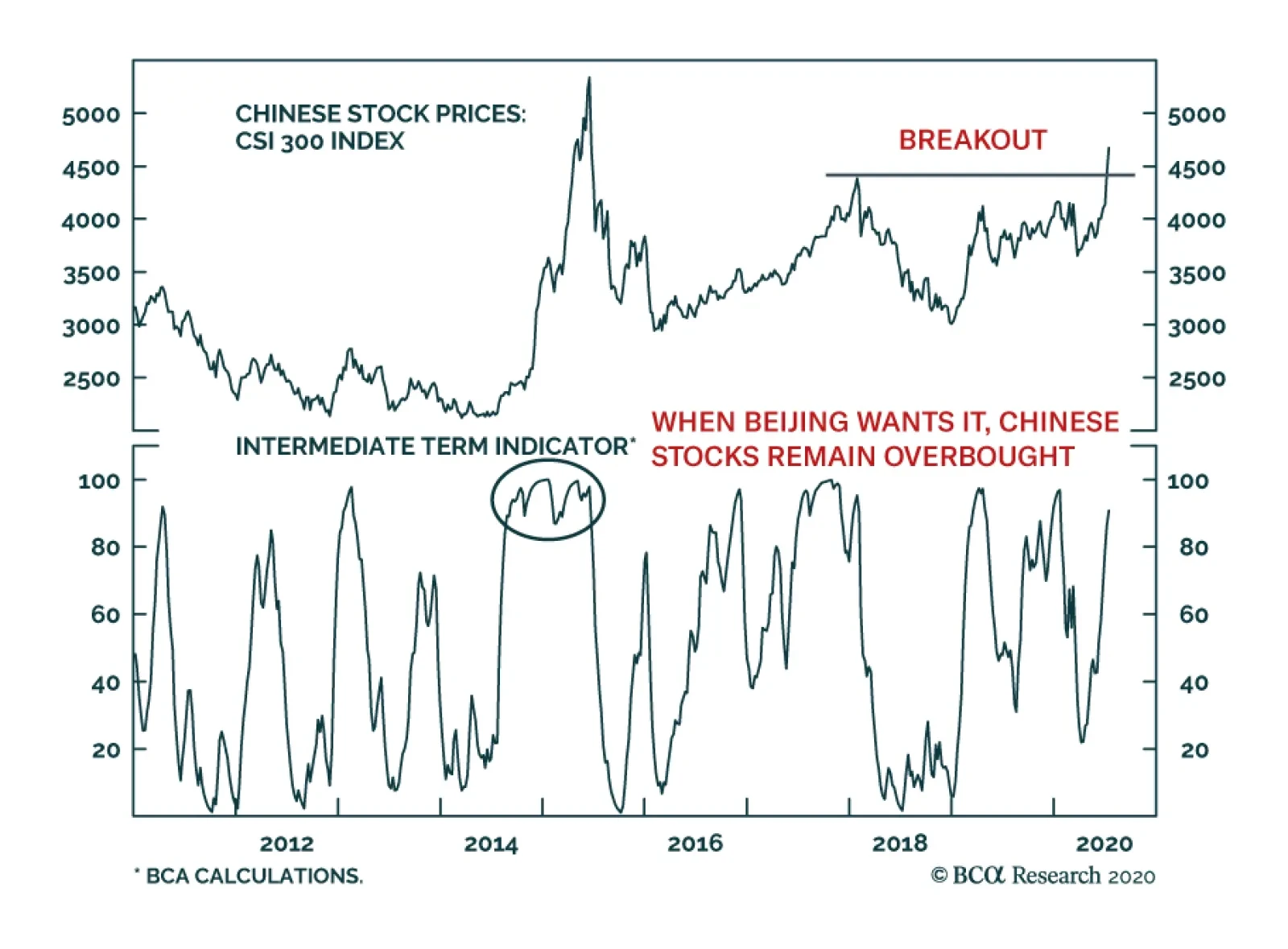

China’s CSI-300 equity index has broken out above its January 2018 peak. BCA Research’s China Investment Strategy team believes this break out has room to run, which should support the relative performance of EM…

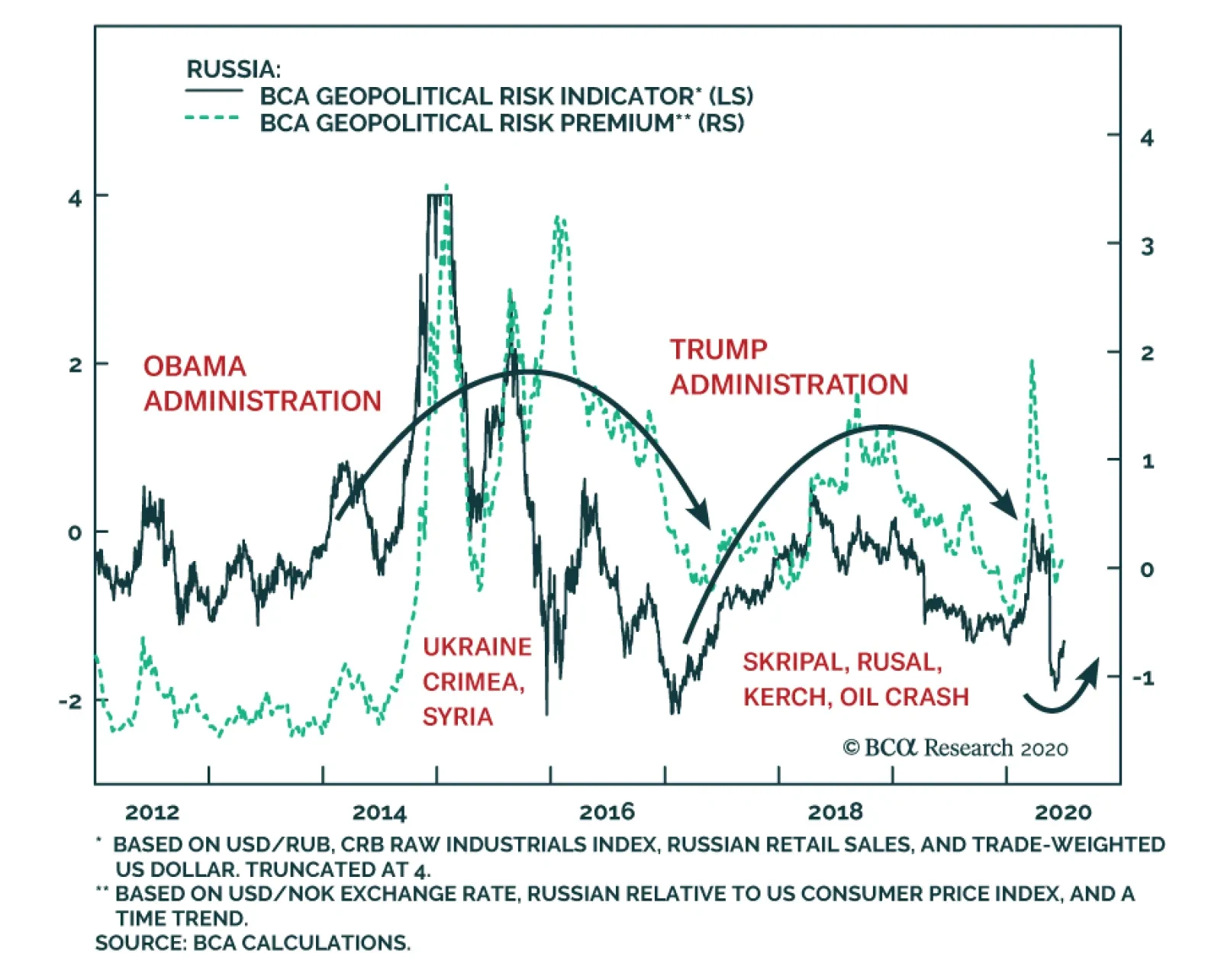

Investors do not need to wait for the US election verdict to assess the general trajectory of US-Russia relations, according to a Special Report released on Friday by BCA Research’s Geopolitical Strategy and Emerging…

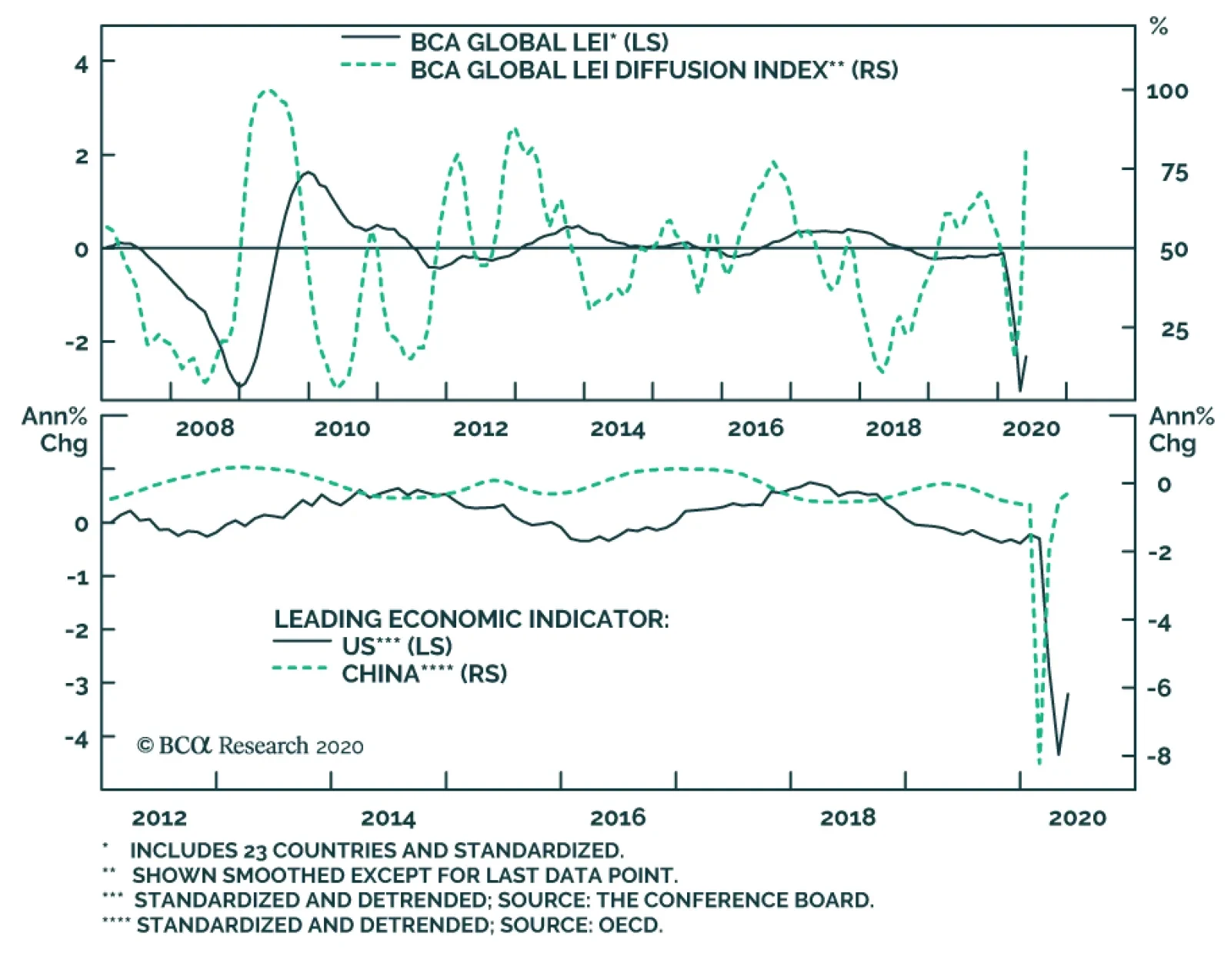

BCA’s Leading Economic Indicator (LEI) rebounded in May suggesting economic fundamentals are rapidly improving. Of the 23 countries included in the indicator, 80% saw an improvement in economic activity vs. last month. This…

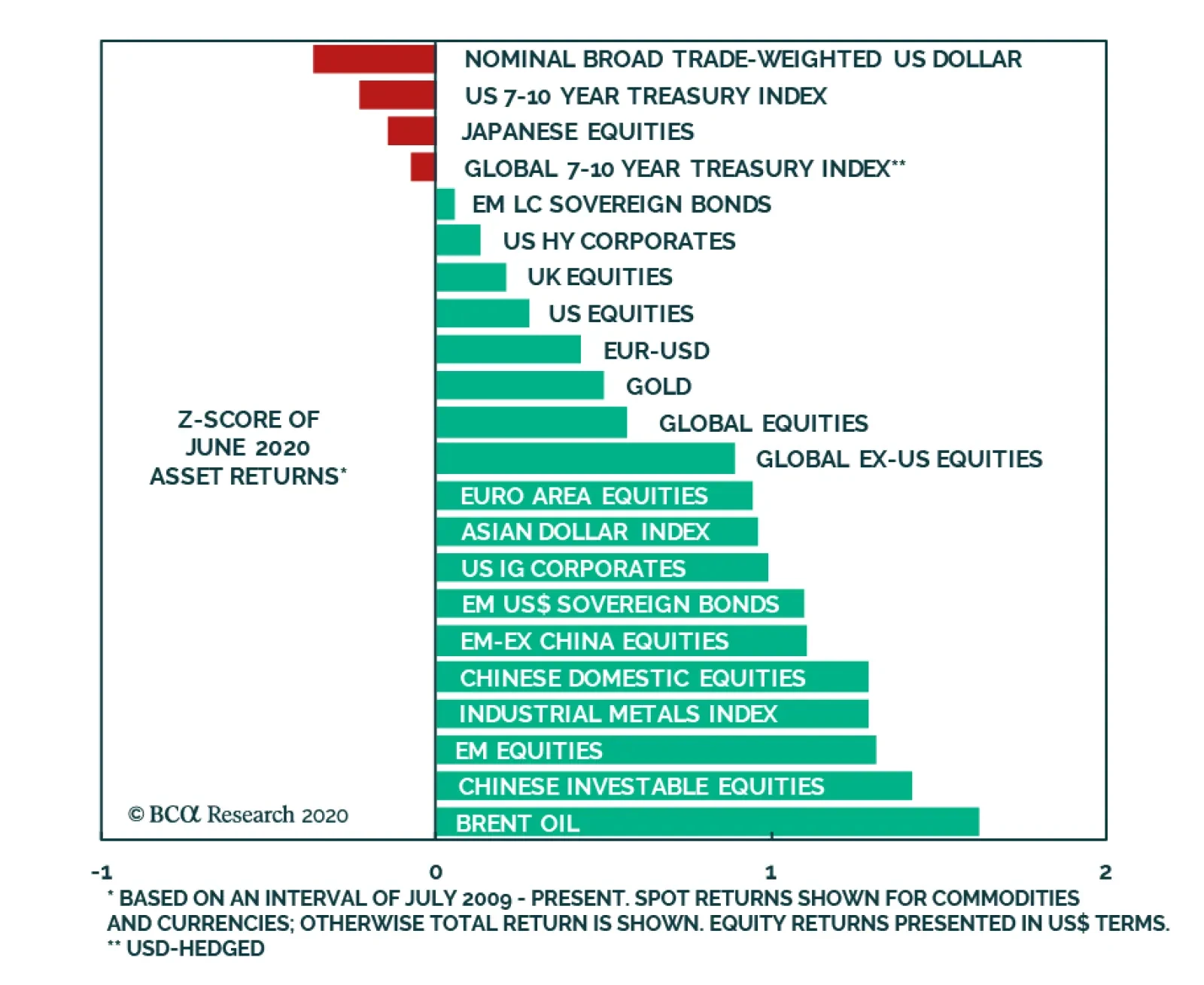

June was the second month in a row to be characterized by expectations of global growth. A cross-sectional review of asset returns shows that the US dollar and treasuries performed the worst, while Brent crude oil, industrial…

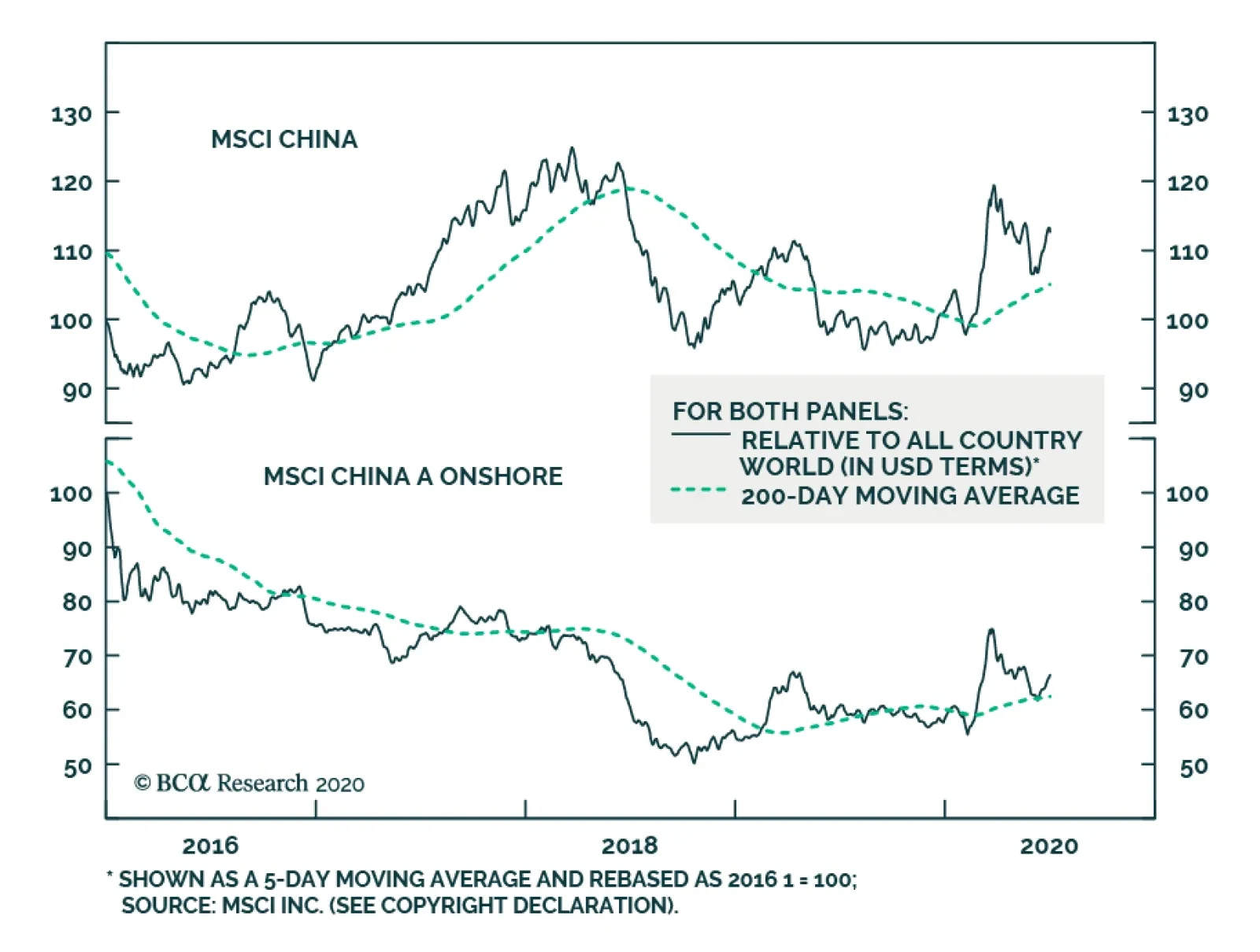

BCA Research's China Investment Strategy service is upgrading Chinese stocks on a tactical horizon and bringing it in line with its cyclical overweight stance. Chinese stocks have fewer downside risks compared to their…

Highlights A clear U-turn in markets could make investors more conscious of losses, making them likely to sell. Hence, the fear-of-missing-out (FOMO) rally could turn into a fear-of-losing-out, or FOLO selloff. The P/E ratio is…

Highlights Recommended Allocation The coronavirus pandemic is not over. Enormous fiscal and monetary stimulus will soften the blow to the global economy, but there remain significant risks to growth over the next 12 months…

Highlights We are moving our tactical call on Chinese stocks from neutral to overweight, bringing it inline with our cyclical stance on Chinese equities. Our cyclical overweight stance is supported by several factors: the rate of…