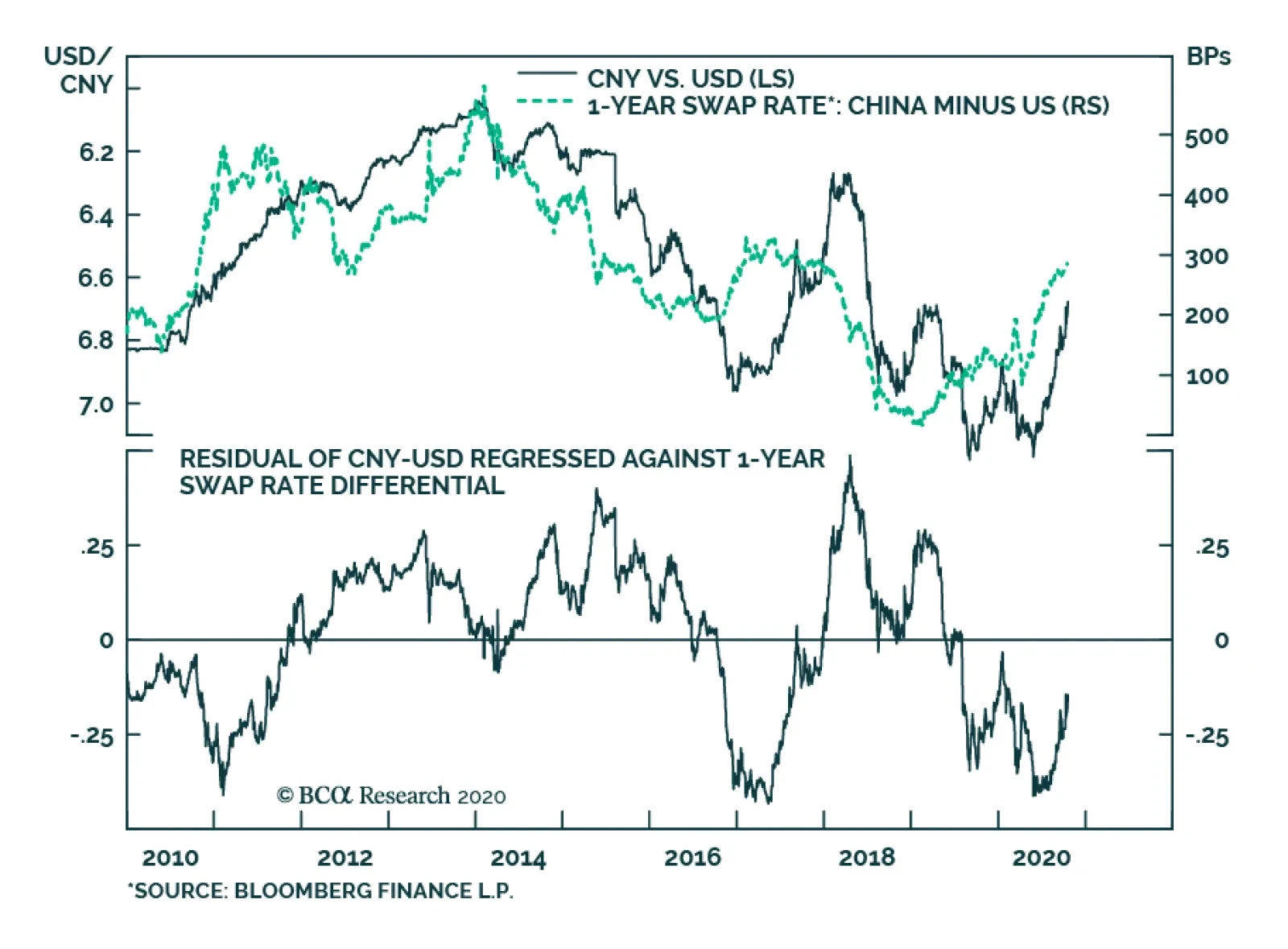

We highlighted in an Insight last week that the RMB’s rise versus the US dollar was partially due to the growth implications of China’s success at controlling the COVID-19 pandemic, but also reflected an interest rate…

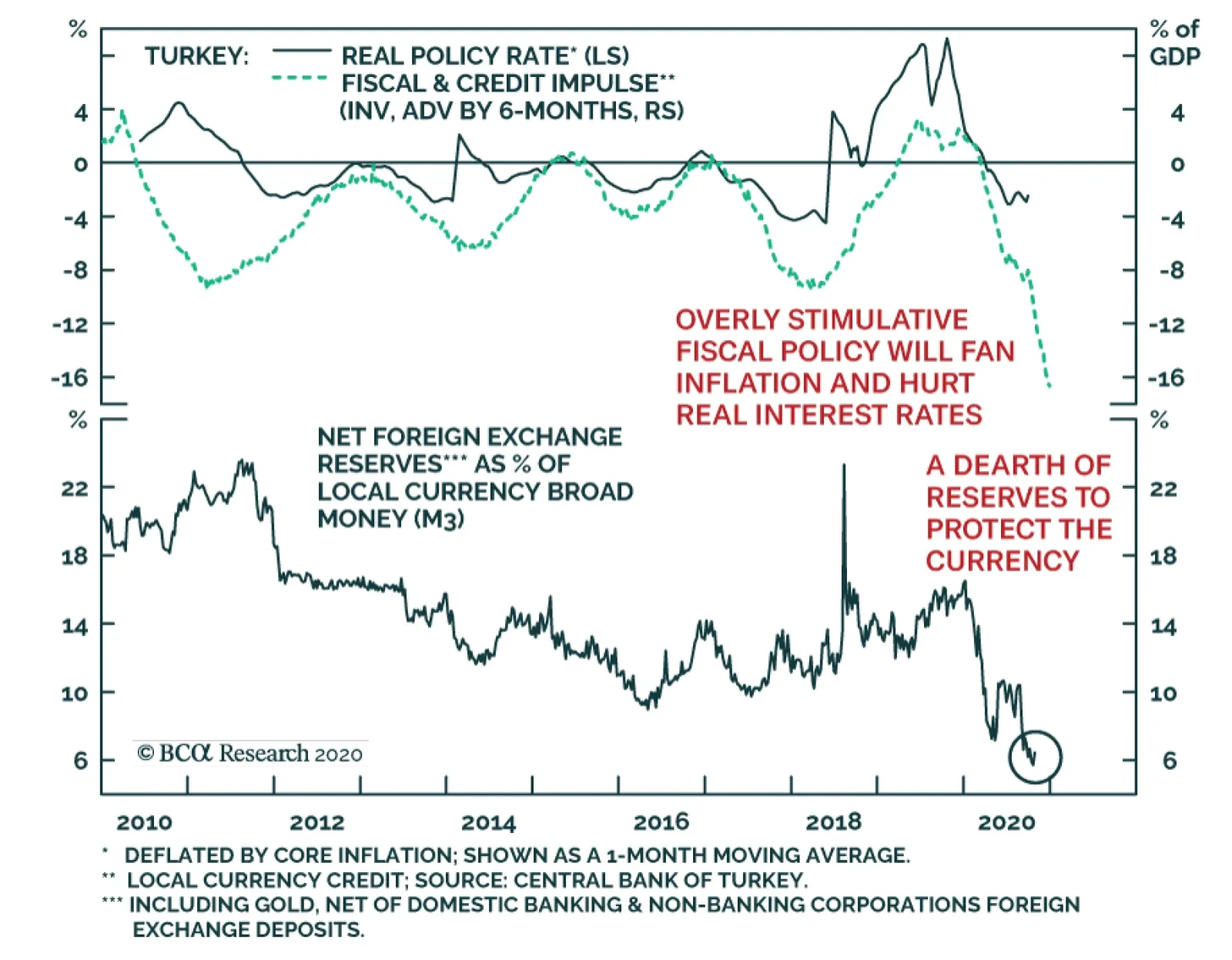

The collapse in the Turkish lira once again accelerated. Some of the weakness reflects a potential Biden presidency, which would result in a marked deterioration of the relationship between the two countries. Moreover, the…

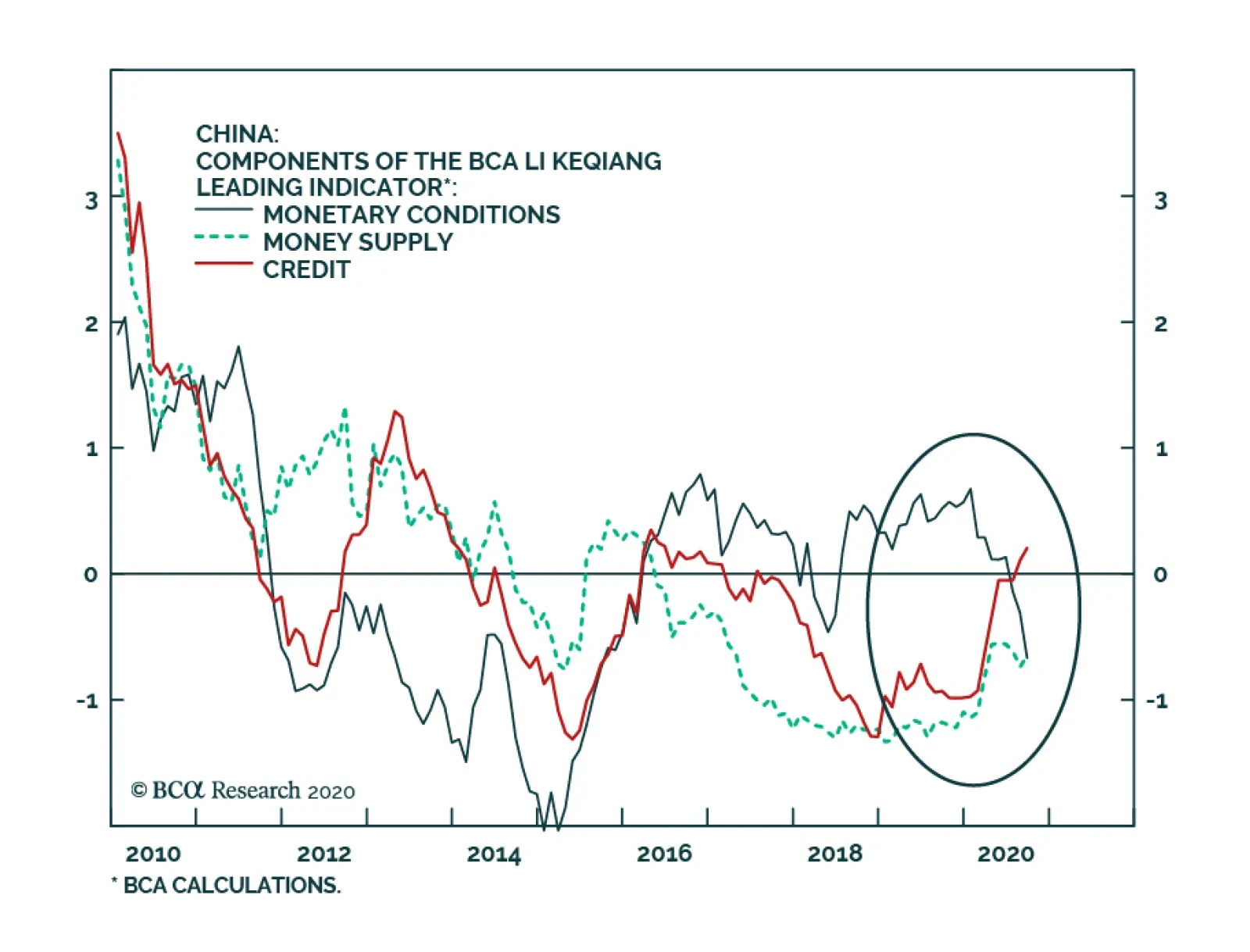

The chart above presents the three sub-components of our BCA Li Keqiang Leading Indicator, which has risen this year but has fallen since June. The chart makes it clear that while the money and credit components of the indicator…

Your feedback is important to us. Please take our client survey today. Highlights New position: Go structurally overweight DM equities versus EM equities. This position is equivalent to structurally overweight healthcare versus basic…

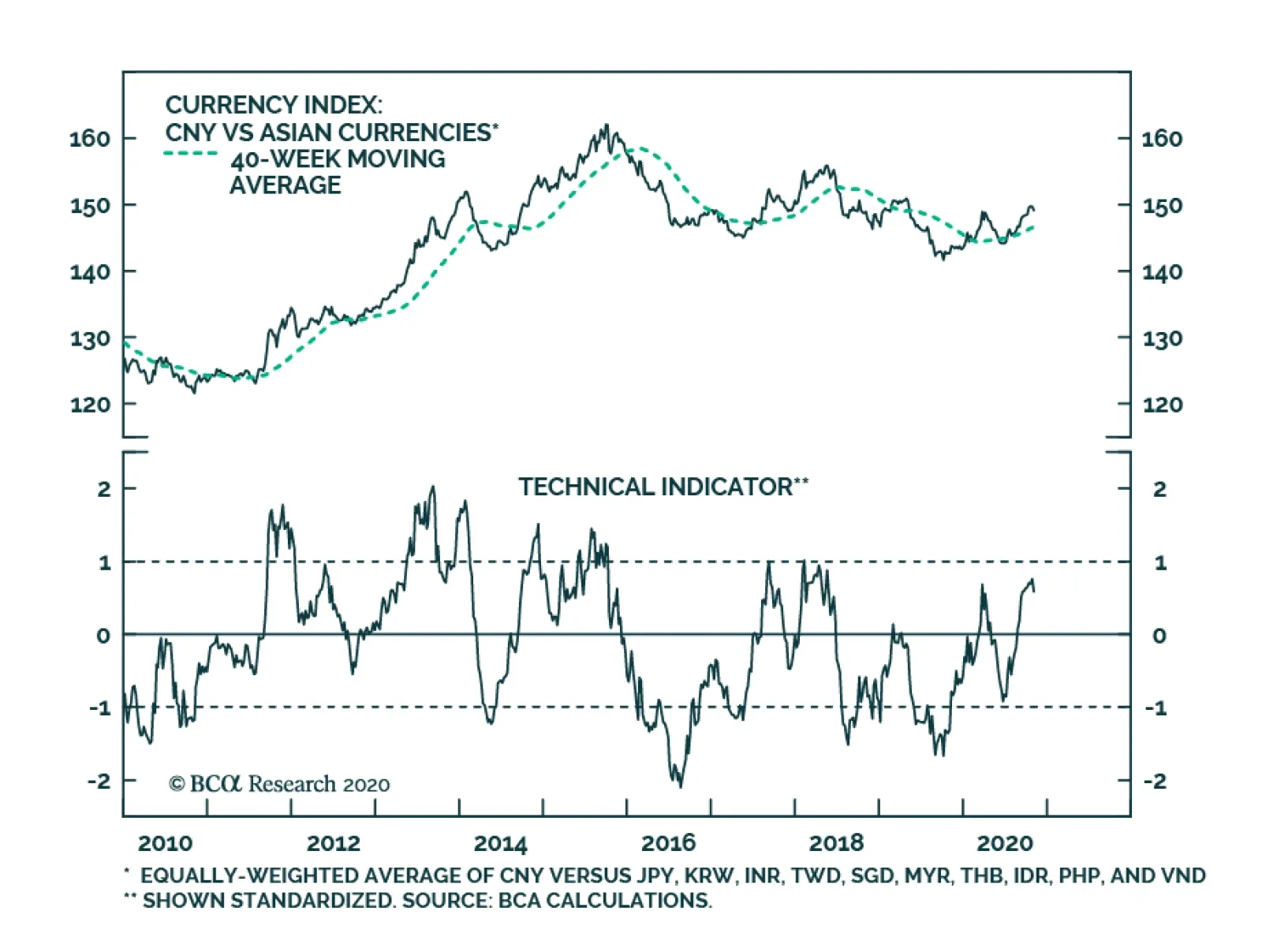

Adjusted for volatility, the rise in CNY-USD over the past month has been among the largest moves in global financial markets. While some of this can be attributed to a decline in the US dollar, the RMB is also up meaningfully…

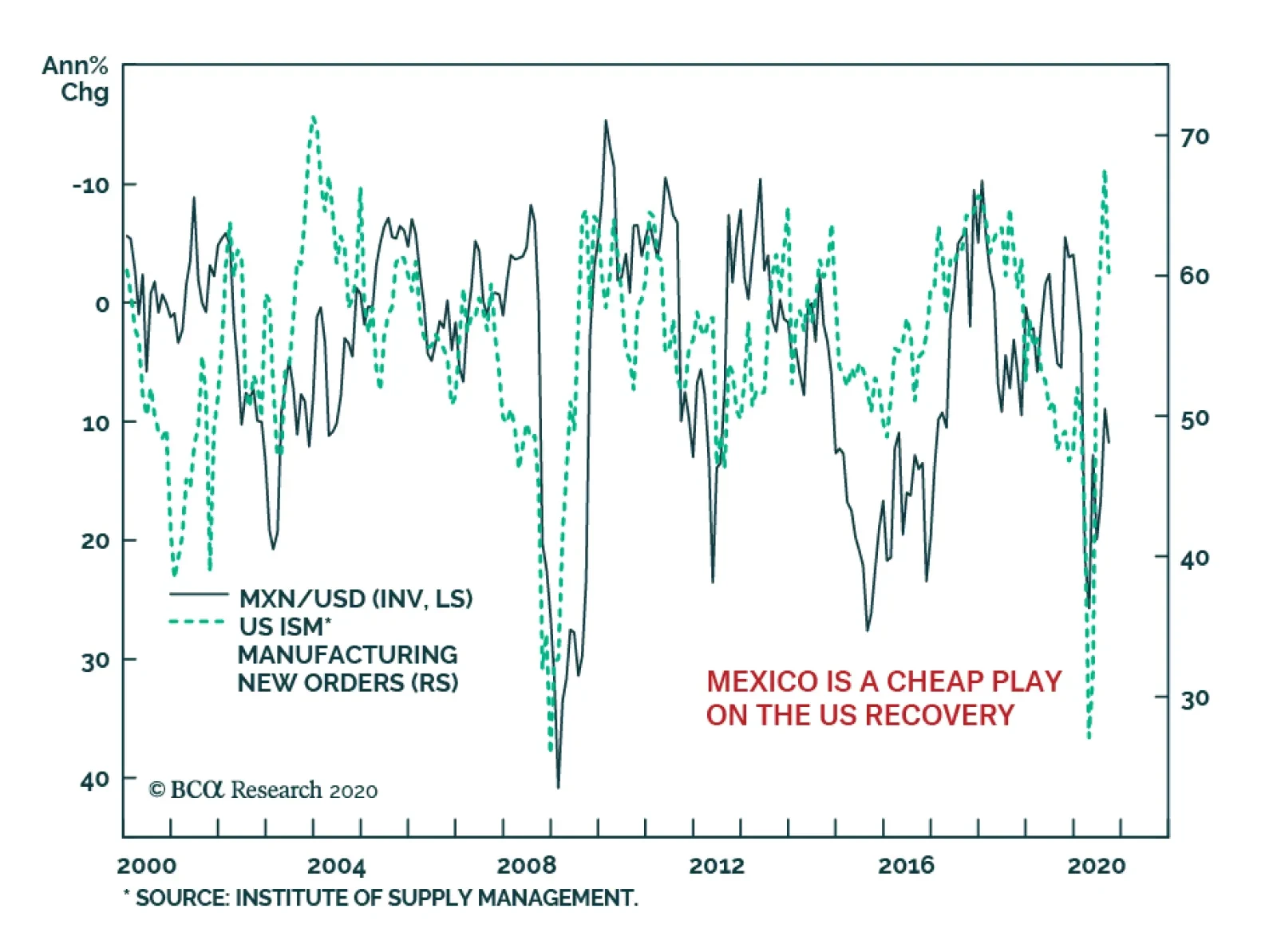

Mexican equities have steadily underperformed their US counterparts since early 2013, when a large wave of peso depreciation began. Mexican stocks have also underperformed EM equities significantly this year. Could Mexican assets…

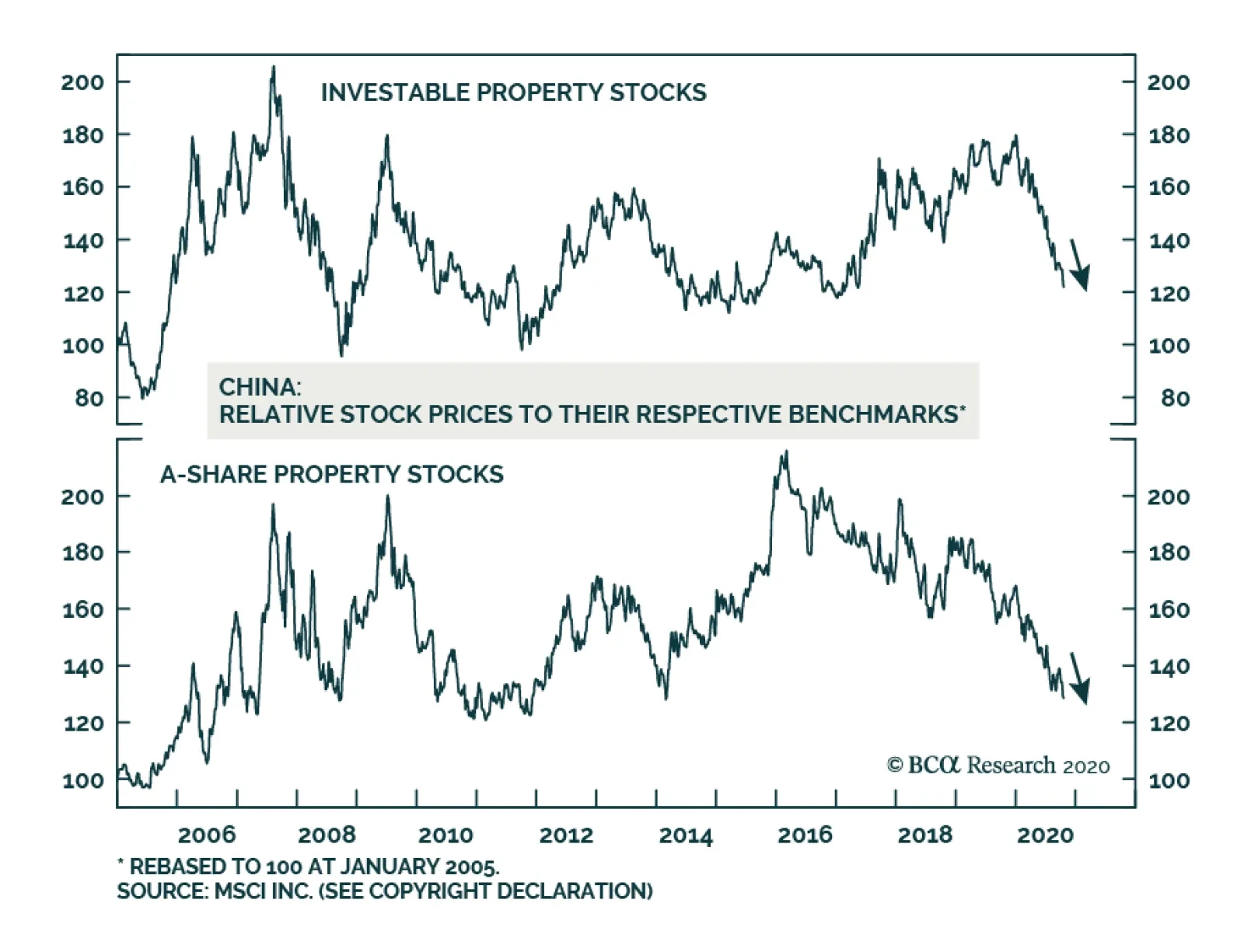

BCA Research's China Investment Strategy service expects Chinese onshore and offshore property stocks to continue underperforming their respective benchmarks. However, the team recommends buying Chinese property developers…