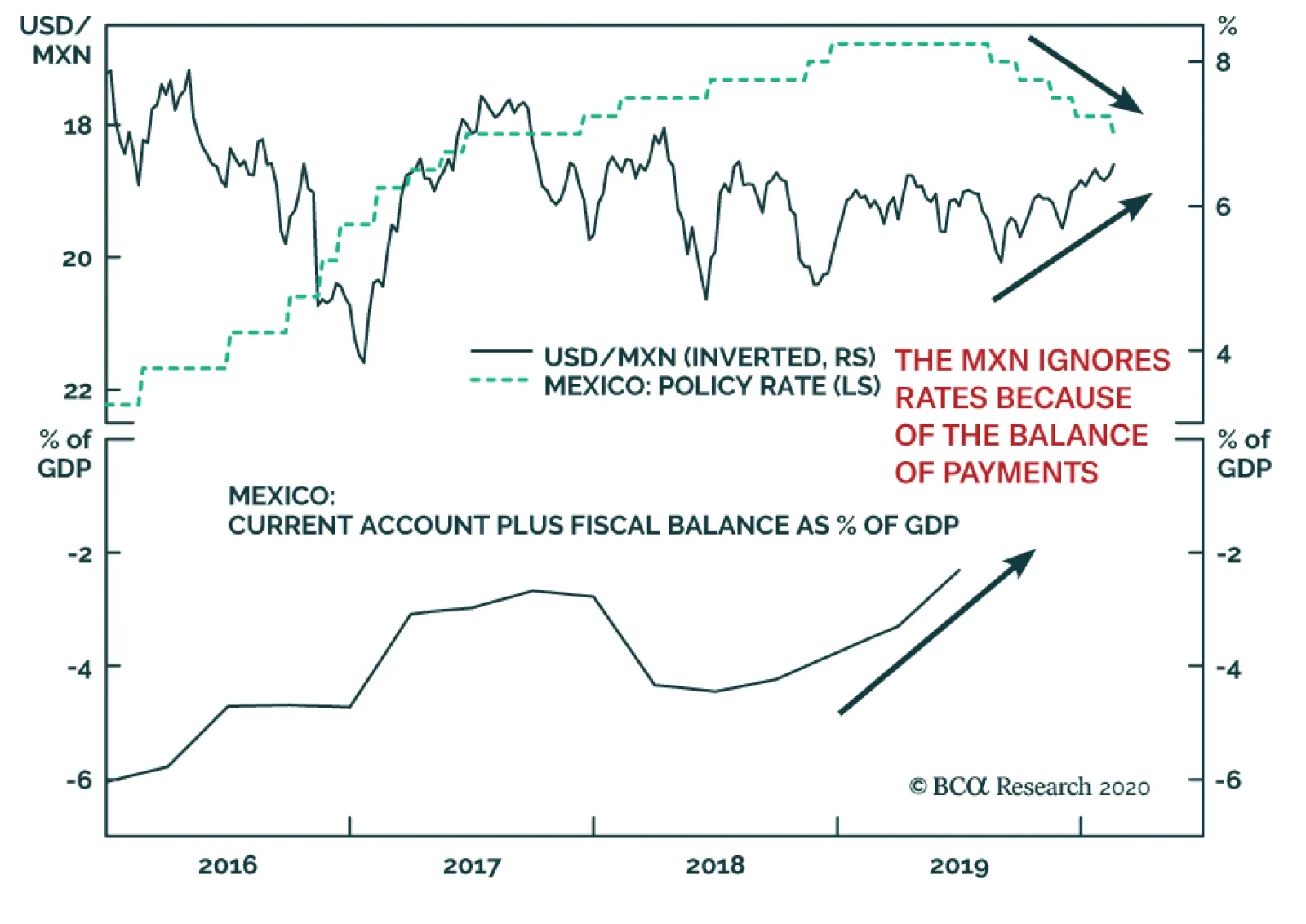

Since the summer of 2019, the Mexican central bank has cut interest rates from 8.25% to 7%. The Mexican economy remains weak, therefore, our emerging market strategist expects Banxico to cut rates to 6%, maybe even lower.…

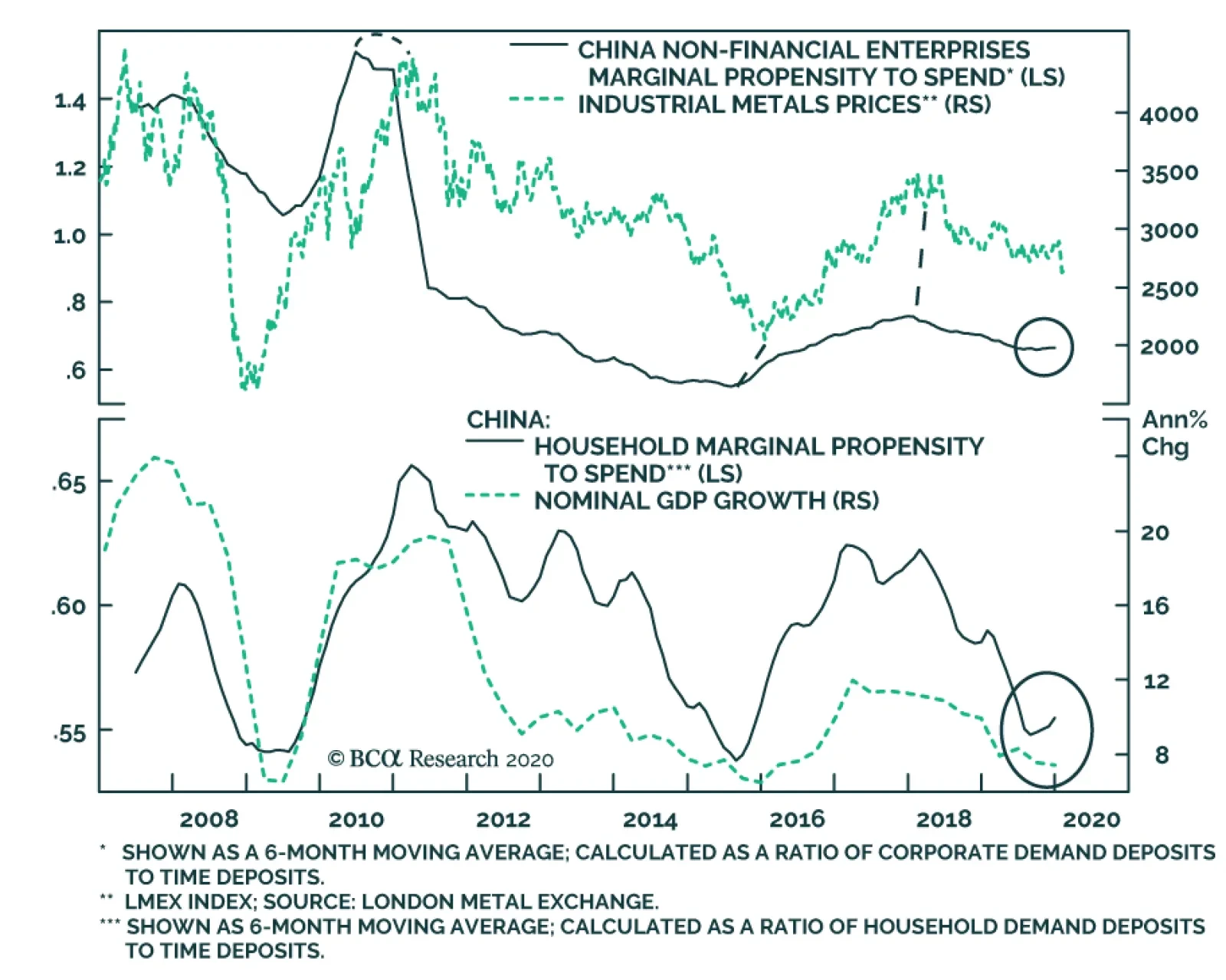

Last week, BCA Research's Emerging Markets Strategy discussed the impact of potential Chinese stimulus. While it is certain that Chinese authorities will inject more fiscal and monetary stimulus into the system, its size is…

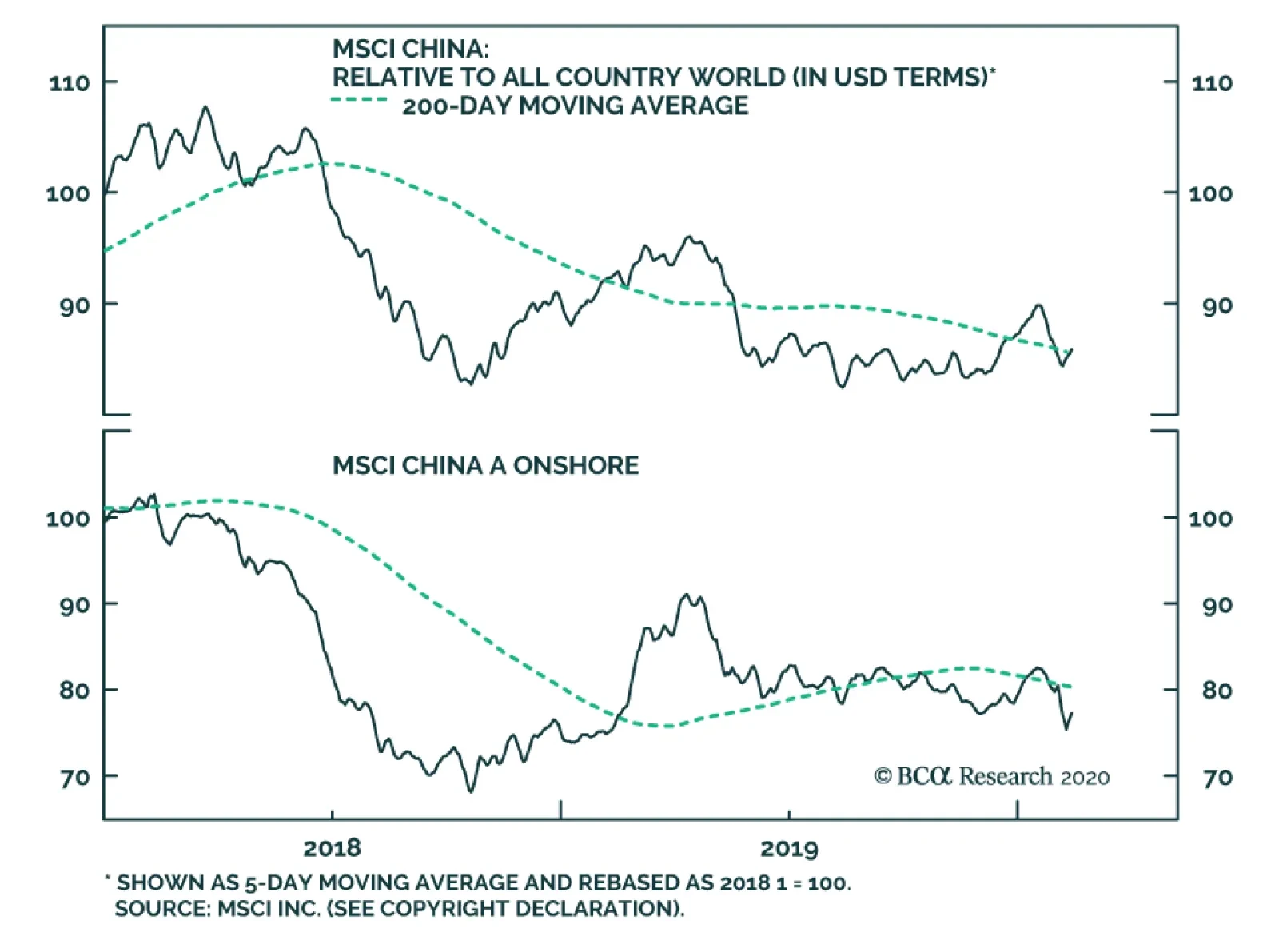

Yesterday, BCA Research's China Investment Strategy service wrote that Hubei’s protracted but isolated lockdown would have a minor impact on China’s overall financial market. Within the MSCI China Onshore Index, there…

Highlights Bulk commodity markets – chiefly iron ore and steel – could see sharp rallies once Chinese authorities give the all-clear on COVID-19 (the WHO’s official name for the coronavirus). These markets rallied…

Highlights An analysis on Turkey is available on page 10. In the short term, EM share prices will likely continue searching for a direction as visibility is extremely low. Beyond the near term, an appropriate strategy for EM equity…

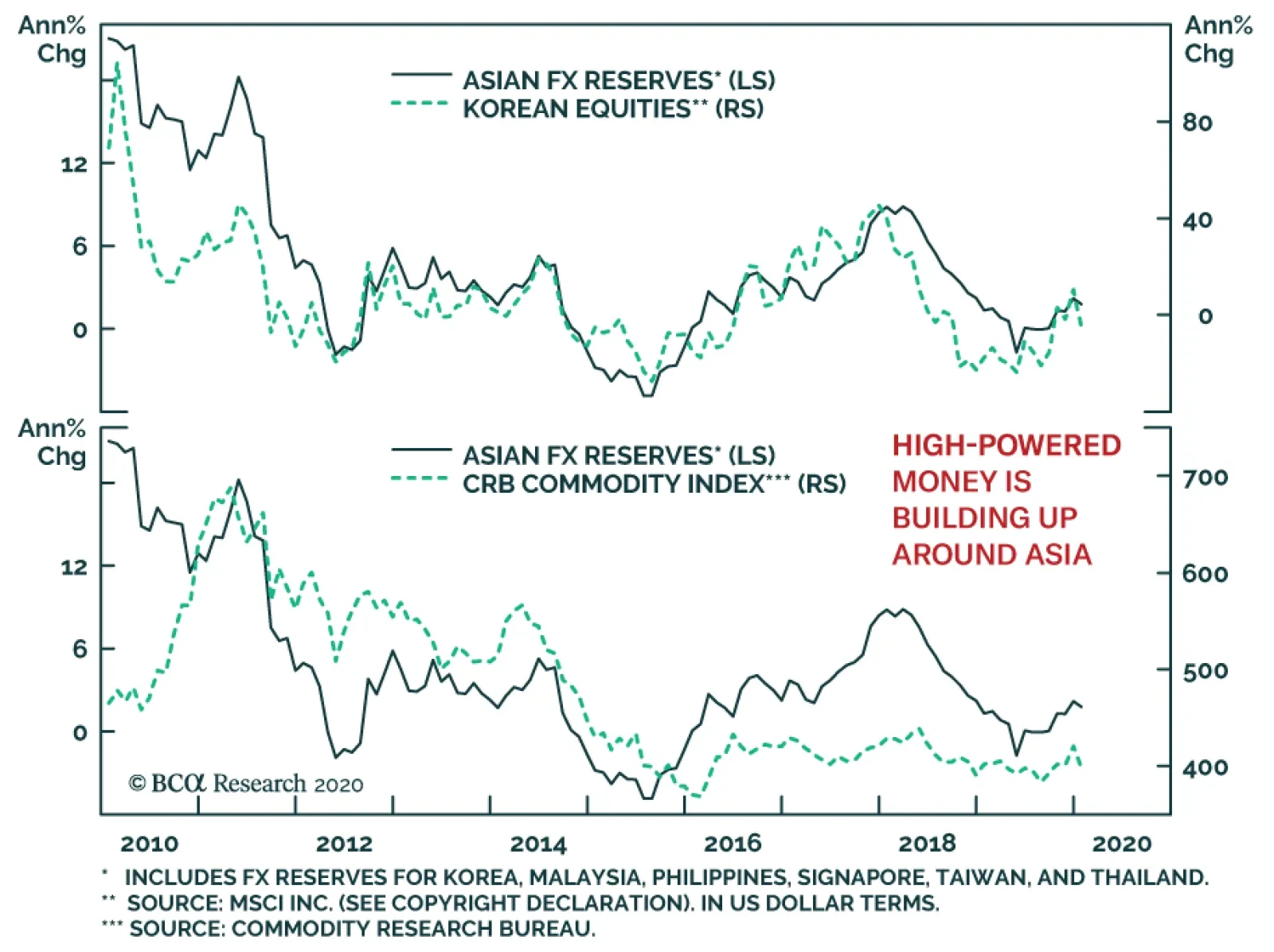

FX reserves in Asian excluding China are once again growing, having overtaken their March 2019 highs. In fact, reserves growth is accelerating. This is an encouraging sign for global trade, as it suggests that the growth in high…

Highlights Global Growth & Market Volatility: Fears over global growth have pushed government bond yields lower as markets discount dovish monetary policy responses to the China viral outbreak. That combination may, perversely, be…

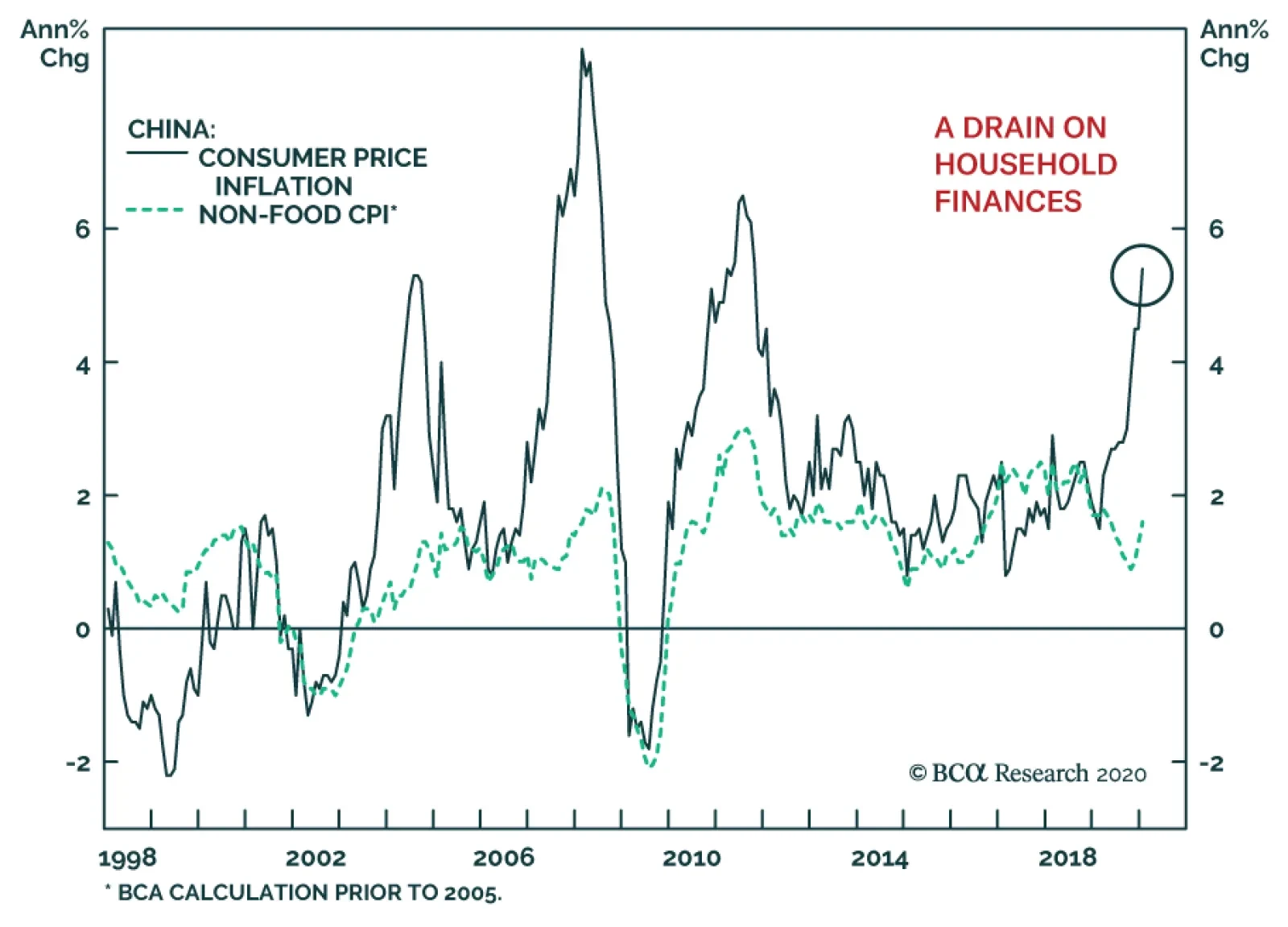

The latest Chinese CPI number was emblematic of the issues faced by Beijing. While CPI excluding food remains at a tame 1.6%, surging food prices have pushed the headline CPI number to 5.4%. Slow growth, elevated food inflation,…

Yesterday, BCA Research's US Investment Strategy service analyzed the coronavirus outbreak. For now, our base case is that the global growth recovery will be delayed, though we expect growth will pick up later this year, provided that…