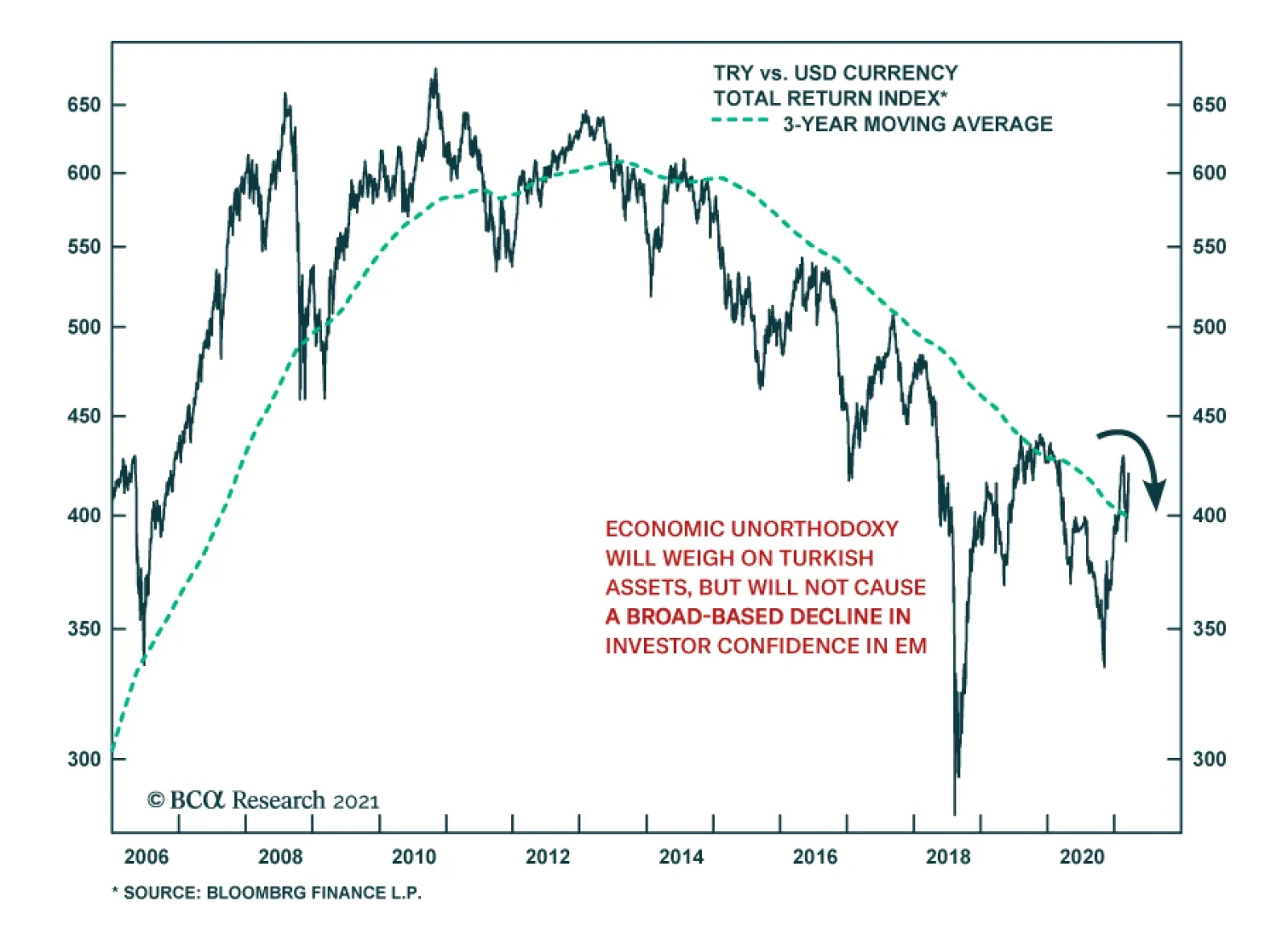

As we expected last November, Turkey’s shift to economic orthodoxy ended up being a case of smoke and mirrors. Four months and a cumulative 875 basis points of interest rate hikes later, Naci Agbal’s policy has proven…

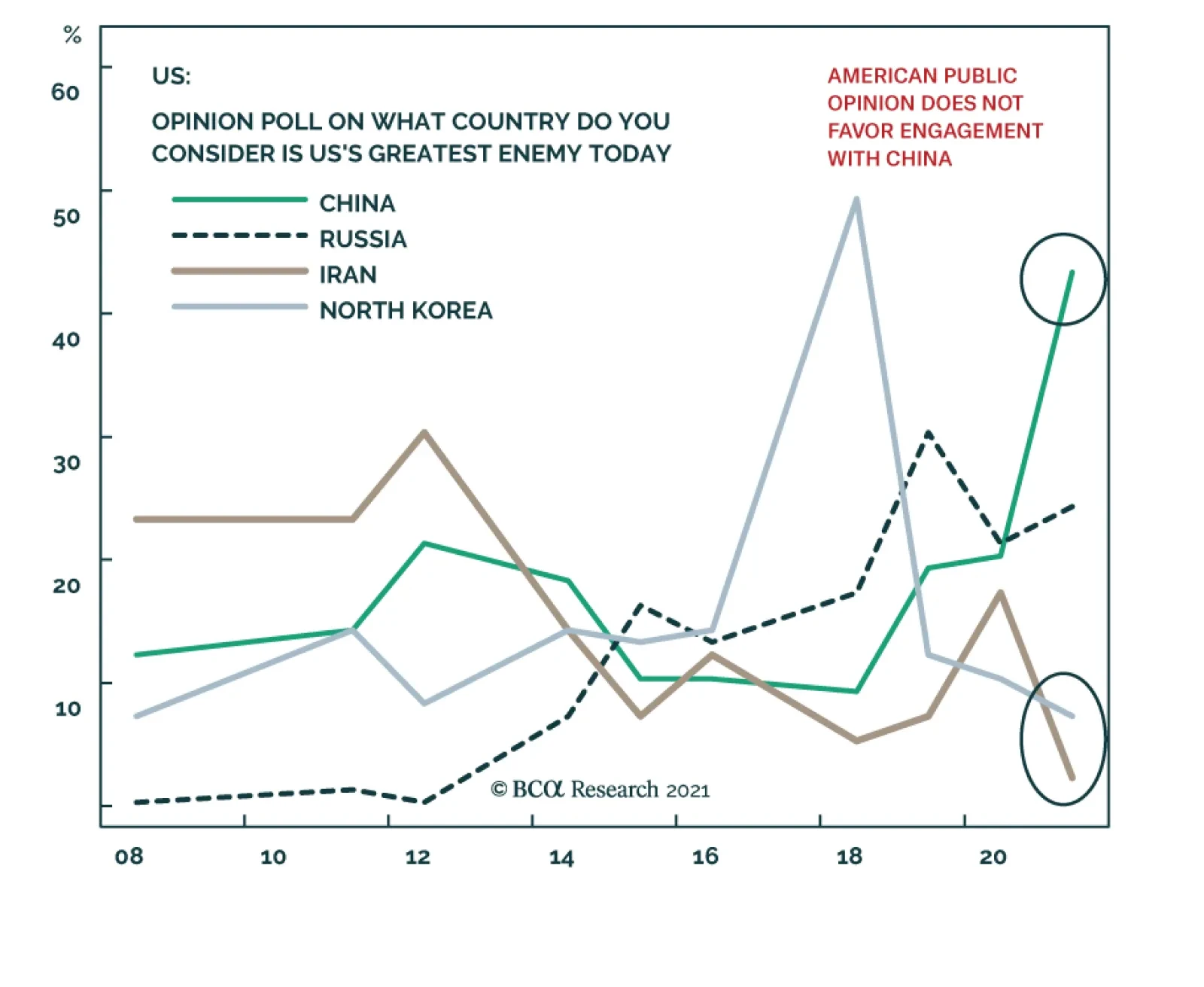

Asian equities fell on Friday in part on negative headlines about US-China talks in Anchorage, Alaska. The two sides exchanged barbs, raising fears that a US-China diplomatic reset may not occur. However, there were also rumors…

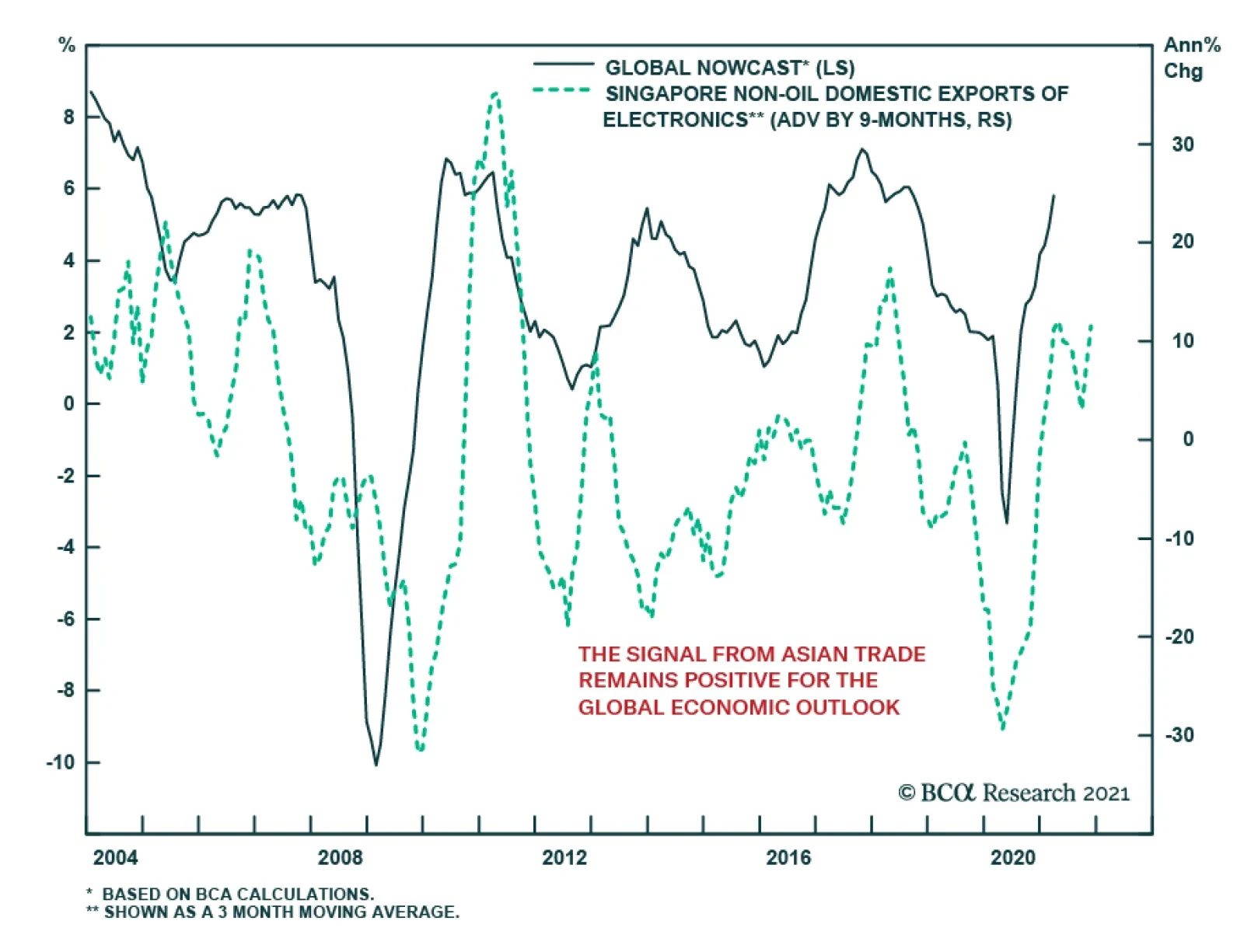

Highlights The Federal Reserve’s ultra-dovish stance is not the only reason for markets to cheer. The US is booming, China is unlikely to overtighten monetary and fiscal policy, and Europe remains a source of positive political…

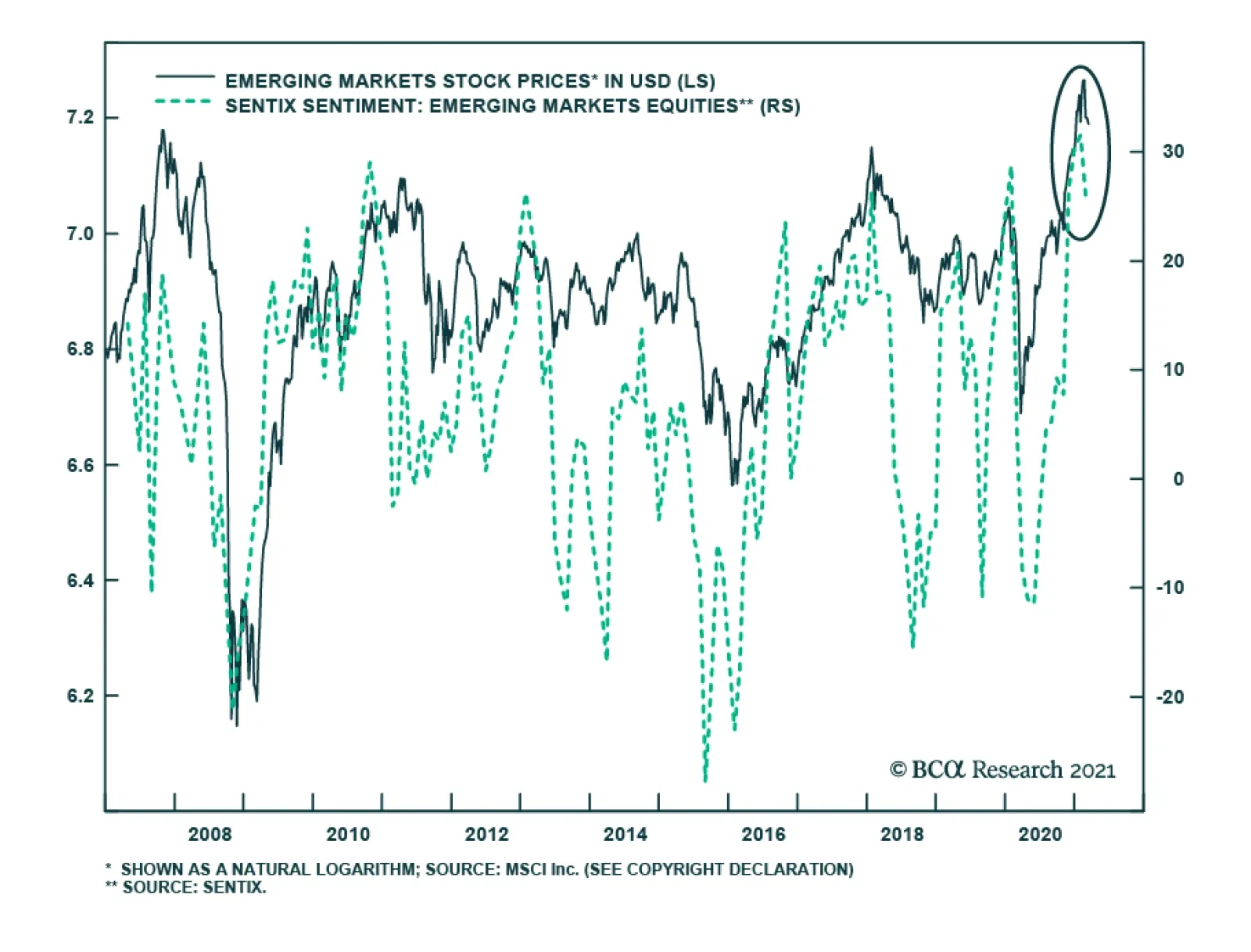

Highlights The breadth of EM equity outperformance versus DM in H2 last year was poor. This outperformance was largely driven by EM TMT stocks. These EM TMT share prices are now facing challenges and are unlikely to provide leadership…

The message from Asian trade has remained largely positive. Recent data on Japanese machine tool orders and Chinese exports show the global manufacturing cycle is well supported. At first blush, Singapore’s most recent…

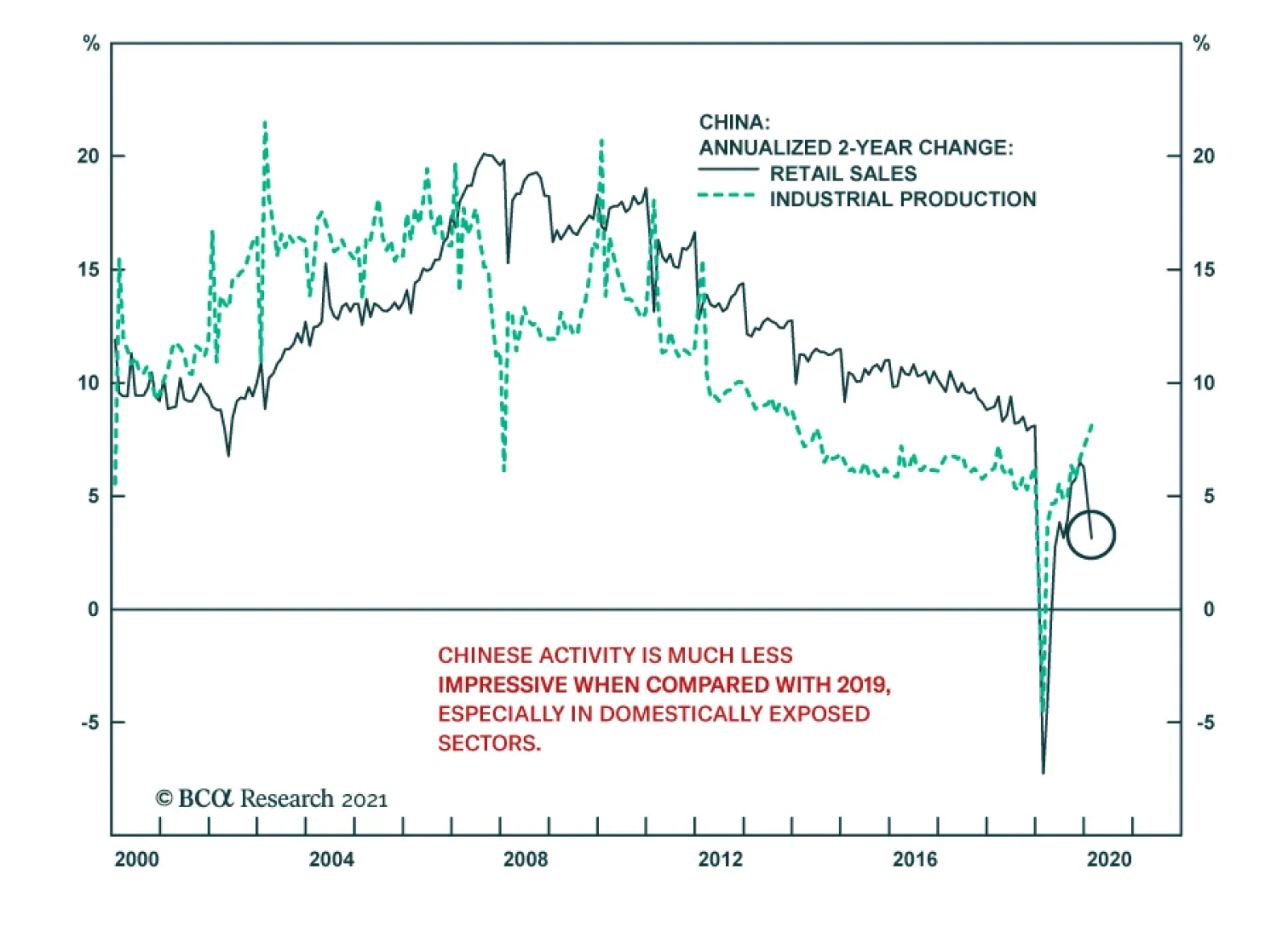

Deterioration in Chinese data pushed us to downgrade the cyclical/defensive portfolio bent from overweight to neutral last month (third panel), and today we highlight yet another warning shot originating across the Pacific…

Highlights The report from last week’s National People’s Congress (NPC) indicates a gradual pullback in policy support this year. Fiscal thrust will be neutral in 2021, whereas the rate of credit expansion will be slightly…

Chinese data releases for February continue to show strong momentum versus last year. Industrial production was up 35.1% y/y in January and February, while retail sales firmed by 33.8% y/y, with both beating consensus…

Highlights The Biden administration’s early actions suggest it will be hawkish on China as expected – and the giant Microsoft hack merely confirms the difficulty of reducing strategic tensions. US-China talks are set to…

BCA Research’s Emerging Markets Strategy service concludes that EMs (ex-China, Korea and Taiwan) are better positioned to handle higher US bond yields today than they were back in 2013. Nonetheless, they will feel some pain…