Highlights Global equities are poised to deliver mid-to-high single-digit returns this year, with the outlook turning bleaker in 2023 and beyond. Non-US markets are likely to outperform. We examine the four pillars that have…

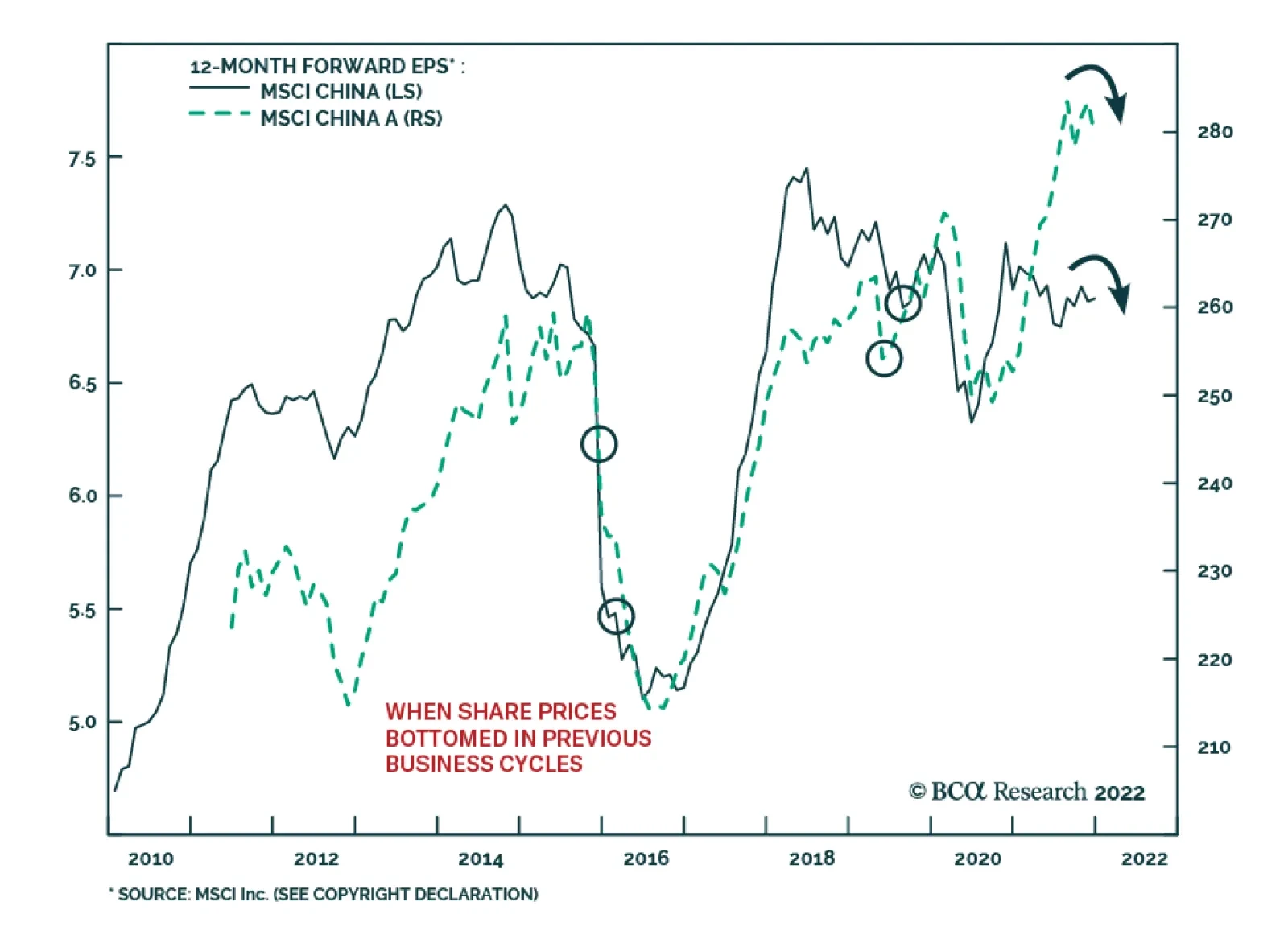

BCA Research’s China Investment Strategy service argues against a cyclically overweight stance towards Chinese stocks. Chinese investable stocks were among the worst performing major equity indices last year, ending 2021…

Highlights For the time being, US core inflation will not drop anywhere close to the Fed’s target range. The Fed will continue tightening until something breaks. US bond yields and the US dollar are heading higher. The S&…

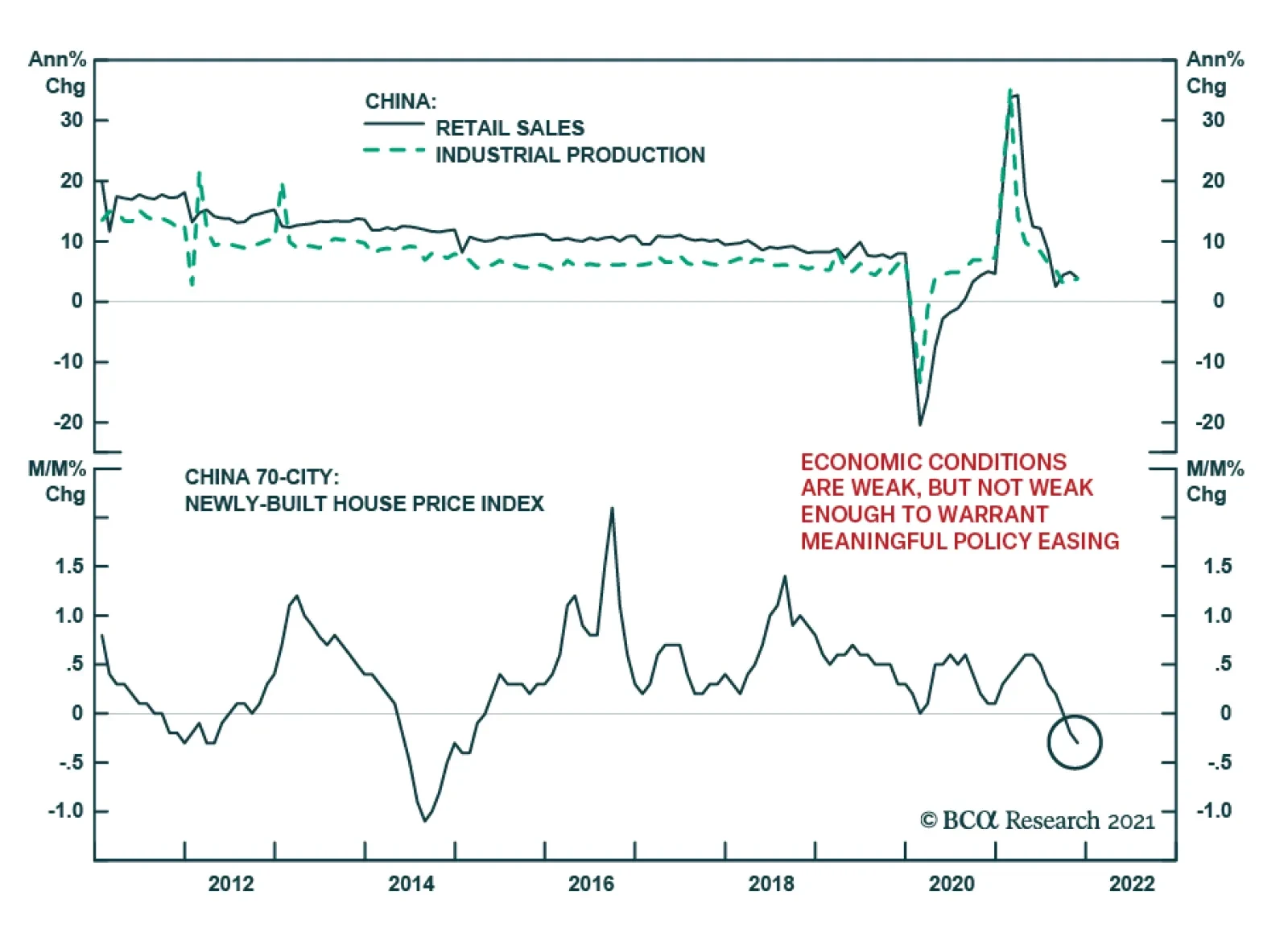

Highlights December’s PMI and our market-based China growth indicator improved slightly, but the underlying data send a mixed signal about the country’s business cycle and do not give a green light for cyclically…

We have entered a new phase of the cycle, with central banks in most developed markets turning more hawkish (the Bank of England surprisingly hiking in December, and the Fed signaling three rate hikes for 2022). How much does…

Highlights Global growth will remain above-trend in 2022, although with more divergence between regions than at any time during the pandemic (US strong, Europe steady, China slowing). Global inflation will transition from being driven…

Chinese economic data for November was generally disappointing and indicate that the domestic economy is slowing. Retail sales growth decelerated sharply to 3.9% y/y versus expectations of a mild 0.2 percentage point decline from…

Highlights Our three strategic themes over the long run: (1) great power rivalry (2) hypo-globalization (3) populism and nationalism. The implications are inflationary over the long run. Nations that gear up for potential conflict and…

Dear Clients, This is the final publication for the year, in which we recap some of the key economic developments this month. Our publishing schedule will resume on January 6, 2022. The China Investment Strategy team wishes you a very…