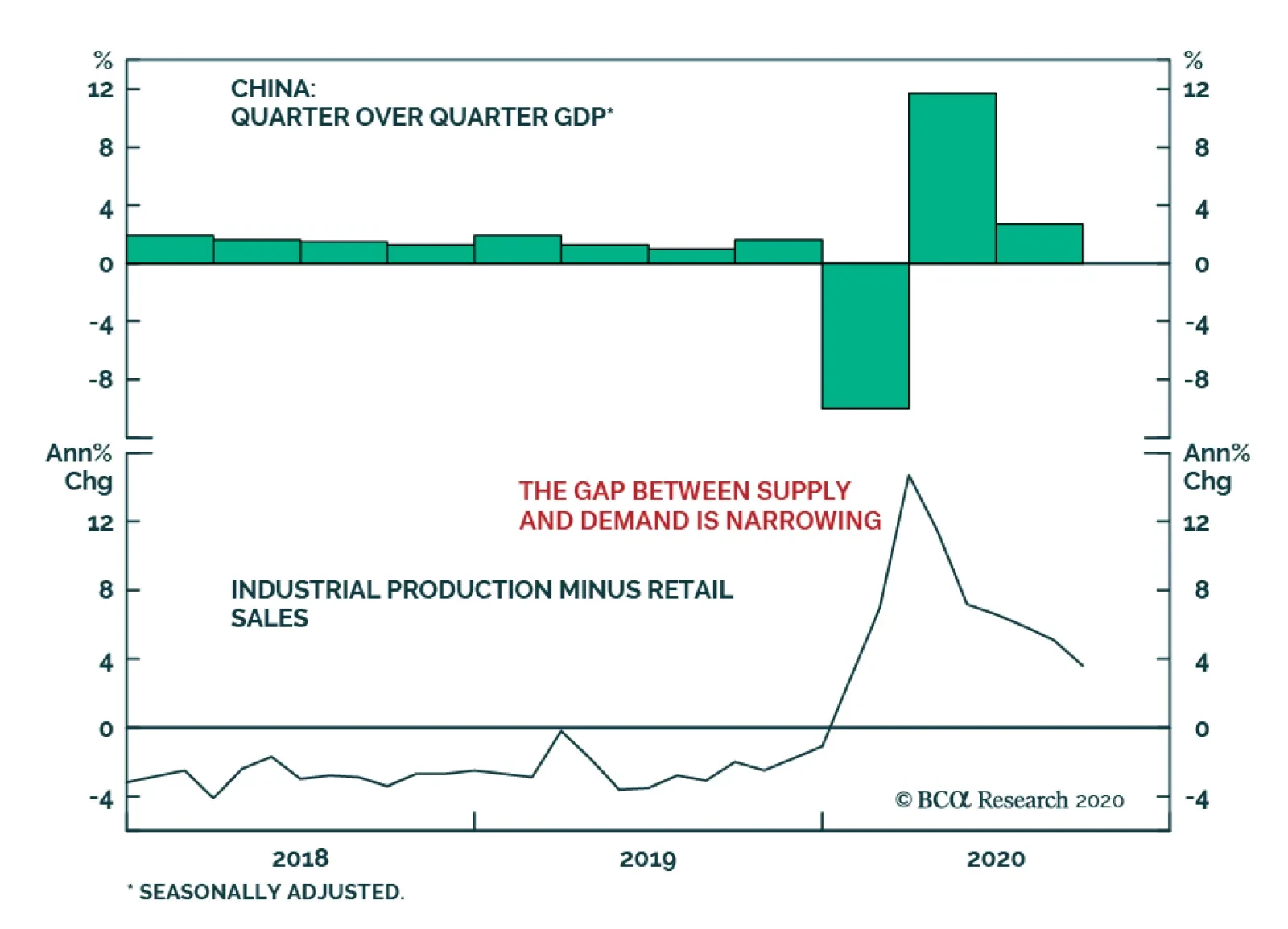

In the third quarter, the Chinese recovery continued, stronger than the headline growth numbers suggested. On a year-on-year basis, real GDP growth improved to 4.9% from 3.2% but missed estimates of 5.5%. Meanwhile, seasonally…

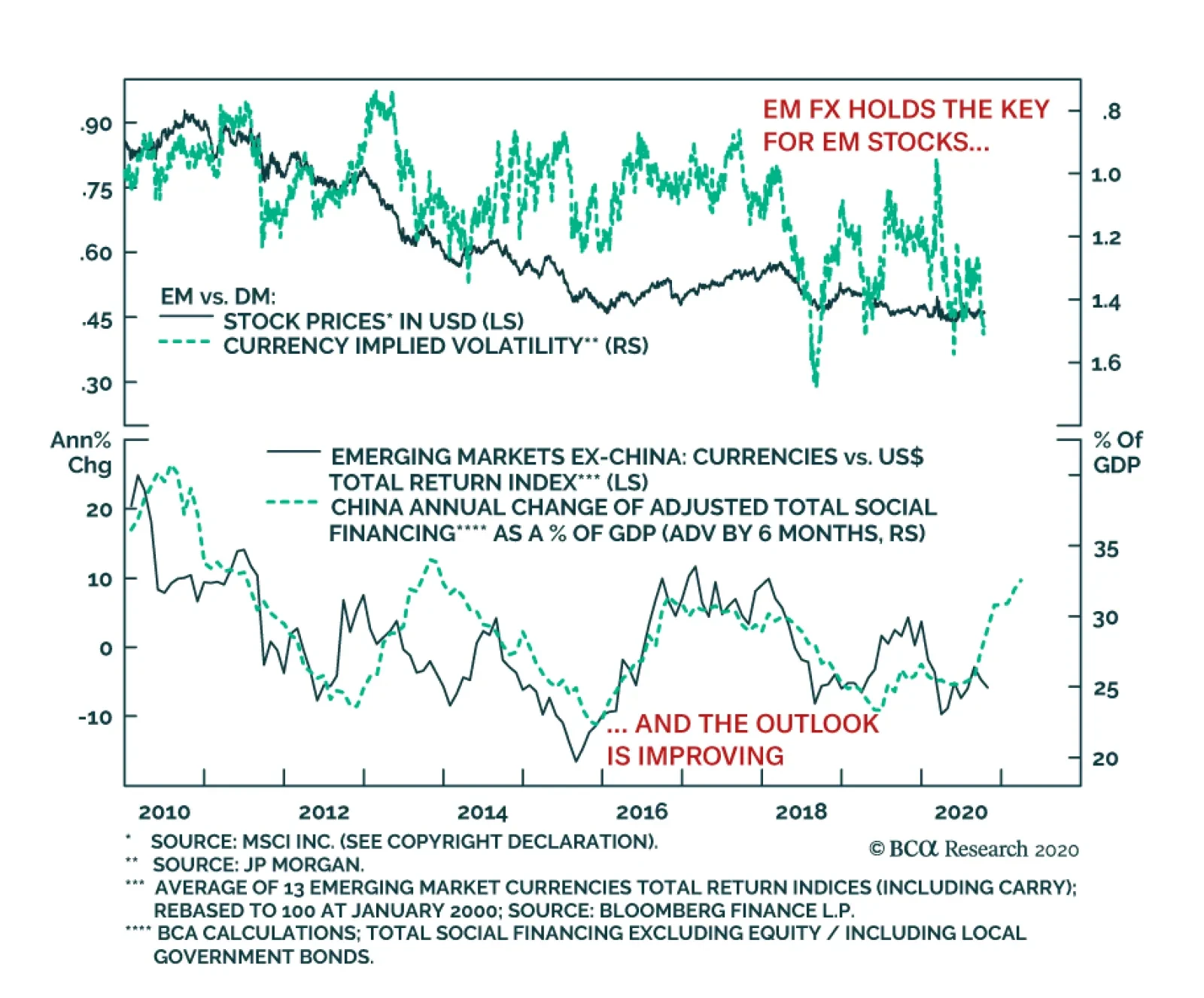

Despite a quick recovery in global industrial activity, EM equities, which normally thrive on rapid global growth, have been incapable of outperforming their DM counterparts. This underperformance reflects two factors. The…

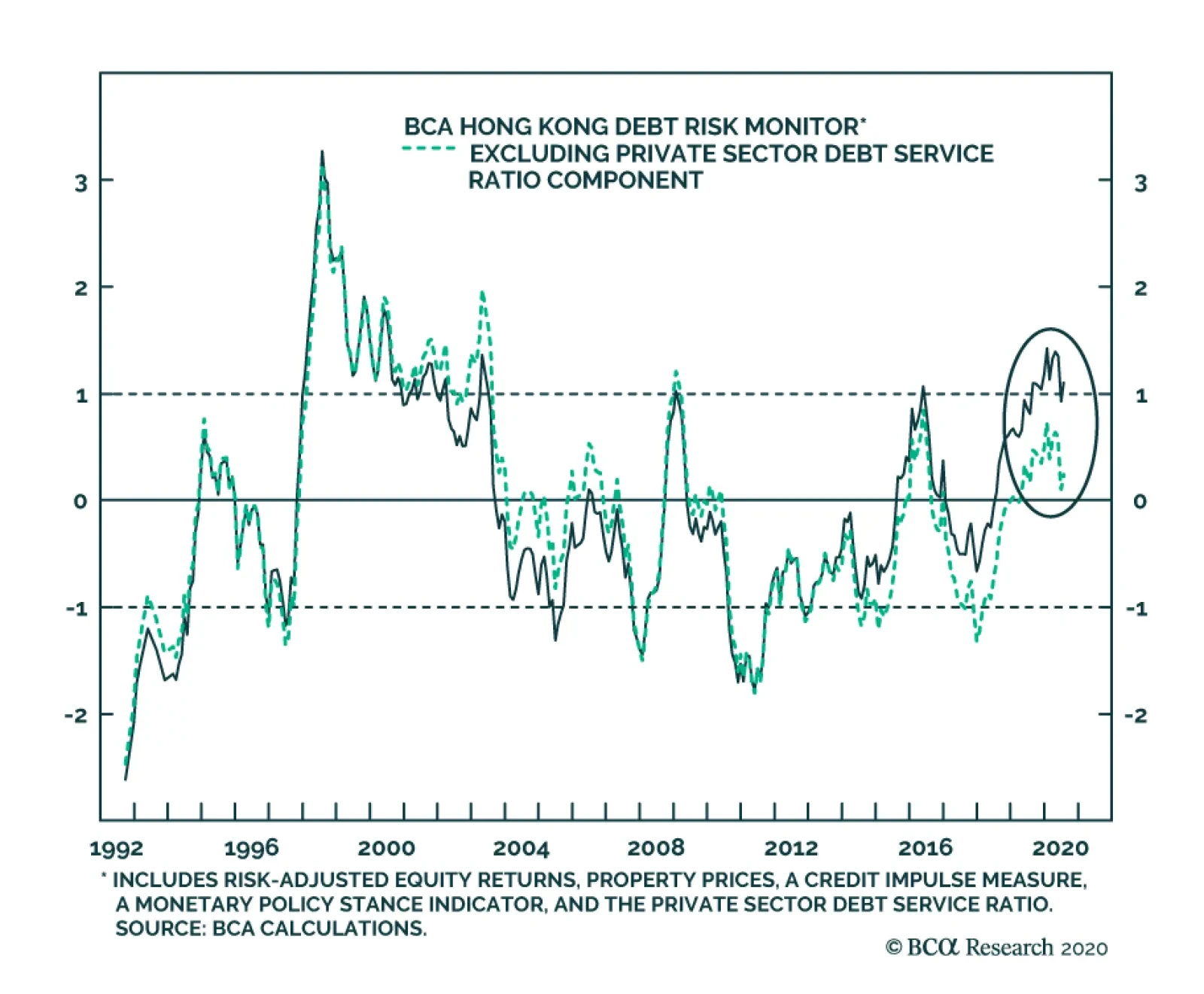

In a previous China Investment Strategy Special Report analyzing Hong Kong’s enormous private sector debt problem, we presented our BCA Hong Kong Debt Risk Monitor (DRM) to help investors gauge the risk of a serious credit-…

Chart Of The WeekInvestor Consensus Is Bearish On Dollar Today we are releasing another issue from our series Charts That Matter. Going forward, this publication will become a regular monthly deliverable to our clients.…

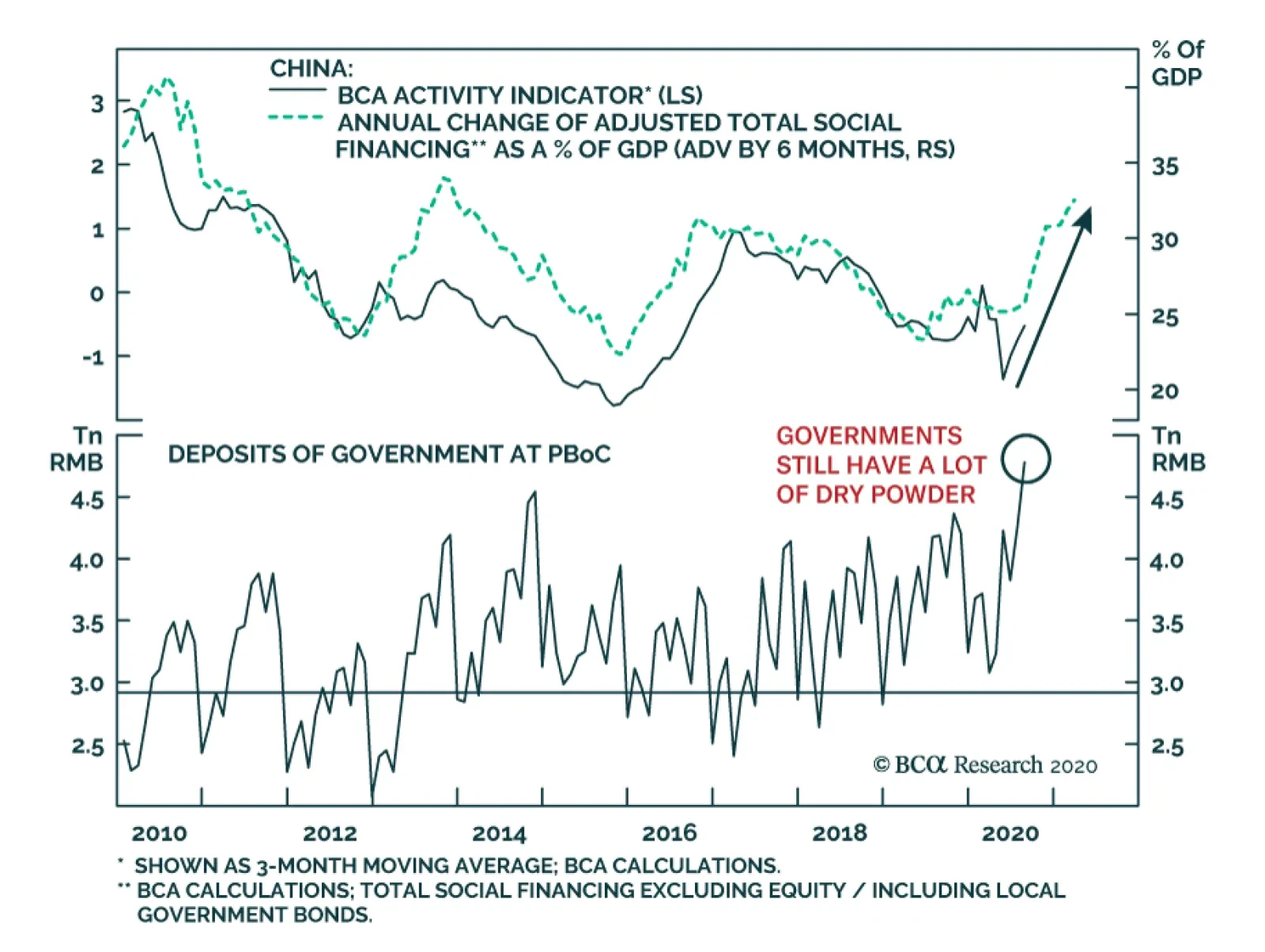

One of the most important leading indicators of global industrial activity continues to send a positive signal for the global business cycle. China’s credit flows remain strong, as new loan issuance rose to CNY1.9trillion…

Highlights Our model suggests that more rate hikes are ahead in 2021; we project a less than 50bps increase in the PBoC policy rate from the current level. Chinese stock prices positively correlate with interest rates and bond yields…

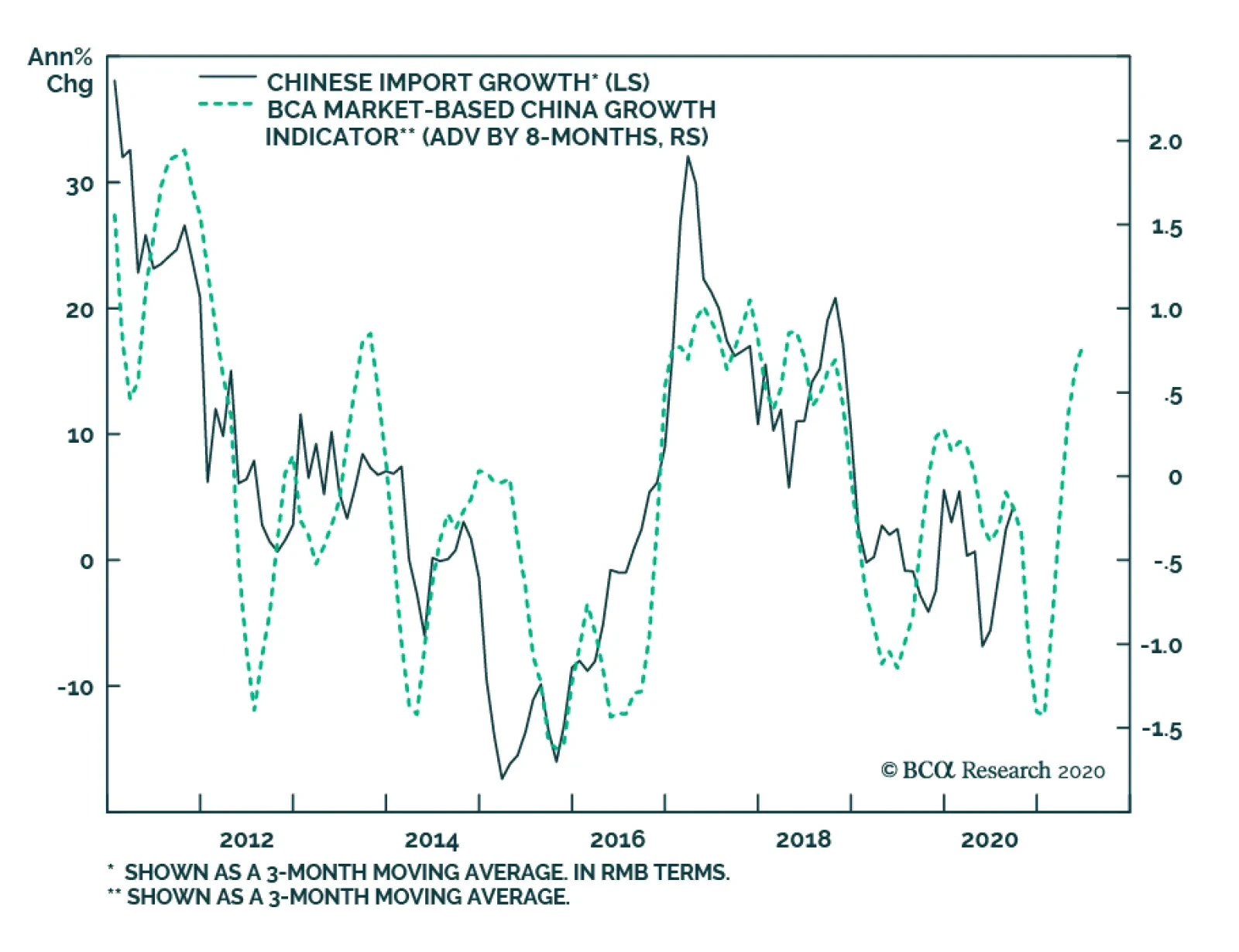

This week’s September import data from China positively surprised investor expectations, having accelerated significantly from August levels. In August, YoY import growth came in at -2.1% in USD terms (-0.5% in RMB terms);…

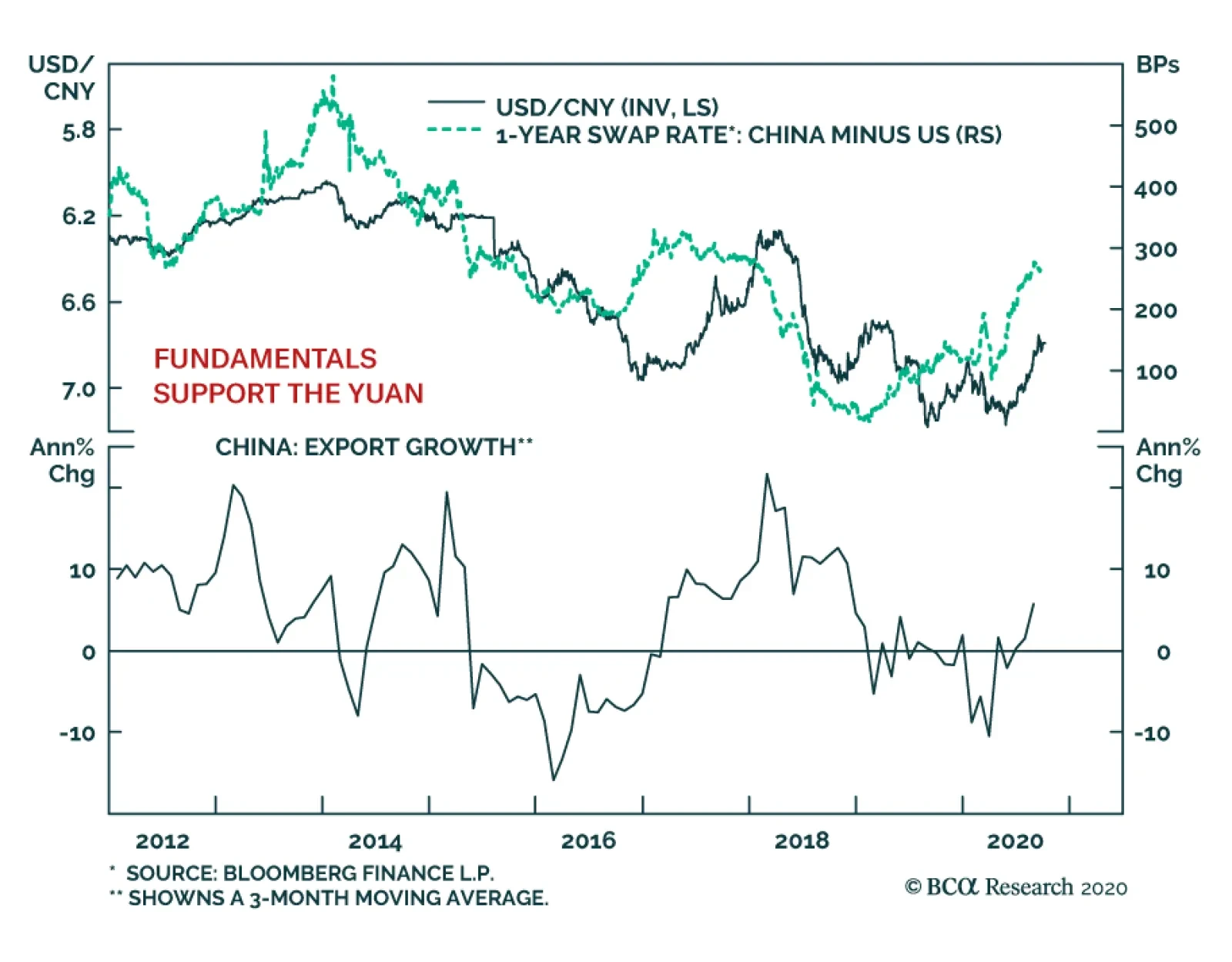

Since May 27, the onshore CNY has appreciated more than 7% against the USD and it trades at levels last seen in April 2019, just prior to the imposition of additional tariffs by the Trump administration on US$250 billion of…

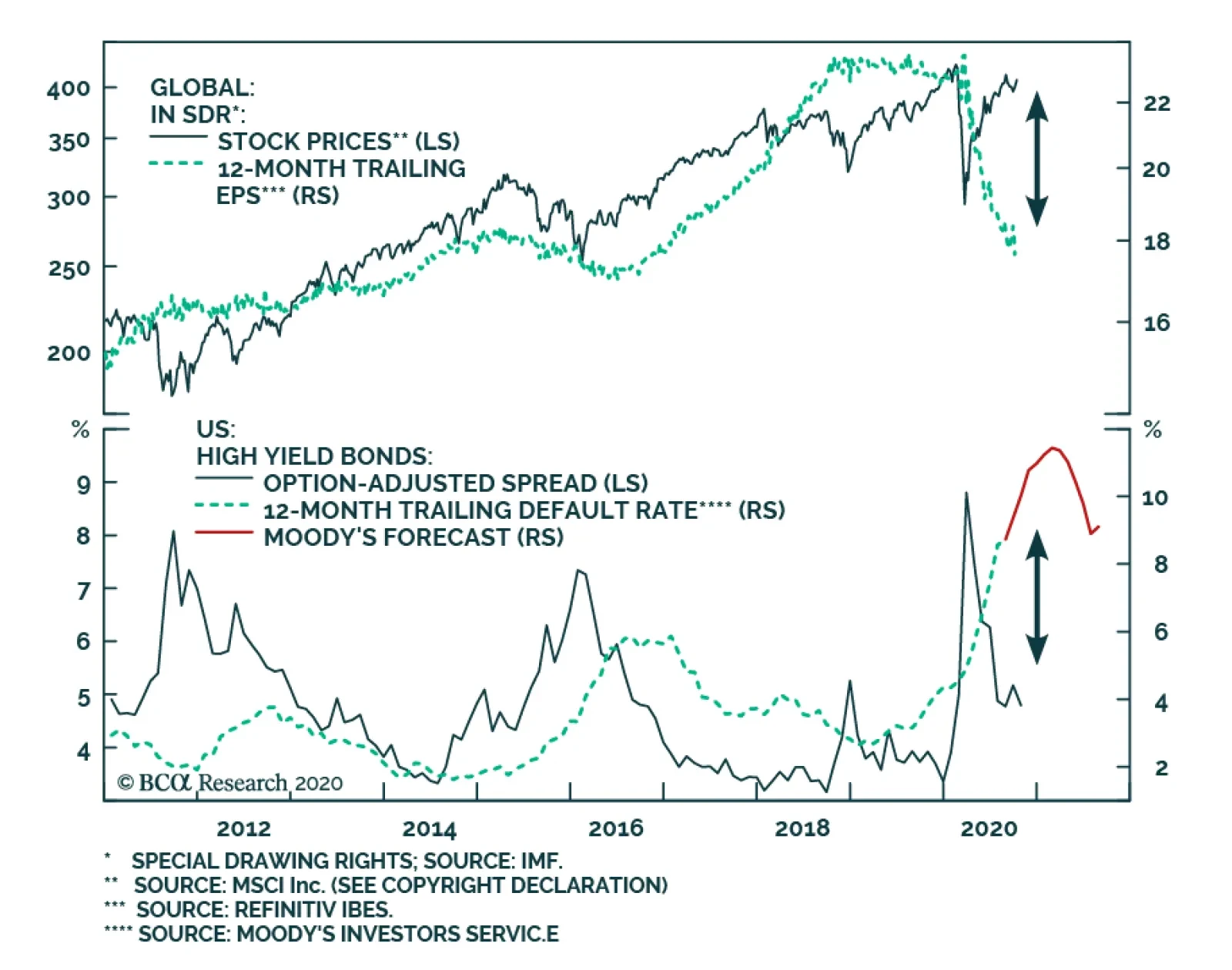

According to BCA Research's Emerging Markets Strategy service, any US financial market risk stemming from the lack of fiscal stimulus will weigh on EM. Global risk assets are vulnerable as US Republicans and Democrats have…

Highlights US market risks stem from both the lack of fiscal stimulus before the new president assumes office in late January. Risk-off moves in US financial markets will weigh on EM. China’s stimulus has peaked and the country…