Dear Client, I participated in a webinar earlier this week with my fellow BCA Research strategists to discuss the coronavirus outbreak and other timely issues. A replay can be accessed from this link. In lieu of our regular report next…

Feature Global markets are moving to price in a negative growth impact from COVID-19. It is impossible to gauge with any precision the magnitude and duration of this negative growth shock. We discussed the potential growth trajectory of…

Highlights Global growth will quickly recover if the Covid-19 outbreak is soon controlled. If the virus's spread doesn't slow, a worldwide recession will take hold in 2020. BCA remains cyclically bullish, but tactical caution…

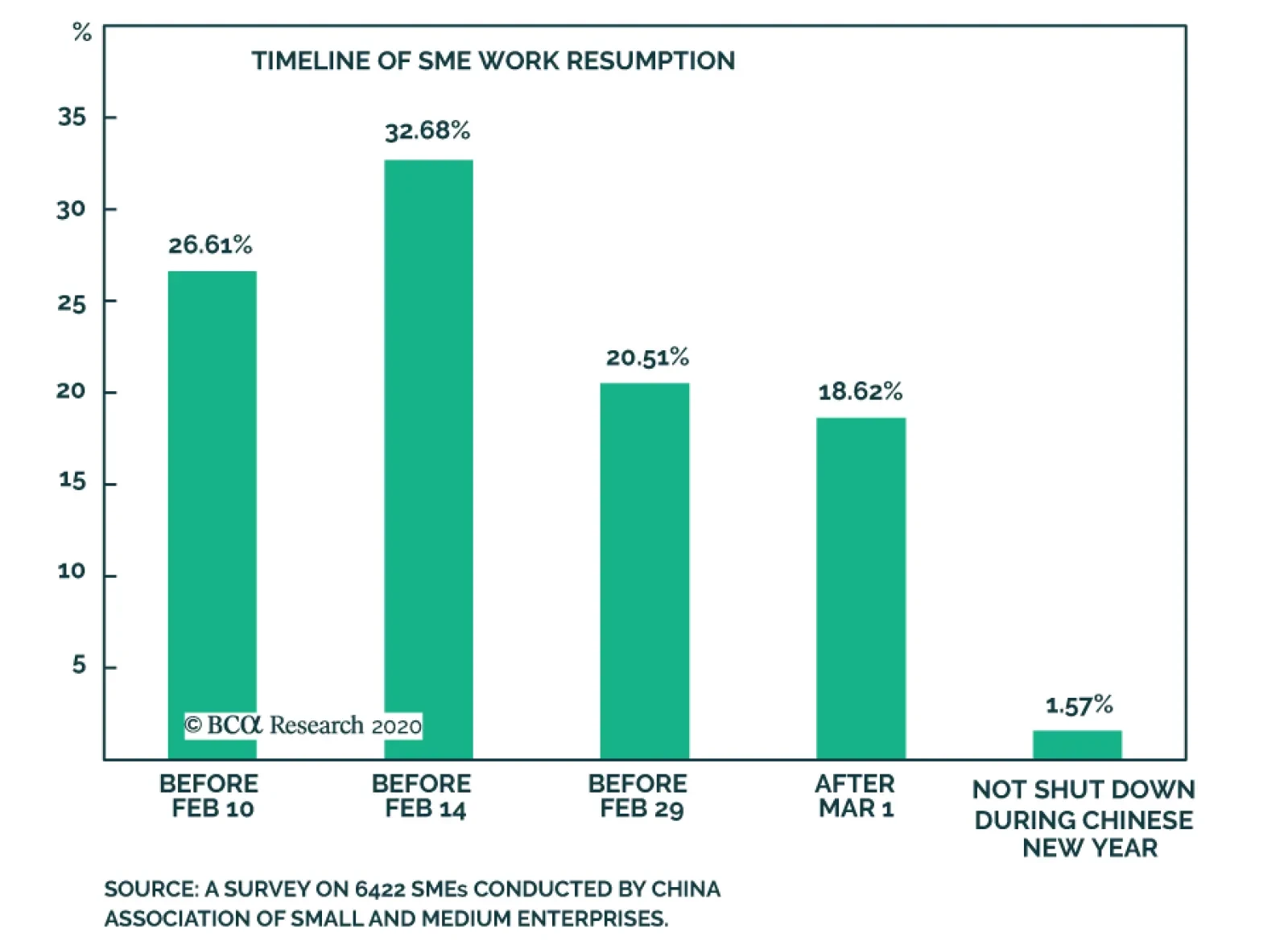

According to BCA Research's China Investment Strategy service, the aggressive containment measures seem to be effective inside China, as manufacturing is resuming. The likely magnitude of the growth shock might be smaller than…

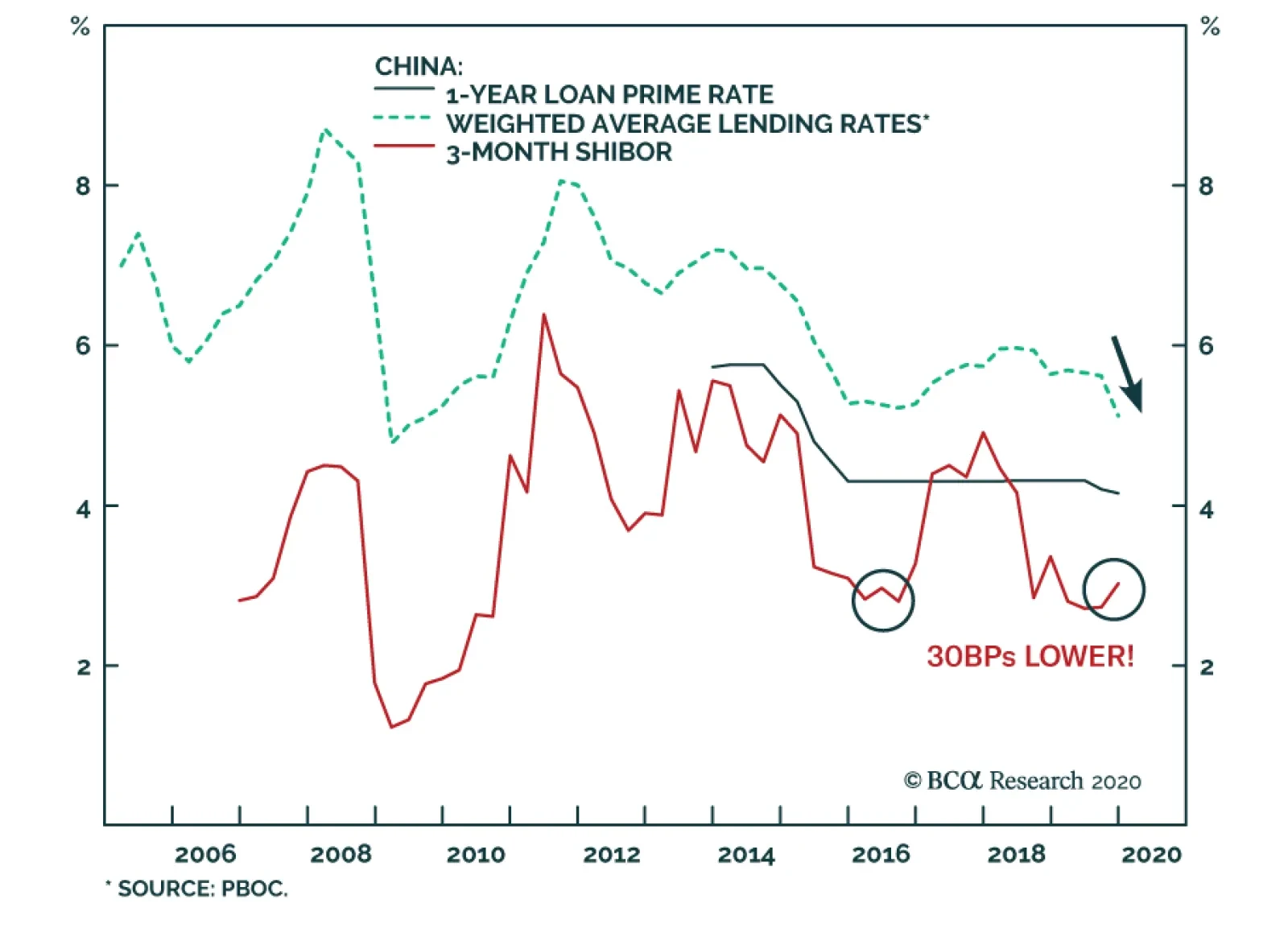

Yesterday, BCA Research's China Investment Strategy service concluded that Chinese policymakers, dealing with an unprecedented public health crisis, are returning to aggressive fiscal and monetary easing. The odds are rising that the…

Highlights In the past week, it is becoming evident that the Chinese leadership is willing to abandon its financial de-risking agenda in exchange for a rapid economic recovery. Monetary conditions are already more accommodative than…

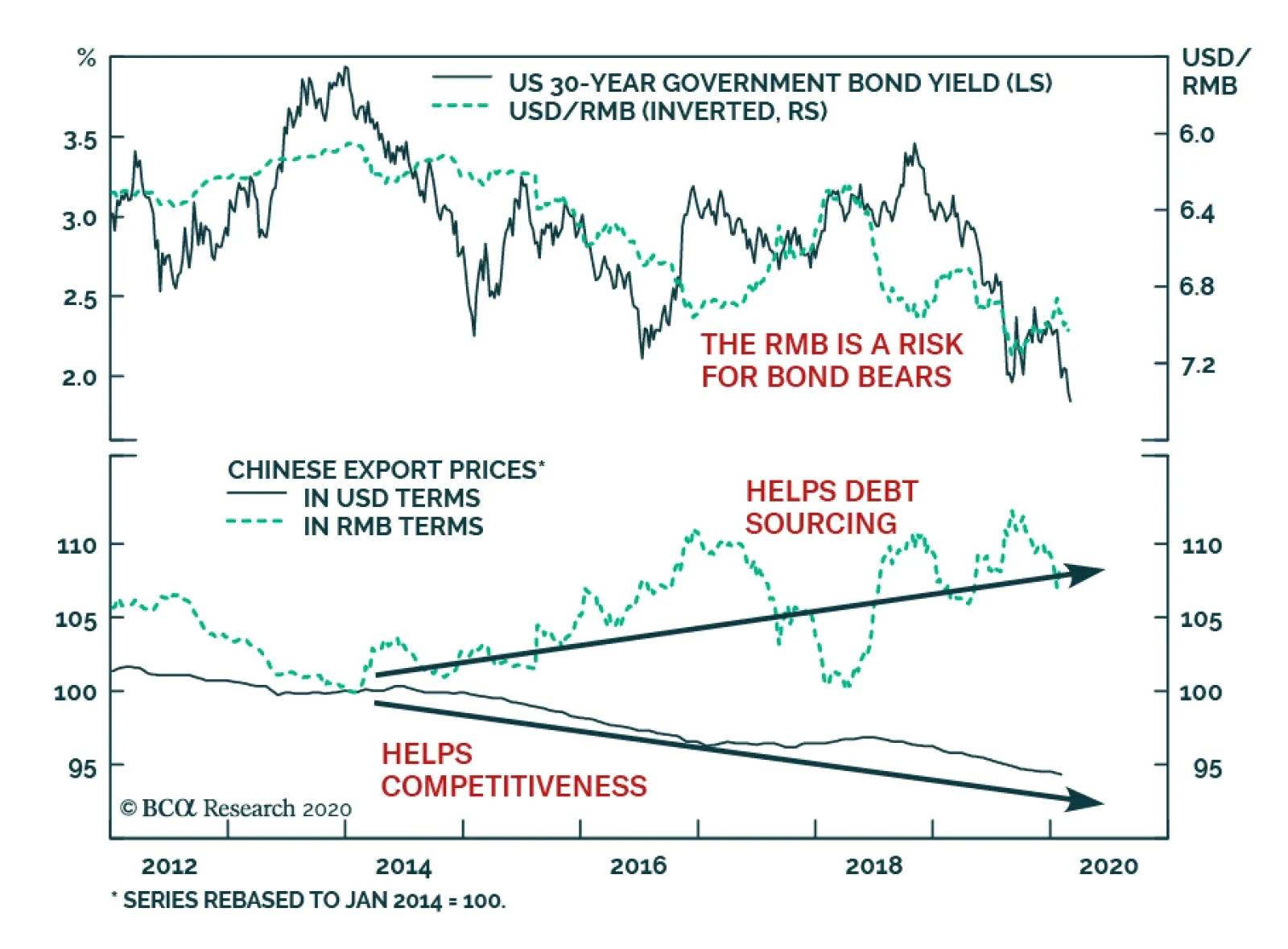

China often uses a weaker currency as a key tool to minimize domestic deflationary pressures. Thanks to the weakness in the RMB, Chinese export prices to the US have fallen more than 5% in USD terms since 2014, yet, they…

Highlights The coronavirus is a wild card that may have a significant impact on the global economy, … : The COVID-19 outbreak is unfolding in real time, half a world away, and its ultimate course is uncertain. For now, our China…