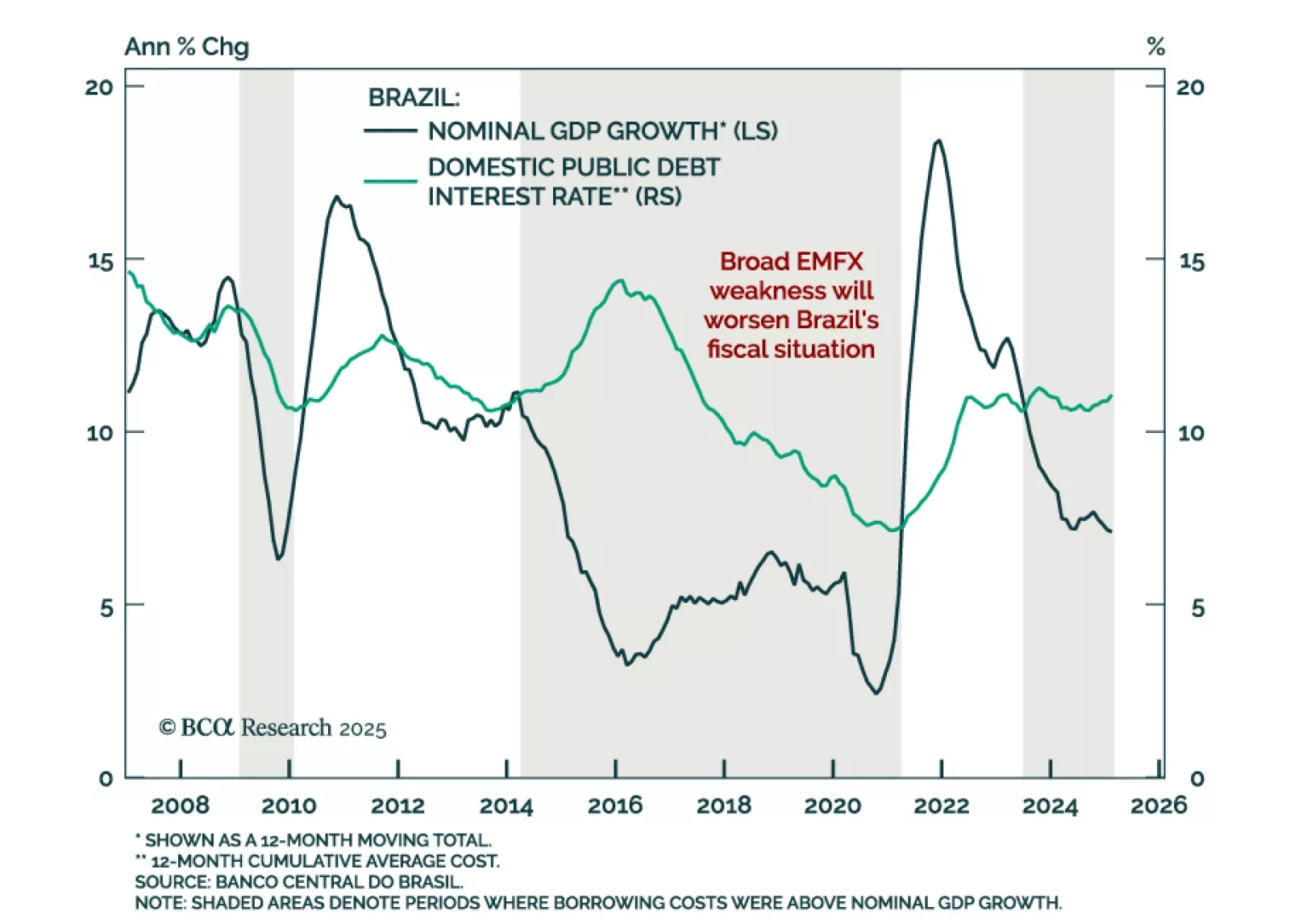

Brazil’s deteriorating fiscal dynamics and rising stagflation risks reinforce our negative stance on Brazilian assets, both outright and relative to EM peers. The latest global financial turmoil, combined with President Trump’s…

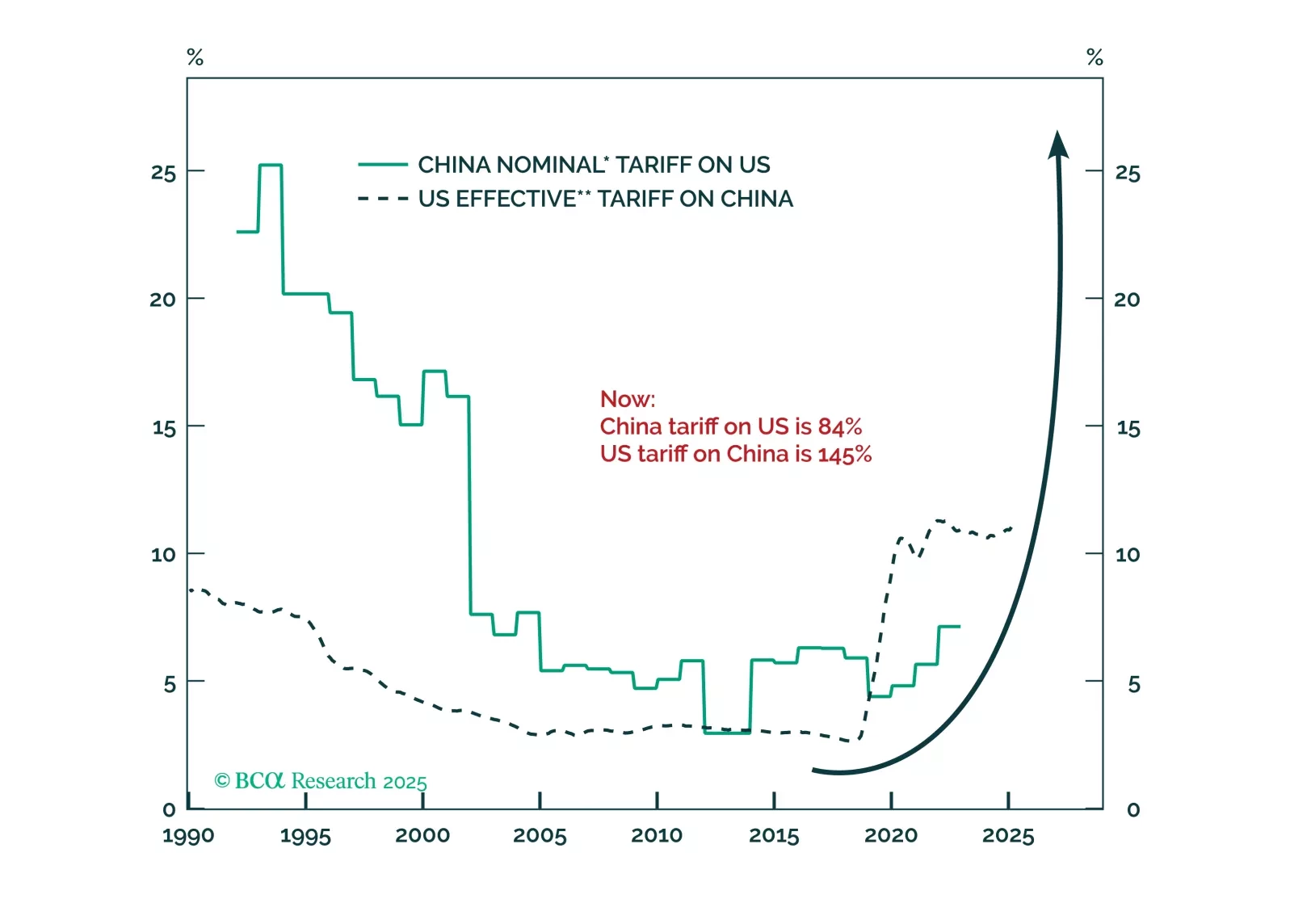

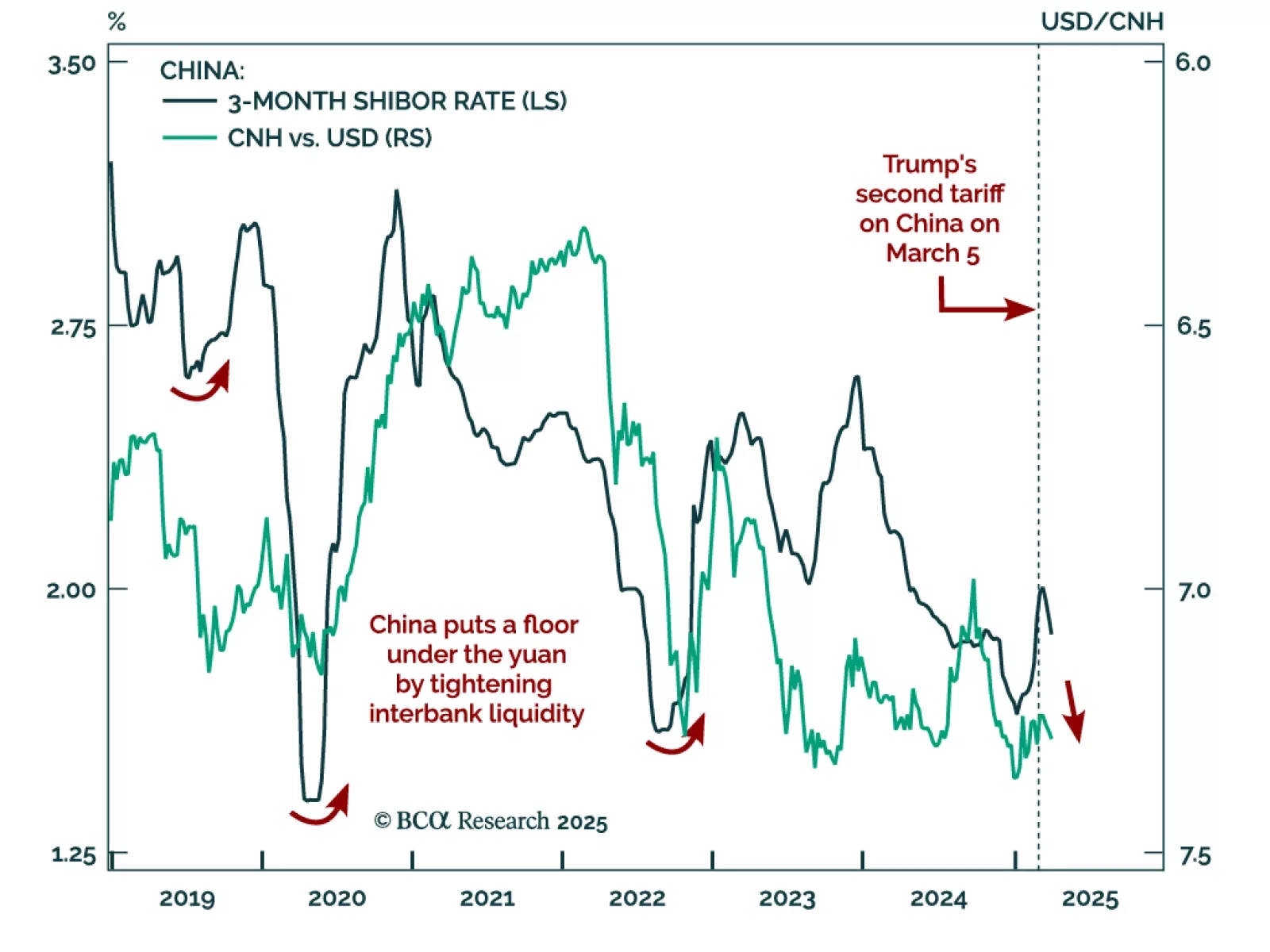

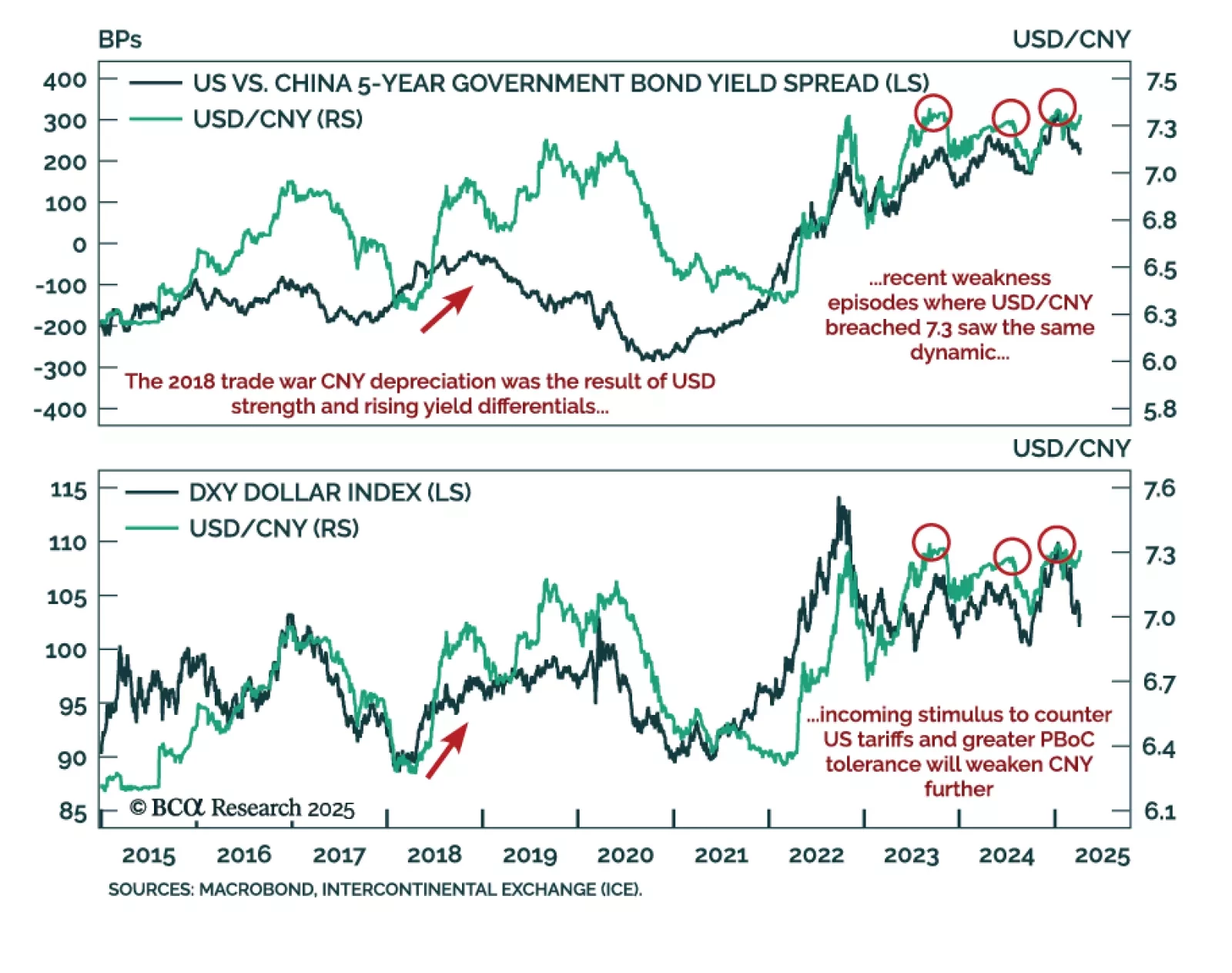

China prepares to devalue the yuan in response to US tariffs. Our Emerging Markets strategists recommend shorting CNH, downgrading offshore Chinese equities, and staying bearish on global risk assets. Beijing sees the tariffs as a…

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

Our Portfolio Allocation Summary for April 2025.

USD/CNY’s break above 7.3 signals more downside is in store for the yuan, supporting short high-beta FX and long CHF and JPY positions. The CNY has weakened in 2025 even as the US dollar has depreciated against most major currencies…

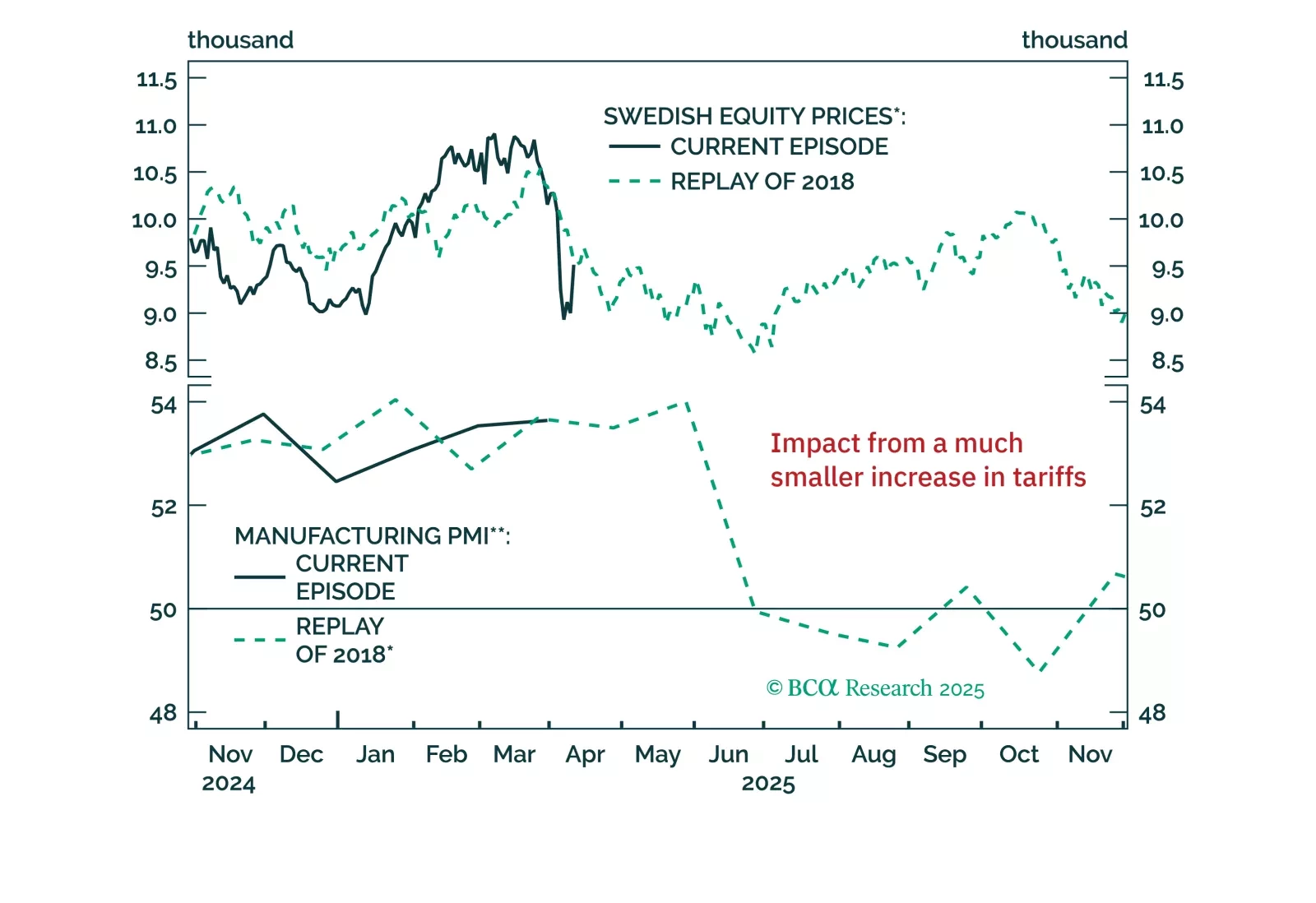

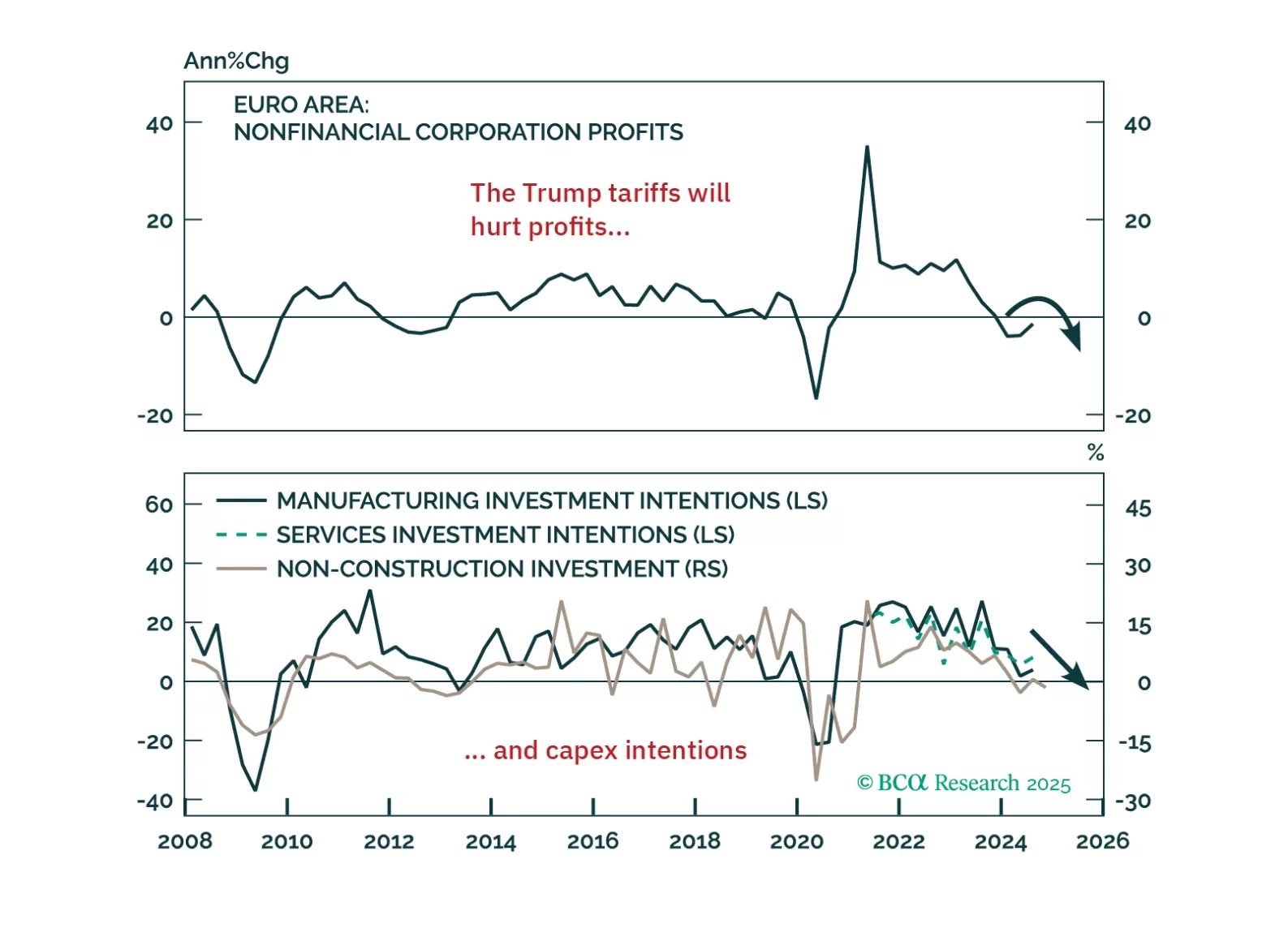

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

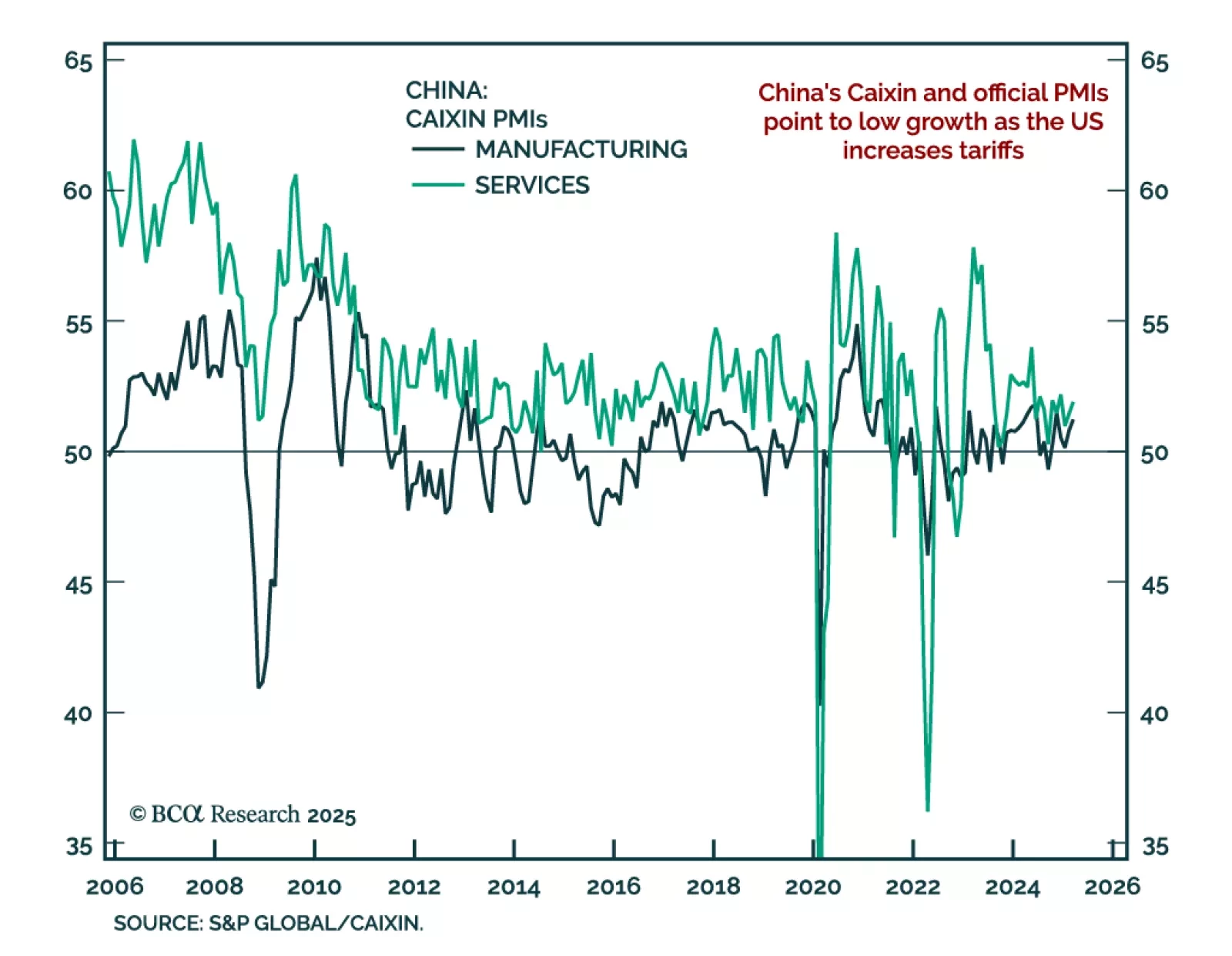

China’s economy remains subdued, supporting our overweight in onshore local-currency bonds and a selective approach to local equities. March Caixin PMIs showed only marginal improvement, with the composite index rising to 51.8 from…

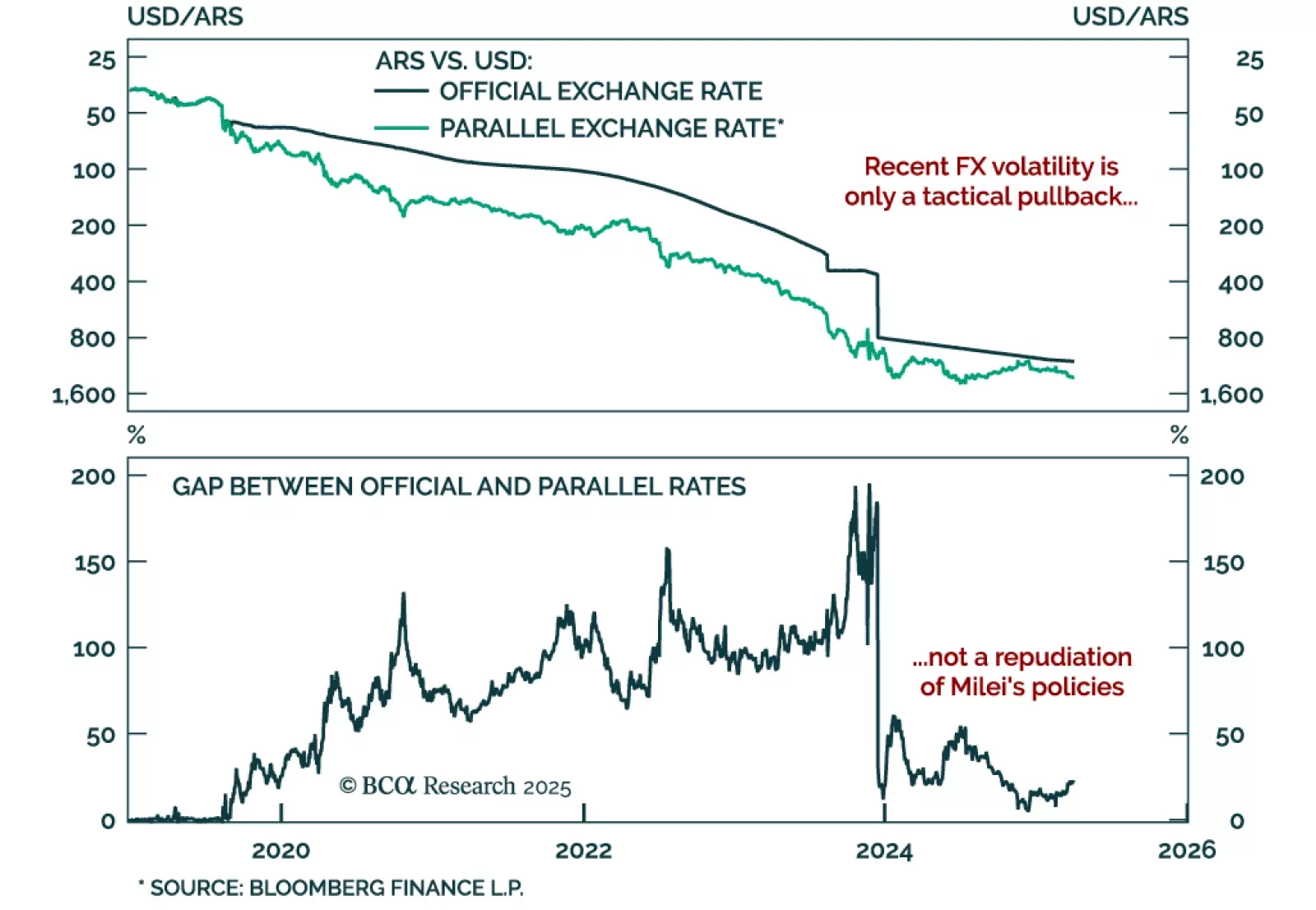

Remain constructive on Argentine assets as recent market moves are a tactical pullback, not a loss of confidence. The gap between official and parallel exchange rates has widened, prompting concerns that markets are questioning…