BCA Research’s China Investment and Geopolitical strategists strongly expect that Chinese authorities will continue to add large amounts of stimulus in the Chinese economy. While the rhetorical focus on employment is a…

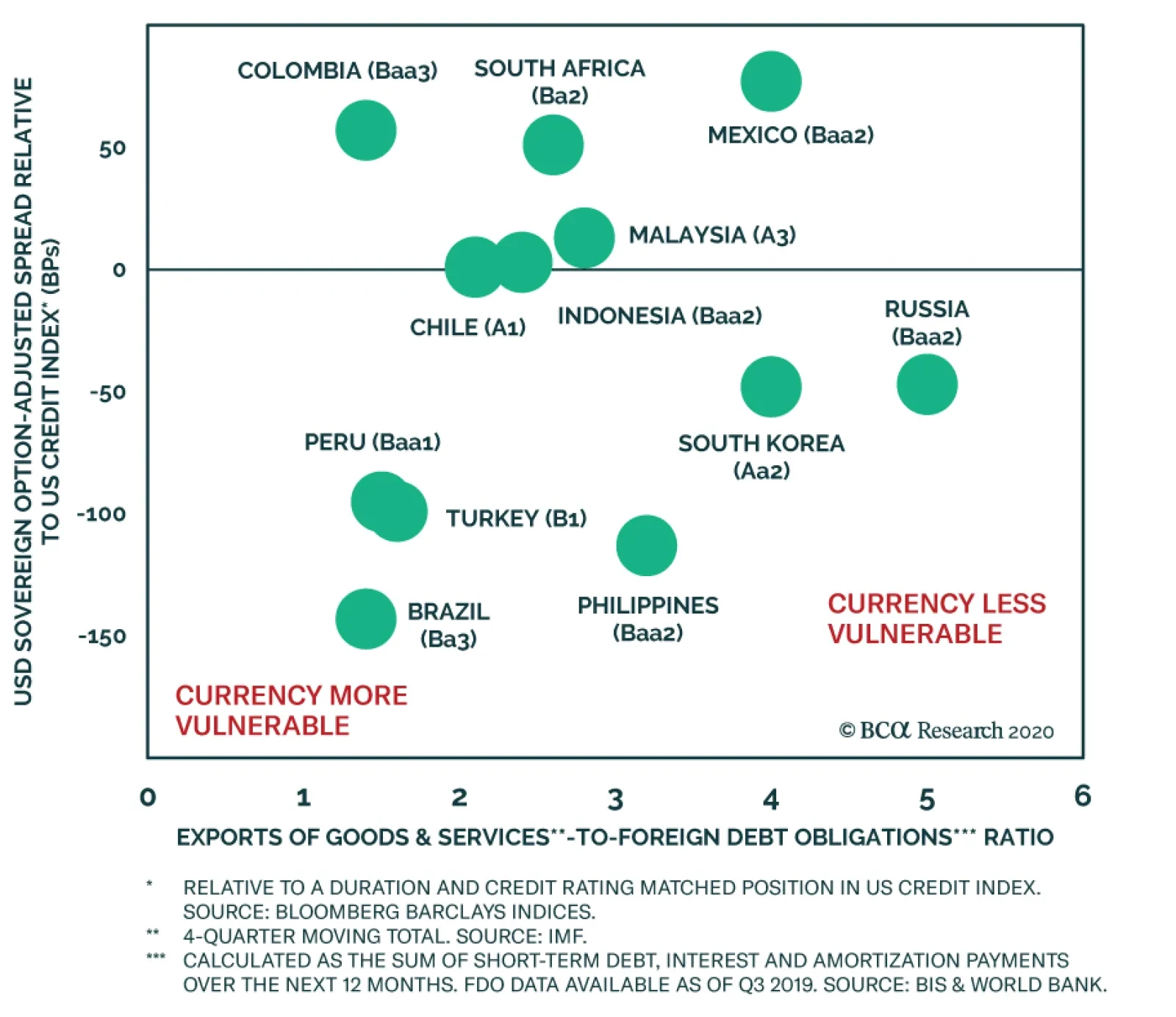

BCA Research's US Bond Strategy service recommends that US bond investors should avoid USD-denominated EM sovereign debt and focus instead on US corporate credit-rated Ba and higher. Of the EM countries with large USD bond…

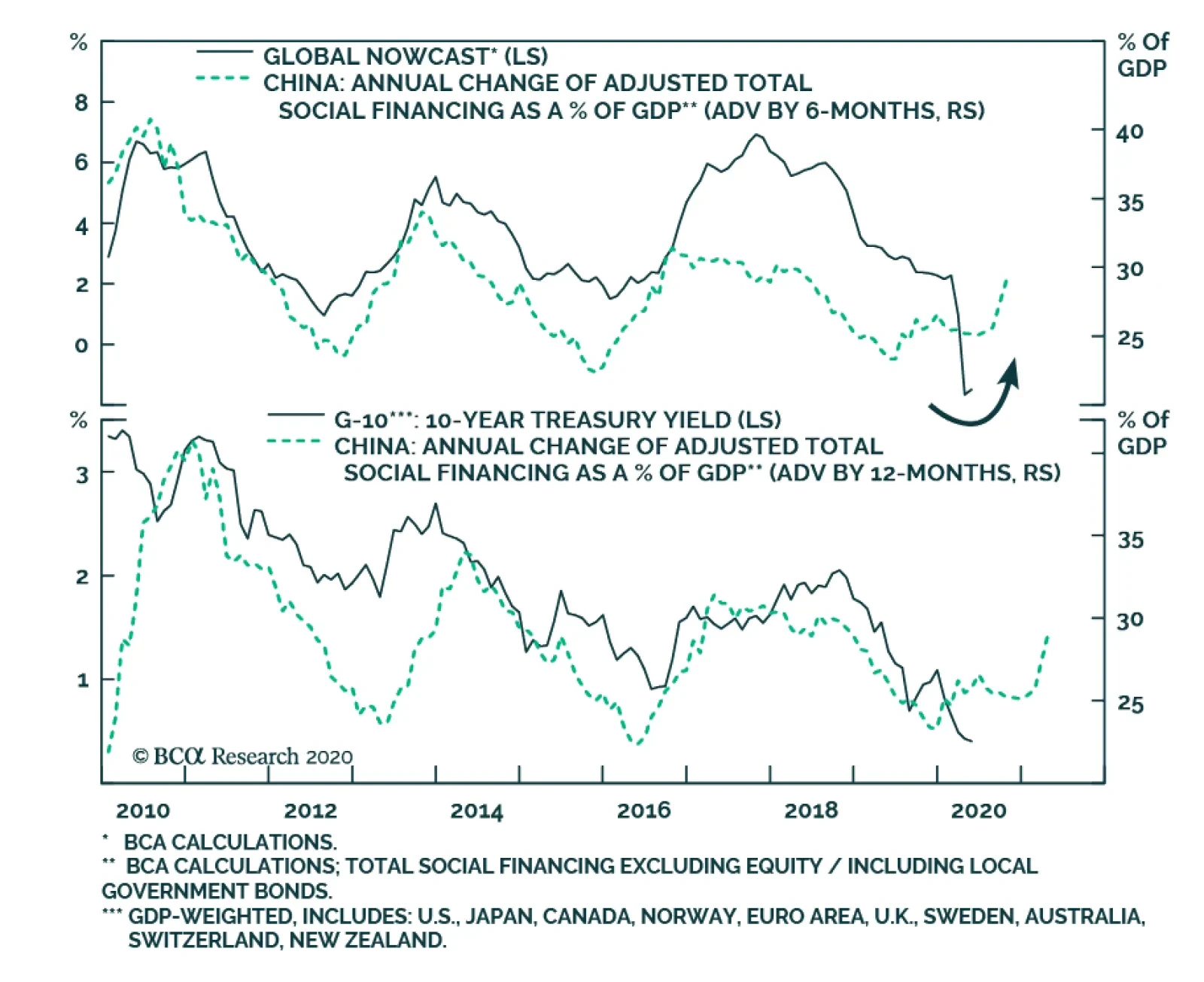

Highlights Treasuries: Despite surging issuance, long-dated Treasury yields will move only slightly higher this year, driven by a modest recovery in global demand. There is also a risk that a second wave of COVID infections will send…

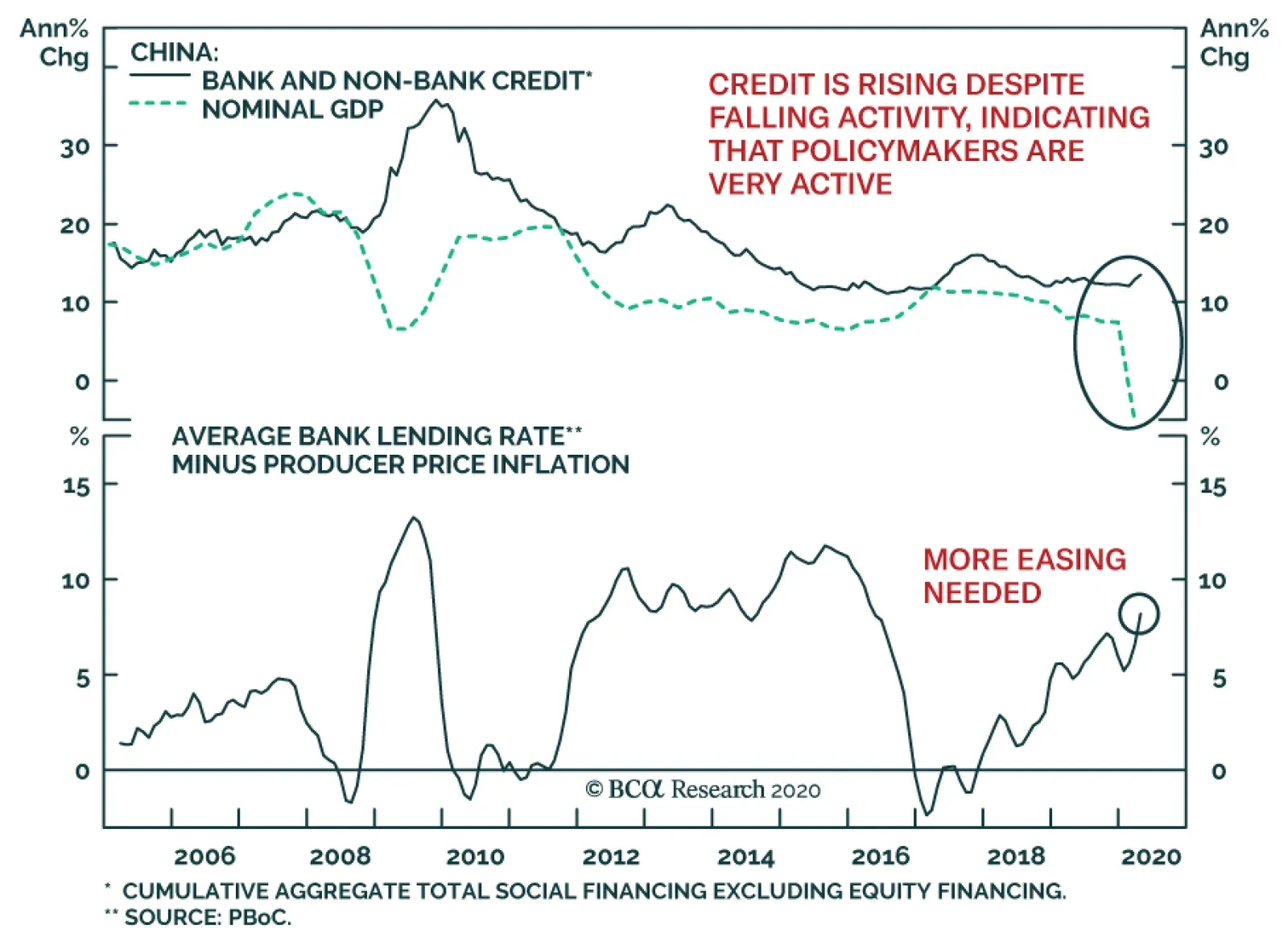

China’s new total social financing flows slowed to CNY3.09 trillion in April, down from CNY5.15trillion in March. Despite the slowdown, credit flows beat expectations of CNY 2.78 trillion. As a result, the 12-month Chinese…

Highlights Ever since the Federal Reserve’s liquidity injections, the dollar has been trading in a bifurcated manner. Historically, this has been a rare event. The main bifurcation has been between developed market and commodity…

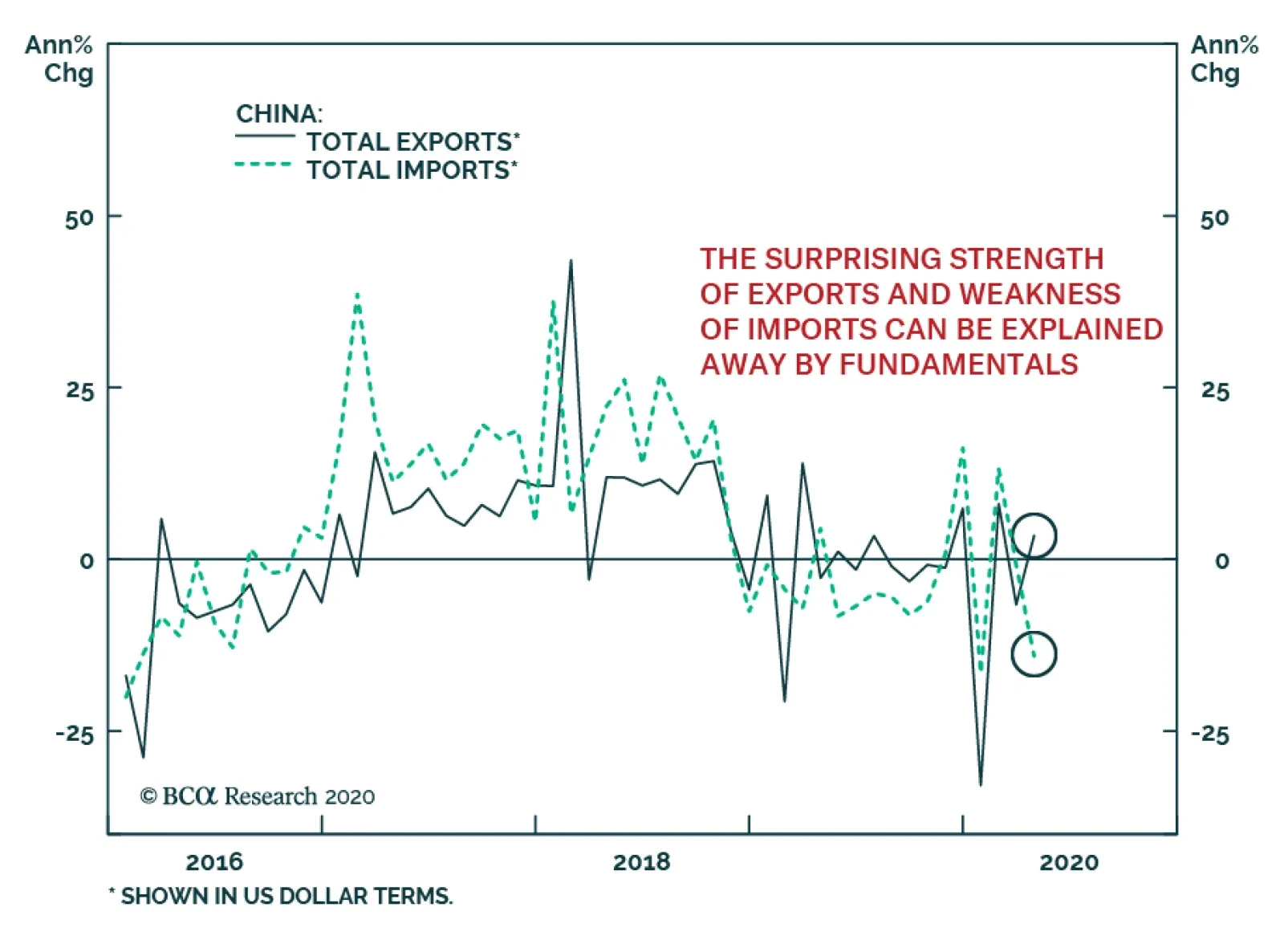

China’s April trade numbers were surprising. Despite a global pandemic that has arrested economic activity among China’s trading partners, annual export growth hit 3.5% in USD terms. Meanwhile, imports denominated in…

Highlights Our baseline view foresees a U-shaped recovery, as economies slowly relax lockdown measures. There are significant risks to this forecast, however. On the upside, a vaccine or effective treatment could hasten the reopening…

Highlights Base metals are rebounding faster than oil in 2Q20, reflecting China’s first-in-first-out recovery from the global GDP hit caused by the COVID-19 pandemic (Chart of the Week). By 3Q20, the rebound in oil markets could…

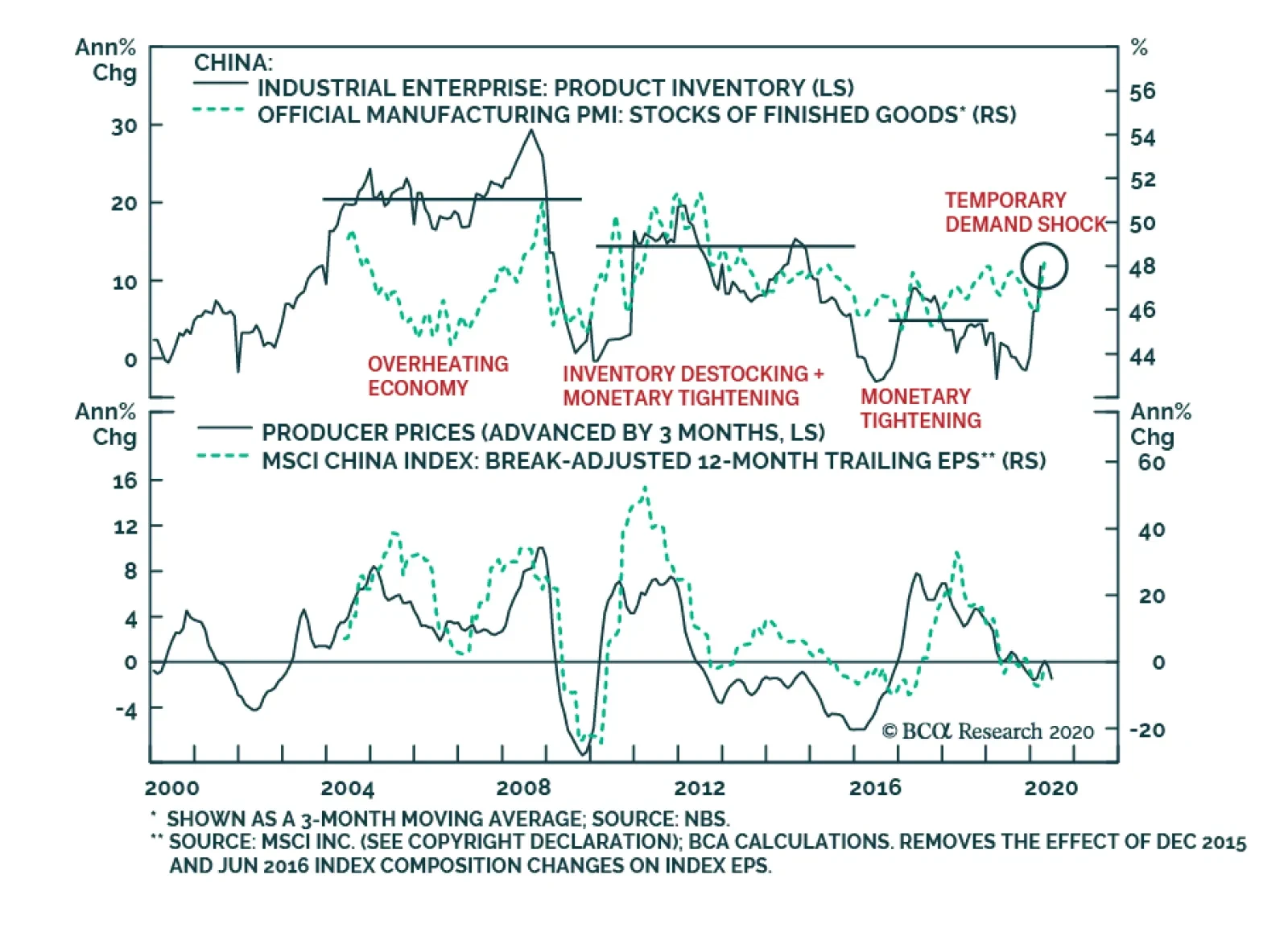

Yesterday, BCA Research's China Investment Strategy service concluded that the pressure on inventory should start to ease in the second half of this year. The imbalance in the recoveries of China’s supply and demand…