Executive Summary Rising TIPS Yields = Equity Multiples Compression Equity sector and style rotations could prevent the broad equity indexes from plunging, but these rotations will not be sufficient to propel the overall…

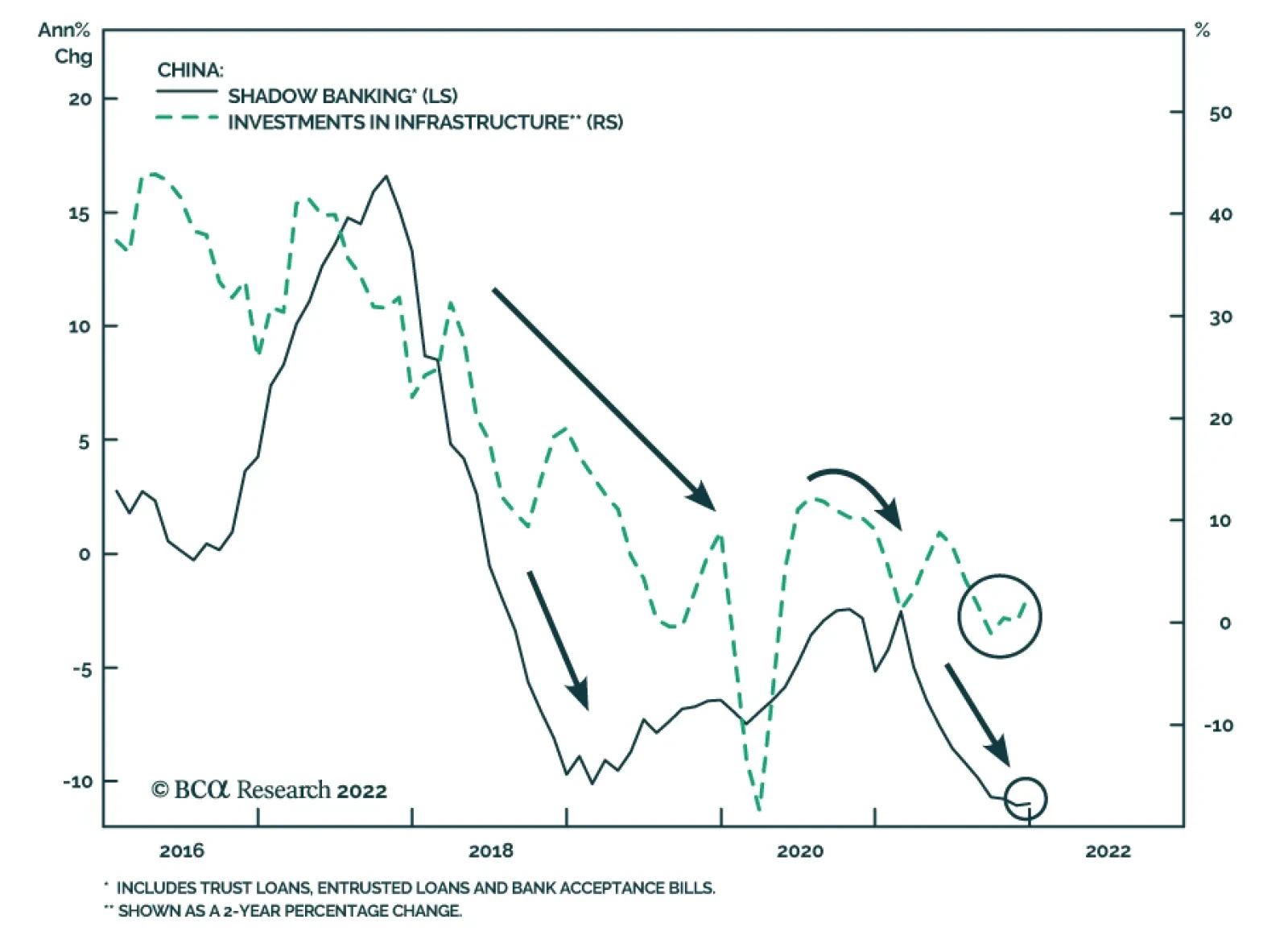

BCA Research’s China Investment Strategy service sees four significant risks to turning bullish towards Chinese domestic stocks (in both absolute and relative terms) in the next 6 to 12 months. A subdued…

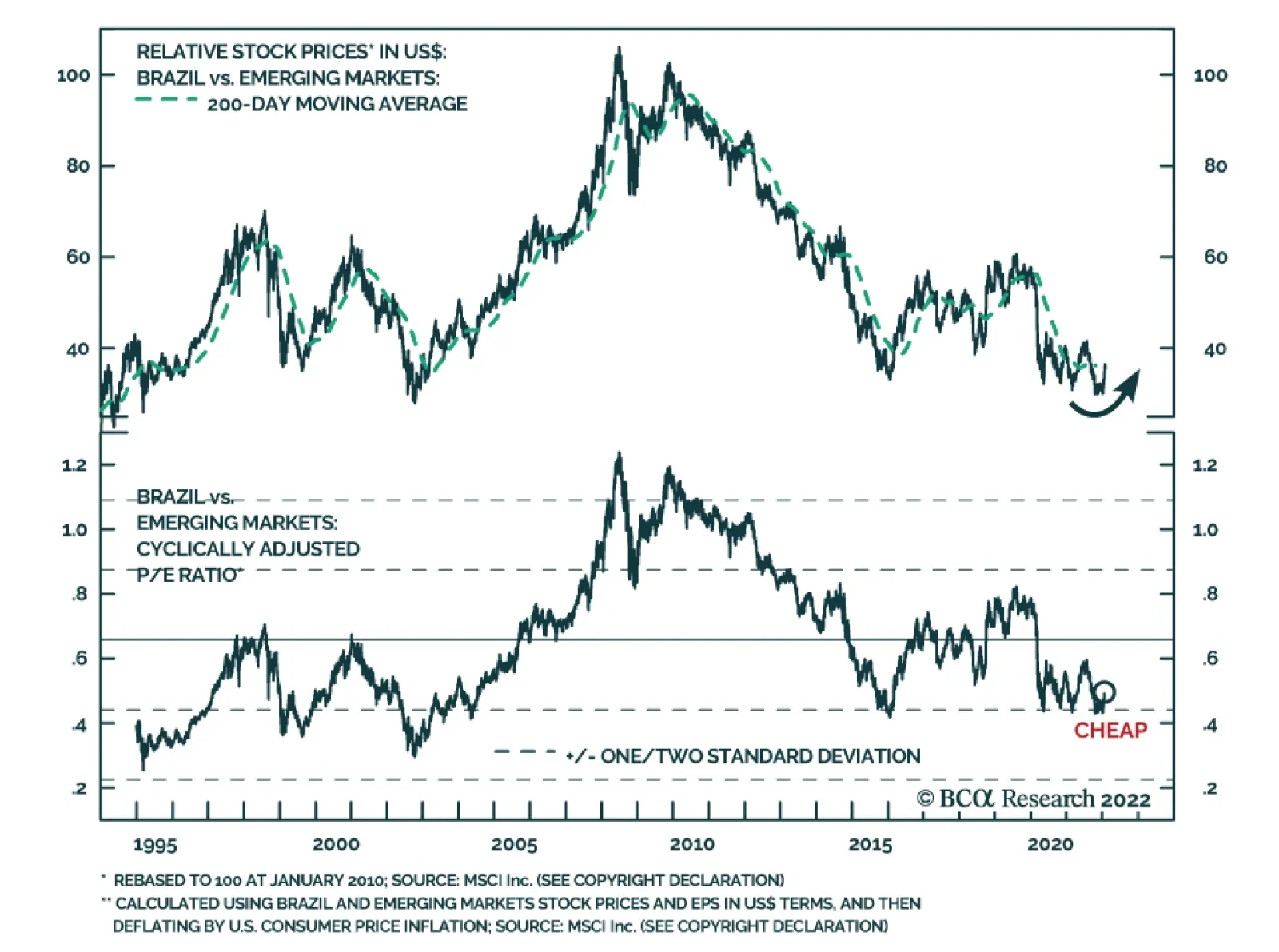

Brazilian risk assets have started the year on a positive note. After falling 23.5% in 2021 – and underperforming emerging market and global equities by 18.9% and 40.3%, respectively – Brazilian equities are up 14.3%…

Executive Summary Chinese Onshore Stock Prices And Earnings Are Set To Deteriorate Macro fundamentals indicate that for the time being there is no basis to overweight Chinese onshore stocks (in both absolute terms and…

Highlights Chart 1Most Sectors Have Fully Recovered Last week’s January employment report shocked markets by showing much greater job gains than had been anticipated. More important than the headline number, however,…

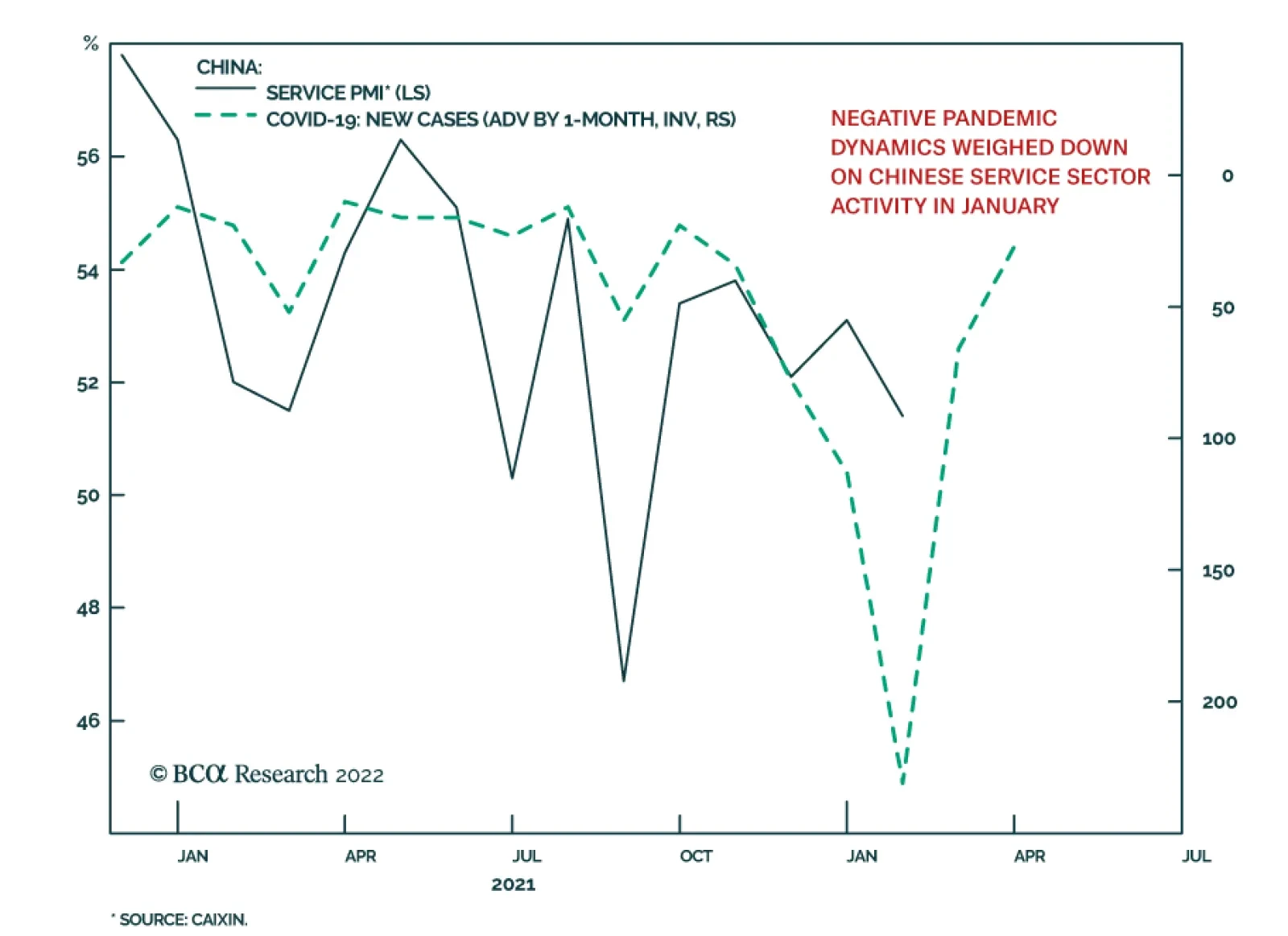

The Caixin PMI suggests that Chinese economic activity stagnated in January. The Composite PMI declined by 2.9 points to 50.1 – a hair above the boom-bust line separating contraction from expansion. The services PMI…

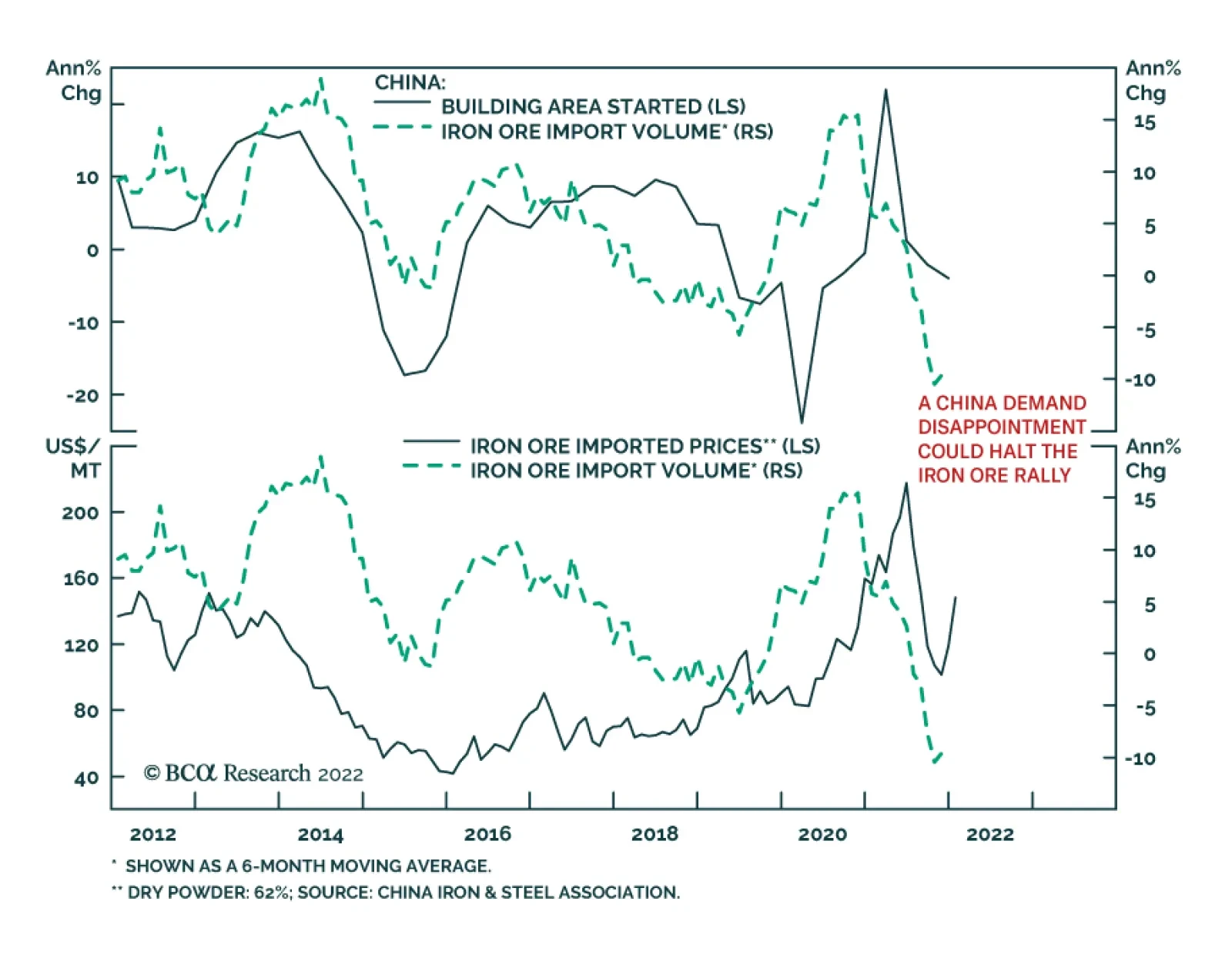

The price of iron ore is up a stunning 73% since mid-November. Both demand- and supply-side factors are likely responsible for this increase. On the demand-side, China has intensified its monetary policy support for the…

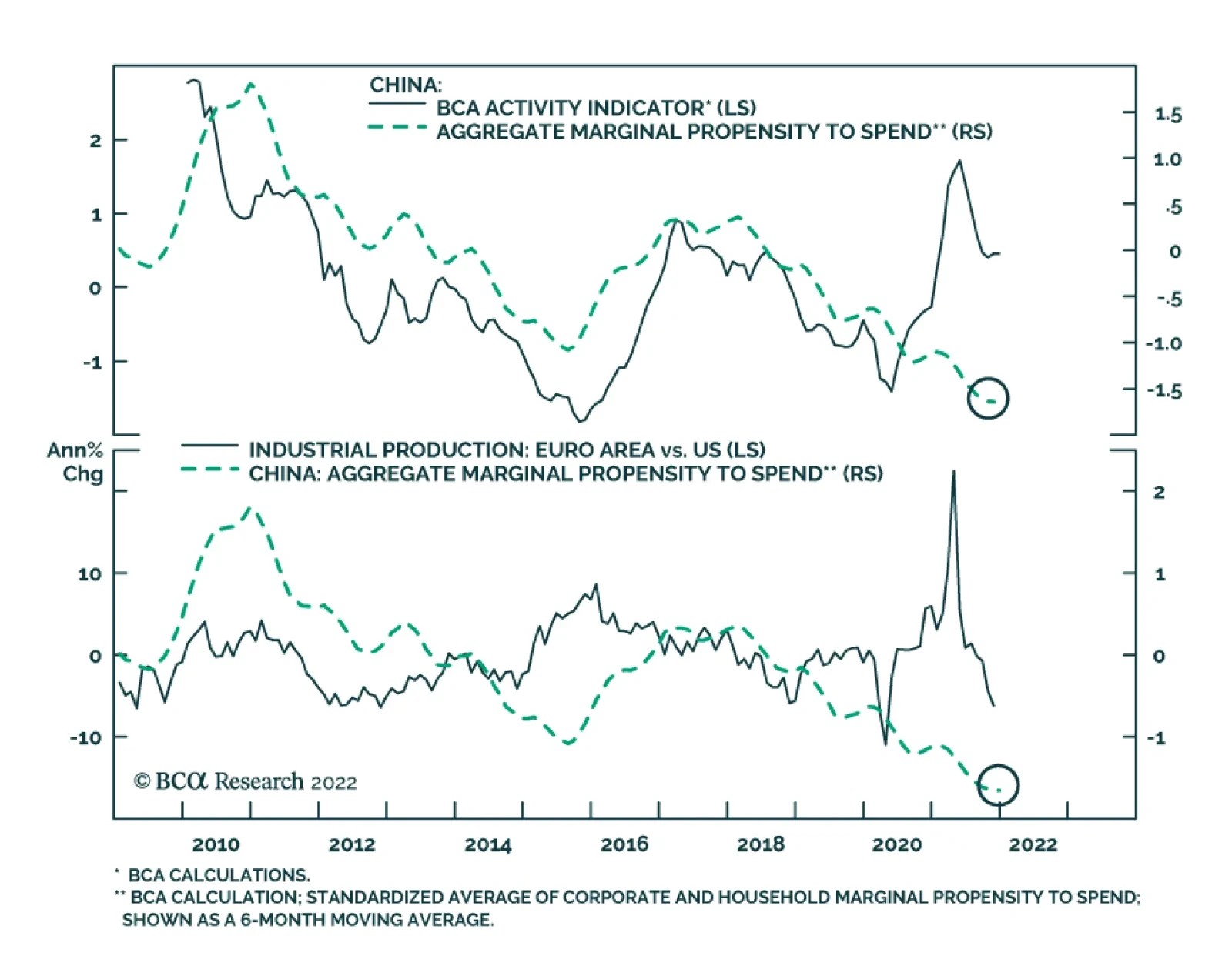

Among the reasons why our China Investment strategists do not anticipate a rapid recovery in Chinese demand is that private sector sentiment is depressed. BCA Research’s marginal propensity to spend indicators for both…

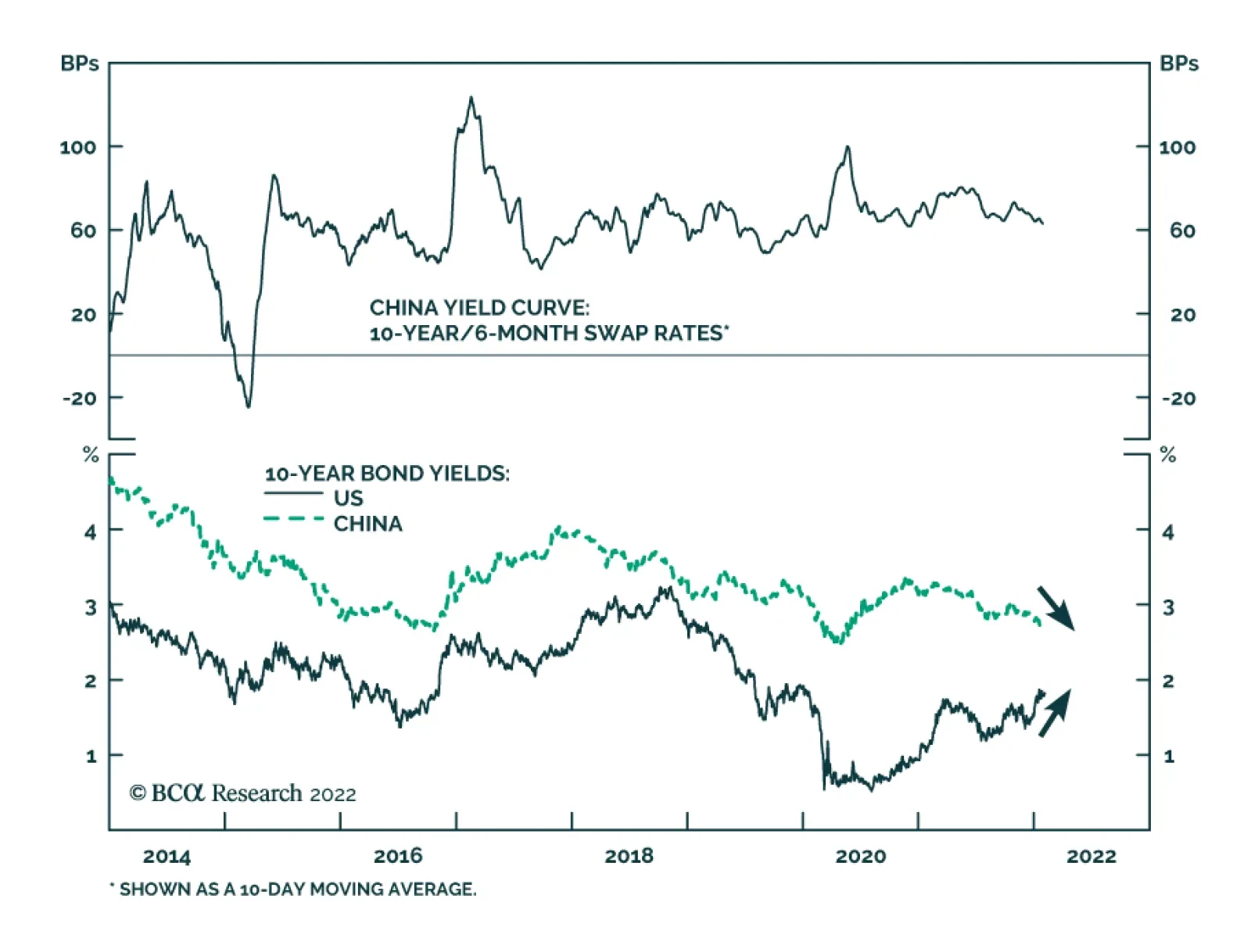

For international investors in local bonds, total returns are predicated on two main drivers: (1) the direction and magnitude of change in bond yields; and (2) currency performance. In all Asian countries, the dominant macro…