Analysis on Turkey is available below. Highlights A dovish Fed or robust U.S. growth does not constitute sufficient conditions for a bull market in EM. China’s business and credit cycles are much more important factors for EM…

Highlights The Chinese economy is still slowing, and there is not yet enough evidence from forward-looking economic data to suggest a turnaround is imminent. Deflation has returned to China’s industrial sector. Even though…

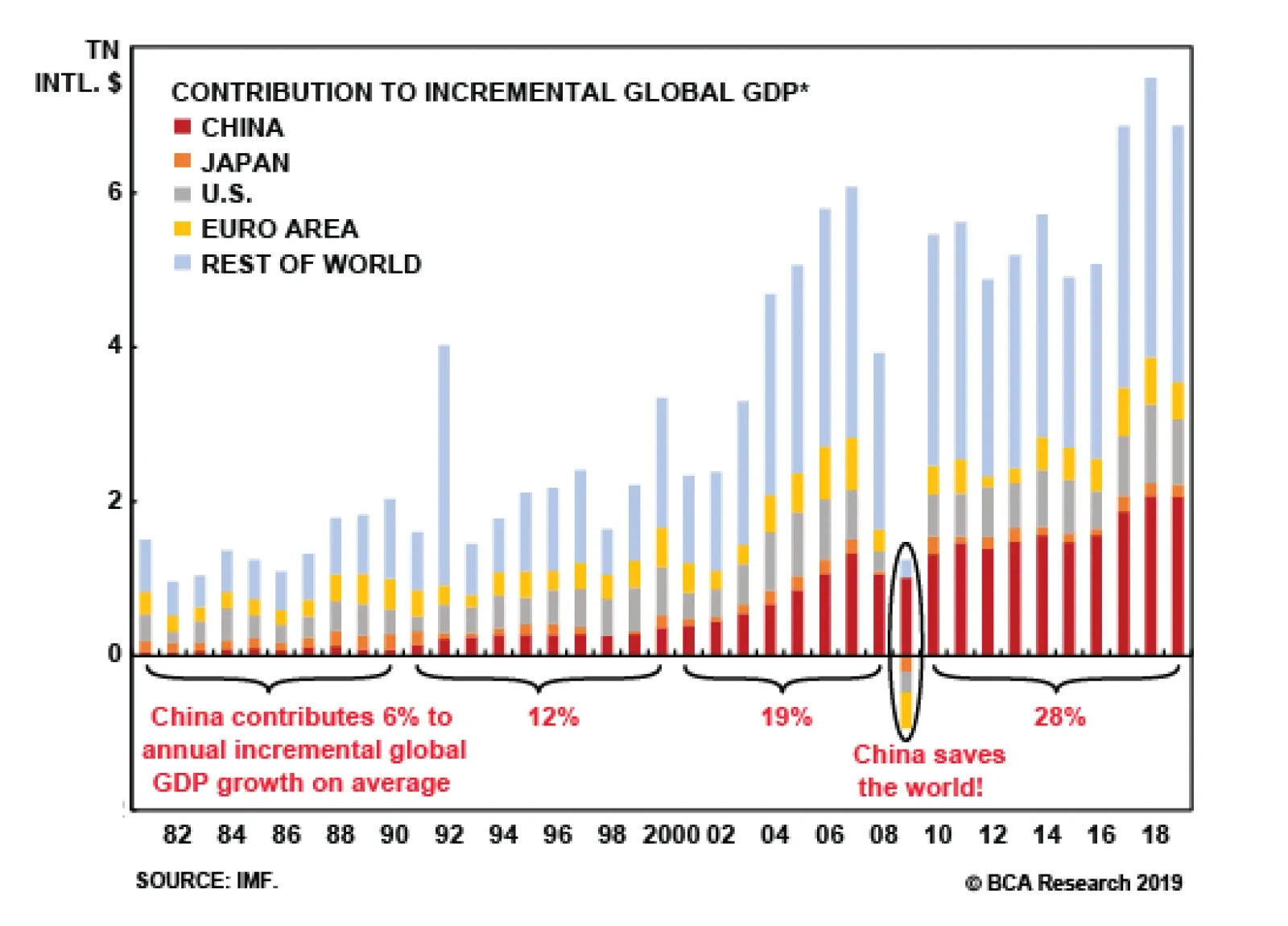

Speaking in the Reichstag in 1897, German Foreign Secretary Bernhard von Bülow proclaimed that it was time for Germany to demand “its own place in the sun.” The occasion was a debate on Germany’s policy…

The challenger power is not blameless. It senses weakness in the hegemon and begins to develop a regional sphere of influence. The problem is that regional hegemony is a perfect launching pad towards global hegemony. And while…

Highlights MARKET FORECASTS Investment Strategy: Markets have entered a “show me” phase. Better economic data and meaningful progress on the trade negotiations will be necessary for stocks to move sustainably…

Analysis on Chile is available below. Highlights Major equity leadership rotations normally occur around bear markets or corrections. Hence, a major broad selloff will likely be a precondition for EM, commodities, global cyclicals…

Highlights Chinese economic activity is declining at a slower pace, but has not yet bottomed. The September PMIs surprised to the upside, suggesting that activity improved last month. Still, PMIs can provide false signals (as they did…

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

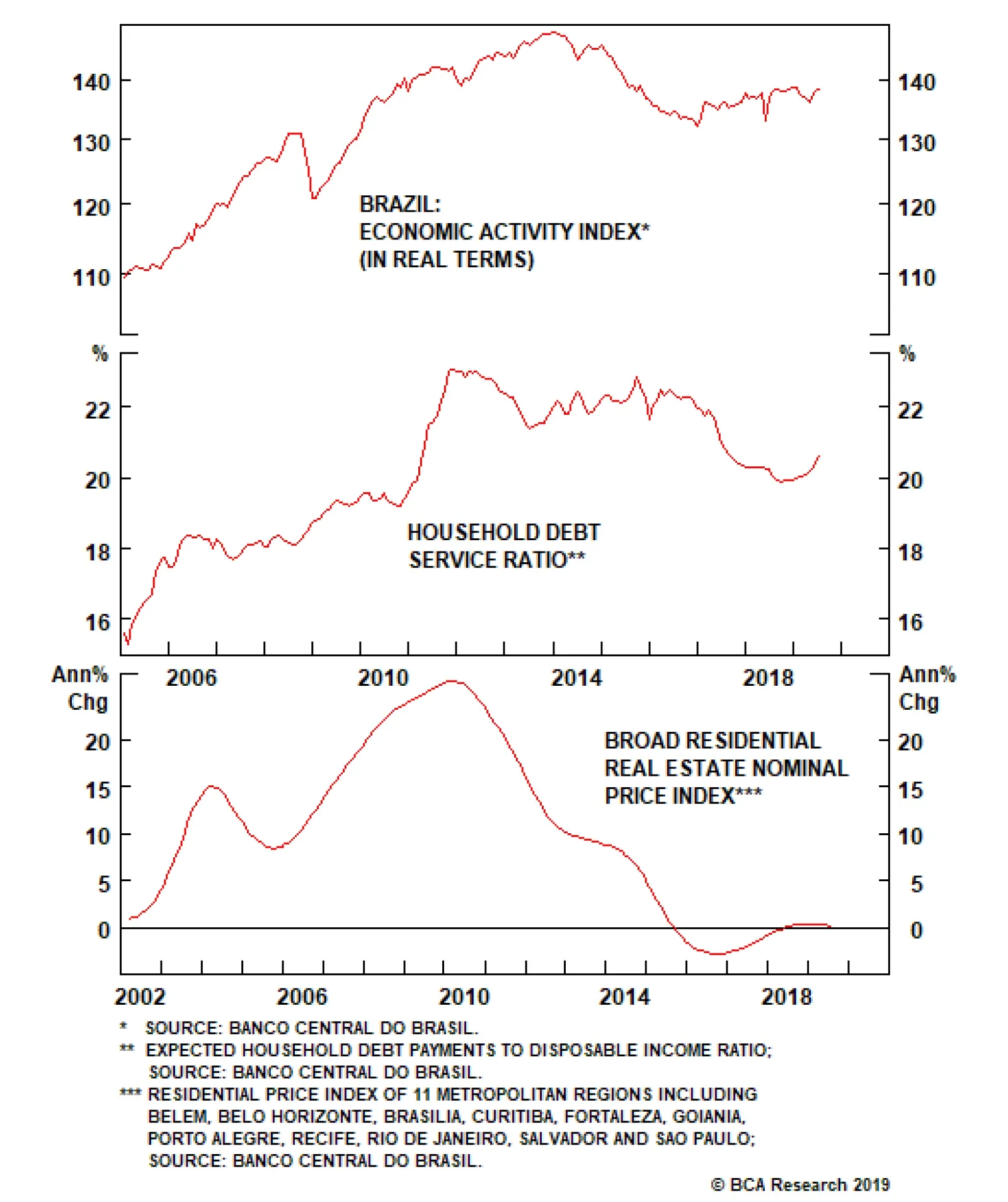

The Brazilian economy is recovering, albeit slowly. The level of economic activity is still well below its pre-recession level but is grinding slowly back. The key economic risk is stall speed. Like an aircraft, if the pace of…