Highlights Incoming economic data suggests that China’s economy is in the process of bottoming, but also that the intensity of a recovery is likely to be more muted than it has been during past economic cycles. Recent Chinese…

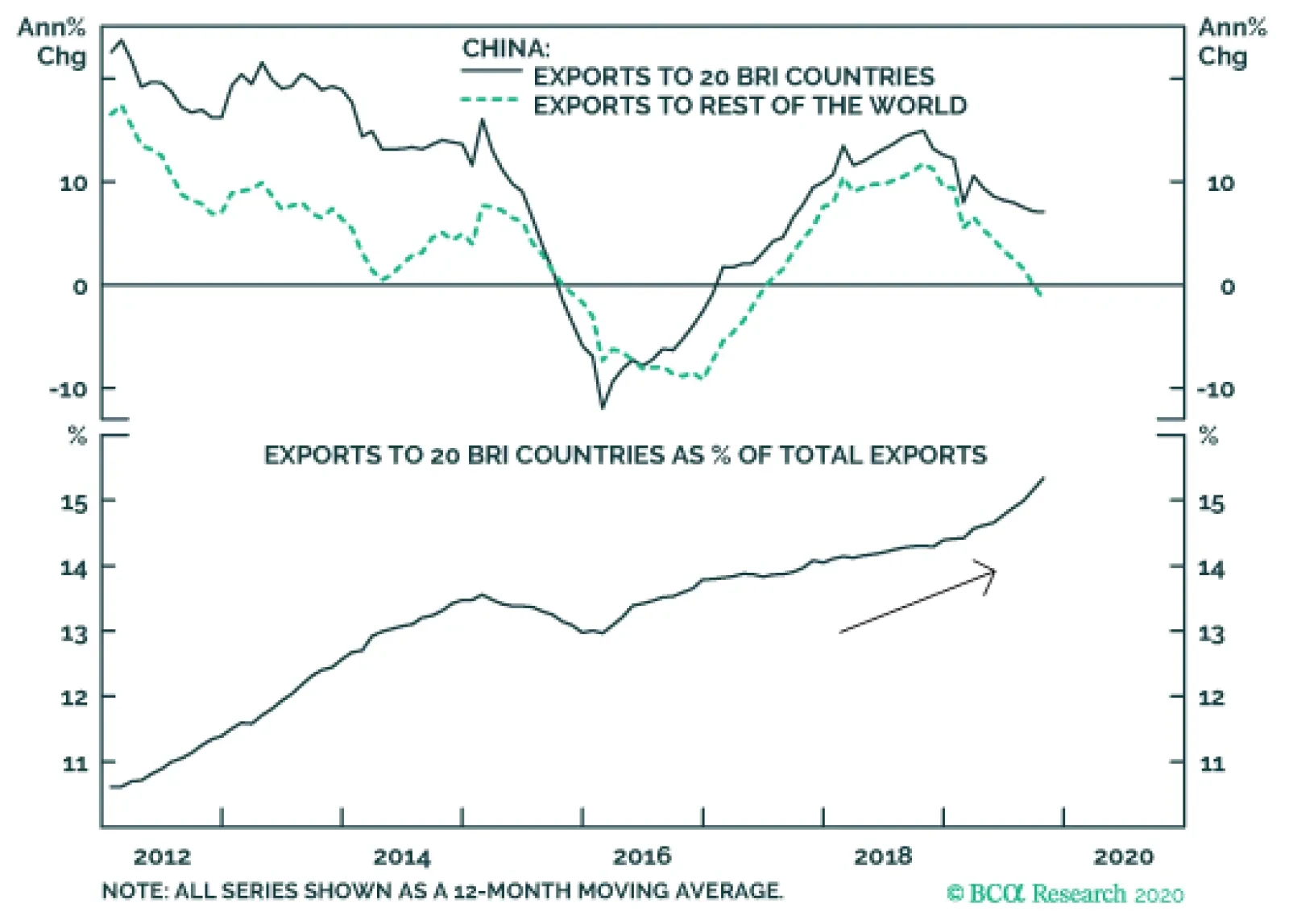

China's exports to BRI countries have done much better than its shipments elsewhere. There are two primary reasons behind the stronger growth in Chinese exports to BRI-recipient countries: As most of China’s…

Highlights The US and Iran are not rushing into a full-scale war for the moment – and yet the bull market in US-Iran tensions will continue for at least the next 2-3 years (Chart 1). This means that while global risk assets can…

Highlights 2020 Model Bond Portfolio Positioning: Translating our 2020 global fixed income Key Views into recommended positioning within our model bond portfolio comes up with the following conclusions: target a moderately aggressive…

With the killing of General Soleimani, Middle Eastern tensions are once again surging. In the US, the House of Representatives may try to wrestle the power to wage war away from President Trump, but the Senate will not…

Feature One of BCA Research’s key geopolitical views since May 2019, outlined recently in our 2020 Outlook, is rapidly materializing: a dramatic escalation in the US-Iran conflict. On January 3 the United States successfully…

Feature Recommended Allocation Since BCA published its 2020 Outlook,1 and the December GAA Monthly Portfolio Update,2 nothing has happened to make us fundamentally change our views. We see the global manufacturing cycle…

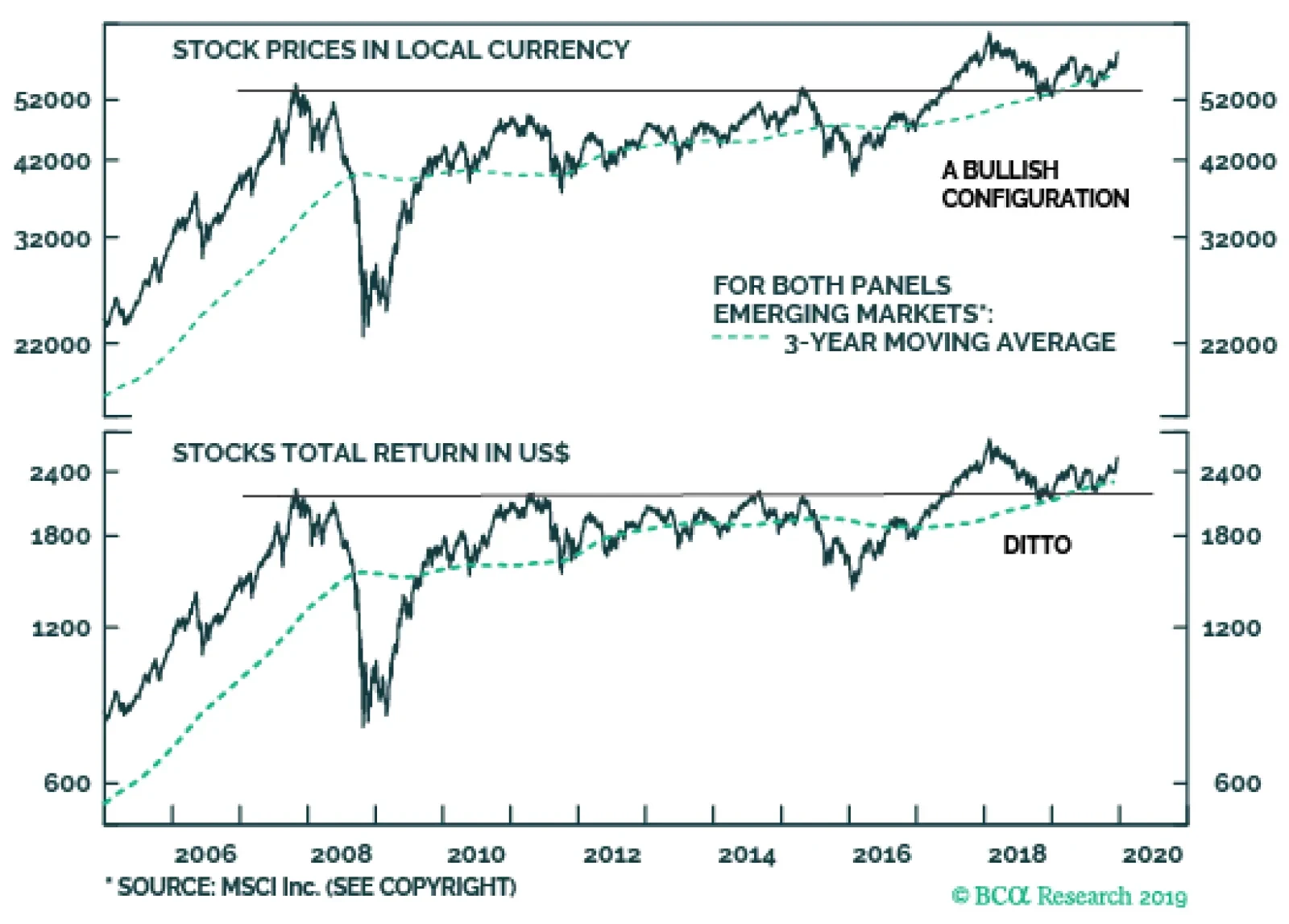

The global liquidity backdrop appears to be conducive for higher share prices. Additionally, the technical profile of EM equities is rather bullish, EM share prices have found a support at their six-year moving average. As…