In their Q2/2021 model bond portfolio performance review, BCA Research’s Global Fixed Income Strategy team updated their recommended positioning for the next six months. Firstly, the team changed its US Treasury curve…

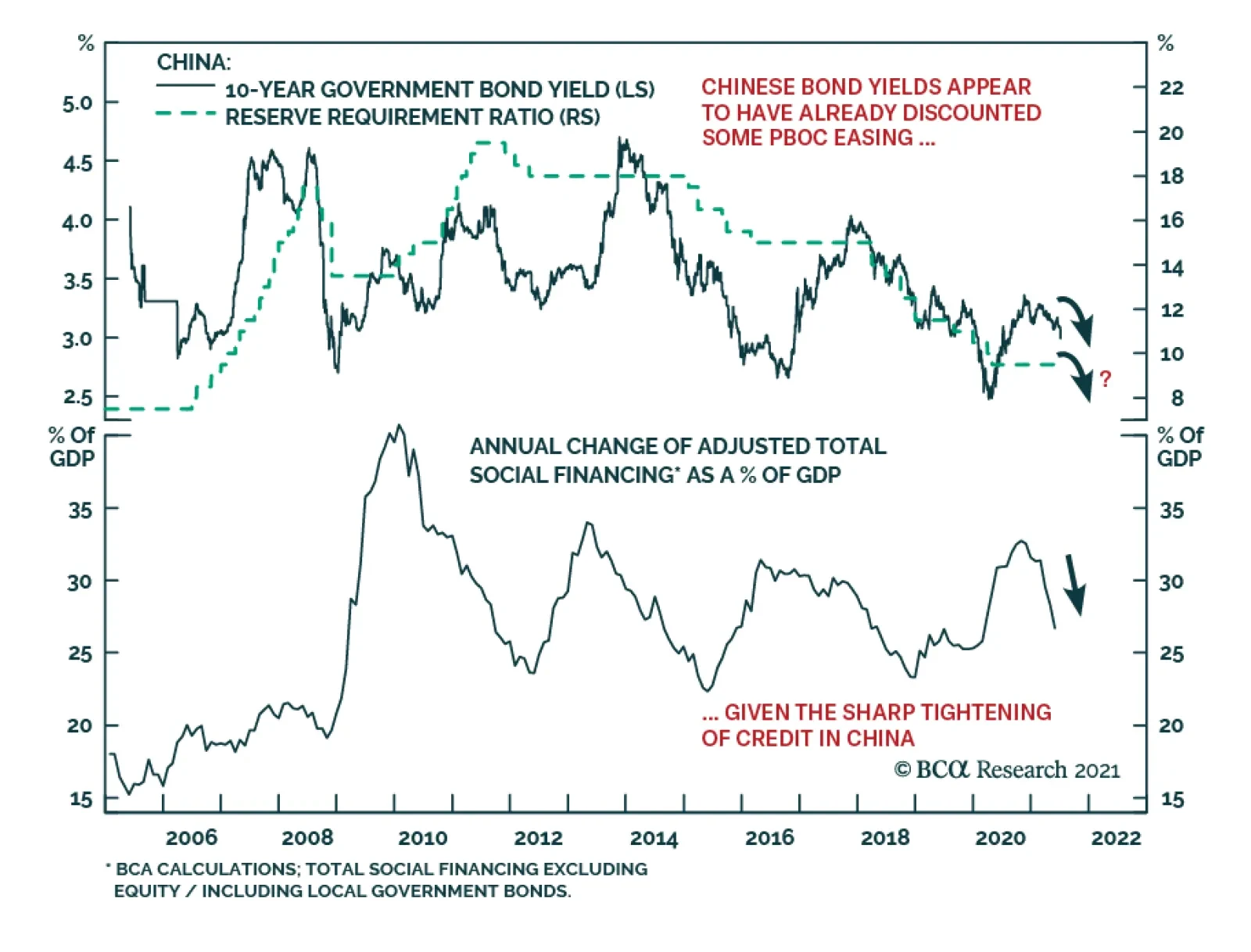

The China State Council meeting on July 7, chaired by Premier Li Keqiang, sent a somewhat ambiguous message on the direction of China’s monetary policy. The press release from the meeting stated that the country will…

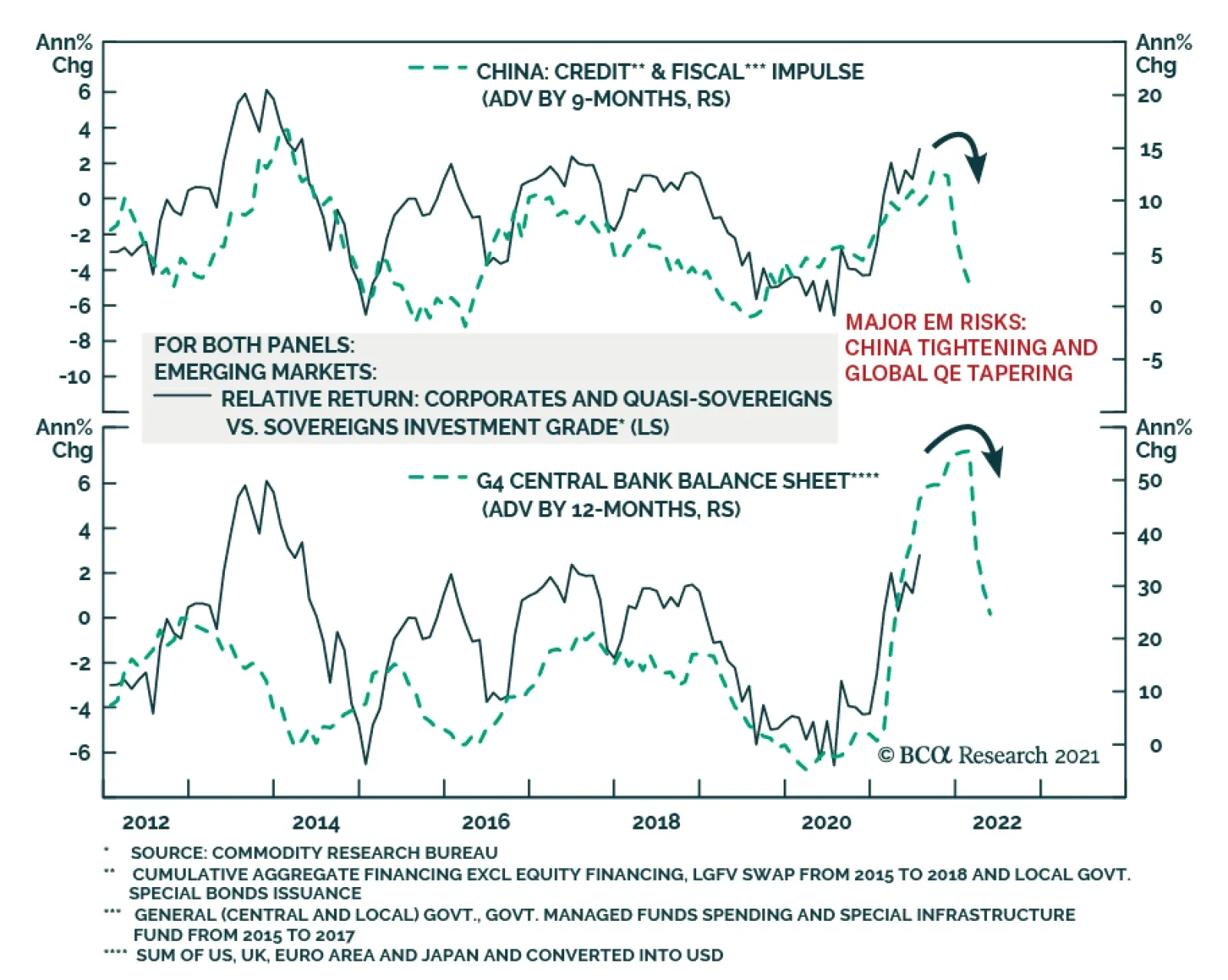

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

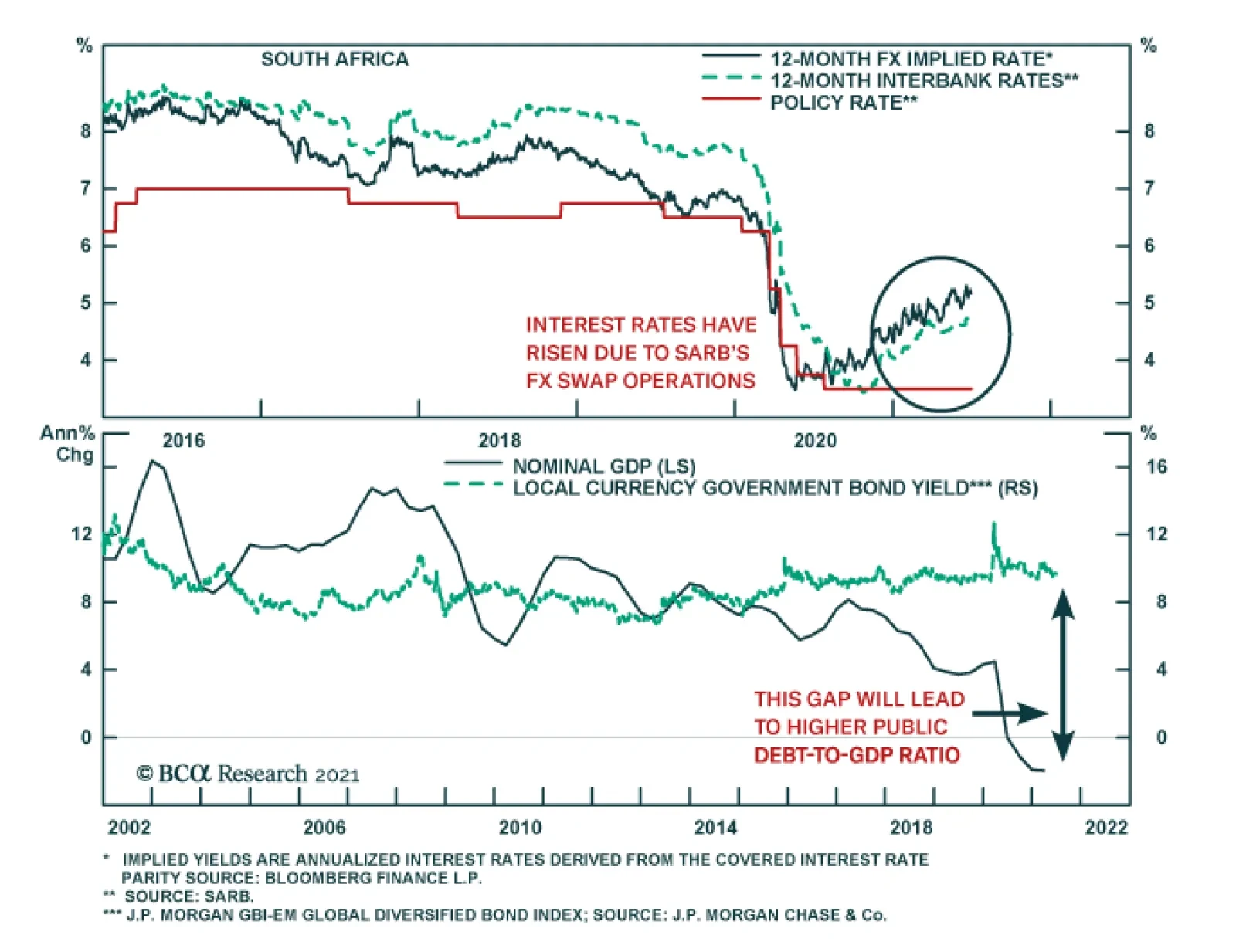

Please note: There will be no Strategy Report next week, July 15. Our next publication will be a Thematic: Charts That Matter, on July 22. Highlights For any country with local currency public debt, the ultimate constraints to lower…

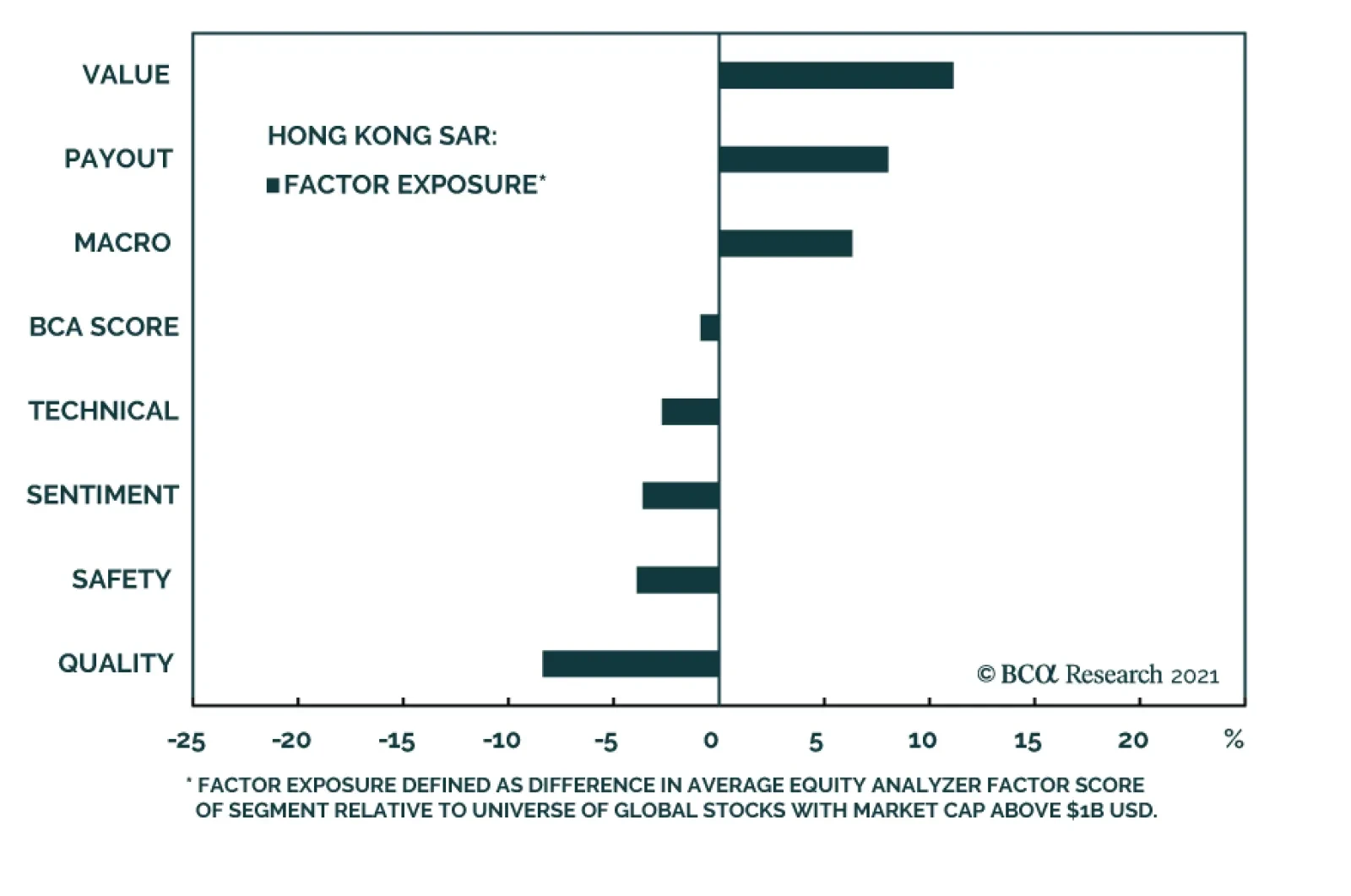

On a long/short basis (long top 10% / short bottom 10% based on the BCA Score), Hong Kong has been the top performing equity market in Equity Analyzer (EA) over the past three months and has been fourth over the past six. The…

GFIS Model Bond Portfolio Q2/2021 Performance Review & Current Allocations: Hitting A Few Roadblocks

Highlights Q2/2021 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark index by -6bps during the second quarter of the year. Winners & Losers: The government bond side of the portfolio…

The central bank’s efforts to sterilize inflows of US dollars from the IMF have inadvertently led to considerably tighter monetary conditions. Not only has the currency appreciated a lot but also market interest rates have…

Highlights Three distinct forces are likely to make South Asia’s geopolitical risks increasingly relevant to global investors. First, India’s tensions with China stem from China’s growing foreign policy assertiveness…

Highlights Gold is – and always will be – exquisitely sensitive to Fed policy and forward guidance, as last month's "Dot Shock" showed (Chart of the Week). Its price will continue to twitch – sometimes…

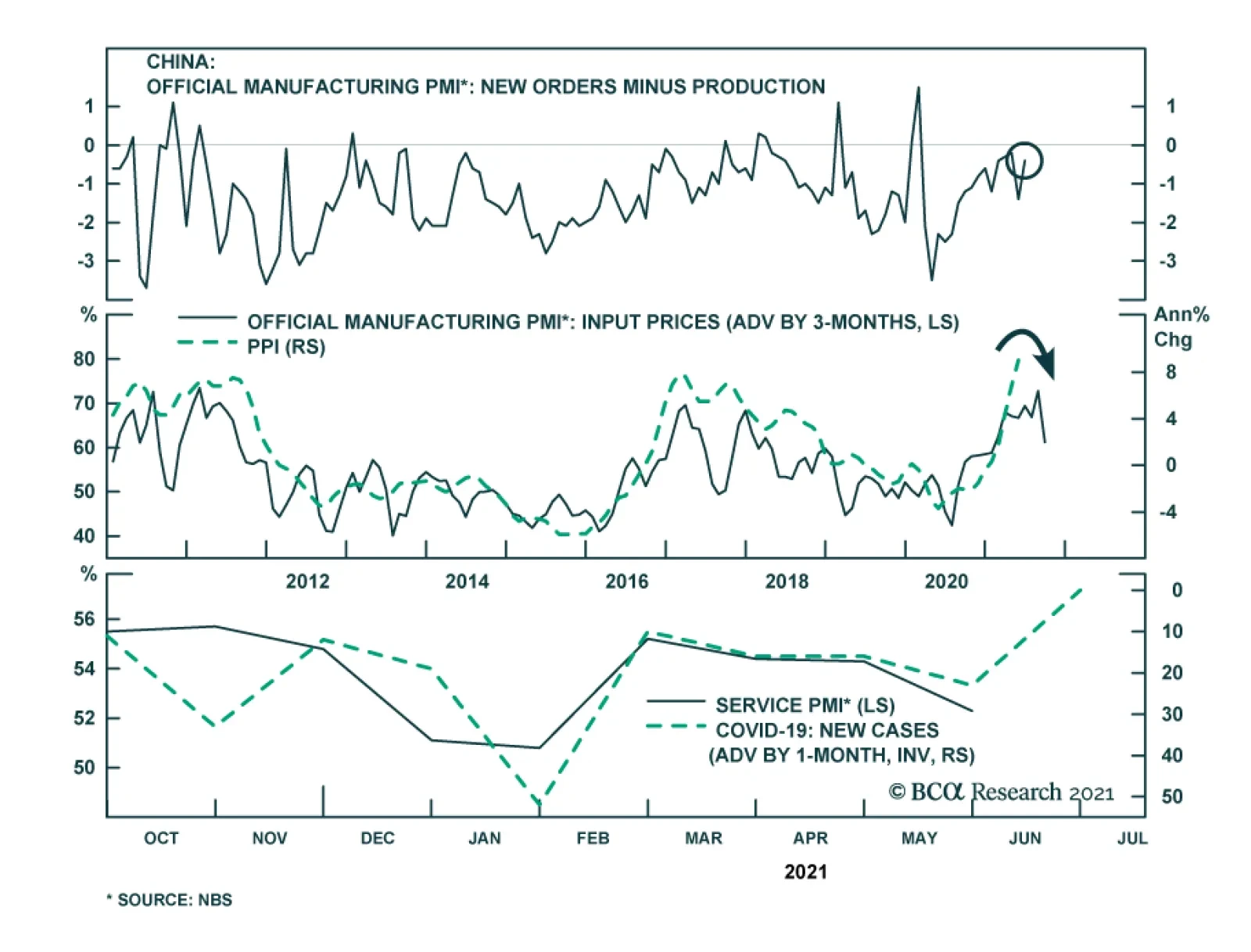

China’s official manufacturing PMI inched down to 50.9 in June from 51.0 in May, extending its downward trend that started in March. Its sub-indexes, however, sent mixed signals. While the new export orders, production and…