China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth slowed to…

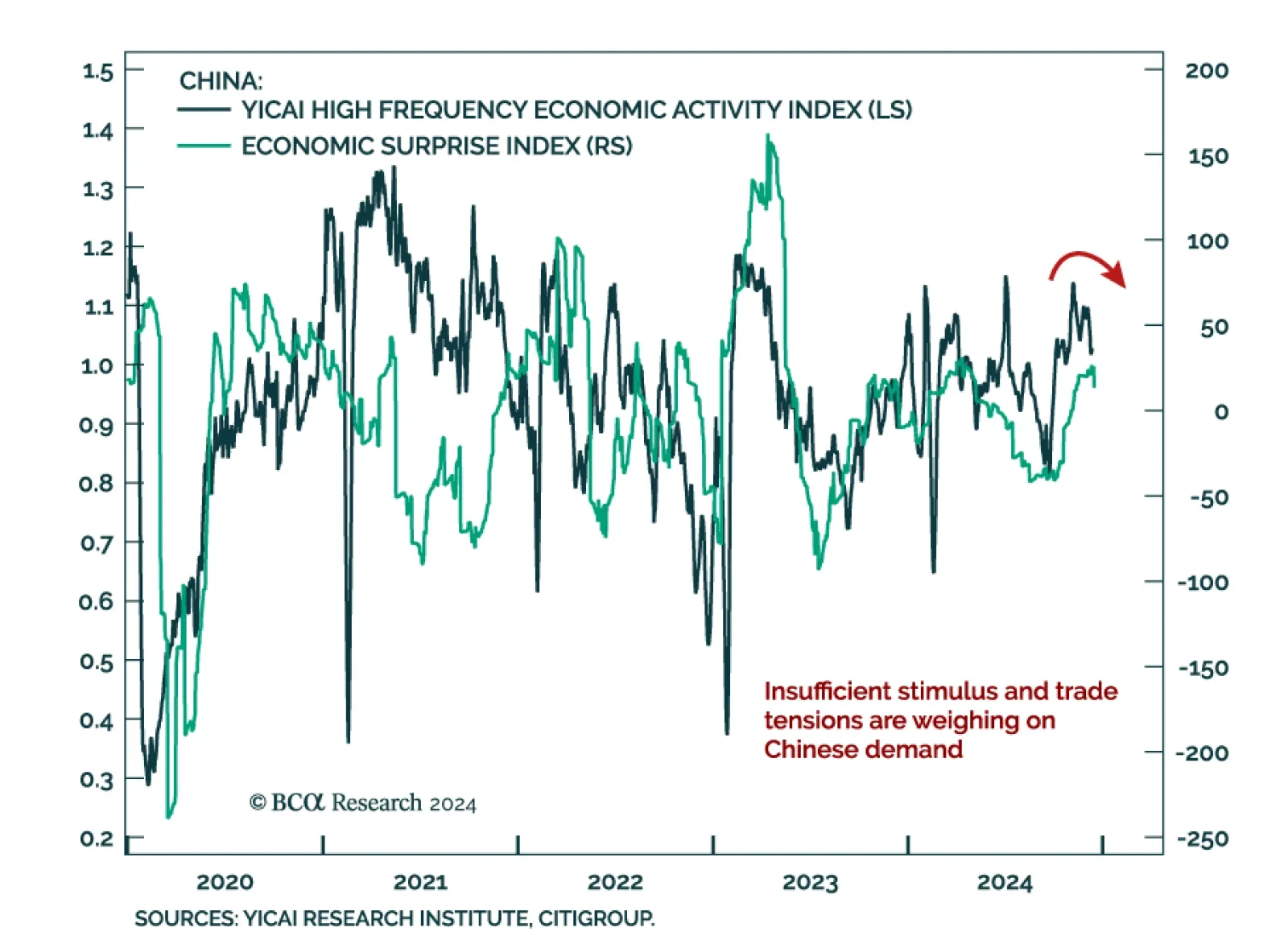

Chinese activity indicators were mixed in November, reflecting the dynamic of a resilient supply side coupled with weak demand. Industrial production growth was roughly flat at 5.4% y/y vs. 5.3% in October, while retail sales…

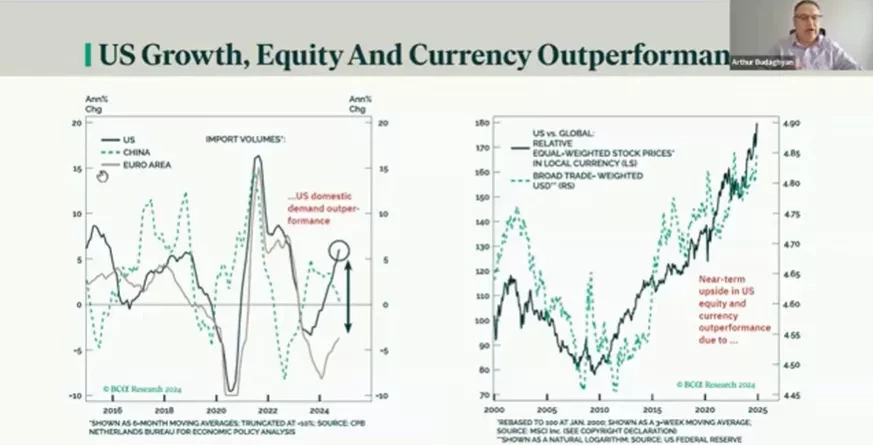

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

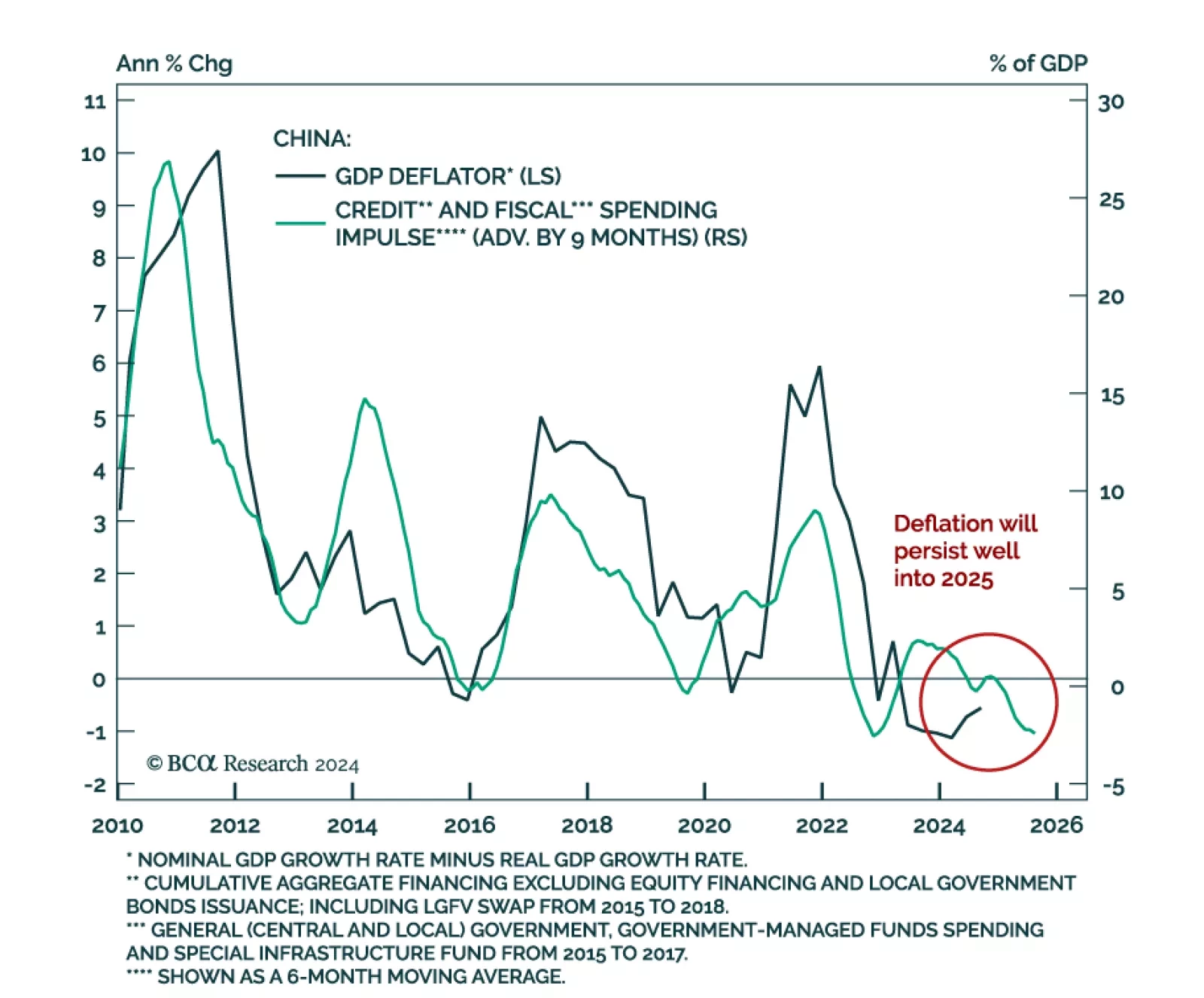

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth…

What is new? EMS is preparing the ground for a potential change in its USD view sometime in H1 2025. This will be a major milestone as EMS has been structurally bullish on the USD since the spring of 2011.

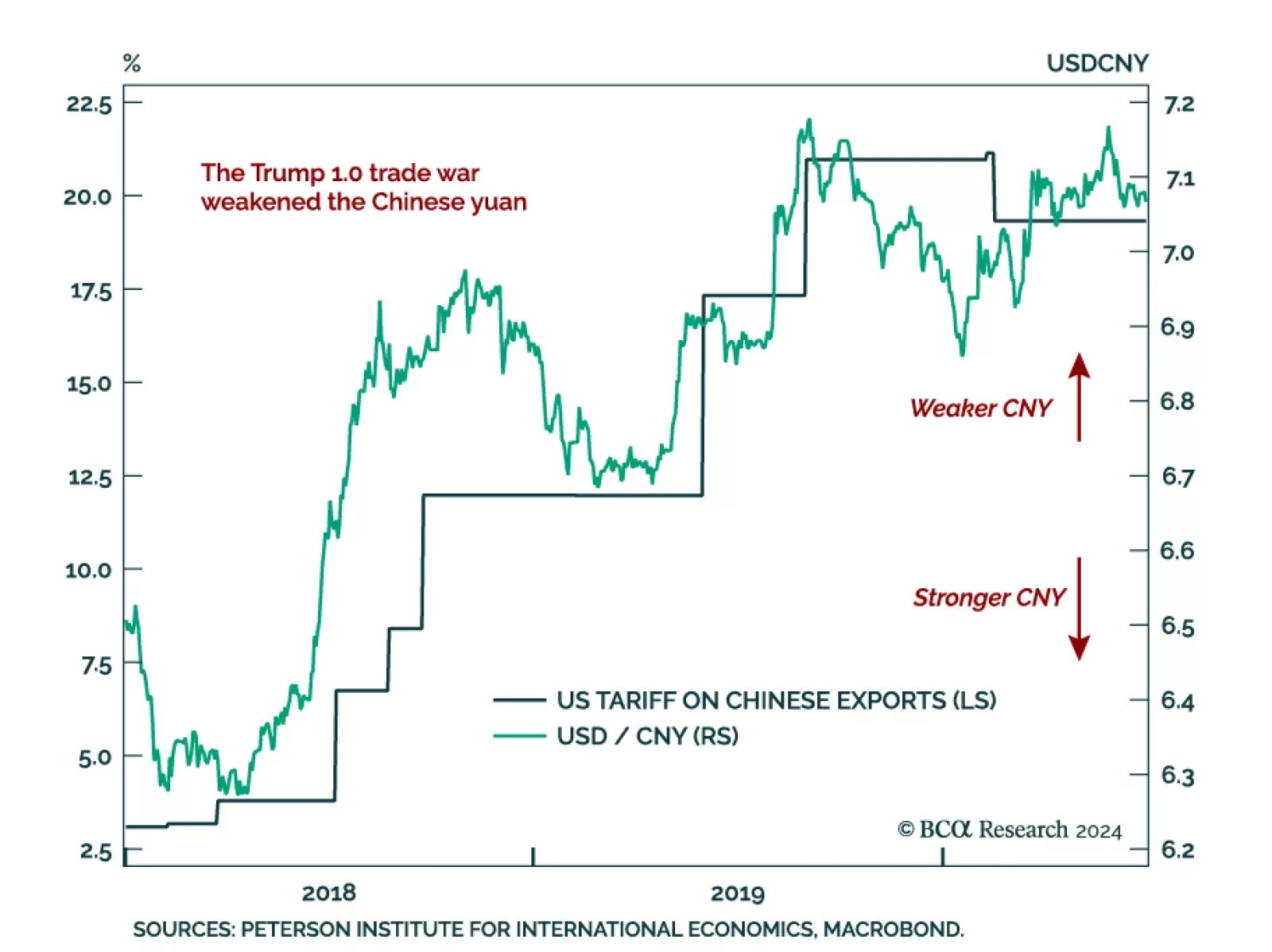

The USD has steamrolled both DM and EM currencies since the US election. Among the victims was the Chinese yuan, with USDCNY strengthening towards 7.3, a multi-year resistance level, from 7.11 on the day of the election. The CNY…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

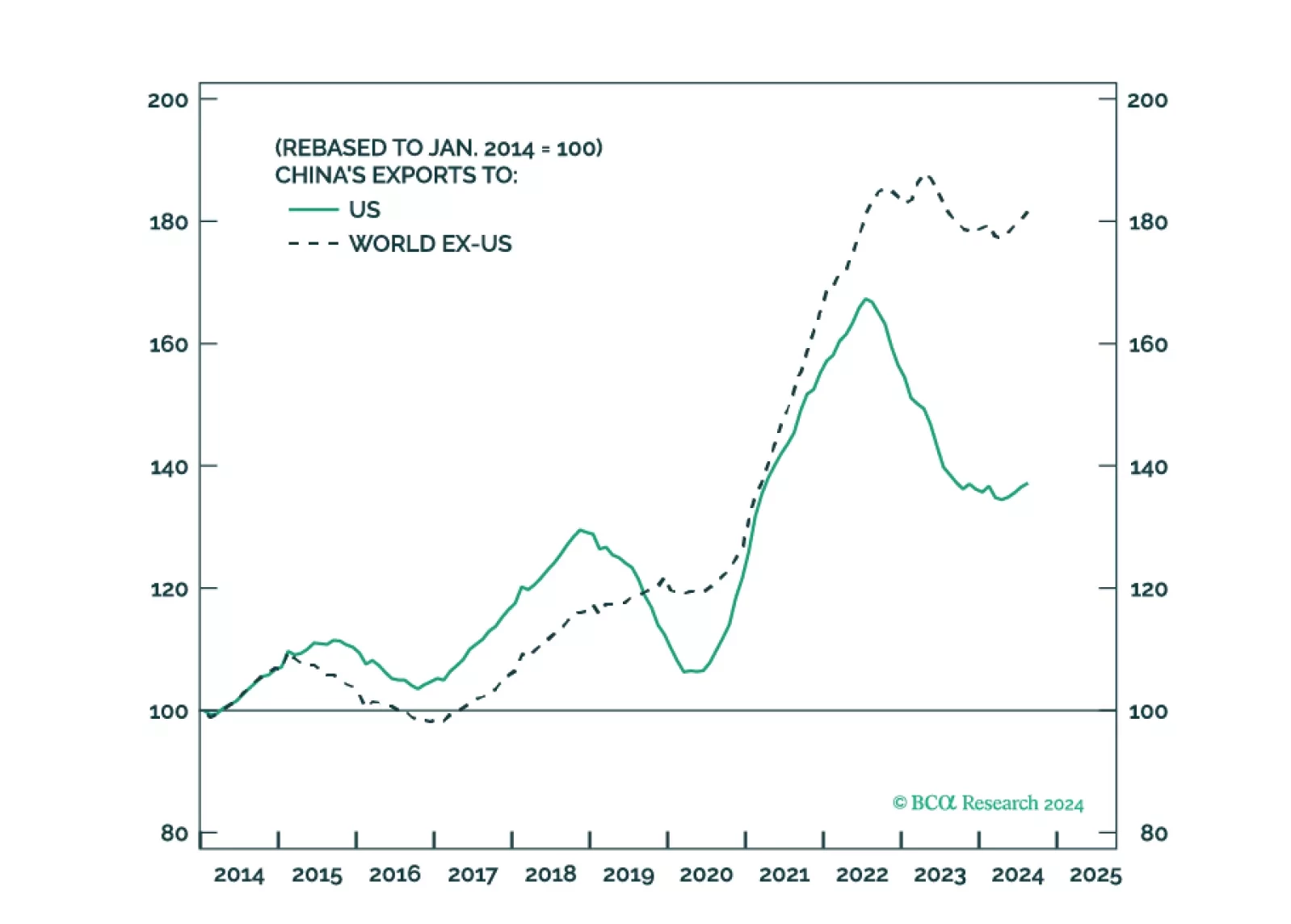

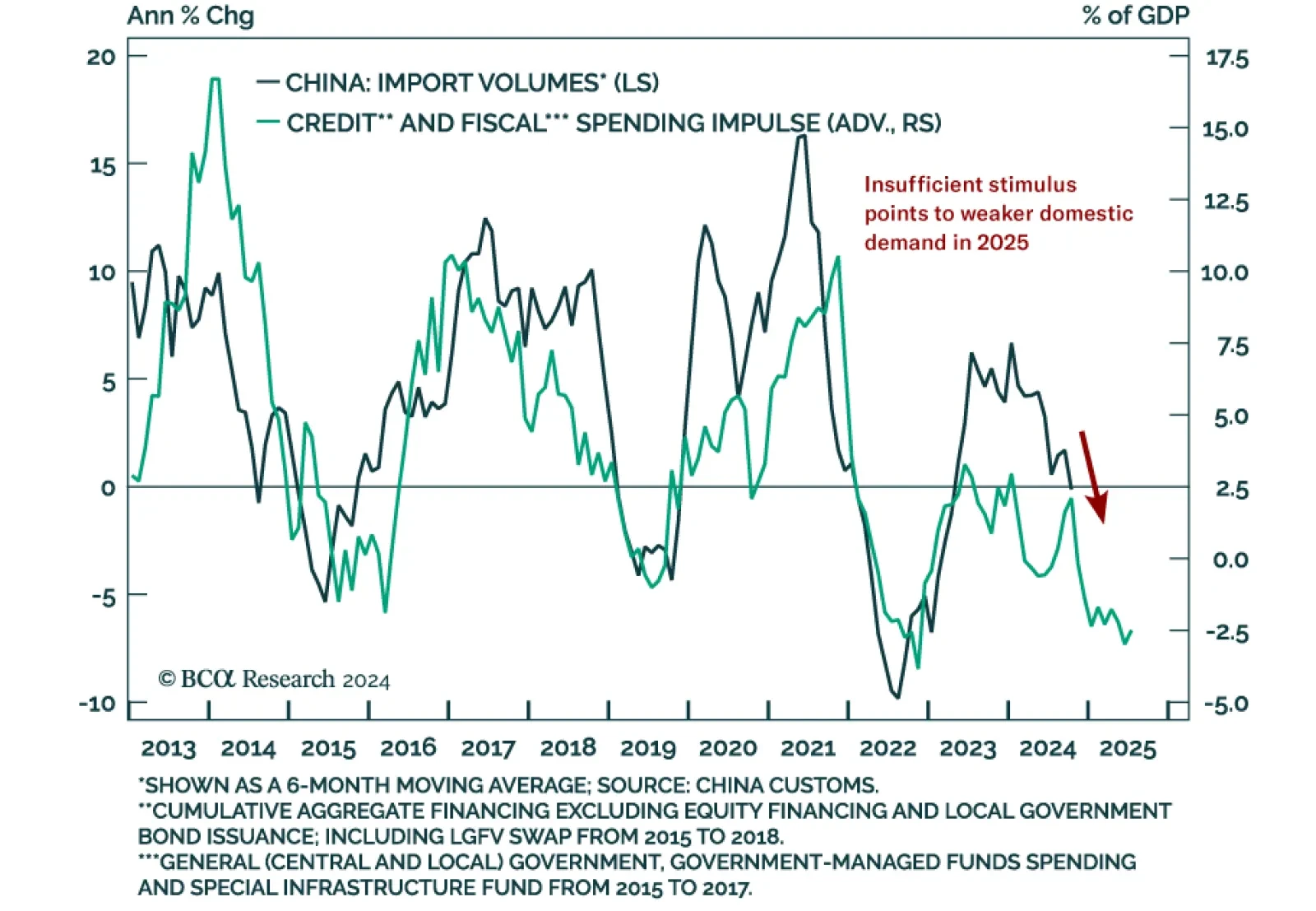

China’s November trade balance increased to CNY 692.8 bln on the back of slowing-but-still-growing exports (down to 5.8% y/y from 11.2% in October), and a worsening imports contraction (-4.7% y/y vs. -3.7% in October). In…