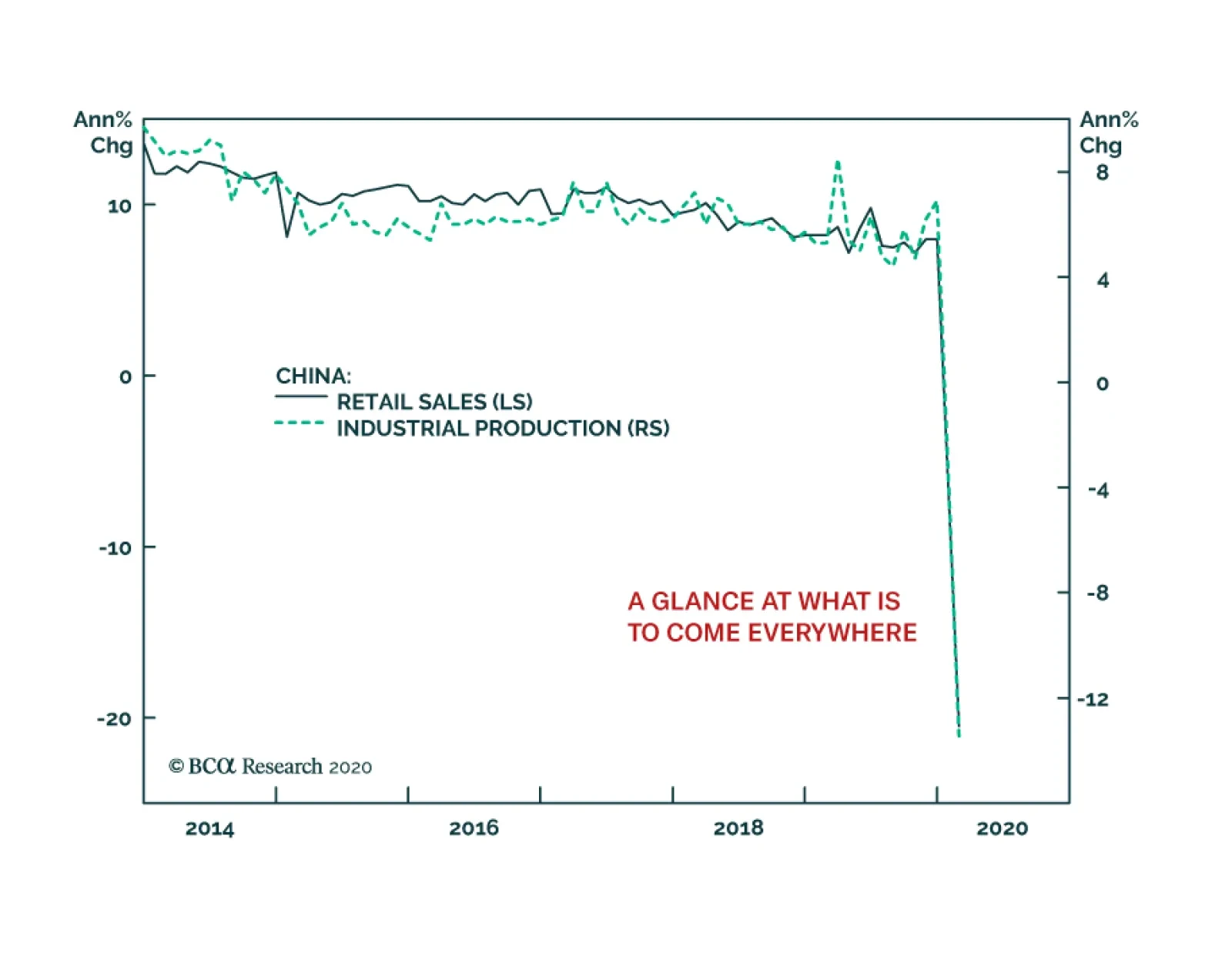

Overnight, China gave us a taste of what is in store for economies implementing quarantine measures. Industrial production contracted 13.5% on an annual basis and retail sales plunged by 20.5%. As dismal as these numbers may be,…

Feature An analysis on Singapore is available below. The plunge in global risk assets is occurring at such a breathtaking pace that any economic analysis is pointless at this time. Economic growth forecasts have been reduced to moving…

Highlights China is moving from virus containment to normalization and economic stimulus. The full weight of the virus panic is only now hitting the US public and has not yet peaked. The US – and western democracies in general…

Dear Client, In addition to this week’s report, BCA Research will hold webcasts over the coming days to discuss the economic and financial outlook amid the myriad of uncertainties gripping global markets. I will take part in a…

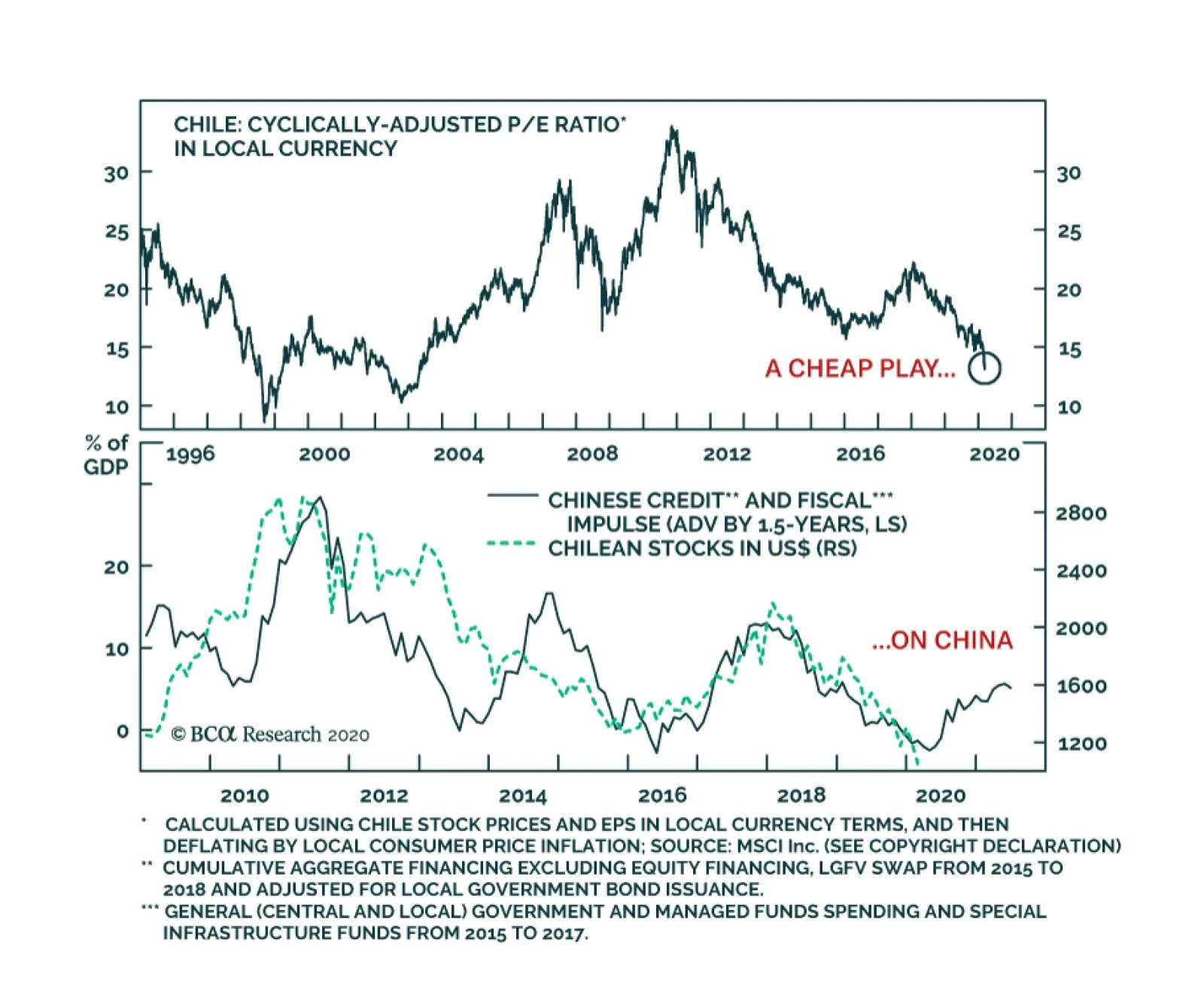

Since February 2018, Chilean stocks in USD terms have fallen more than 50% to their 2008 lows. They now trade at their cheapest cyclically-adjusted P/E ratio since 2003. This cheapness is particularly significant as Chilean and…

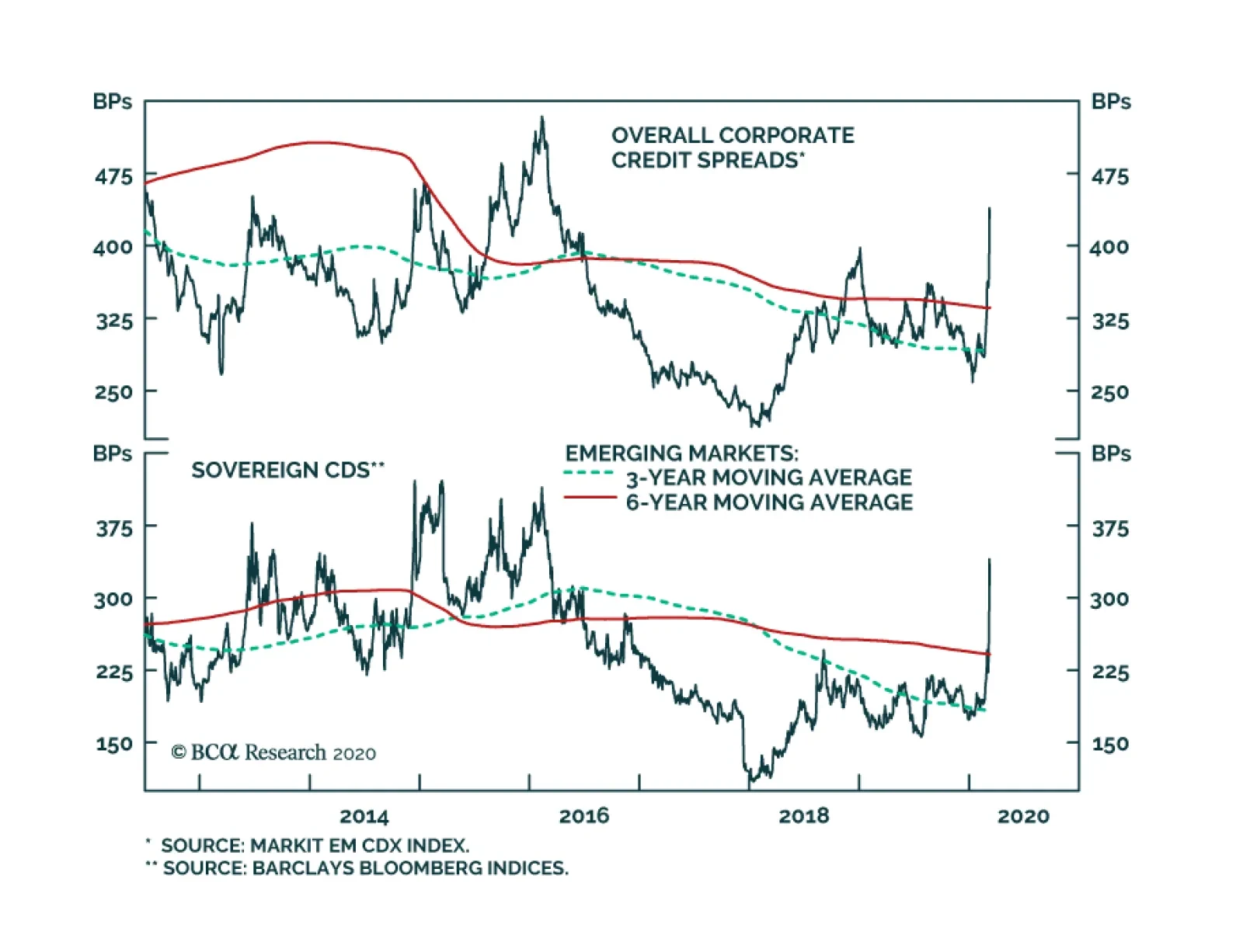

Yesterday, BCA Research's Emerging Markets Strategy service took a look at EM sovereign and corporate spreads. Inflows to EM fixed-income funds were enormous in 2019. Meanwhile, EM corporate and sovereign spreads have broken out.…

Highlights China should fare a global recession better than most G20 economies, given its large domestic market and powerful policy response. China is likely to frontload a large portion of its multi-year infrastructure…

Highlights Bear markets occur in phases, and their narrative can mutate. What began as a selloff caused by the coronavirus outbreak could well mutate into an oil crash-led selloff, and then mutate again into a selloff due to policy…