Please note that we will be presenting a webcast on Thursday March 11 at 10:00 AM EST for the Americas and EMEA regions and on March 12 at 9:00 HKT/12:00 AEDT for APAC clients. We will be discussing macro themes and investment strategies…

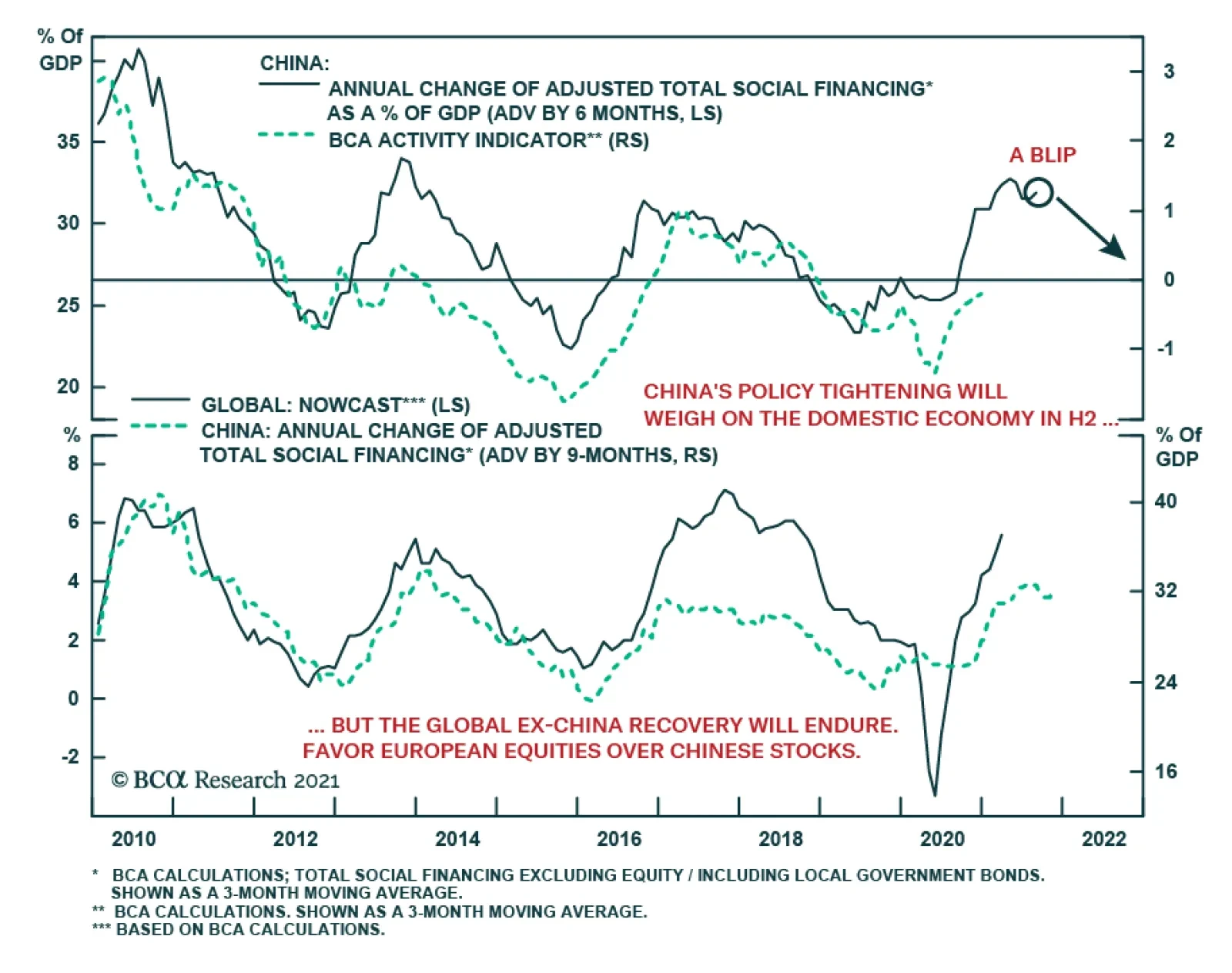

China’s all-important credit data surprised to the upside in February, declining by less than anticipated. Aggregate financing was nearly double consensus expectations, coming in at CNY 1.71 trillion from CNY 5.17 trillion…

Highlights China’s economic recovery is in a later stage than the US. A rebound in US Treasury yields is unlikely to trigger upward pressure on government bond yields in China. Imported inflation through mounting commodity and…

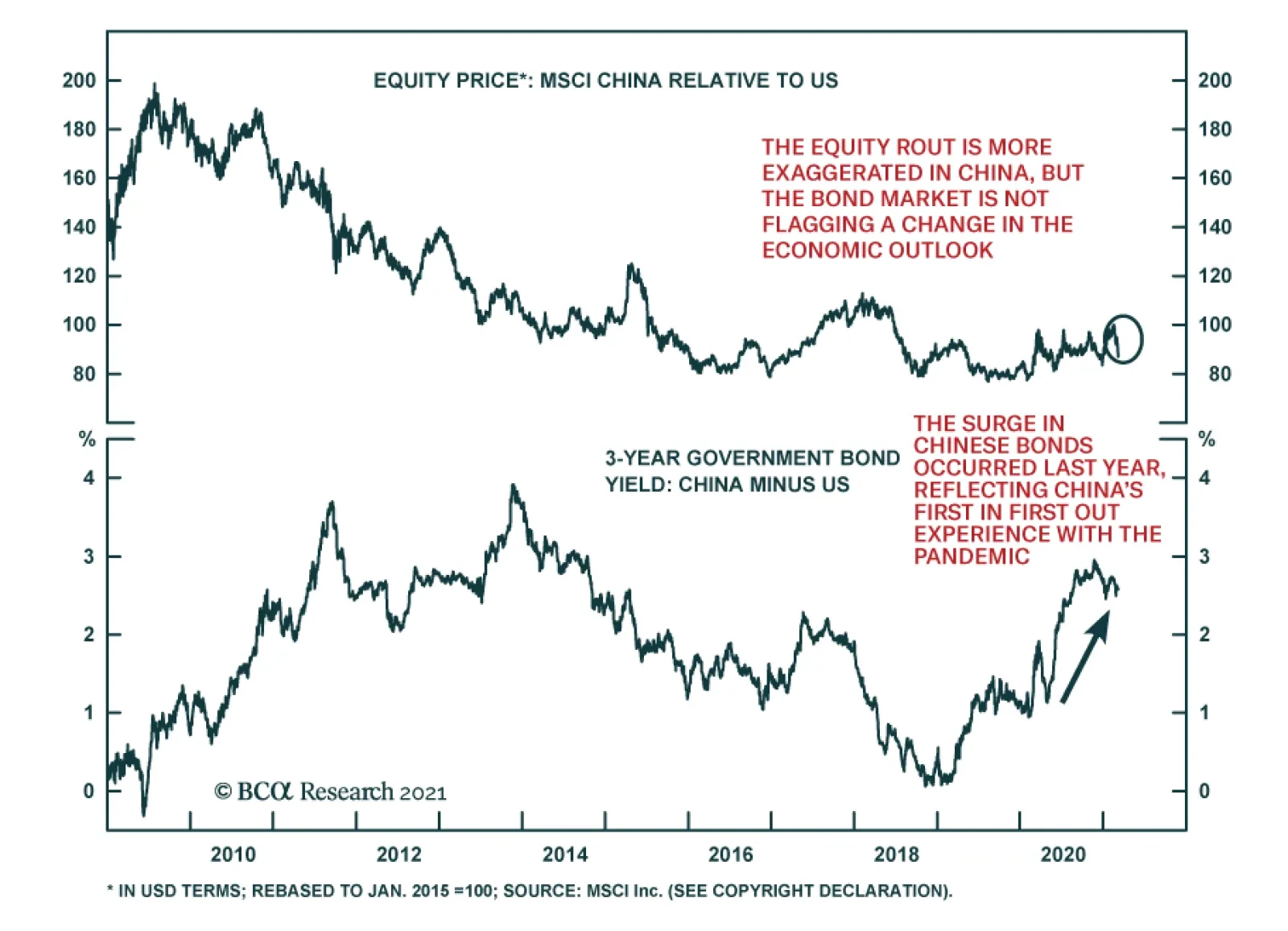

Chinese markets have been in somewhat of a slump. The CSI 300 was the only major global equity benchmark in the red on Tuesday, falling 2.15% on the day and bringing down the index’s year-to-date performance to -4.61%. The…

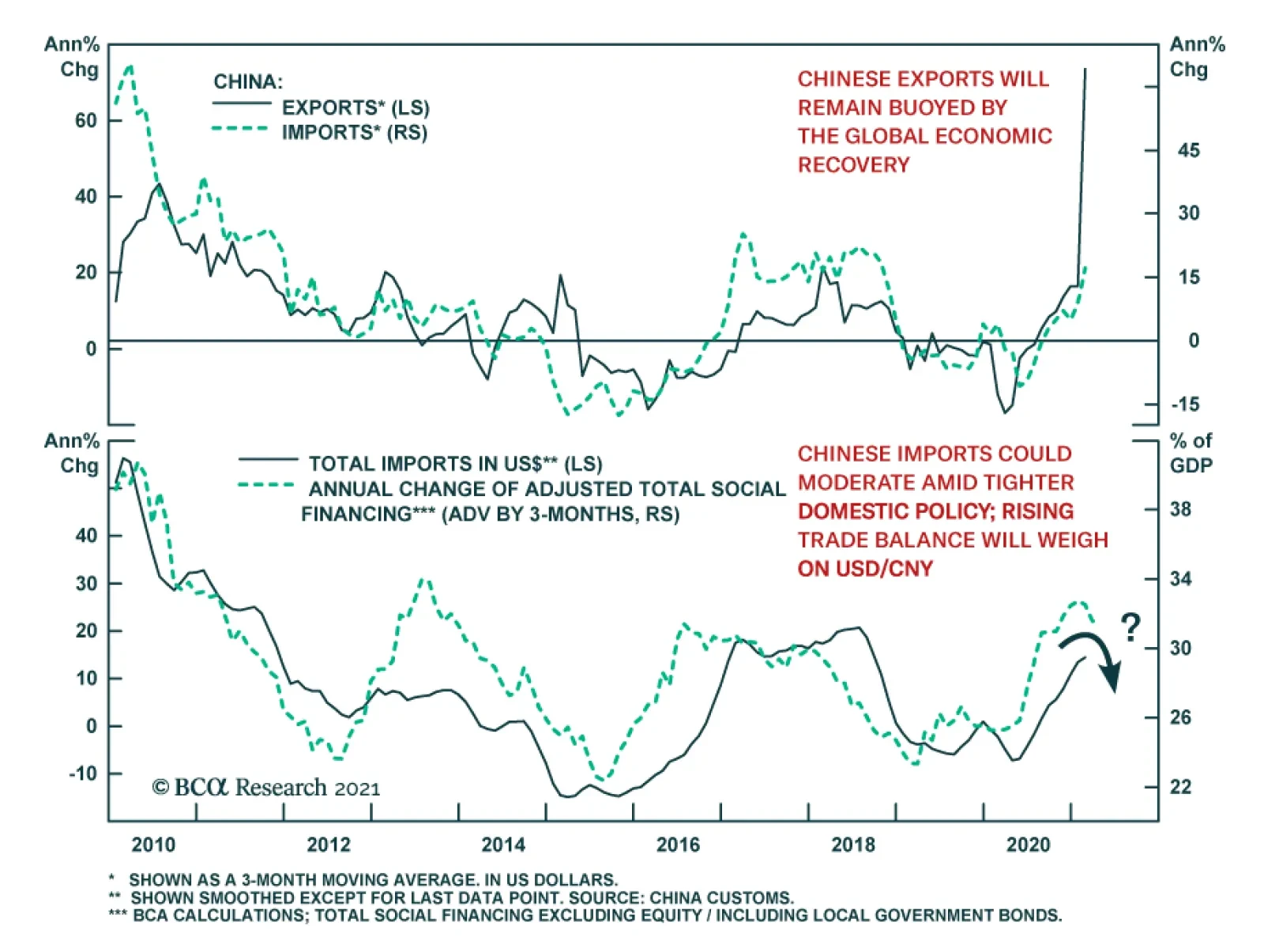

Chinese trade beat expectations by a large margin in the first two months of the year. Exports in January and February were up a cumulative 60.6% y/y in USD terms versus expectations of a 40.0% y/y increase, marking a significant…

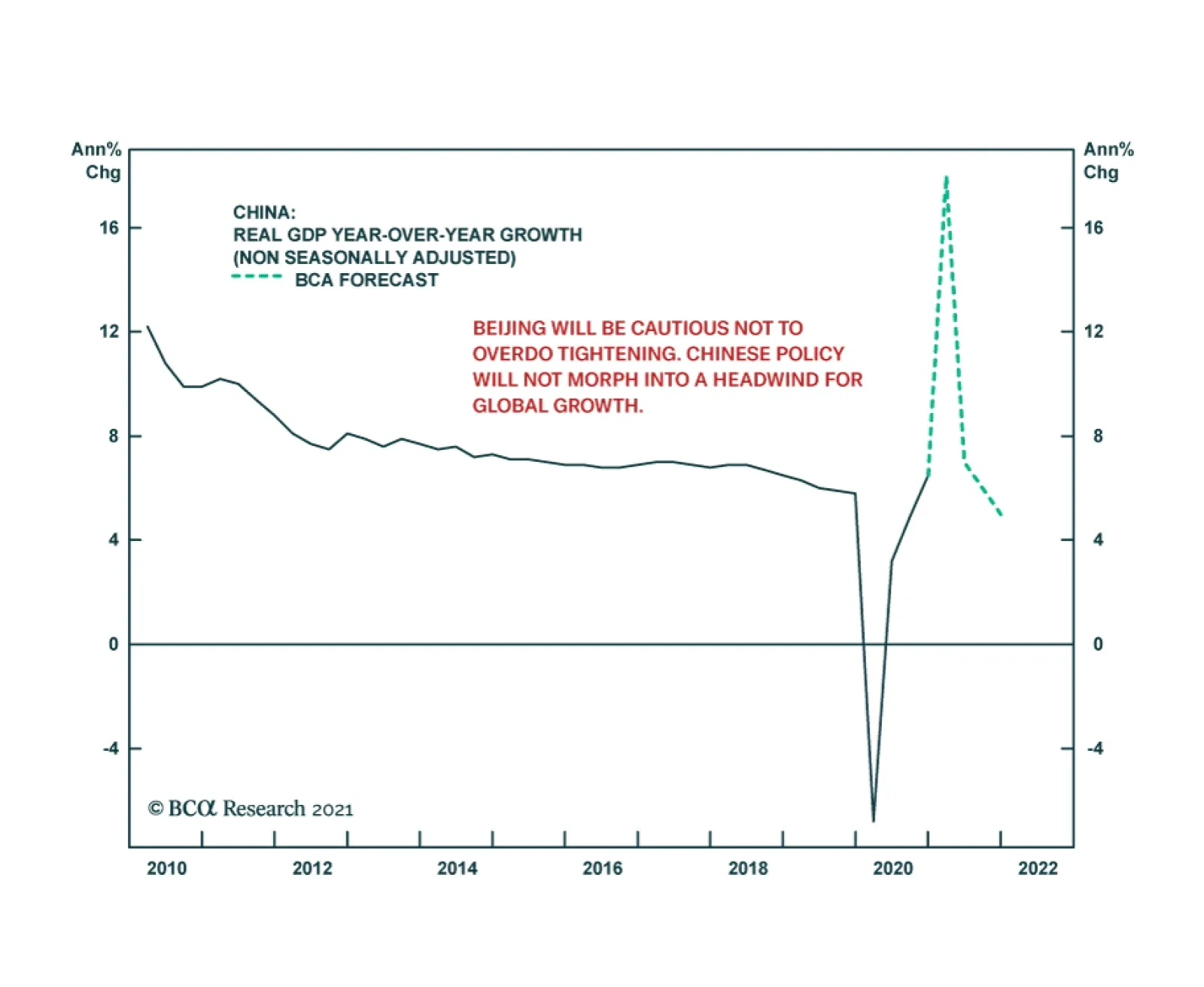

China’s annual National People’s Congress kicked off on Friday with the unveiling of economic targets and budgets for the year. Beijing once again abandoned the numerical GDP growth target, instead setting it “…

Dear client, In addition to this week’s abbreviated report, we are also sending you a Special Report on currency hedging, authored by my colleague Xiaoli Tang. Xiaoli’s previous work mapped out a dynamic hedging strategy for…

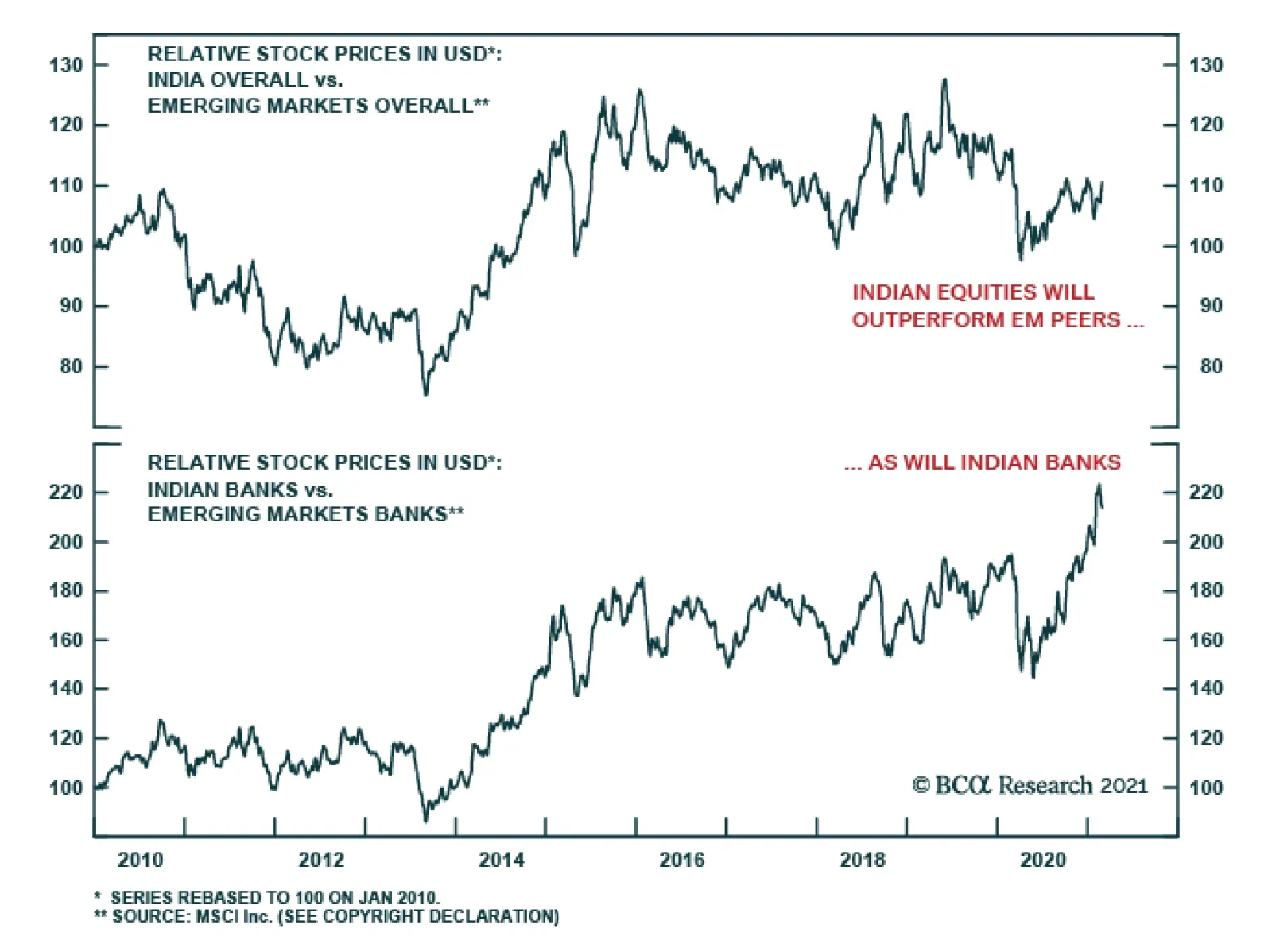

Our Emerging Markets Strategy team recently recommended that dedicated EM equity investors upgrade India from neutral to overweight in an equity portfolio. India is likely to see its inflation remain under control, thanks to a…