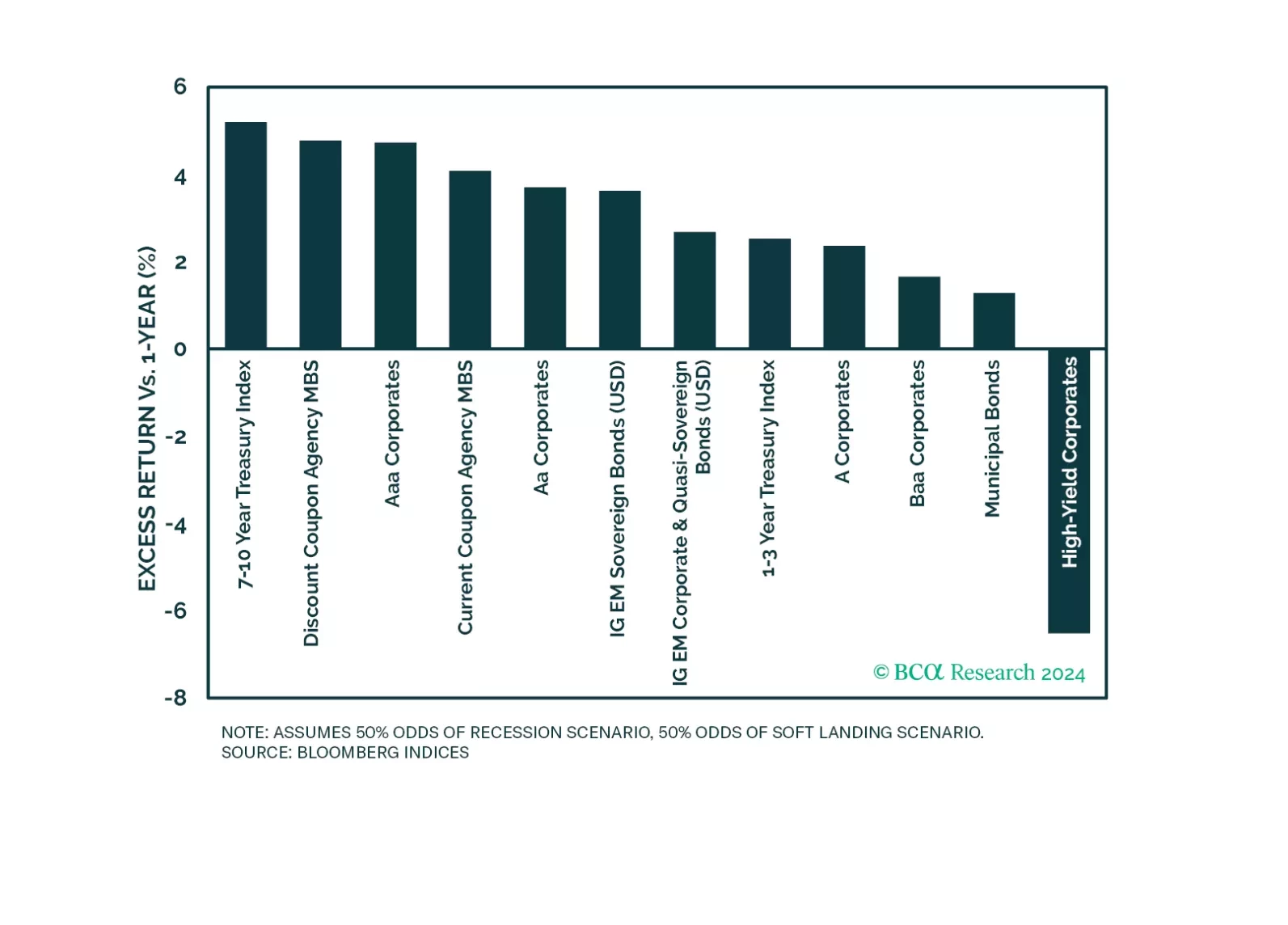

We update our 12-month return projections for different US fixed income sectors in soft-landing and recession scenarios.

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

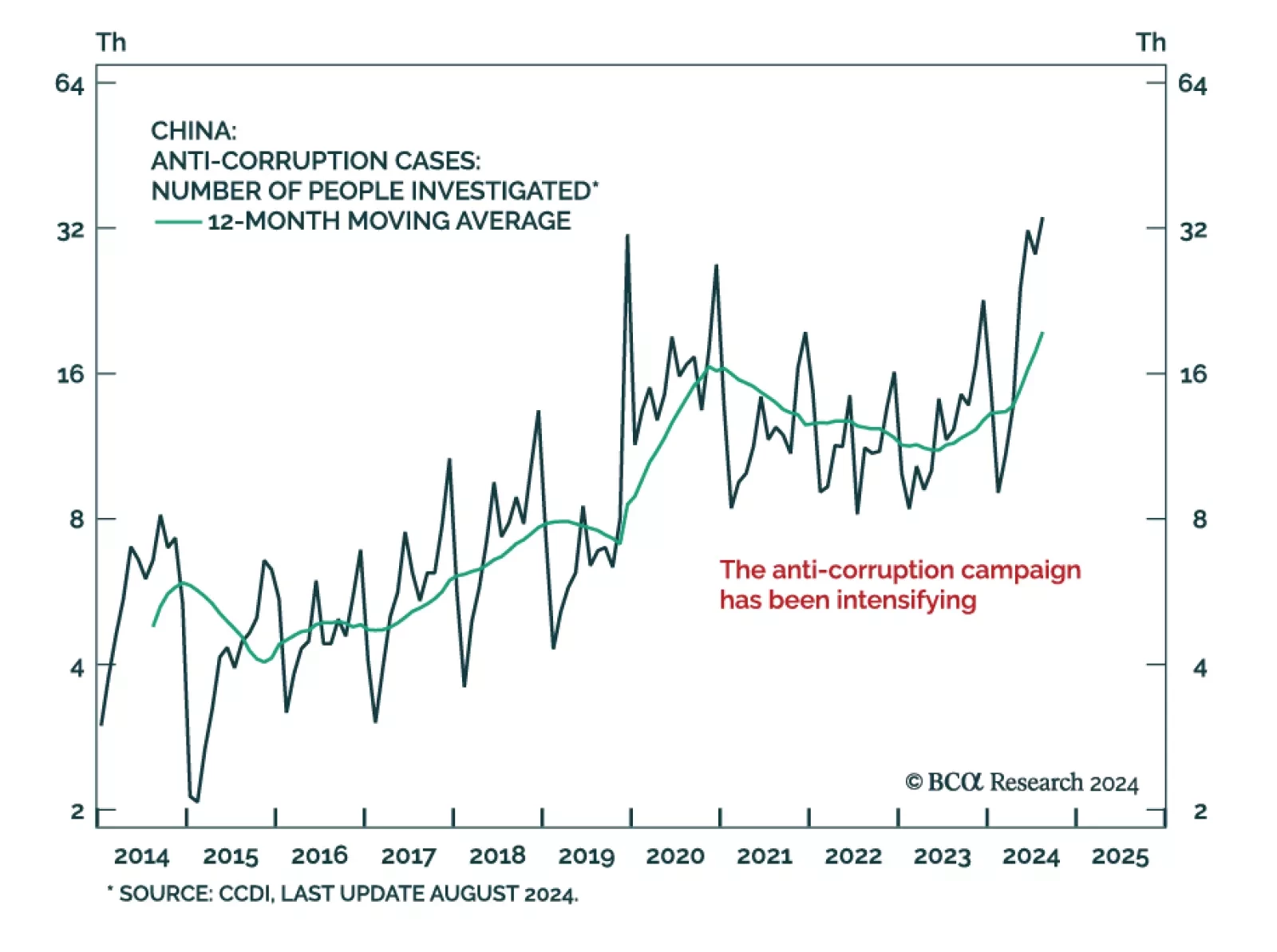

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

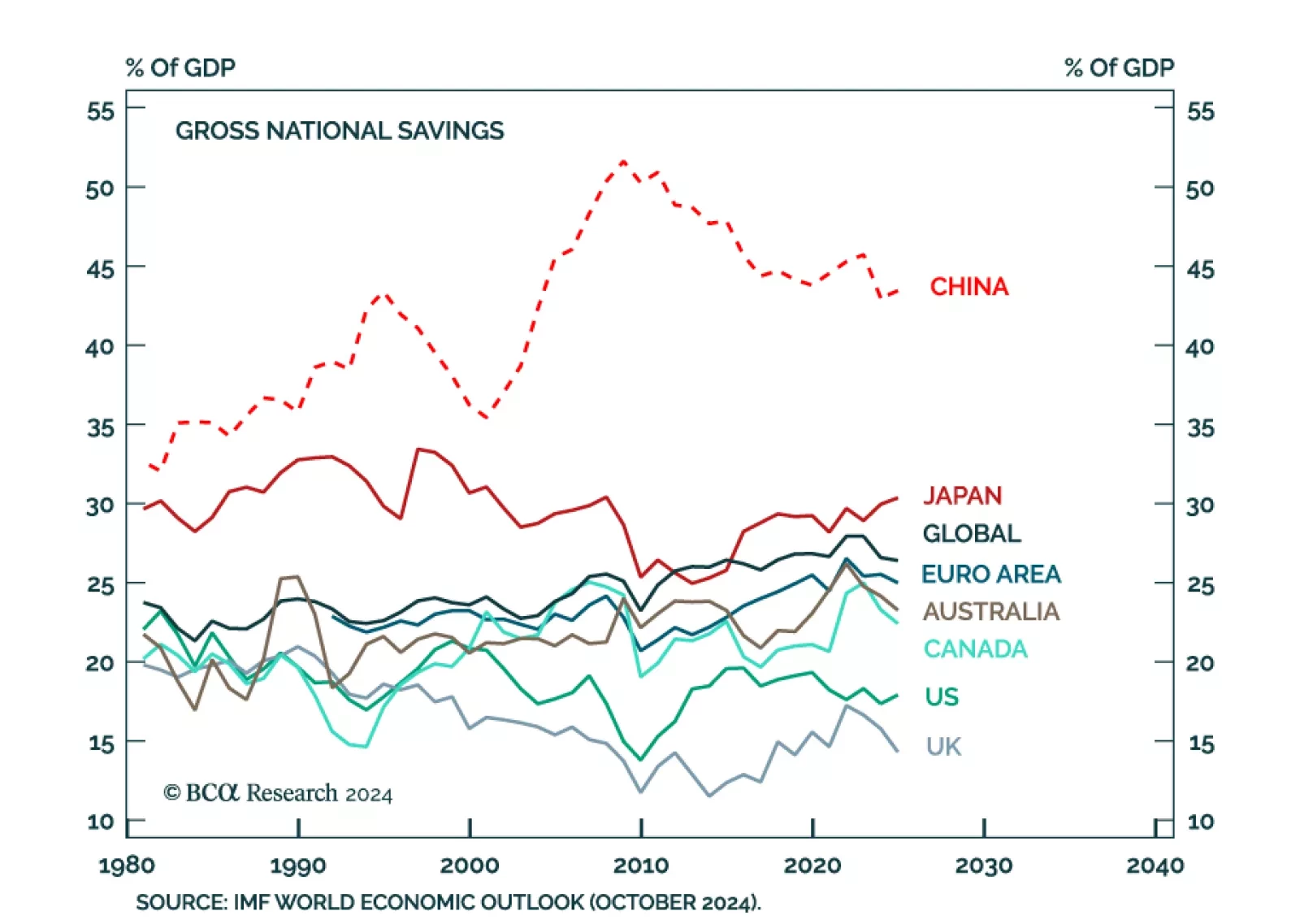

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

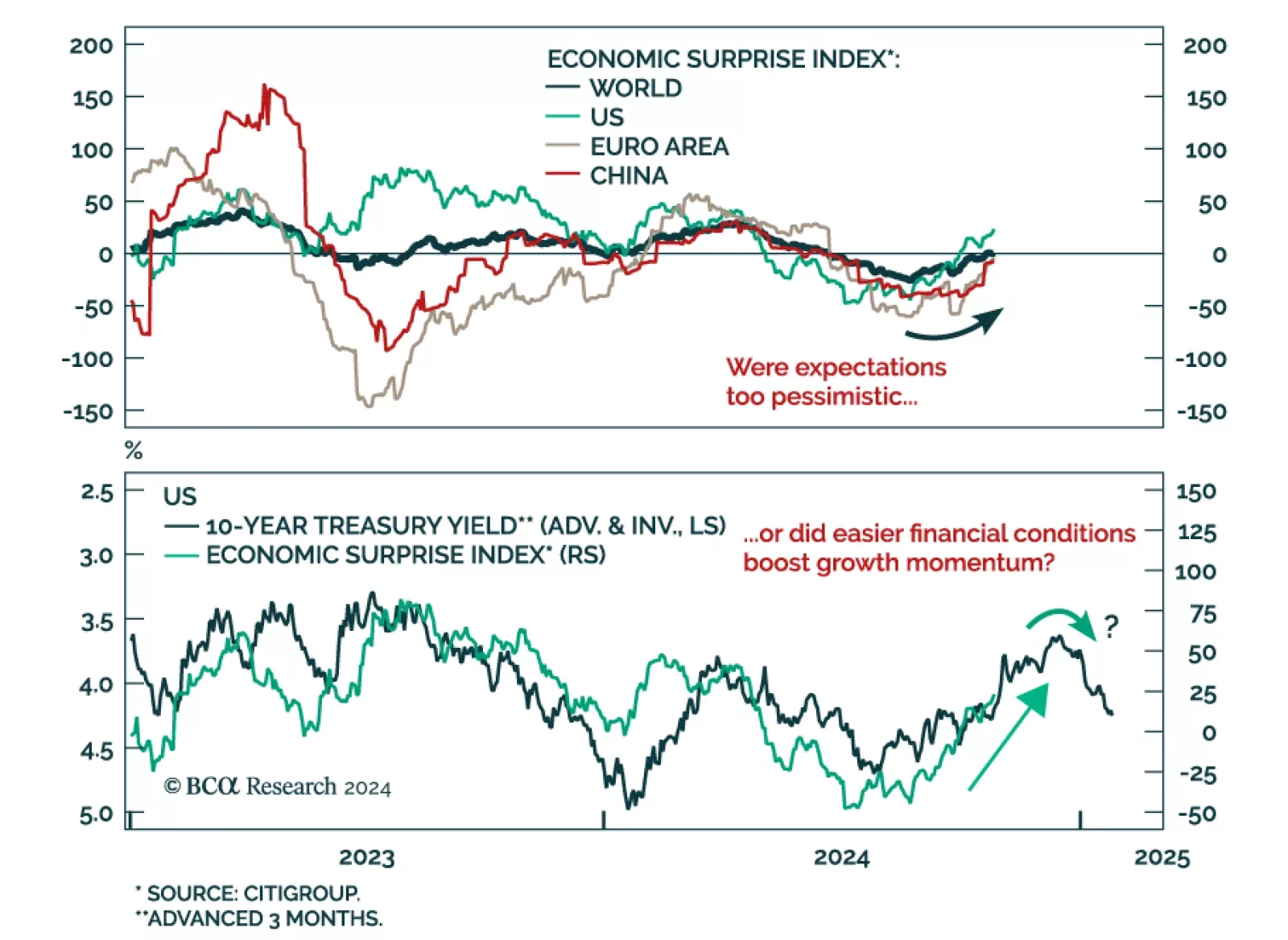

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…

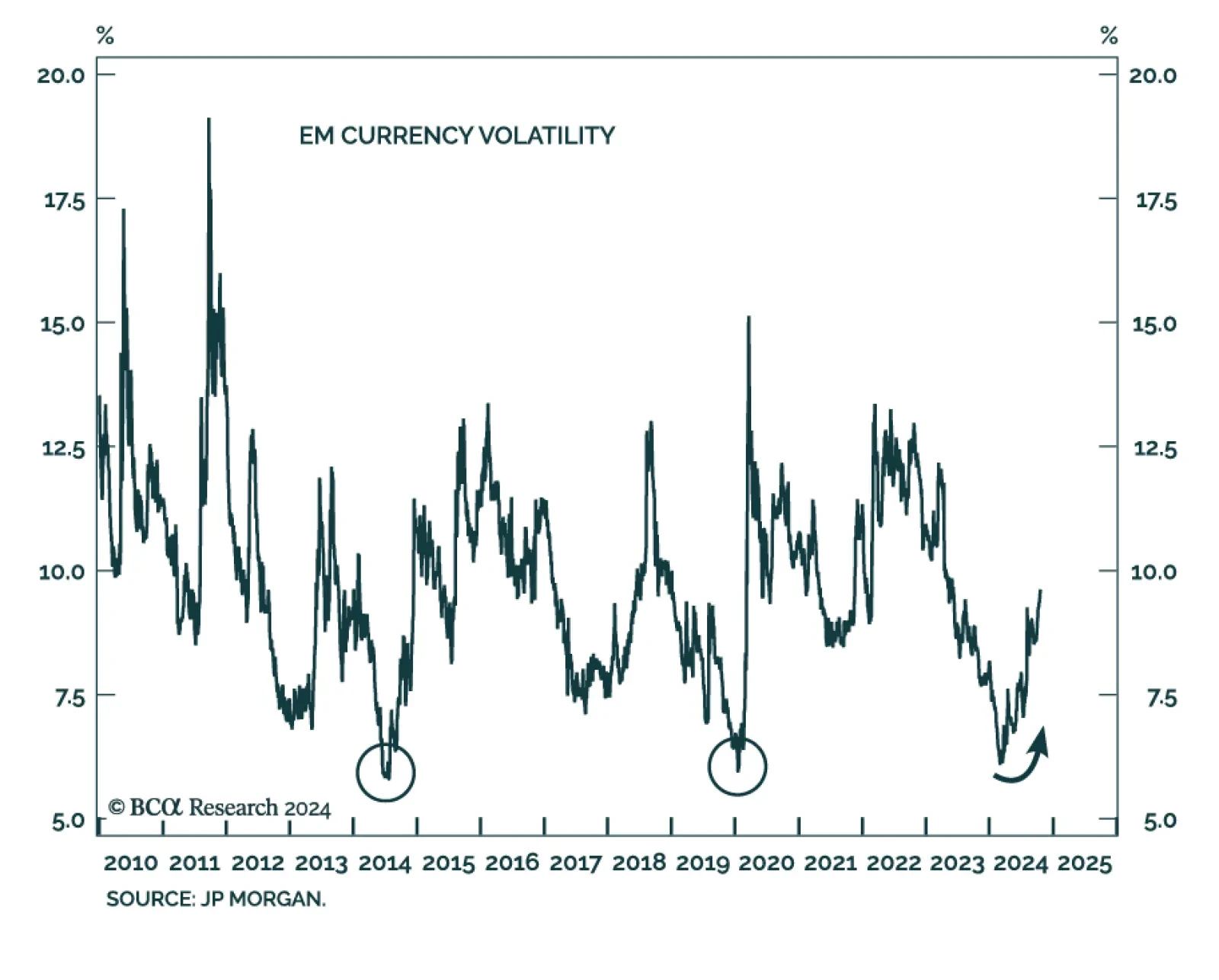

Our Emerging Markets Strategy team sees evidence of a “Trump trade” across markets, as the dollar strengthens, Treasury yields jump, and US small caps try to break out. However, the tactical and cyclical outcomes…

As the odds of a Trump victory increase, there are indications that the “Trump trade” has commenced in global financial markets, with negative short-term implications for EM. In short, the US dollar will strengthen, and US bond…

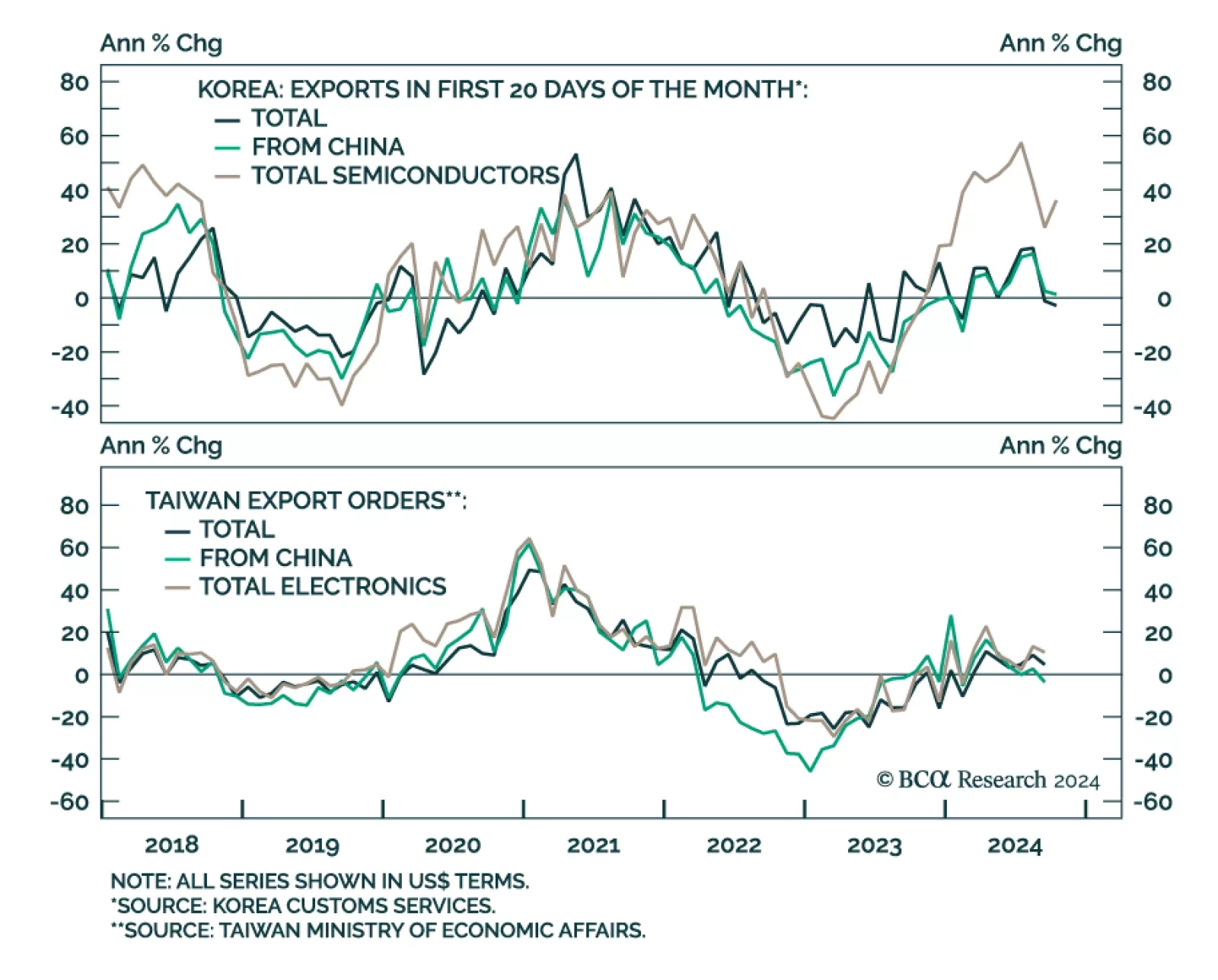

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…