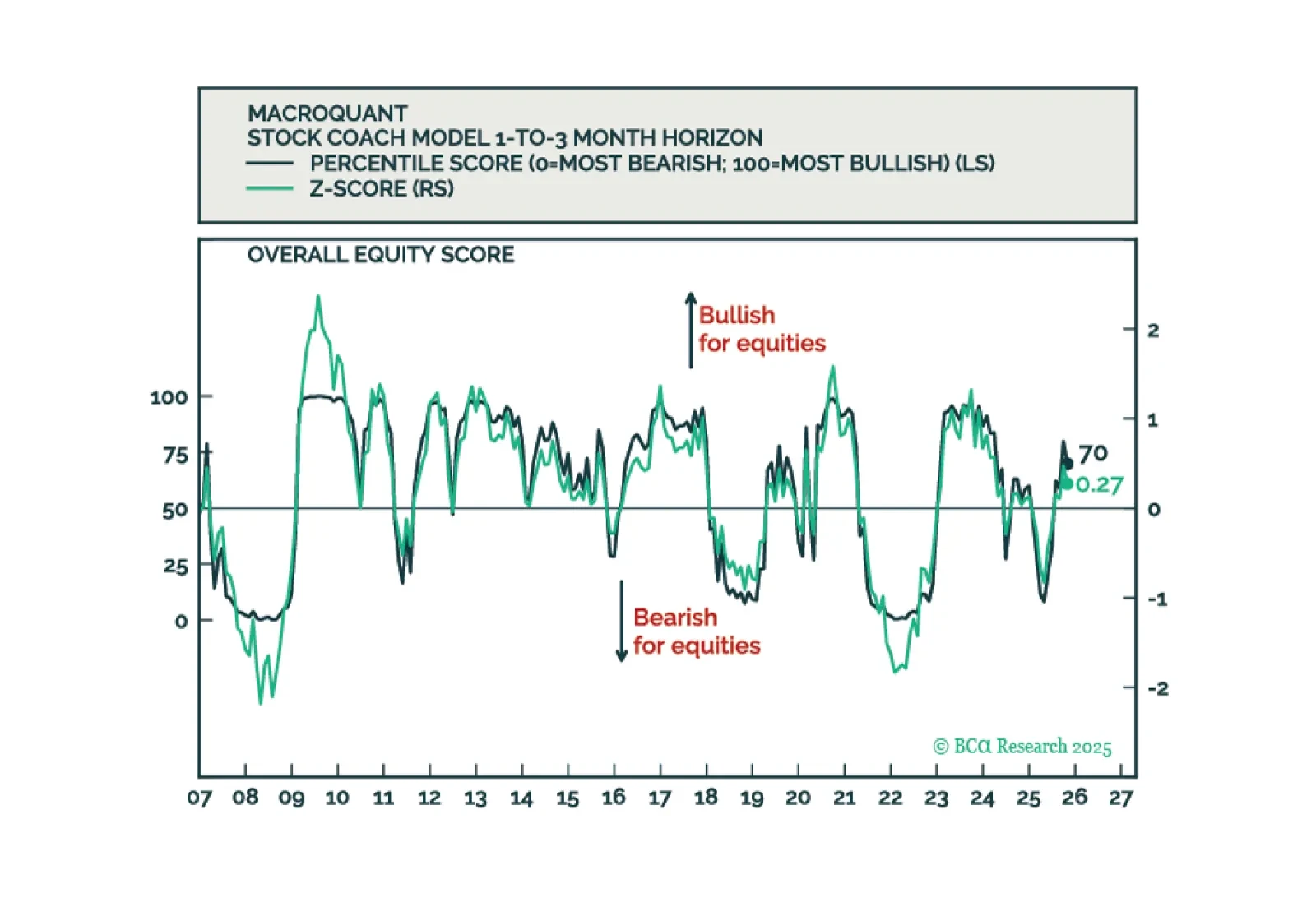

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

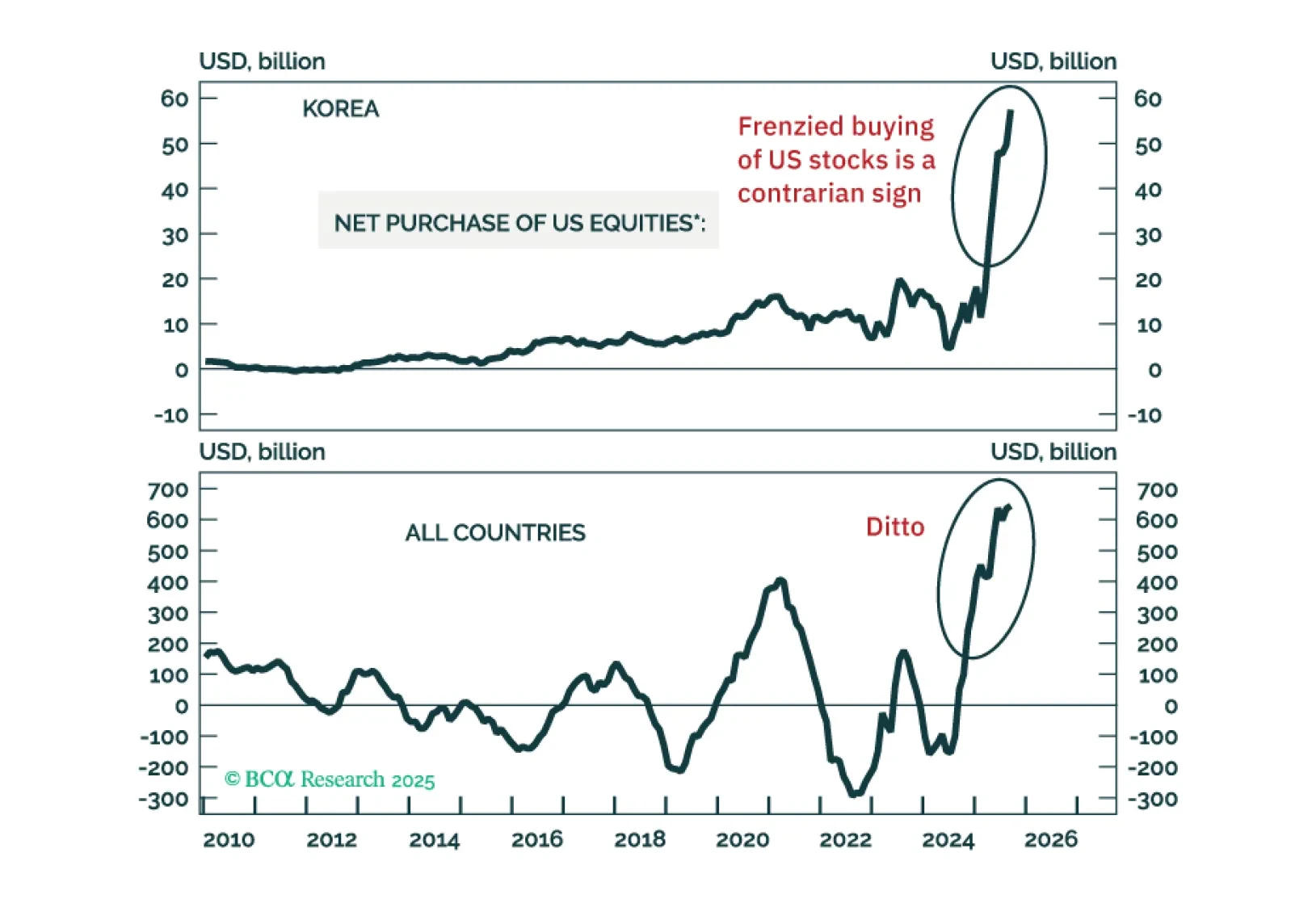

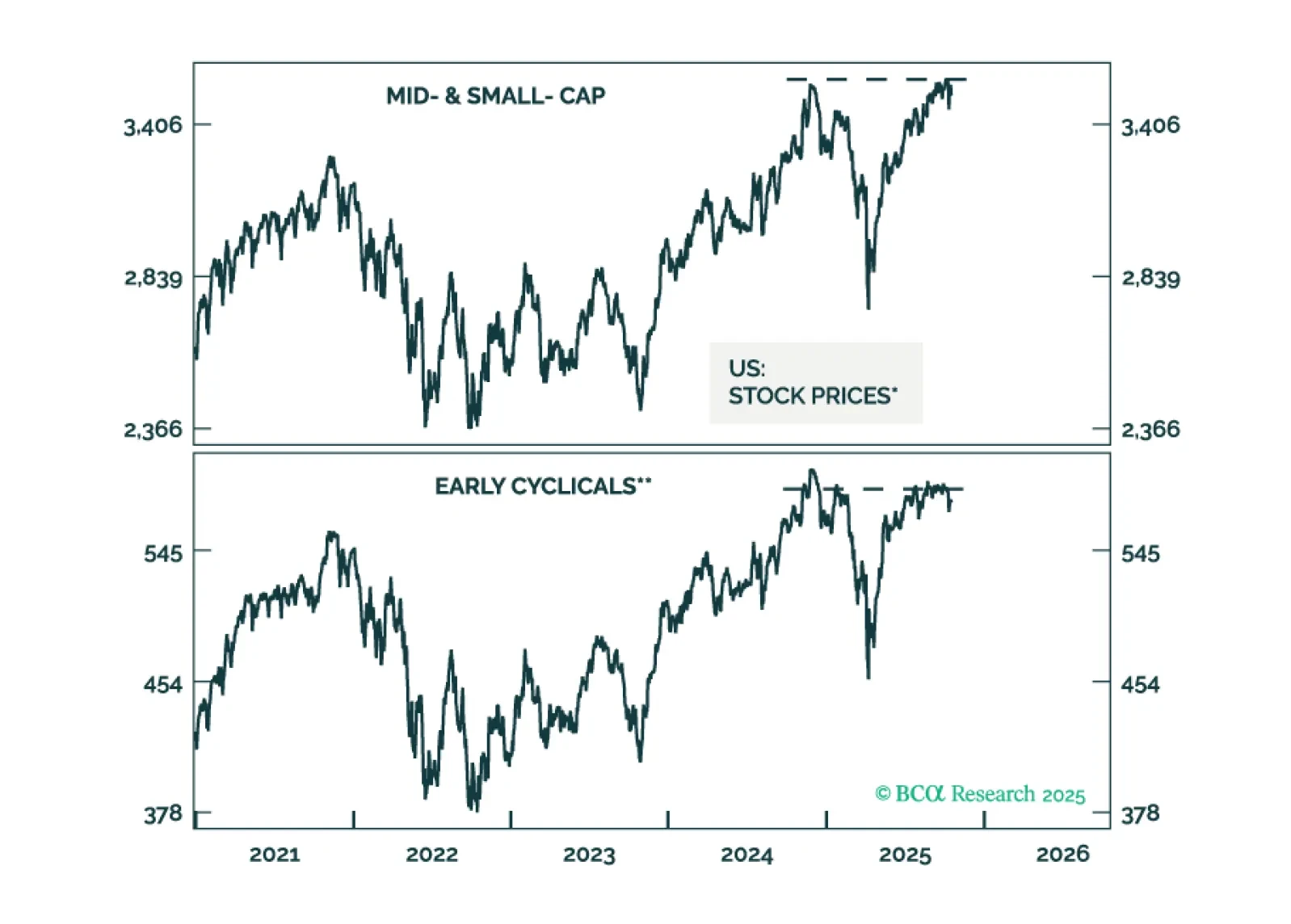

Many key equity indexes have failed to break above major resistance levels, while risky segments have begun to crack. Altogether, this suggests that a major peak in risk assets has probably been made. Short the MSCI EM stock index…

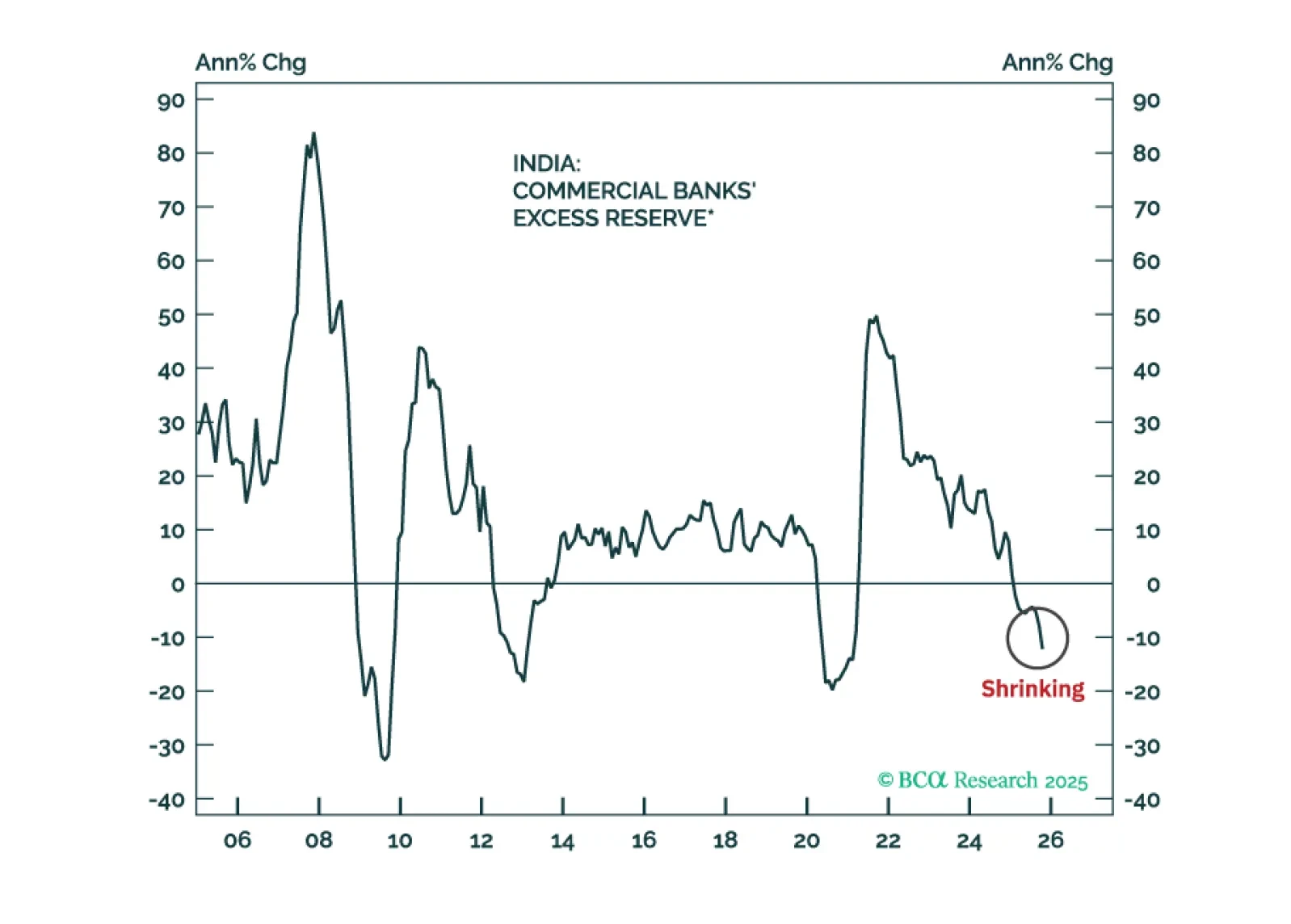

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

We recommend a new relative tech equity trade that will likely produce positive returns over the next six to 12 months, regardless of whether the AI hype continues or reverses.

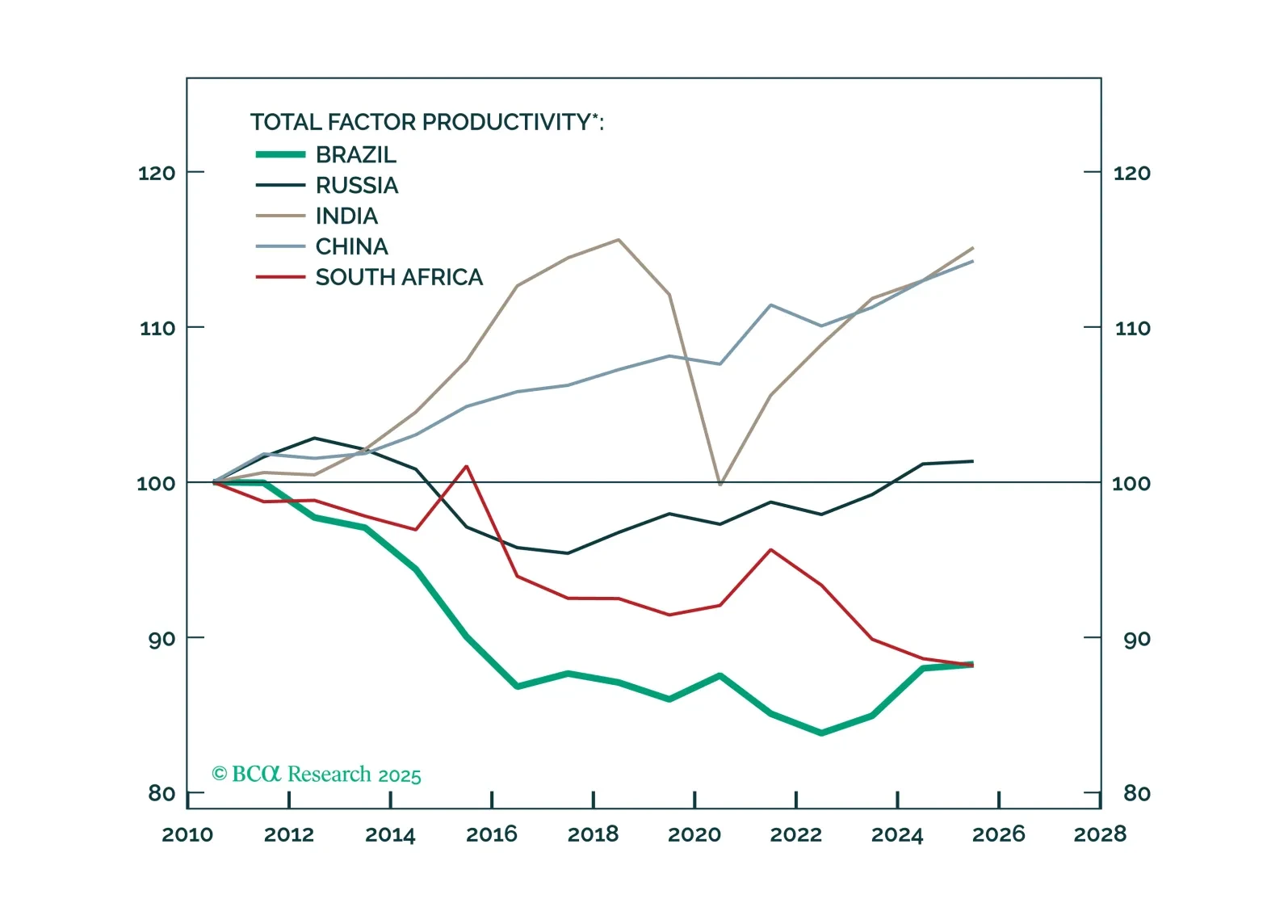

Brazil’s bleak macro outlook persists – rising debt, weak productivity, and political inertia. With 2026 elections looming, genuine reform seems unlikely, though Argentina’s bold turnaround could pressure Brasília to rethink its…

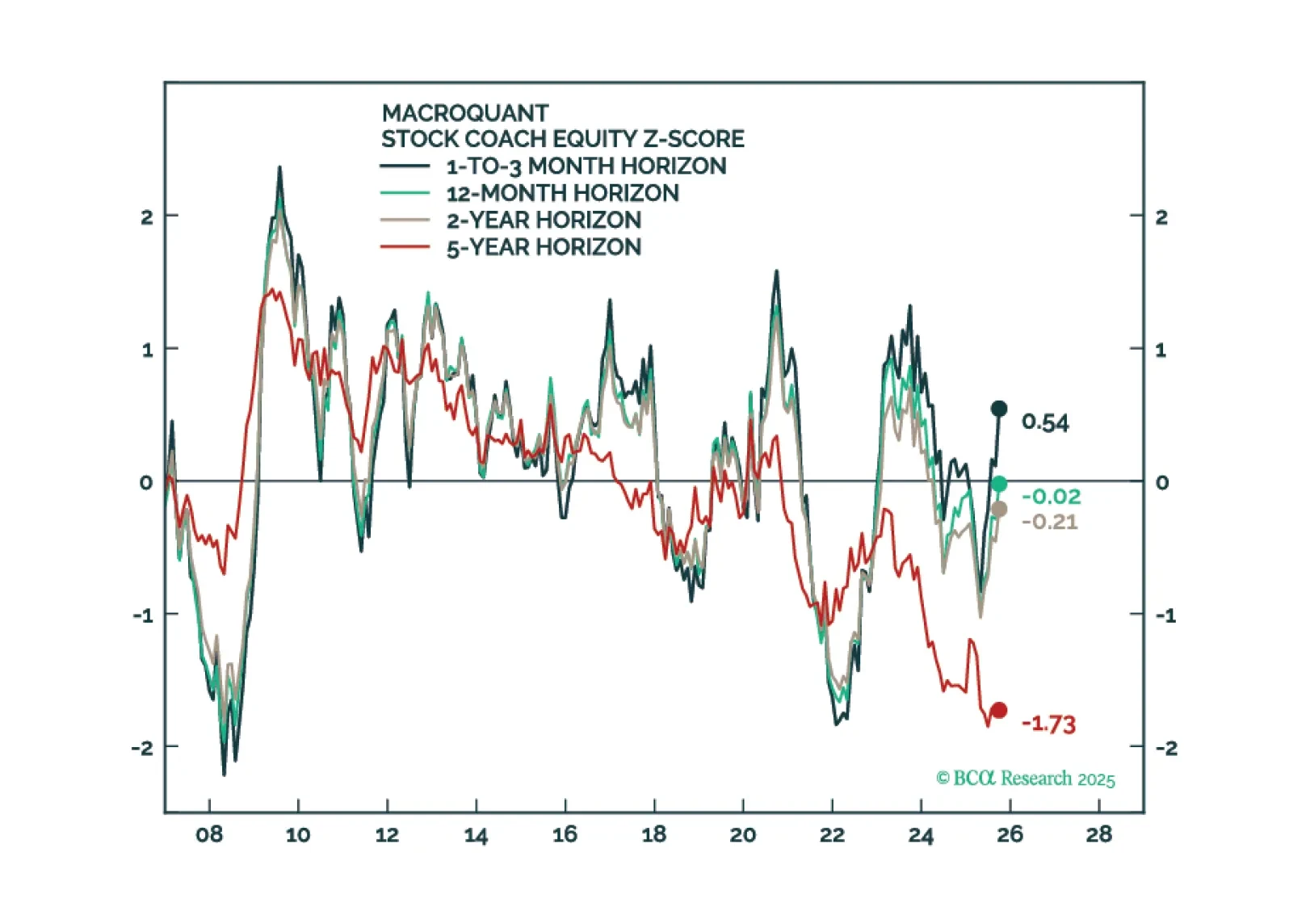

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

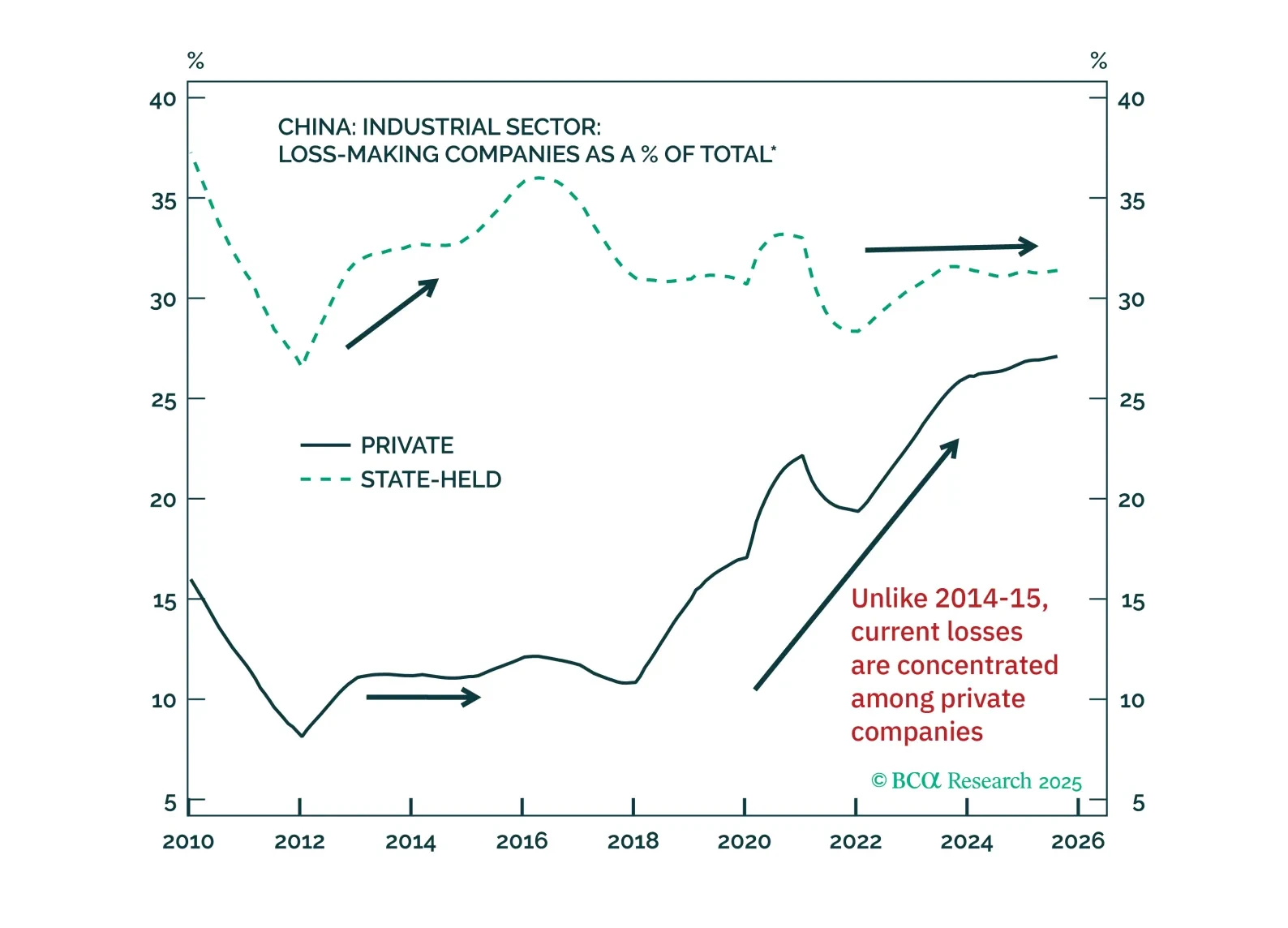

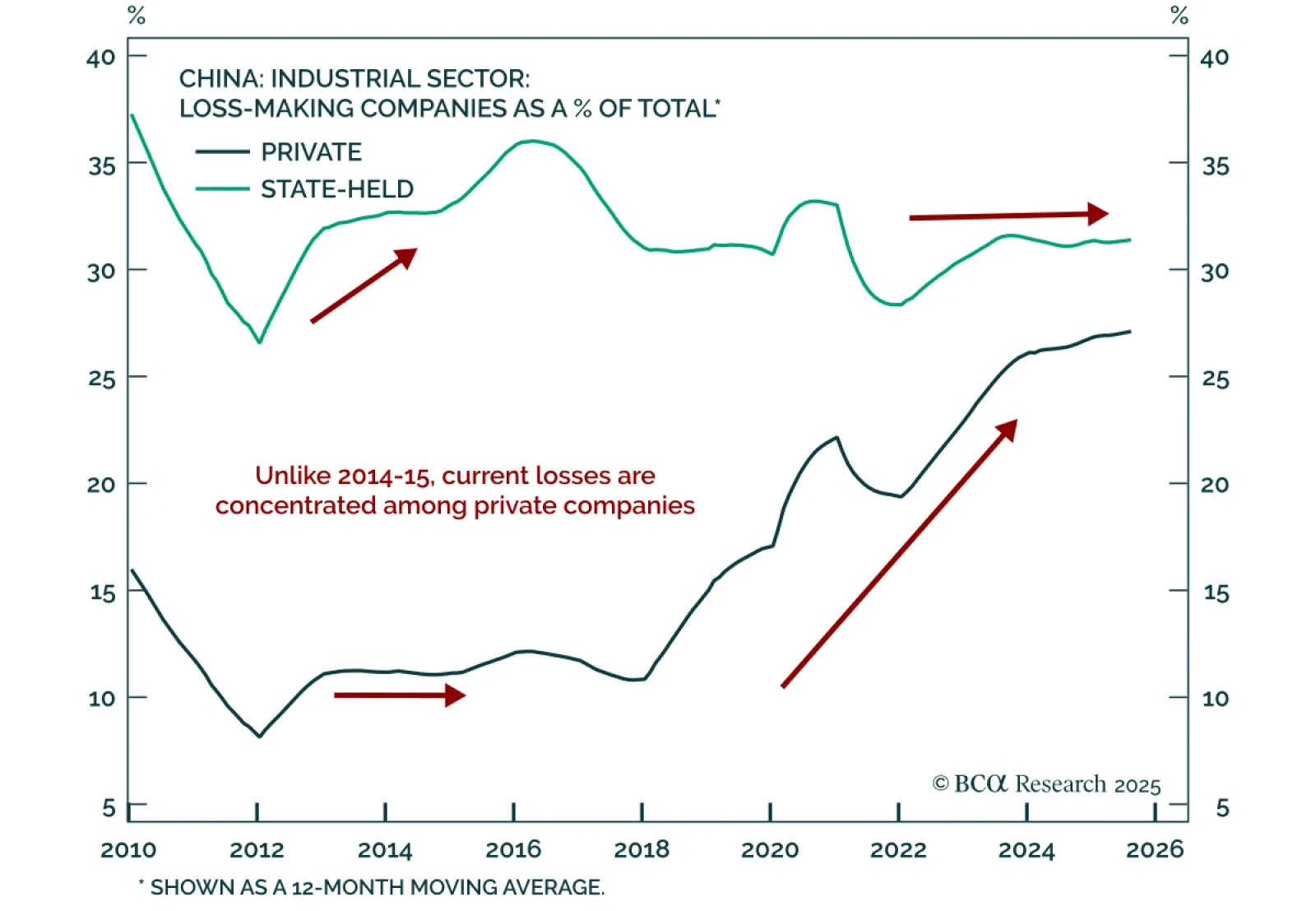

Our Emerging Markets strategists advise against chasing the rally in Chinese equities, as anti-involution policies are unlikely to end deflation or support a sustainable earnings recovery. The rally has been partially based on the…

In global markets, speculative forces have intertwined with the sound fundamentals of specific equity segments, perplexing investors. This report aims to distinguish between excessive price run-ups and healthy fundamentals…