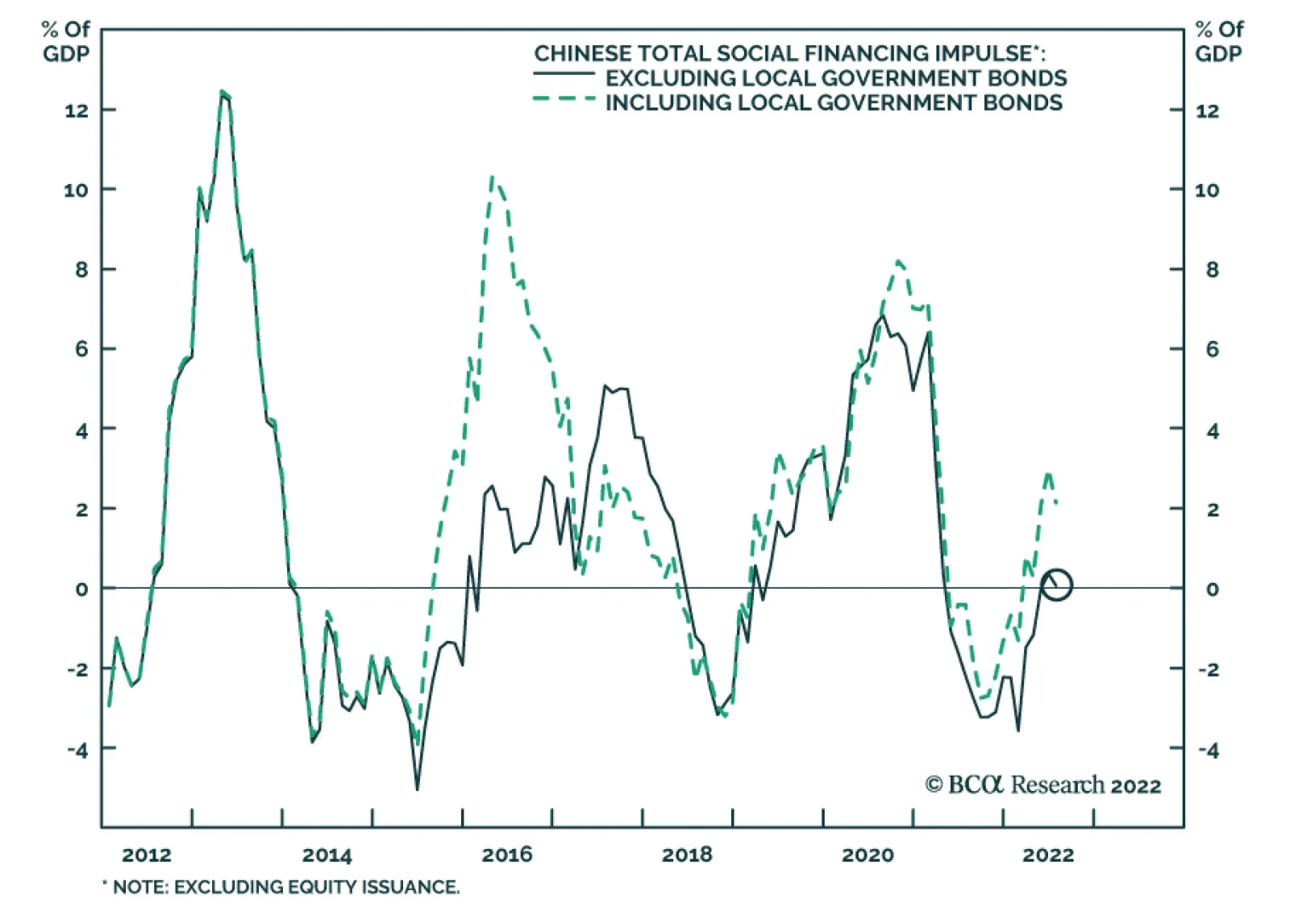

Chinese credit growth slowed in July with aggregate financing totaling CNY 756 bn, significantly below both June’s CNY 5.17 tn and expectations of CNY 1.35 tn in July. New loans slumped to CNY 679 bn from CNY 2.81 tn,…

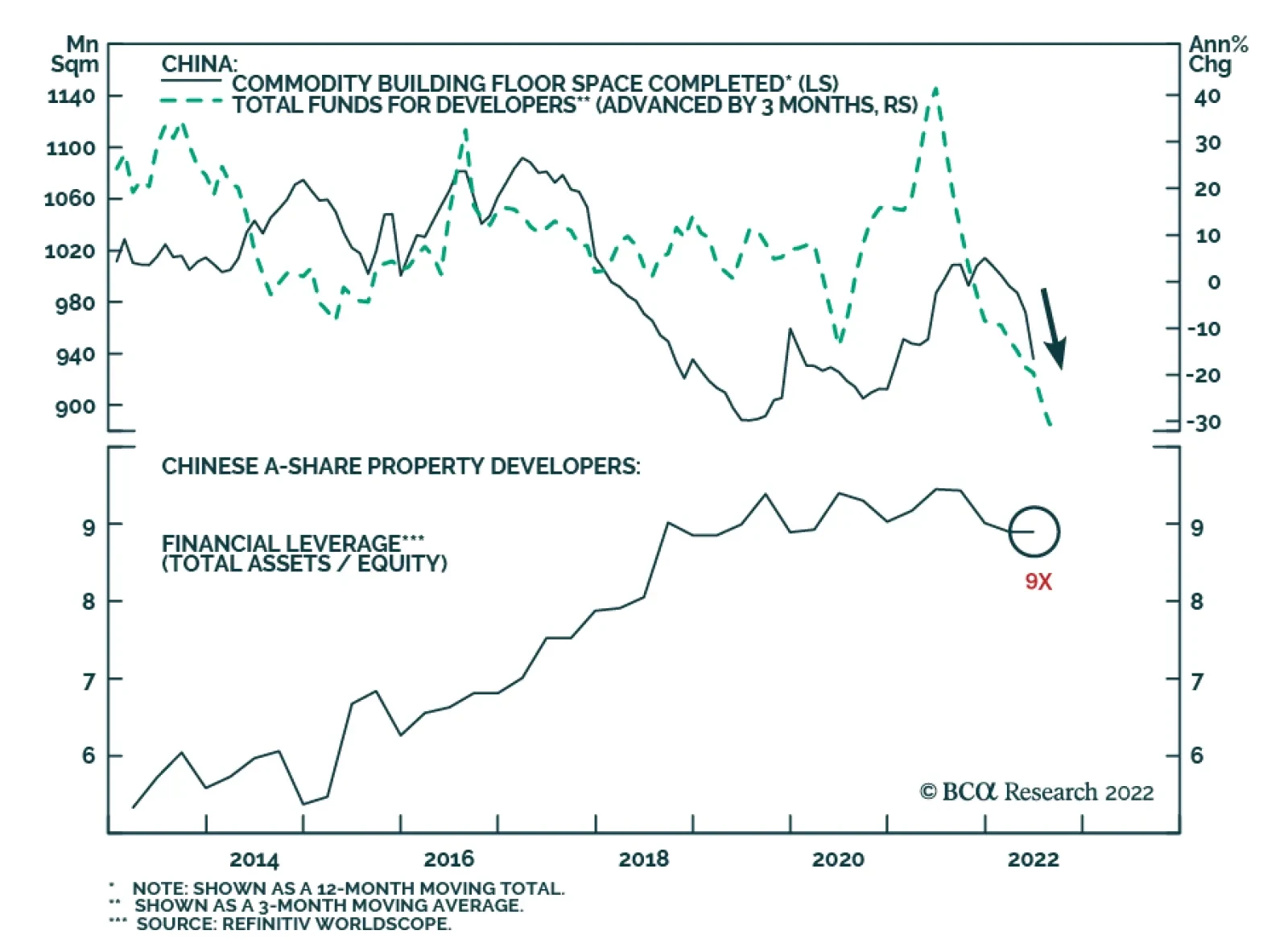

According to BCA Research’s Emerging Markets Strategy service, Chinese housing market woes (among other factors) will reduce the efficiency of current stimulus measures. In particular: The bailout funds for…

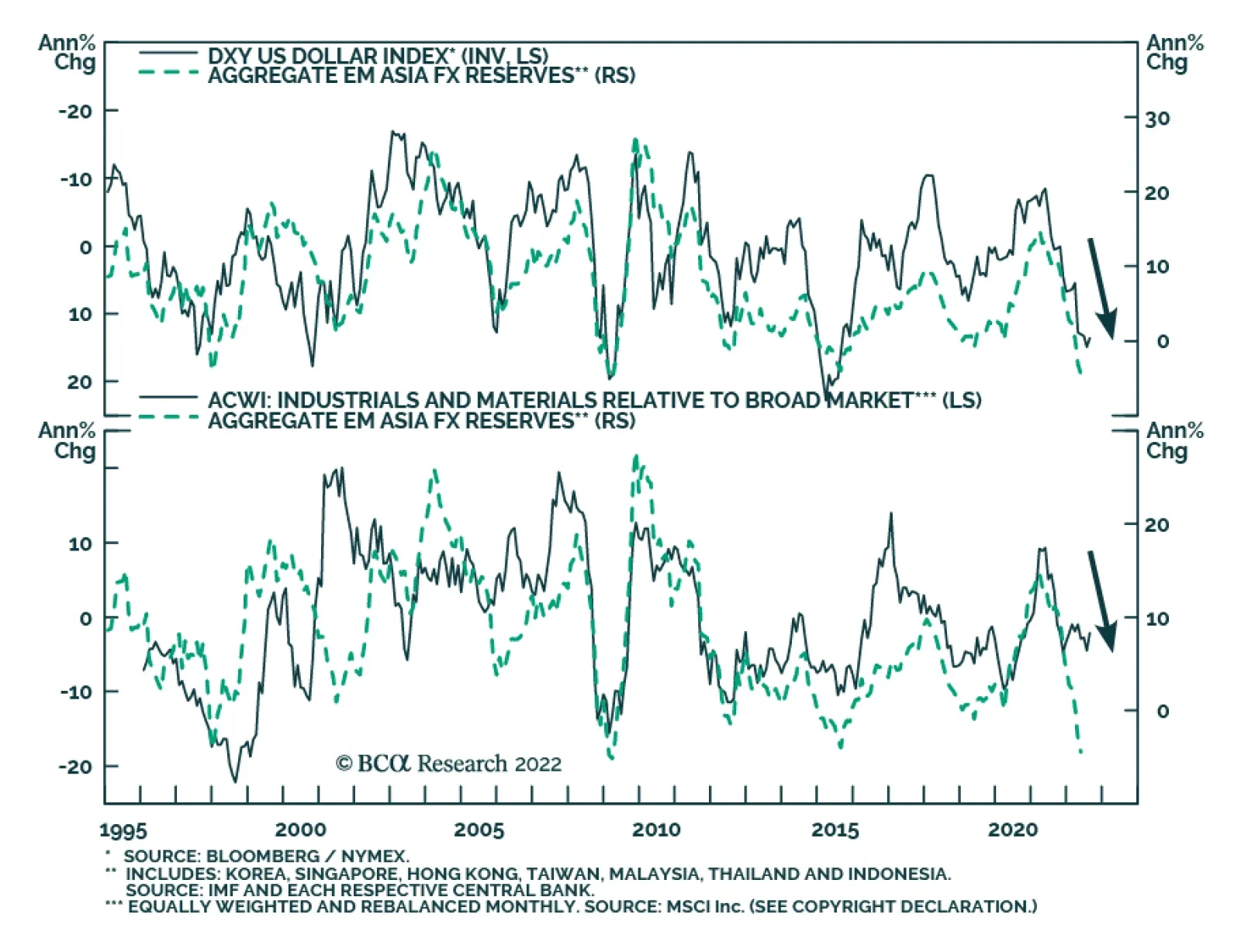

FX reserves in Emerging Asian economies (ex-China) have been falling. The broad-based nature of this dynamic is particularly noteworthy as Indonesia, Thailand, Malaysia, Hong Kong, Singapore, and South Korea are all…

Executive Summary Oil Markets Remain Tight US and Iranian negotiators received an EU proposal for reviving the Iran nuclear deal on Monday, which could return ~ 1mm b/d of oil to markets. The EU’s embargo of…

Executive Summary Unit Labor Costs, Not Oil Prices, Are The Key To US Core Inflation Inflation is not about oil, food or used car prices. Looking at prices of individual components of a consumer basket is akin to missing…

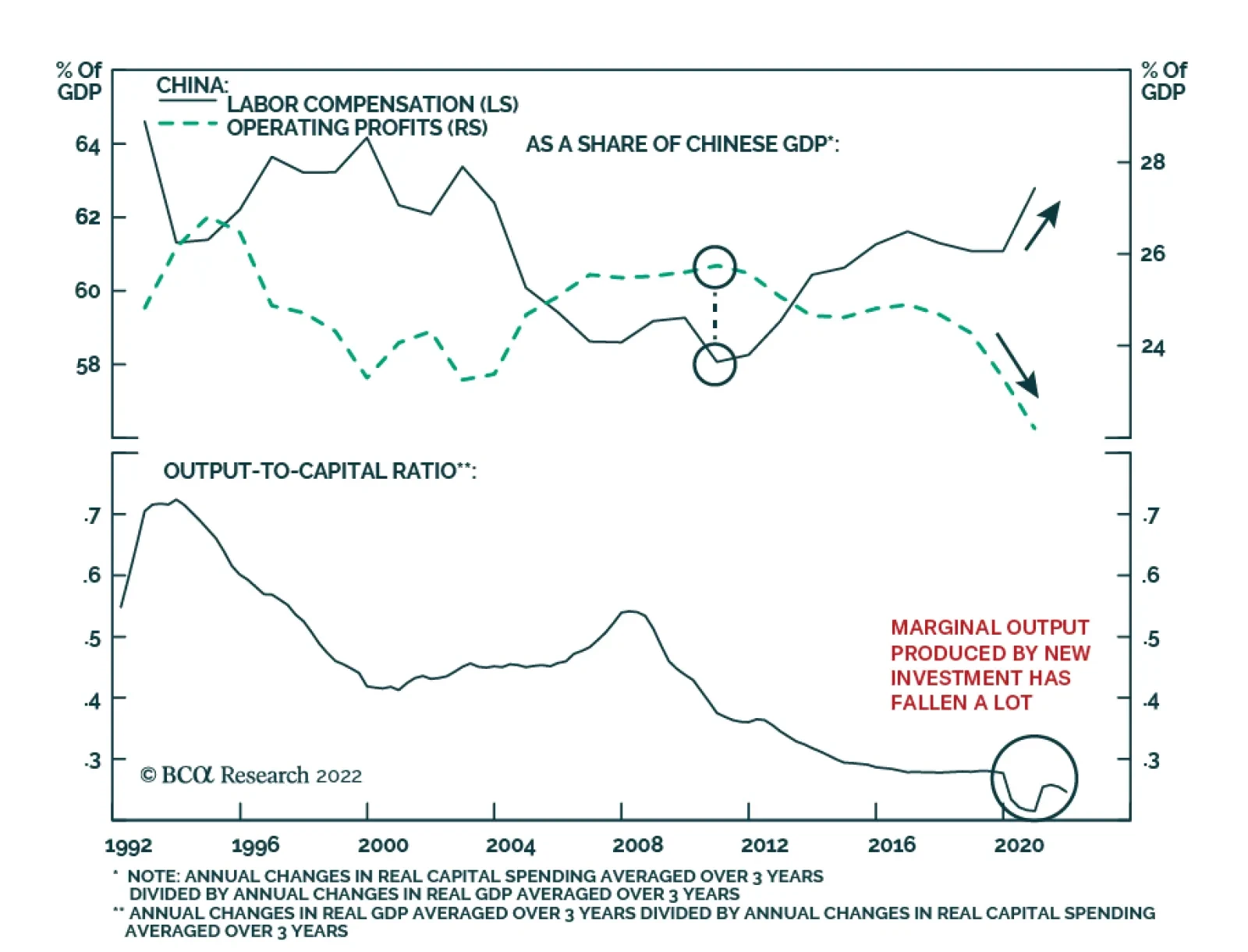

According to our China Investment strategists, the following factors will weigh on China’s corporate profitability in the long term: 1. Demographics and rising labor costs: A shrinking workforce since mid-2010s has led…

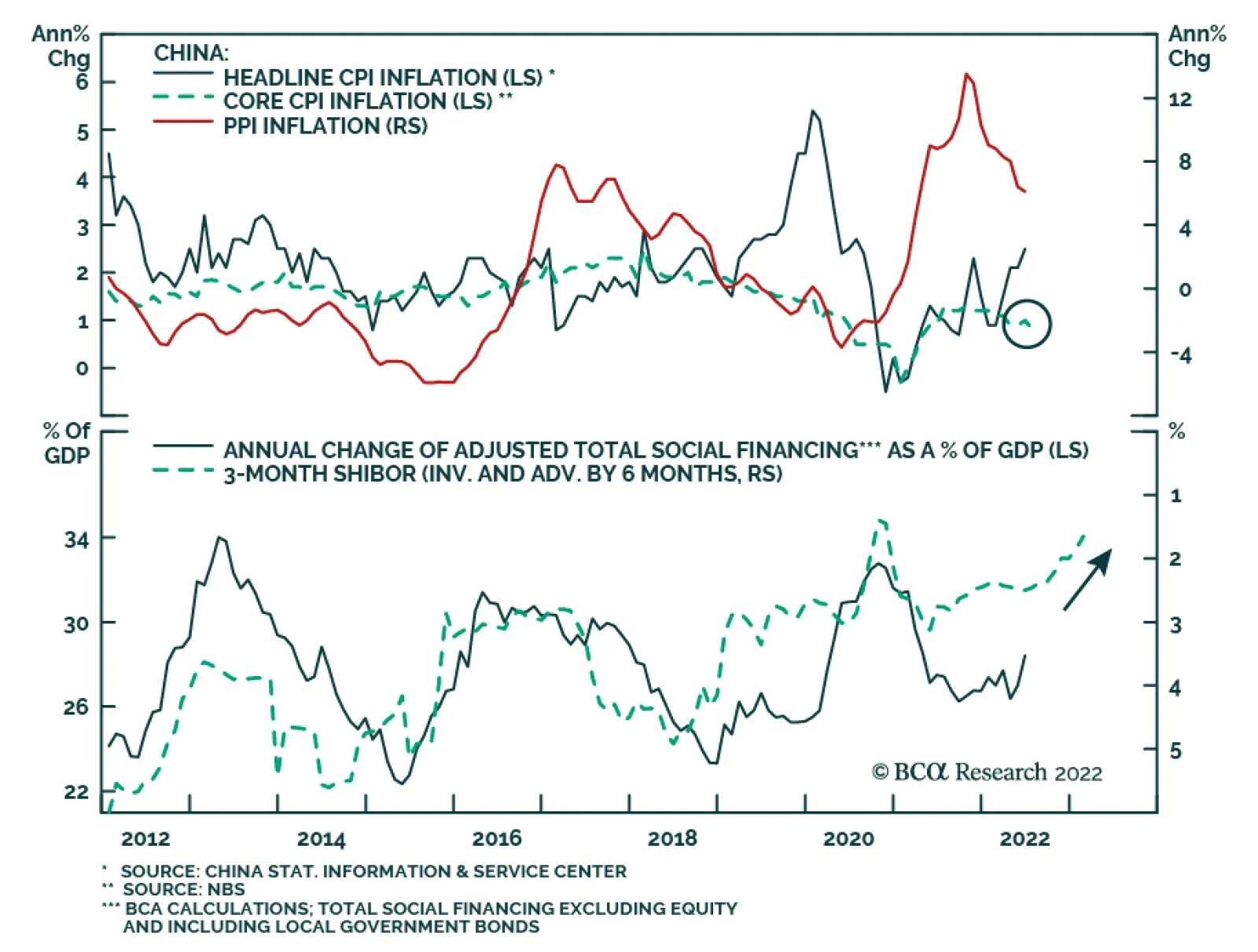

Although Chinese headline CPI inflation increased from 2.5% to a 2-year high of 2.7% in July, the details of the release suggest that the PBoC (unlike many of its global peers) does not face pressure to tighten policy. In…

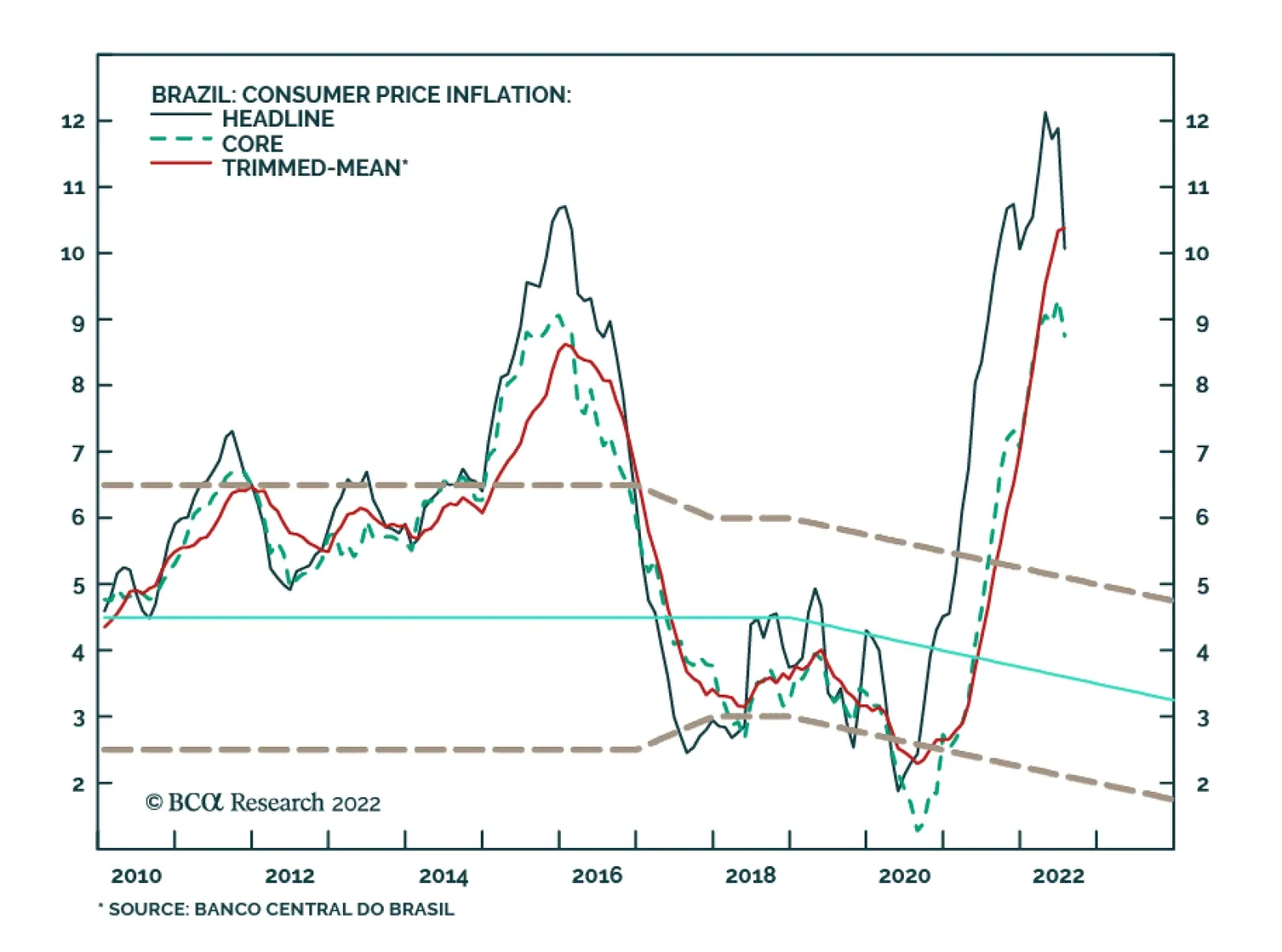

Last week, the Central Bank of Brazil (BCB) announced another 50bp rate hike, which is smaller than previous 75-150bp increments. In addition, the BCB stated that “the Committee will assess if maintaining the Selic rate by…