Mexican equities and European bank stocks have been trading in close tandem, indicating that common shocks are driving them both. For now, each of those markets continue to trade at very depressed levels. Funding stresses…

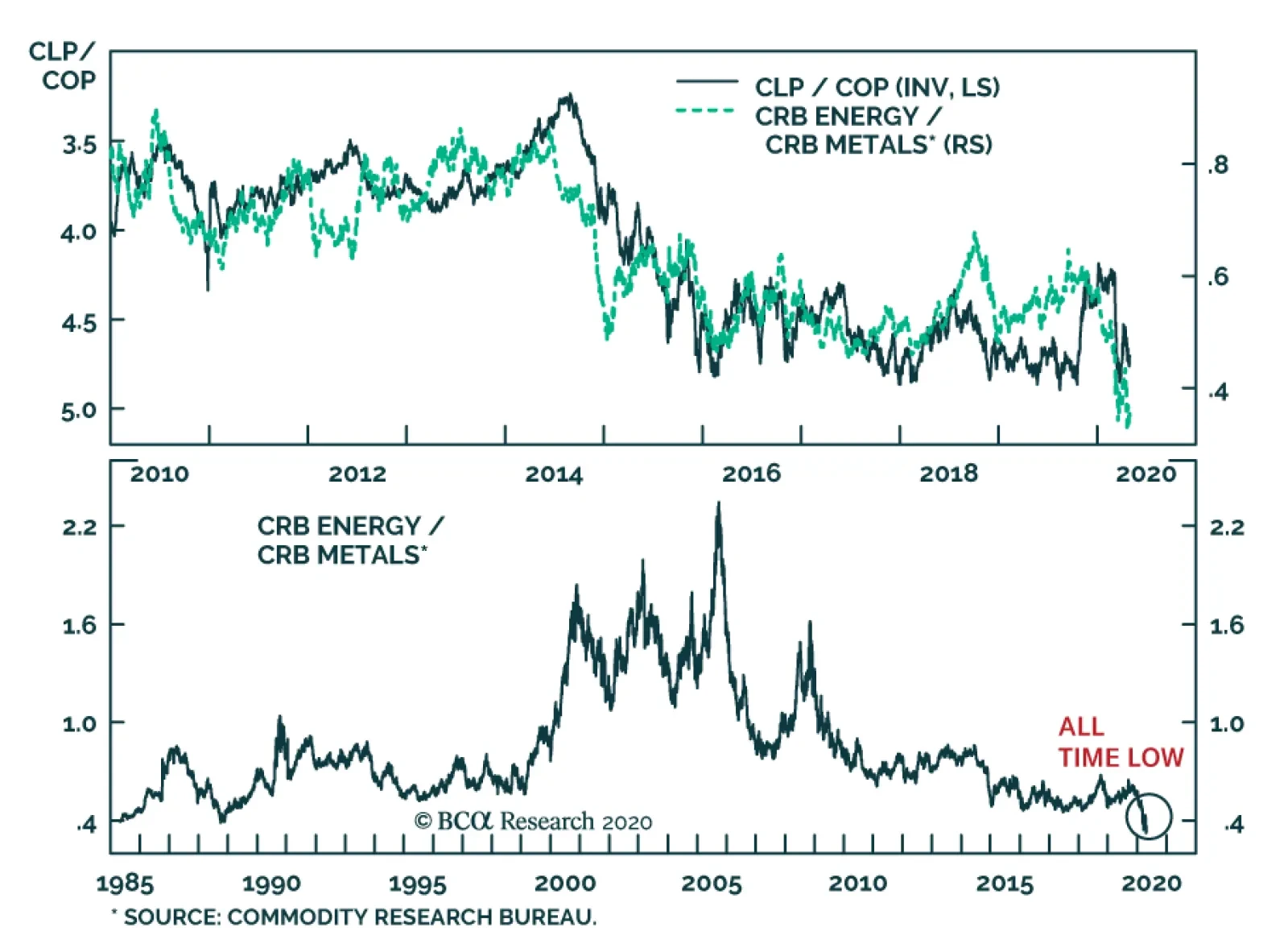

Based on the CRB indices, energy prices have fallen to an all-time low relative to industrial metals. Sure, oil demand has collapsed and storage is near full capacity, but the slope of the oil curve suggests that prices already…

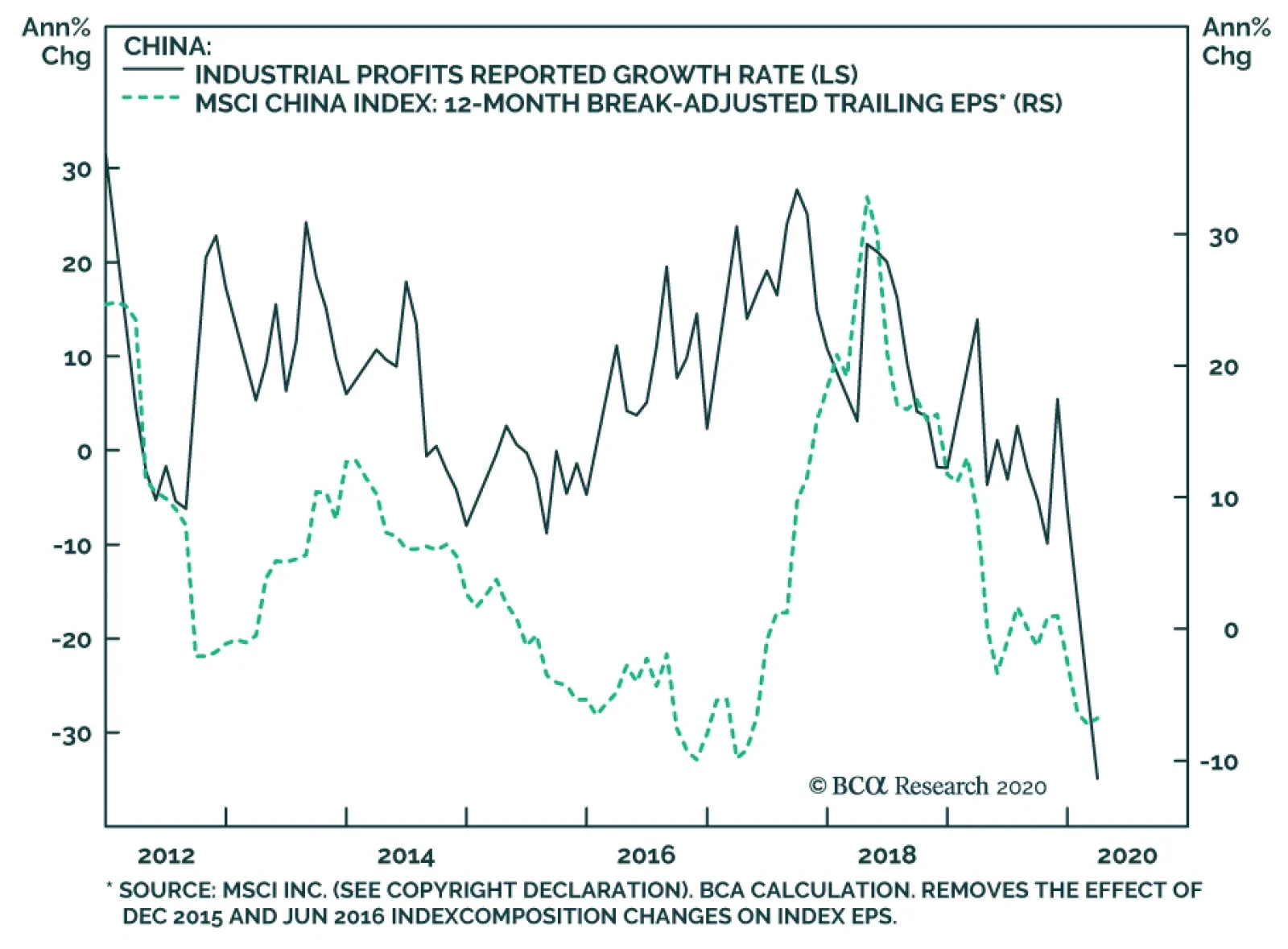

China reported predictably terrible numbers for industrial profits in Q1: CNY 781 billion, down 36.7% year-on-year. Of the 41 industry categories, 39 saw profit declines, with petroleum and coal making an outright loss year-to-…

Yesterday, BCA Research's Geopolitical Strategy service provided investors with an update on North Korea. As we are going to press we have received no official information concerning Kim Jong Un’s status, but the situation…

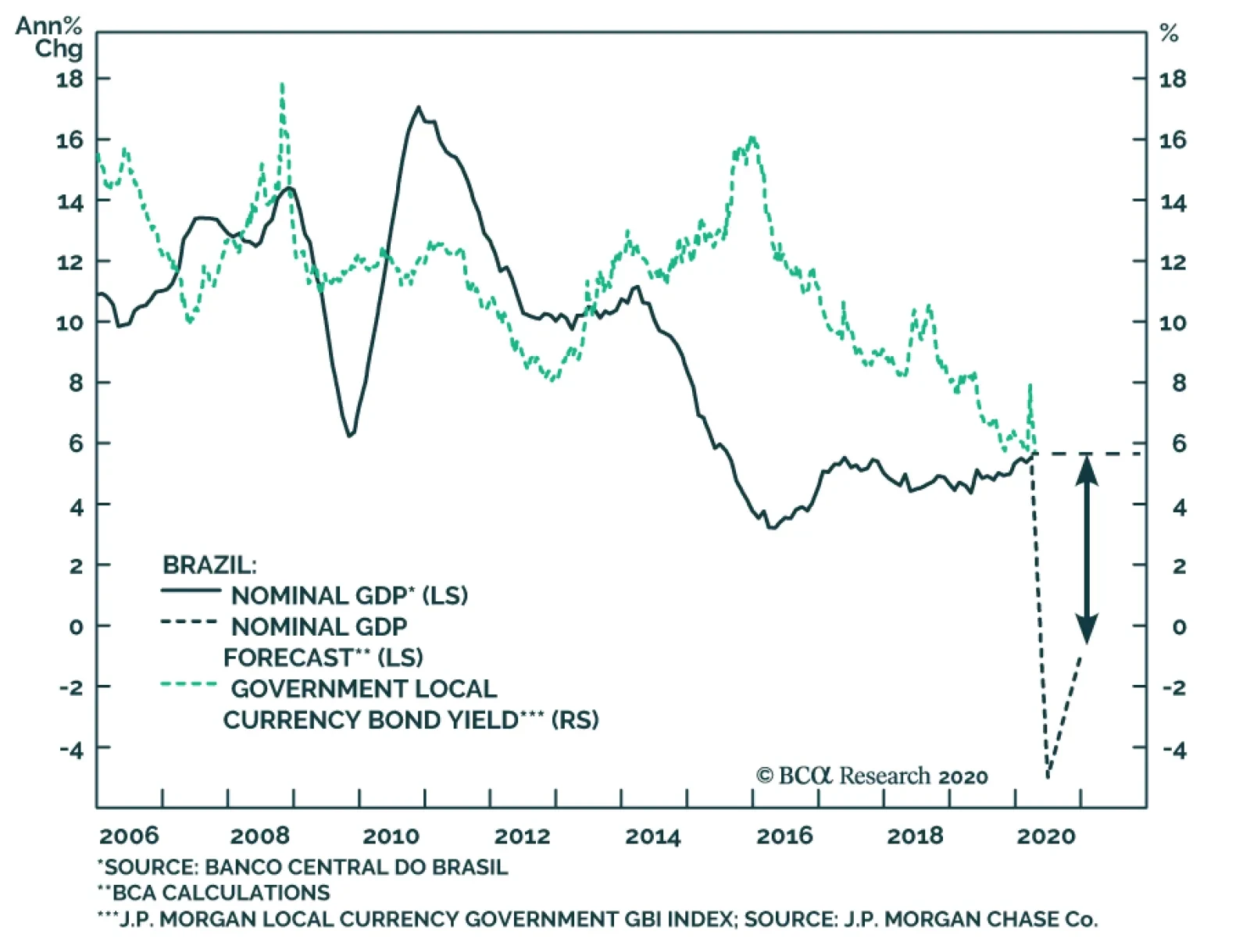

BCA Research’s Emerging Markets Strategy service continues to recommend underweighting Brazil and shorting the BRL versus the US dollar. Brazilian markets plunged last Friday due to the ongoing political crisis.…

Highlights Kim Jong Un’s sickness or death is a matter of speculation and it is best to remain skeptical for now. If Kim dies or is incapacitated, it is a serious concern for North Korean and hence regional stability – and…

Highlights The collapse in oil prices supercharges the geopolitical risks stemming from the global pandemic and recession. Low oil prices should discourage petro-states from waging war, but Iran may be an important exception. Russian…

Highlights Uncertainty over the duration of lockdowns globally will continue to hamper the estimation of the global demand recovery for commodities. This uncertainty will continue to fuel safe-haven demand for USD for the balance of…

Highlights Yesterday we published a Special Report titled EM: Foreign Currency Debt Strains. We are upgrading our stance on EM local currency bonds from negative to neutral. Before upgrading to a bullish stance, we would first need…

Highlights The Chinese economy is recovering at a slower rate than the equity market has priced in. There is a high likelihood of negative revisions to Q2 EPS estimates and an elevated risk of a near-term price correction in Chinese…