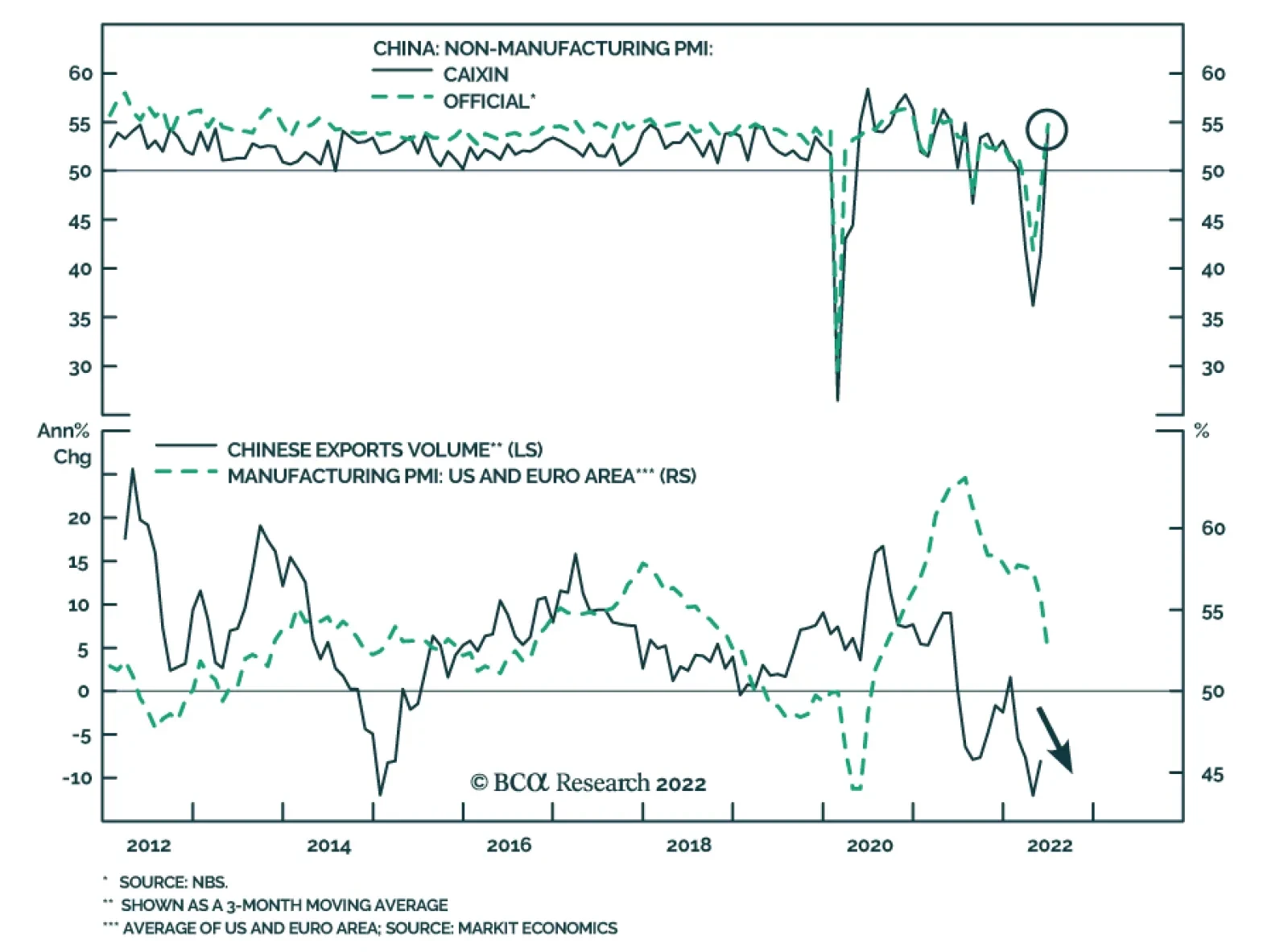

China’s service sector is expanding anew after 3 months of contraction. The China Caixin non-manufacturing PMI surged to 54.5 in June from 41.4 in May, handily exceeding expectations of 49.6, and pointing to the…

Highlights Chart 1Are Expectations Too Dovish? The dominant market narrative has clearly shifted in the last few days. The primary concern among investors used to be that the Fed had fallen behind the curve on inflation. Now…

Executive Summary China: GeoRisk Indicator A new equilibrium between NATO, which now includes Sweden and Finland, and Russia needs to be reestablished before geopolitical risks in Europe subside. Russia aims to inflict a…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of the year and beyond.

Executive Summary Accelerating wages will make core consumer inflation sticky in the US. In addition, inflation is a lagging variable and is still well above the Fed’s target. These dynamics imply that the Fed will not make a…

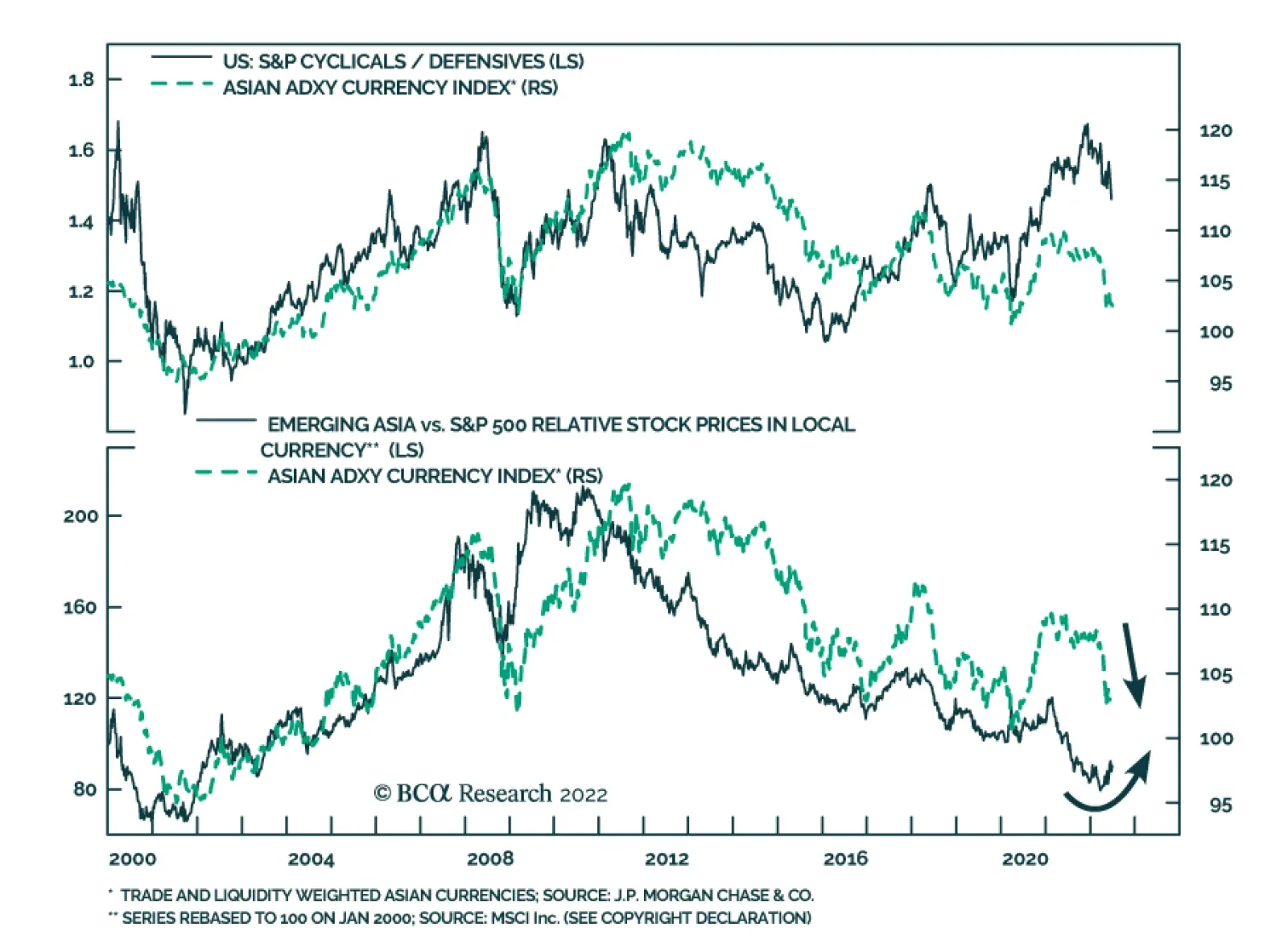

The signal from Asian currencies is consistent with trends within US equities. The ADXY – a trade-weighted index of emerging Asia’s most actively traded currencies vis-à-vis the USD – has collapsed below…

Executive Summary Long-Term Contracts Needed To Increase LNG Supply The EU will have to reverse course and execute long-term contracts with natural gas producers, LNG shippers and pipeline operators to incentivize…

Executive Summary There has never been a modern era recession or sharp slowdown in which the oil price did not collapse. In a recession, the massive destruction of oil demand always overwhelms a tight supply. Across the last six…

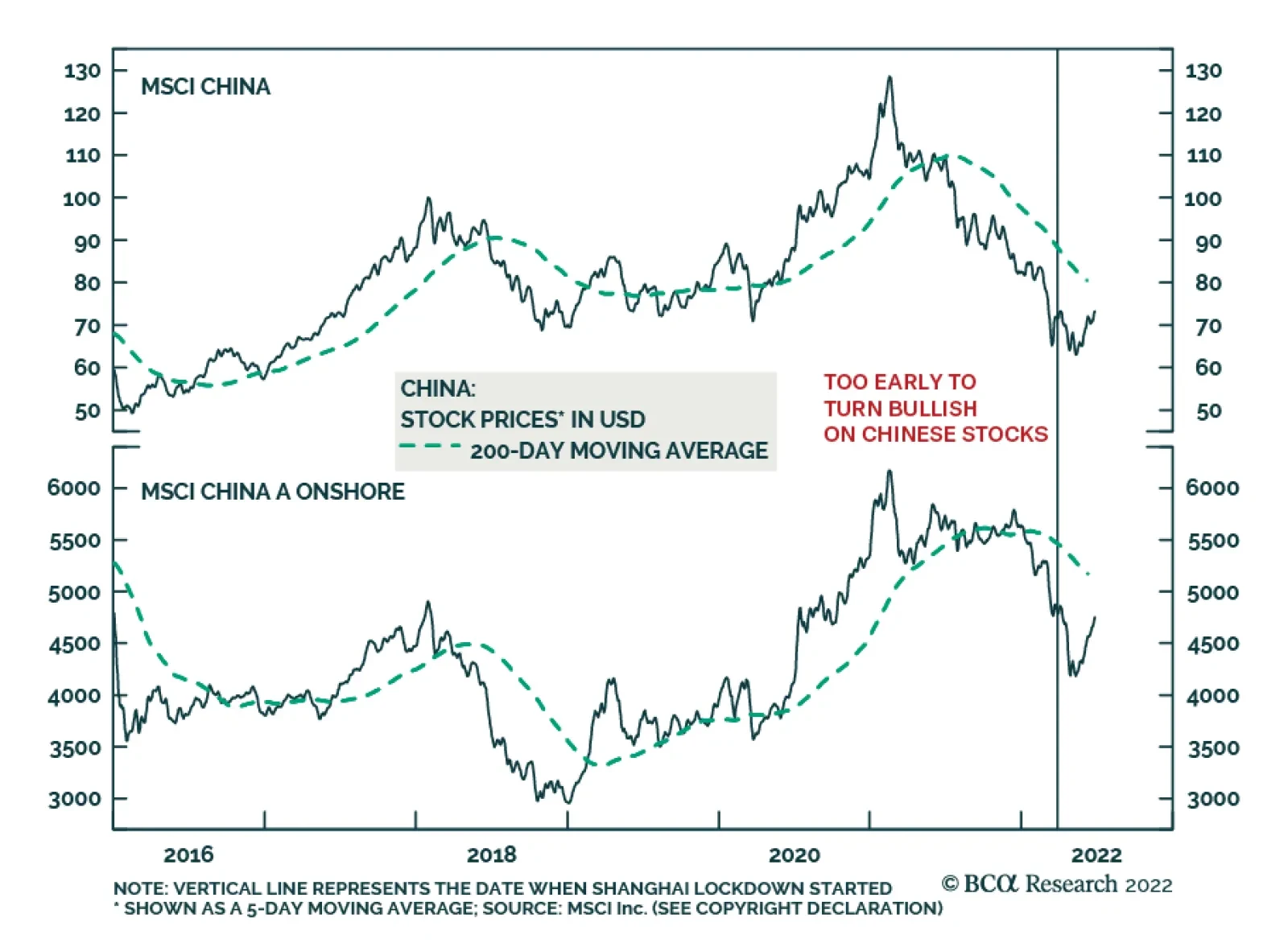

BCA Research’s China Investment Strategy service continues to recommend a neutral stance in Chinese equities within a global portfolio. China’s economic data moved up slightly in May from an extremely depressed…