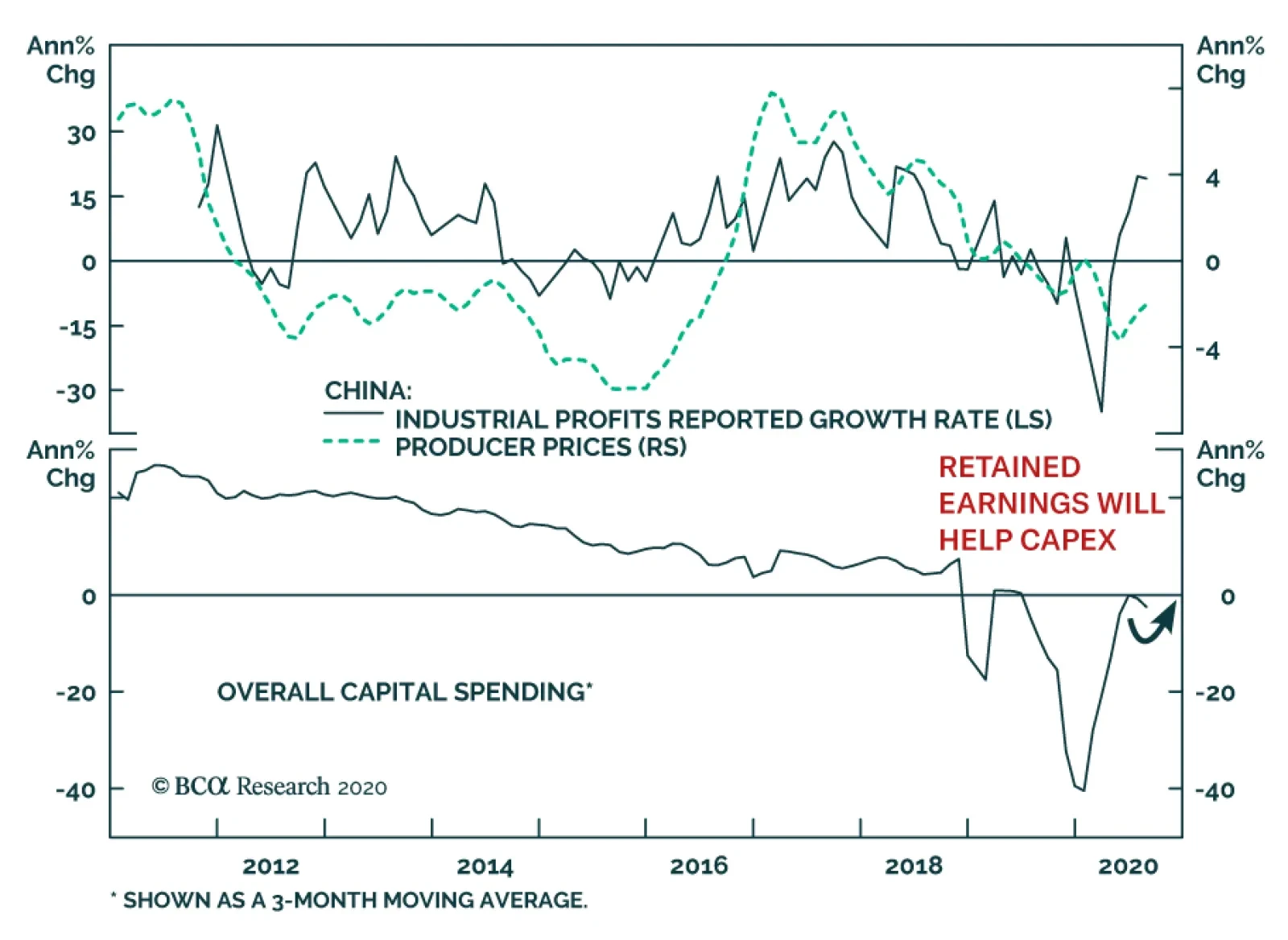

Chinese industrial profits hit the press last weekend. In August, they grew 19.1% annually, which represented the fourth straight month of profit growth. The continued industrial production rebound, the stabilization of PPI…

Highlights Portfolio Strategy We recommend investors participate in the equity market rotation during the ongoing correction and position portfolios for next year’s bull market resumption by preferring unloved and undervalued…

Highlights Senate Republicans would be suicidal not to agree to a fiscal relief bill before the election. Democrats are still offering a $2.2 trillion package. Grassroots Republican voters will forgive Republicans for blowing out the…

Highlights Global GDP growth estimates from the OECD point to a stronger recovery in oil demand than markets are pricing in at present (Chart of the Week). Our forecast for Brent remains at $46/bbl for 2H20 and $65/bbl on average…

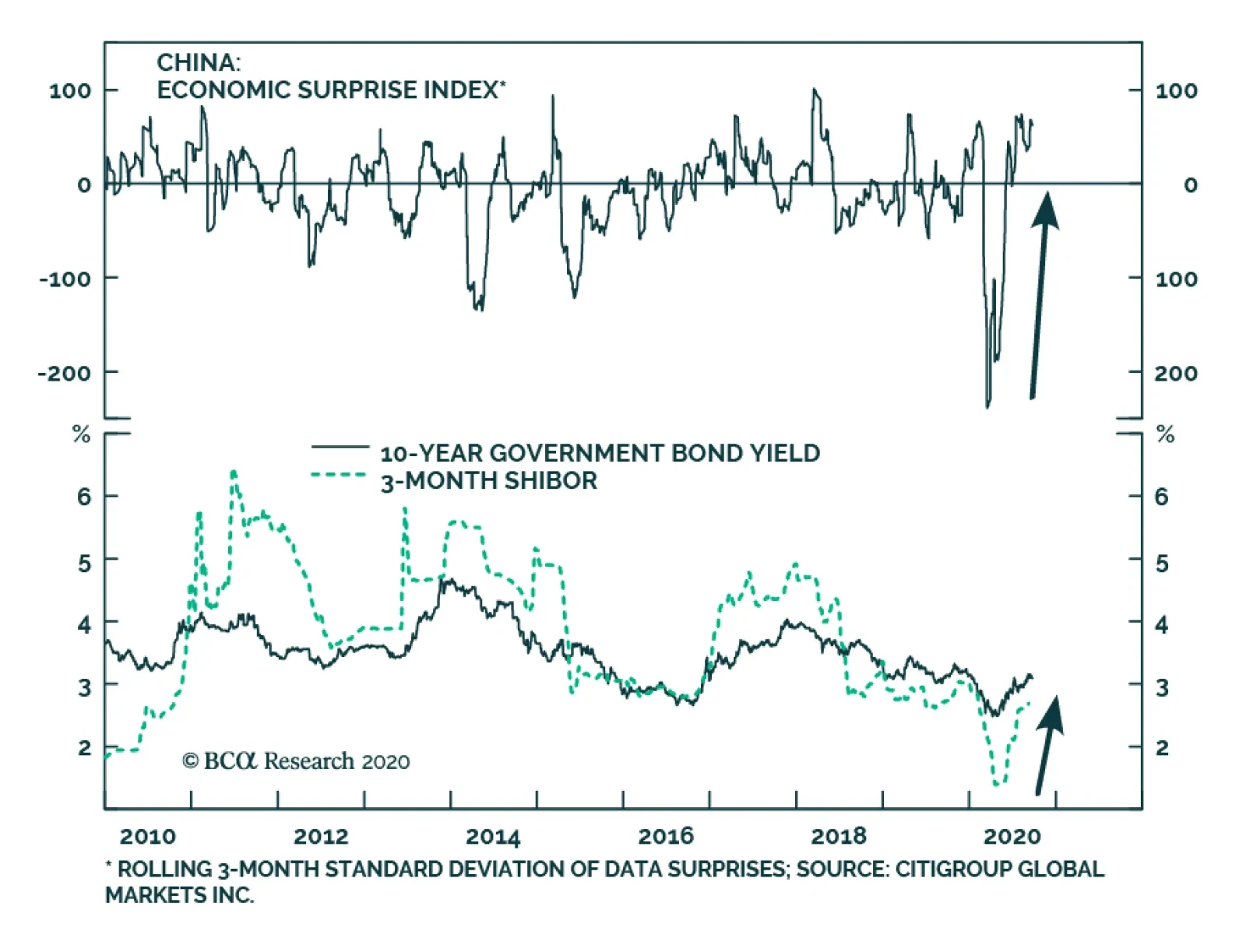

BCA Research's China Investment Strategy service analysis concludes that the extremely accommodative phase of monetary conditions has ended. Authorities will begin tightening policy by the middle of next year. The rising…

Highlights The rising policy rate in the past couple months has been driven by a liquidity crunch, which is expected to ease in Q4. Government bond yields, which have been trending upwards since May, will also take a breather. The…

Highlights While we are bearish on the US dollar in the long run, the greenback is primed for a rebound in the near term. Consistently, commodities prices will relapse and EM currencies will depreciate versus the US dollar. Global…

Highlights The global recovery has legs, but it will follow a stop-and-go pattern. Global fiscal policy will ultimately remain loose enough to create an appropriate counterweight to three major risks. Risk assets are still attractive…

Highlights Bank credit 6-month impulses are plunging, and the pandemic is resurging. Maintain an overweight to growth defensives (technology and healthcare). In the short term, profits will be more resilient in a resurgent pandemic.…

Kenya: An Incomplete Adjustment The Kenyan shilling will depreciate by 15-20% in the next 12 months. The downward pressure on the currency stems from the country’s sizeable current account deficit. In addition, Kenya needs lower…