Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook for the year ahead. This report is an edited transcript of our recent…

Highlights Lingering weakness evident in fundamental supply-demand data will fade next year, and with it the downward pressure on oil prices. Price risk is skewed to the upside: Continued monetary accommodation from systematically…

Highlights Analysis on the Chinese property market is available below. In the Philippines, domestic demand is set to accelerate at the hands of the government’s fiscal boost. The current account deficit will widen and the peso…

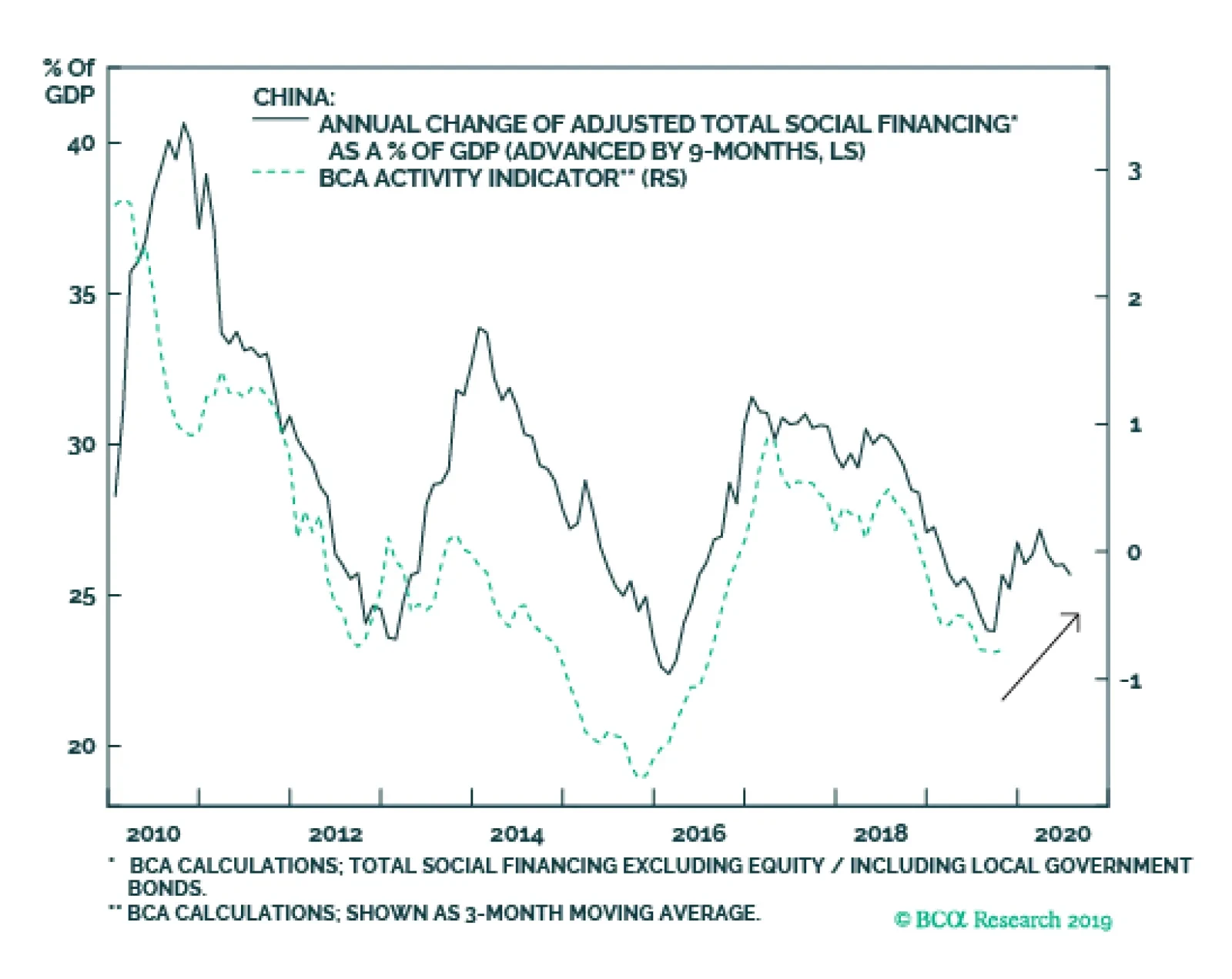

Historically, China’s credit formation has consistently led economic activity by about three quarters. Even though credit growth this year has not been as strong as in previous expansionary cycles, a turning point in the…

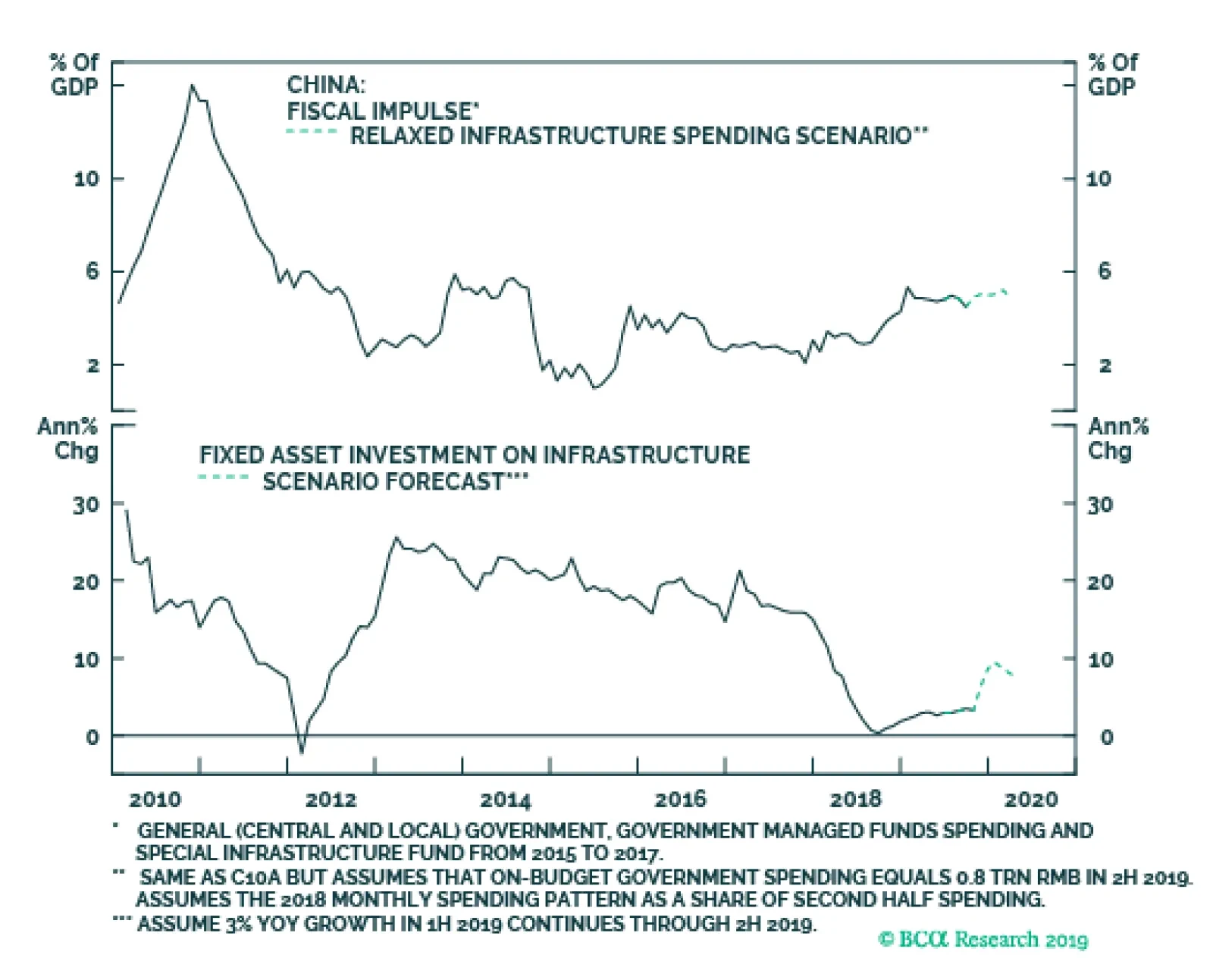

The Chinese economic growth model remains reliant on credit formation and capital investment. Therefore, the sustainability of an economic recovery depends on whether Chinese policymakers are willing to keep the stimulus wheel…

Feature We spent the past two weeks visiting and exchanging views with our clients in Asia. We presented our view that the ongoing stimulus measures are beginning to bear fruit in terms of stabilizing China’s economic activity, and…

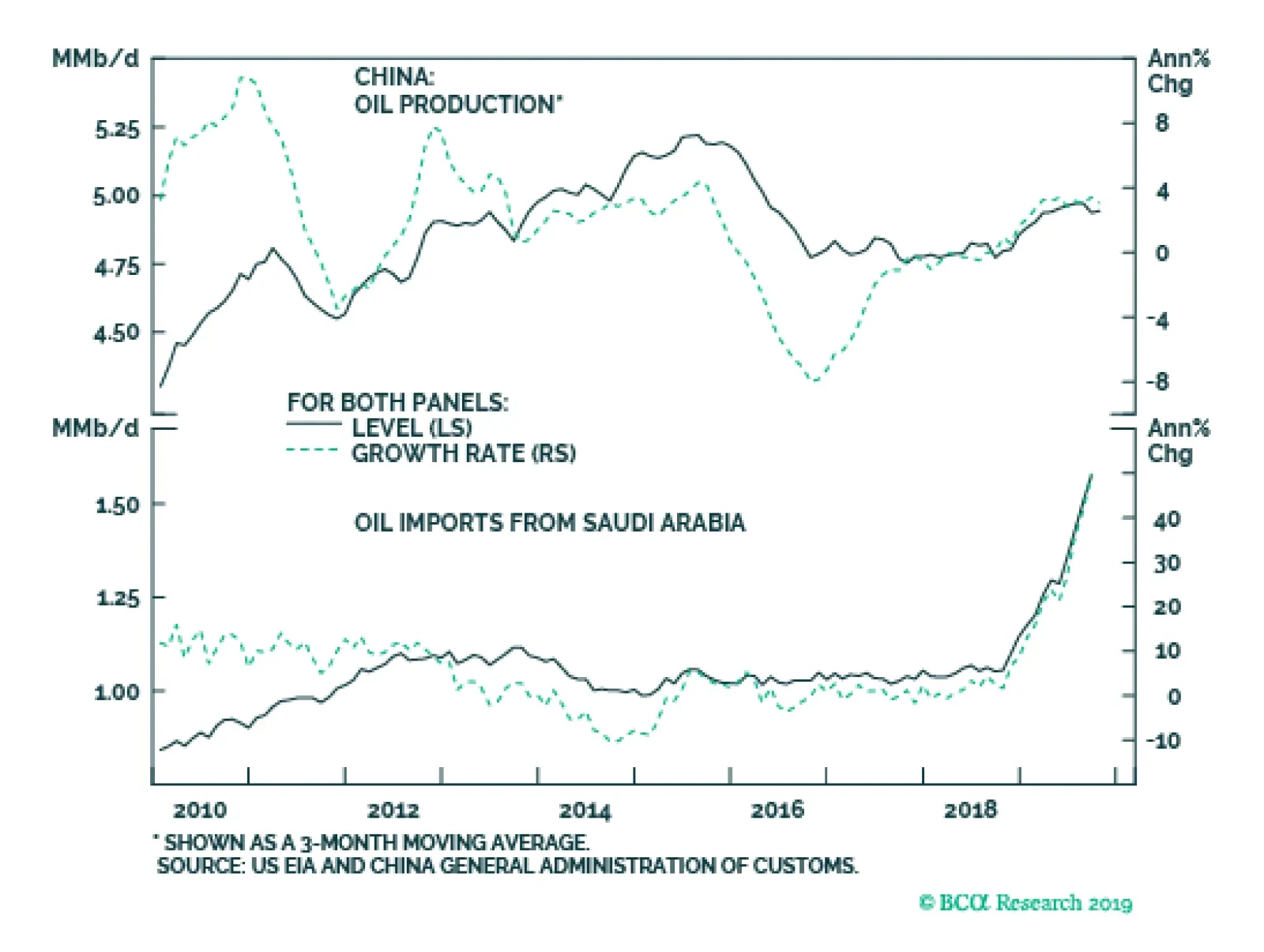

China’s interest in Aramco goes back almost four years. It reflects an economic and geopolitical calculus encompassing more than an equity claim on the world’s largest, lowest-cost, most profitable oil company.…

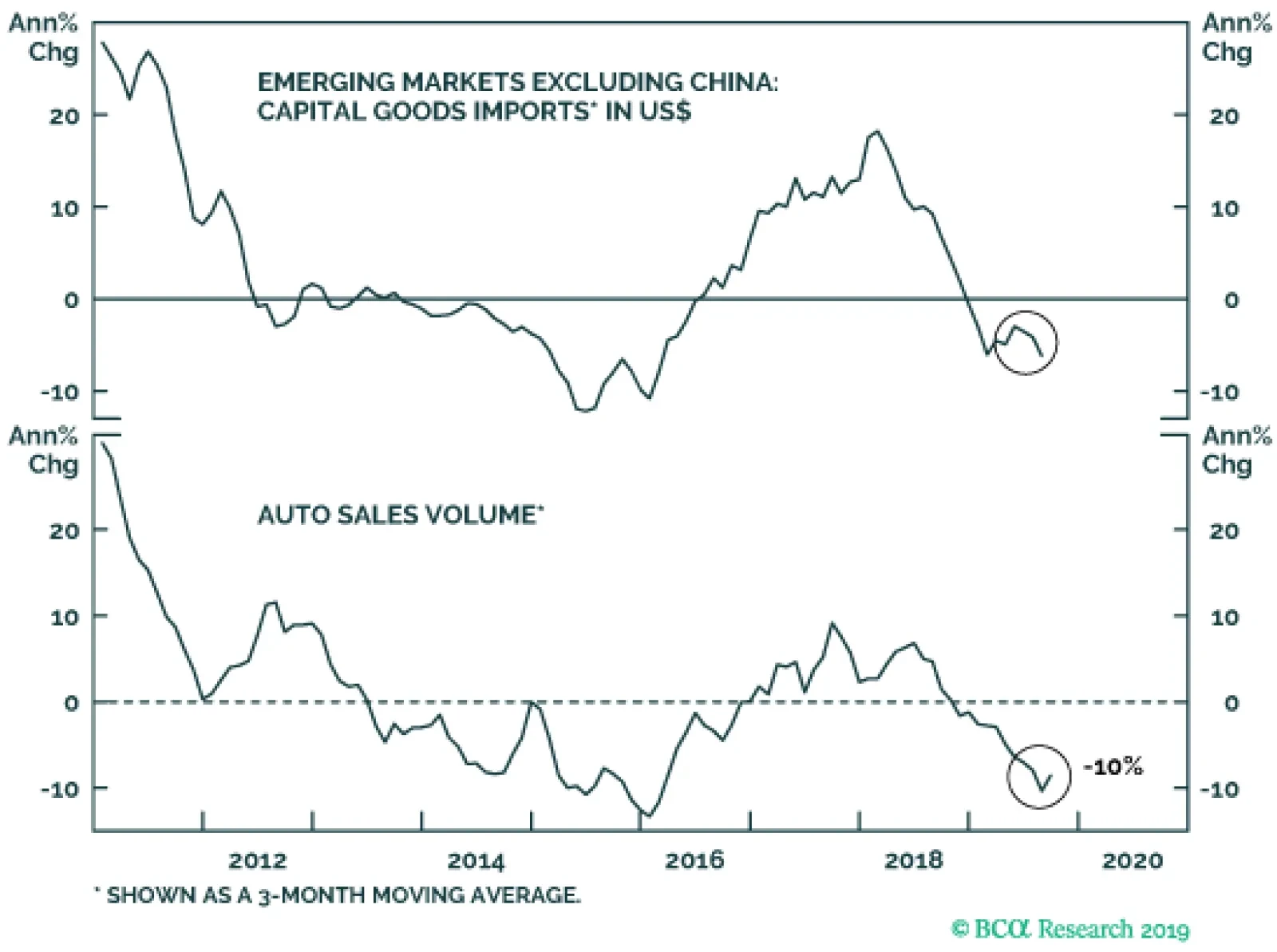

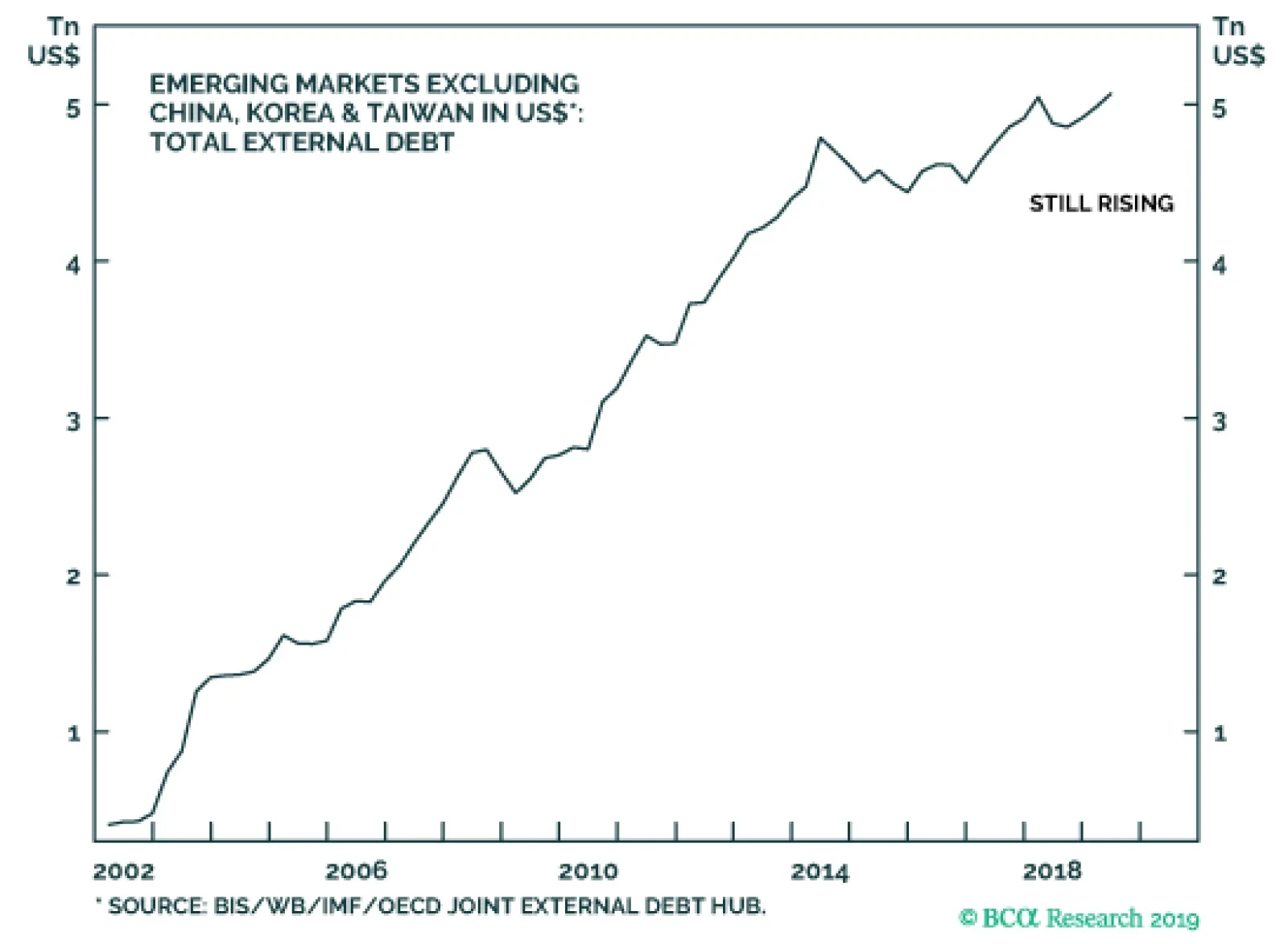

Low and rapidly falling inflation accompanying extremely weak real growth constitute the current hazards to EM economies and their financial markets. Headline and core inflation in EM ex-China, Korea and Taiwan – the…

Bond yields and exchange rates often act as shock absorbers and re-balancing mechanisms for the global economy. The agility and corresponding adjustments of these financial variables assure a more stable real global economy.…