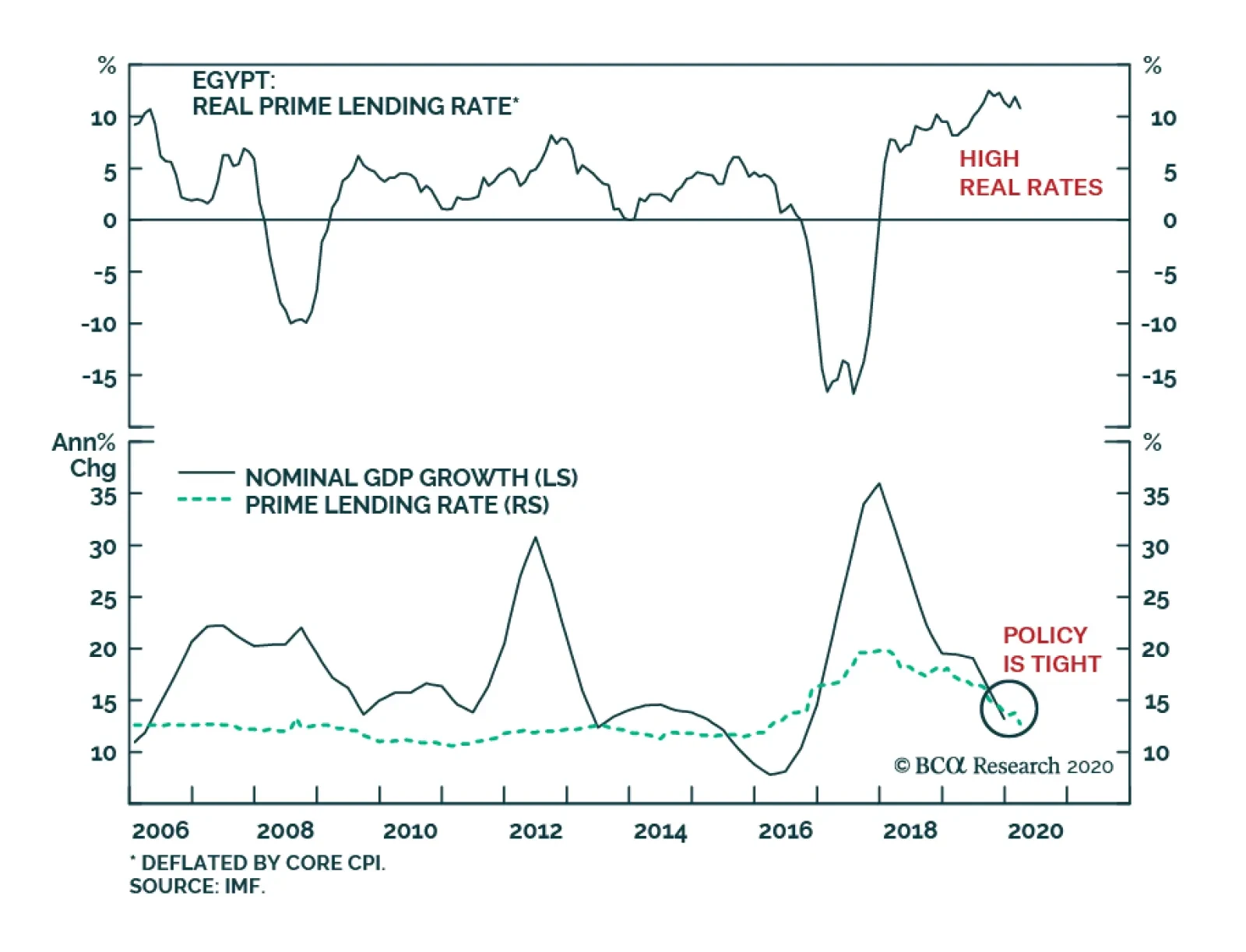

Please note that yesterday we published Special Report on Egypt recommending buying domestic bonds while hedging currency risk. Today we are enclosing analysis on Hungary, Poland and Colombia. I will present our latest thoughts on the…

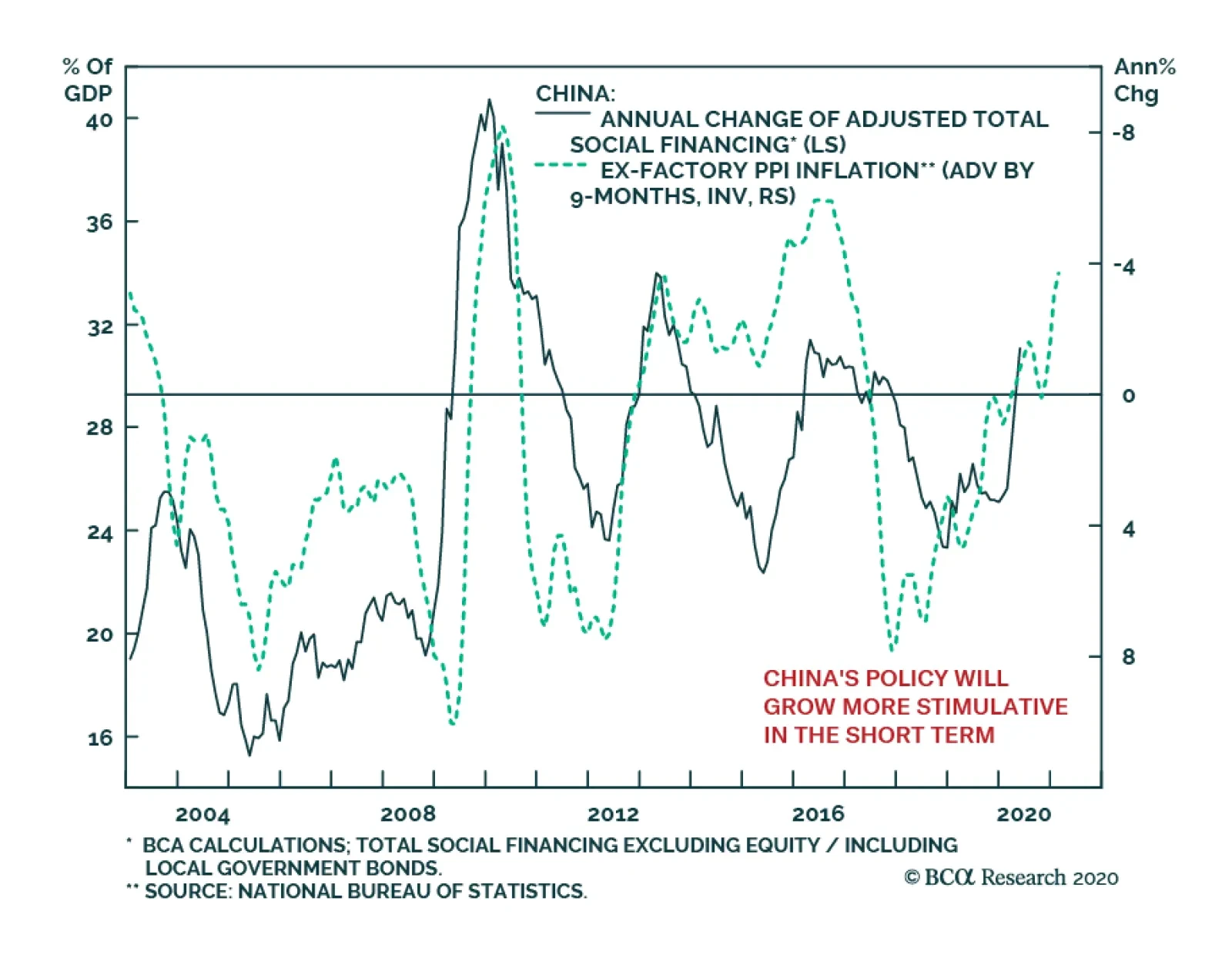

China’s total social financing flows remain strong. In May, TSF rose to CNY3.19 trillion from CNY3.09 trillion in April, even as new loans slowed from CNY1.70 trillion to CNY 1.58 trillion. Moreover, local governments…

BCA Research's Emerging Markets Strategy service believes that the Central Bank of Egypt (CBE) will allow the currency to depreciate and will cut interest rates materially. A Devaluation would offer an attractive opportunity…

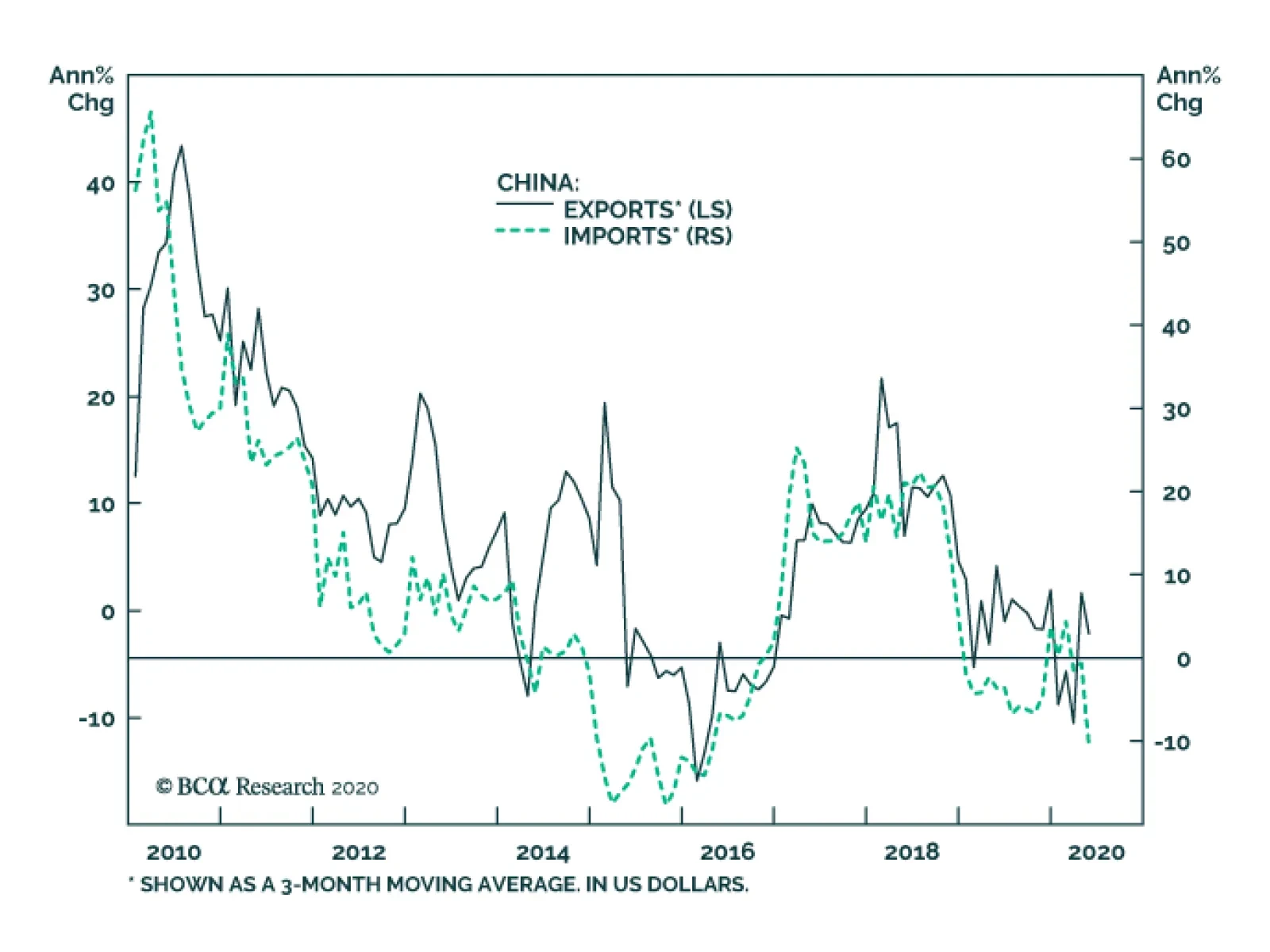

Chinese economic data continue to reflect the evolution of the global economy. In USD-term Chinese exports contracted 3.3% on a year-on-year basis and imports fell 16.7%. Chinese exports remain more resilient than feared.…

Highlights Our base case reflects our view that China’s strong fiscal and monetary stimulus, combined with a weaker US dollar, will provide a favorable backdrop for copper markets in 2H20. Supply factors are for the most part…

Highlights Risks assets have entered a FOMO-driven mania phase that could last for a few more weeks. Markets are ignoring the particularities of this recession and are treating the post-lockdown activity snapback as a V-shaped…

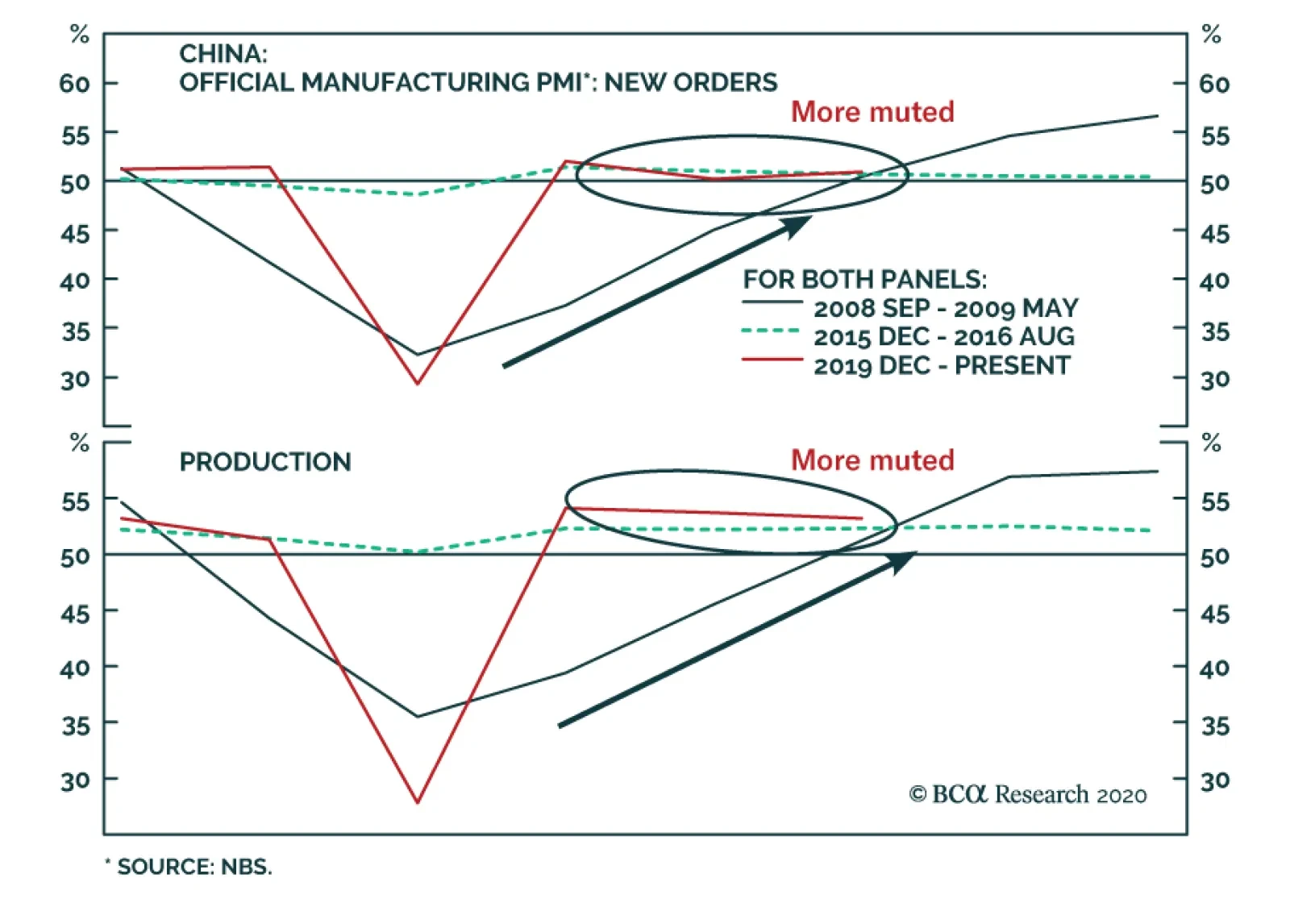

BCA Research's China Investment Strategy service shows that demand is struggling to outpace supply. China’s official manufacturing PMI slipped to 50.6 in May from 50.8 a month earlier. While the reading suggests that…

Highlights The Chinese economy continues to recover, albeit less quickly than the first two months following a re-opening of the economy. The demand side of the Chinese economic recovery in May marginally outpaced the supply side,…