We are publishing the November issue of Charts That Matter. The key message from the charts on the following pages is that investor sentiment on global growth is elevated and the reflation trade is a bit overstretched. As a result, risk…

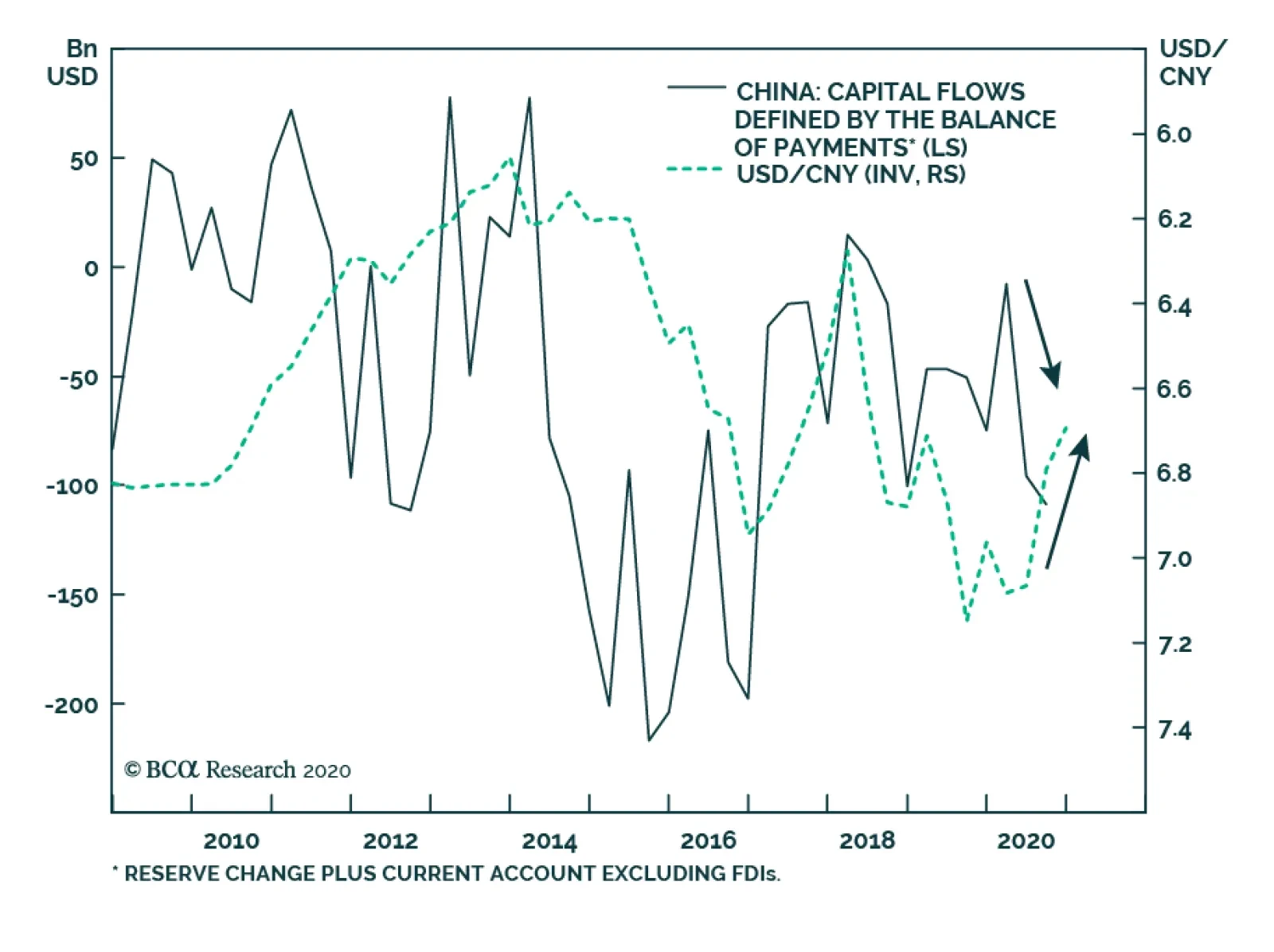

According to BCA Research's China Investment Strategy service, at least a good portion of the recent capital outflows out of China likely occurred due to an effort by Chinese policymakers to slow the pace of the RMB’s…

Highlights In the first nine months of 2020, China's capital outflows, measured by the Balance of Payments (BoP) data, have been the largest since 2016. Unlike 2016, the outflows are mainly driven by a strategic accumulation of…

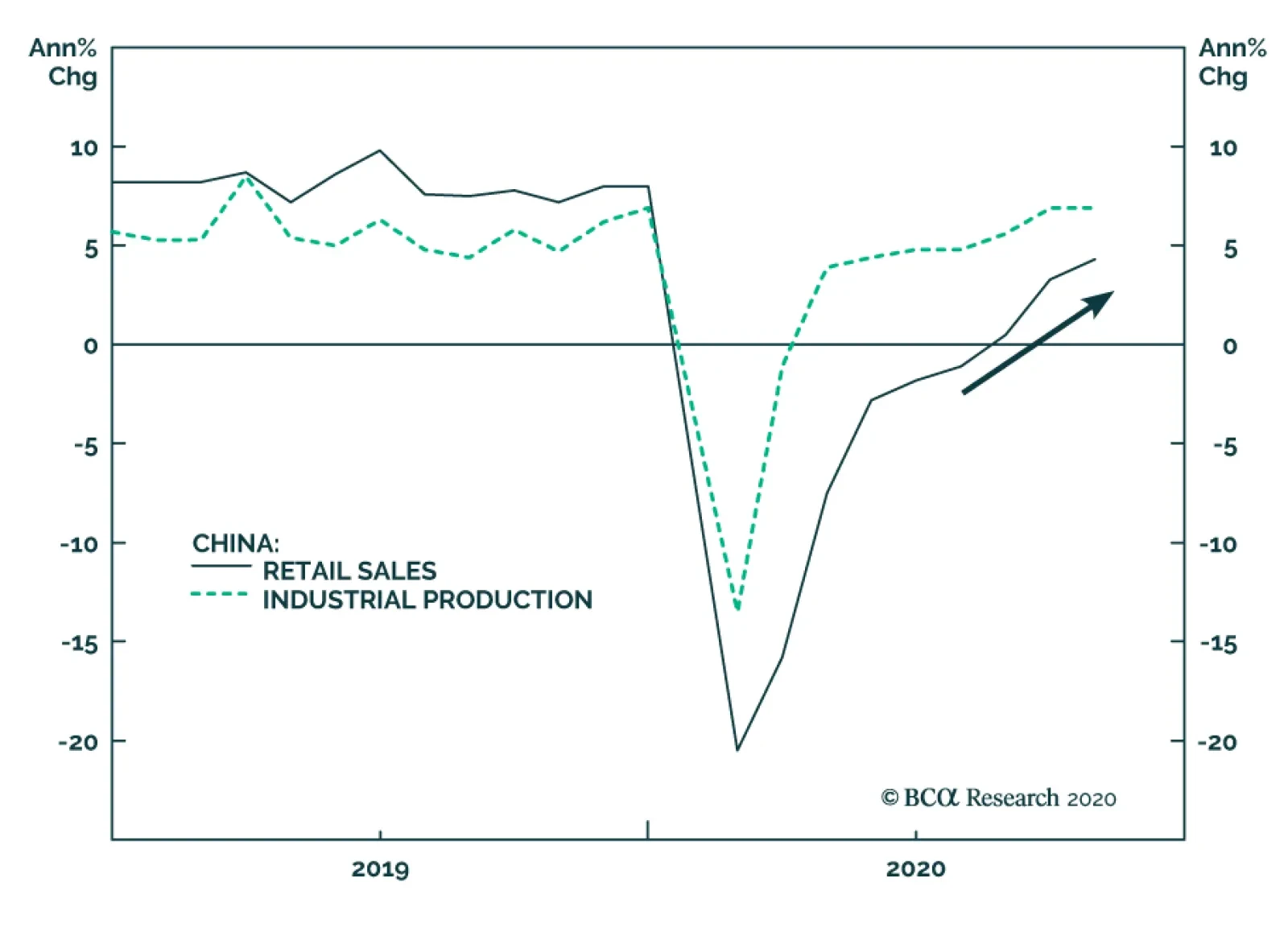

The Chinese economy continued its recovery in October, with both fixed asset investment and industrial production beating expectations. The former accelerated to 1.8% year-on-year from 0.8% year-on-year, while the latter remained…

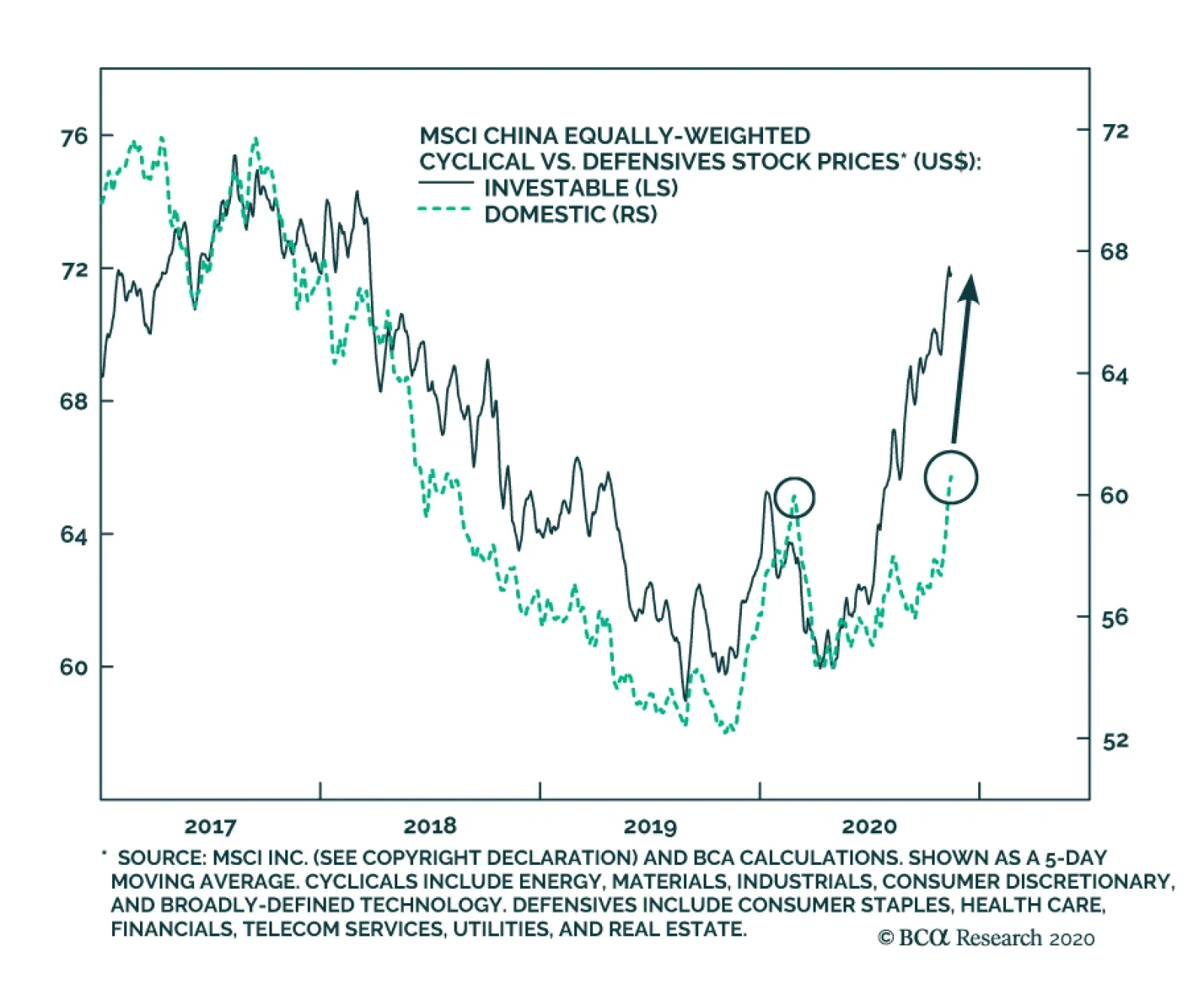

The chart above presents the relative performance of Chinese cyclicals versus defensives for both the investable and domestic markets. Here, cyclical and defensive sectors are equally-weighted within each index, so as to avoid…

Highlights US inflation expectations will moderate, and US real yields will rise. This will support the US dollar. The potential rebound in the US dollar will cap any upside in EM ex-TMT stocks. Rising US real yields are a risk to…

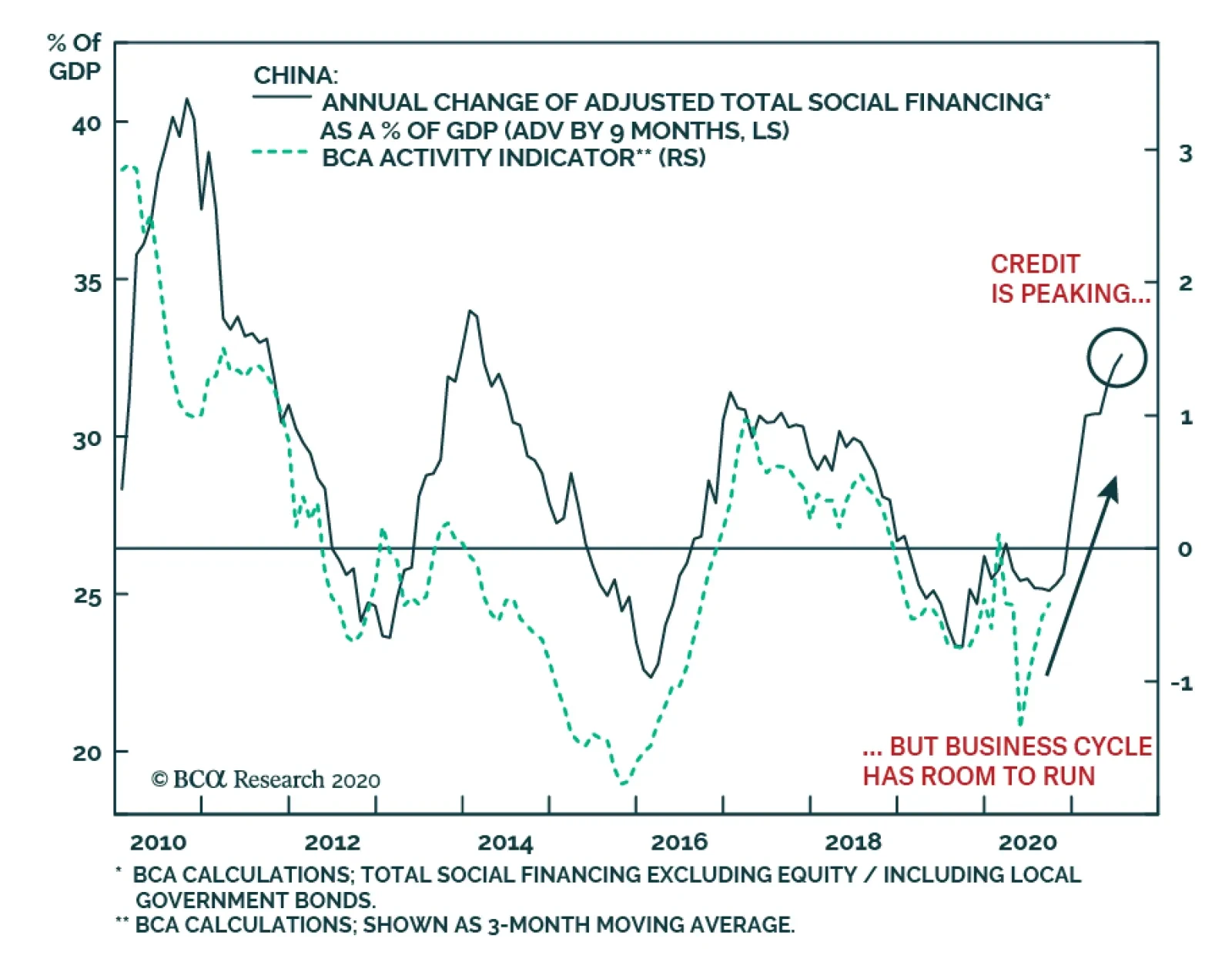

China’s aggregate financing decelerated significantly in October to CNY1.42 trillion from CNY3.48 trillion. New loan issuance also slowed to CNY689.8 billion from CNY1.9 trillion, slightly below expectations of CNY775…

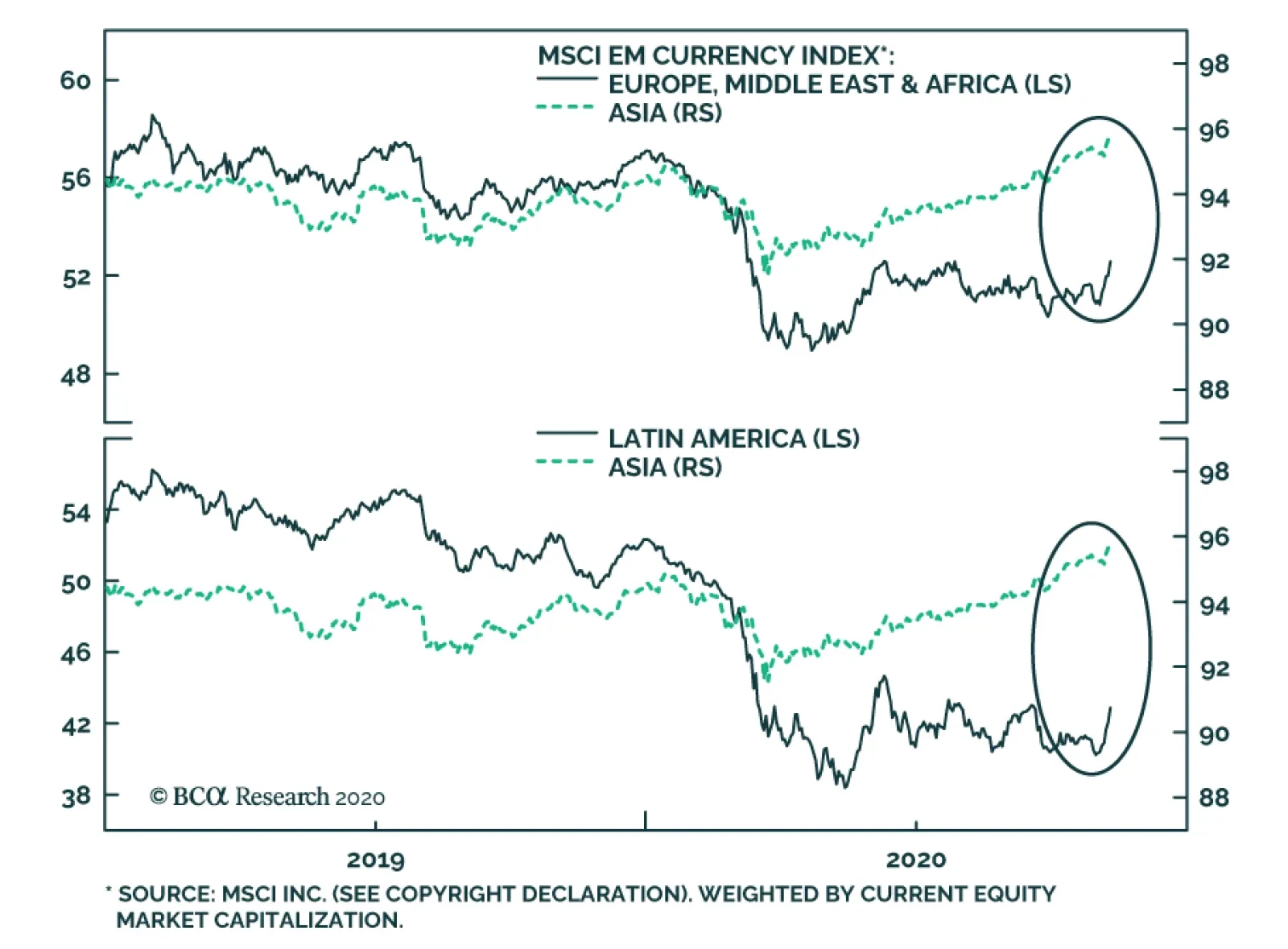

Since late-March, the MSCI Emerging Markets Currency Index has rallied nearly 10%, and has recently risen above its pre-pandemic peak. This has caught the attention of some investors, who often interpret aggregate EM currency…

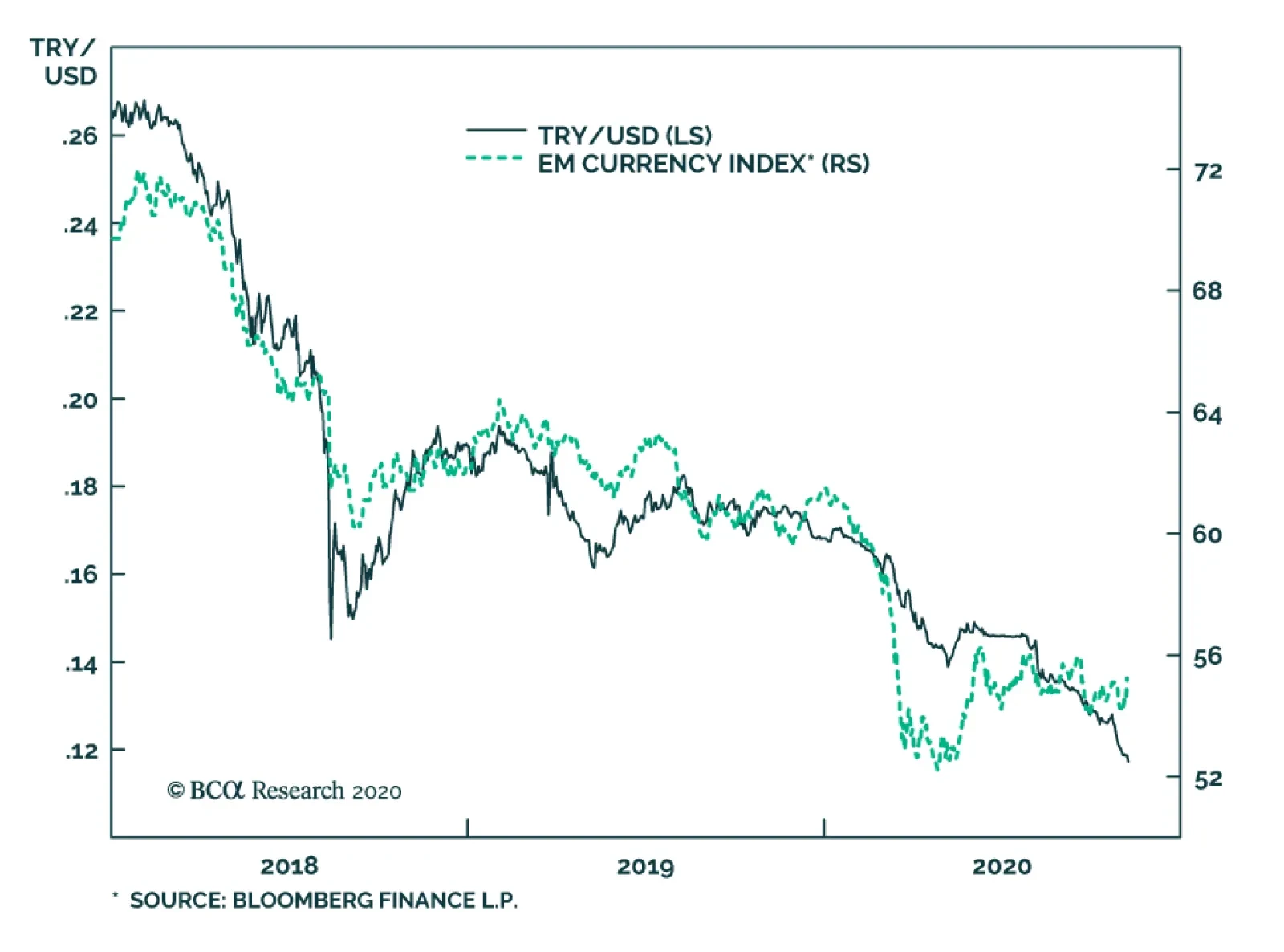

This past weekend was an eventful one in Turkey. President Recep Tayyip Erdogan fired central bank governor Murat Uysal on Saturday, replacing him with former finance minister and trusted ally Naci Agbal. The following day,…

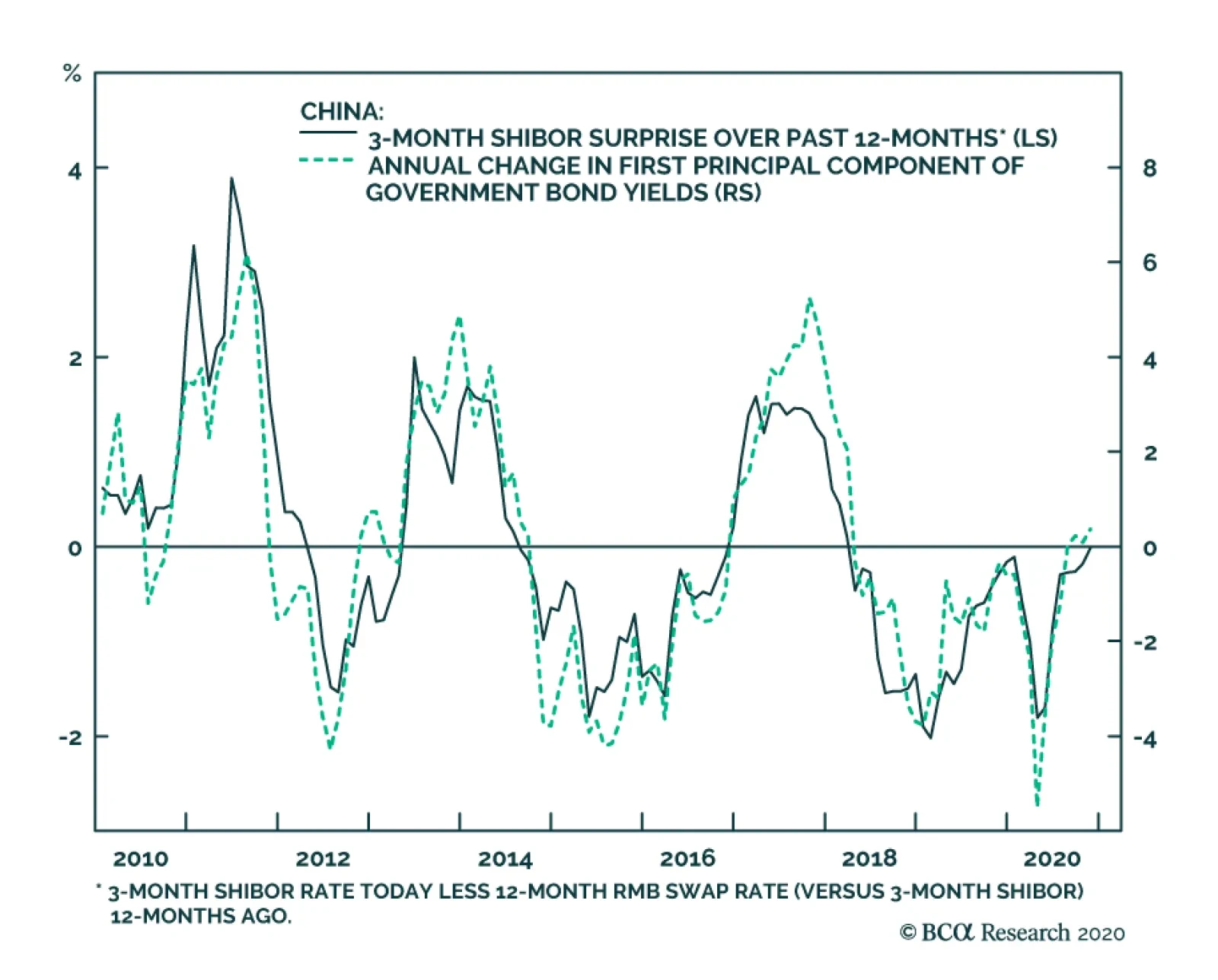

In a Special Report earlier this year, our China Investment Strategy service applied the “Golden Rule Of Bond Investing”, which links developed economy government bond returns to central bank policy rate “…