BCA Research's Emerging Markets Strategy service believes that the risk is high that retail investors are starting to drive a mania that could last a while. When retail investors invest aggressively and central banks buy…

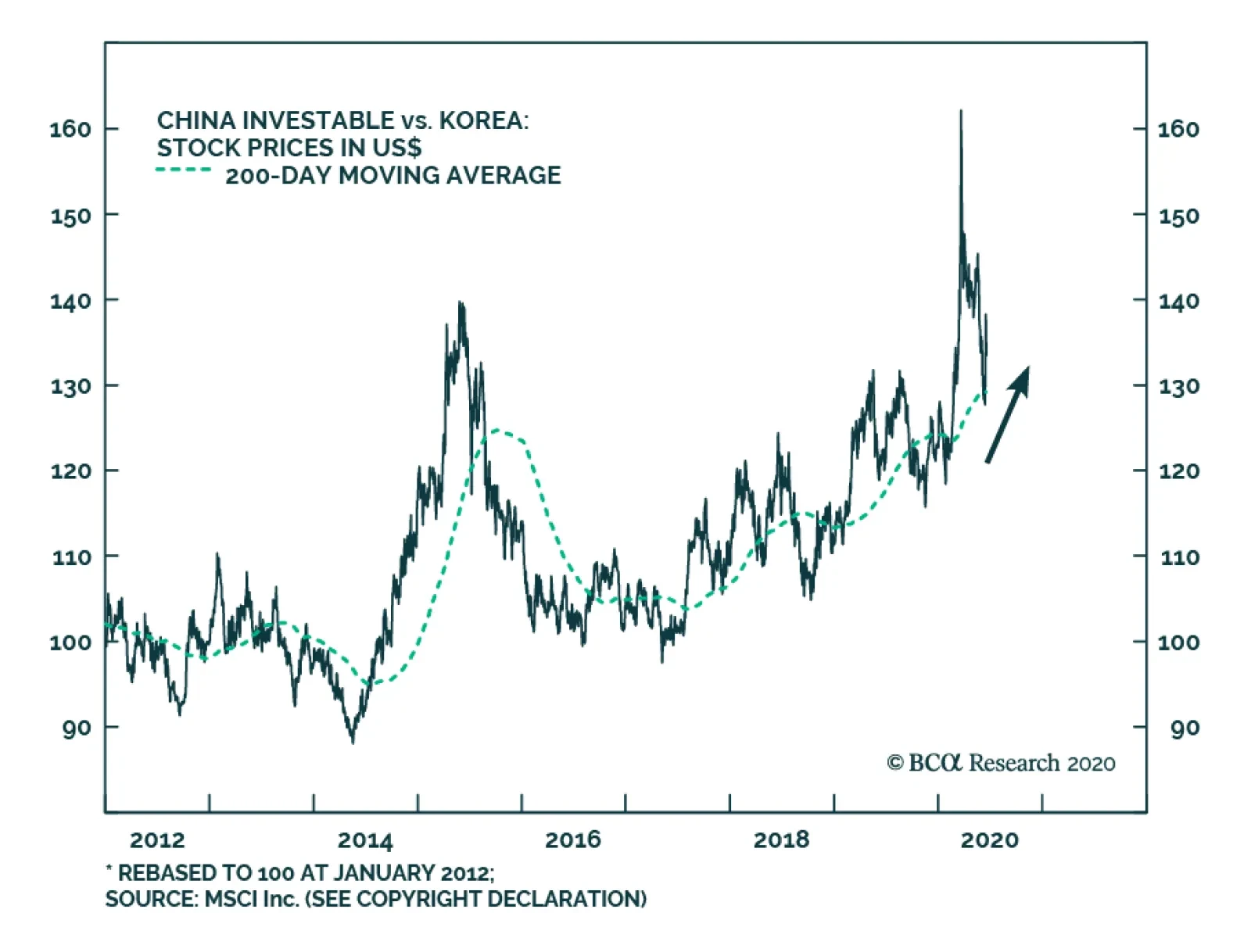

BCA Research's Emerging Markets Strategy service is moving China from neutral to overweight and downgrading Korea from overweight to neutral relative to the EM equity benchmark. Regarding Korean equities, the risks are as…

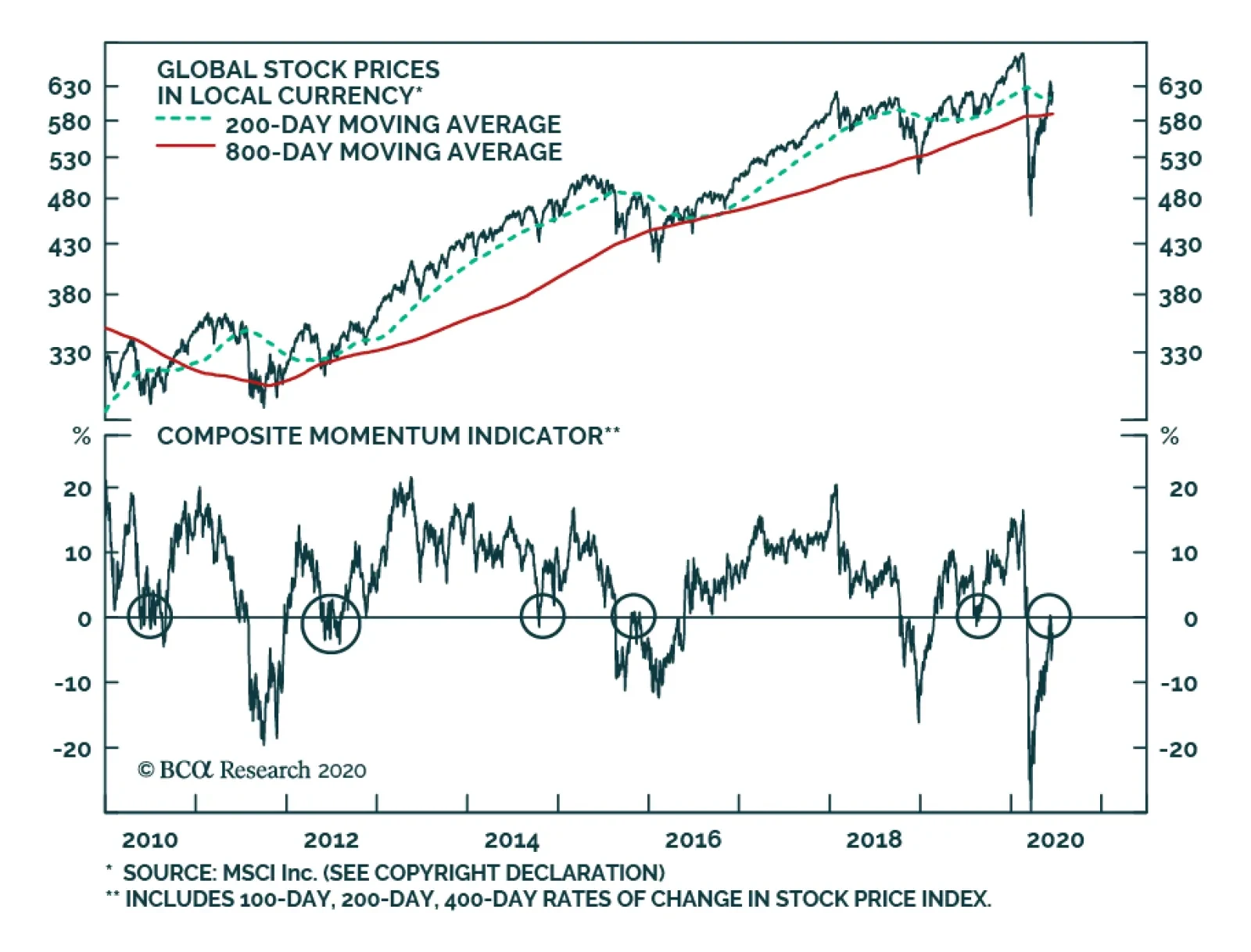

Highlights When retail investors invest aggressively and central banks buy assets en masse, economic fundamentals take the back seat and momentum becomes king. Global risk assets are at a fork in the road: either they will relapse…

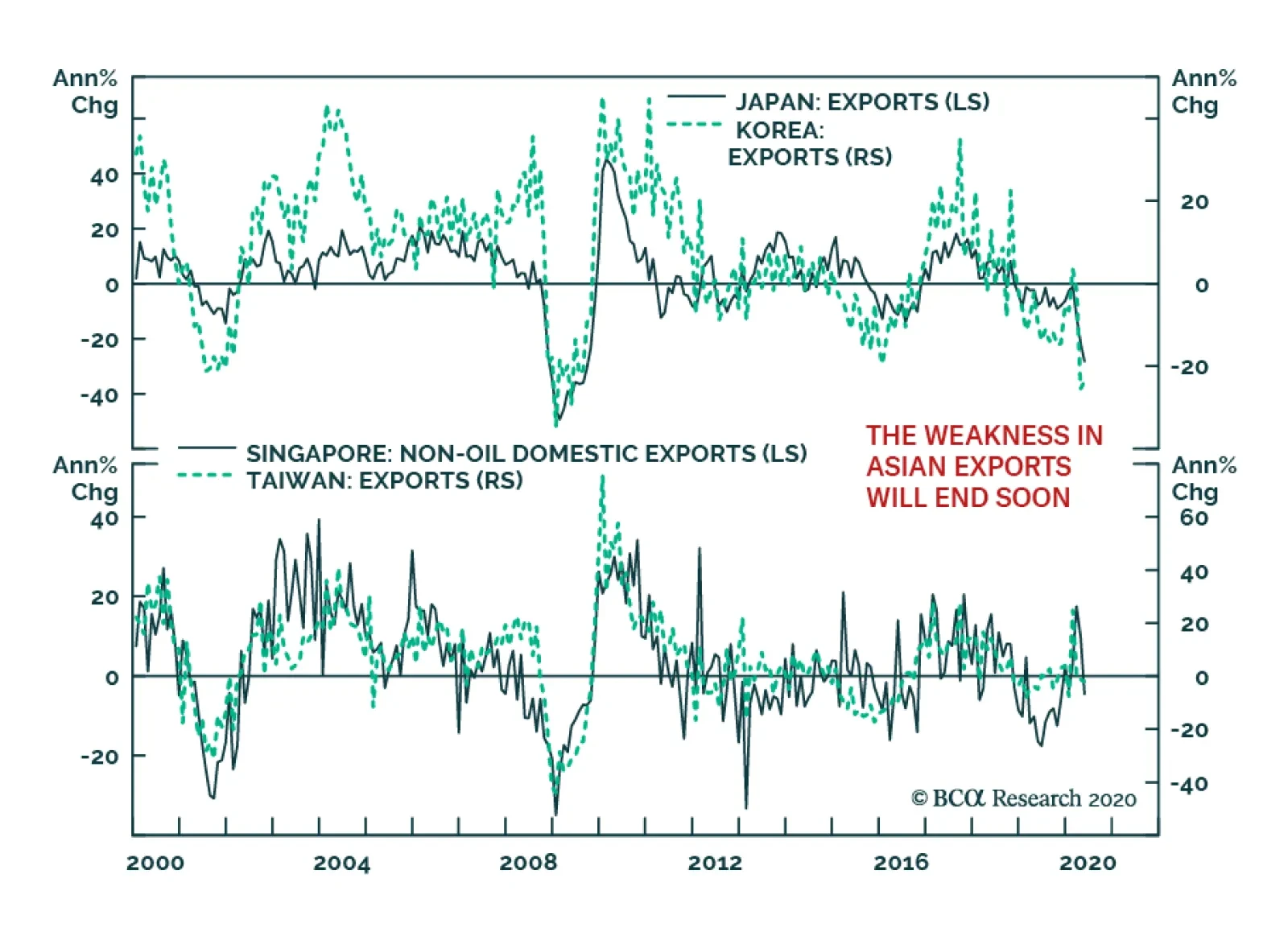

In recent months, the message from Asia’s trade data has been cacophonous. After big positive prints, annual export growth in Singapore fell to -4.5% in May. Taiwanese shipments growth is mildly negative. Meanwhile, Korean…

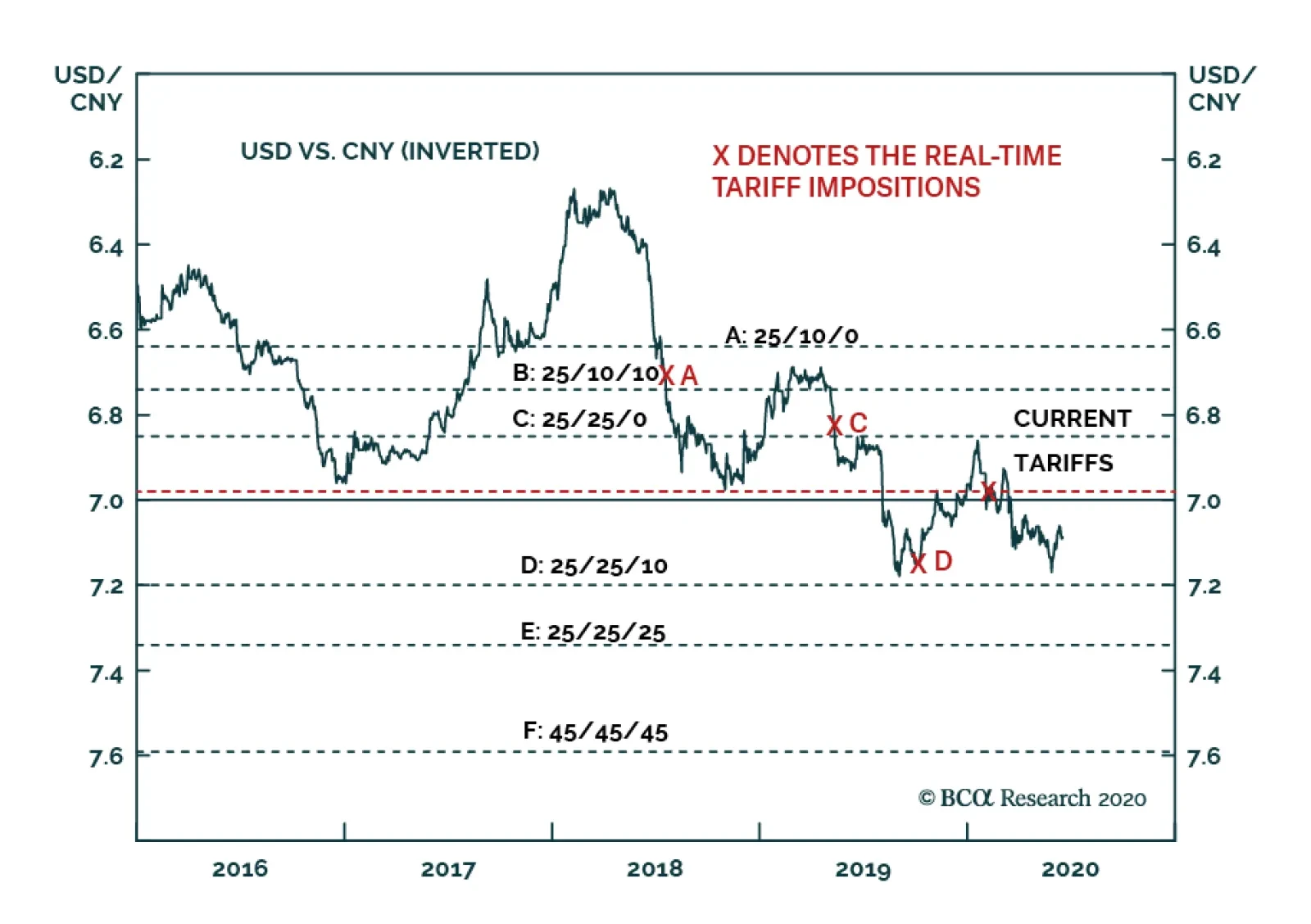

BCA Research's China Investment Strategy service and Foreign Exchange Strategy service recommend investors use any depreciation in the CNY caused by tensions between the US and China to accumulate renminbis, as any tariff-…

Highlights China and India periodically fight each other on their fuzzy Himalayan border with zero market consequences. A major conflict is possible in the current environment – but it would present a buying opportunity.…

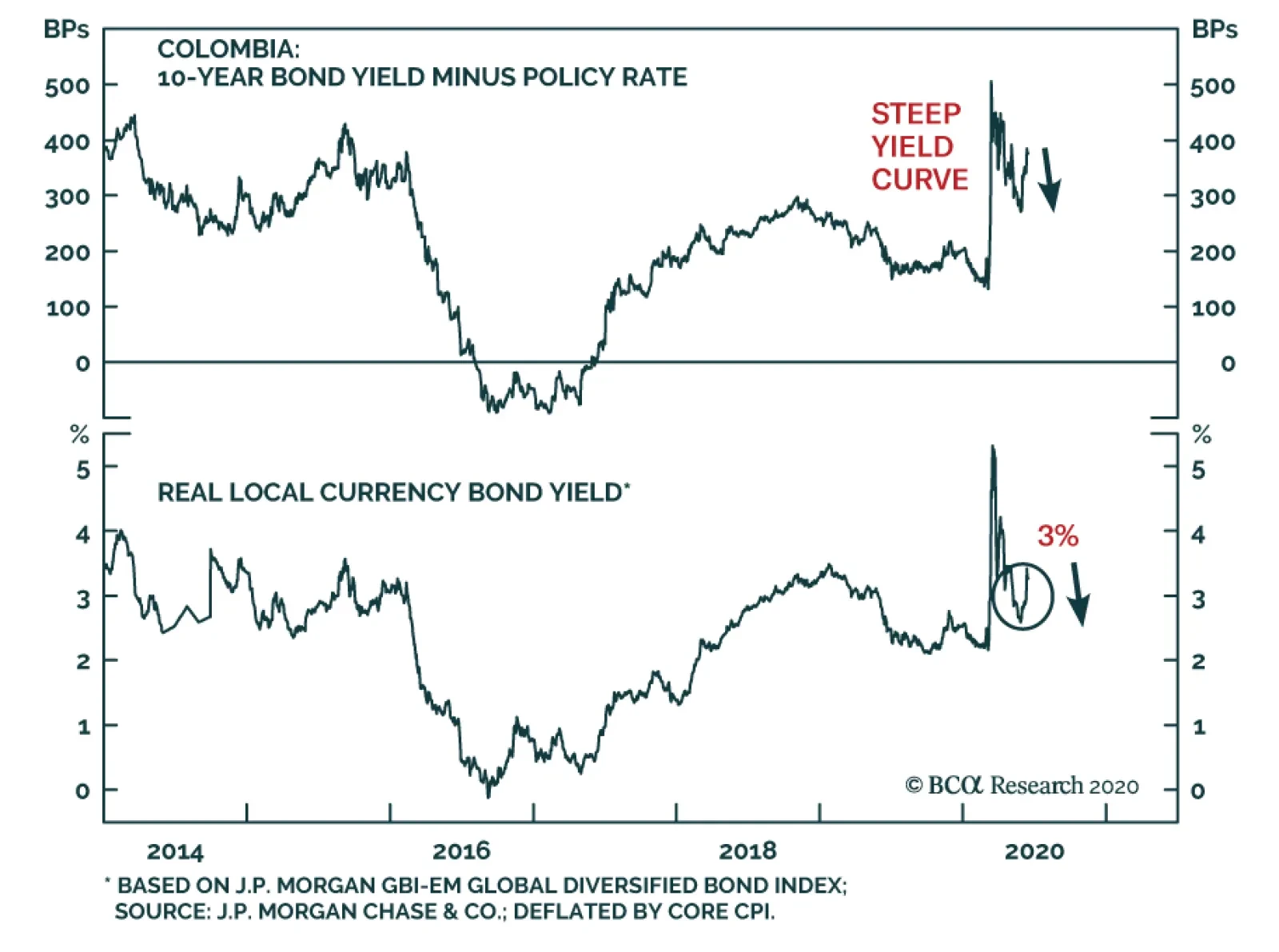

BCA Research's Emerging Markets Strategy service reiterates its recommendation to receive 10-year swap rates and recommends investors to overweight local-currency Colombian sovereign bonds relative to the EM benchmark.…

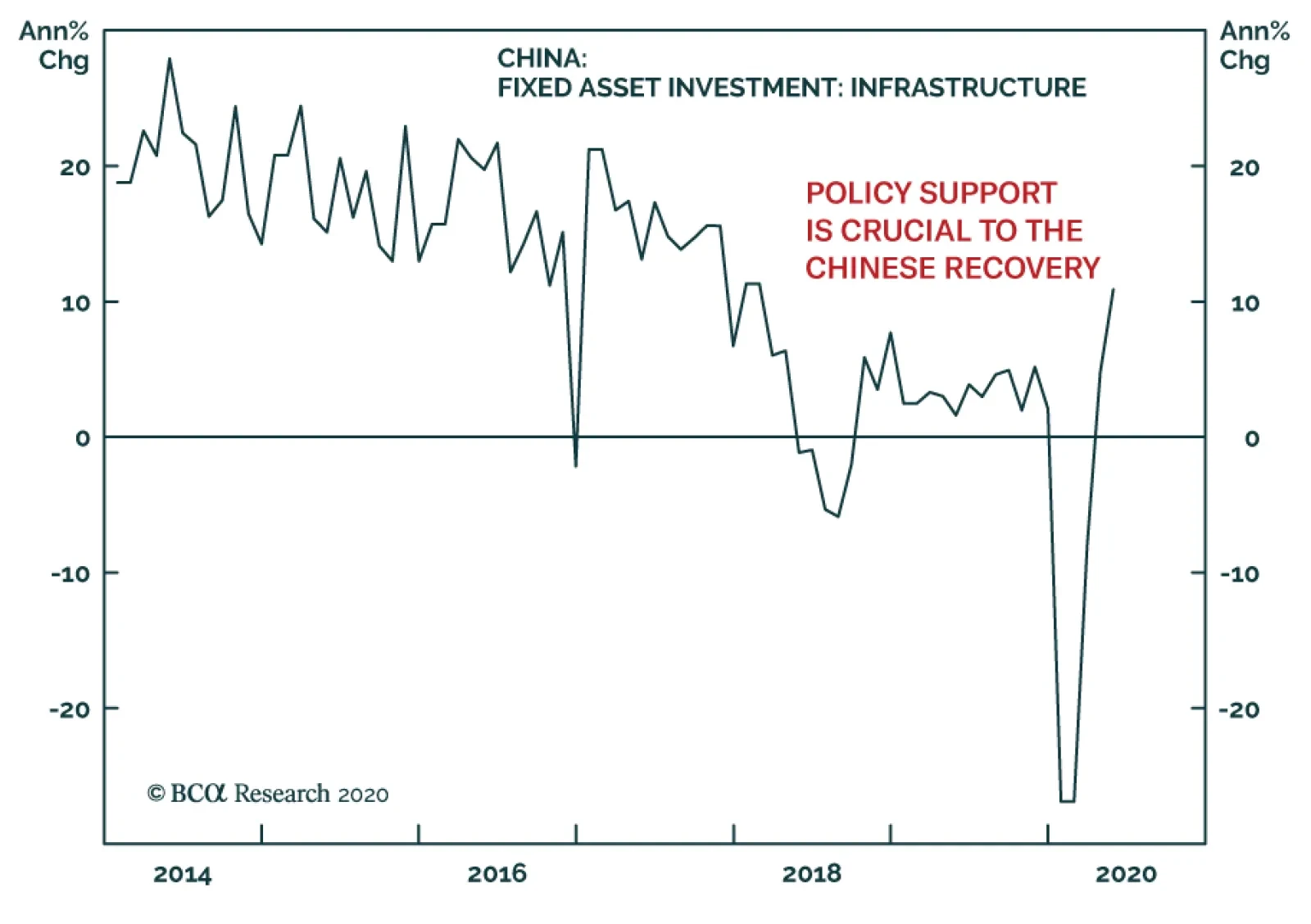

China’s recovery continues to carry the mark of government policy. In May, industrial production grew 4.4% on an annual basis. Retail sales are still contracting relative to last year but they are improving on a…