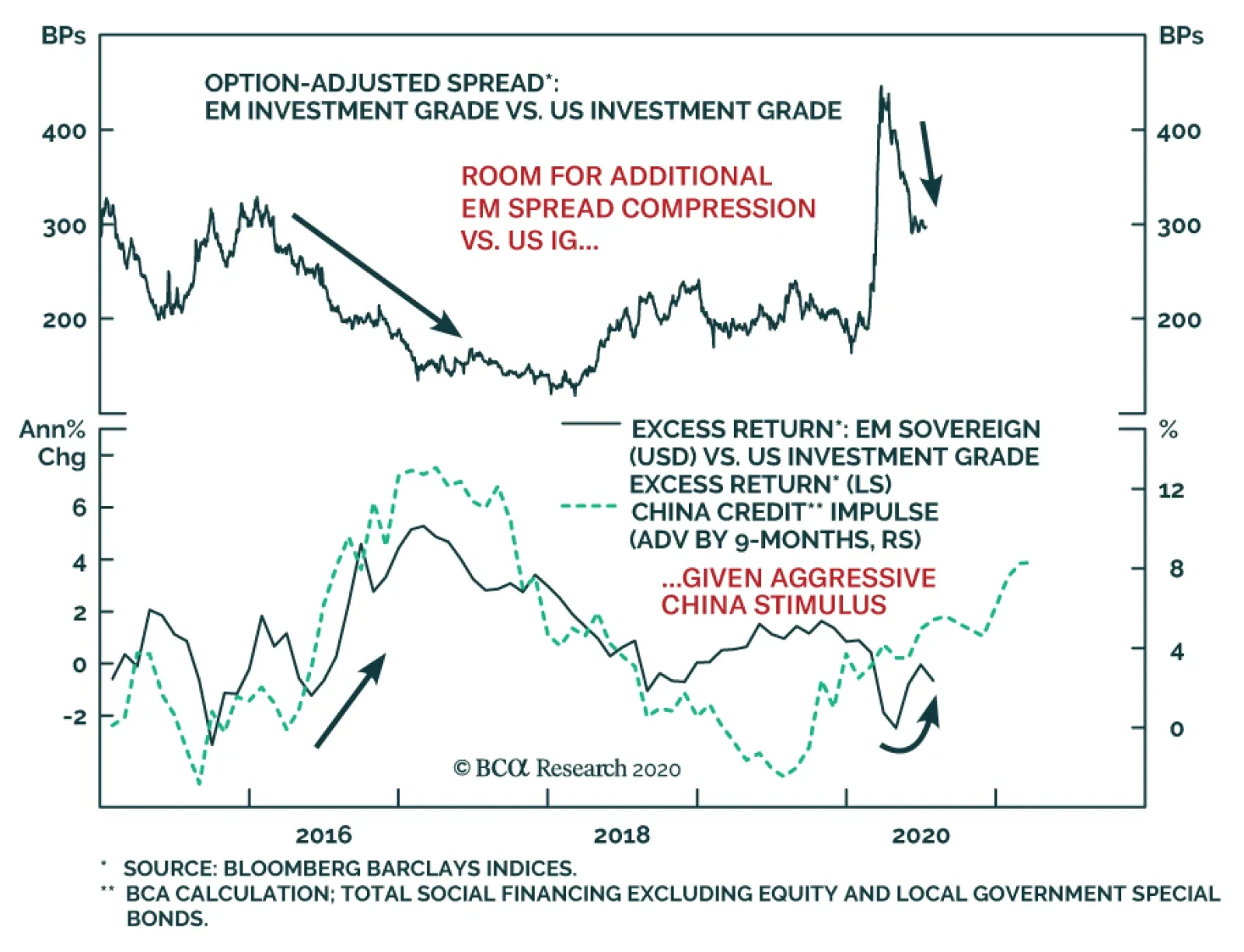

BCA Research's Global Fixed Income Strategy service is upgrading its allocation to EM USD-denominated corporates and sovereigns to neutral. A weaker USD and a clear bottom in growth are required to buy EM USD-denominated…

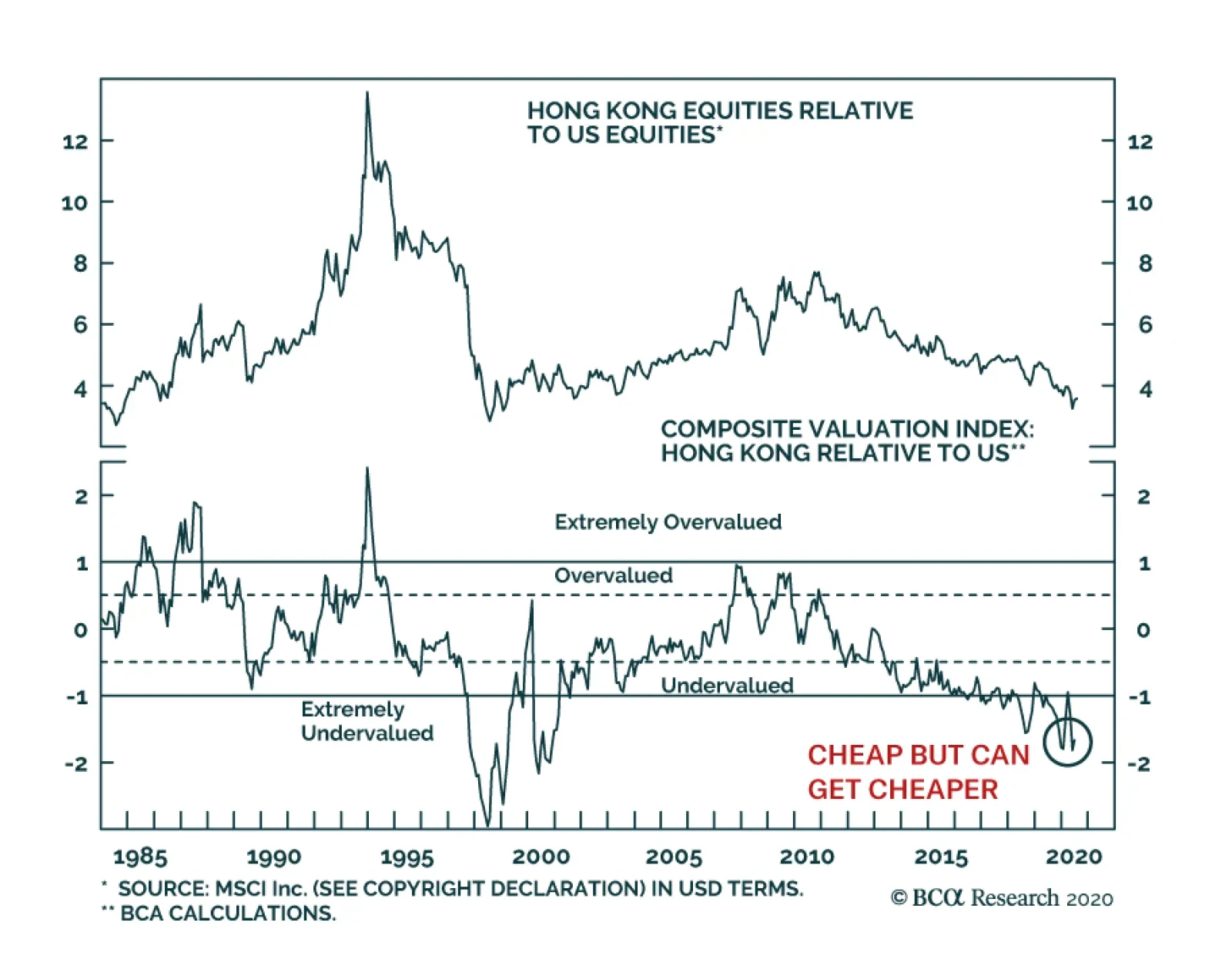

The growing incursion of Beijing into the governance of Hong Kong is accentuating the woes of a stock market already hurt by its heavy exposure to financials. As a result, investors are increasingly questioning the relevance of…

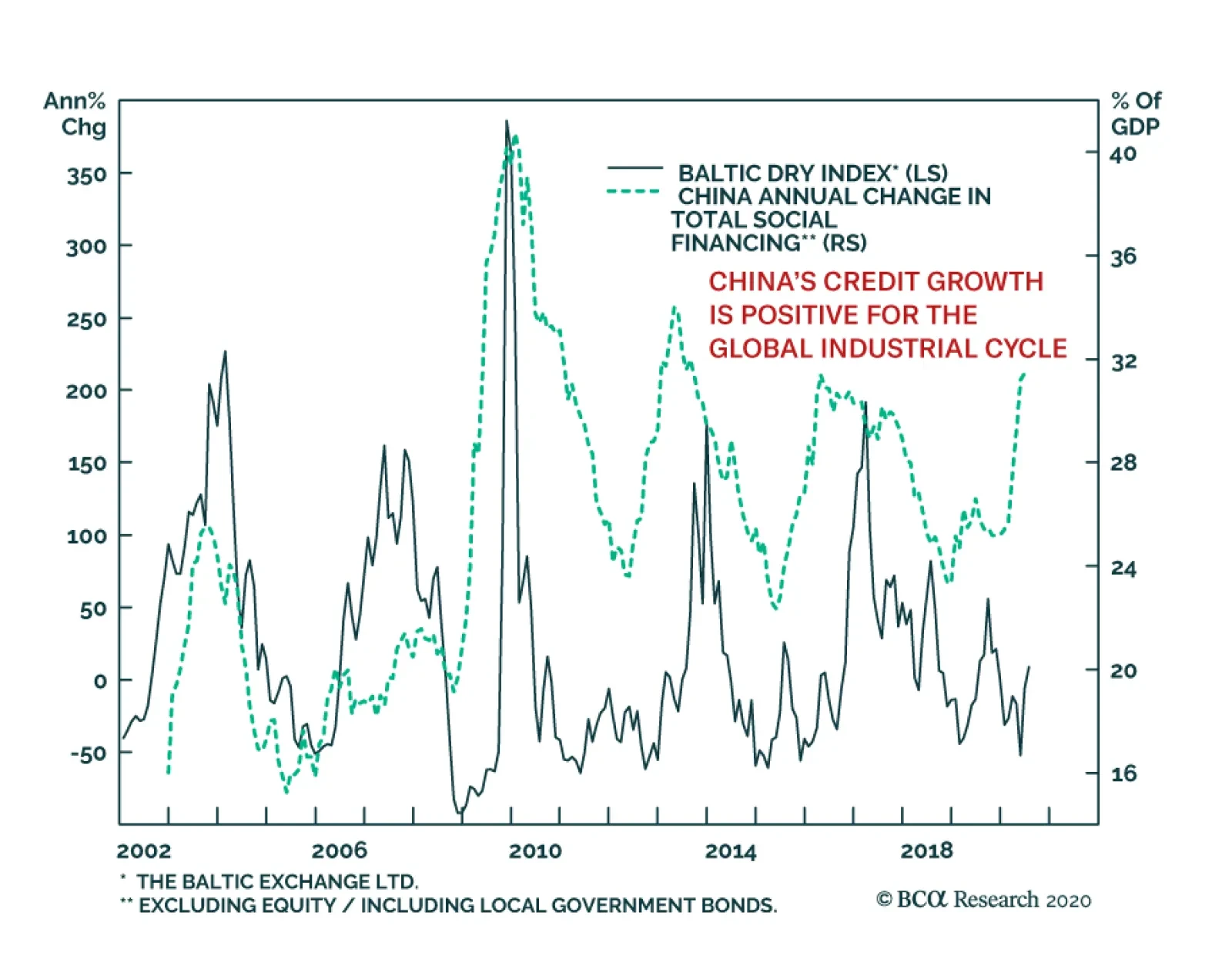

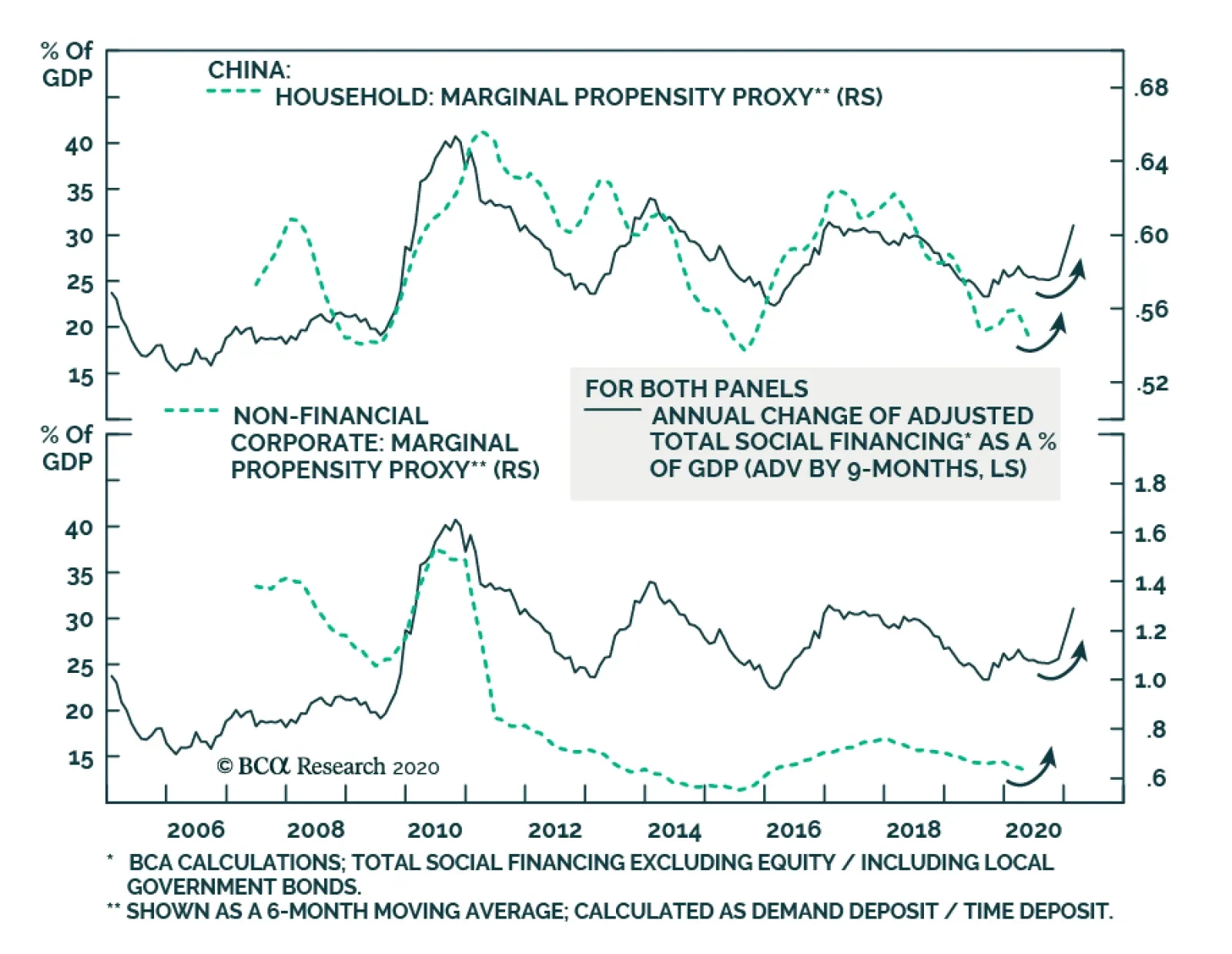

China’s credit growth remains strong. In June, new loans hit CNY1.8 trillion, bringing new bank lending to CNY12.1 trillion for the first half of 2020, which beats the previous peak of CNY9.7 trillion recorded in H1 2019.…

Highlights The bull market in US-Iran tensions was never resolved, and now a series of suspicious explosions in Iran raises the possibility that tensions will re-escalate. Iran’s interest lies in waiting out Trump so that a…

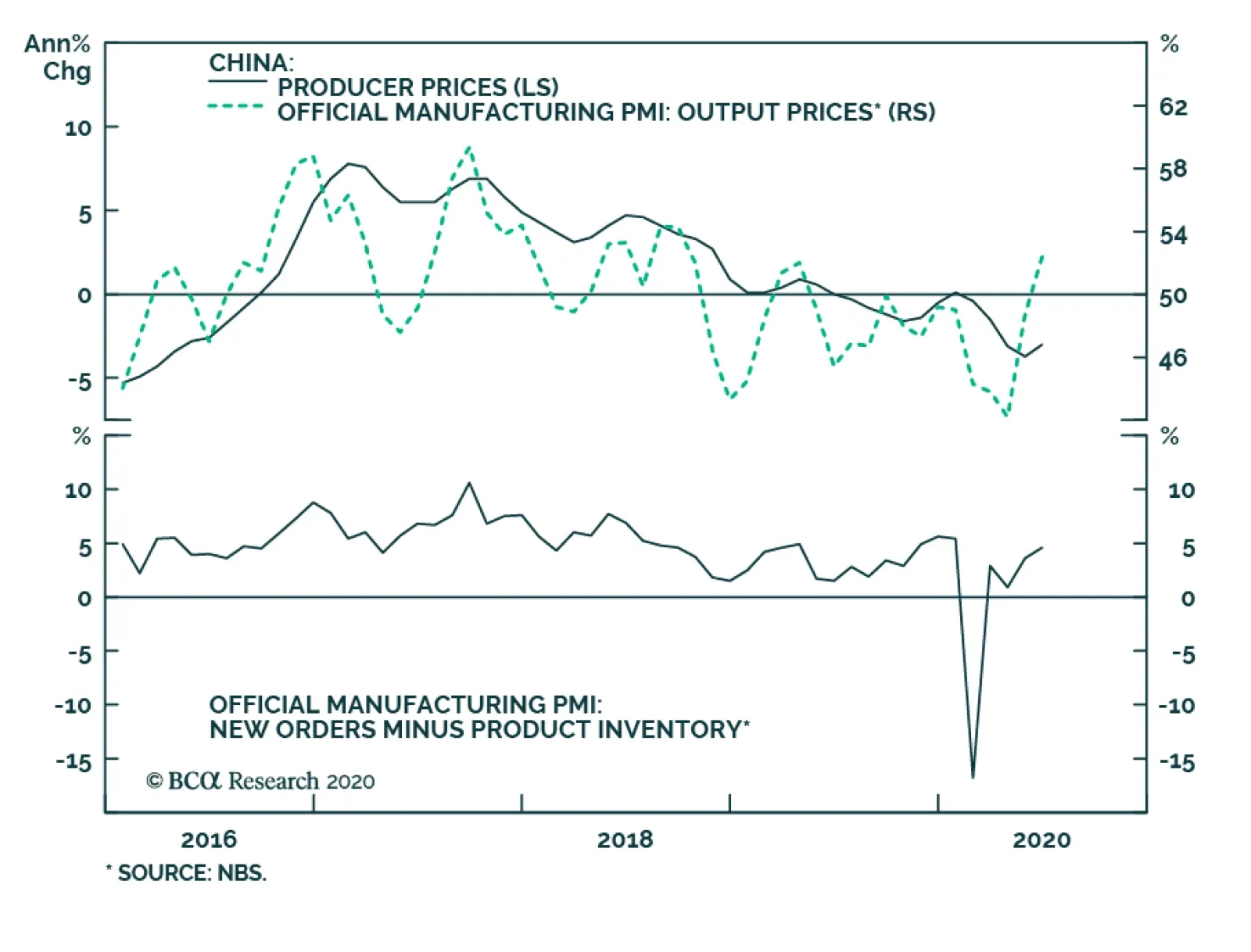

China’s official manufacturing PMI ticked up to 50.9 in June from 50.6 in the previous month. The Caixin manufacturing PMI came in at 51.2 in June vs. 50.7 in May and beat the market expectation of 50.5. Both readings…

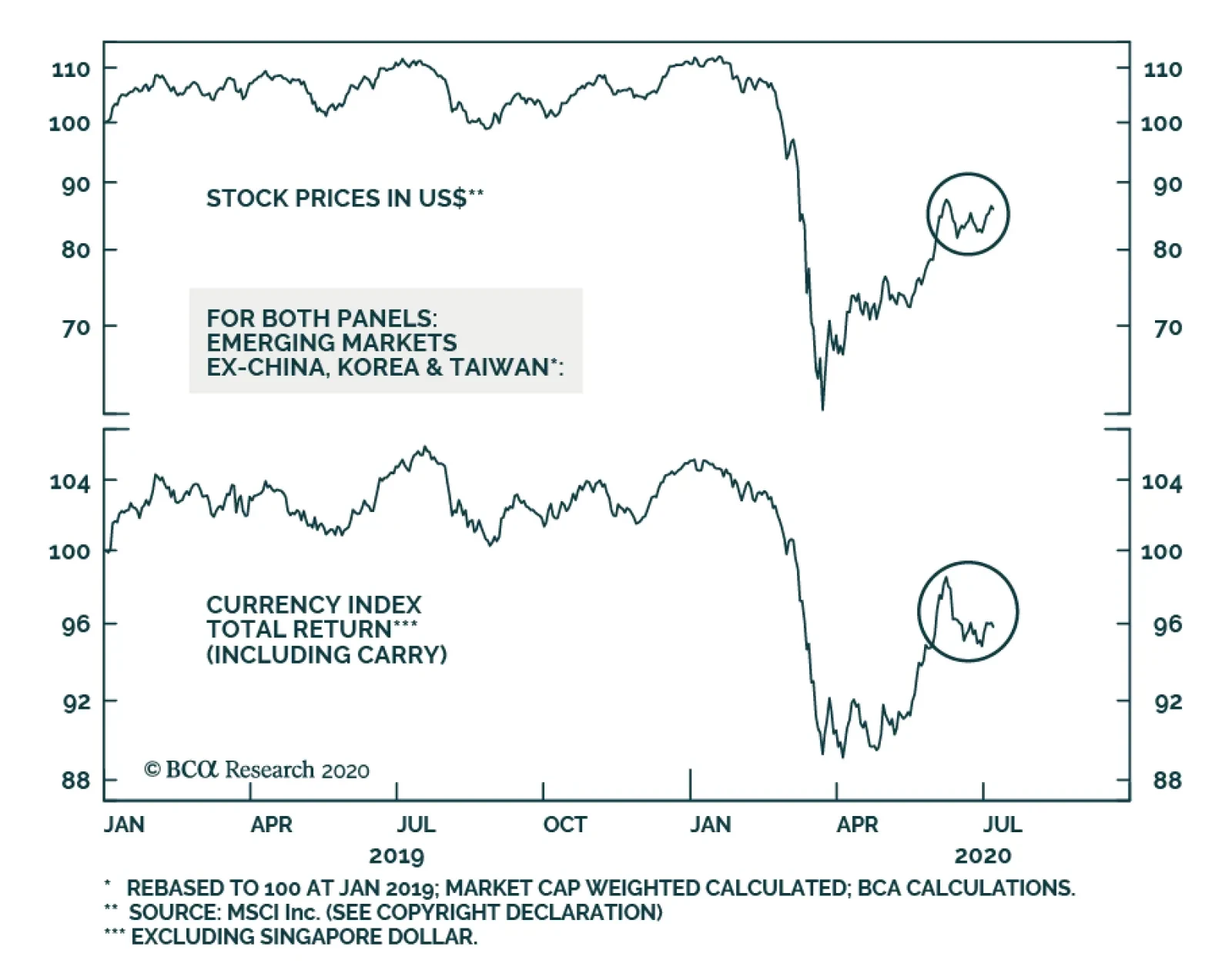

BCA Research's Emerging Markets Strategy service was recently asked what it will take for them to go long EM risk assets and currencies in absolute terms. EM equities, credit markets, and currencies are driven by three, or more…

Feature Over the last several years when I travelled to Europe, I would meet with Ms. Mea, an outspoken client of the Emerging Markets Strategy service. We have published our conversations with Ms. Mea in the past and this semi-annual…

BCA Research's China Investment Strategy service concludes that although the intensity of the PBoC’s monetary easing may start to taper in H2, the central bank is likely to stay on the easing course and keep liquidity…

Dear Client, In lieu of our regular report next week, I will present our view on China’s economic recovery, geopolitical risks, and implications on financial markets in two live webcasts. The webcasts will take place next Wednesday…

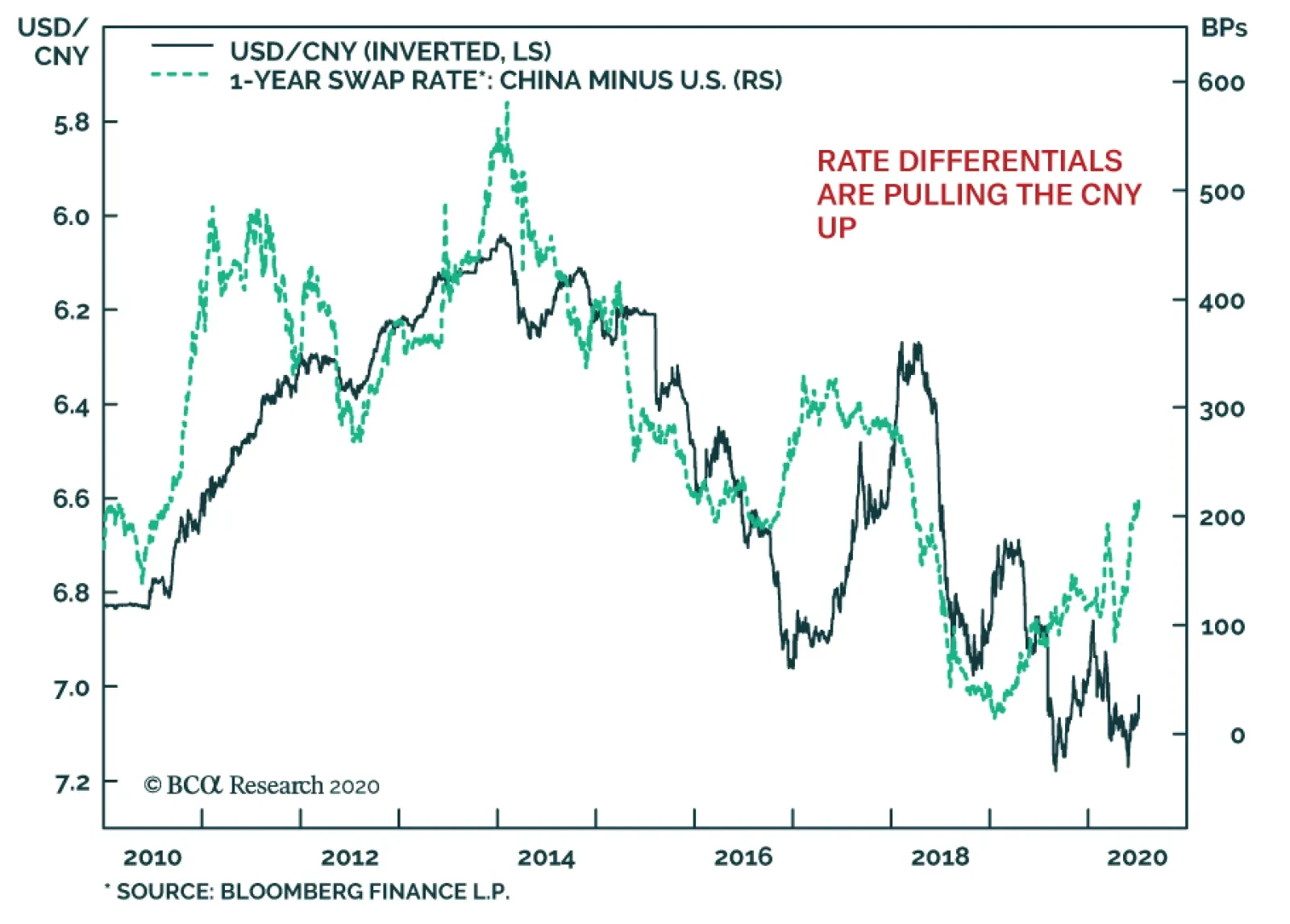

Since March 2018, the Chinese yuan has been driven by geopolitical forces, specifically, the evolution of tariffs imposed by the US on China’s exports. In recent weeks, financial variables seem once again to drive the…