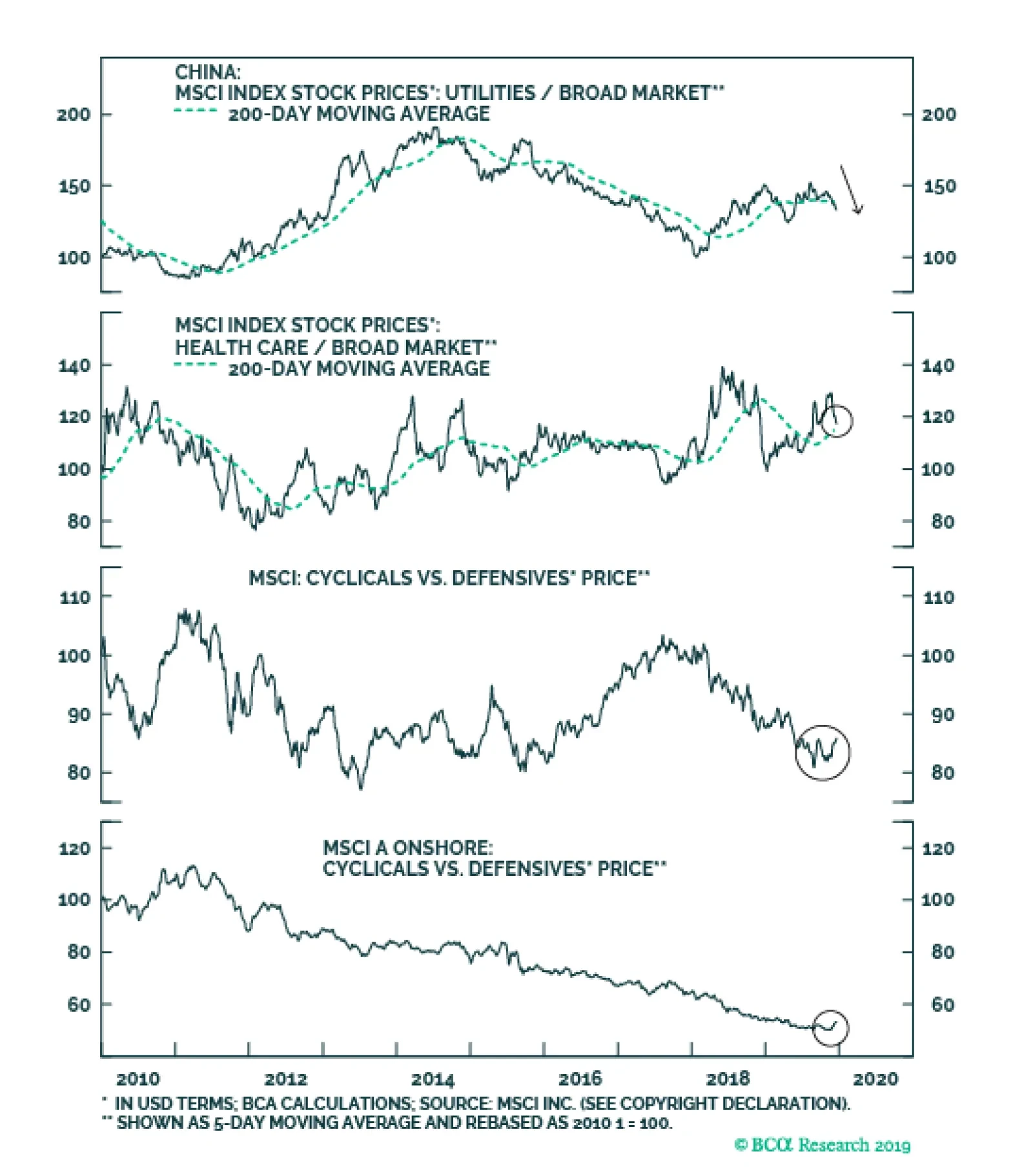

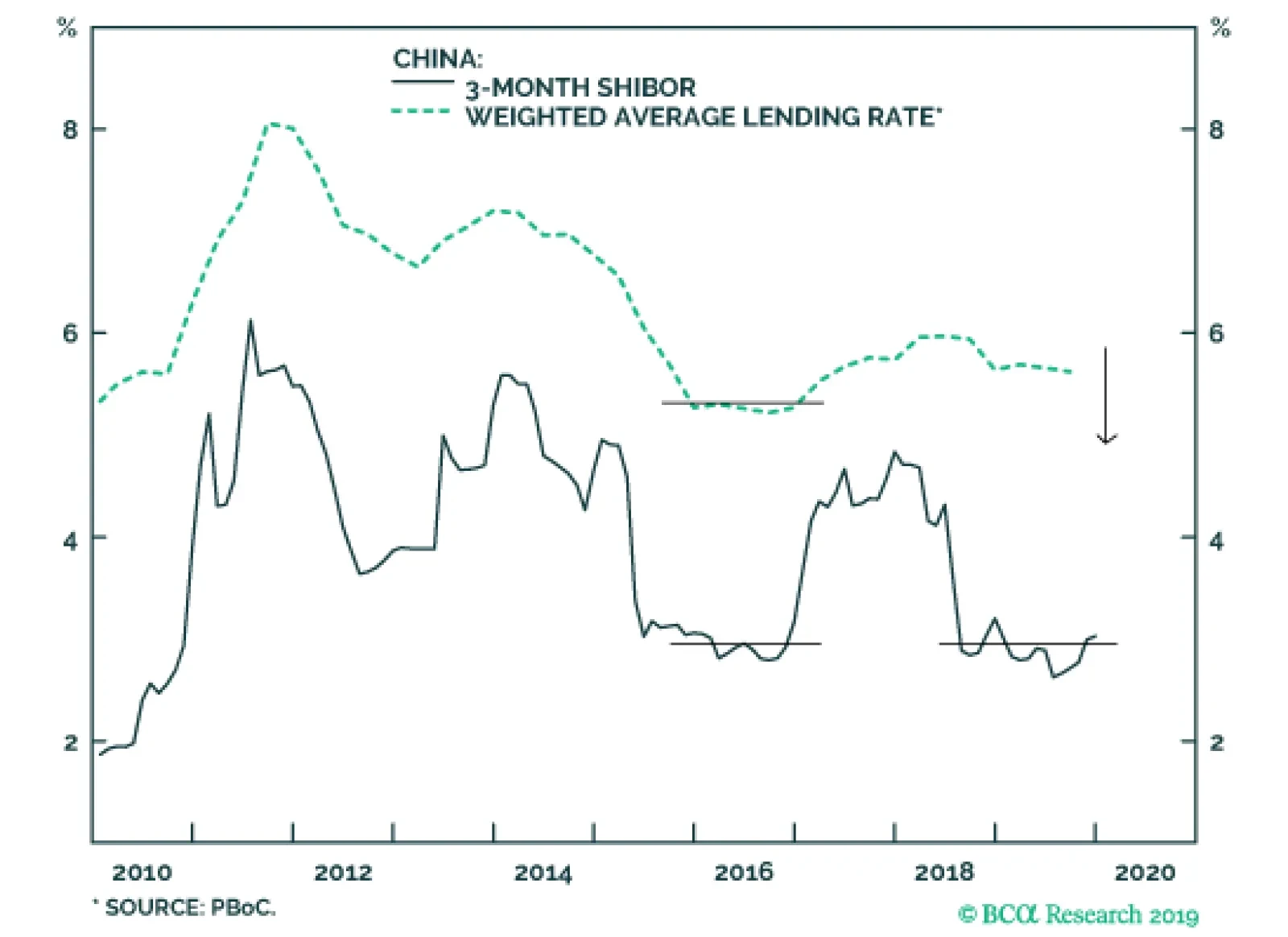

Chinese investable equity market is sending a bullish signal. This shift is accompanied by two modestly bullish developments: First, the annual China Economic Work Conference (CEWC) concluded on December 12 with support for…

2020 will mark the final year of the “Three Major Battles” against financial deleveraging, poverty elimination, and pollution. In this year’s CEWC statement, for the first time in three years, the order of…

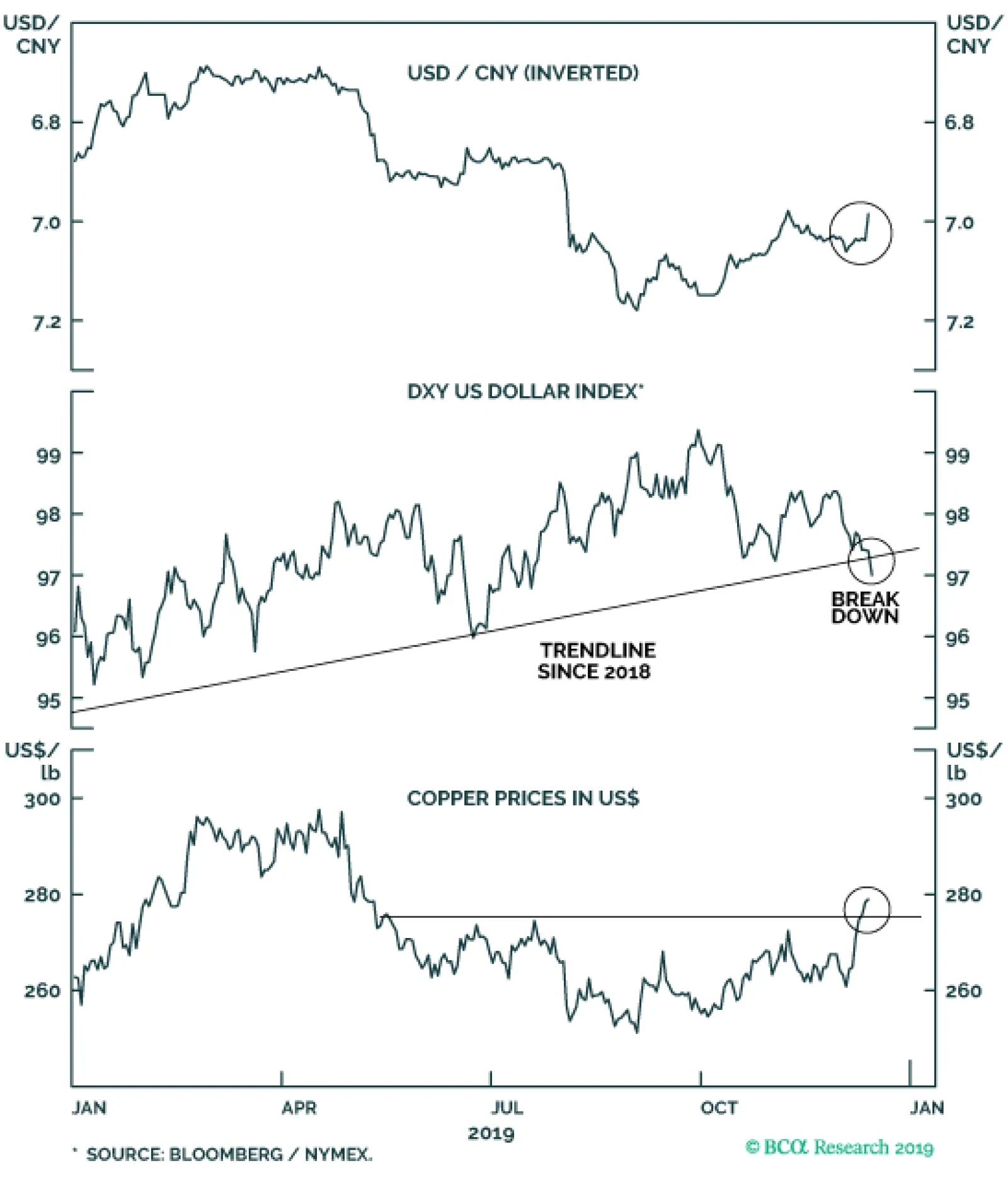

An analysis on Ukraine is available below. Highlights A number of liquidity and technical reasons have led us to give benefit of the doubt to the bullish market action and chase this EM rally. We still doubt that the US-China…

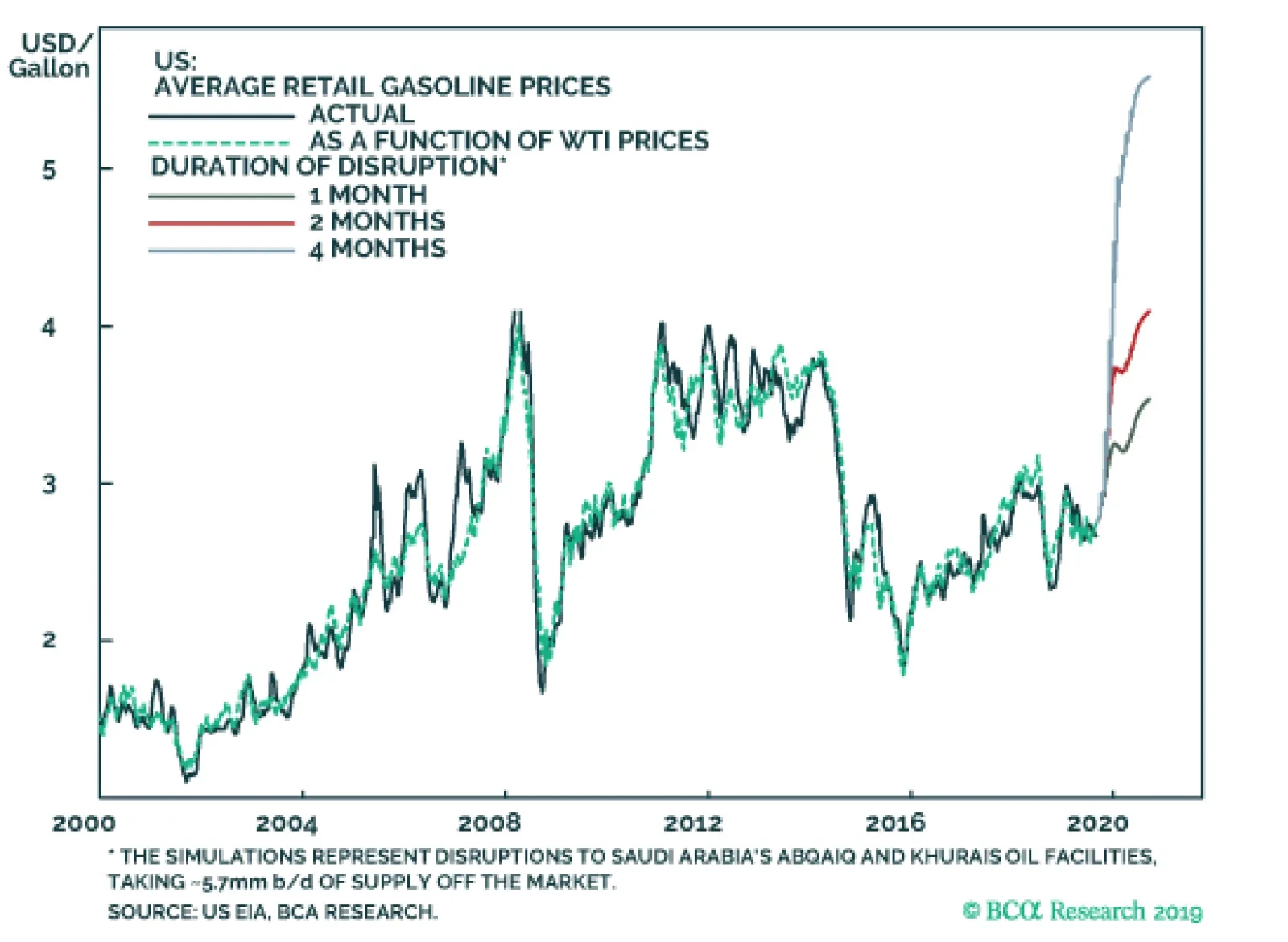

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

Dear Clients, In our final publication of the year, we bring you a recap of this past week’s significant events in Sino-US relations and the key messages from the Central Economic Work Conference. Accordingly, we are upgrading our…

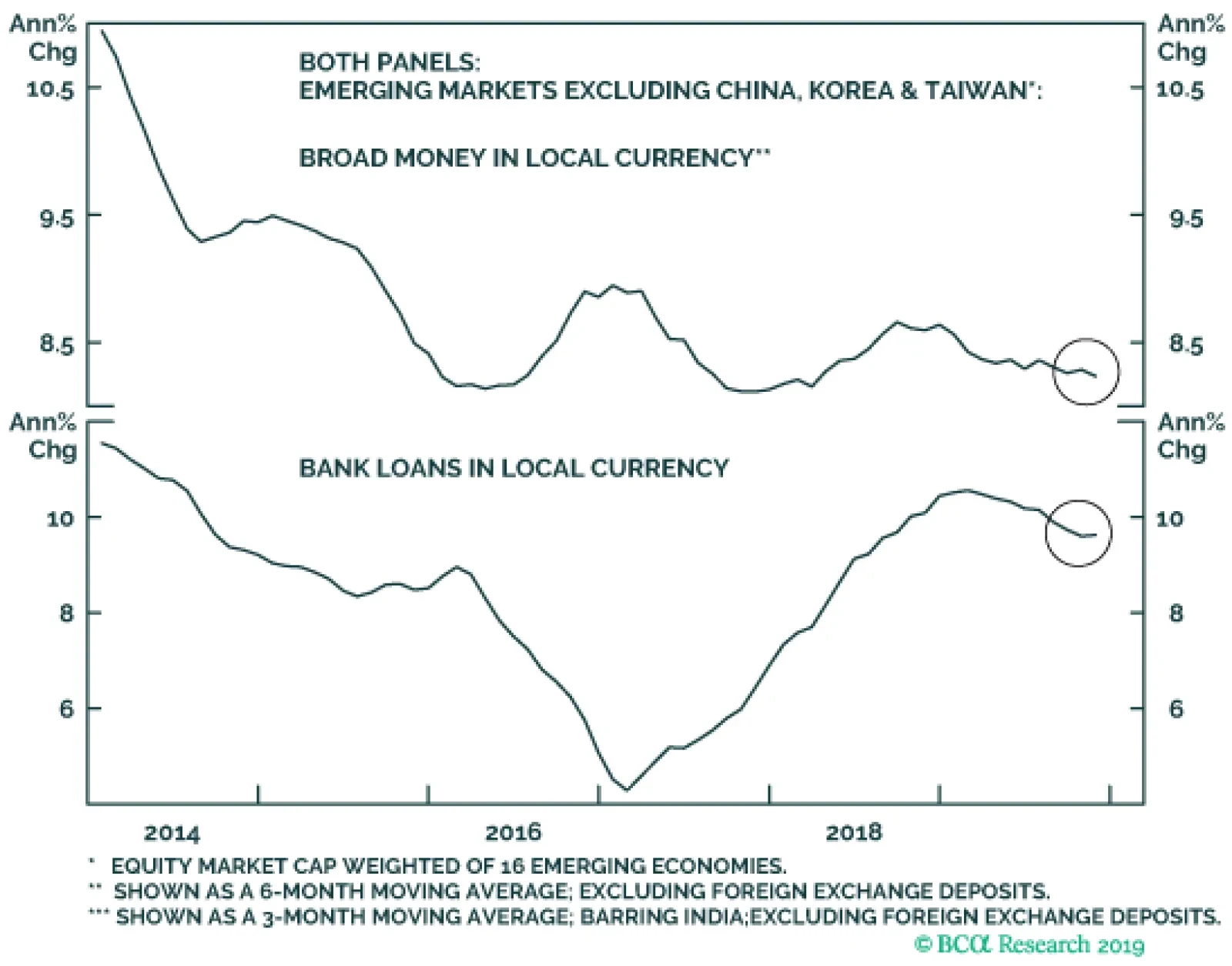

In EM ex-China, Korea and Taiwan, not only are exports weak, but domestic demand remains downbeat. Despite interest rate cuts by EM central banks, real interest rates remain elevated because inflation has dropped as much as…

Deflationary pressures are mounting in Thailand. Therefore, the central bank will cut interest rates much further. Hence, we continue to recommend overweighting Thai domestic bonds within an EM local bond portfolio, currency…

Opinion polls show that the Iranian public primarily blames the government for the collapsing economy, and yet that American sanctions are siphoning off some of this anger. This could tempt Iran’s leaders to stage…

Details of the deal have still not been fully clarified in a consistent fashion by both sides; but one thing is clear, no further tariffs are forthcoming next year as long as China abides by its agricultural purchases. The main…