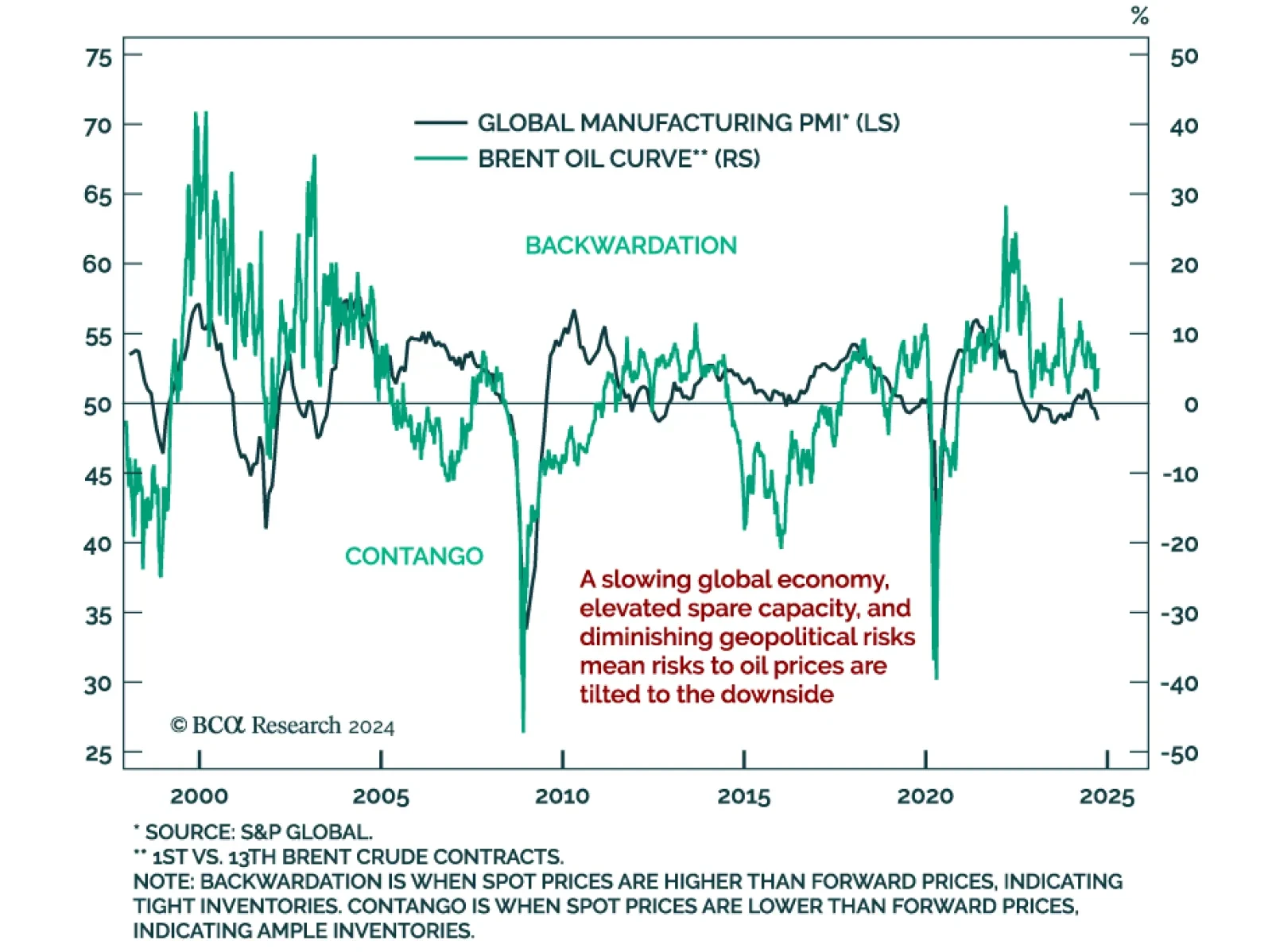

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

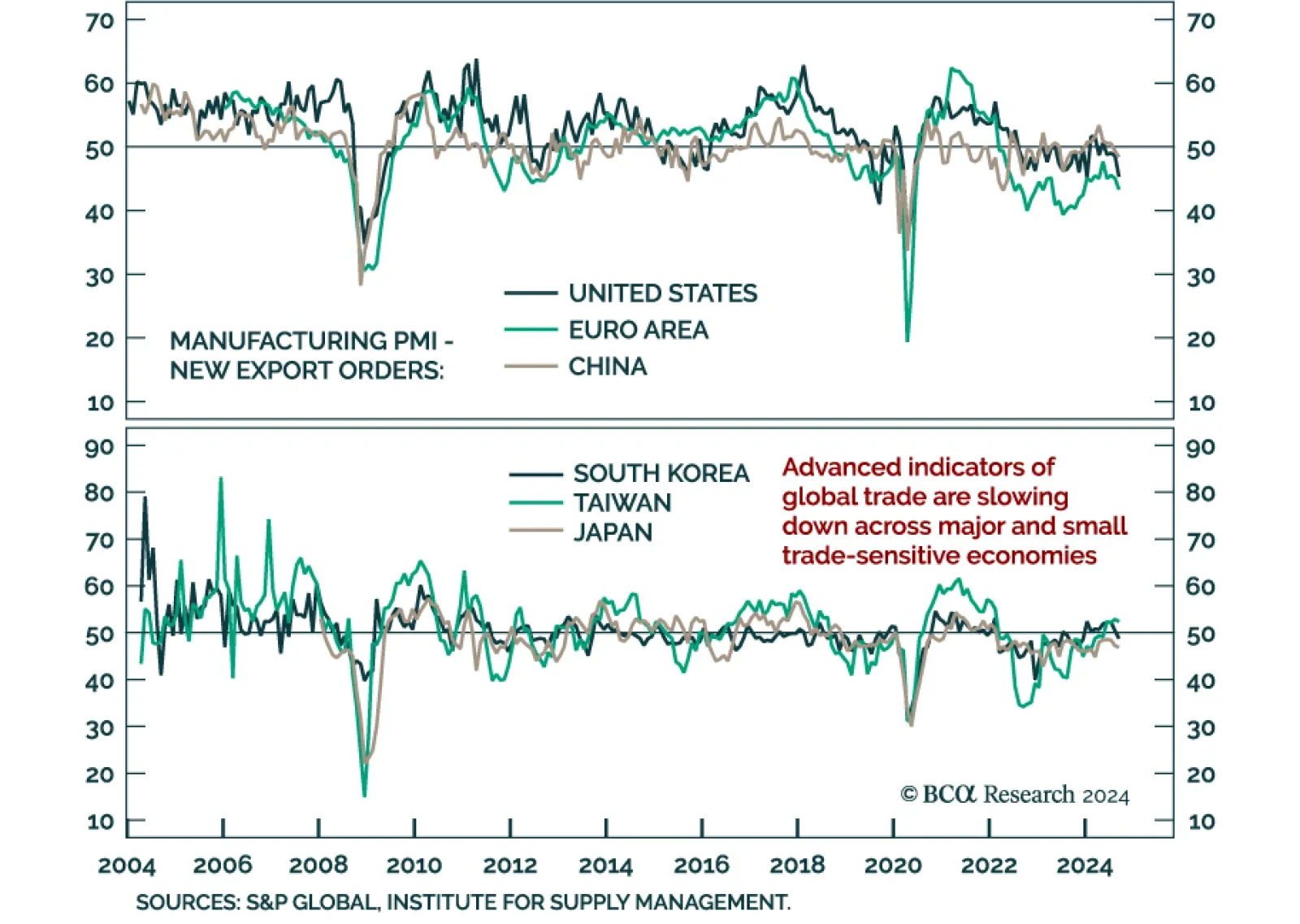

September numbers for East Asian trade disappointed across the board. Japanese exports dropped 1.7% year-on-year (YoY) after rising 5.5% in August, and Singapore’s non-oil domestic exports decelerated to 2.7%YoY after…

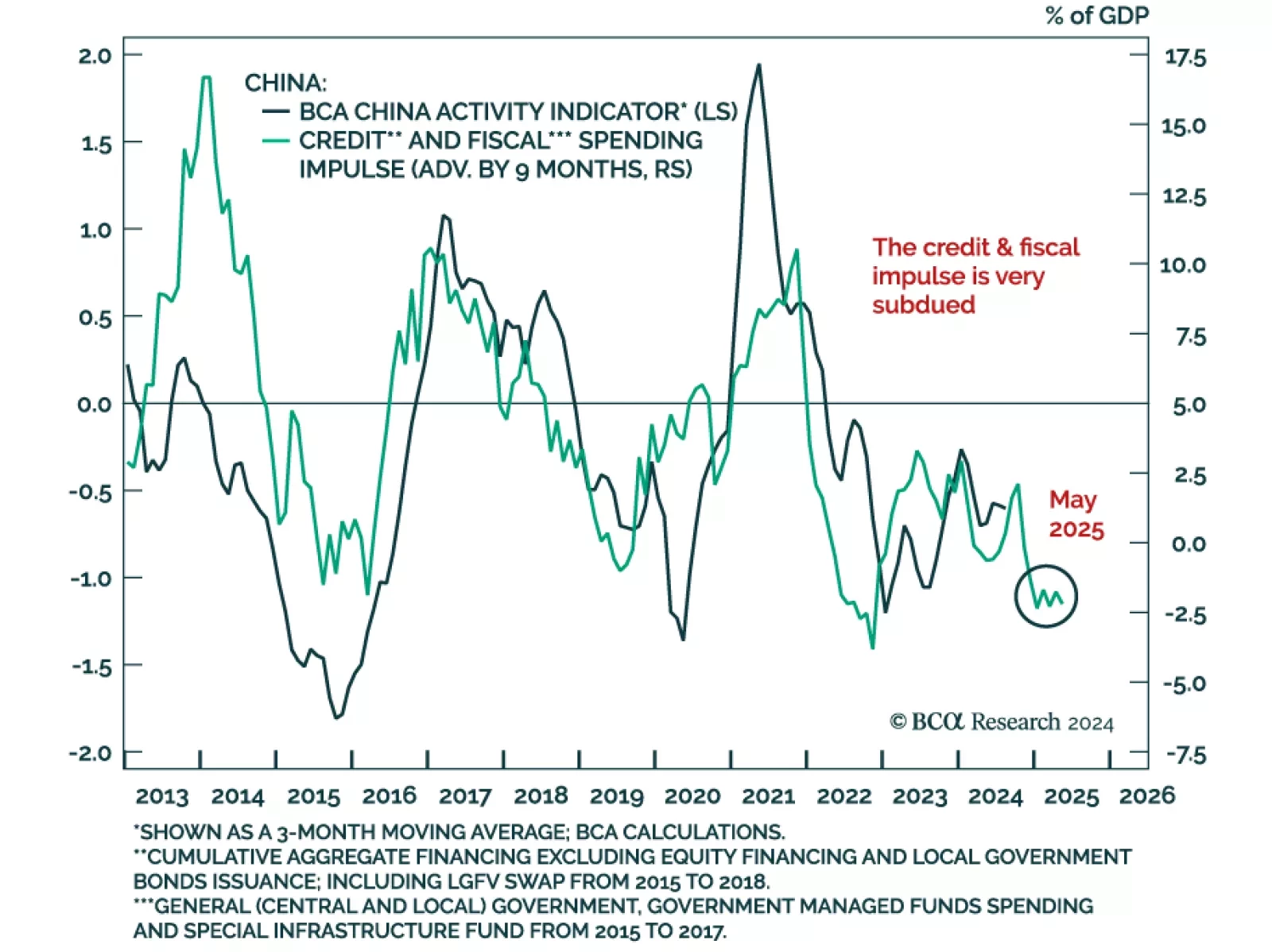

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

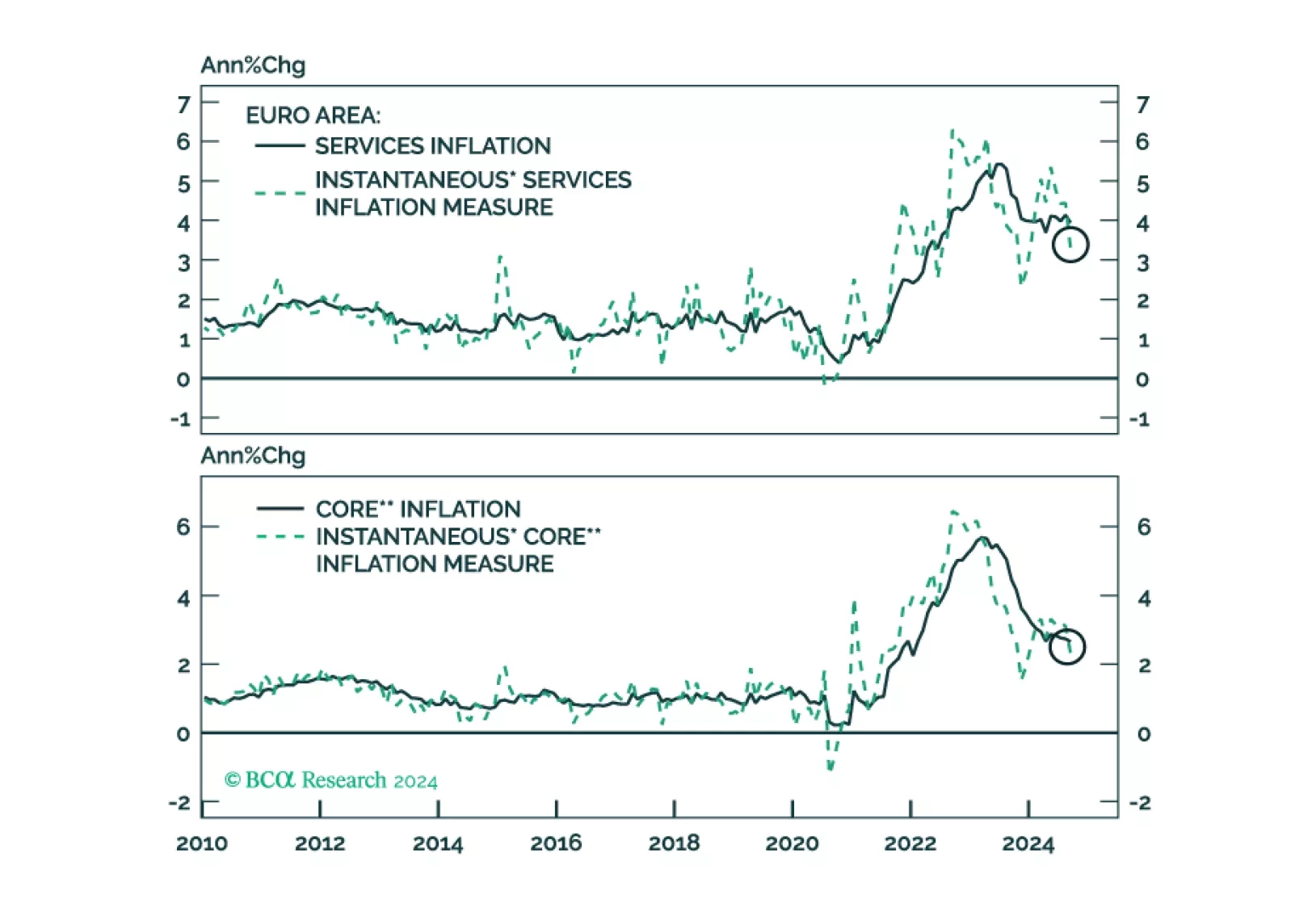

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

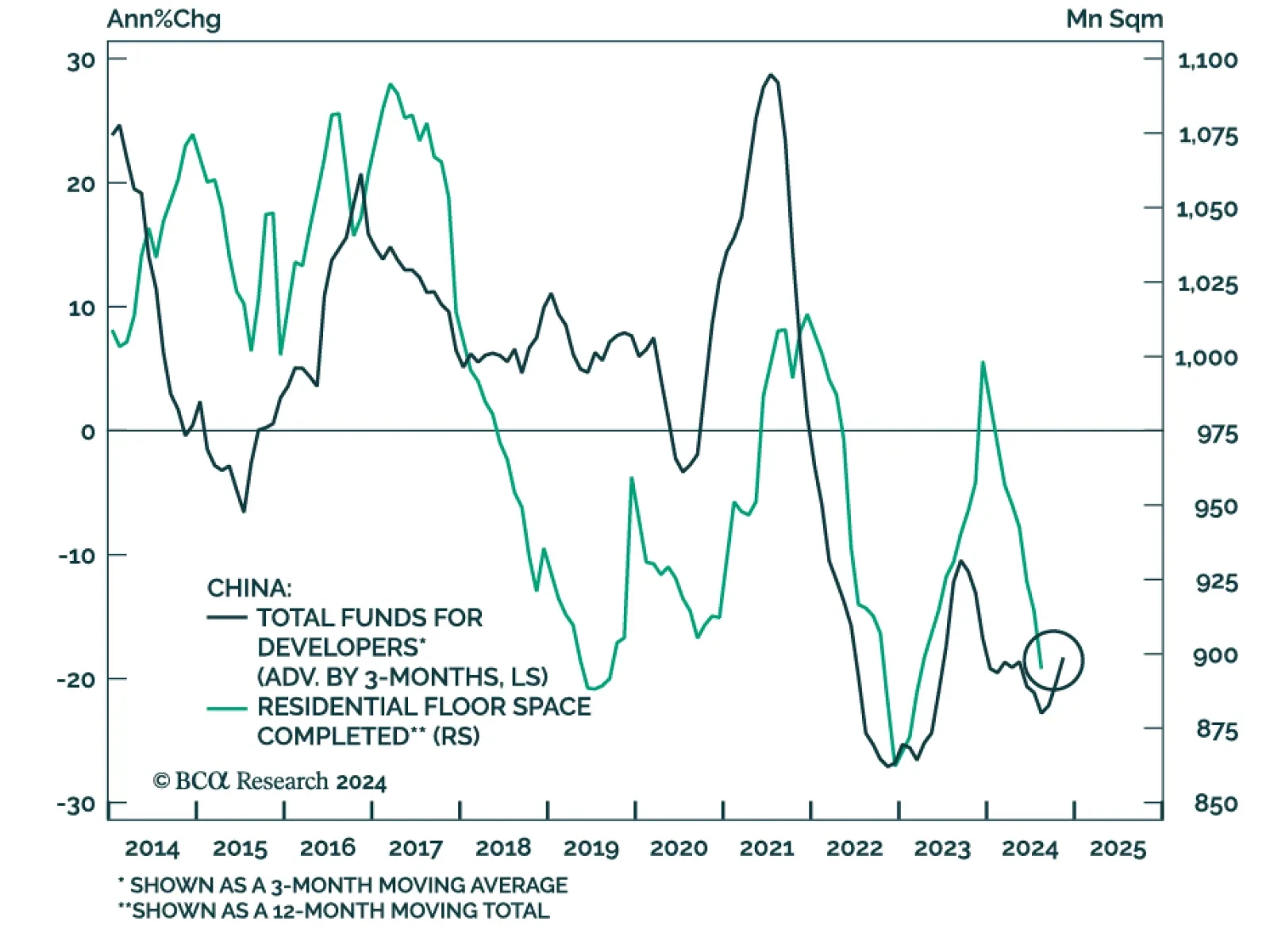

China’s Housing Administration Chief held a press conference yesterday to unveil two property-sector stimulus plans. According to our China strategists, the details were underwhelming and led to a decline in Chinese…

While recent cross-asset developments have sent a risk-on signal, with equities and bond yields both higher, the commodity complex has recently been sending a more somber message. “Dr. Copper” is a bellwether for…

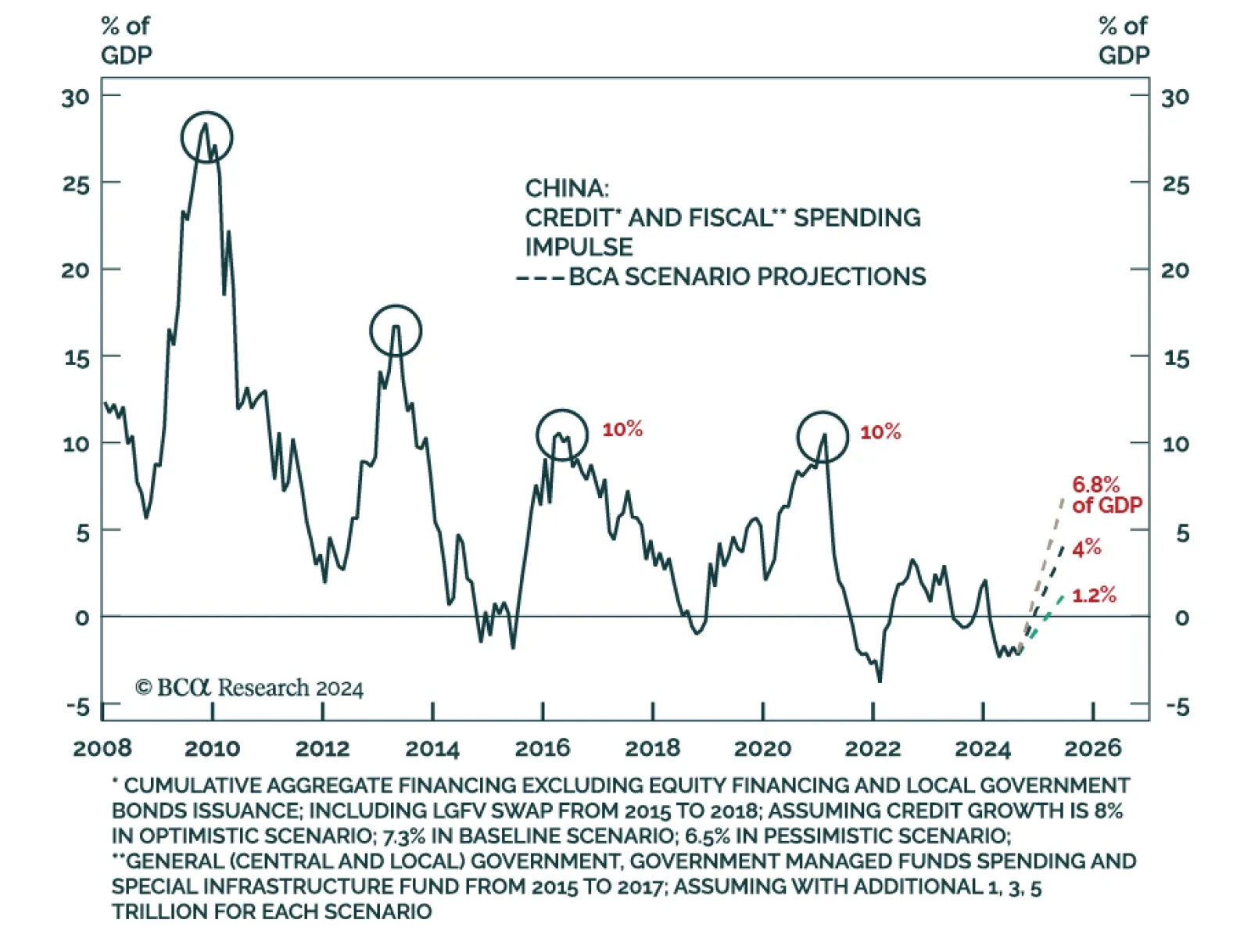

Our China and Emerging Market strategy teams analyzed this weekend press conference by the China’s Ministry of Finance (MoF), that provided additional details on the recently announced fiscal stimulus plan. Our…

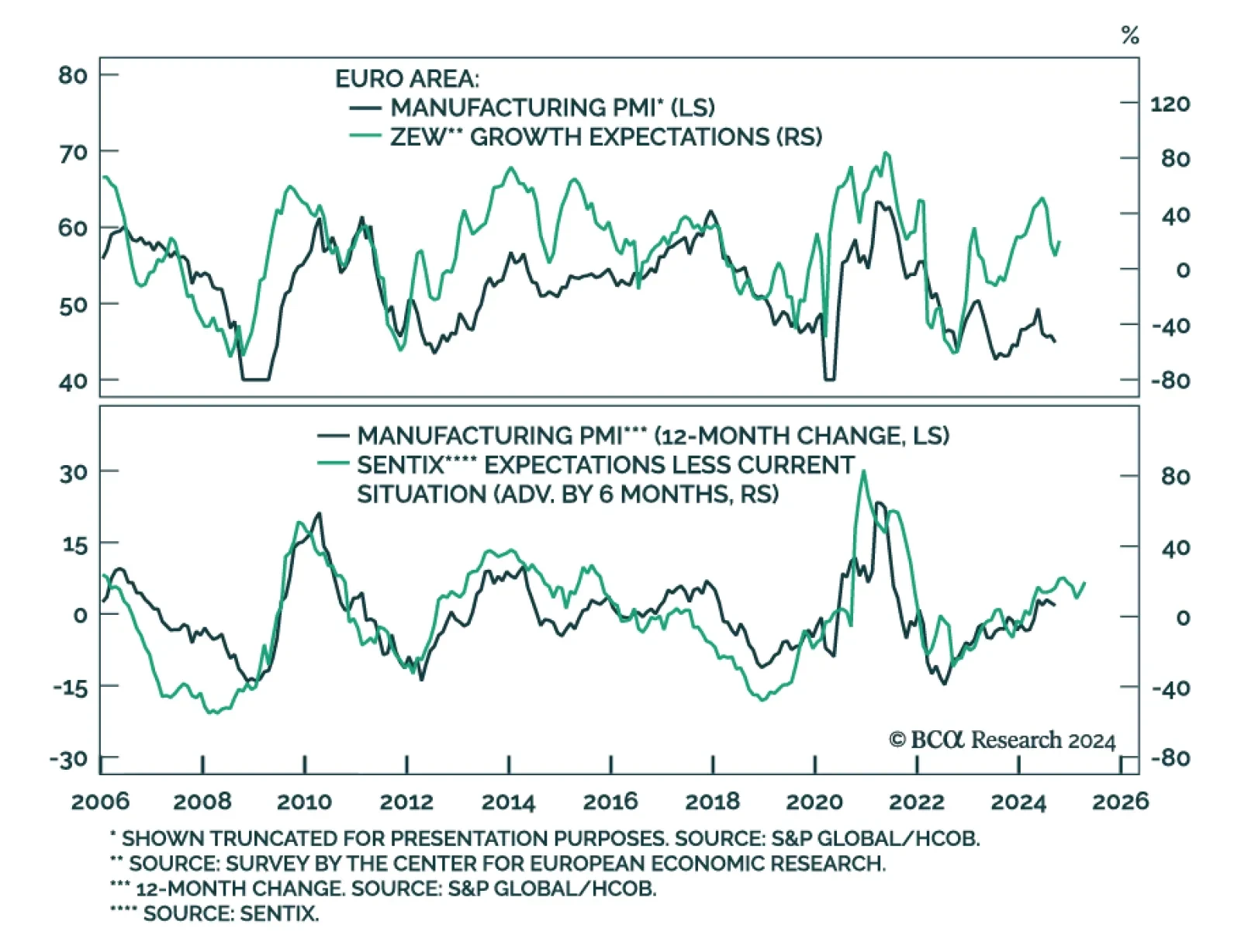

Economic expectations for the both Germany and the Eurozone ticked up in October and surprised positively for the first time since they collapsed this summer. The assessment of current conditions however worsened, going from -84.…

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

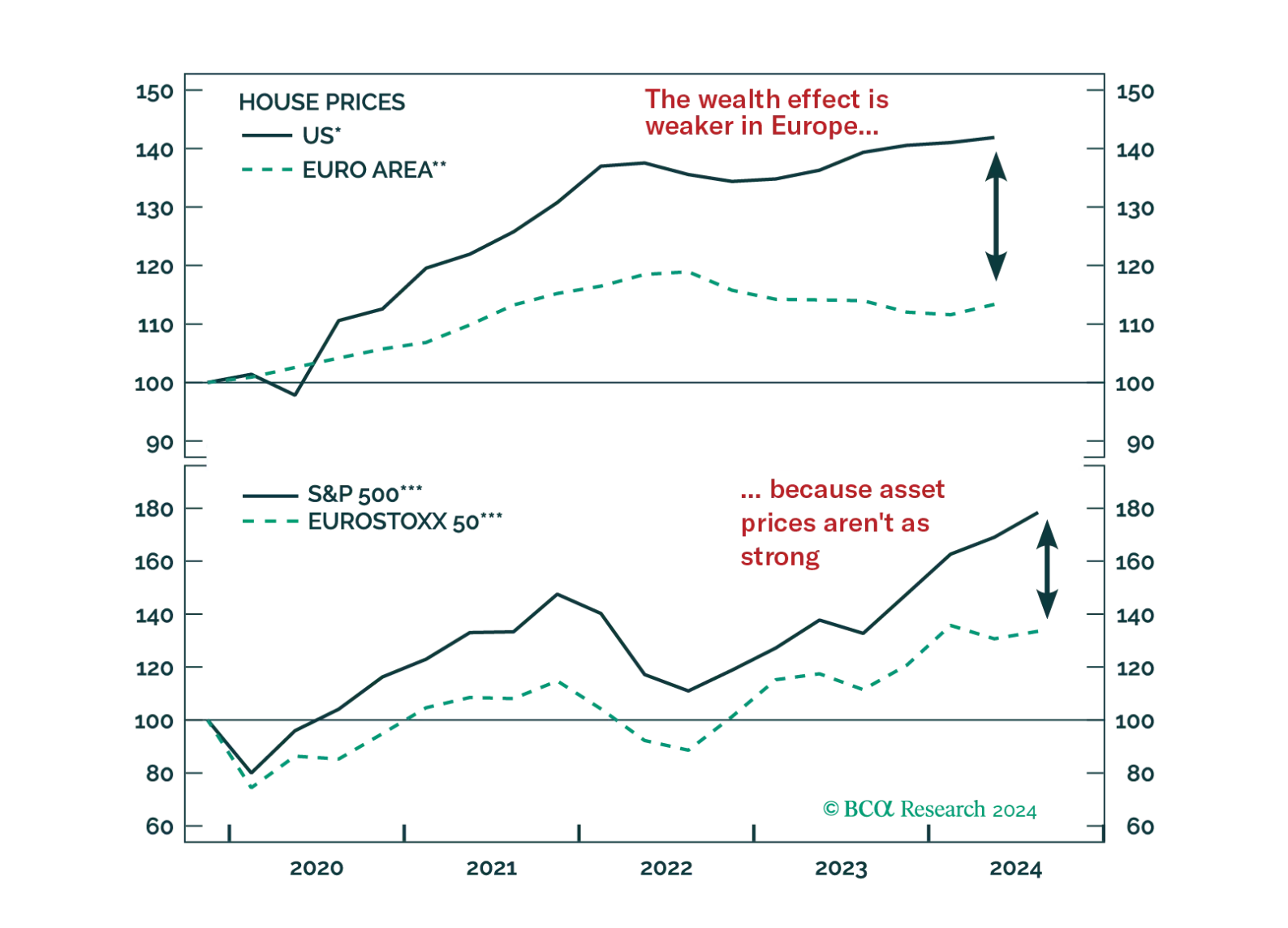

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.