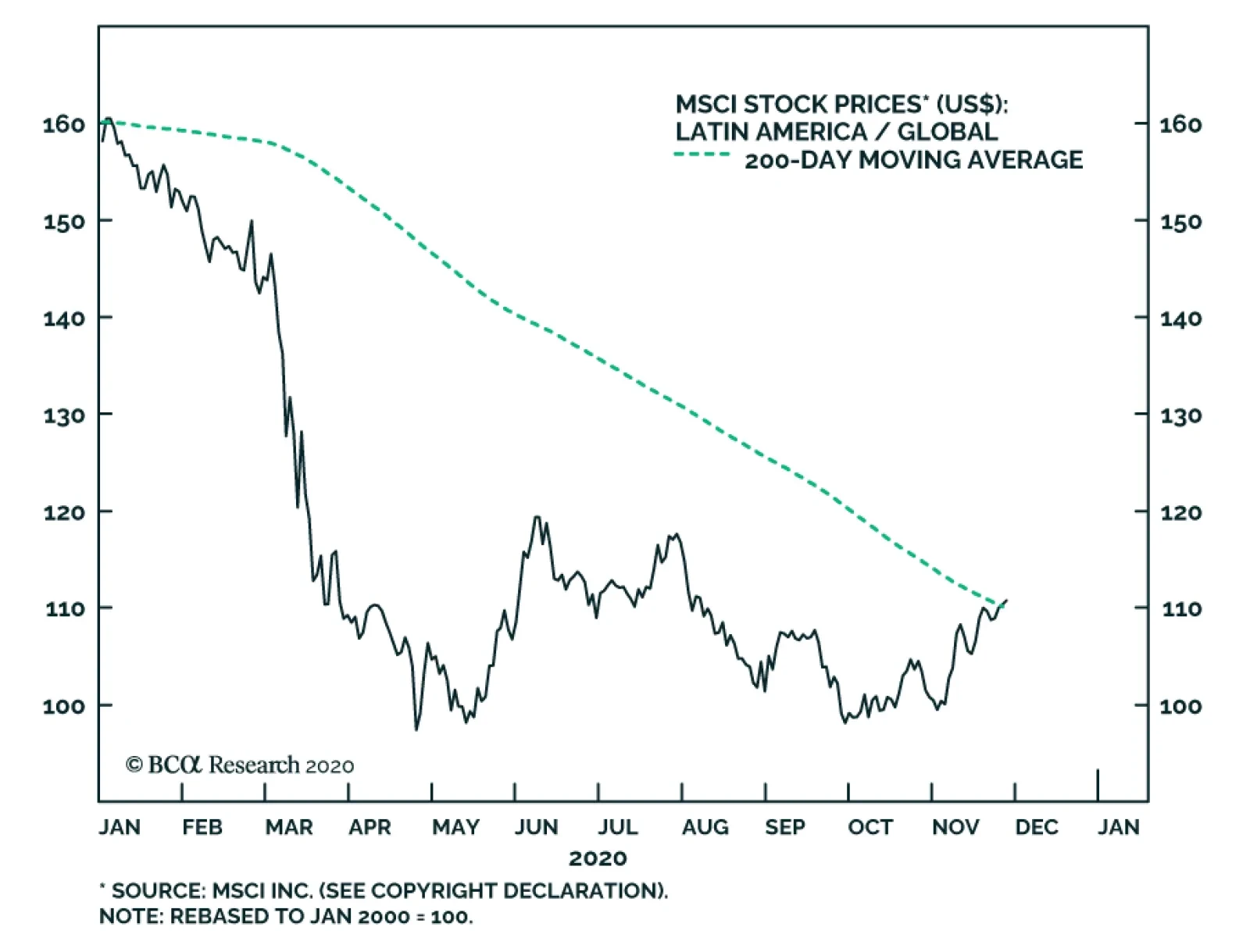

In late-October, Latin American (“LATAM”) relative equity performance was not meaningfully higher than its late-April low. This month, LATAM has outperformed global stocks significantly and is now challenging its 200-…

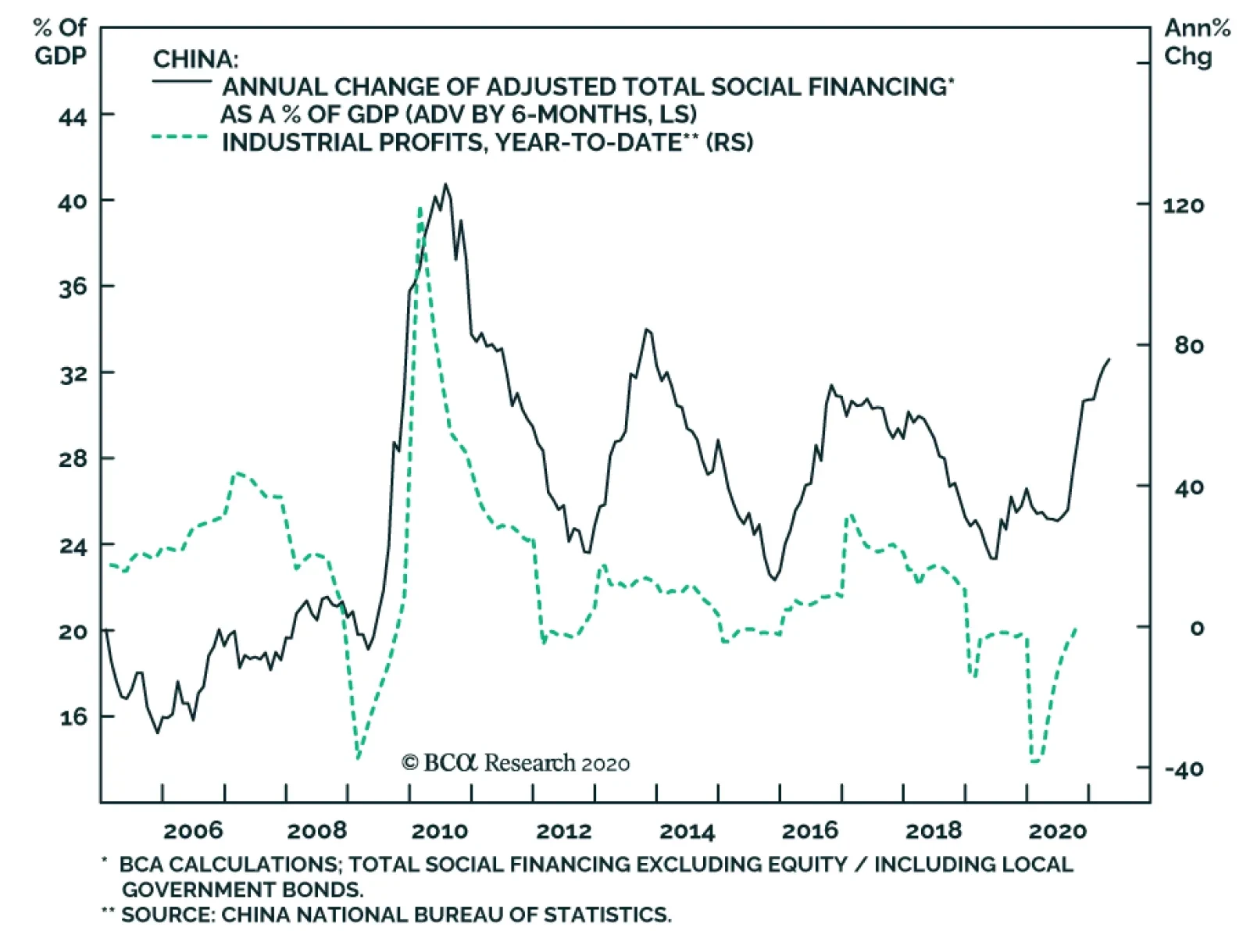

China’s industrial profits rose by a headline-grabbing 28.2% on a year-on-year (y/y) basis in October from 10.1% y/y the prior month. However, the data print overstates the underlying conditions. For one, the strong…

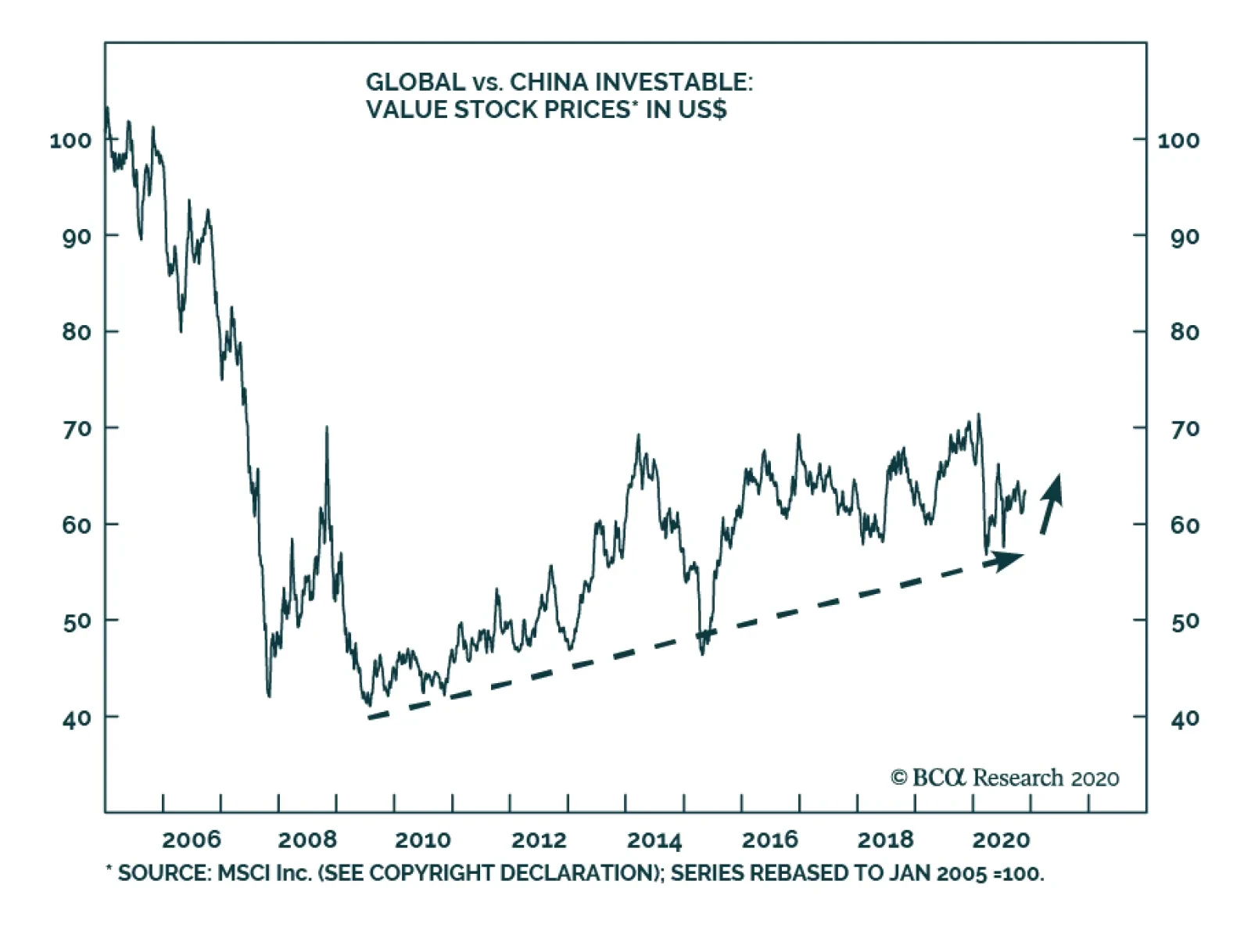

BCA Research's Emerging Markets Strategy service recommends going long global value / short Chinese value stocks. The upcoming anti-trust regulation for platform companies is a positive development for the entire Chinese…

Highlights New recommendation: Go neutral growth versus value on a 6-12-month horizon… …and exploit the greater opportunities within the growth universe and within the value universe. Within the growth universe,…

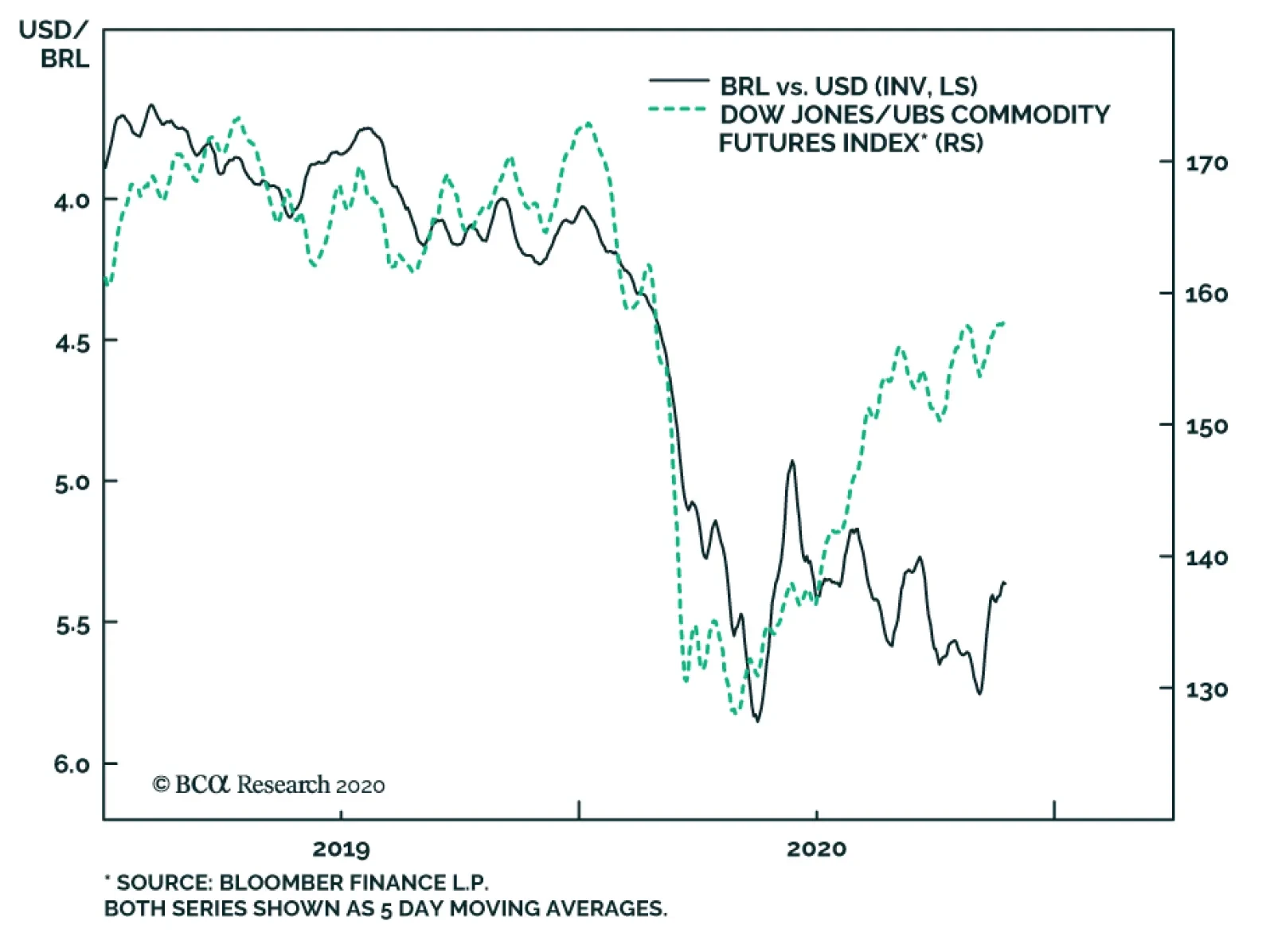

On Monday, Paulo Guedes, Brazil’s economy minister, argued that the Brazilian real has likely overshot its equilibrium level of around USD-BRL = 5. The chart above highlights the divergence that has developed between the…

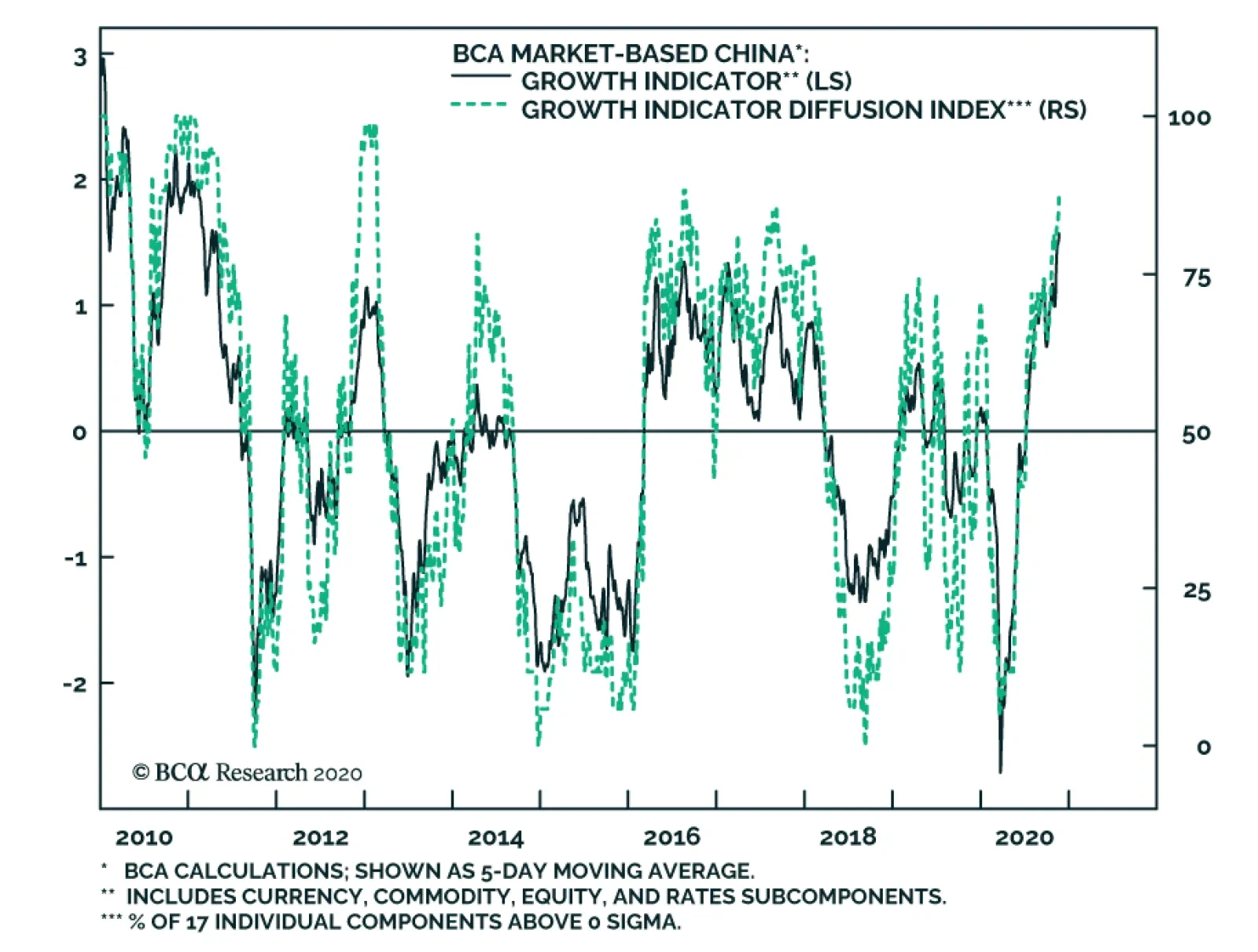

The chart above highlights BCA’s Market-Based China Growth Indicator, along with its diffusion index. The purpose of the indicator is to act as a broad proxy of investor expectations for Chinese growth, and to illustrate…

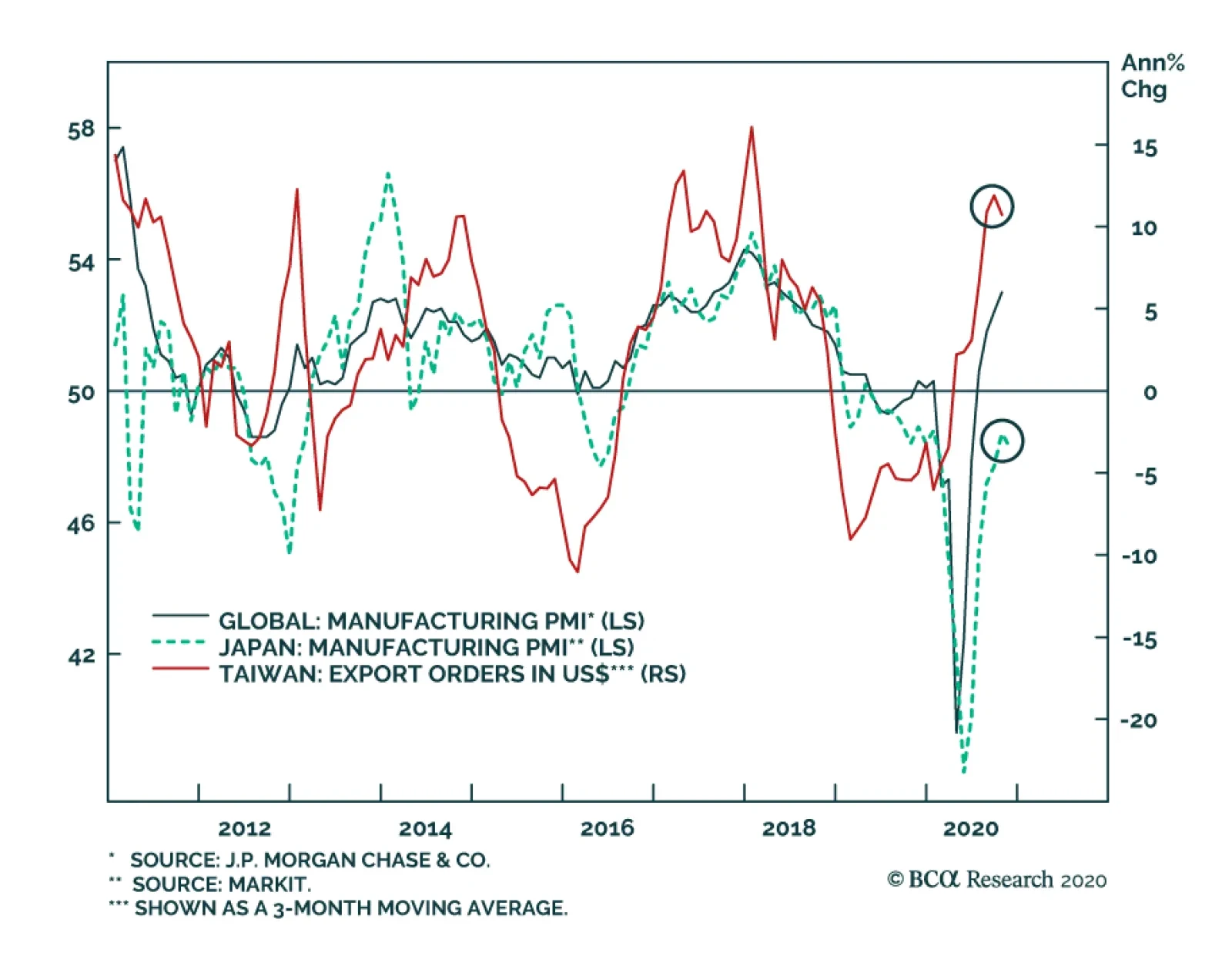

Taiwanese export orders remained resilient in October, ticking down to 9.1% year-on-year (y/y) from 9.9% y/y. An acceleration in the pace of shipments to the US supported the continued strength in Taiwanese exports, and while…

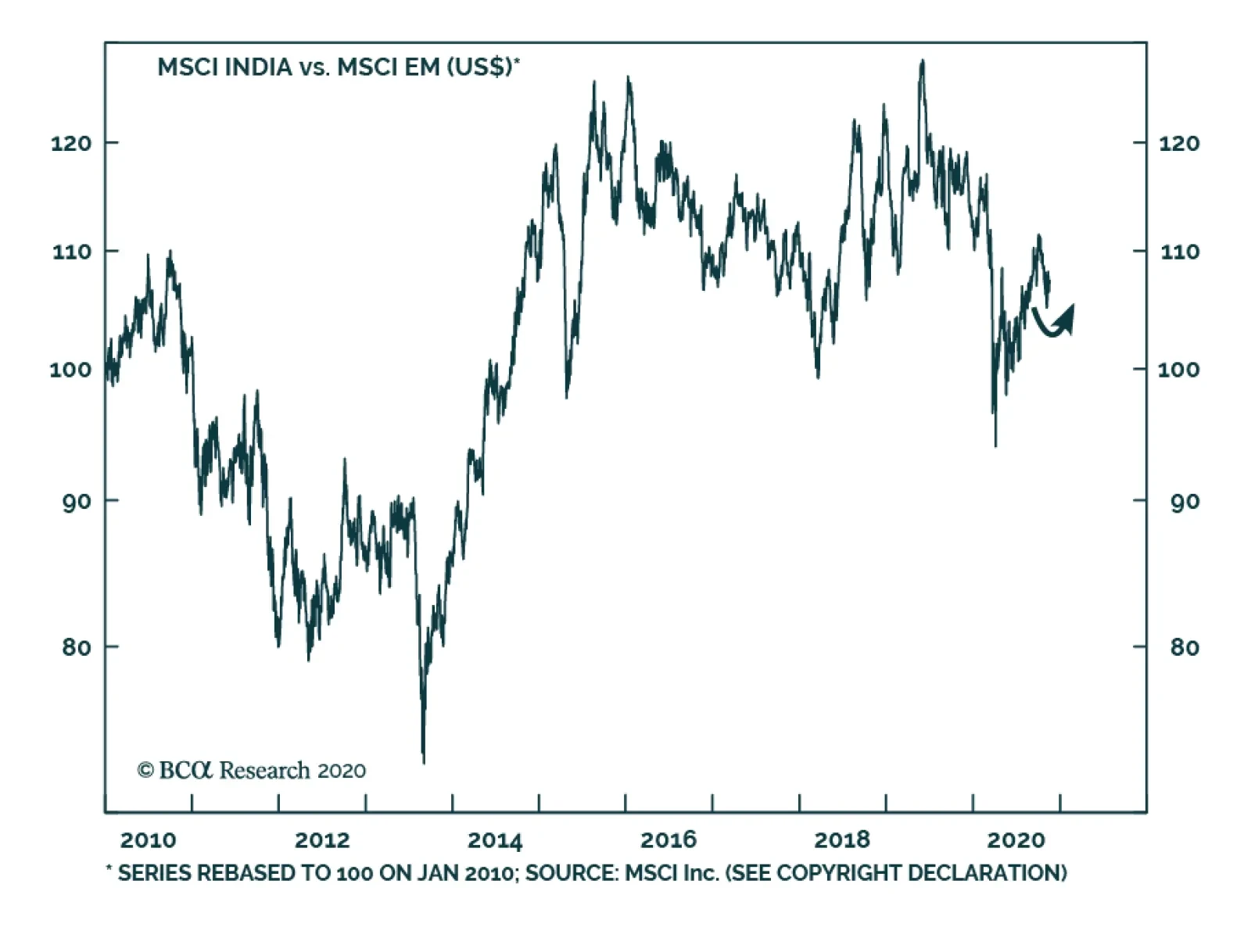

According to BCA Research's Emerging Markets Strategy service, India's structural reform agenda warrants upgrading Indian stocks to neutral within an EM equity portfolio. While valuations are expensive, part of the…