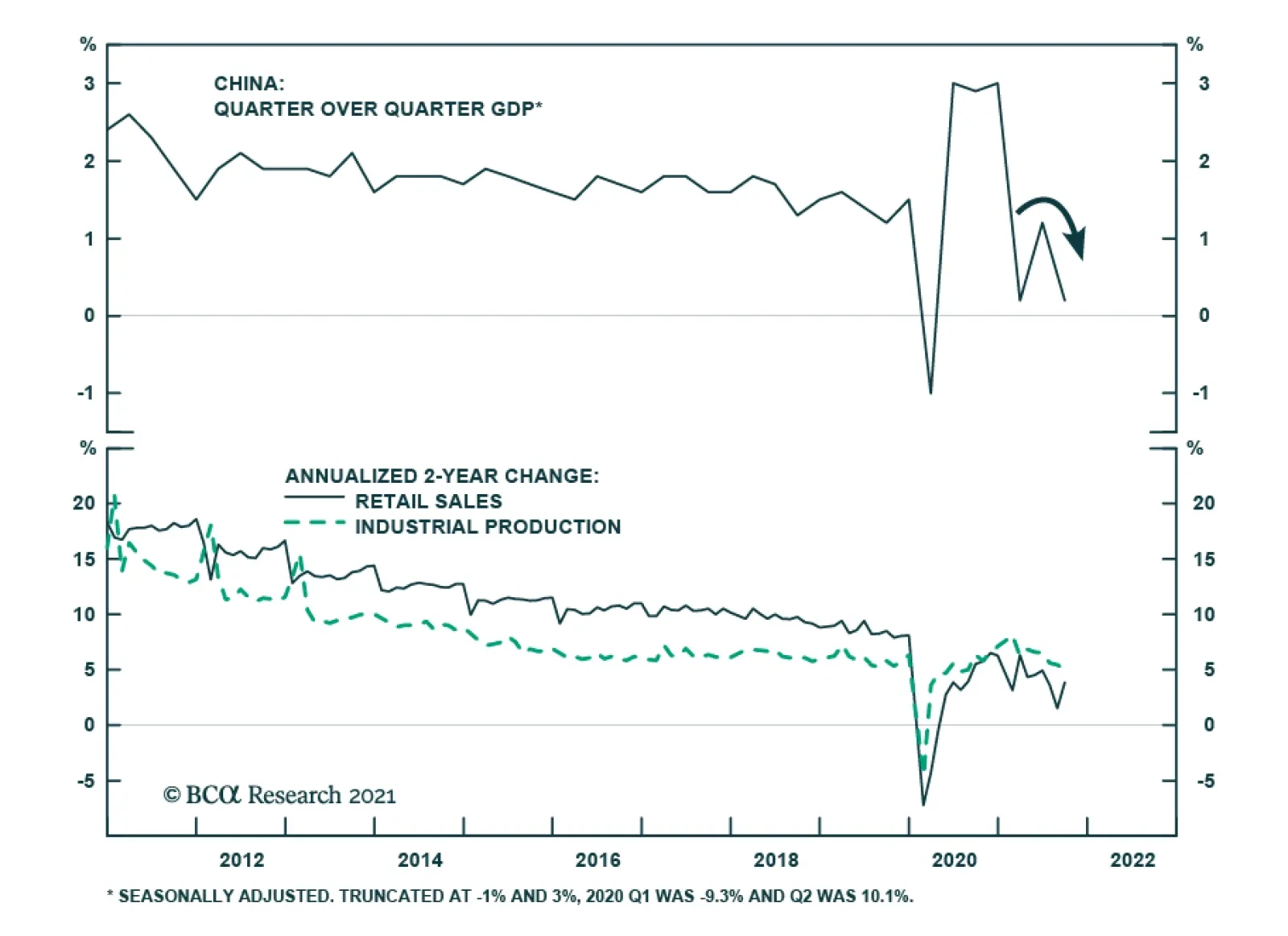

China’s Q3 GDP release confirms that economic activity is decelerating sharply. GDP grew 4.9% y/y – slightly below consensus estimates of 5.0% y/y and significantly slower than Q2’s 7.9% y/y rate. The quarter-on-quarter pace…

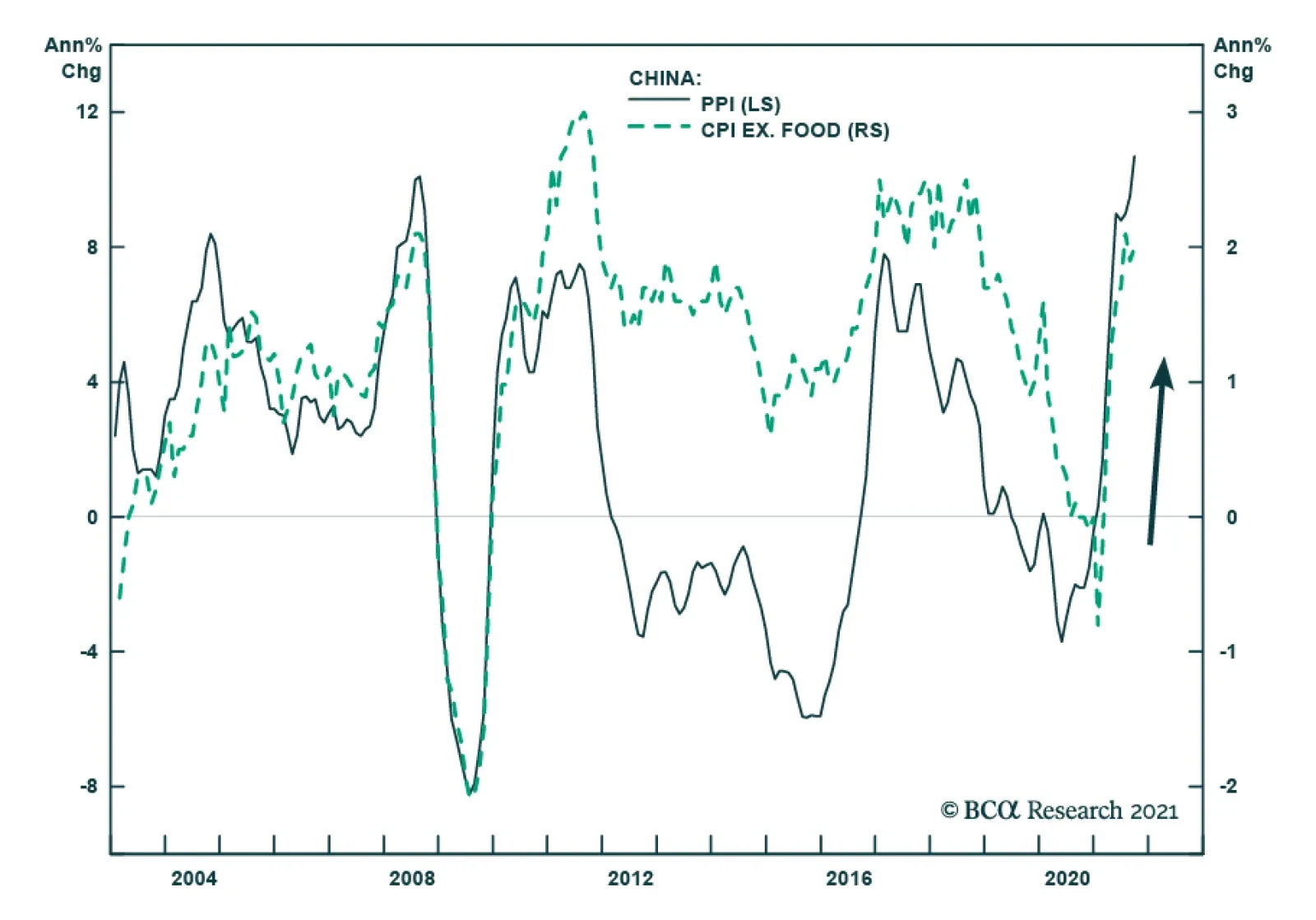

On the surface, China’s CPI and PPI are sending mixed signals about inflationary pressures. Producer prices grew 10.7% y/y in September – a nearly 26-year high – and were a slight upside surprise to expectations of a more muted…

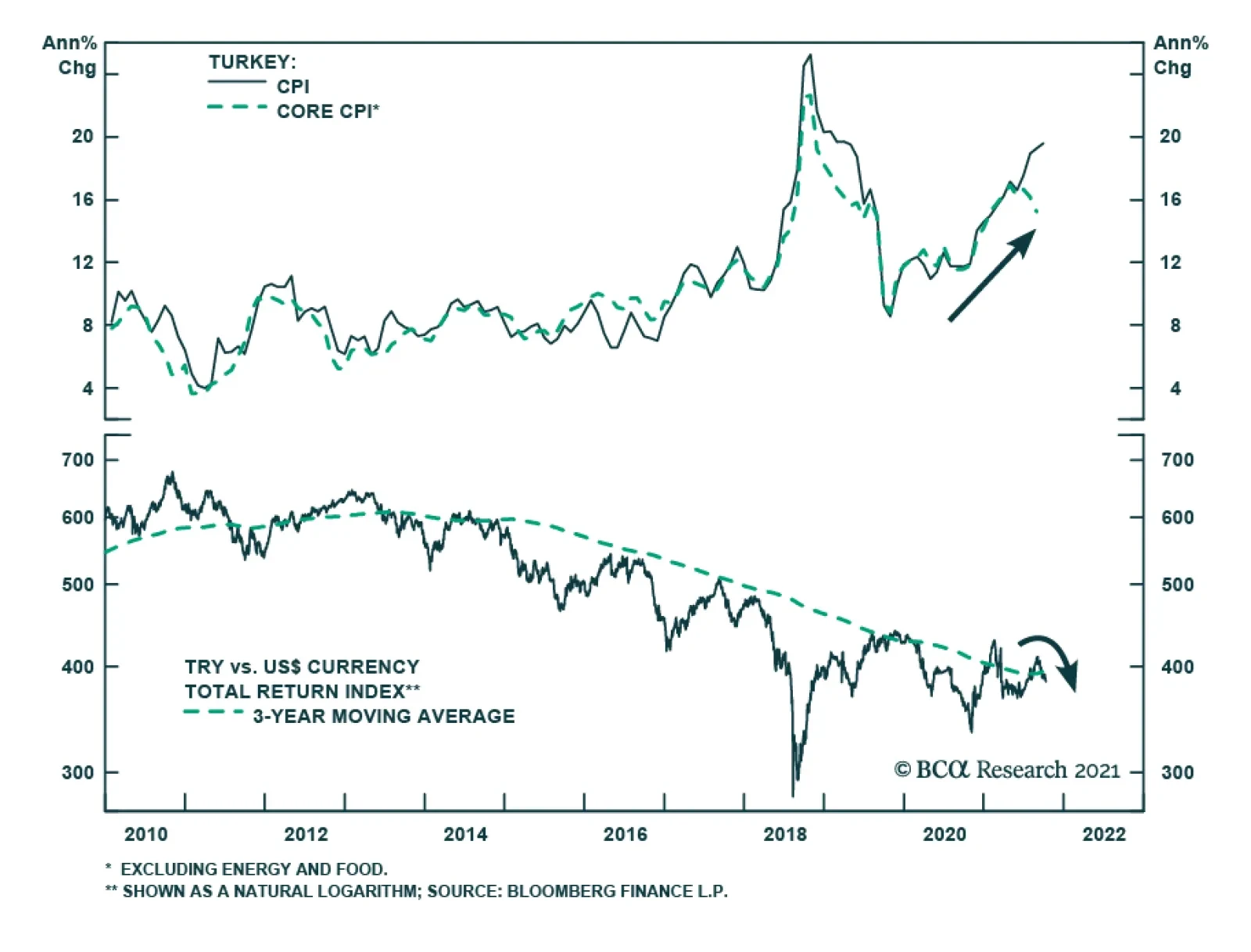

The Turkish lira collapsed to an all-time low on Thursday following news that President Recent Tayyip Erdogan sacked two central bank deputy governors. One of the officials dismissed – Ugur Namik Kucuk – was the only member of…

Highlights The surge in energy prices going into the Northern Hemisphere winter – particularly coal and natgas prices in China and Europe – will push inflation and inflation expectations higher into the end of 1Q22 (Chart of…

Highlights As US inflation proves to be not-so-transitory, US interest rate expectations will rise. Slowing Chinese domestic demand and rising US interest rate expectations will support the US dollar. The net impact from China’…

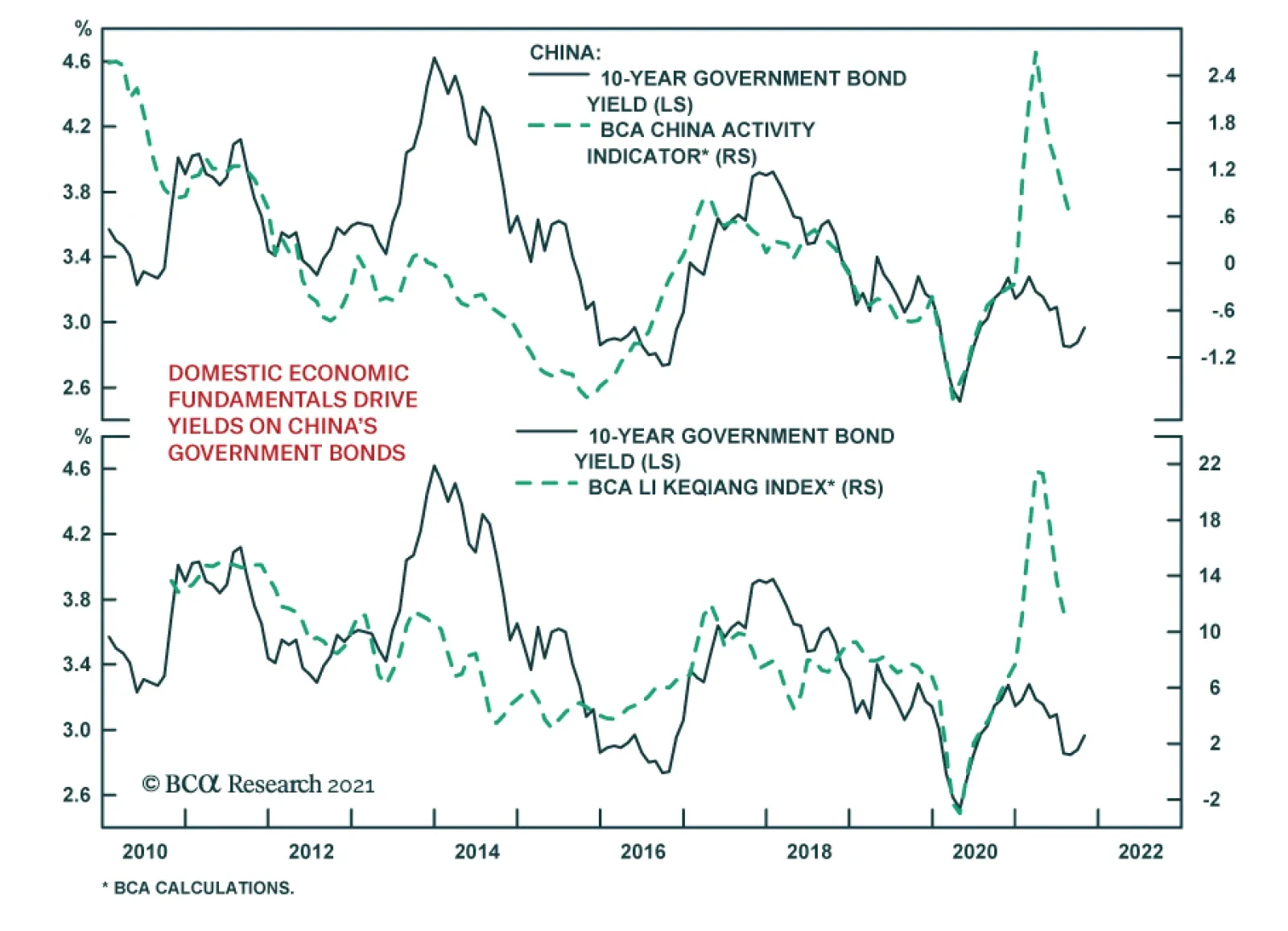

According to BCA Research’s China Investment Strategy service, the Chinese yield curve will likely flatten with long-term government bond yields dropping more than short-term rates in next six to nine months. The long-end of…

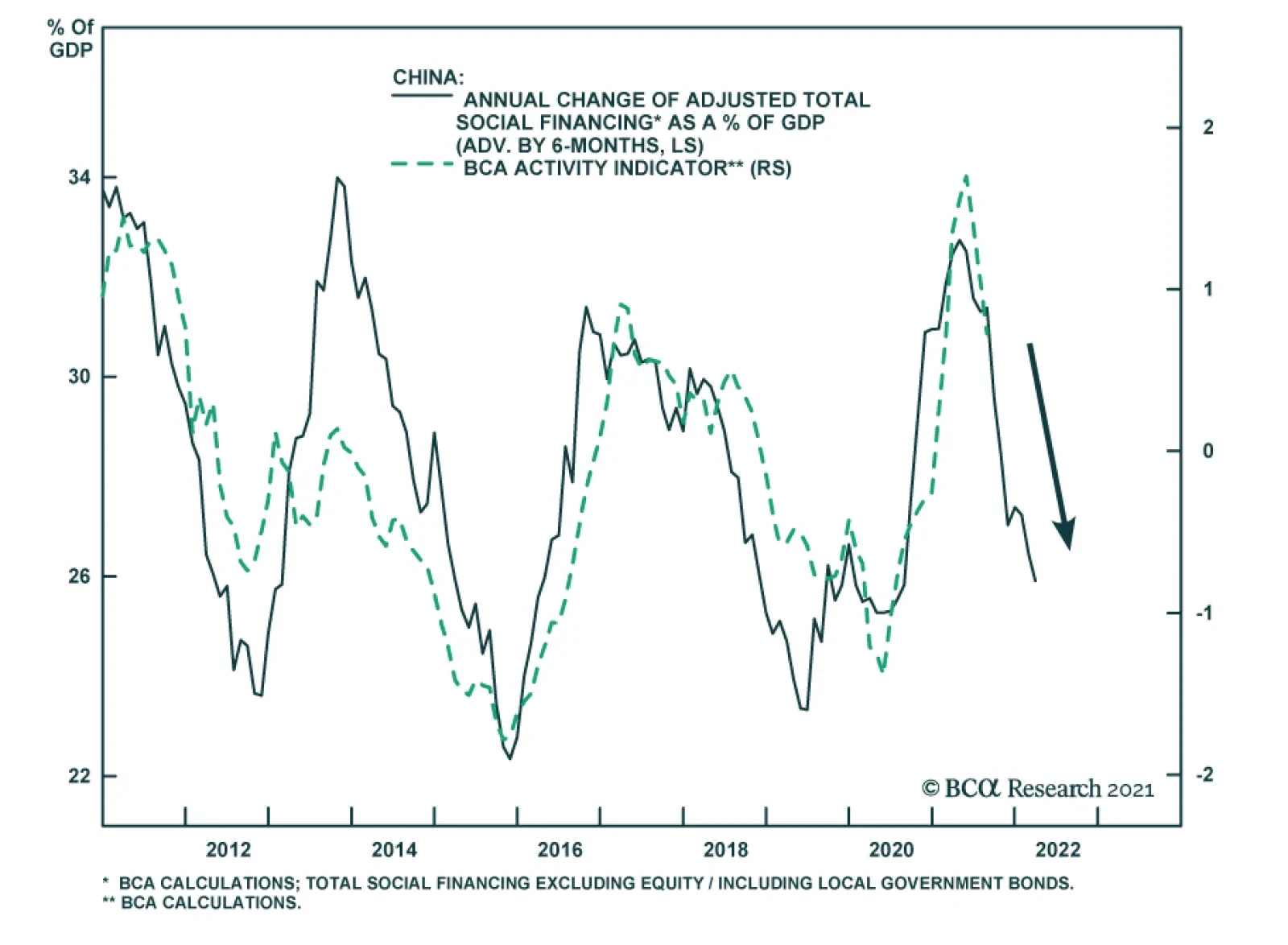

China’s September money supply and credit data was a slight disappointment to expectations. Aggregate financing fell from 2.96 trillion RMB to 2.90 trillion RMB and M1 growth decelerated to 3.7% from 4.2%. Although new yuan loans…

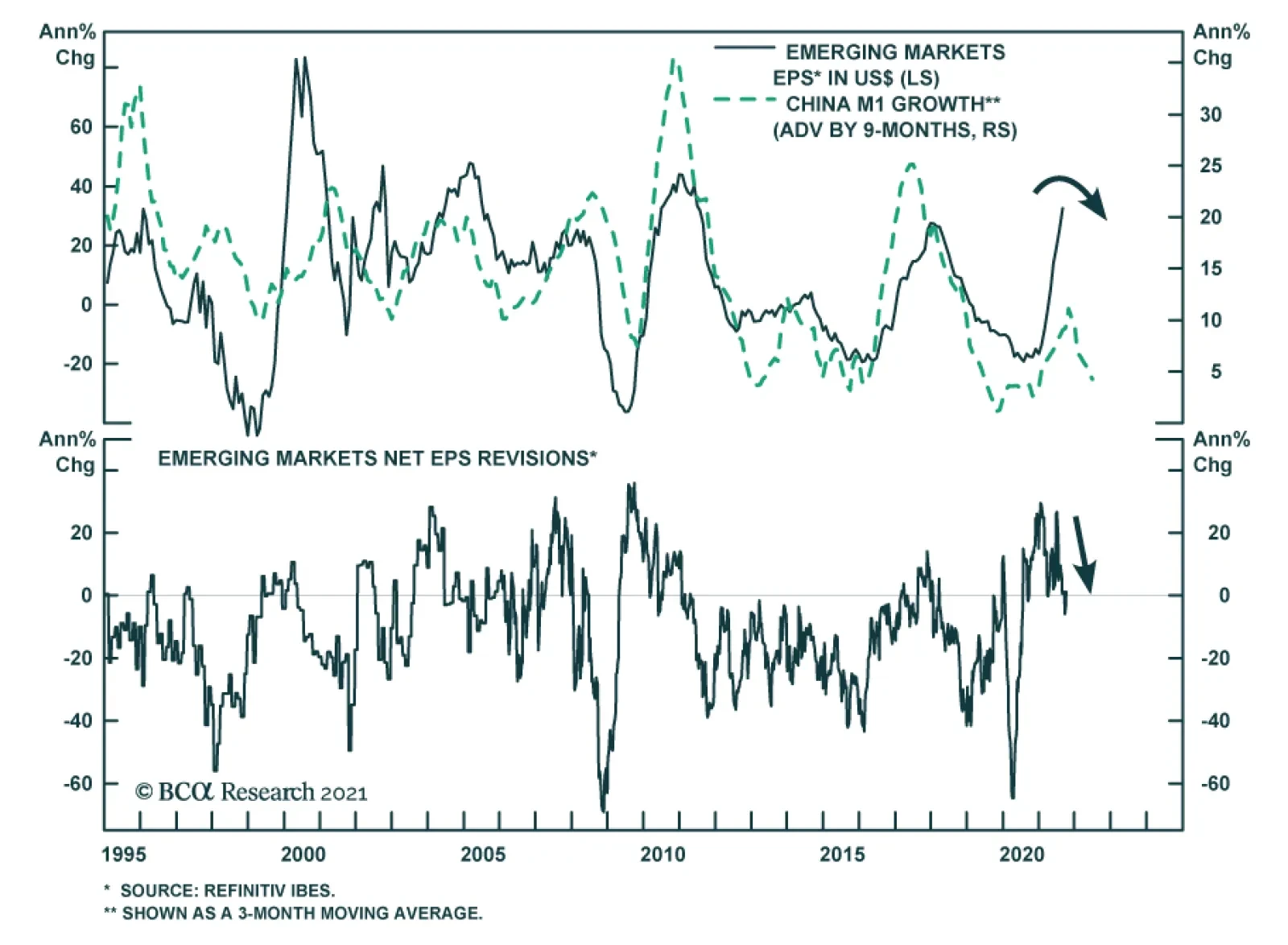

China’s money and credit cycles drive Chinese imports and therefore ultimately impact emerging market economies and EM corporate profitability. Thus, the moderation in China’s money and credit cycle (see Country Focus) is…