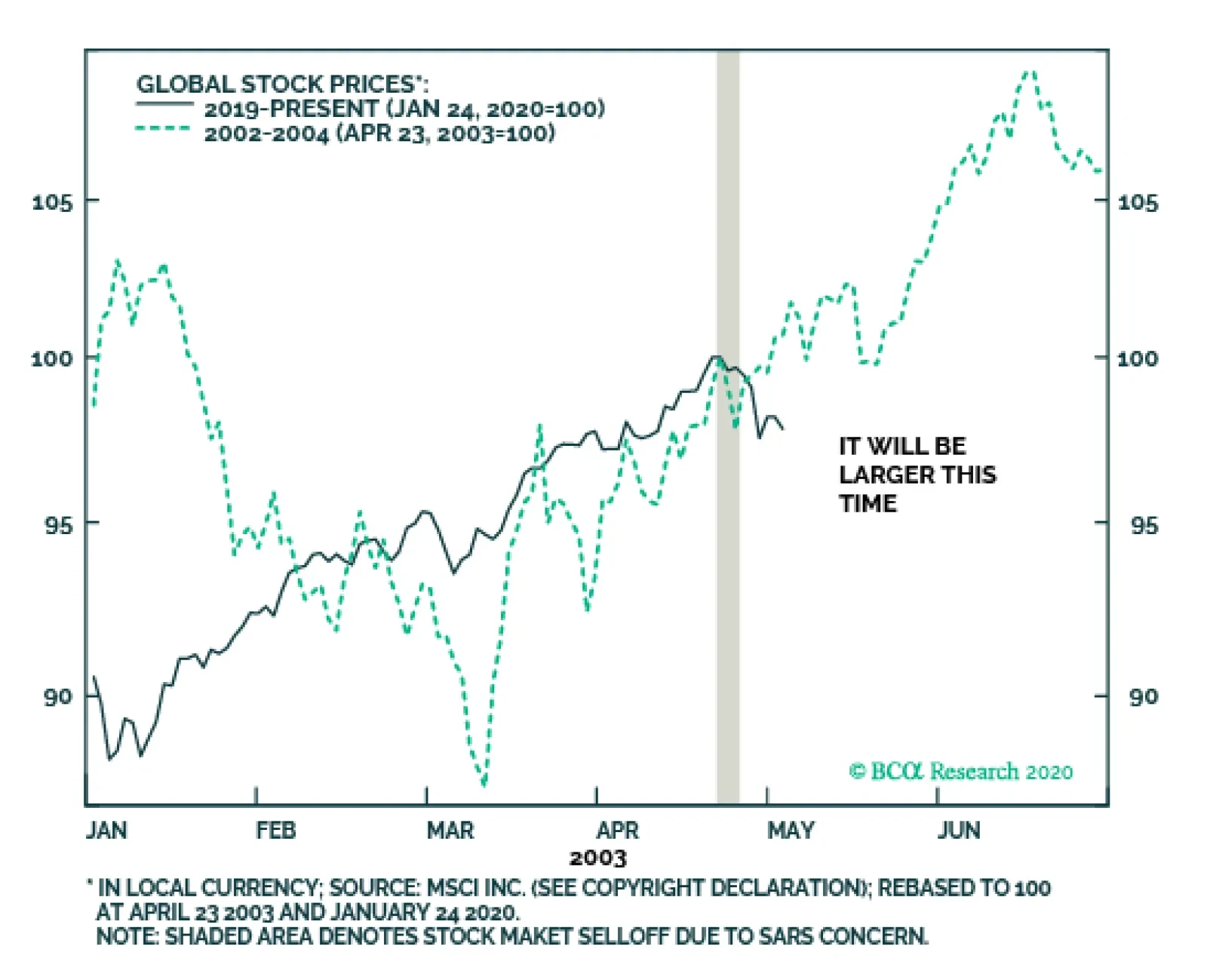

It is tempting to compare the potential impact of the current coronavirus outbreak on the global economy and financial markets with that of SARS in the spring of 2003. The correction in global equities due to the SARS outbreak…

Next week, we will focus on the following key items: The spread of nCoV-2019: We will continue to monitor how the coronavirus is spreading, especially as a case of human-to-human transmission has been reported in the US. In…

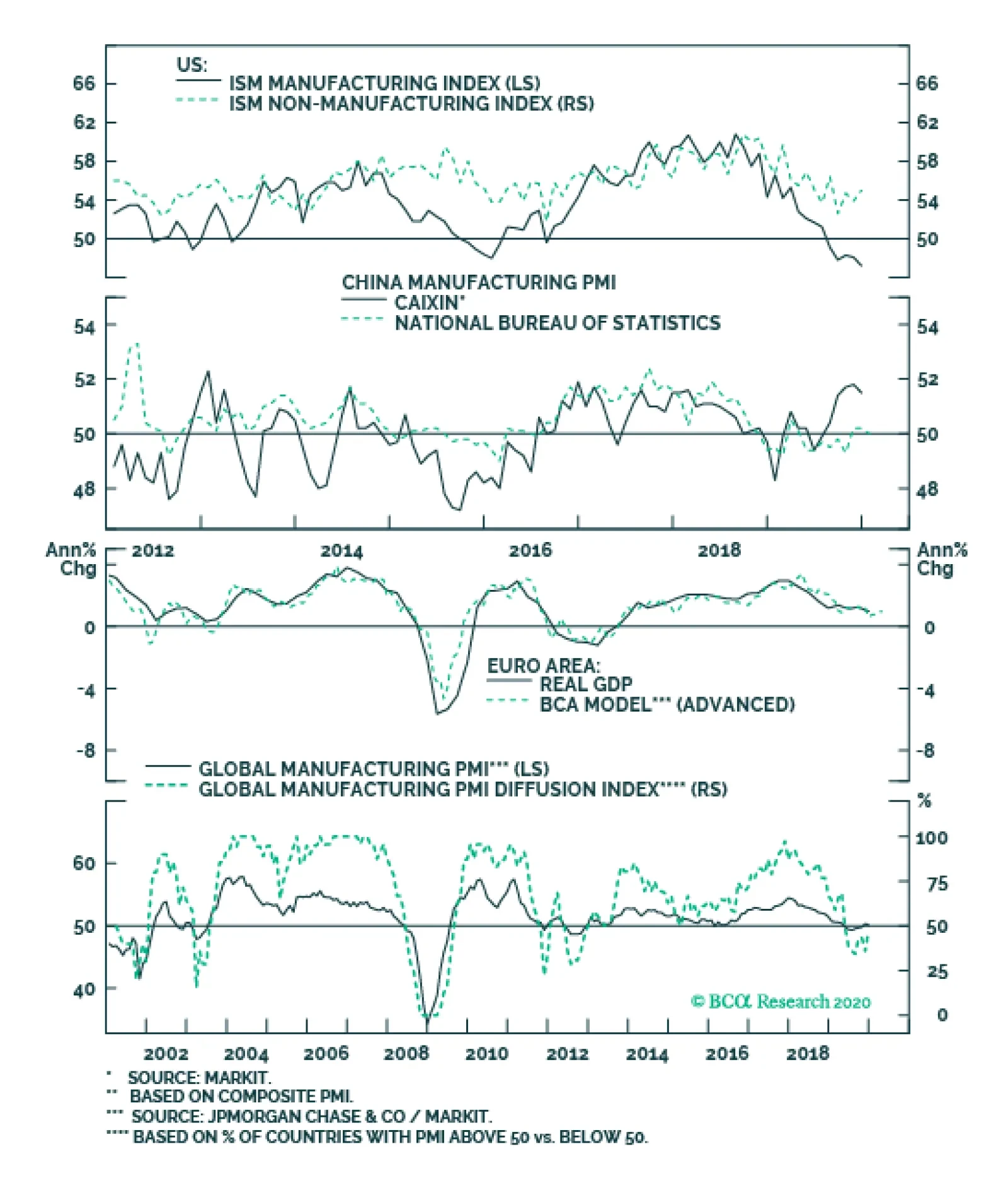

Highlights China’s economic rebound in Q1 will be delayed due to the coronavirus, which will have a larger negative hit than SARS. New stimulus measures will assist a rebound in demand later this year. Europe remains a…

Highlights The intense focus on the weakening of global oil demand expected in the wake of another coronavirus outbreak in China – dubbed 2019-nCoV – obscures likely supply-side responses by OPEC 2.0. The producer…

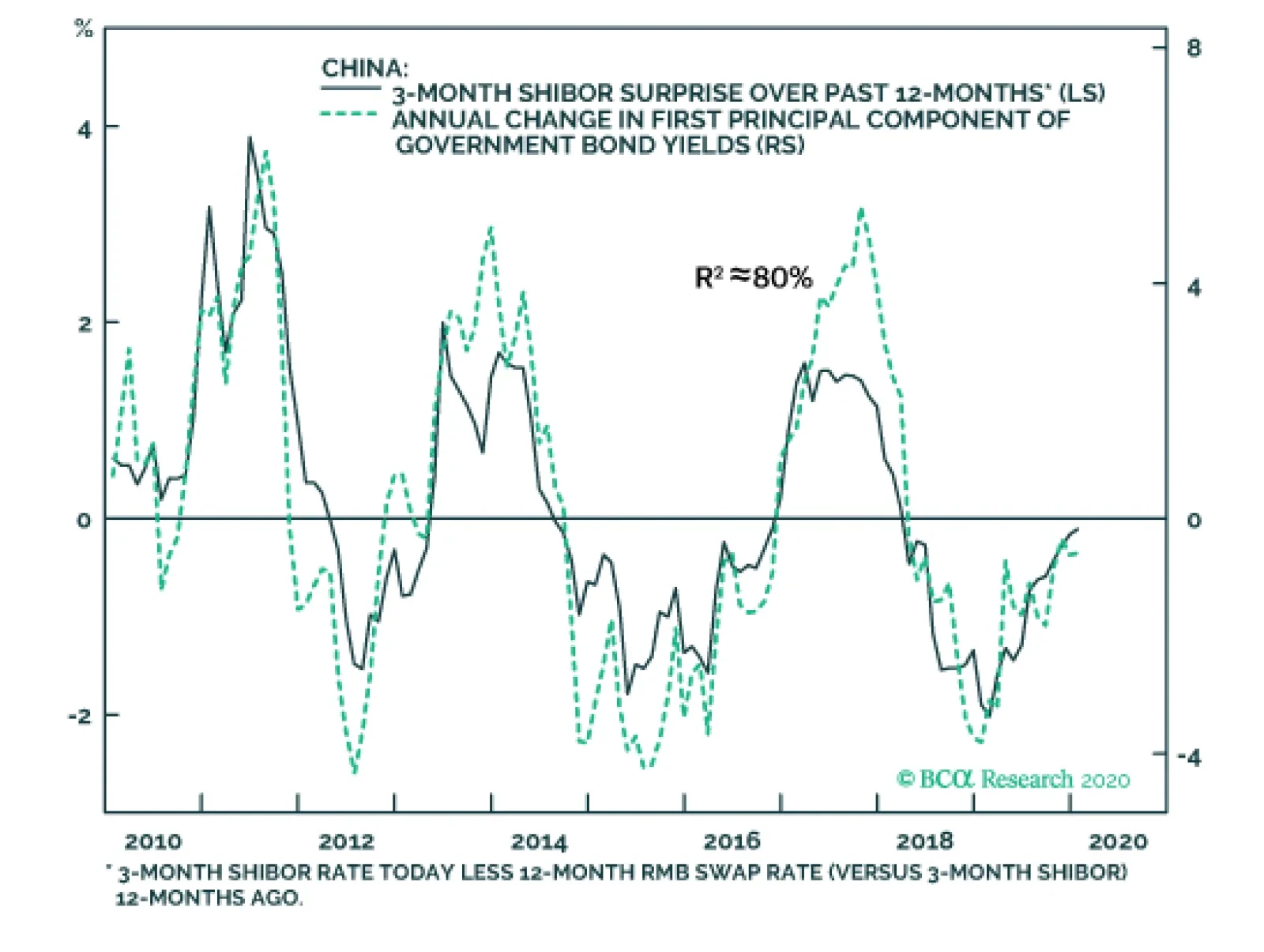

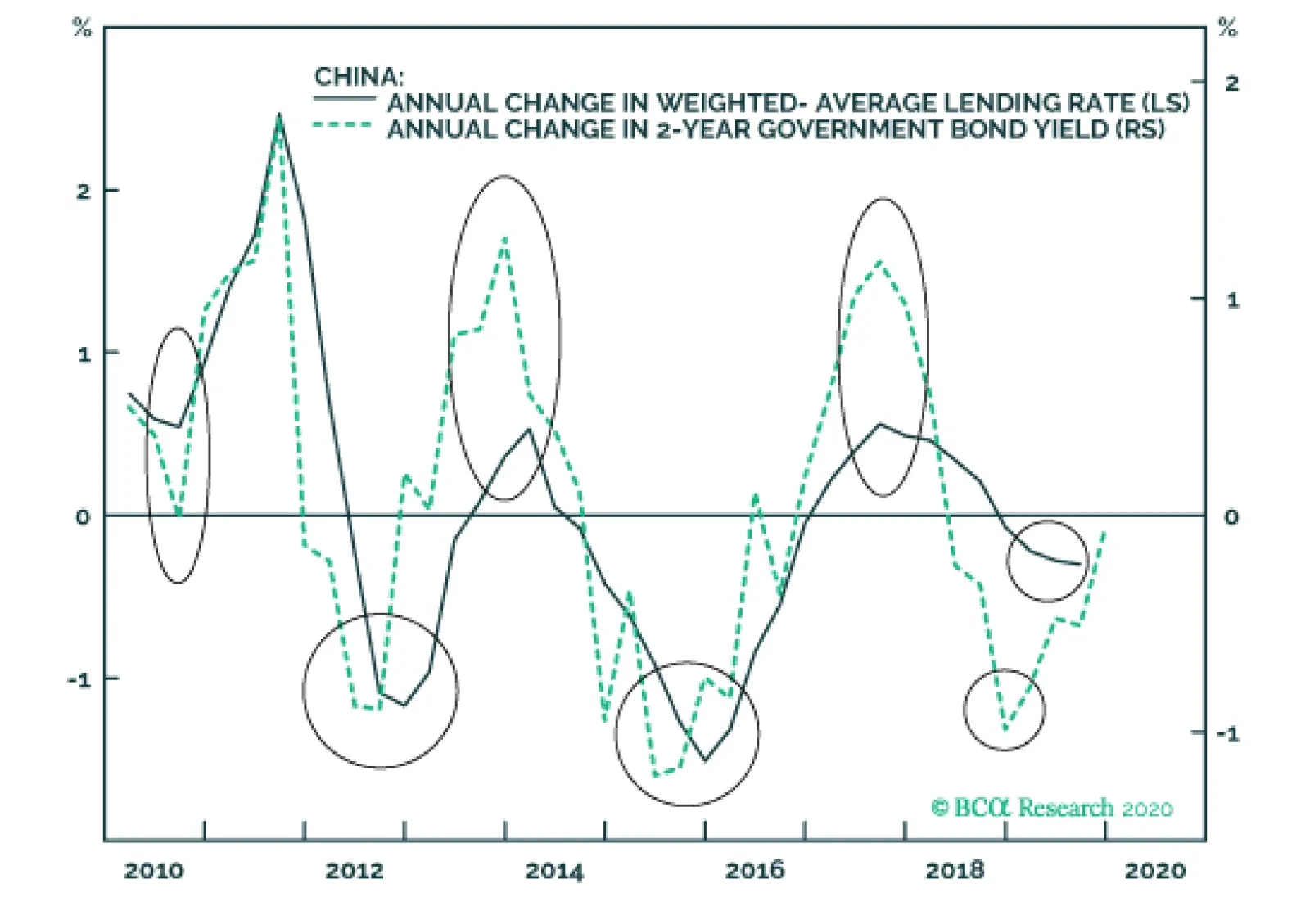

The Golden Rule links government bonds excess returns to policy rate “surprises”. In China, the 3-month SHIBOR surprise does the best job at explaining Chinese government bond yields, even in periods like 2015 or…

First, the PBoC is generally a reactive central bank and historically lags pickups in economic activity. Secondly, any additional easing by the PBoC is likely to be focused on reducing corporate lending rates, not interbank…

Highlights The liquidity-driven rally will soon be followed by an acceleration in global growth. The economic recovery will bump up expectations of long-term profit growth. The dollar has downside, but the euro will not benefit much…

An analysis on Hong Kong is available below. Highlights The correction in EM risk assets and currencies will be larger than during the SARS outbreak. A number of market indicators that are pertinent for EM assets are sending a…