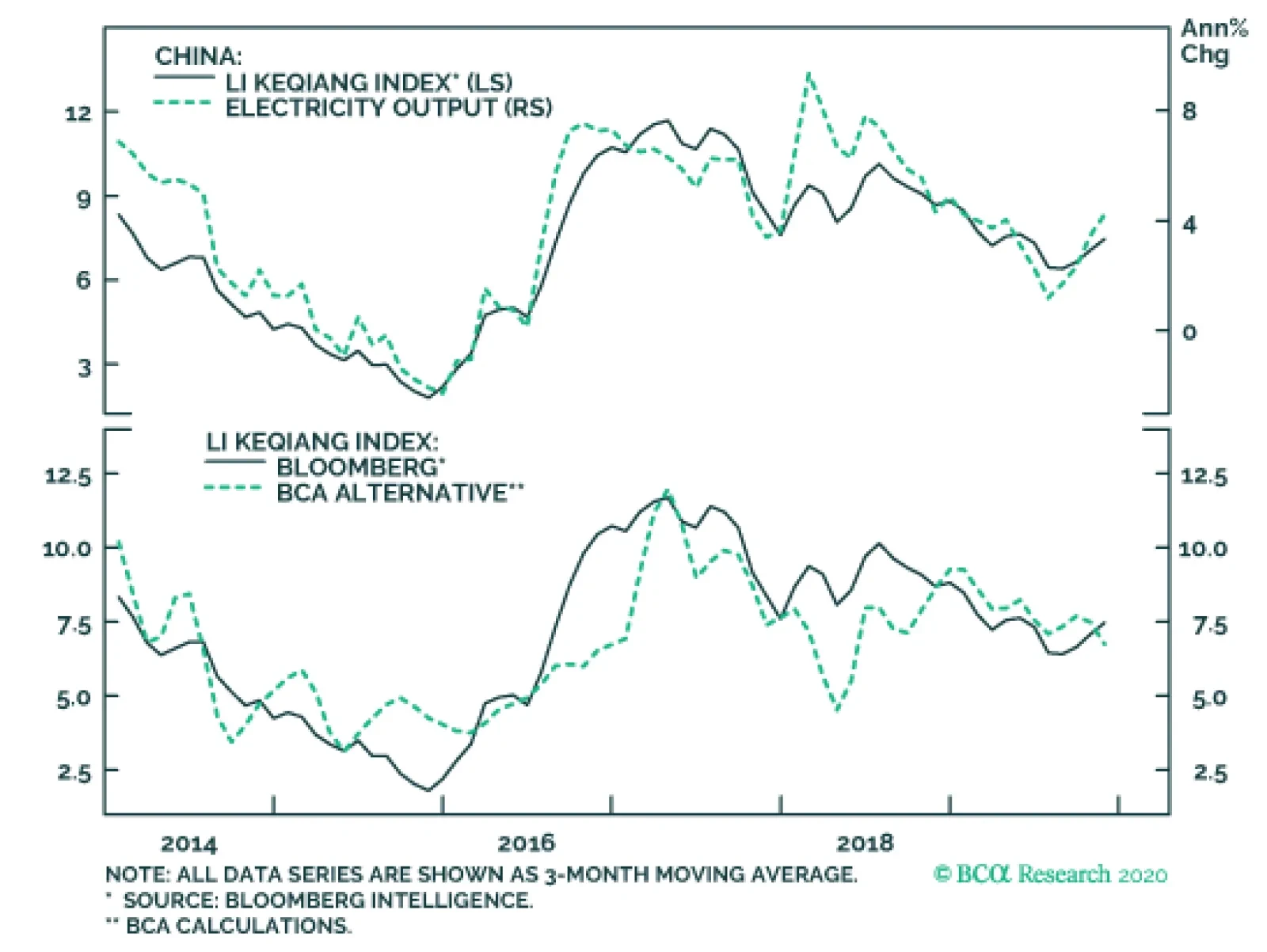

On a smoothed basis, the Bloomberg Li Keqiang index (LKI) rose in November, driven largely by an improvement in electricity output. While our alternative LKI is weaker than Bloomberg’s measure, we see the improvement in the…

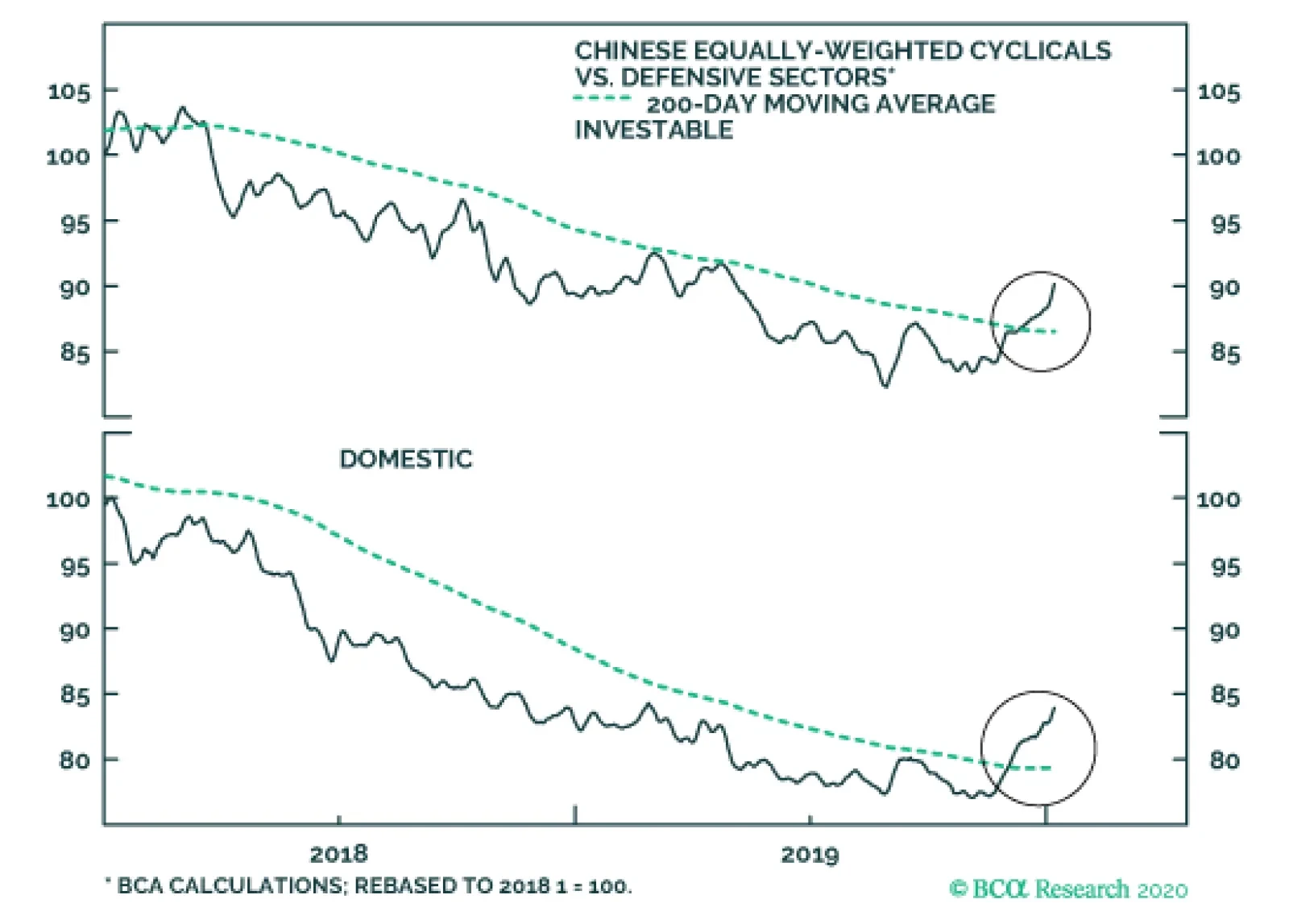

Over the past month, the most notable equity development is that cyclical sectors have outperformed defensives in both the investable and domestic markets and have broken above their respective 200-day moving averages. Among the…

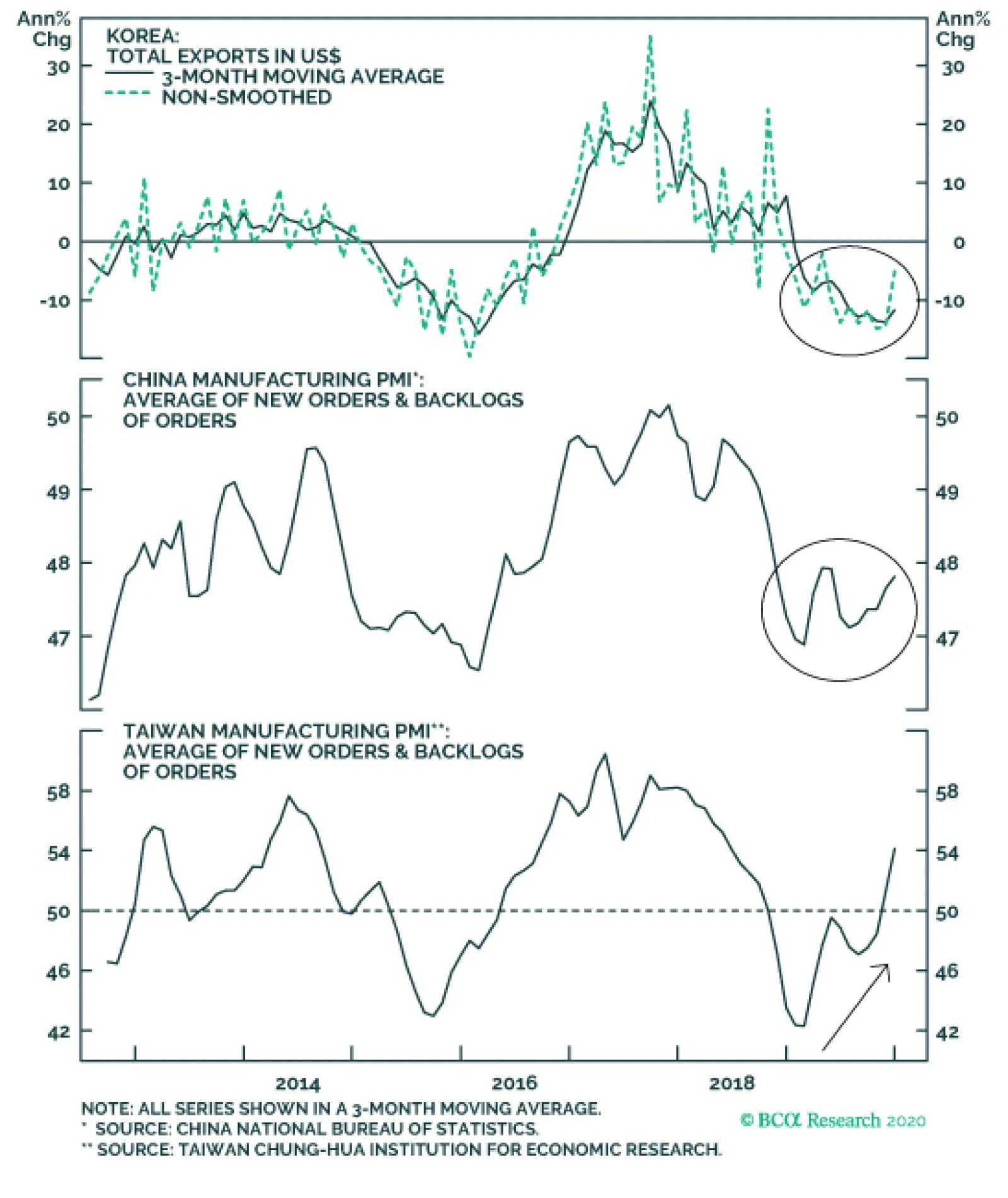

A number of green shoots are emerging in Asia. December data point to a budding recovery in Asia’s business cycle: manufacturing PMIs rose in December in Korea, Taiwan and Singapore. The measure was flattish in China and…

Highlights Remain short the DXY index. The key risk to this view is a US-led rebound in global growth, or a pickup in US inflation that tilts the Federal Reserve to a relatively more hawkish bias. Stay long a petrocurrency basket. The…

Highlights Global Investment Strategy View Matrix Receding trade tensions; diminished risks of a hard Brexit; reduced odds of a victory for Elizabeth Warren in the US presidential elections; liquidity injections by most…

We doubt any serious US-Iran negotiations will take shape until 2021 at the earliest – and any negotiations could fail and lead to another, more serious round of military exchanges. This means that today’s reprieve…

Highlights Iran responded with missile attacks on Iraqi military bases hosting US troops in retaliation for the assassination of Gen. Qassem Soleimani, the commander of the Quds Force. The post-attack messaging from Iran and the US…

Highlights An analysis on Indonesia is available below. We intend to maintain our long EM stocks position, initiated on December 19, as long as the MSCI EM equity index does not break below our stop point of 6% below current levels.…