Highlights An analysis on India is available on page 12. There is extreme complacency in global financial markets. With currency markets’ implied volatility at a record low, we recommend going long EM currency volatility. The…

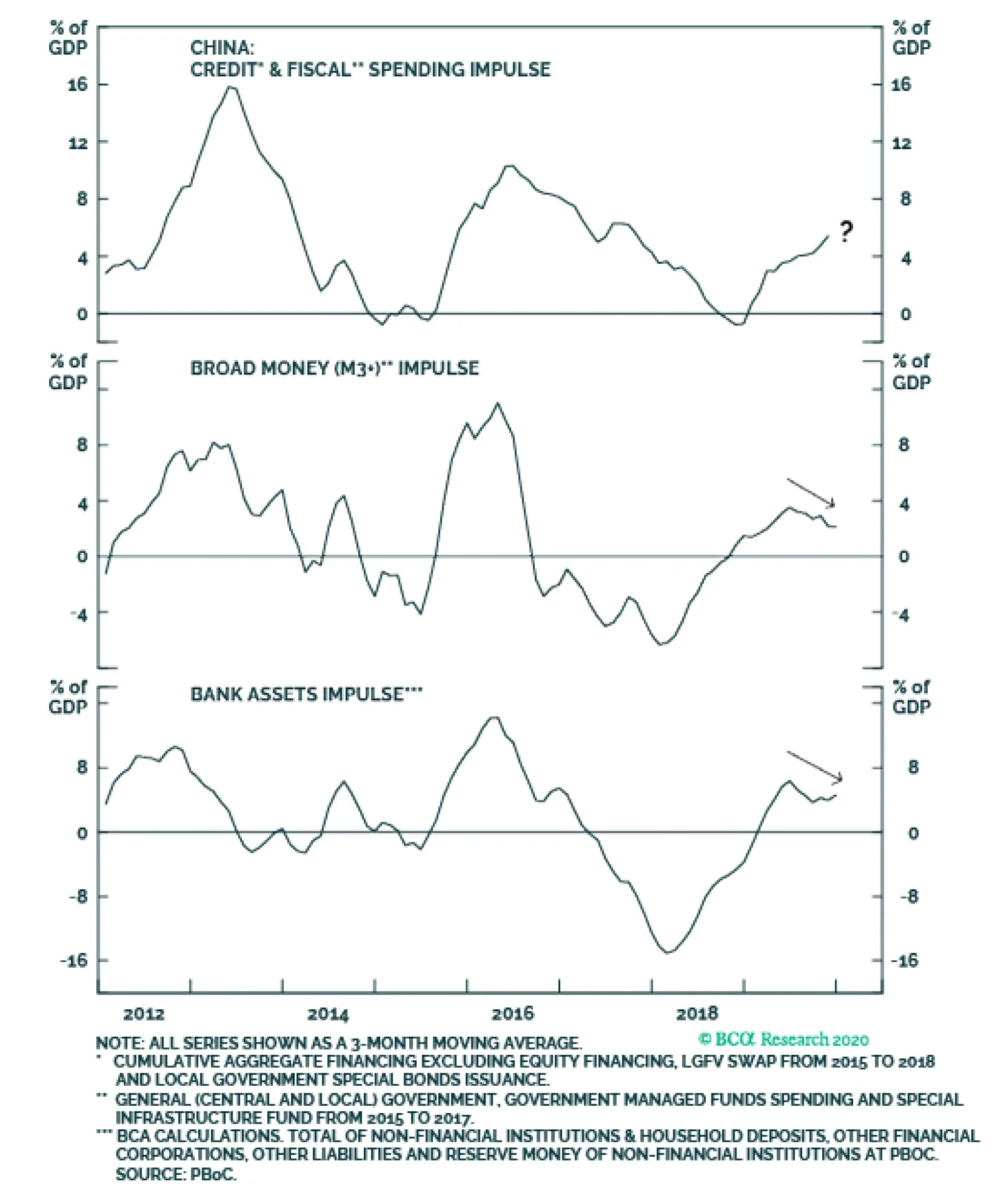

Highlights The bank credit 6-month impulse is likely to drop sharply in Europe, drop modestly in the US, but remain positive in China. Hence, the momentum of first-half economic data is likely to be worse in Europe than in China…

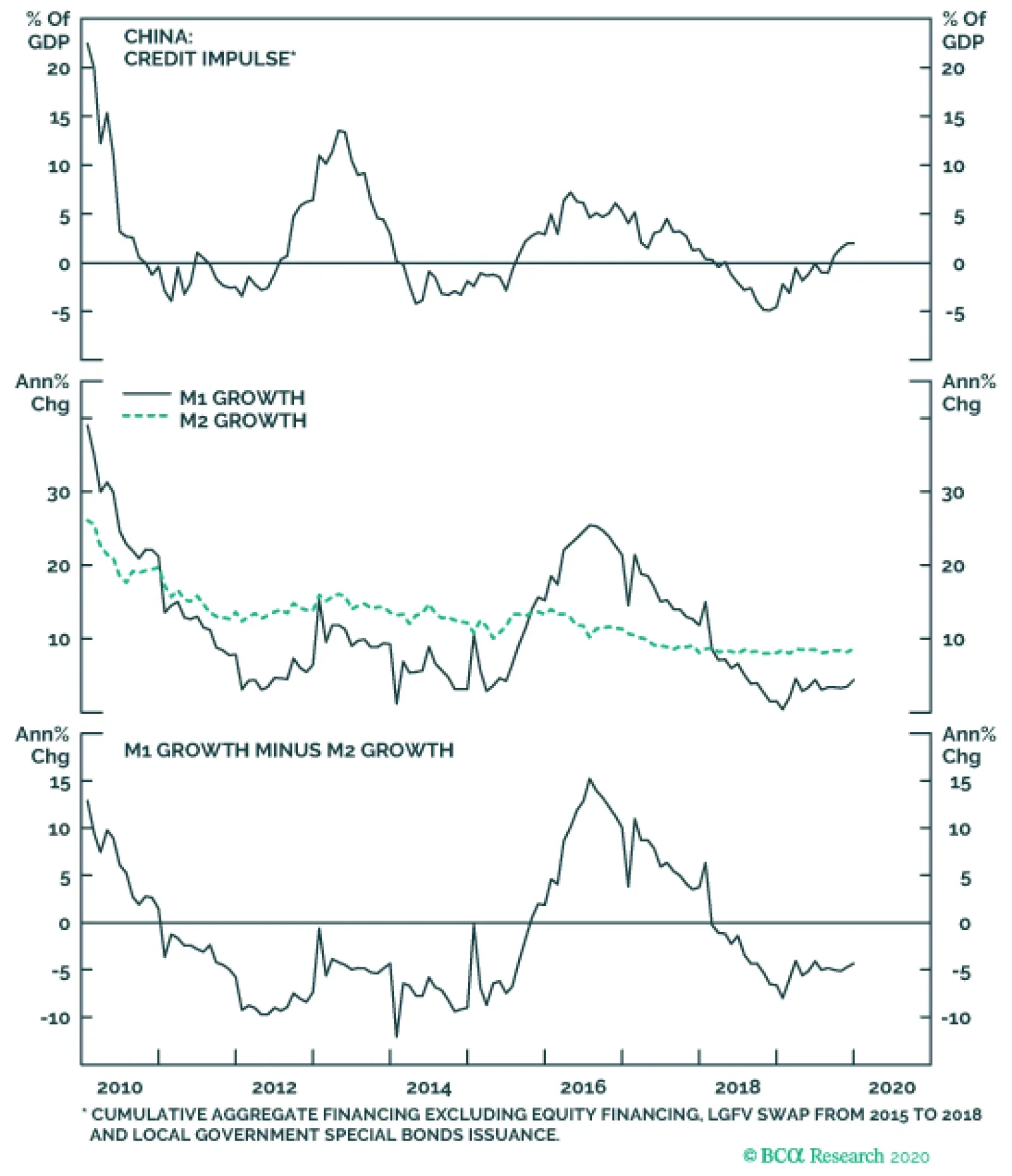

Highlights The recently signed Phase One deal is positive for China and global equity markets as it brings a temporary truce to the trade war. However, China is unlikely to change its current policy trajectory to create additional…

While Chinese authorities are most likely targeting “around 6%” in 2020, the authorities may allow an undershoot in the 5.5%-5.9% range. They will argue that the GDP target for 2020 has already been met on a compound…

Highlights We continue to have a positive view on global equities over the next 12 months, but see heightened risks of a near-term correction. Despite dwindling spare capacity, government bond yields are still lower today than they…

Highlights We expect both the Australian dollar and Chinese RMB to move higher in the coming months. A key catalyst is broad-based weakness in the US dollar. The composition of goods benefiting from the US-China Phase I deal are a…

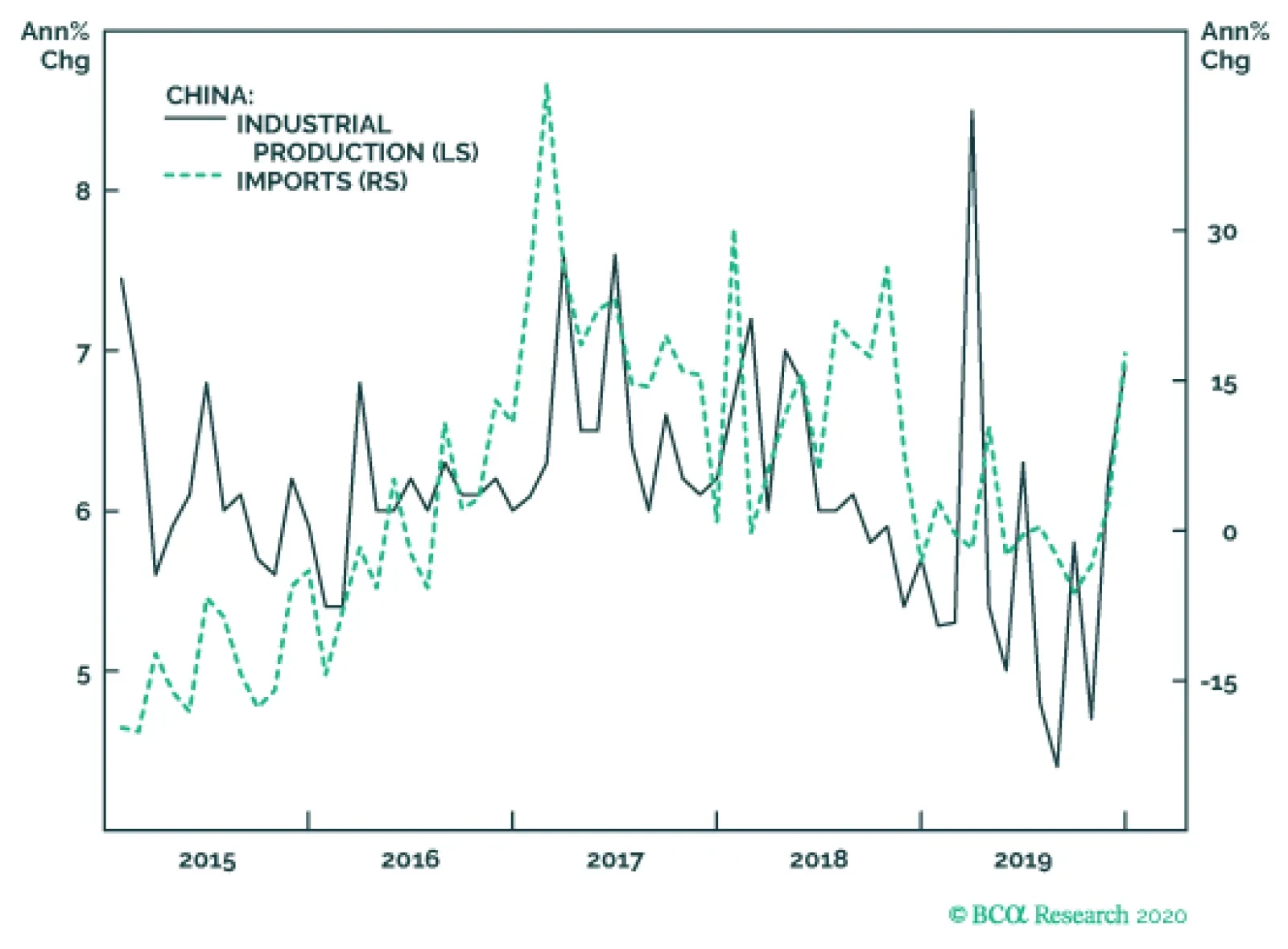

Chinese economic activity is picking up steam. This morning’s releases showed that industrial production accelerated further in December, rising 6.9%. Additionally, fixed-asset investments, retail sales and quarter-on-…

Highlights Our top five geopolitical “Black Swans” are risks that the market is seriously underpricing. With the “phase one” trade deal signed, Chinese policy could become less accommodative, resulting in a…

Highlights The World Bank lowered its growth forecast for EM economies – the growth engine for commodity demand – to 4.1% from 4.6% for 2020, which still will outpace last year’s rate of 3.5%. Our high-conviction…

The Sino-US “phase-one” trade deal was signed yesterday to much fanfare. The scale of the promised Chinese imports of US products and services is large, requiring $200bn-worth of additional Chinese purchases of US…