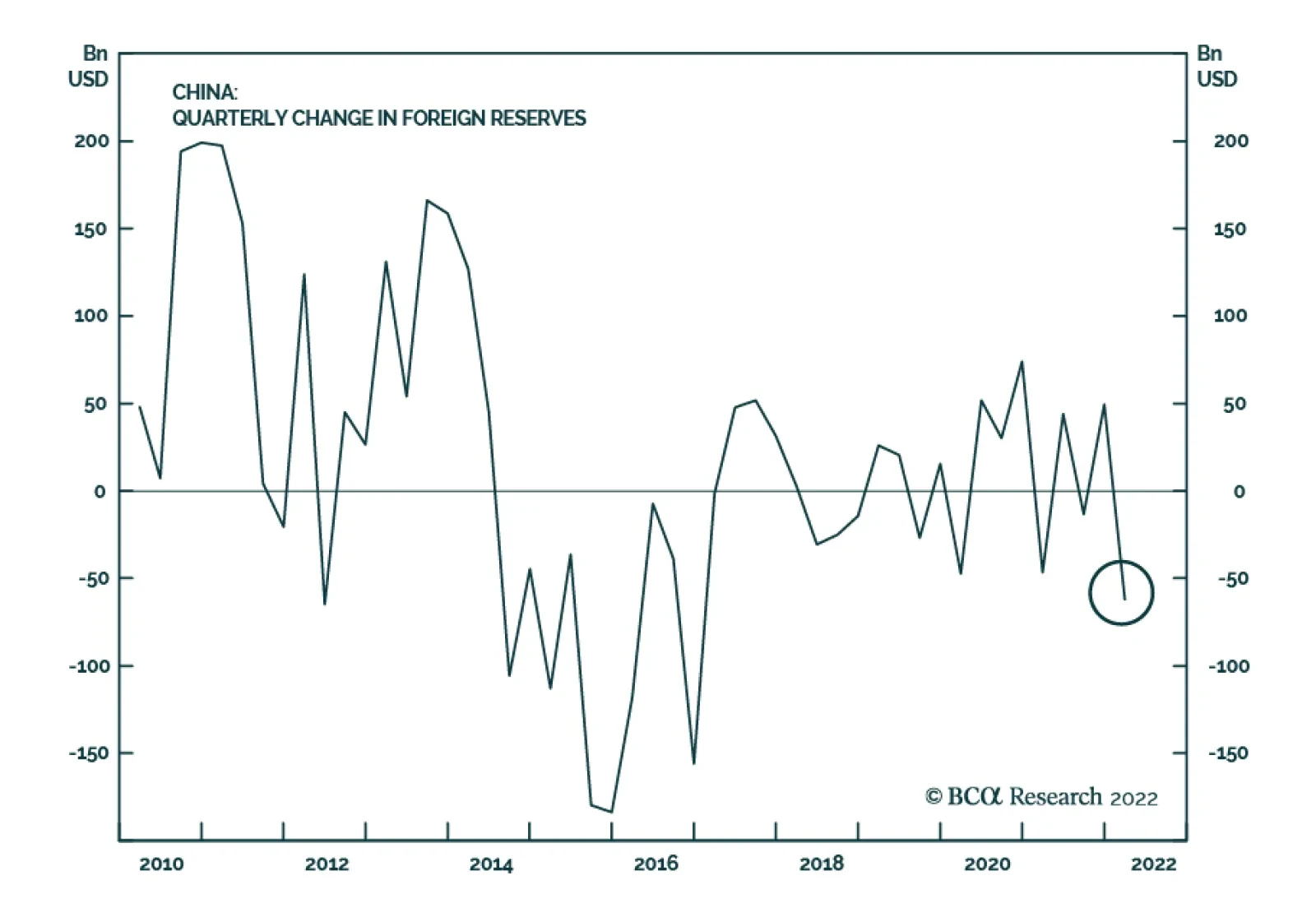

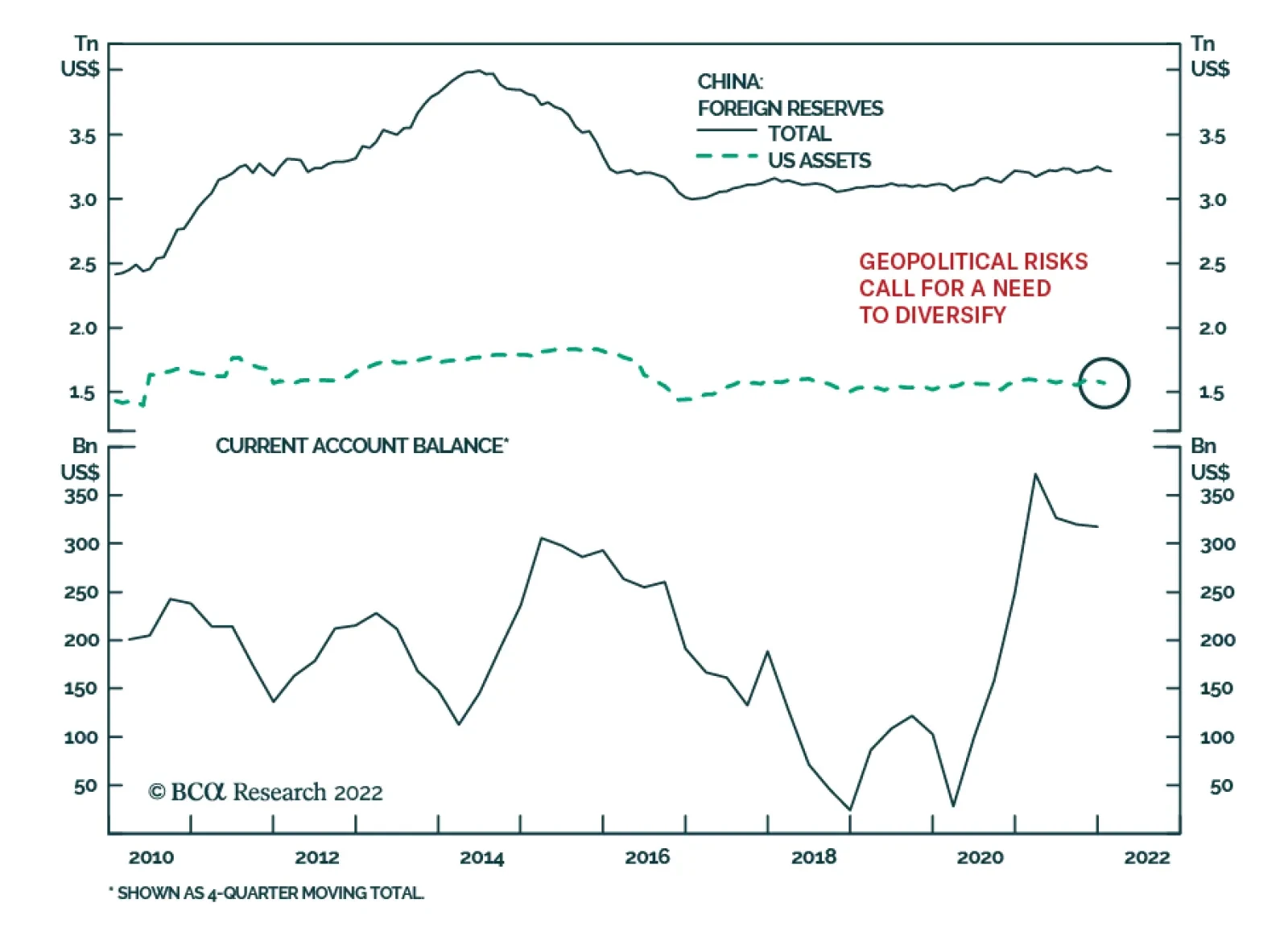

According to BCA Research’s China Investment Strategy service, the drop in the first quarter FX reserves reflects losses in China’s official FX asset portfolio and increased capital outflows. Newly released data…

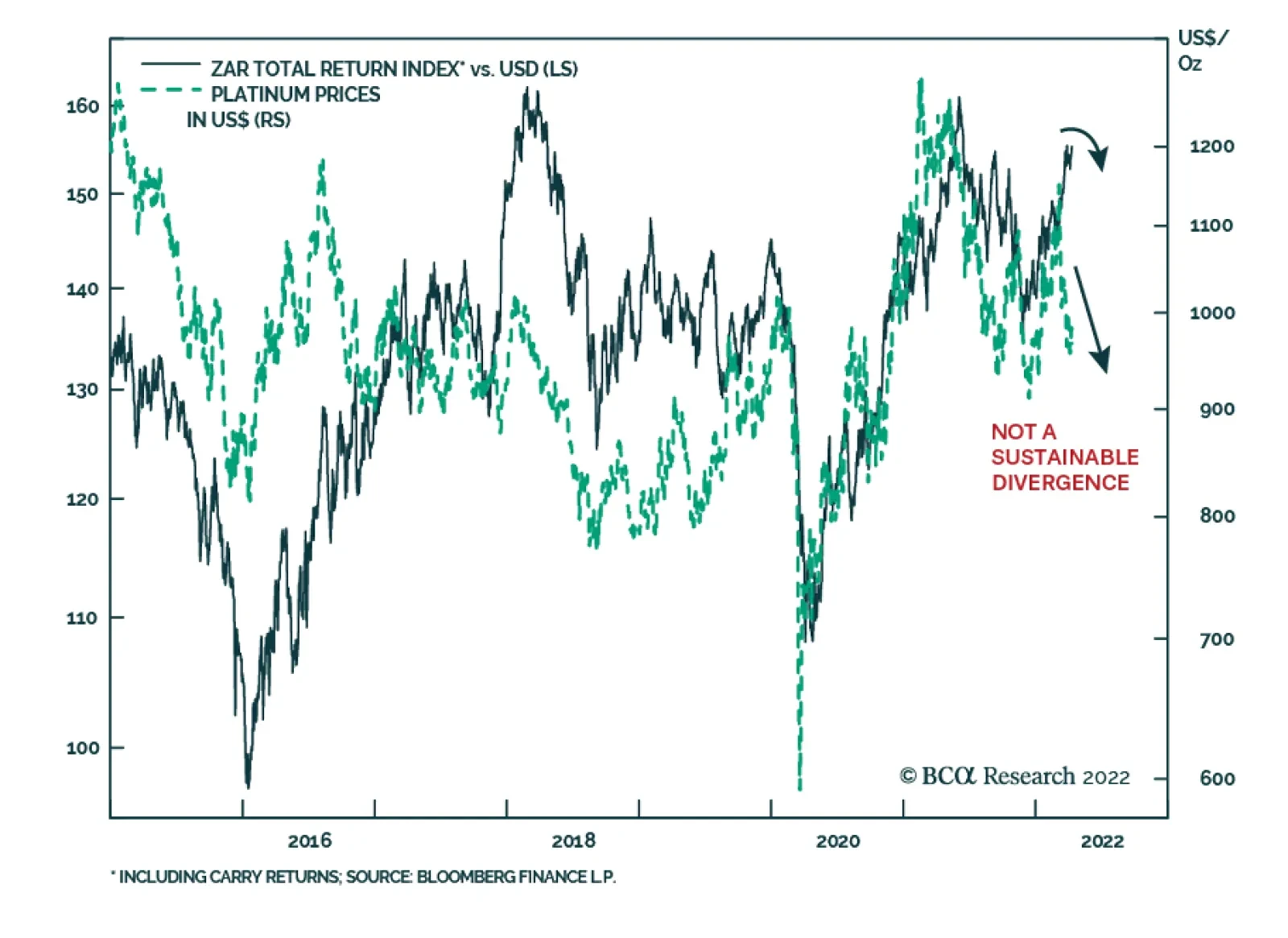

South African financial markets have shot up and have dramatically outperformed their EM peers. The rotation into commodities following Russia’s invasion of Ukraine has greatly benefited commodity plays like South Africa…

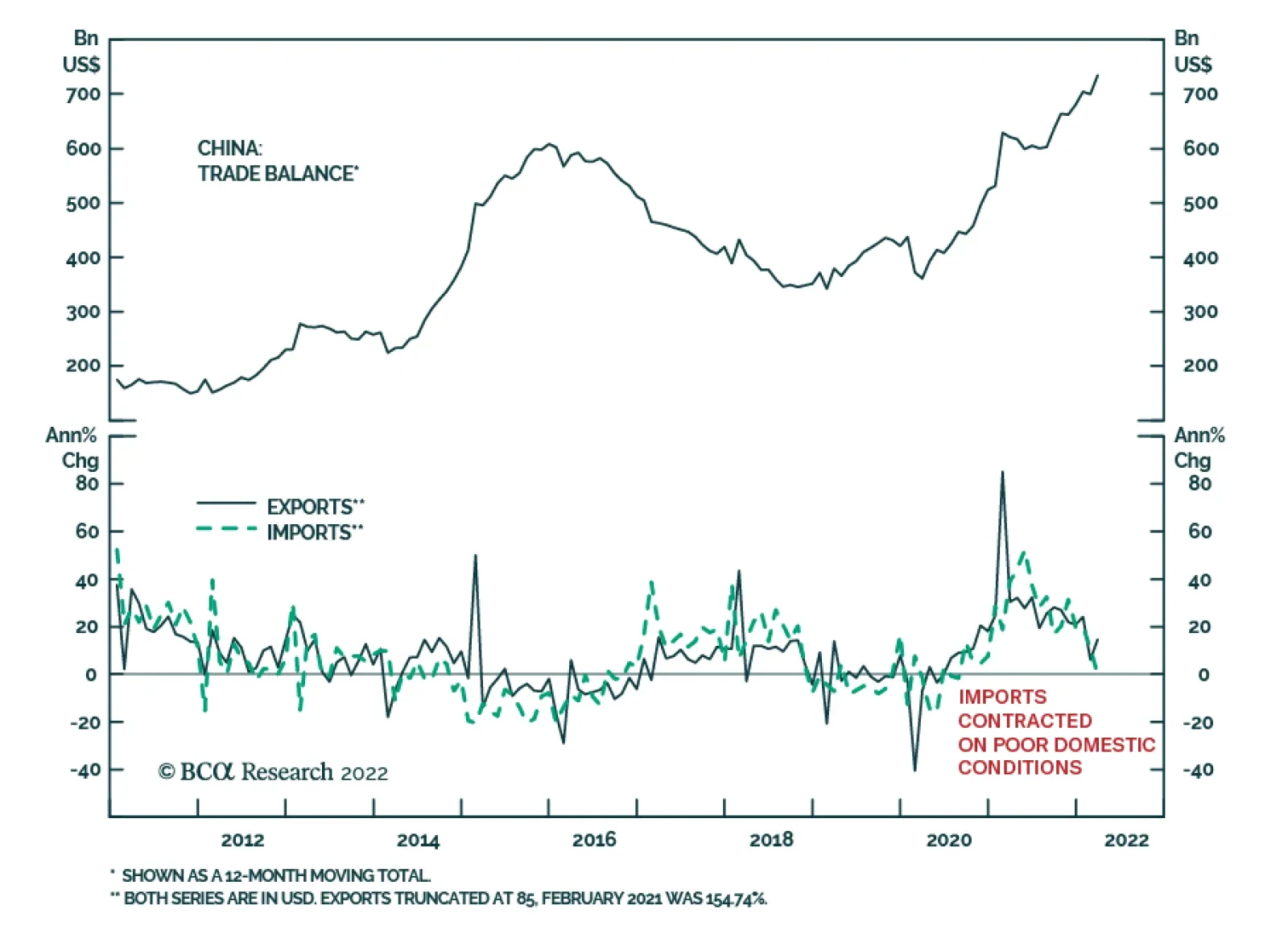

China’s trade surplus widened from USD 30.6 billion to USD 47.4 billion March, surprising expectations that it would narrow to USD 21.7 billion. Both export and import dynamics explain the wider surplus. On the export…

Executive Summary Onshore Equity Market Outflow Pressures Remain, At Least In The Near Term China’s foreign exchange (FX) reserves fell in the first three months of 2022. The reduction was the largest quarterly fall…

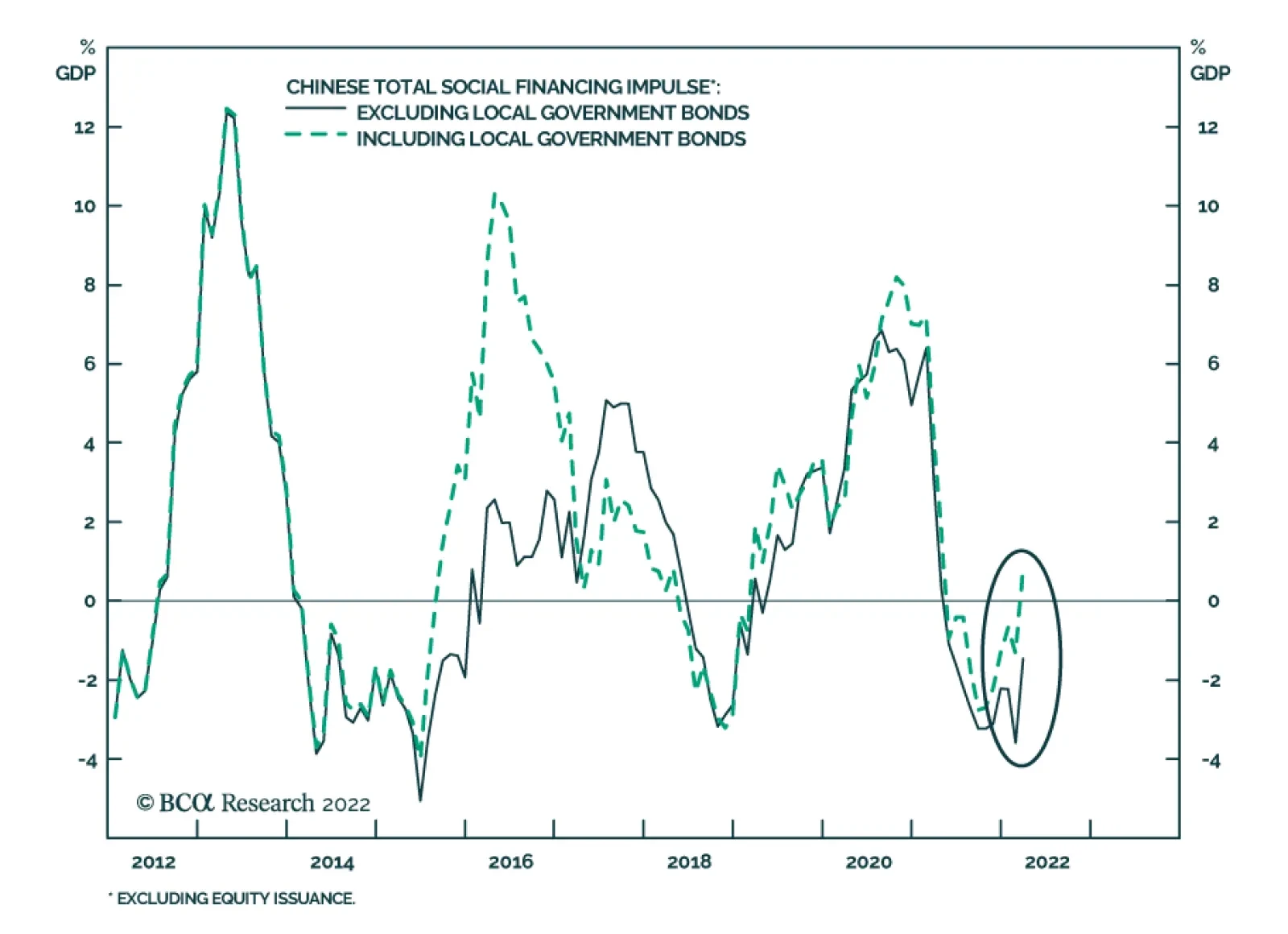

China’s money and credit data surprised to the upside in March. Aggregate financing jumped to CNY 4.65 trillion from CNY 1.19 trillion and beat expectations of a CNY 3.55 trillion increase. Similarly, new bank loans more…

Executive Summary The Ukraine war reinforces our key view that commodity producers will use their geopolitical leverage this year. The market is growing complacent again about Russian risks. Iran is part of the same dynamic. If US-…

Western sanctions against Russia following its invasion of Ukraine have essentially frozen a large share of the country’s foreign exchange reserves. Last month, Russia’s finance minister Anton Siluanov revealed that…

Executive Summary Fed policy and the US stock market are on a collision course. US core inflation will not fall below 3.5% unless the economy slows considerably below its potential for a few quarters. As long as US share prices do…

Executive Summary Natgas Price Surge Boosts Hydrogen's Prospects Russia's invasion of Ukraine and the surge in EU natural gas prices it provoked will accelerate investment in clean-hydrogen technology, which uses…

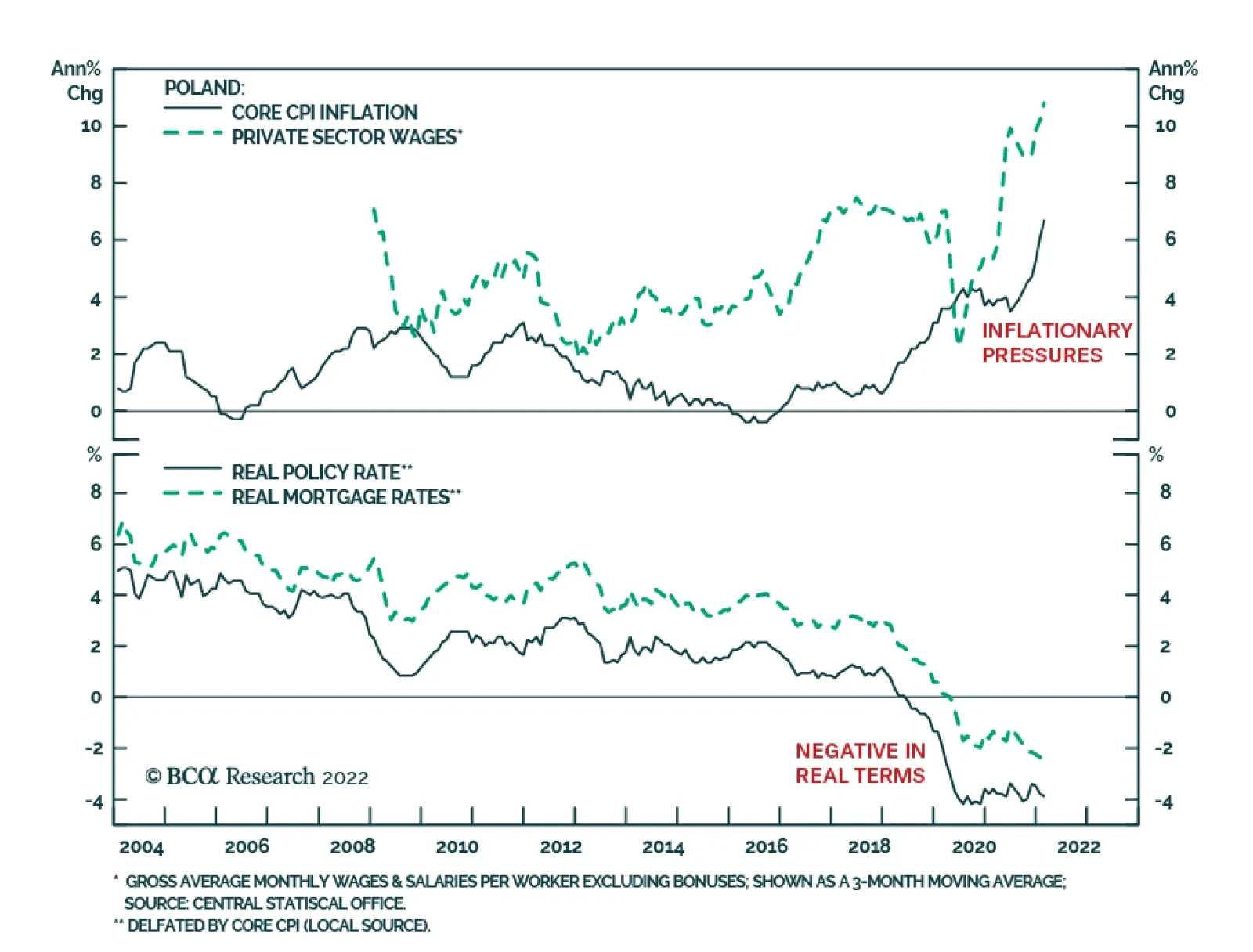

The Polish central bank (NBP) surprised markets yesterday with a 100bps rate hike to 4.5%, following a 75bps rate hike last month. The central bank rate hikes come after strong headline and core inflation prints in recent months…