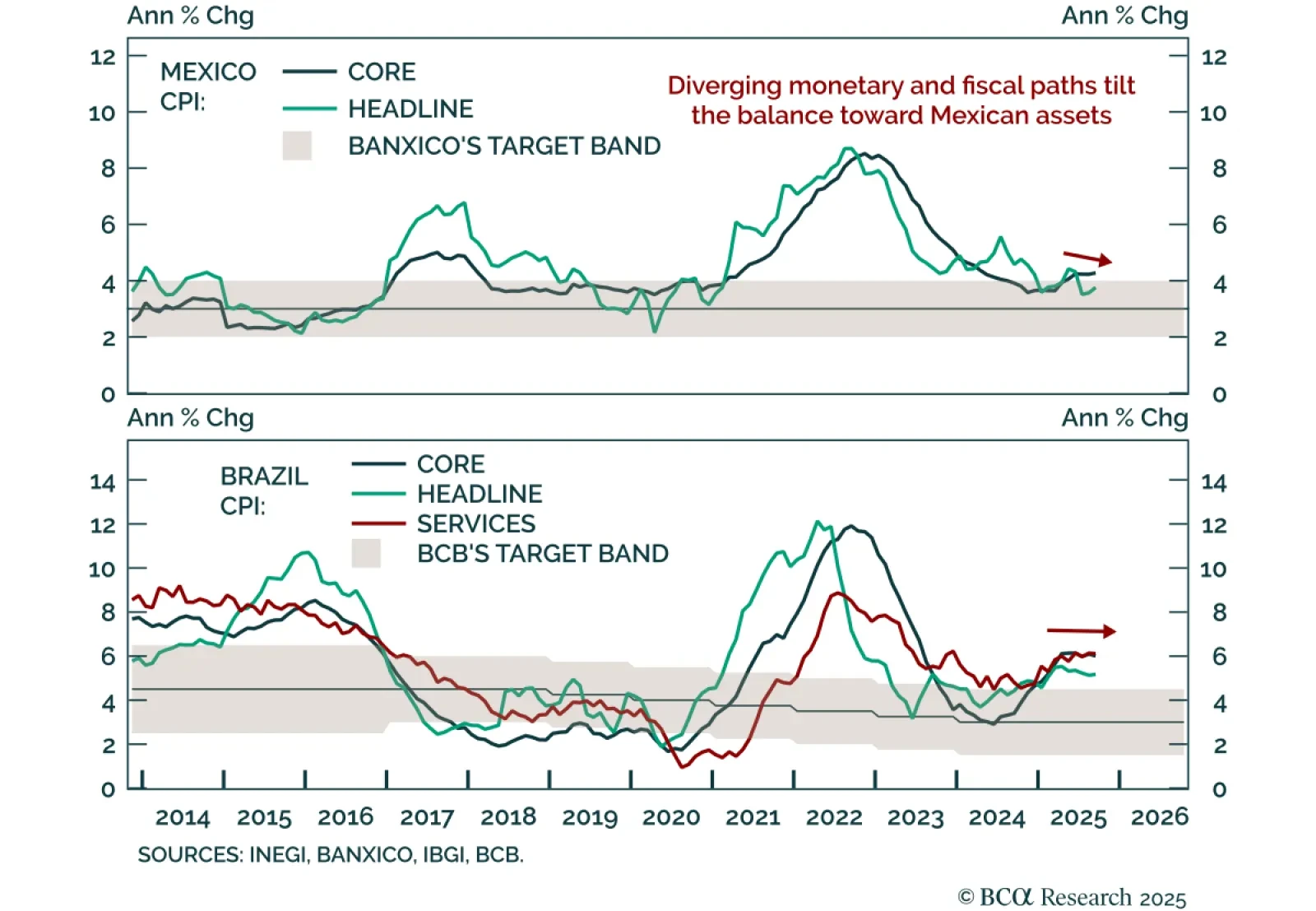

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

Our Portfolio Allocation Summary for October 2025.

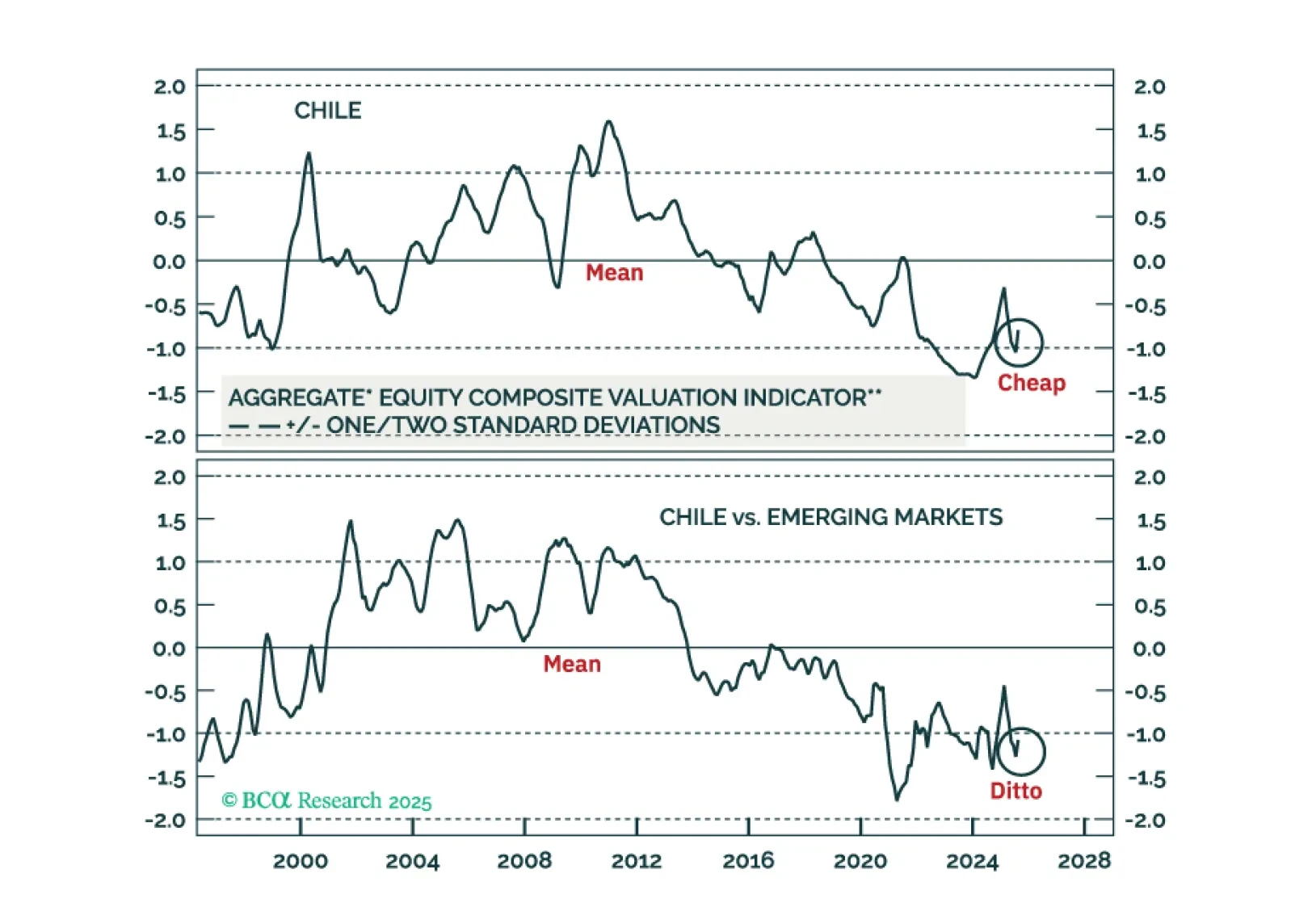

Chilean equities are undergoing a structural re-rating. A political swing back to a pro-business administration, a benign macro backdrop, and a resilient exchange rate will drive Chilean markets’ outperformance versus EM peers.…

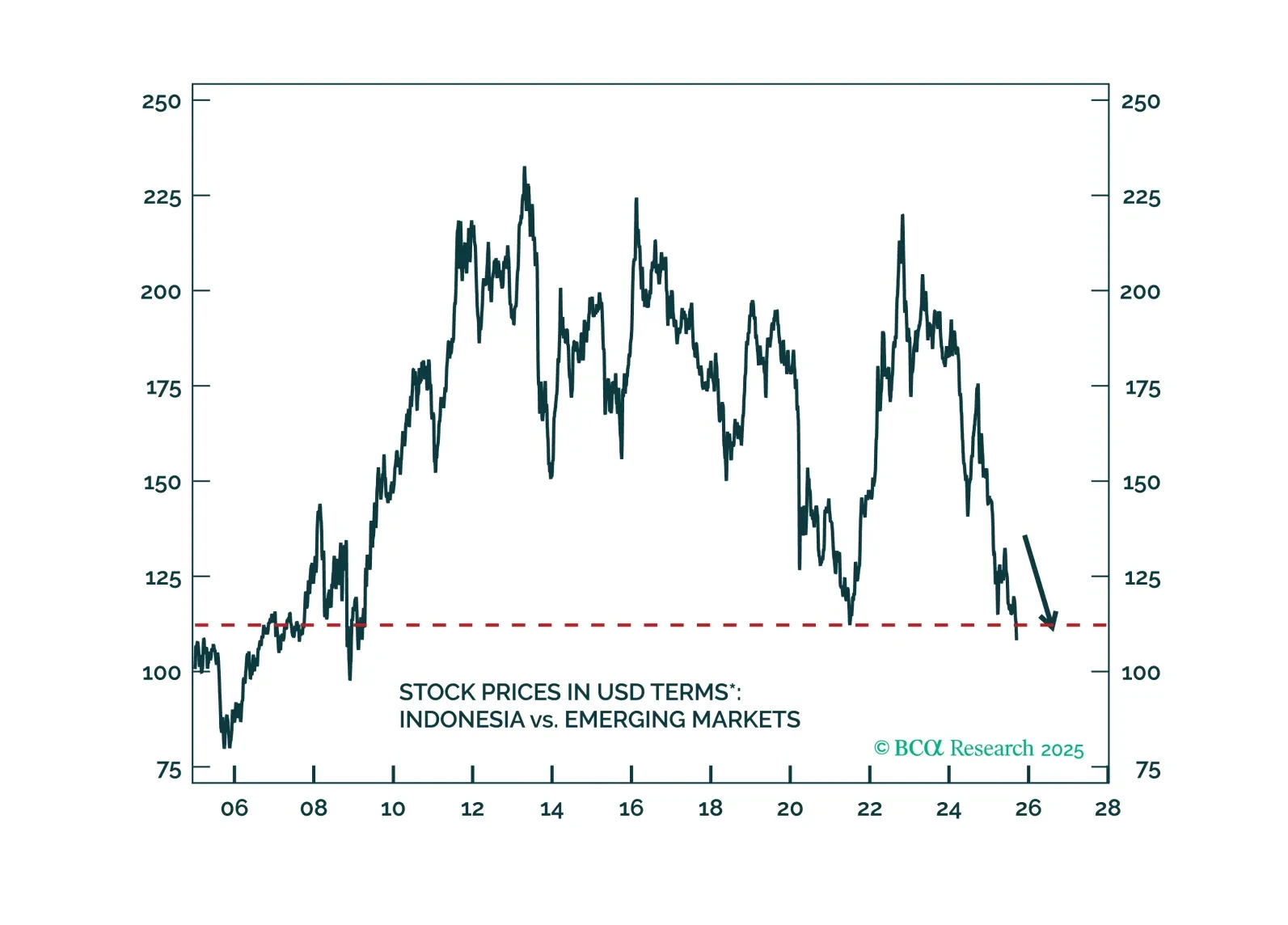

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…

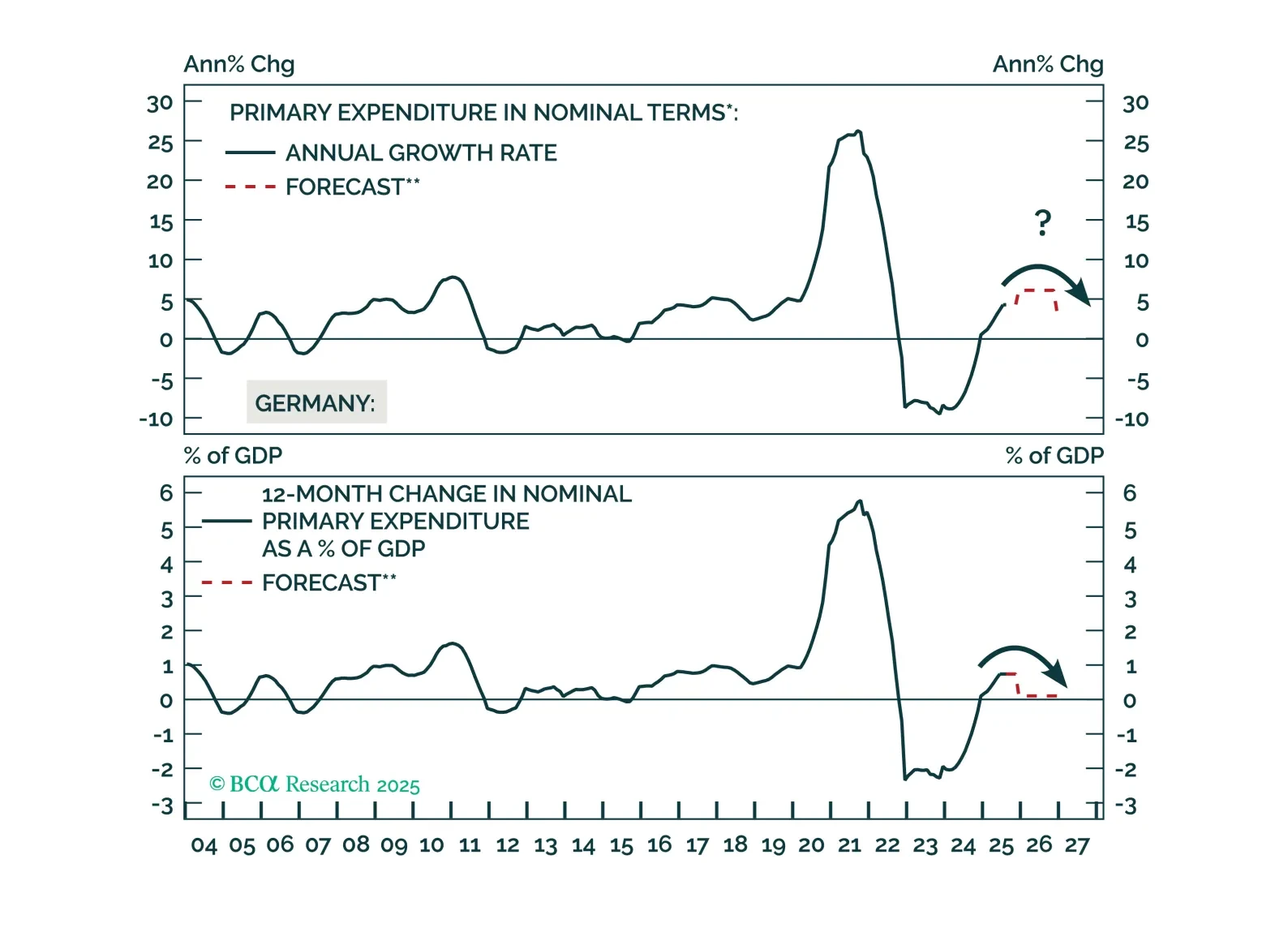

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

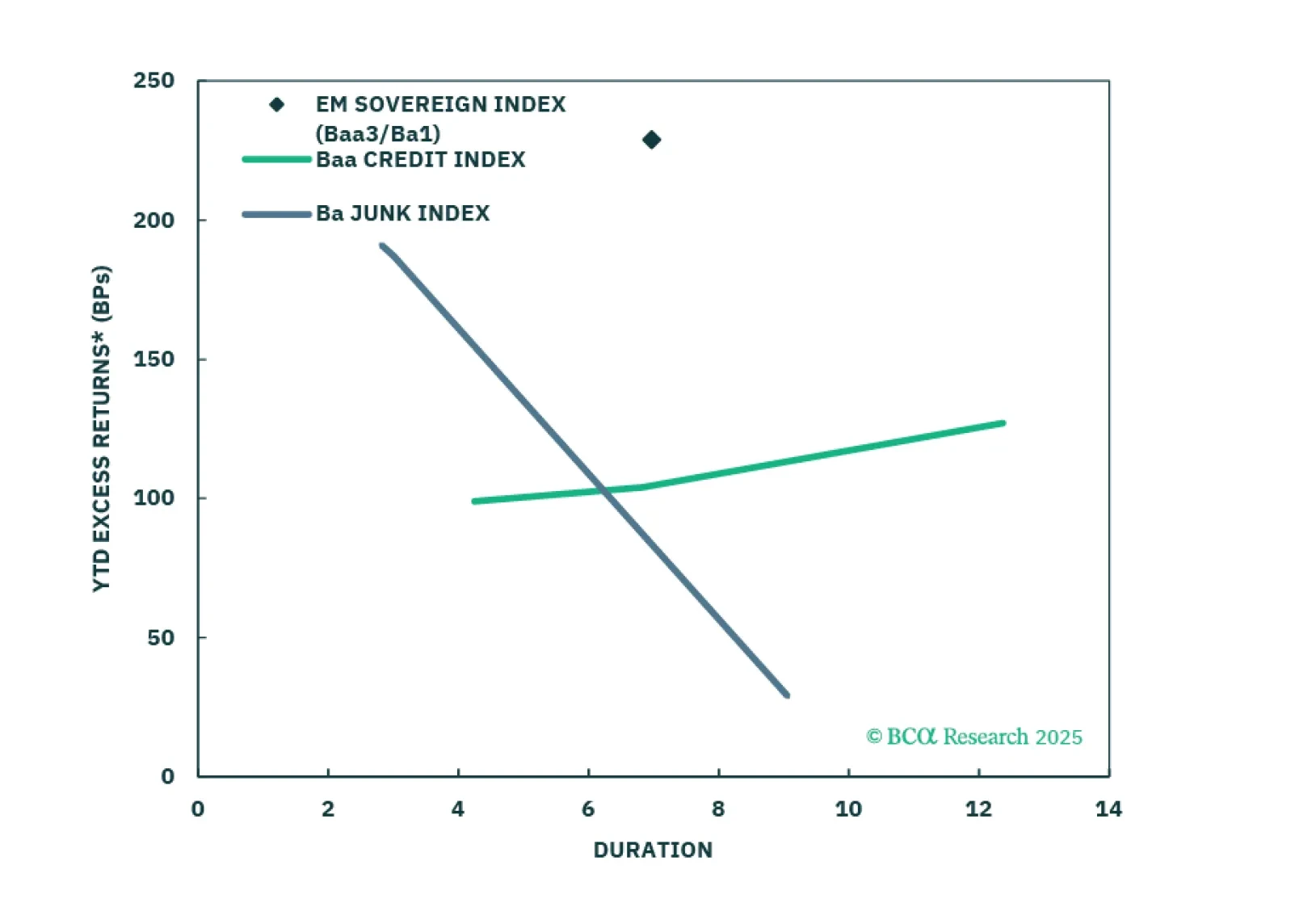

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

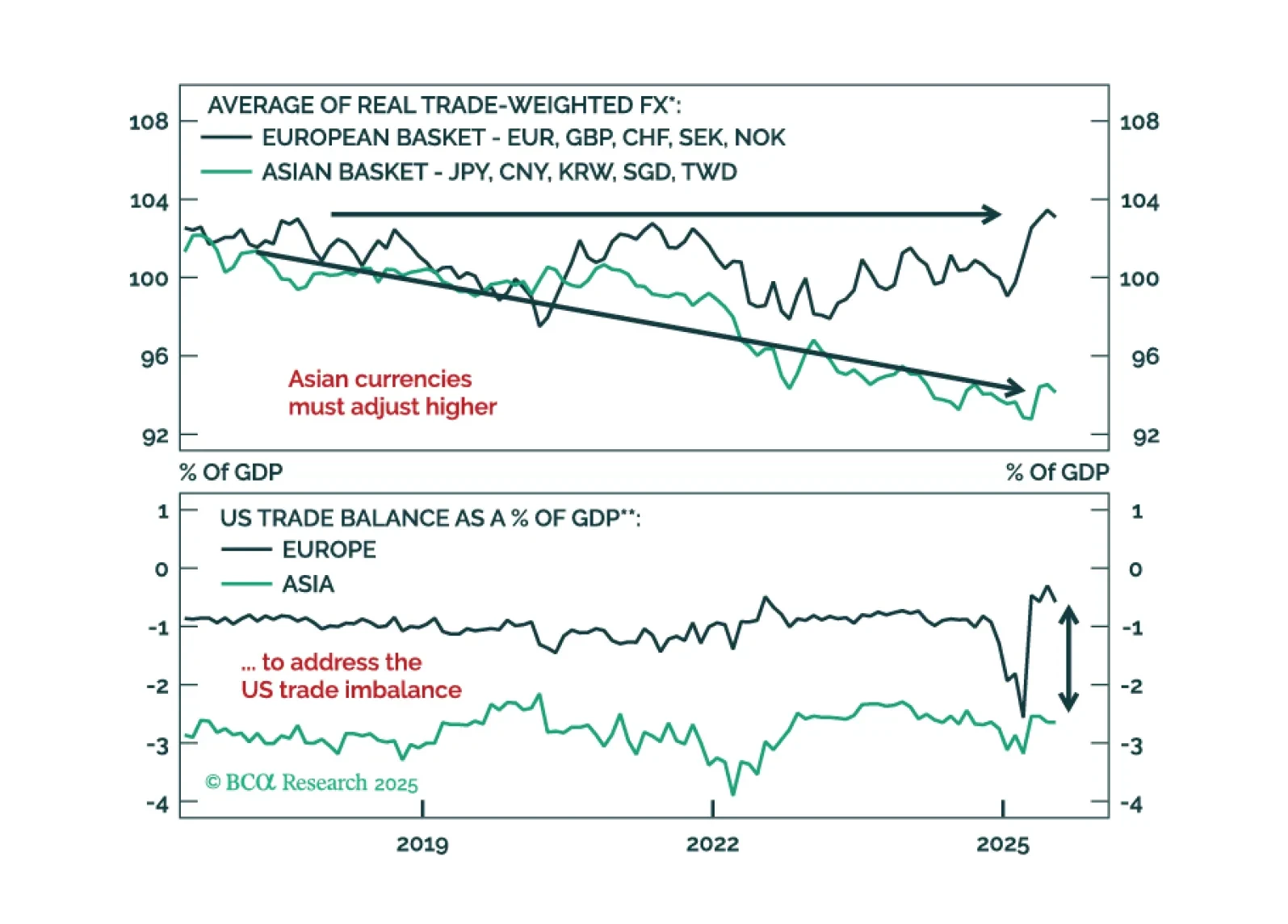

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

Our Portfolio Allocation Summary for September 2025.

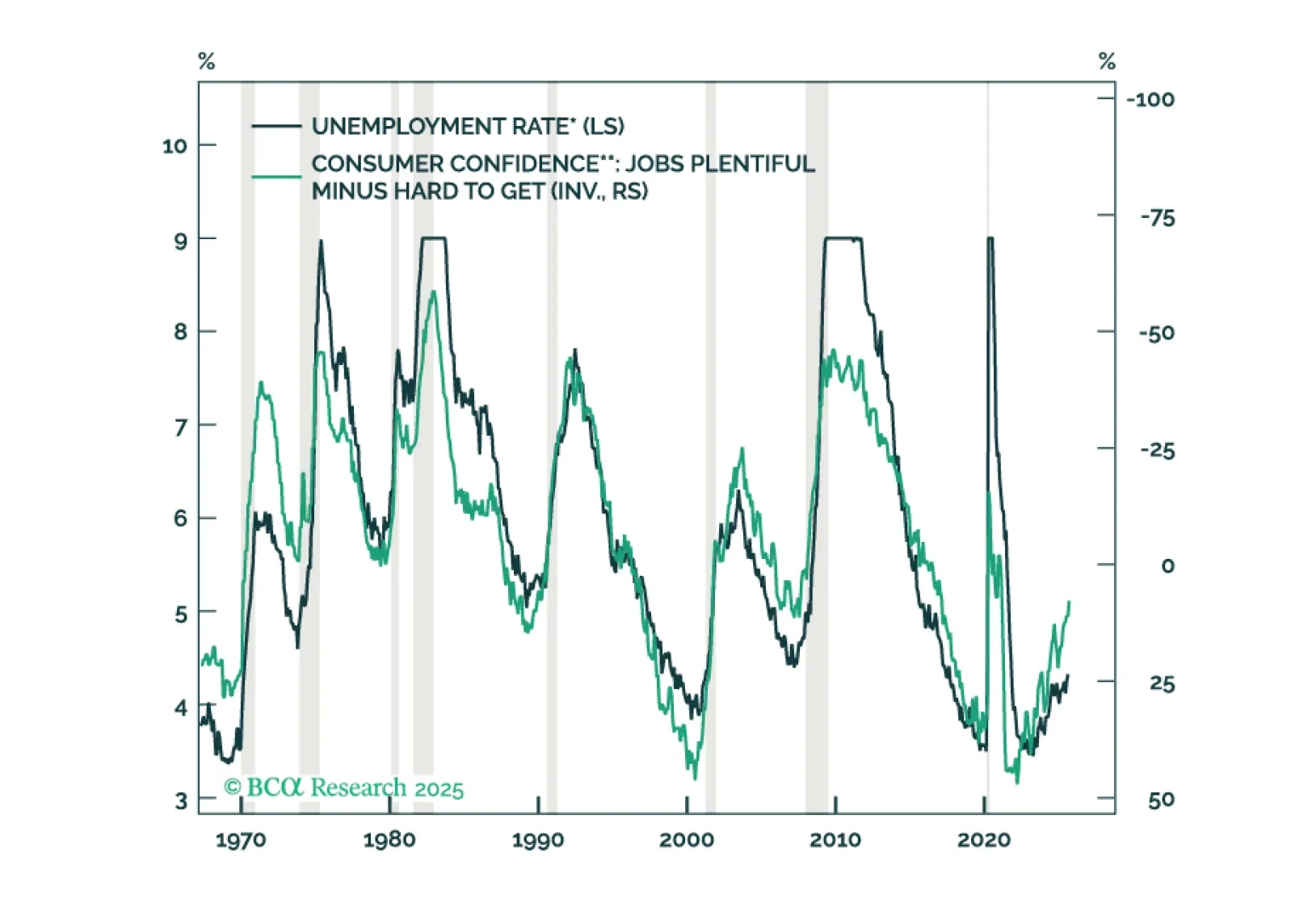

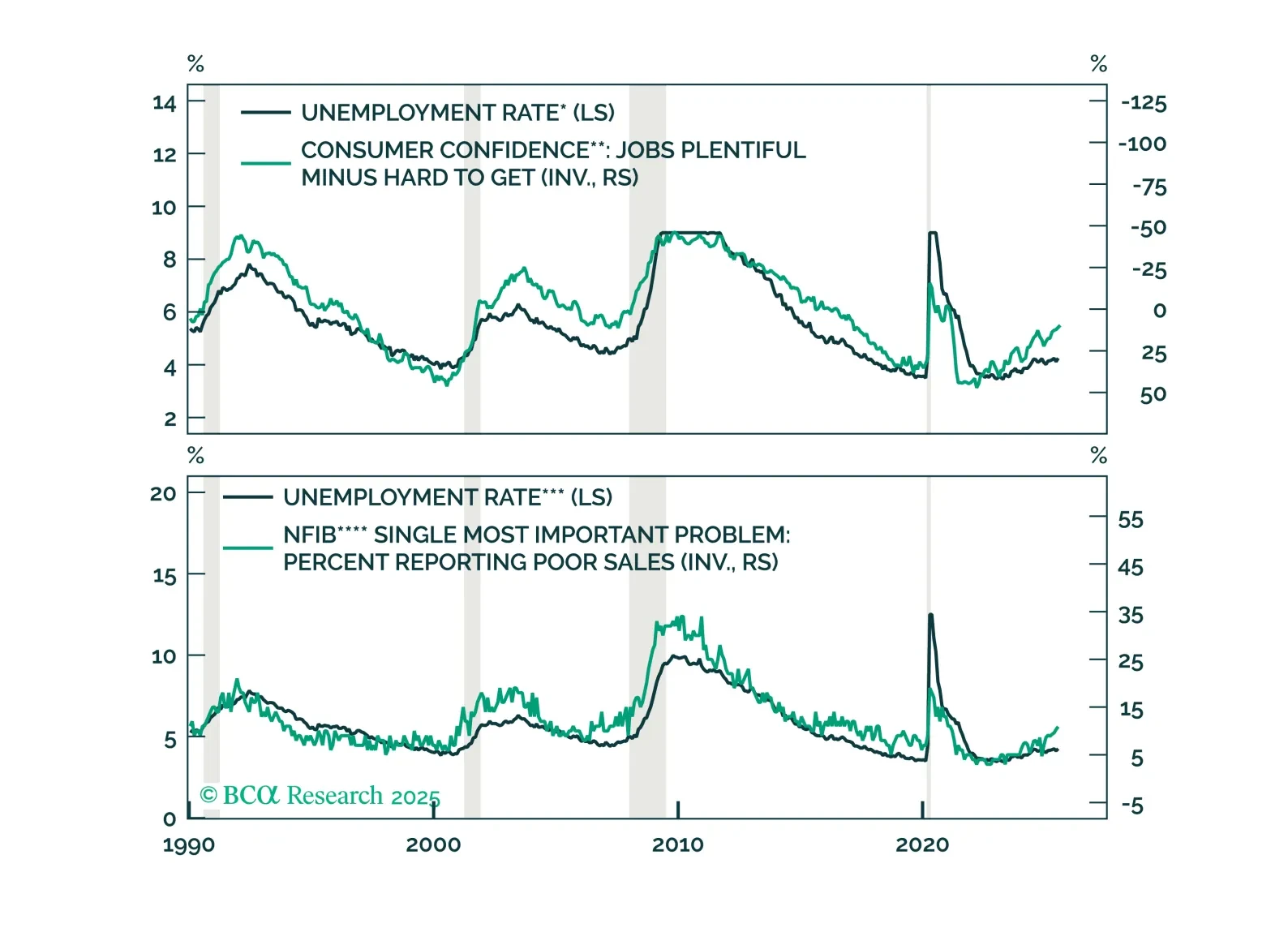

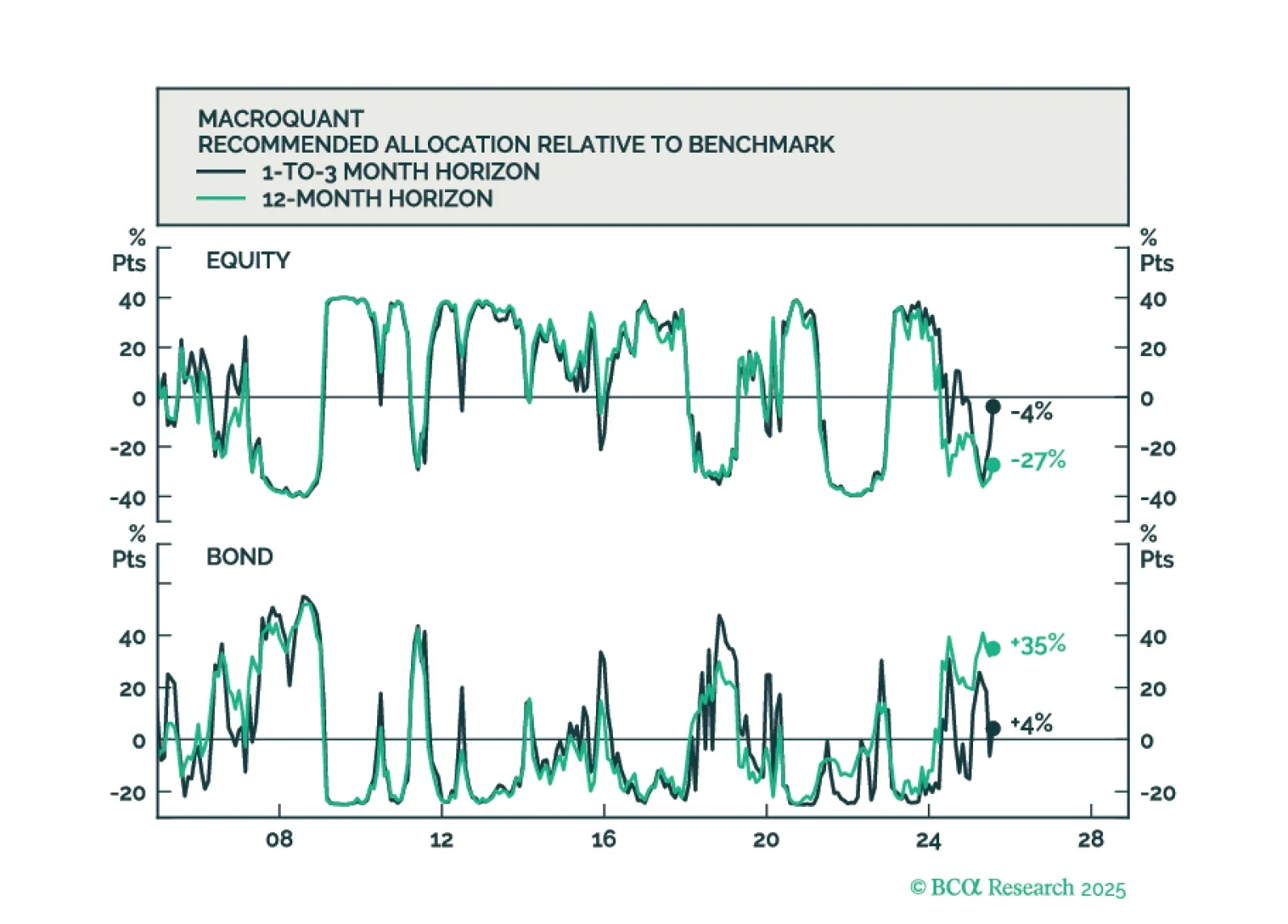

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.