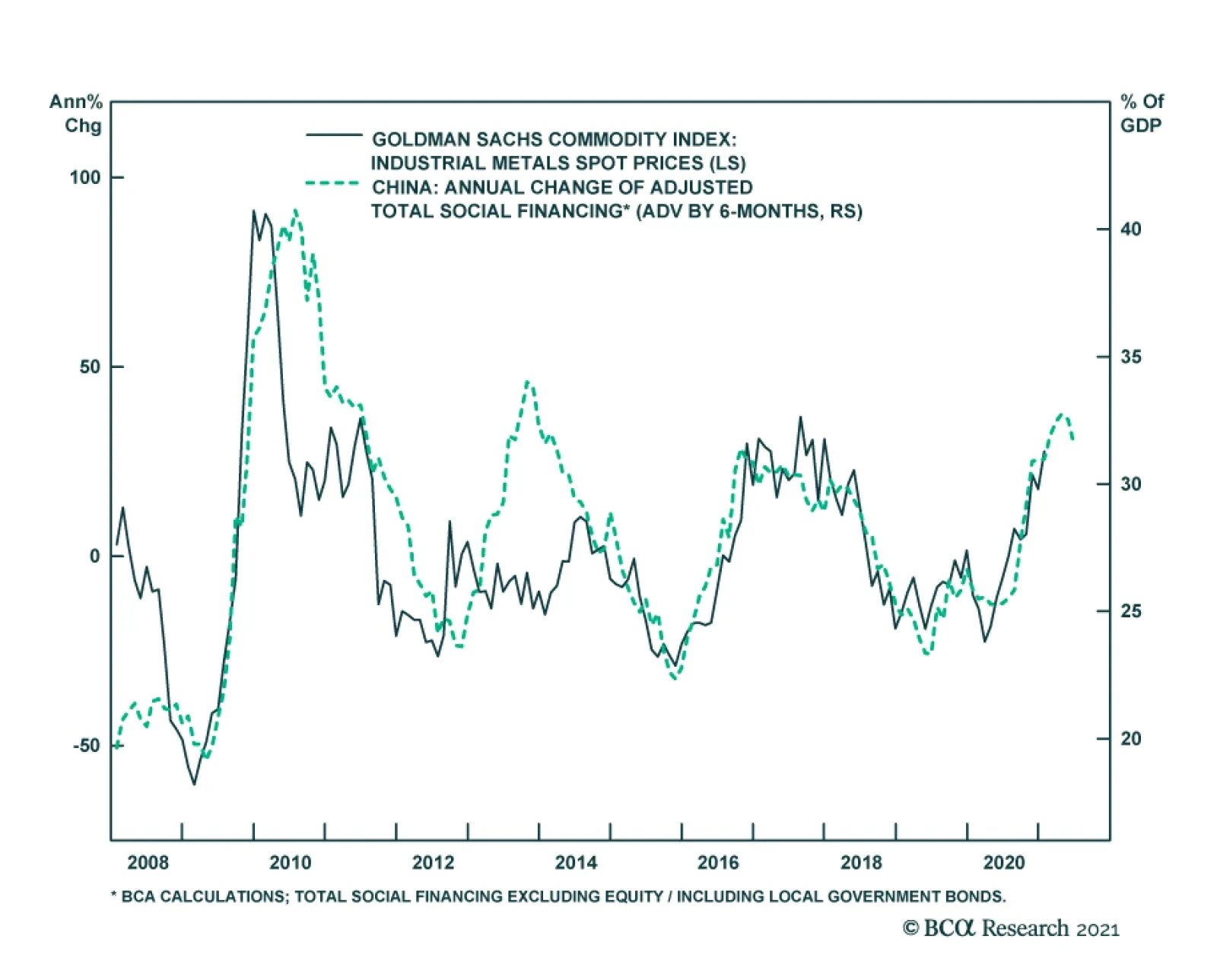

BCA Research’s Global Investment Strategy service concludes that continued Chinese stimulus will support commodities and cyclical equity sectors. It will also allow the RMB to strengthen further, which should be beneficial…

Highlights The enormous size of US stimulus and overflow of liquidity is creating a thrill akin to riding a tiger. Remarkably, this kind of jubilation is very similar to what EM experienced in 2009-10. That was followed by a lost…

Highlights Pandemic uncertainty is keeping the USD well bid by raising global economic policy uncertainty. When this breaks – i.e., as higher vaccination rates push contagion rates down – the USD will resume its bear market…

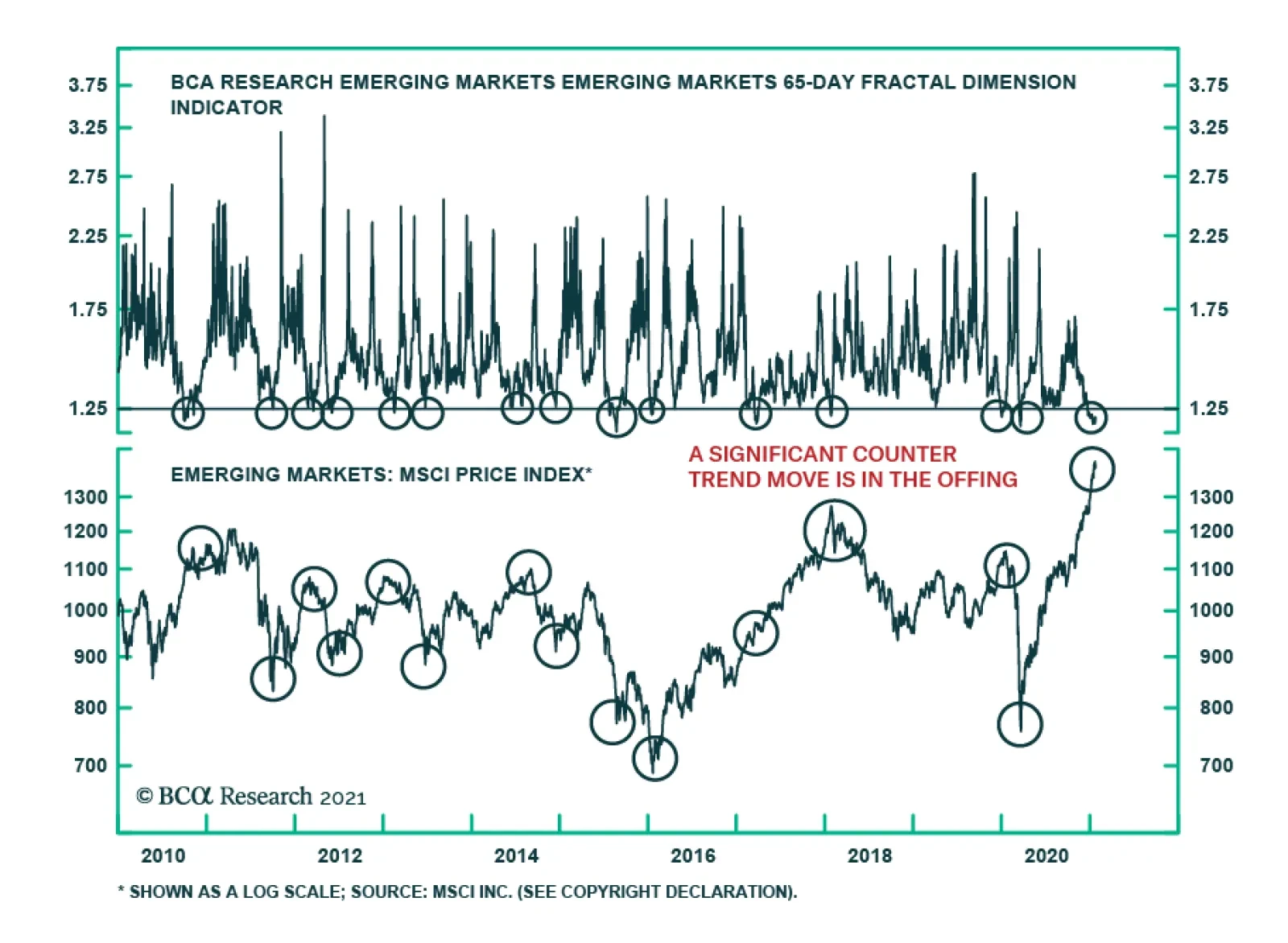

EM equity prices have experienced a spectacular rise since last year’s trough and hit a new all-time high. However, BCA Research’s Fractal Dimension indicator is flashing a warning sign for EM stocks. A reading below…

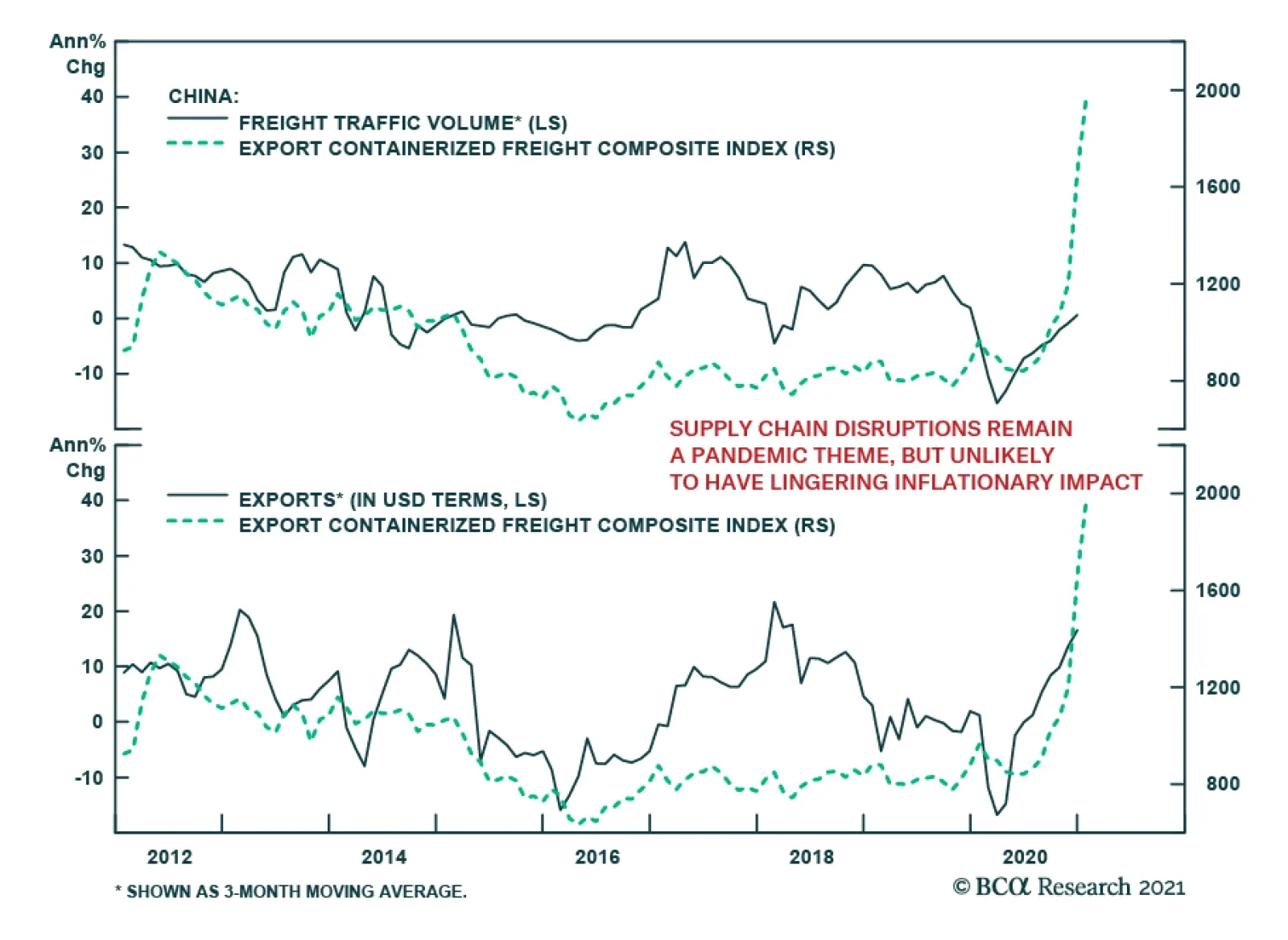

The recent massive jump in freight costs overstates improvements in global trade. Chinese exports have been accelerating at a healthy clip and freight traffic is recovering, but the surge in China’s containerized freight…

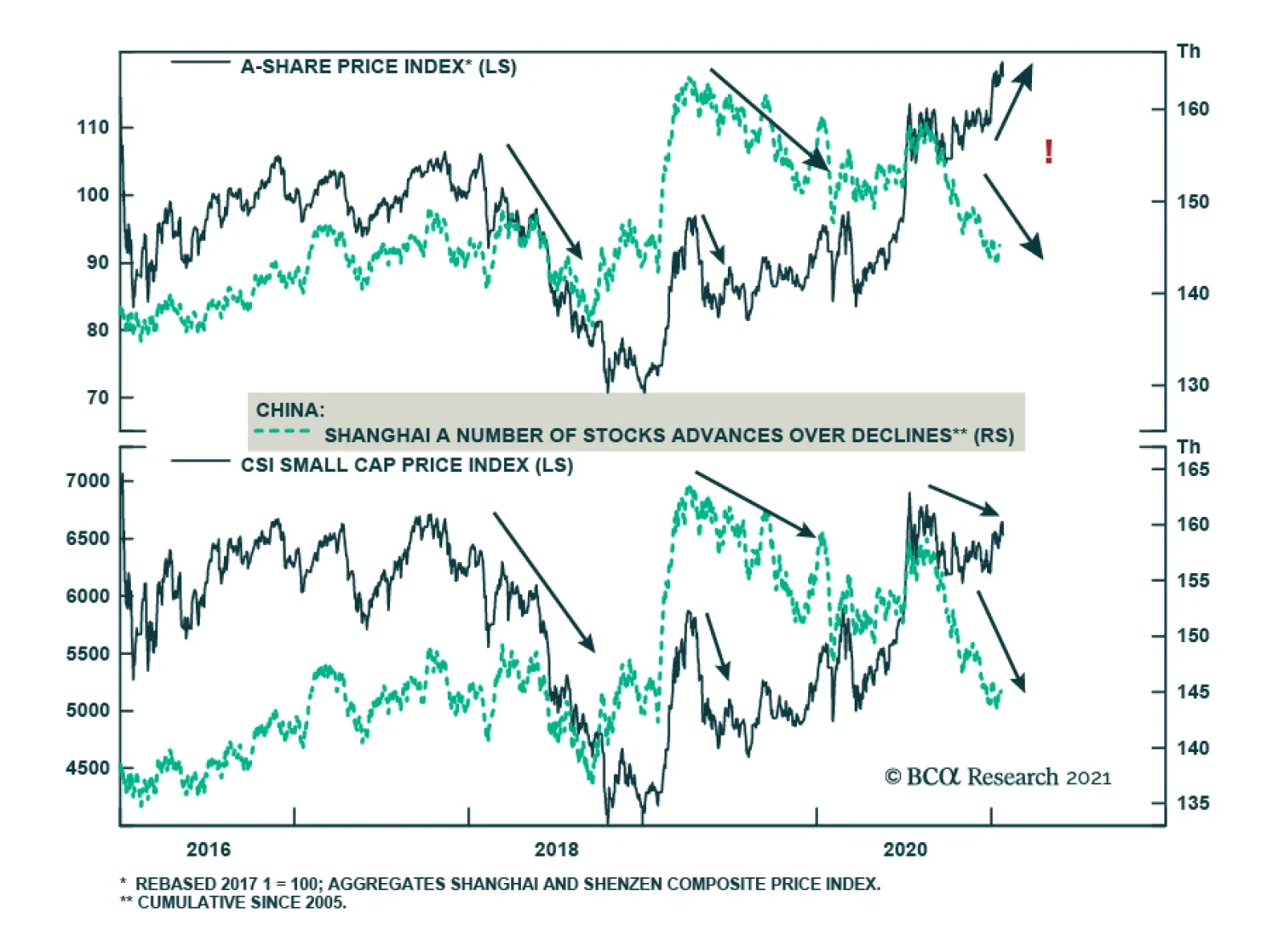

According to BCA Research’s China Investment Strategy service, overstretched stock prices relative to earnings risk a snapback in A-shares. We remain cautious on short-term prospects for China’s onshore equity markets…

Highlights A positive backdrop still supports a cyclical bull market in Chinese stocks, but the upside in prices could be quickly exhausted. Investors may be overlooking emerging negative signs in China’s onshore equity market.…

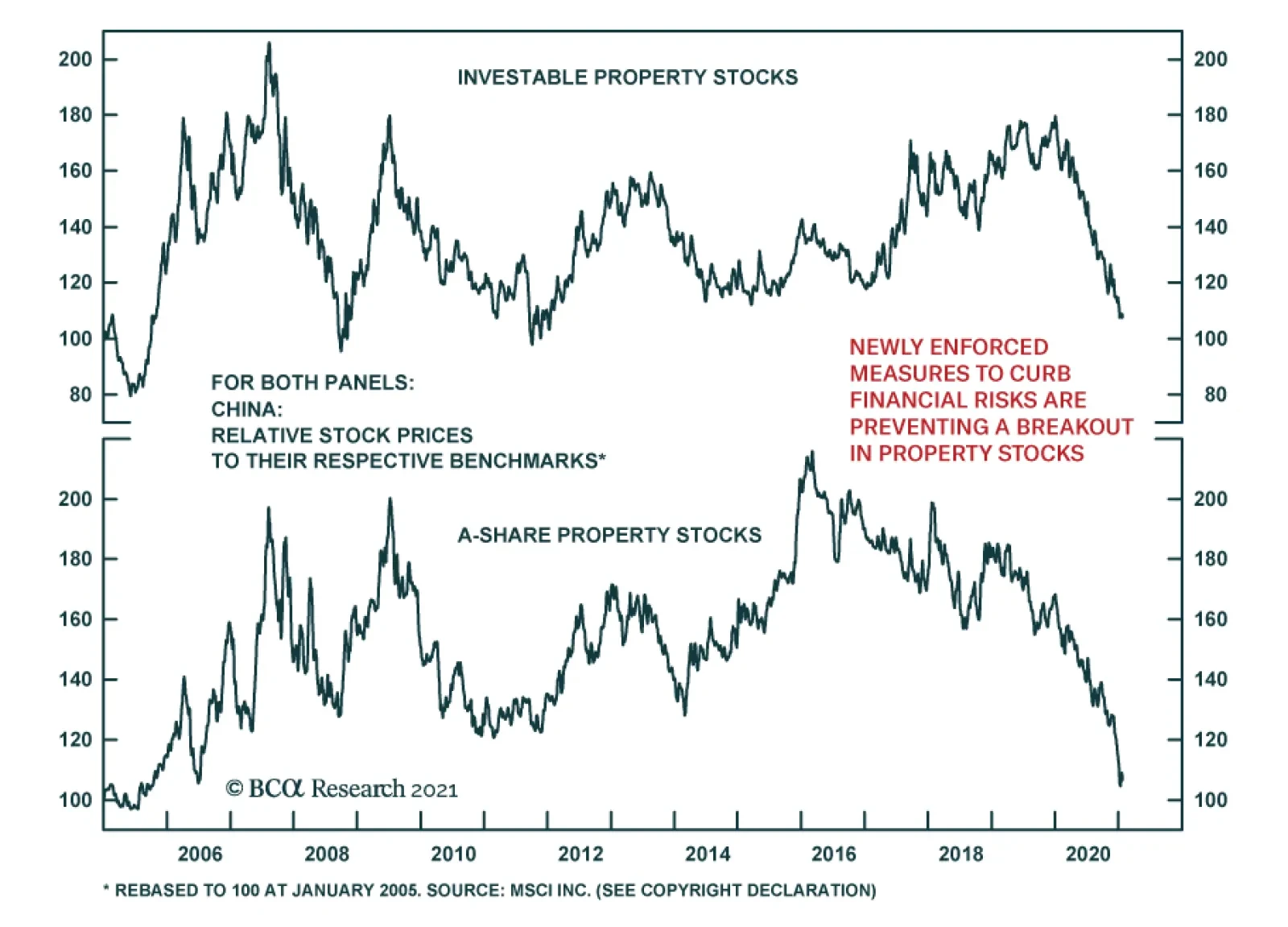

Chinese property had a standout 2020. Property sales broke records and property investments expanded 7% y/y, outpacing total fixed asset investments. But despite this hot performance, property developers’ equities were…

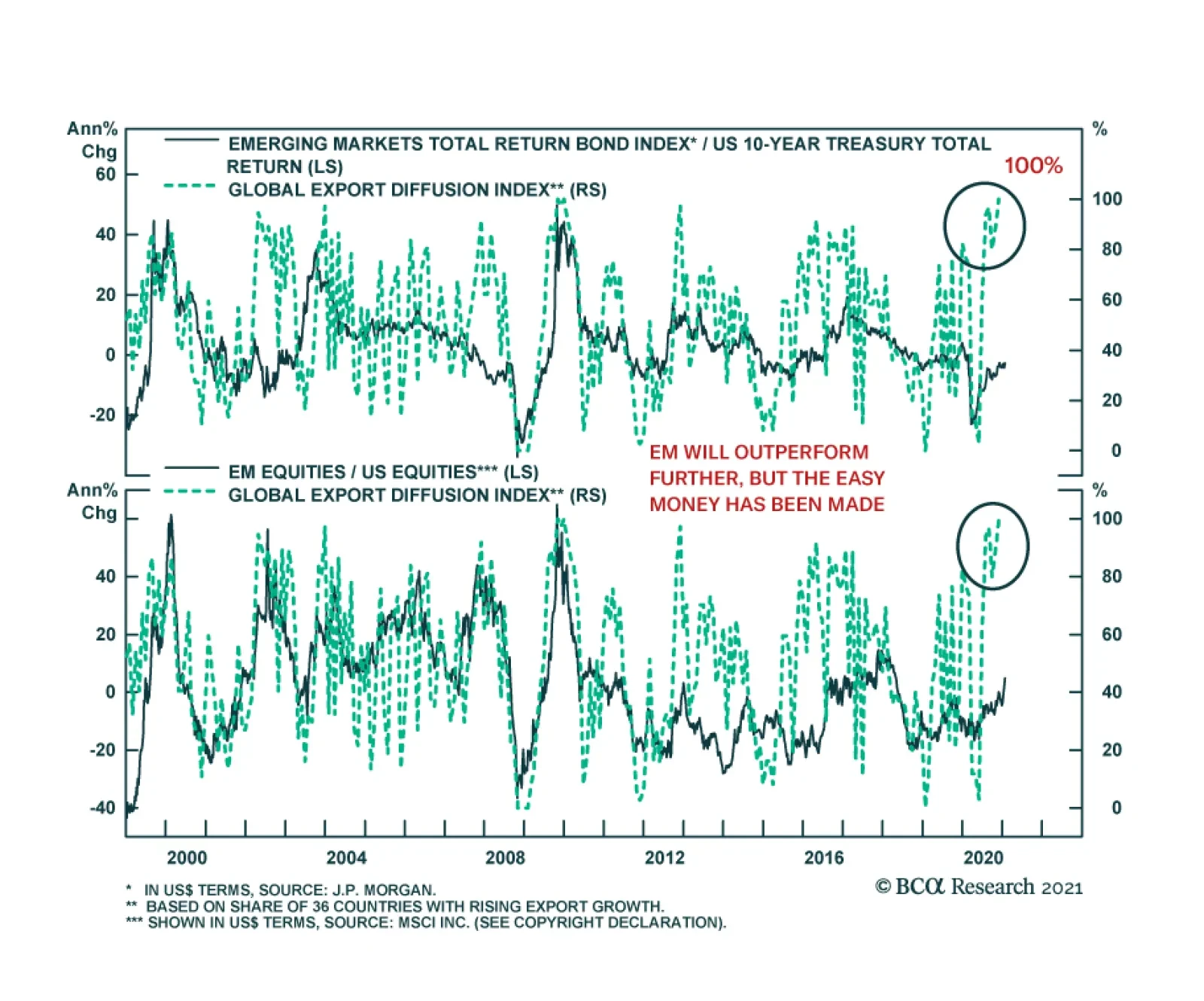

The main characteristic of EM assets remains their elevated sensitivity to global growth. The near-continuous underperformance of EM equities from late 2010 to early 2020 mostly reflected the poor performance of global economic…