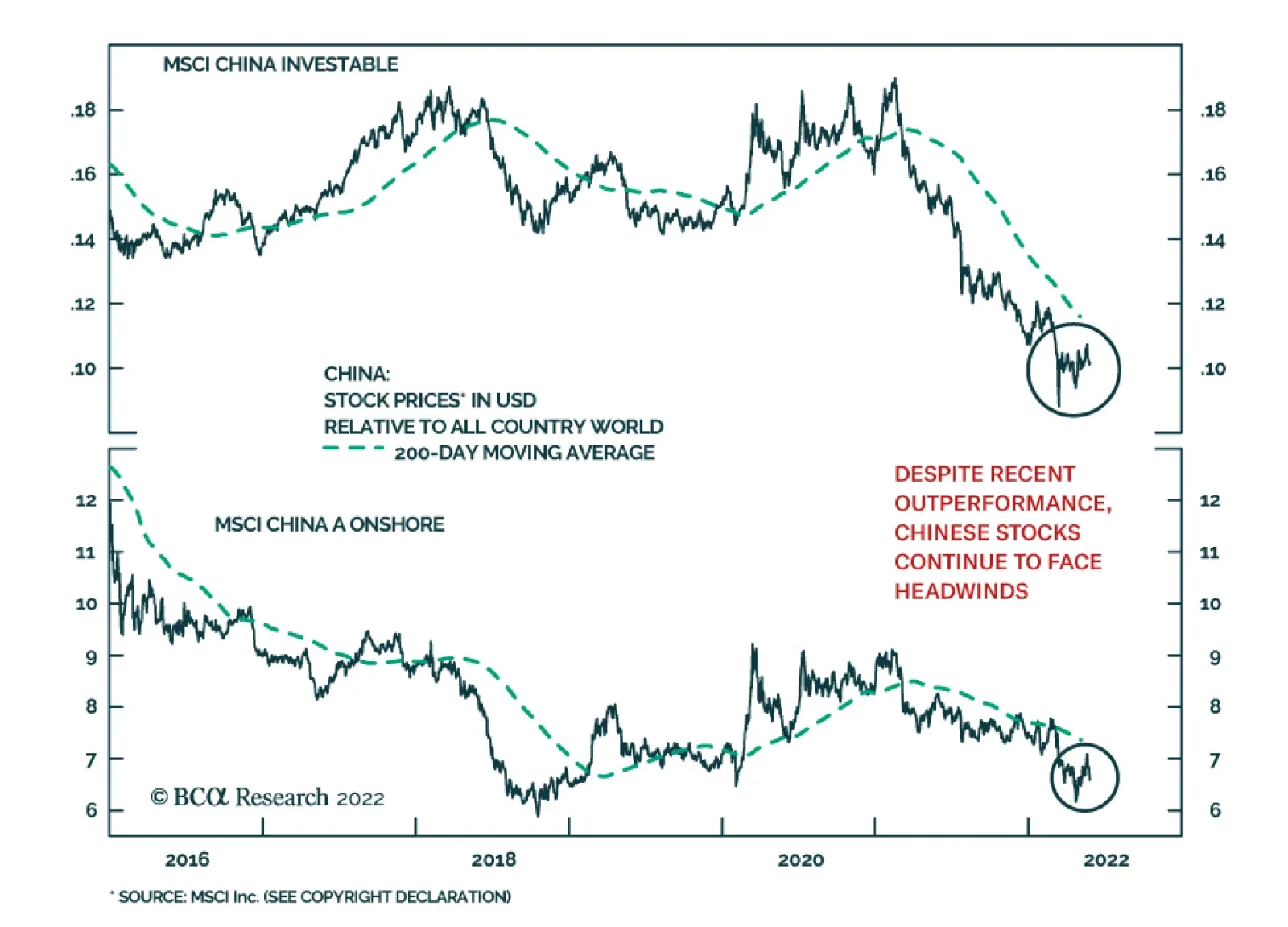

After having faced strong selling pressures since the beginning of the year, Chinese stocks have stabilized in recent weeks. Investor sentiment towards Chinese stocks appears to be improving amid positive policy developments.…

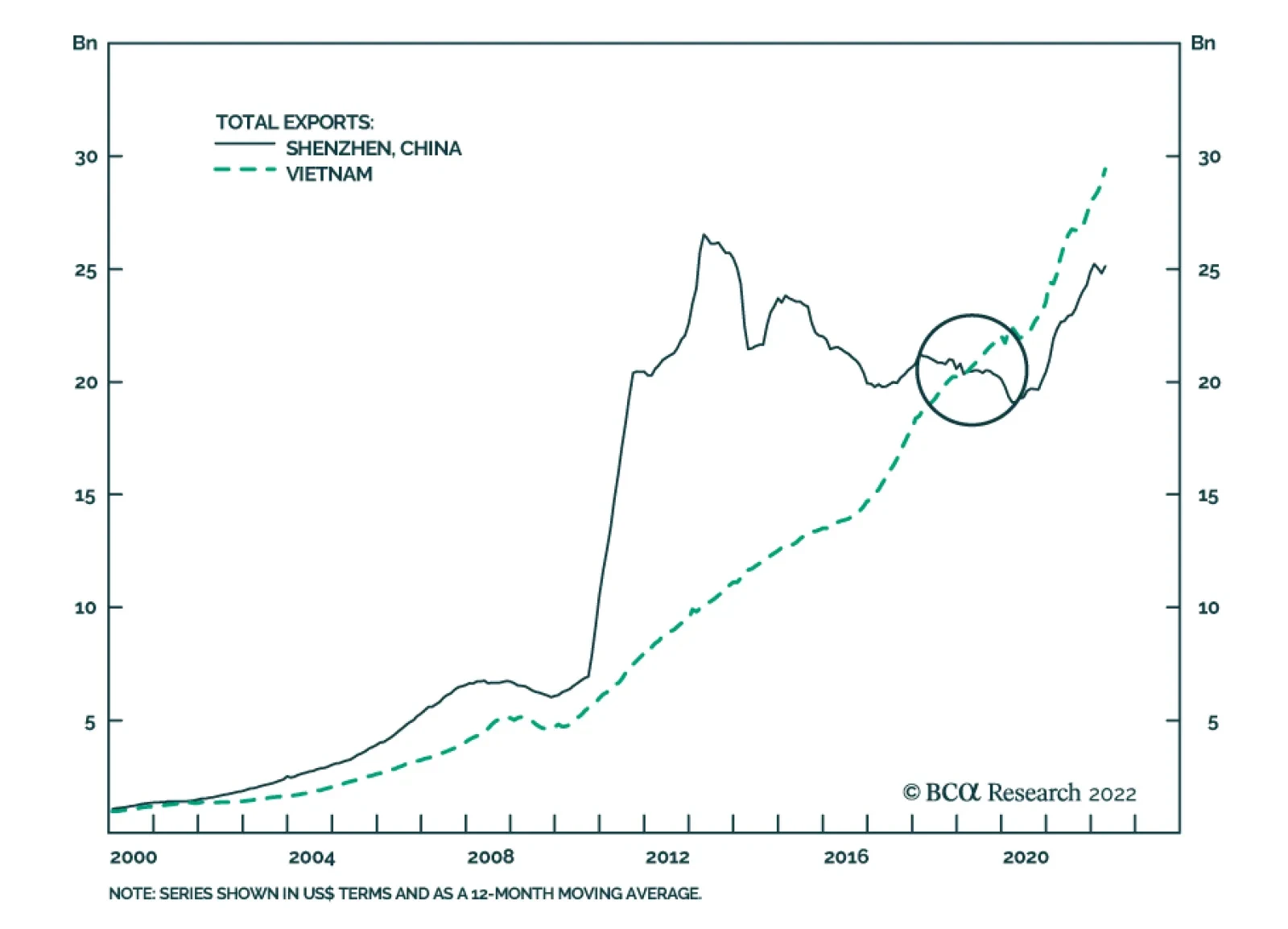

Recent data releases from Vietnam have been relatively resilient. The 22.6% y/y increase in May retail sales indicates that domestic demand is robust. And although export growth decelerated to 16.4% y/y from April’s 25% y/y…

Listen to a short summary of this report. Executive Summary US Financial Conditions Have Tightened Significantly This Year US financial conditions have tightened by enough that the Fed no…

Executive Summary KRW vs JPY: A Play On Global Slowdown And Lower US Bond Yields Global financial markets appear to be moving away from inflation worries to pricing in a major growth slump. Global growth is downshifting,…

Executive Summary EU Surprises Carbon Market With Increased CO2 Emission Allowance Supply The EU's failed foreign policy – premised on ever-deeper engagement with the Soviet Union and, after it collapsed, Russia…

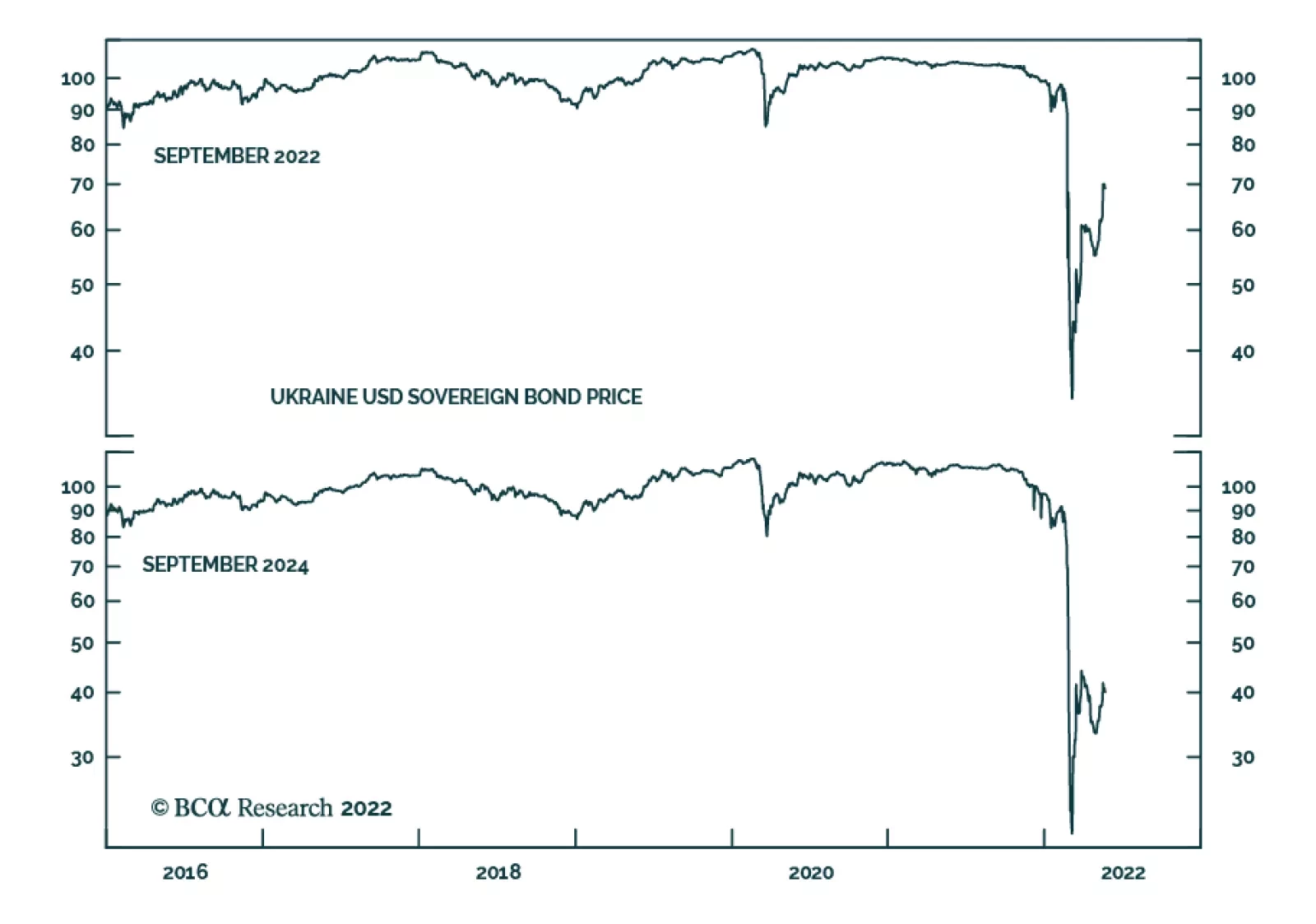

Although Ukranian US dollar sovereign bonds have rebounded since the beginning of the war, their risk-reward tradeoff is not yet attractive. First, the war is likely to be prolonged. US and NATO military and economic…

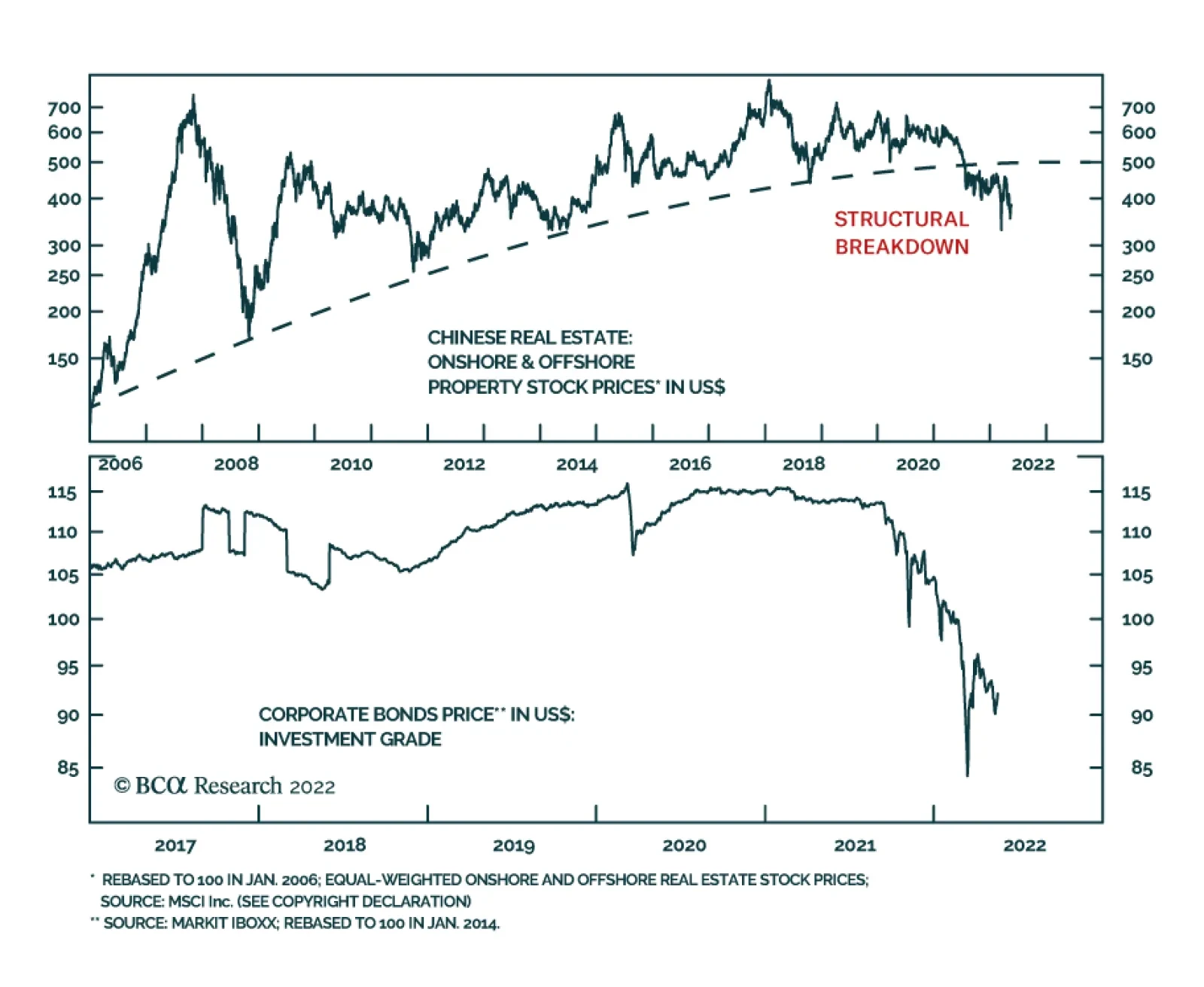

Executive Summary Credit Demand Collapsed Business activity data from April showed a broad-based contraction in China’s economy. Credit growth tumbled as demand collapsed. Bank loan expansion slowed by the most in…

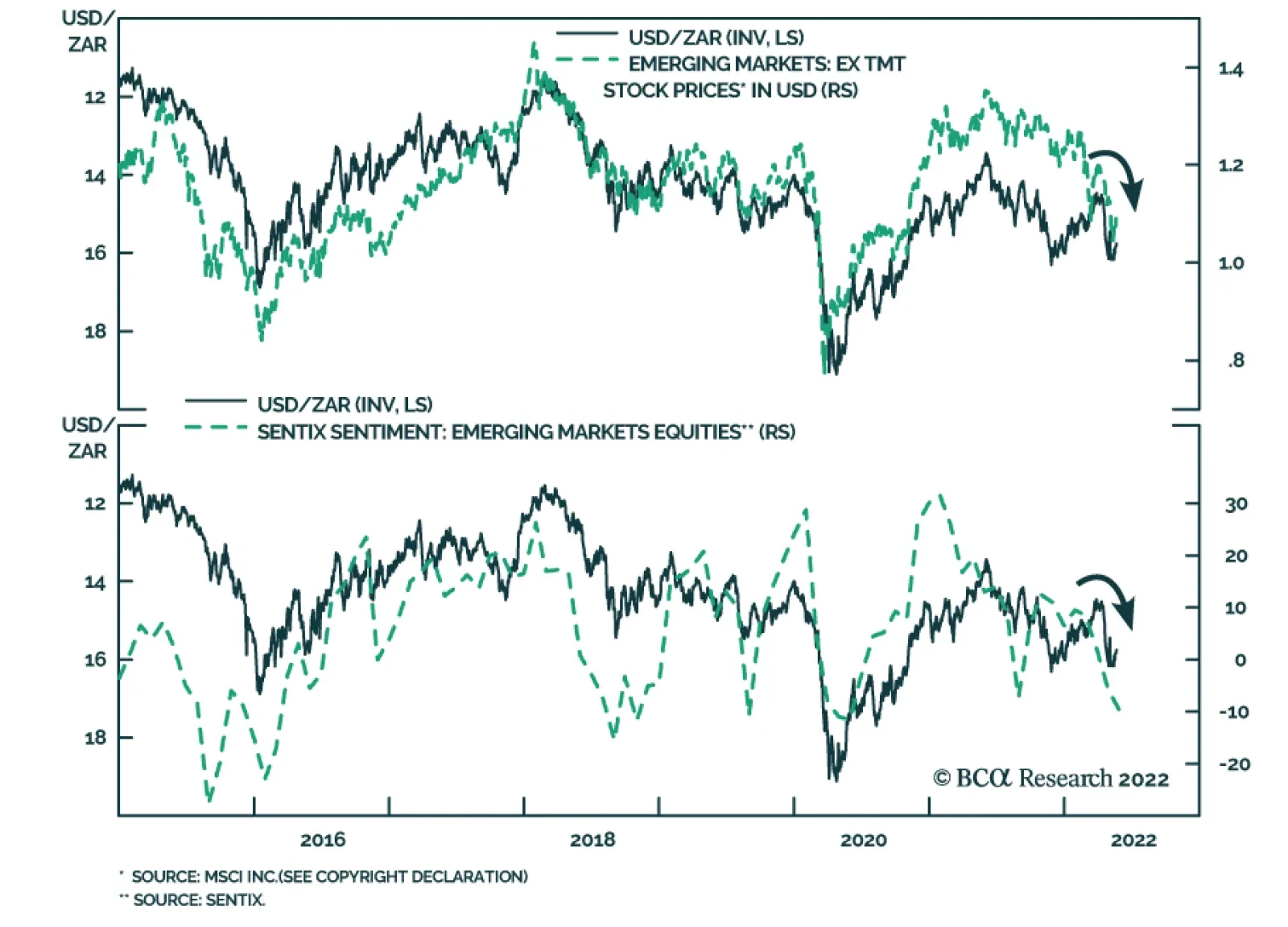

After a resilient first quarter, the South African rand experienced a sharp late-April selloff that brought it back down near late-2021 lows. However, the currency has been appreciating over the past week, recouping some of the…

Executive Summary Villains Still Lurking European assets and the euro already discount a significant worsening of Europe’s economic outlook. If the global economic situation were to stabilize, then European assets…

The PBoC reduced the five-year loan prime rate – the mortgage reference rate – by 15bps on Friday to 4.45%, below expectations of 4.55%. This marks the latest attempt by Chinese policymakers to revive the housing…