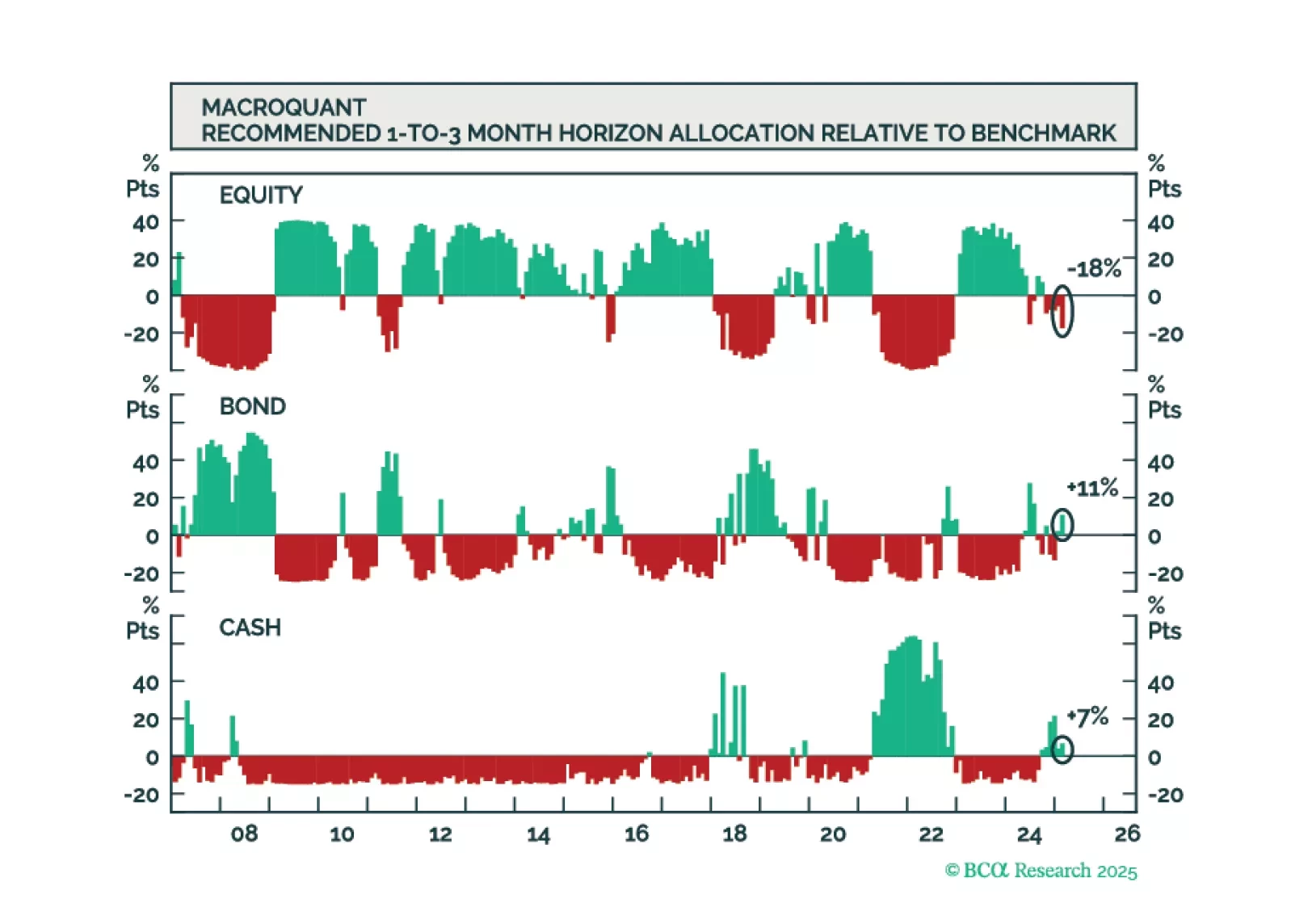

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

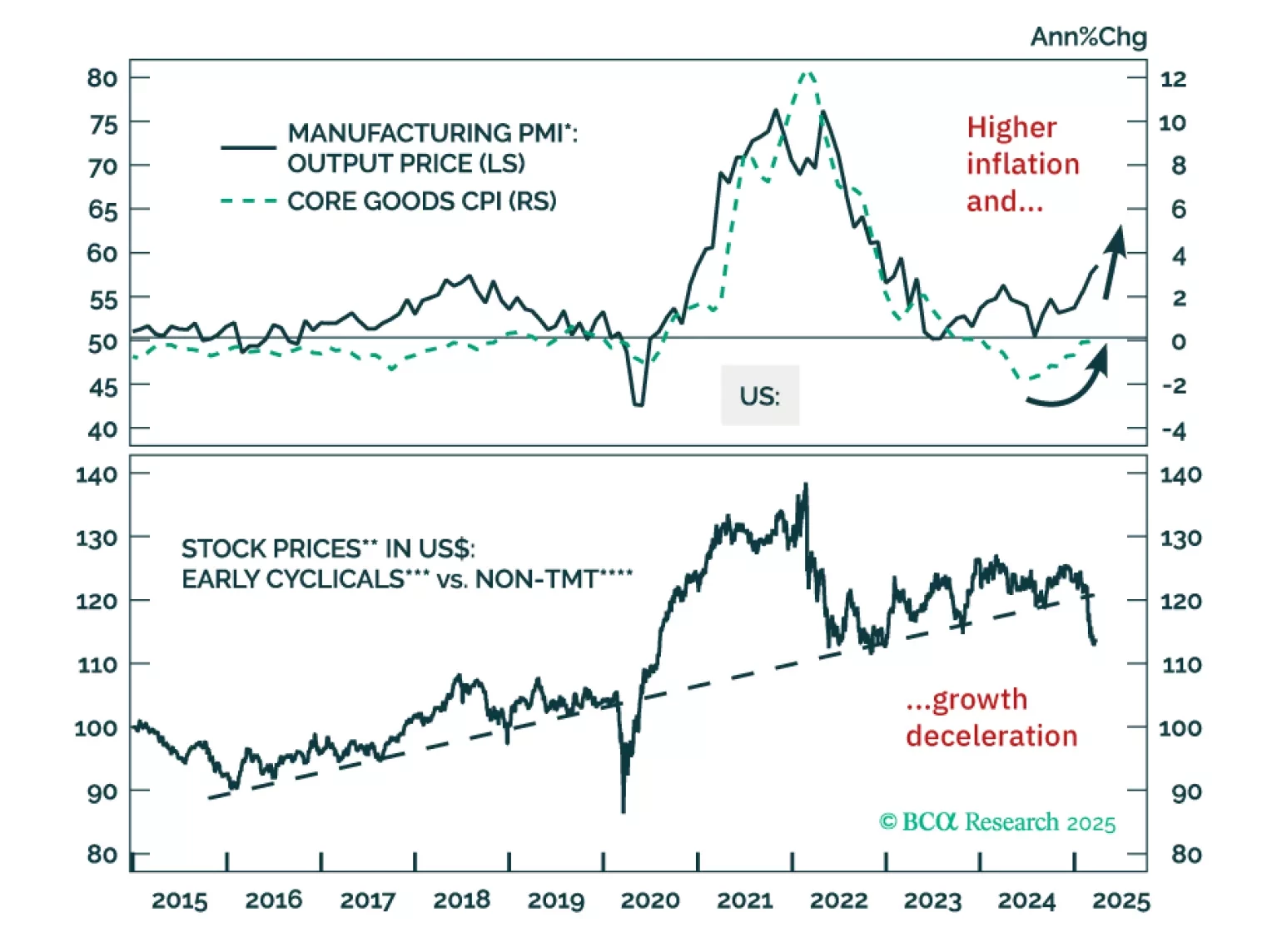

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

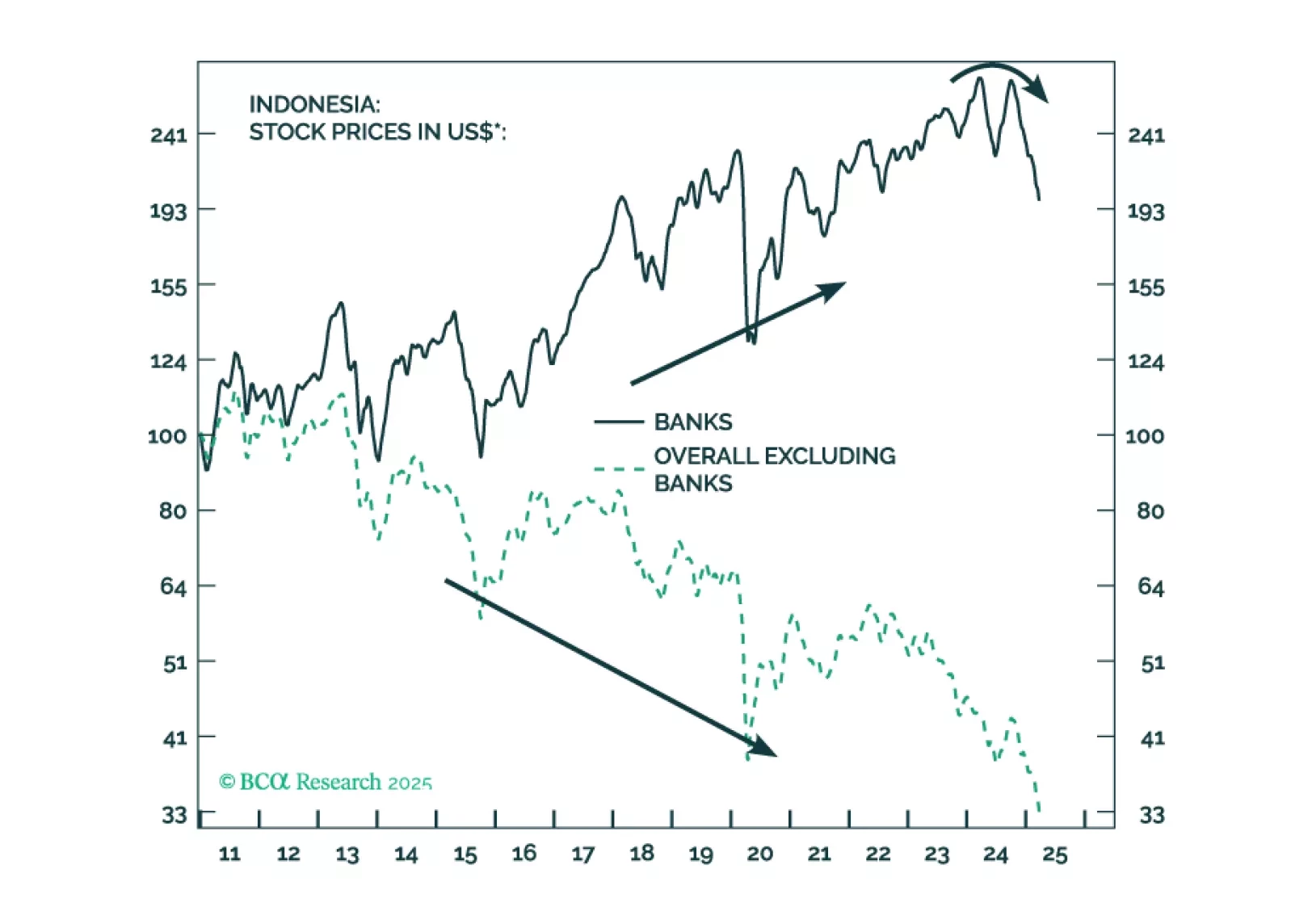

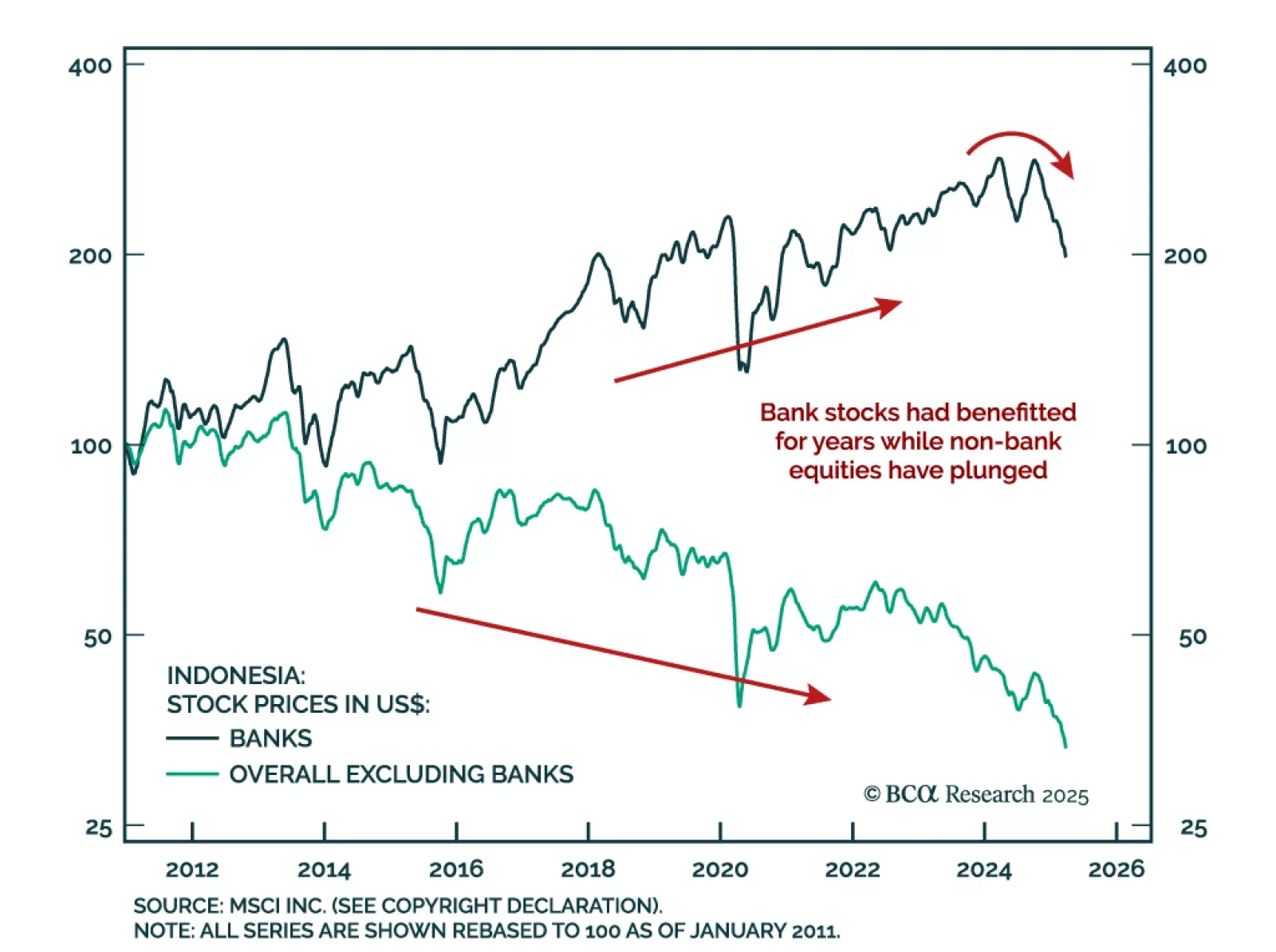

Our Emerging Markets strategists maintain a neutral view on Indonesia within EM equity and bond portfolios but continues to recommend shorting the rupiah versus the US dollar. They are closing their long Indonesian banks/short EM…

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

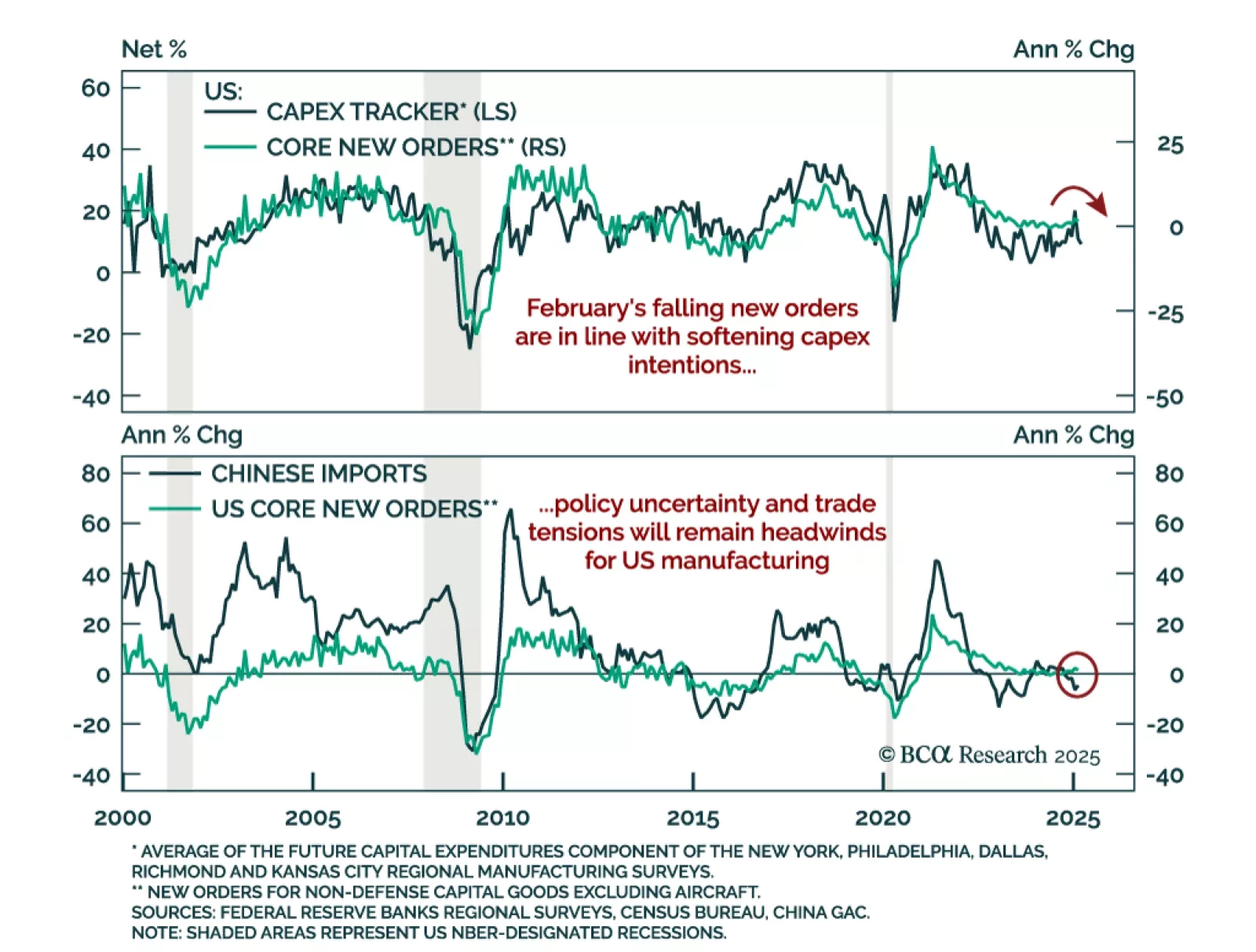

A drop in core capex orders points to slowing business spending and softening global growth. Businesses appear to have front-loaded shipments ahead of potential tariffs while deferring new orders amid policy uncertainty. With hiring…

This report presents our interpretation of signals from the main equity, bond, and currency markets around the world. The key takeaways are: (1) Chinese stocks are behind the resilience of the EM MSCI Index; (2) …

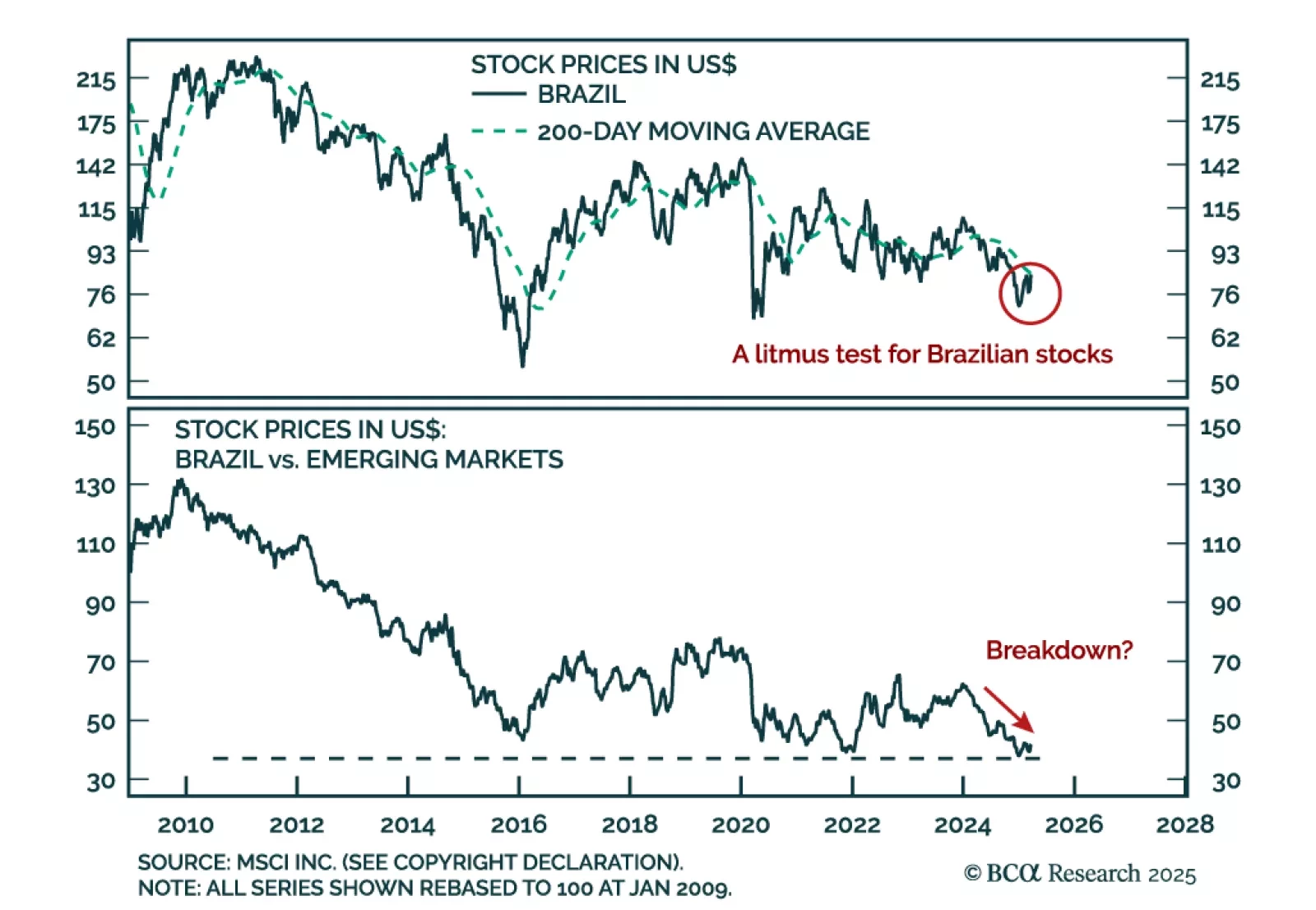

Our Emerging Market strategists downgraded Brazilian equities as public debt dynamics deteriorate and macro fundamentals weaken. While they previously maintained a neutral stance despite being bearish on the Bovespa, the risks have…

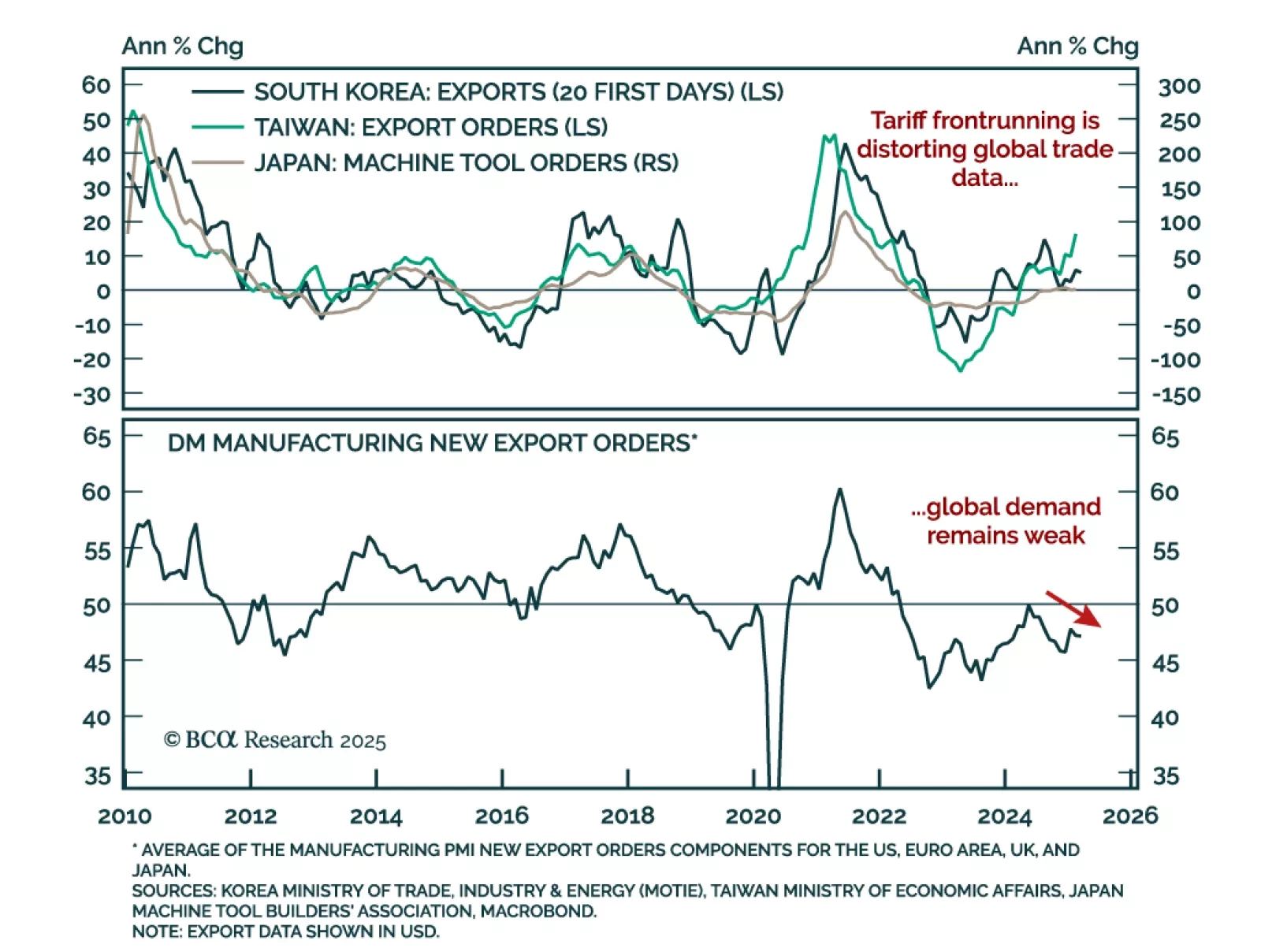

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

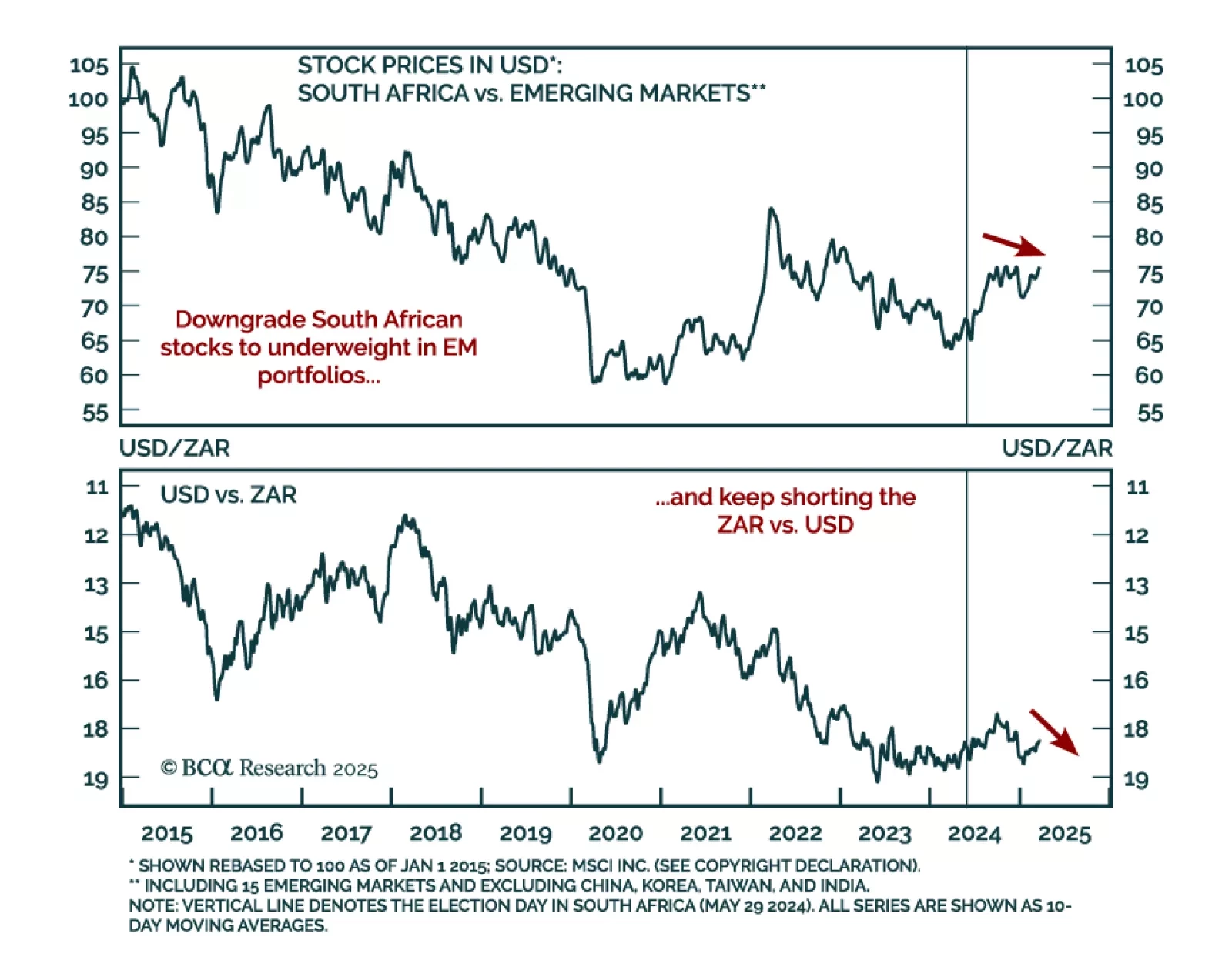

Our Emerging Market strategists reviewed their recommendations on South African assets as economic prospects start fading. South Africa’s fiscal tightening will suppress growth without achieving the necessary 4.2% primary…