Highlights Investors should remain overweight global stocks relative to bonds over the next 12 months and begin shifting equity exposure towards non-US markets. Bond yields will rise next year as global growth picks up, while the…

Highlights The US-China trade talks will continue despite Hong Kong. The UK election will not reintroduce no-deal Brexit risk – either in the short run or the long run. European political risk is set to rise from low levels,…

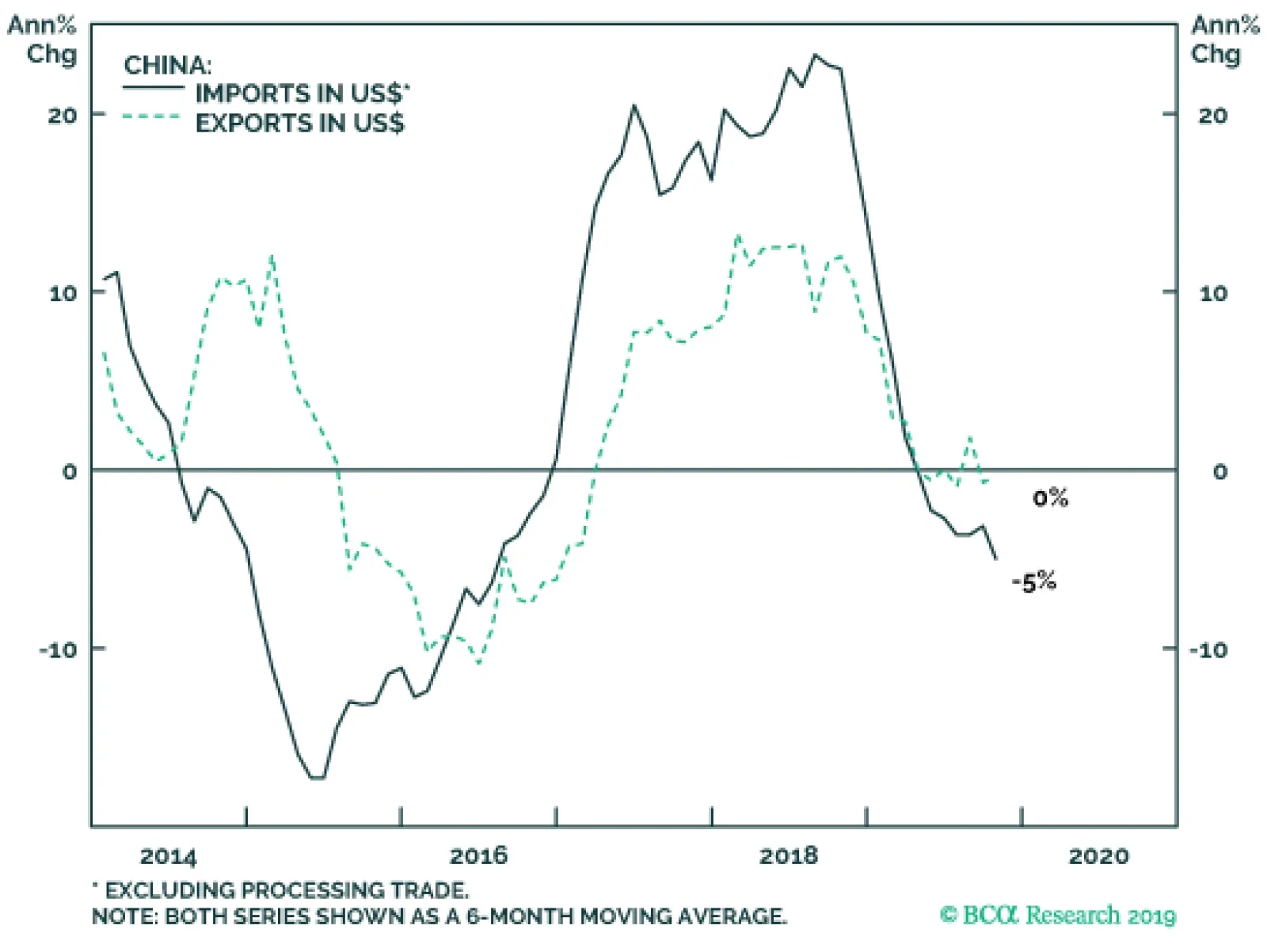

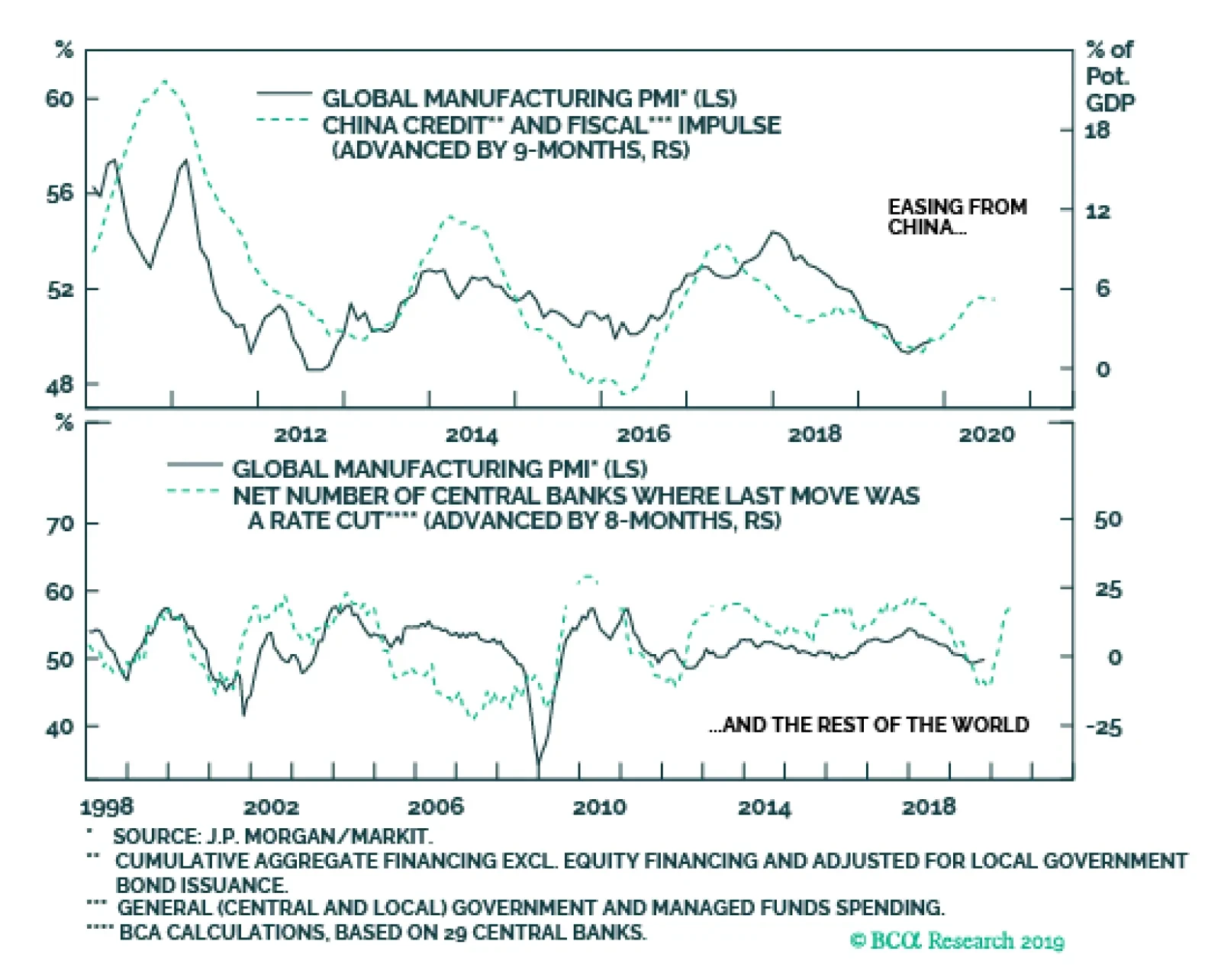

The disconnect is due to a somewhat false narrative that the global trade and manufacturing recession, as well as the EM/China slowdown, were primarily caused by the US-China trade confrontation. The principal reason behind…

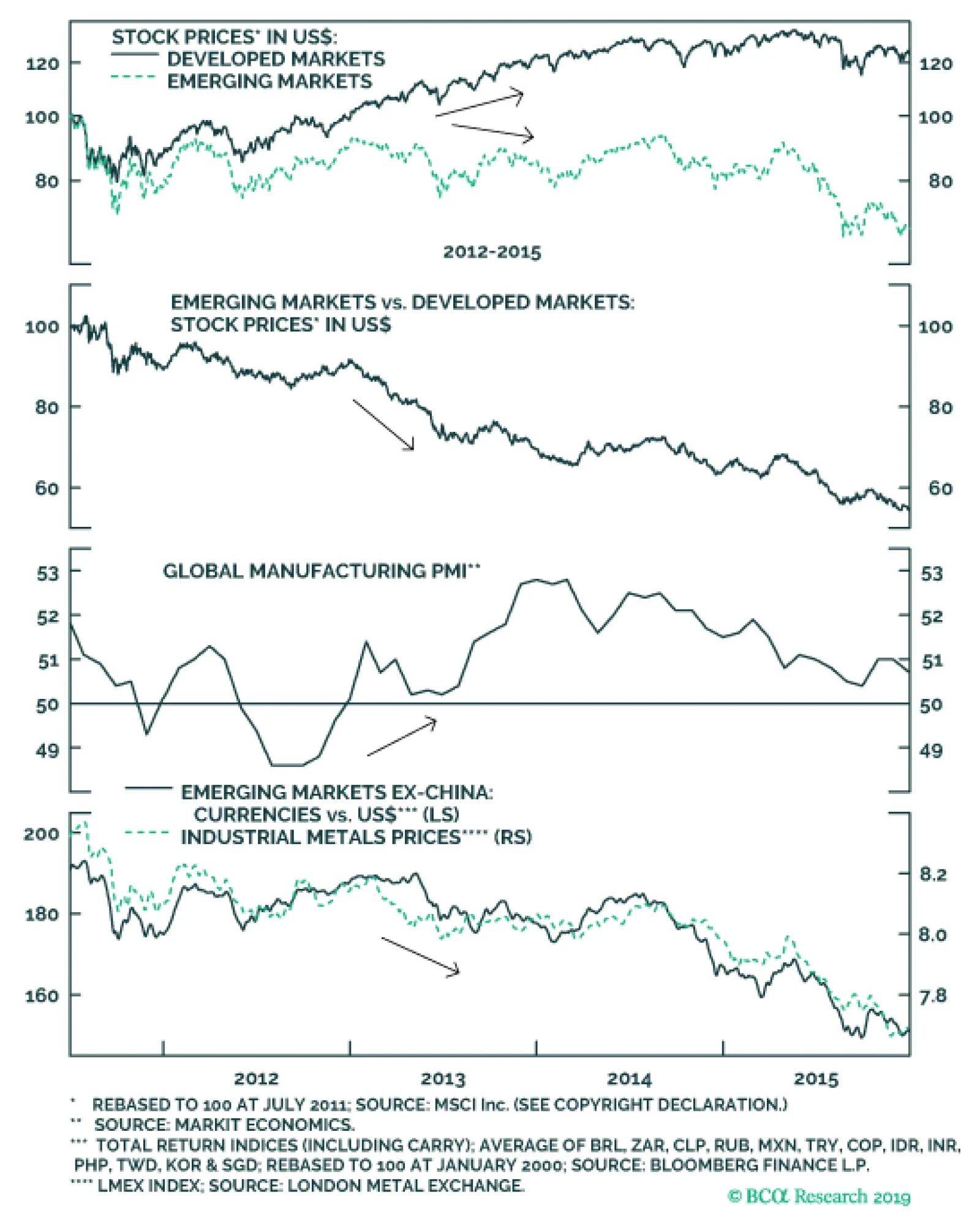

We do not believe in the sustainability of the current EM rebound in general, and the likelihood of an EM outperformance versus DM is particularly low. The high-beta segments of the US equity market and the overall Euro Stoxx…

An analysis on Brazil is available below. Feature Chart I-1Poor Performance By EM Stocks, Currencies And Commodities I had the pleasure of meeting again with a long-term BCA client Ms. Mea last week during my trip to Europe…

Highlights The seemingly interminable discussions around the “phase one” deal touted by US and Chinese trade negotiators notwithstanding, base metals prices are primed for a rally. The bottoming in base metals prices…

We expect Chinese policymakers to adopt a more pro-growth policy stance because they are spooked by the downtrend in their economy. While the Politburo Standing Committee has not abandoned its structural reform agenda, it…

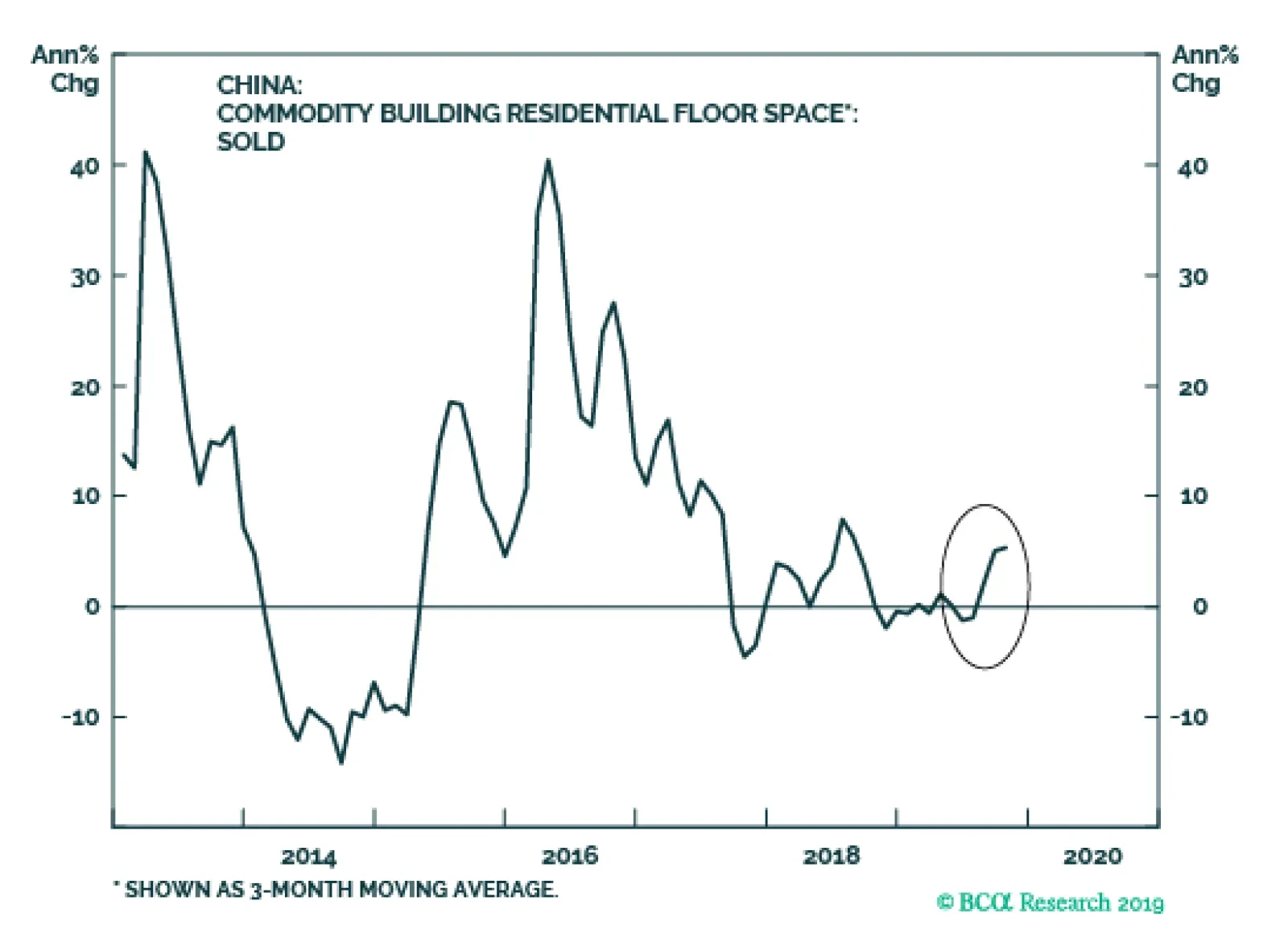

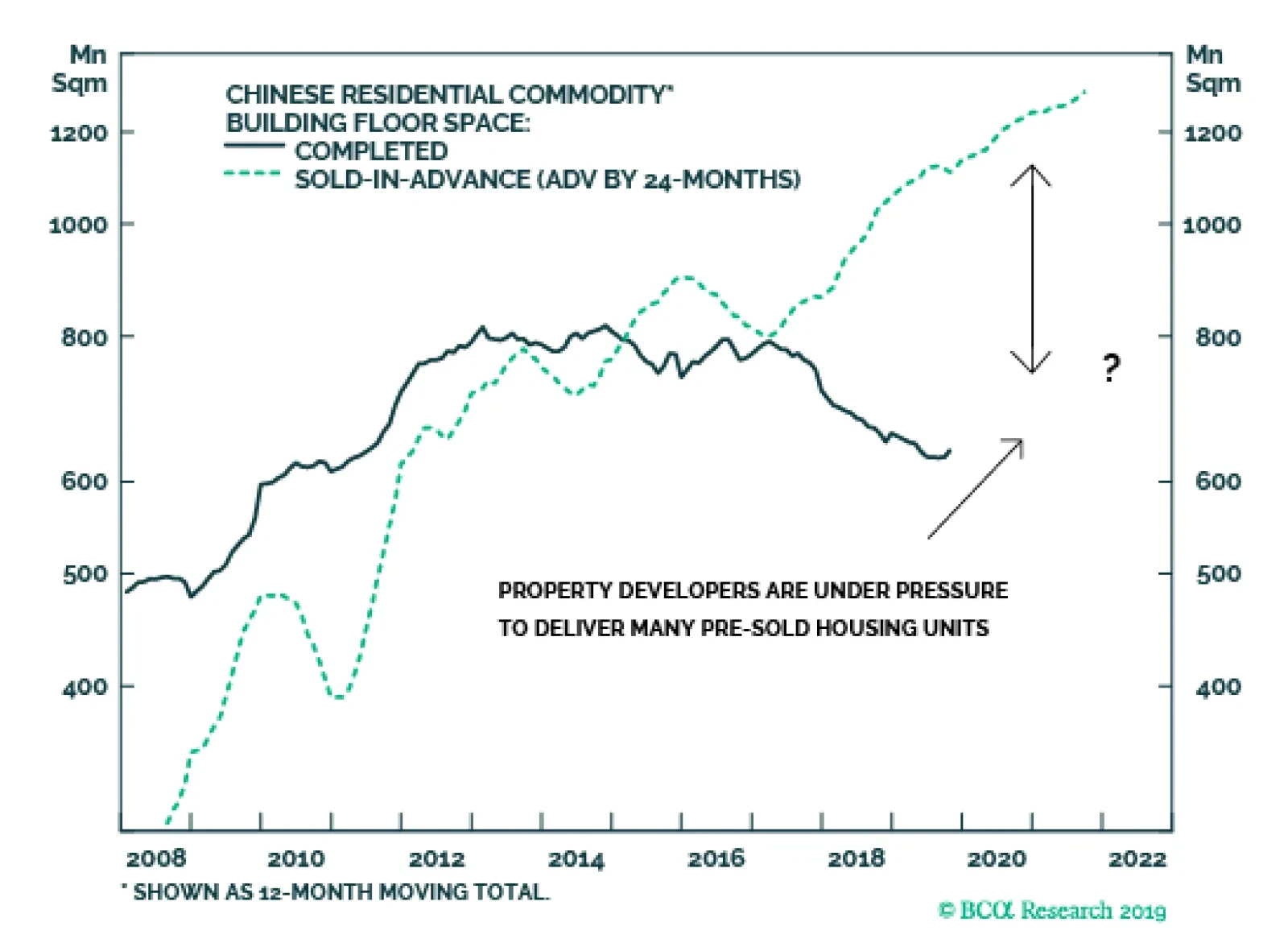

Falling home prices and relatively tight financing conditions for property developers will likely prevent a recovery in construction activity. There has recently been a pickup in residential property sales. Our research…

Falling Chinese property prices should discourage new starts and new construction. Falling prices signal that supply is exceeding demand, with producers typically responding by curtailing output. This holds true for any industry…