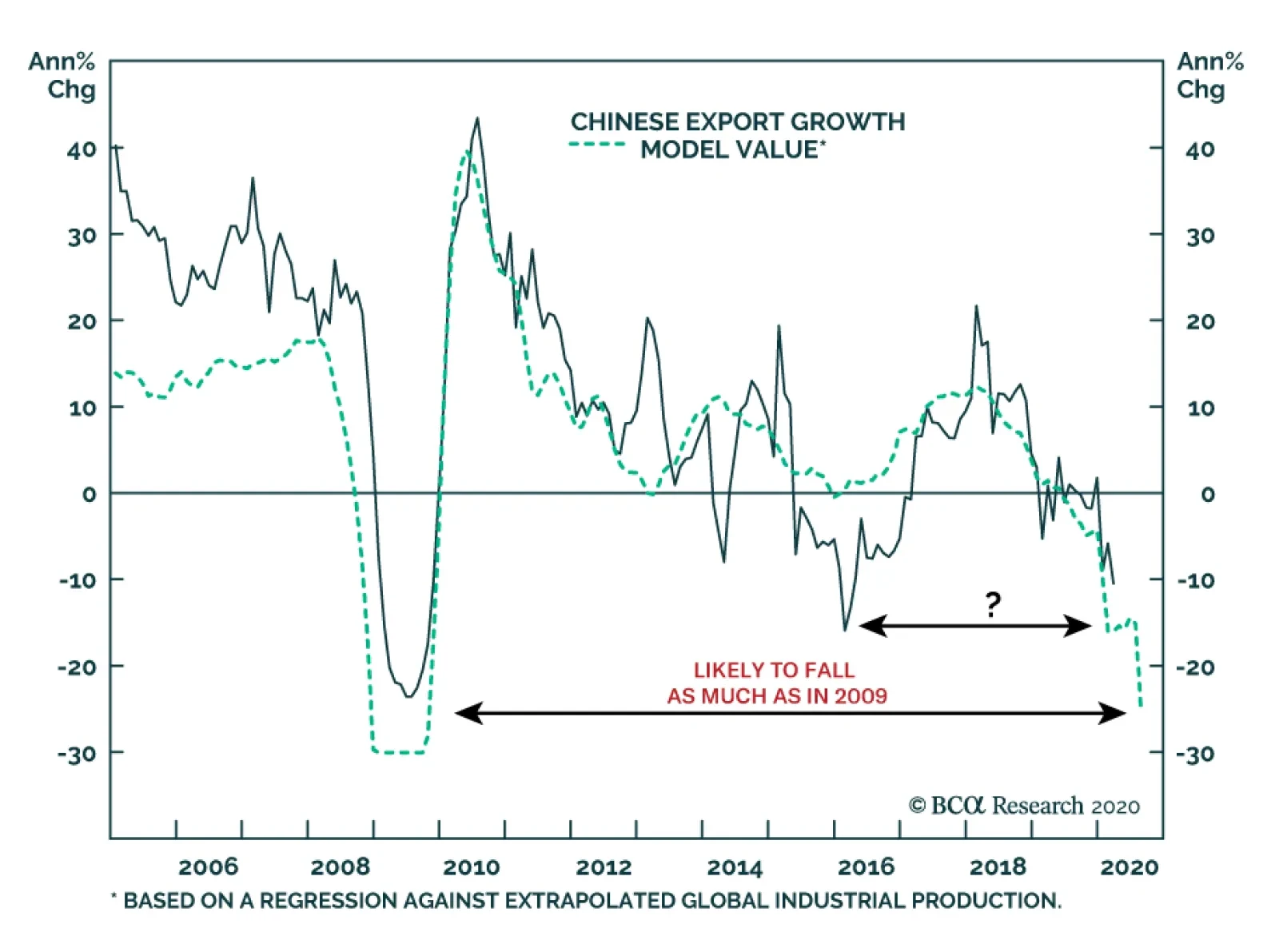

Highlights The current pace in the recovery of China’s domestic demand has not been robust enough to fully offset the impact from the collapse in exports. The level of industrial inventory jumped to a five-year high, but it will…

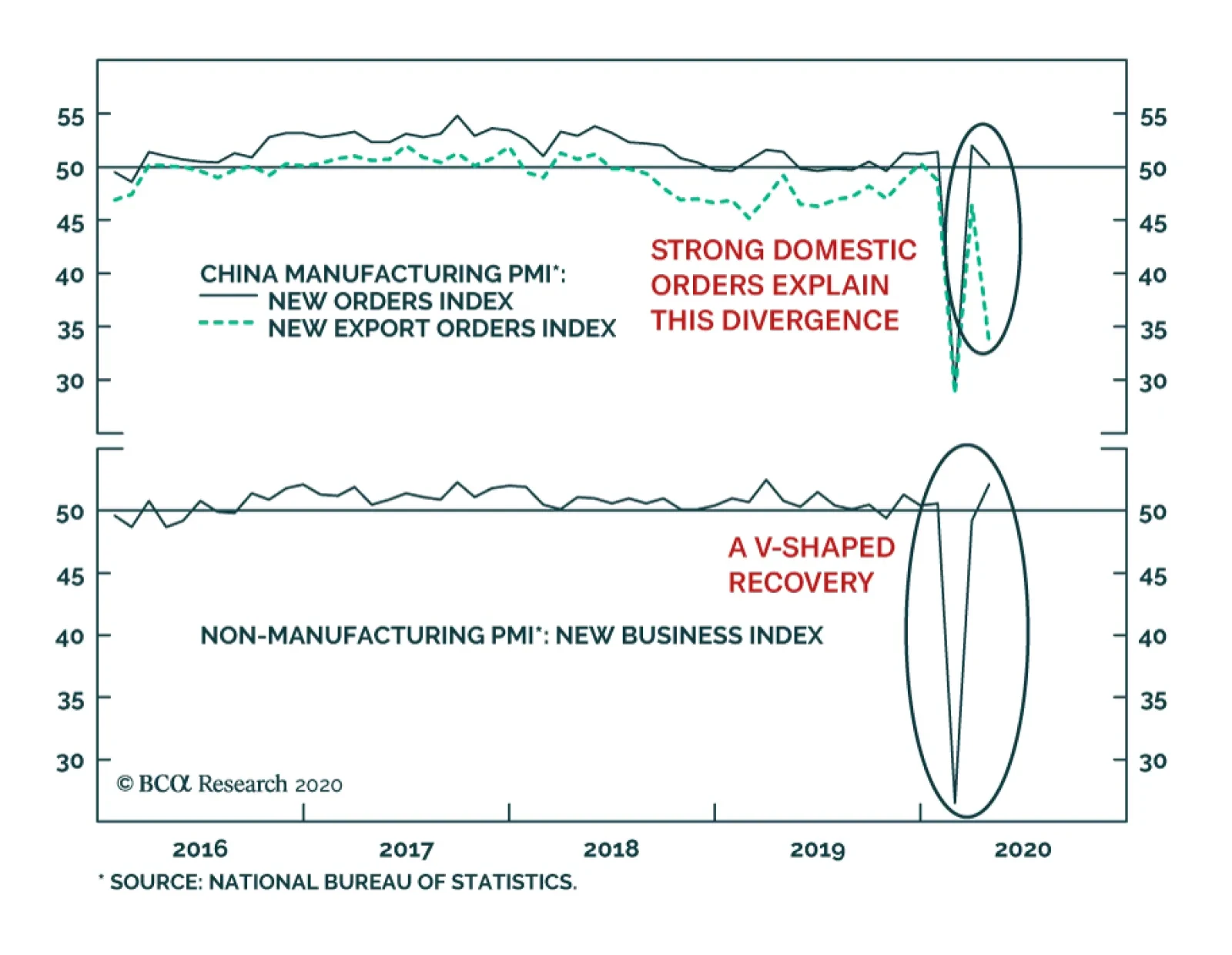

In sharp contrast to the US, the Chinese PMIs were soft. When looking at overall manufacturing activity, there is little redeeming feature. However, the details of the survey reveal that the export sector is a drag on activity,…

Highlights Over the past 24 hours the White House has taken several steps indicating that President Trump is adopting the “war president” posture in the run-up to the US election. The intensity of the US-China rivalry can…

Highlights The global economy will contract at its fastest pace since the early 1930s, but will not slump into a depression. Easy monetary conditions, an extremely expansive fiscal policy, and solid bank and household balance sheets…

Analyses on Chinese autos and Brazil are available below. Highlights The Fed’s aggressive monetization of public and some private debt has inspired investors to allocate cash to risk assets However, a number of cyclical…

BCA Research's China Investment Strategy service expects the recovery in Chinese domestic demand to pick up momentum in the second half of this year. A modest recovery in oil prices in Q3 will not be enough to return China's PPI…

Highlights Even as a net oil importer, China loses more than it gains when oil prices collapse. An oil price collapse generates a formidable deflationary force, which will further depress China’s industrial pricing power and…