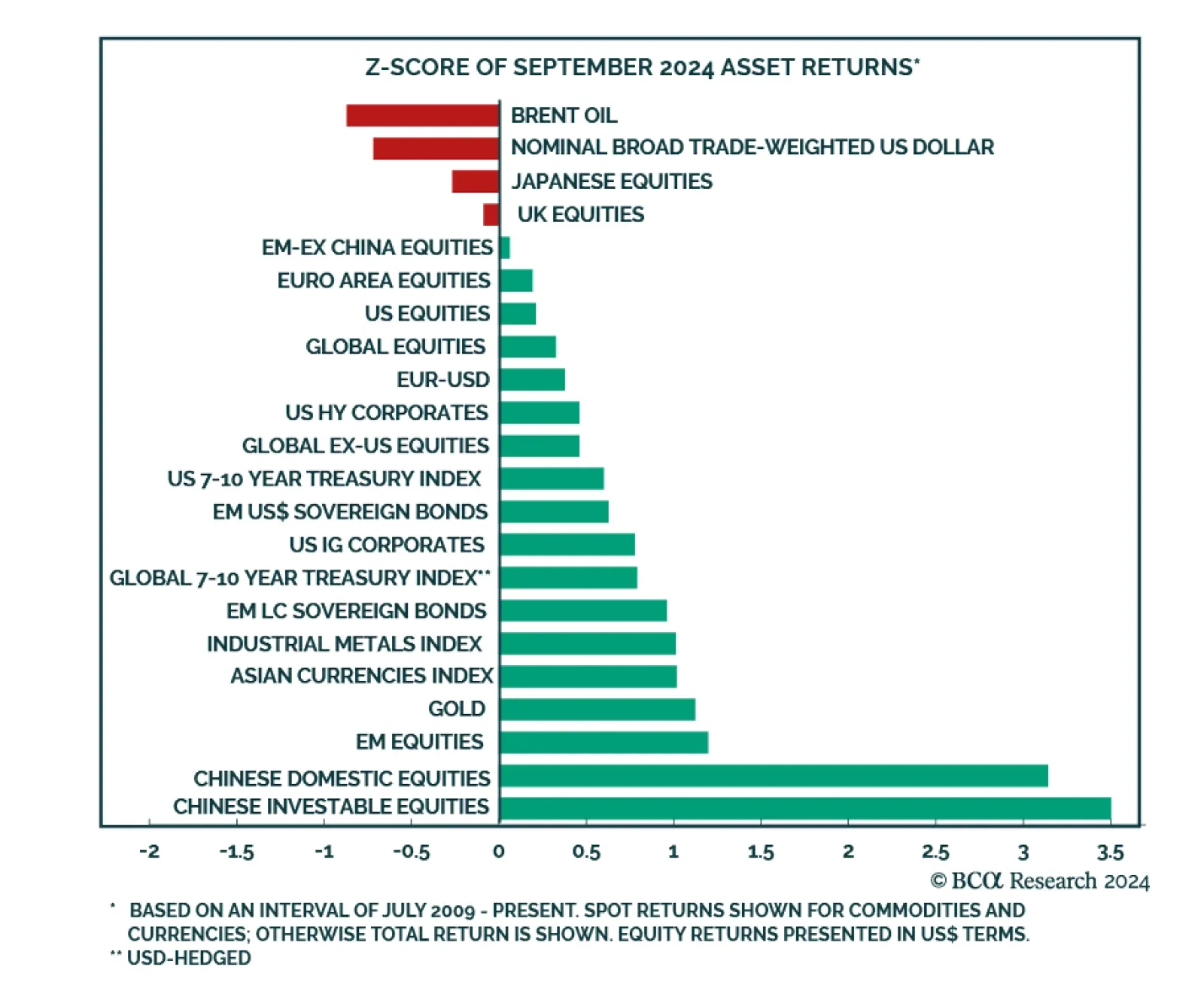

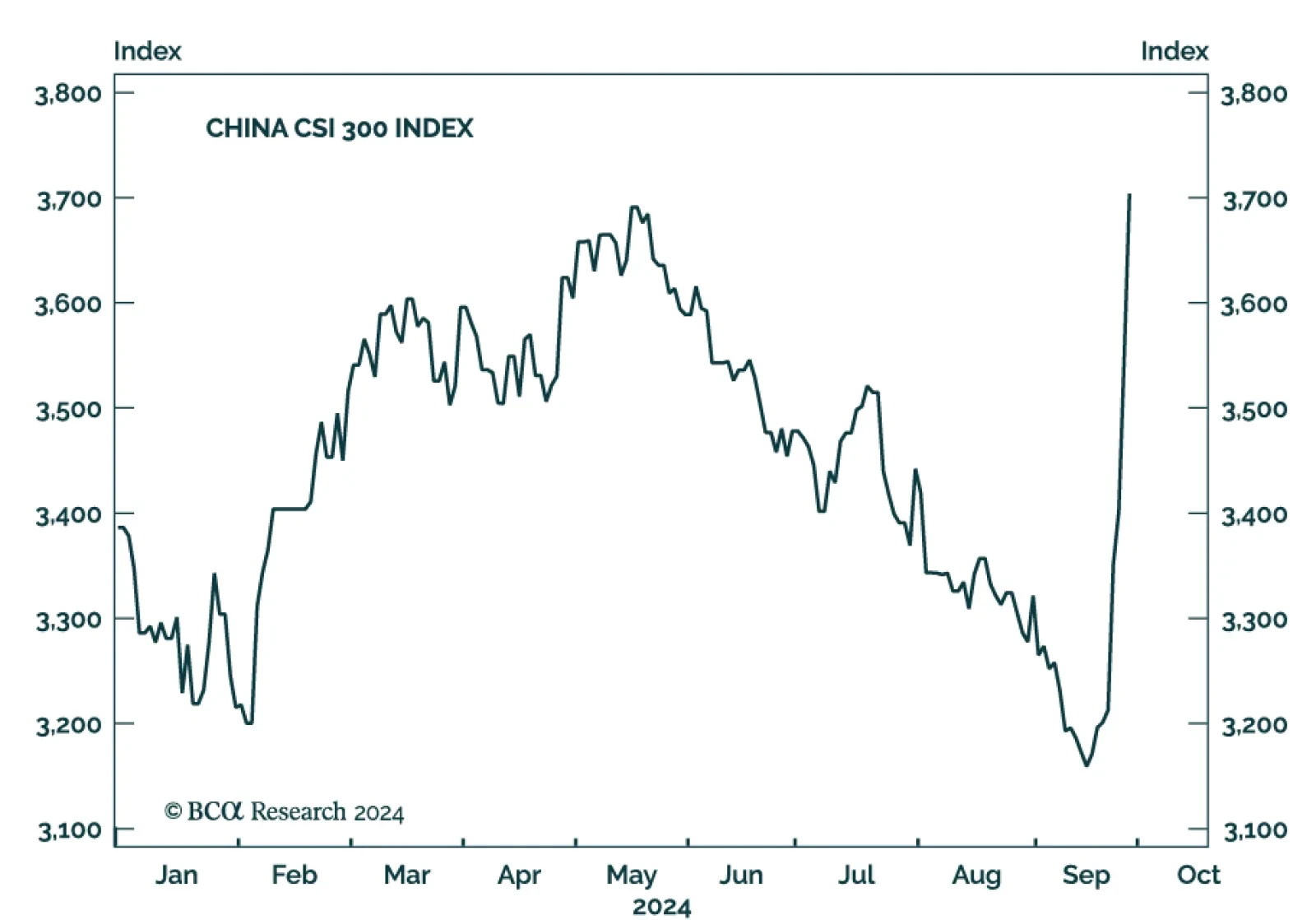

The Fed embarked on a new easing cycle with a bang and China delivered its largest stimulus since 2015, leading to a strengthening in the risk-on soft-landing narrative in September. Chinese and EM equities led the pack. We…

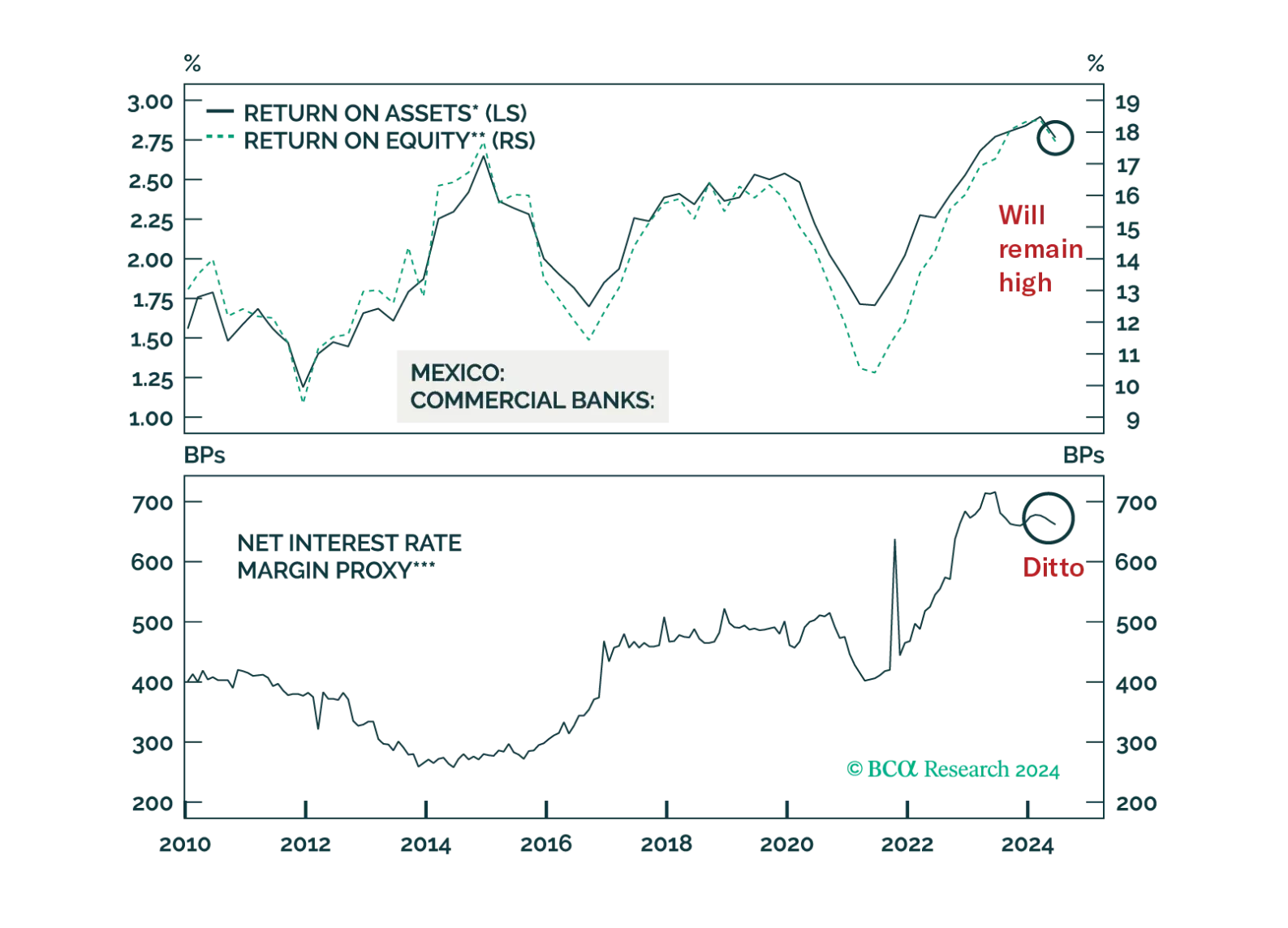

The politically induced selloff in Mexican markets has gone too far. In our view, investor fears about the constitutional changes are largely unwarranted. These reforms will have little to no ramifications for the economy in the…

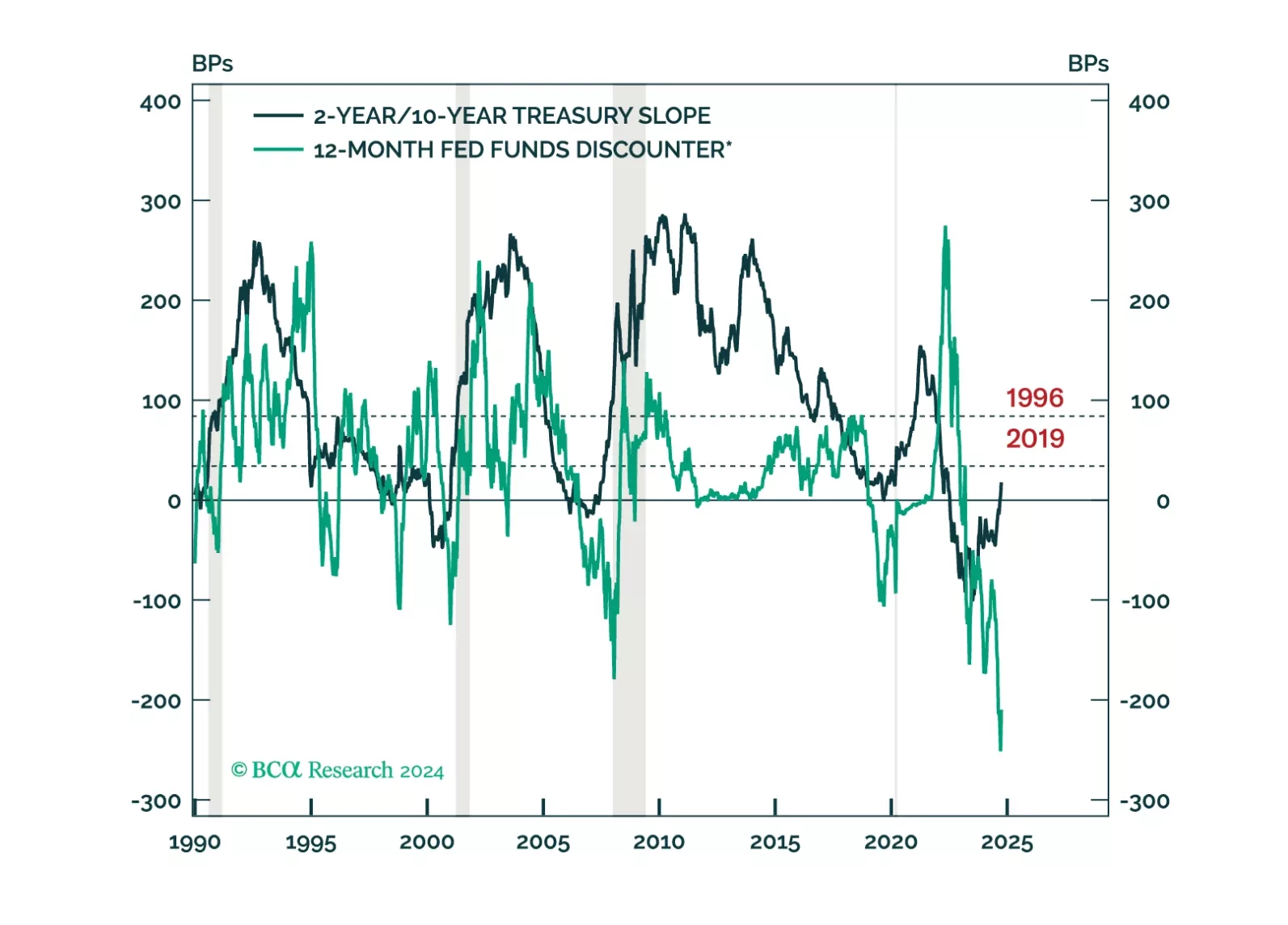

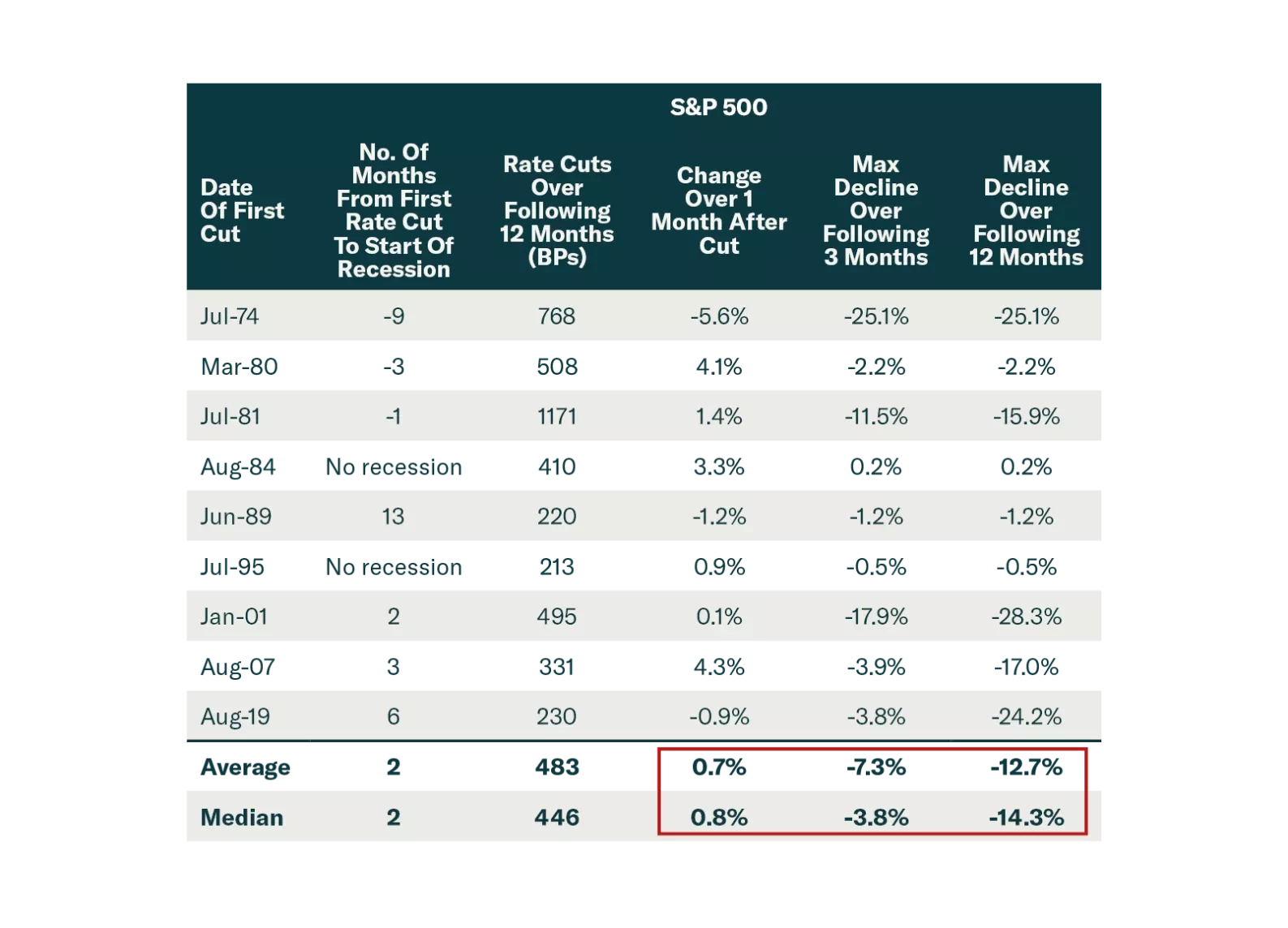

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

According to BCA Research’s Emerging Market Strategy service, the monetary and fiscal policies announced last week are unlikely to produce a meaningful business cycle recovery in China. Below are actions the authorities…

September’s Chinese PMIs were uninspiring. The Caixin manufacturing PMI dipped into contraction territory (50.4 to 49.3) despite expectations it would modestly improve. The alternative NBS manufacturing PMI improved from 49…

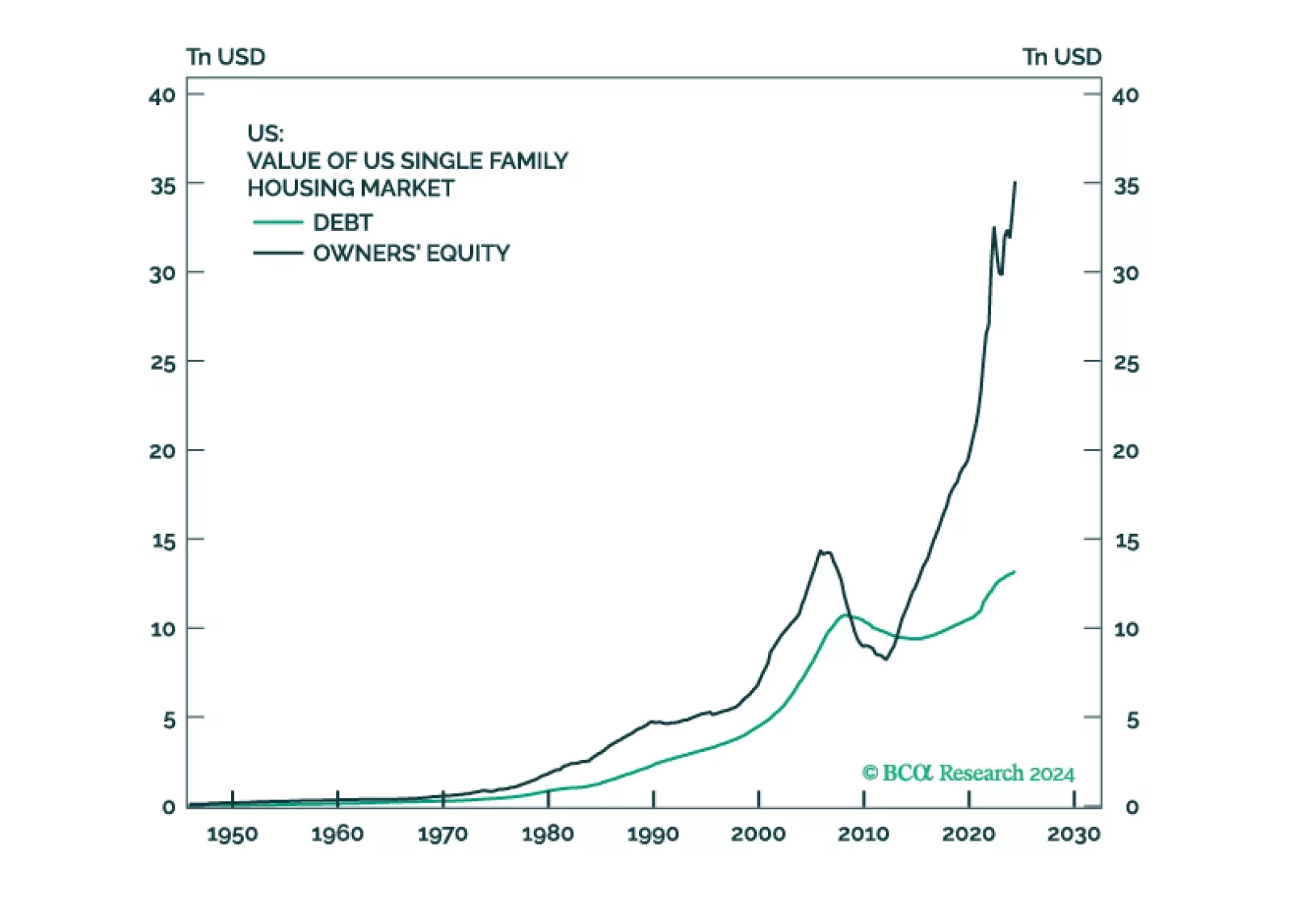

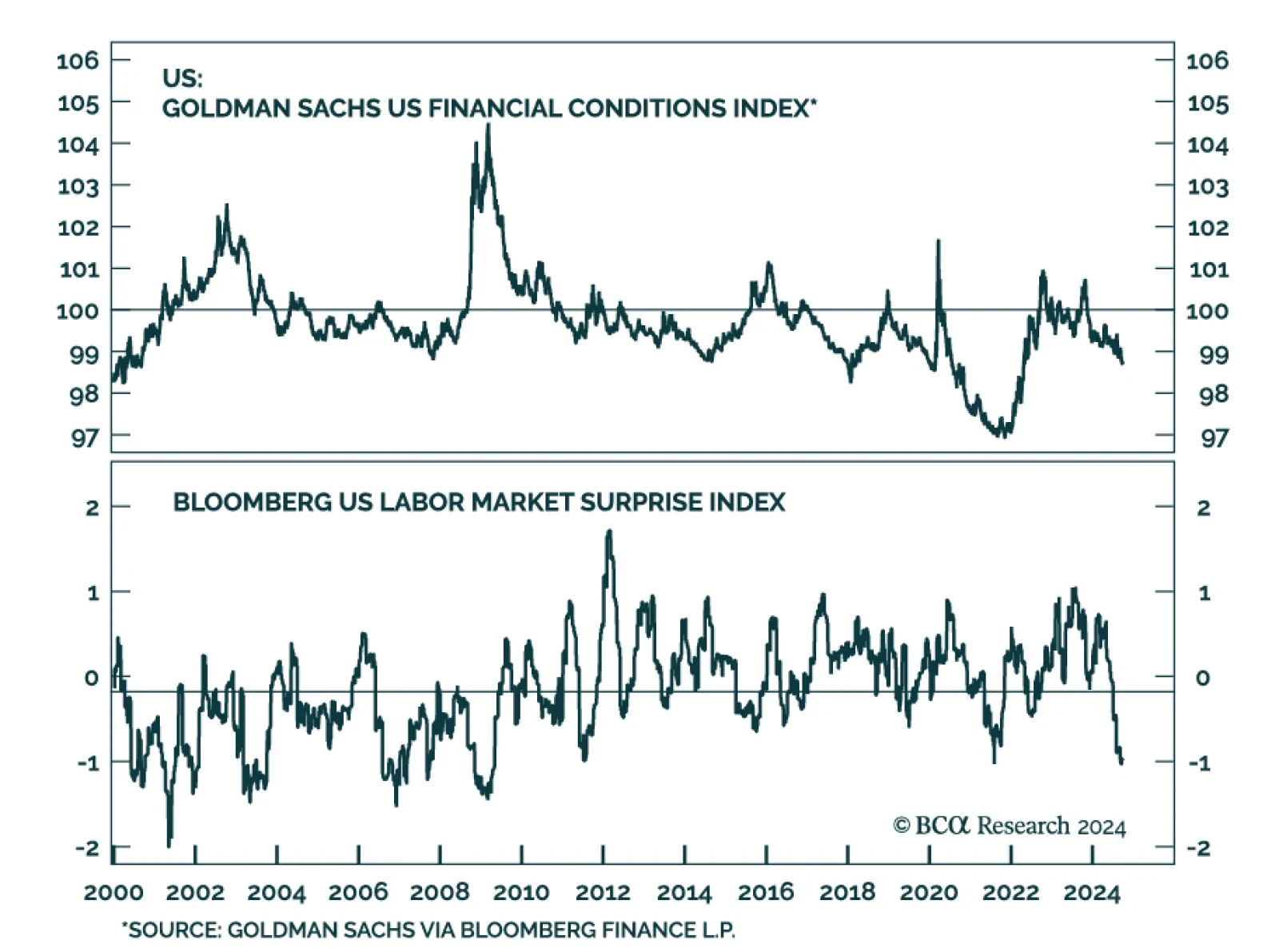

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…