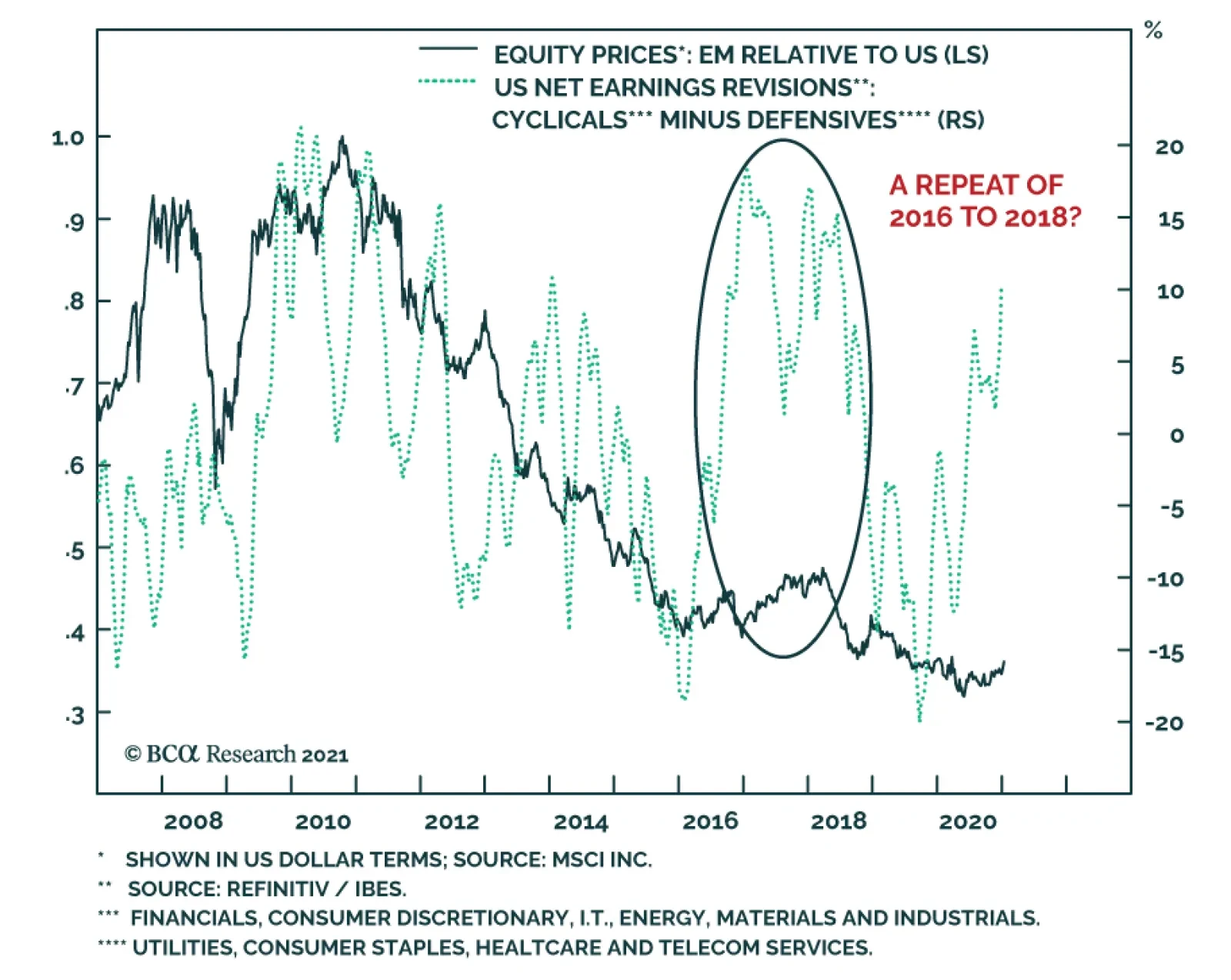

The reality that the market rally will become more volatile (see Indicator Spotlight) does not preclude a meaningful outperformance of EM equities relative to the US. In fact, BCA Research expects EM equities to perform in line…

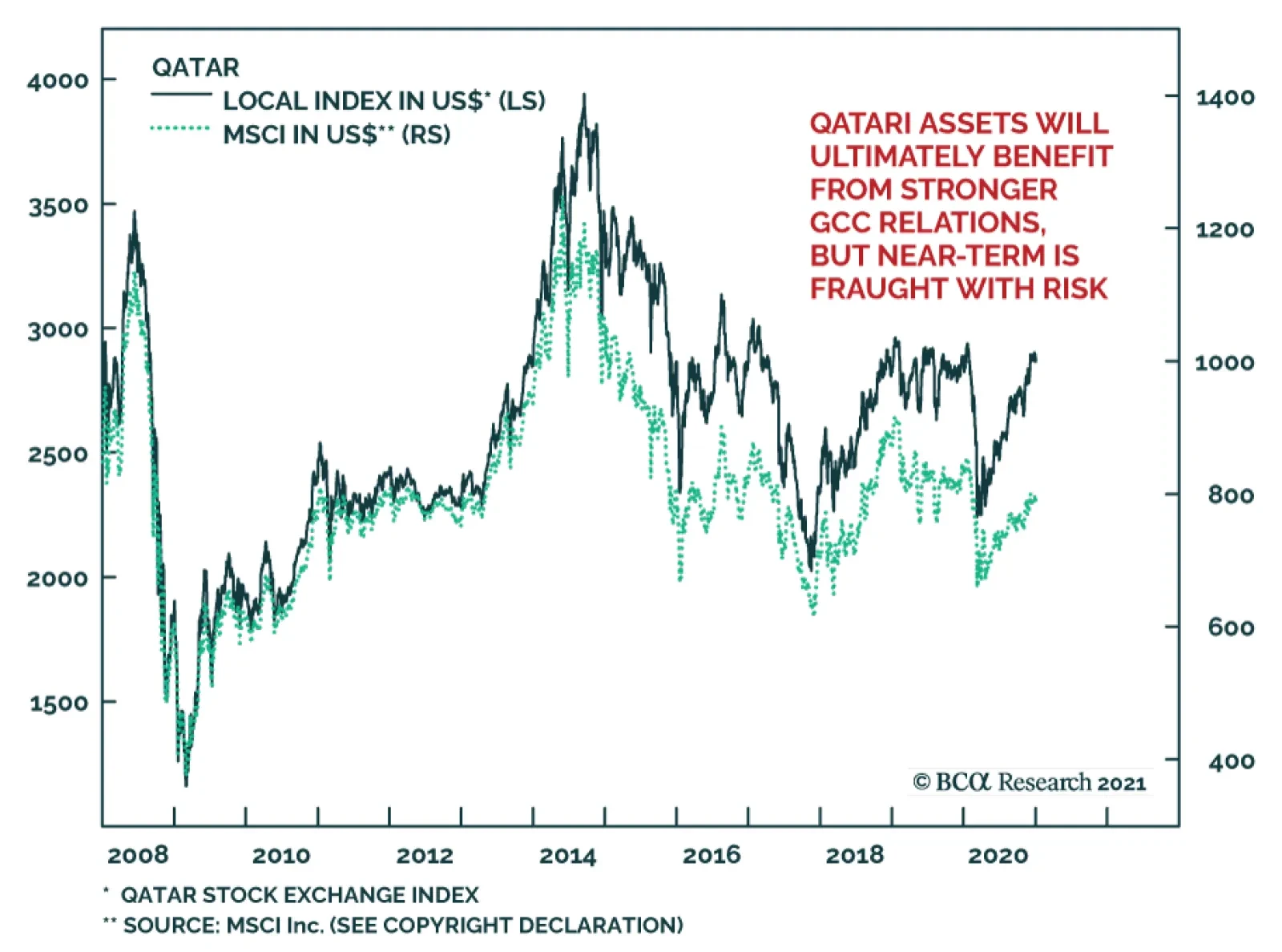

The Qatar-Saudi Arabia rapprochement is positive for the medium-term outlook for Arab Gulf economies and stocks. Qatar managed to survive the air land and sea blockade by rerouting flights through Iran (with a $100 million/year…

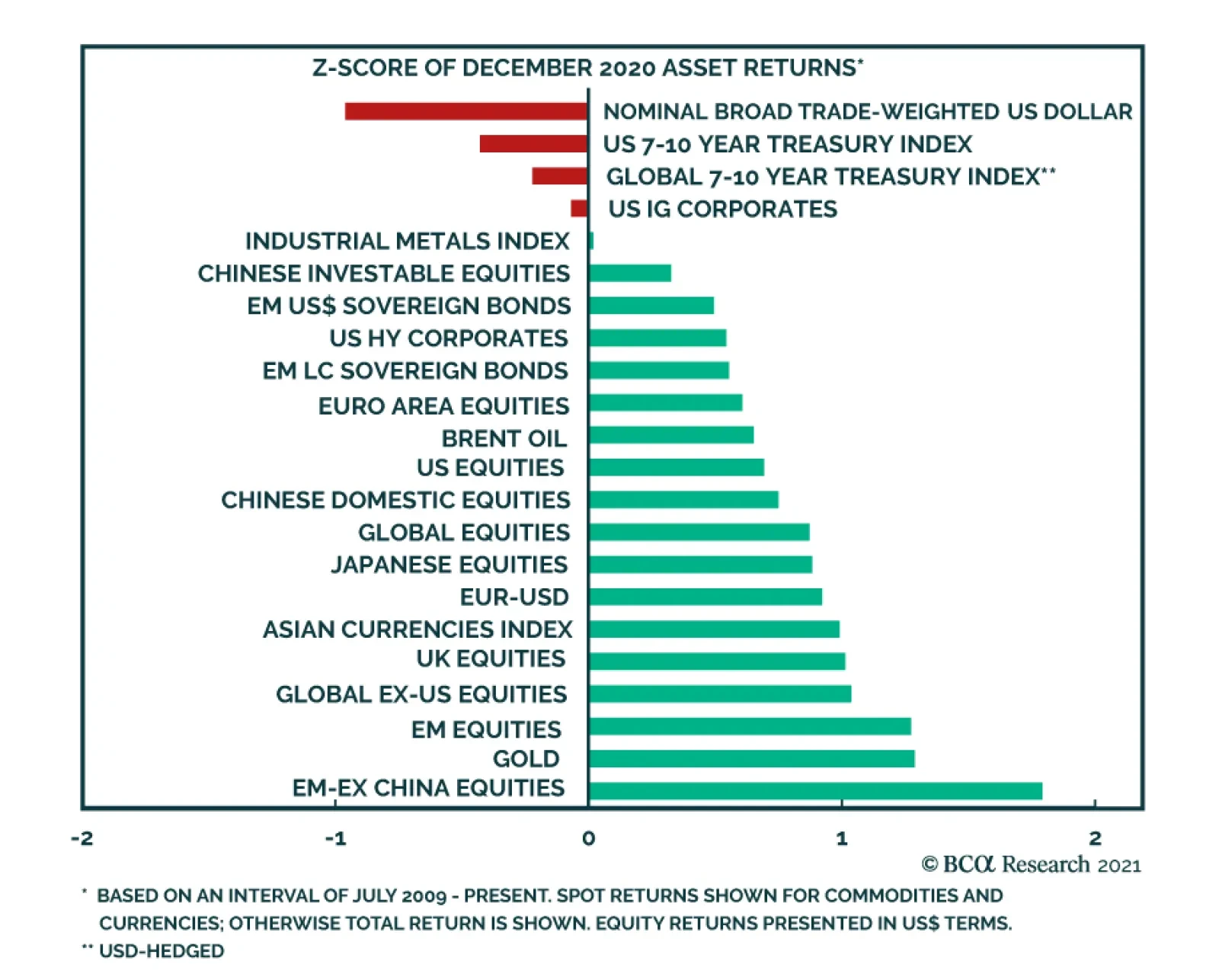

The reflation trade remained the dominant theme for markets this December. The dollar suffered the largest negative abnormal returns of all the major asset classes while EM equities and gold offered the strongest risk-adjusted…

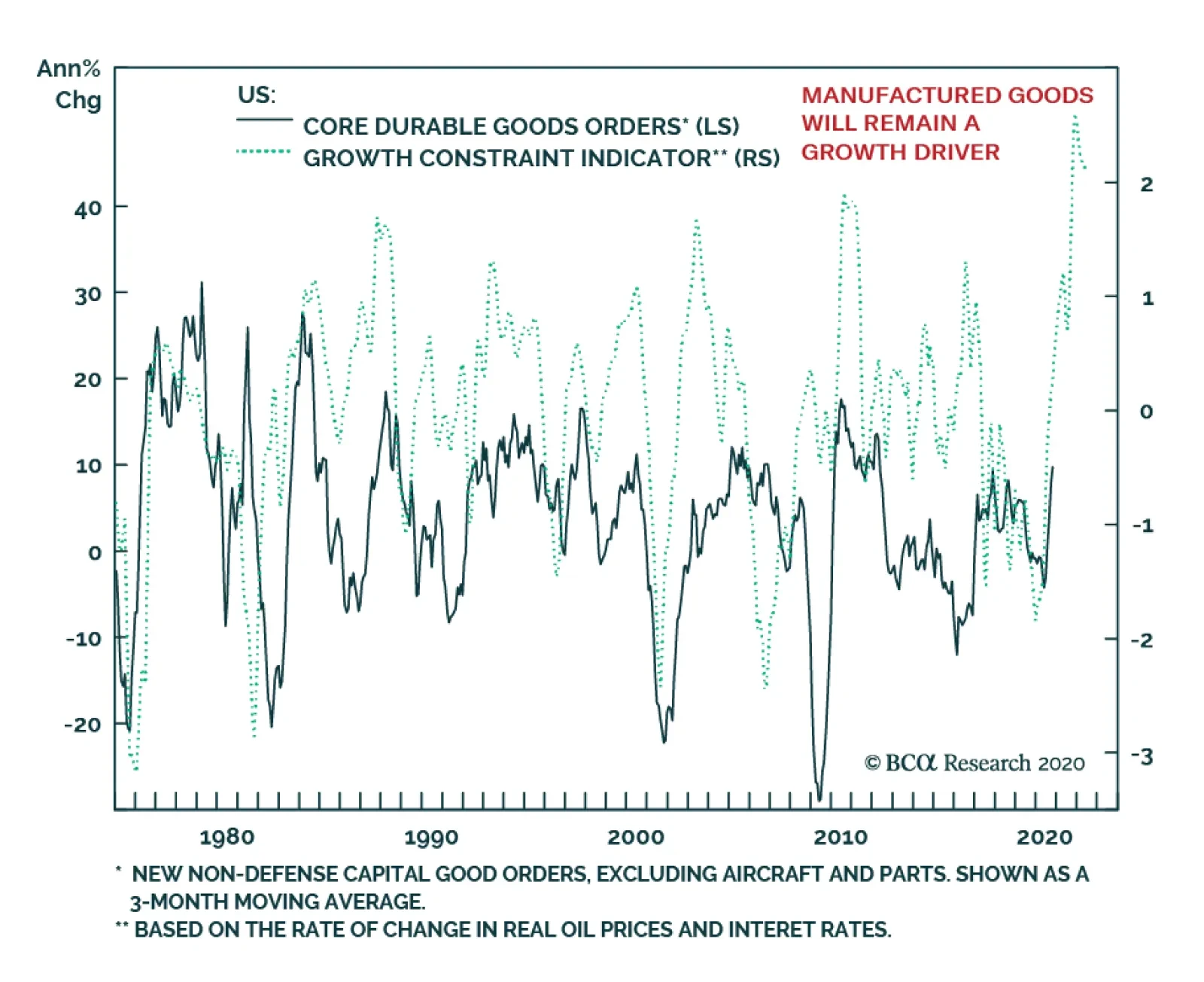

Highlights The ongoing pandemic underscores the need for fiscal and monetary policymakers to continue to provide a reflationary “bridge” until vaccination ends the threat to the health care system. The pending deal being…

Over the next two weeks, we will focus on the following key items: On December 22, December's Conference Board Consumer Confidence survey: This release will help gauge consumer sentiment heading into the holidays and the new…

This is our last report of this year. We will resume publications in January. The EM strategy team wishes you a happy holiday season and a prosperous new year. Chart Of The weekFiscal Thrust Is A Major Negative In 2021 Emerging…

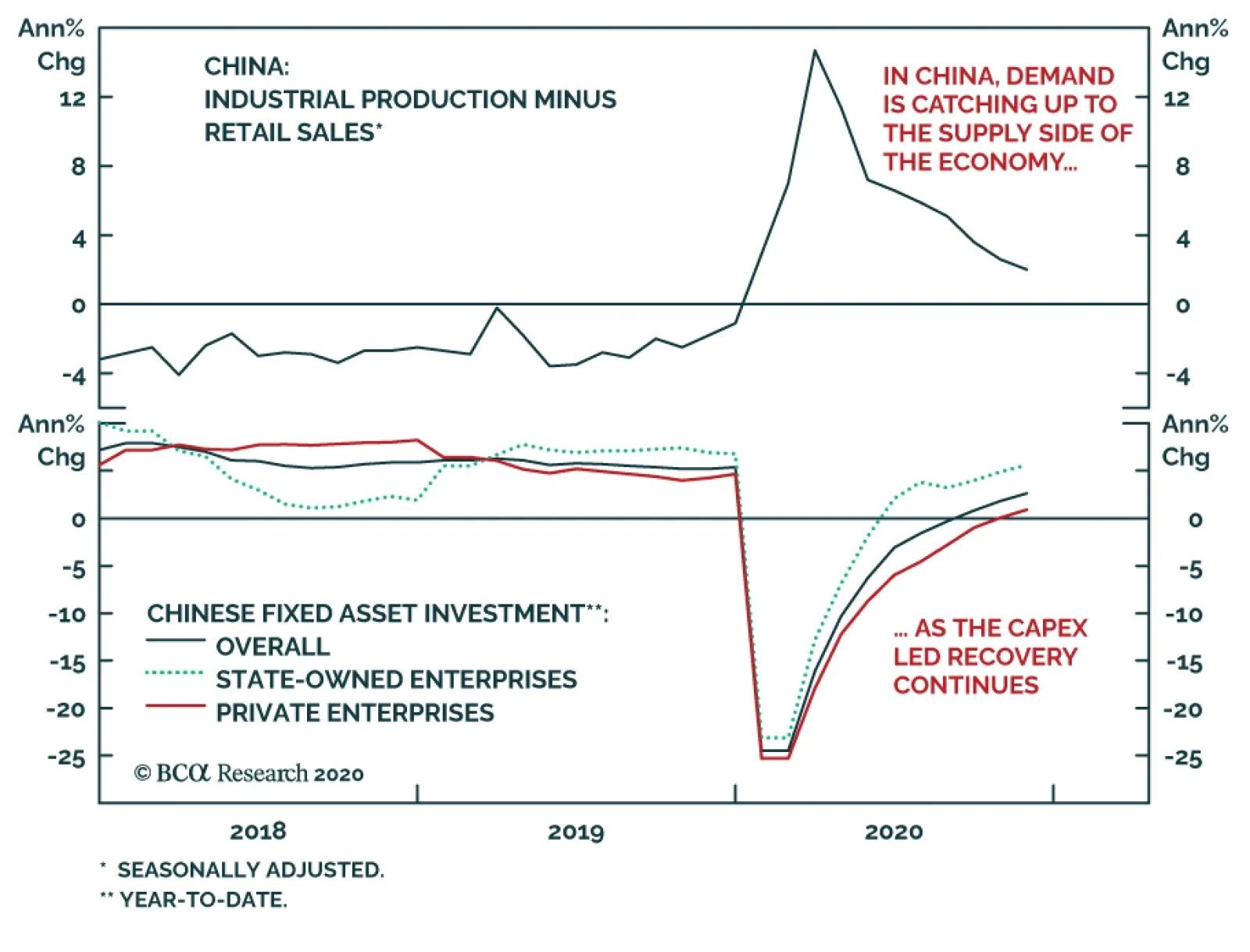

The Chinese economy continued to recover in November in line with consensus expectations, indicating that the massive stimulus deployed this year is buoying the Chinese business cycle. Retail sales climbed higher to 5.0% y/y from…

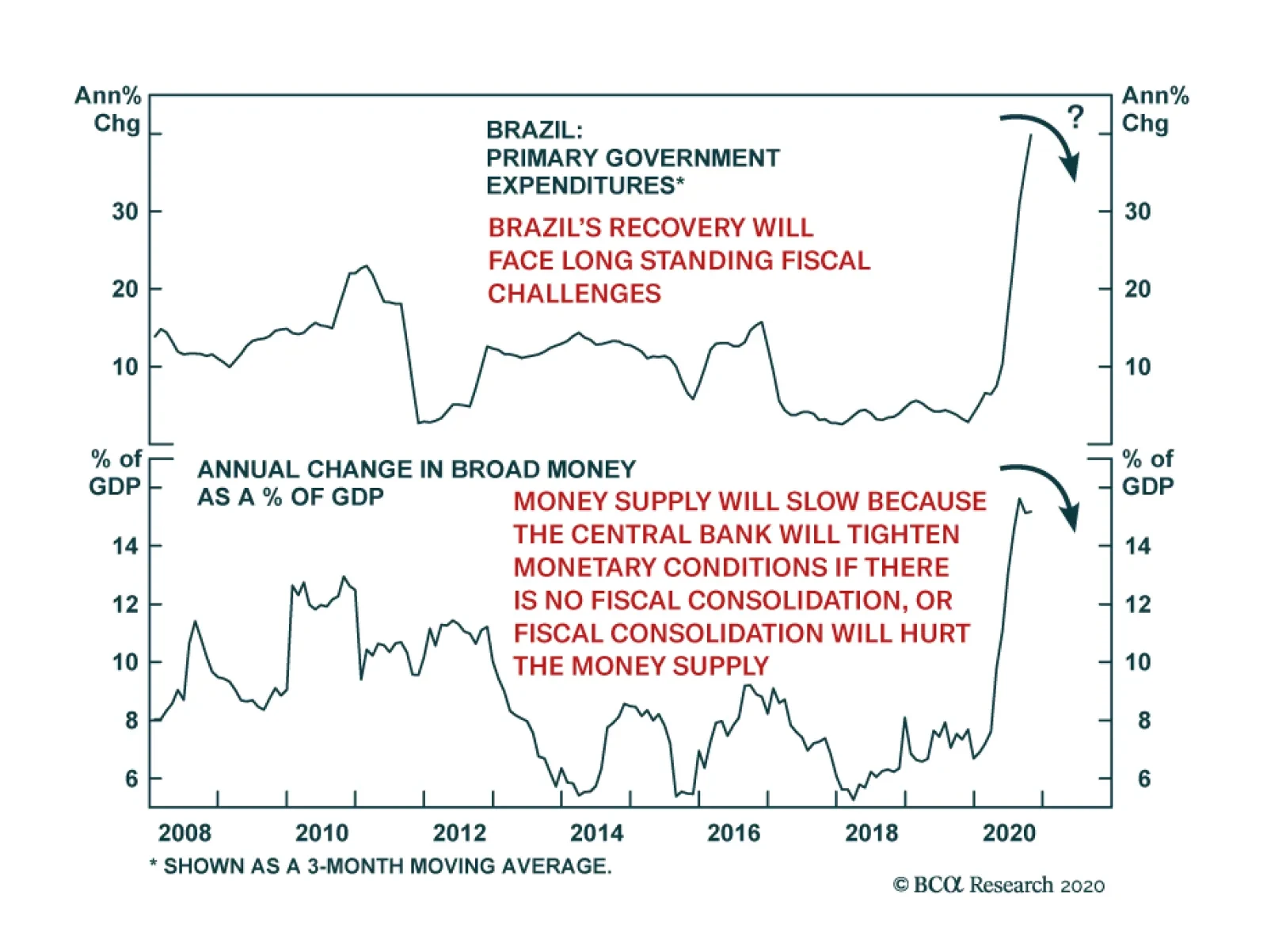

The Brazilian economy has managed the pandemic relatively well this year due to generous fiscal spending. However, fiscal constraints now threaten to derail the recovery. Fiscal sustainability, an issue even prior to the…

Highlights With a vaccine already rolling out in the UK and soon in the US, investors have reason to be optimistic about next year. Government bond yields are rising, cyclical equities are outperforming defensives, international stocks…