Emerging Markets

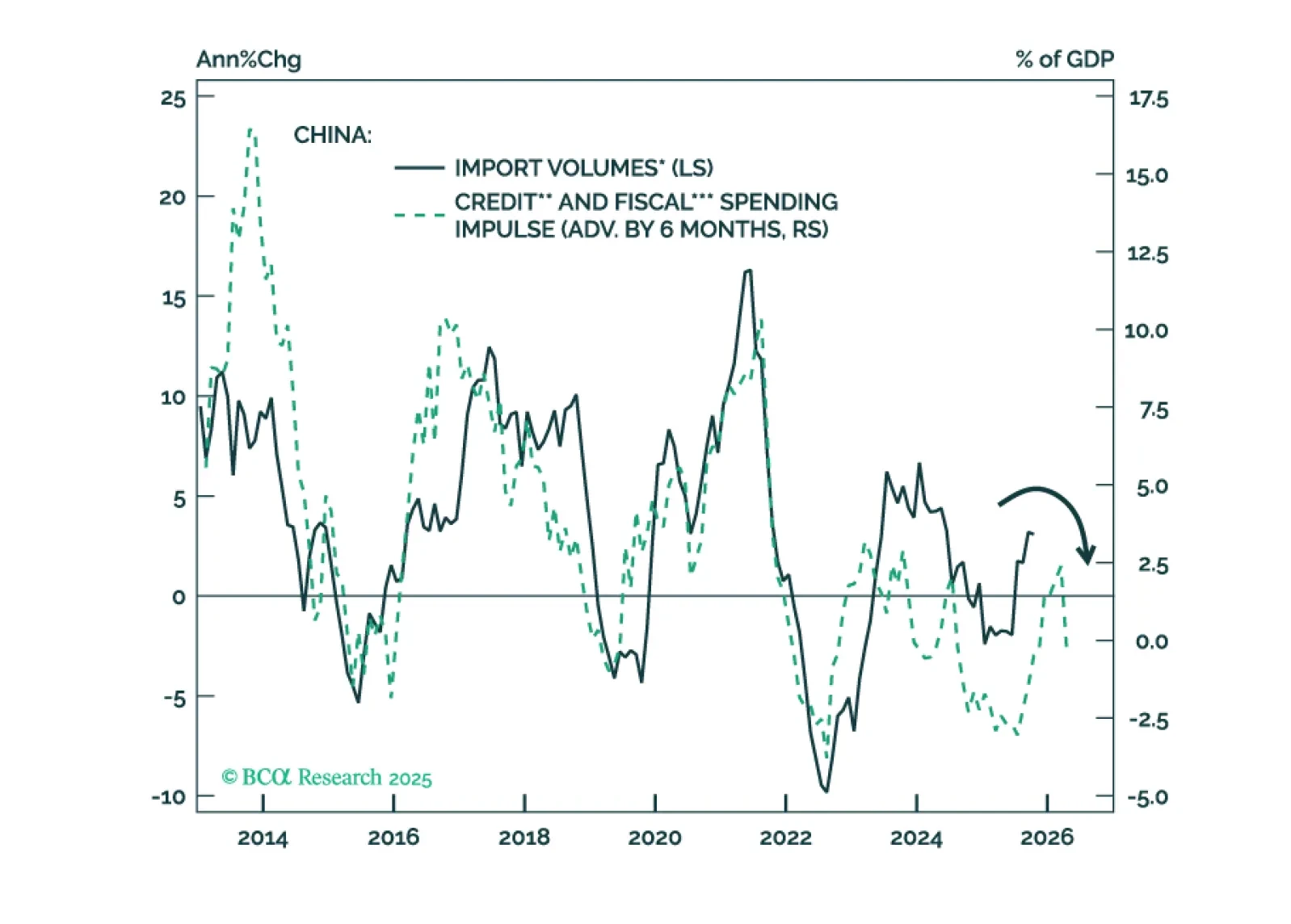

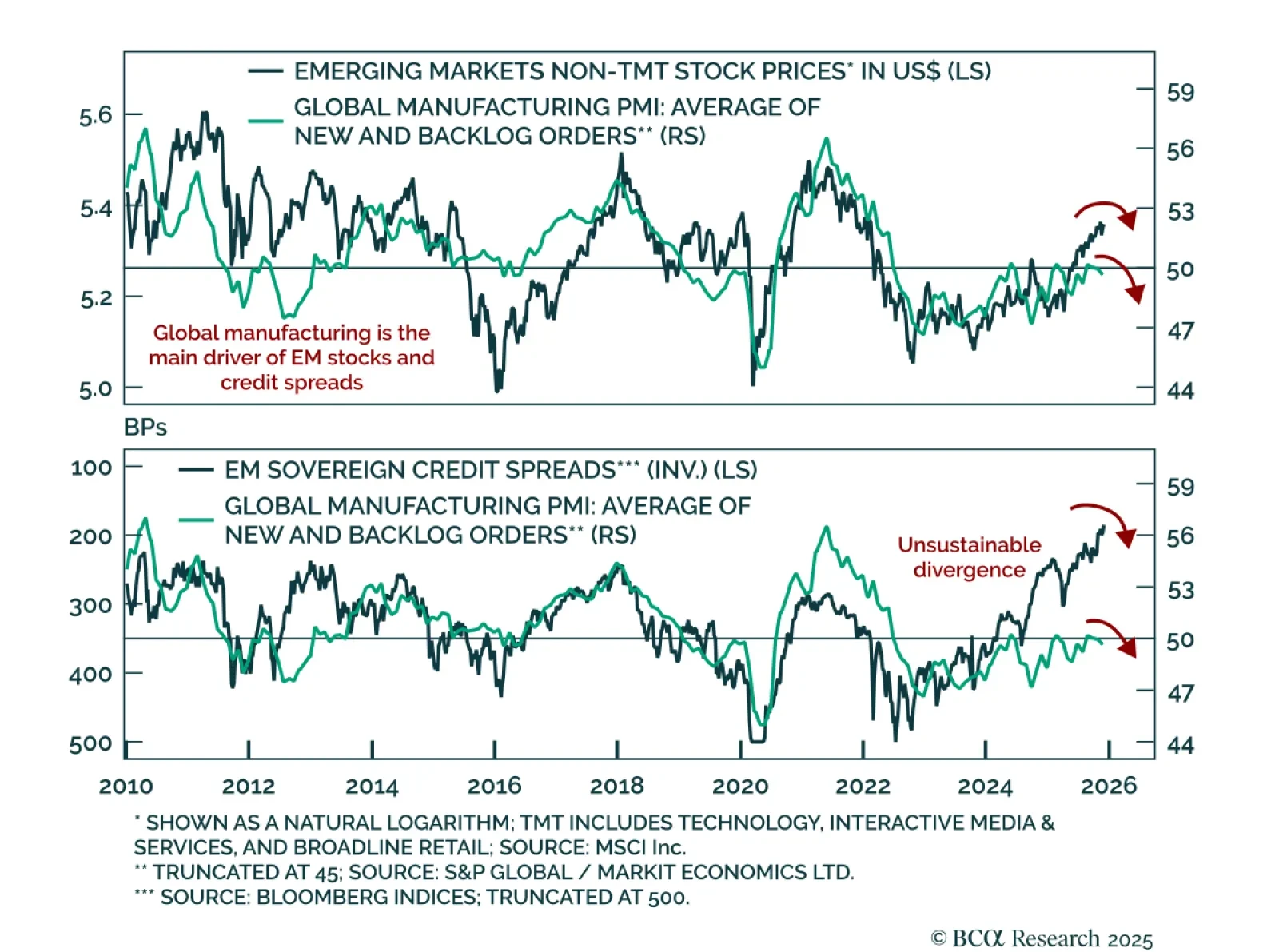

Risk assets in EM/China and cyclical commodities will sell off in H1 2026. A shift toward aggressive policy stimulus in China and a clear improvement in global manufacturing are needed to produce durable rallies in EM/China risk assets and the prices of energy and industrial metals.

Our Portfolio Allocation Summary for December 2025.

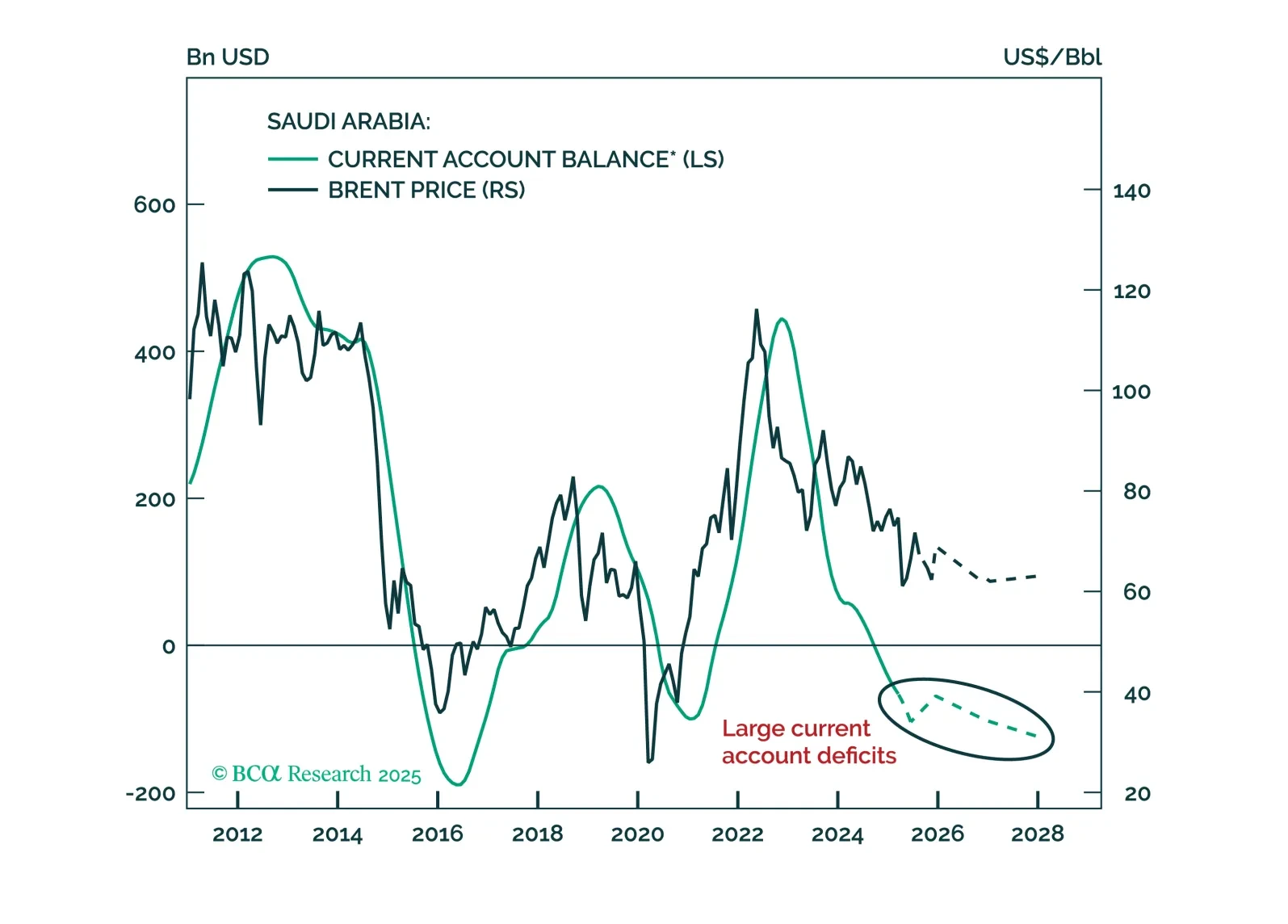

The Kingdom faces a troika of global factors in the next 12-18 months: (1) US policy rates will be cut considerably; (2) the US dollar will depreciate significantly; and (3) crude prices will remain low.

How should investors position themselves in this market?

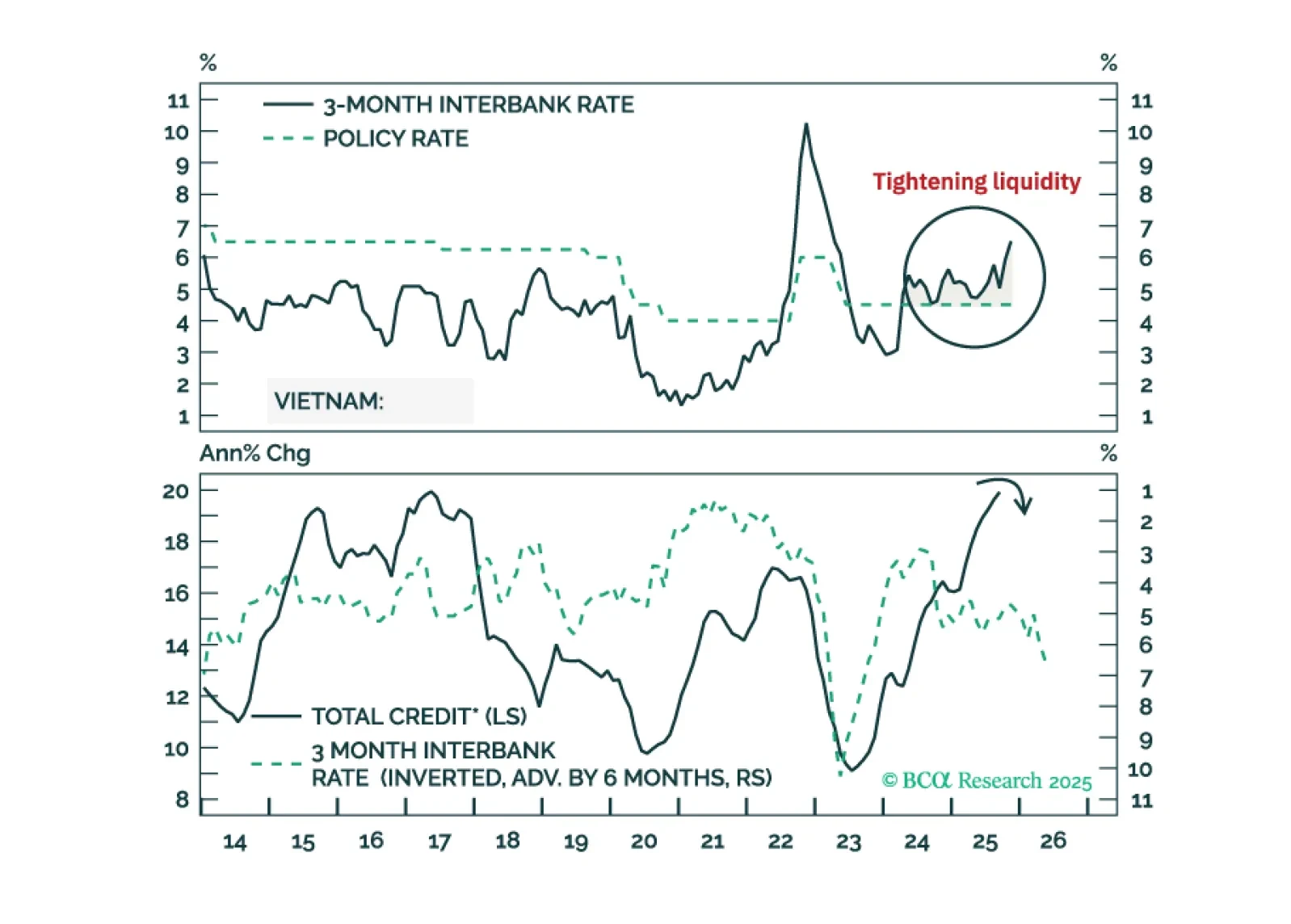

We remain bullish on the alpha-generating potential of Vietnamese stocks over the medium and long term. But our negative outlook on global/EM beta makes us bearish on this bourse in absolute terms over the medium term.

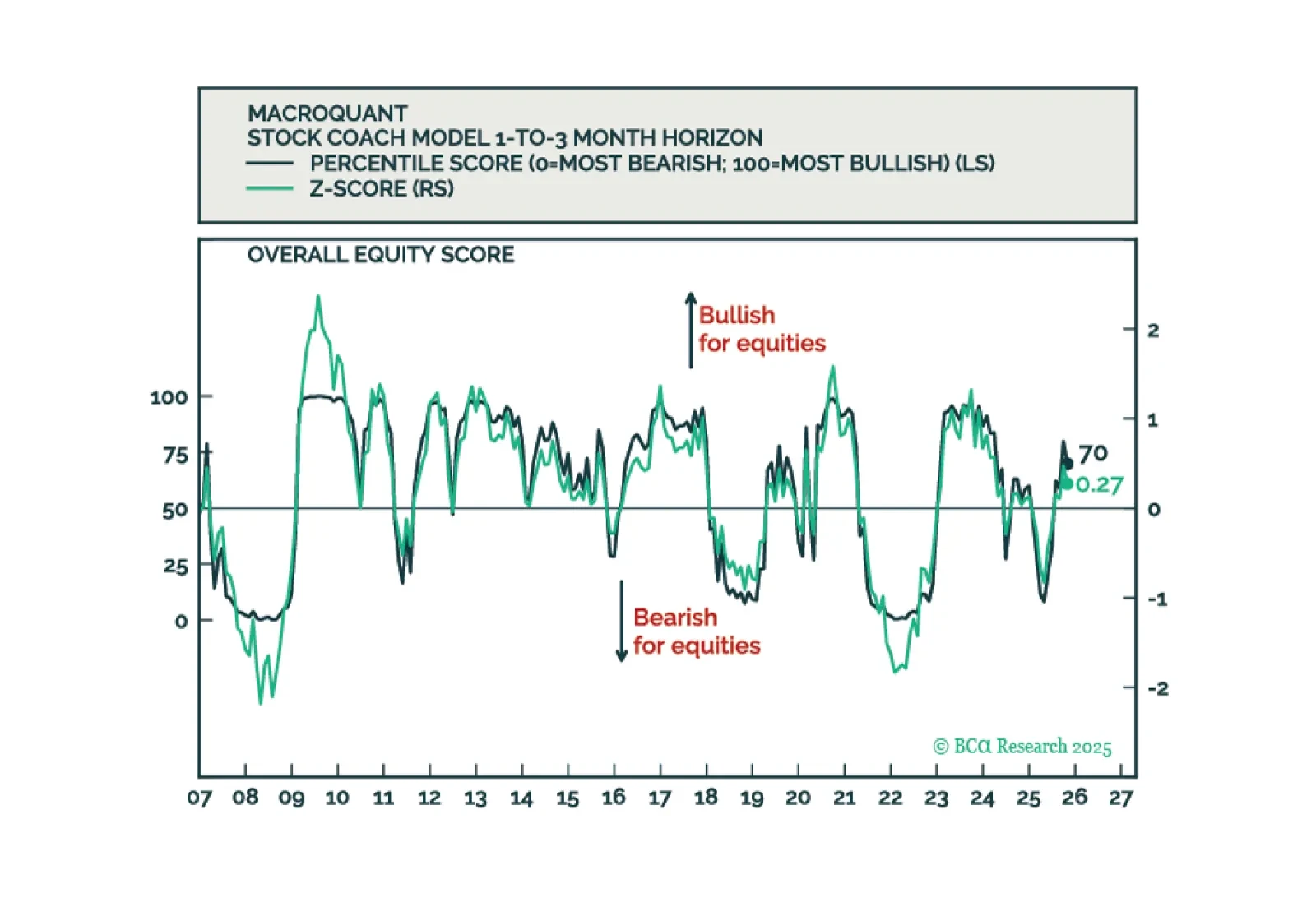

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

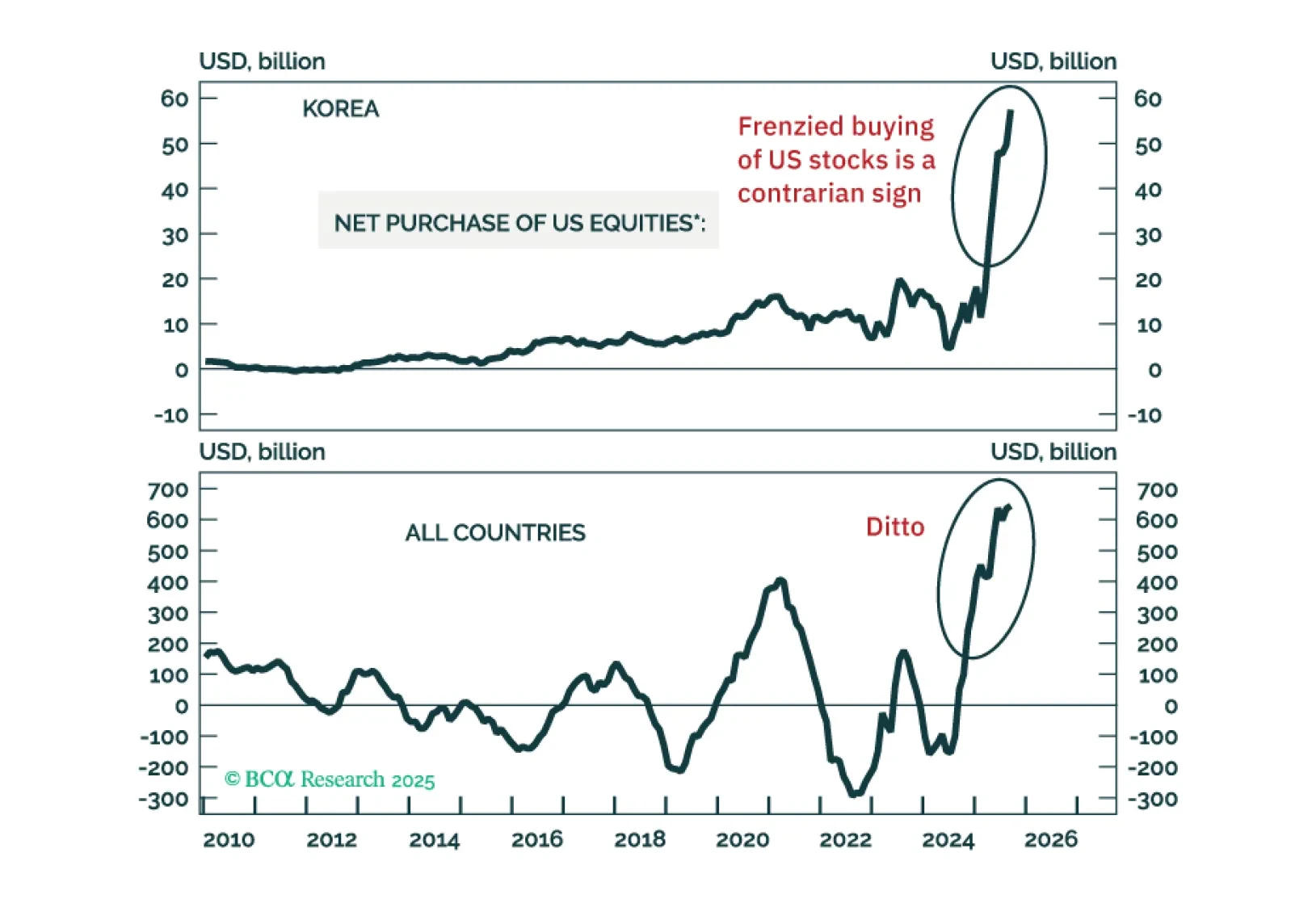

Many key equity indexes have failed to break above major resistance levels, while risky segments have begun to crack. Altogether, this suggests that a major peak in risk assets has probably been made. Short the MSCI EM stock index with a stop loss at 1470.

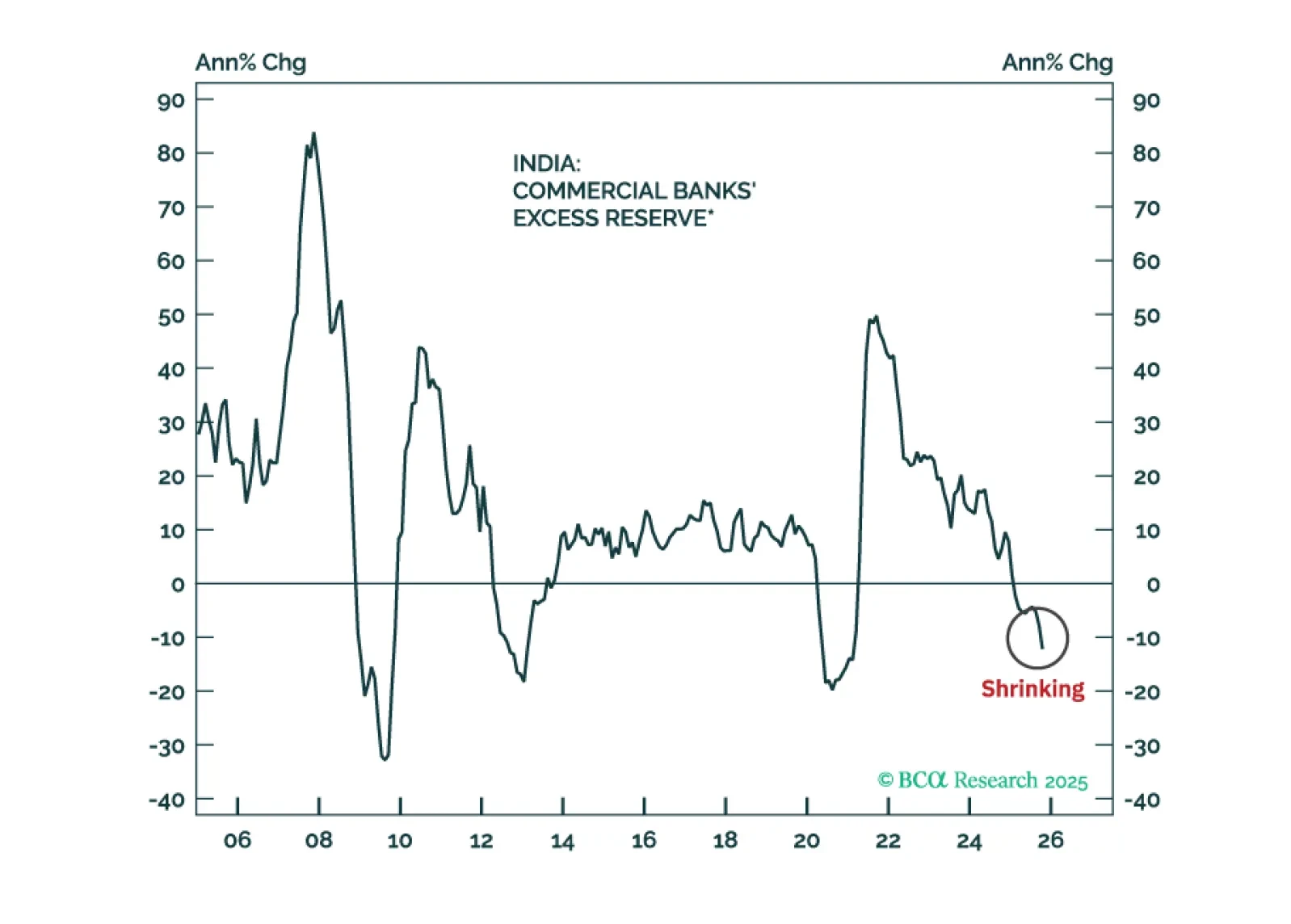

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

We recommend a new relative tech equity trade that will likely produce positive returns over the next six to 12 months, regardless of whether the AI hype continues or reverses.

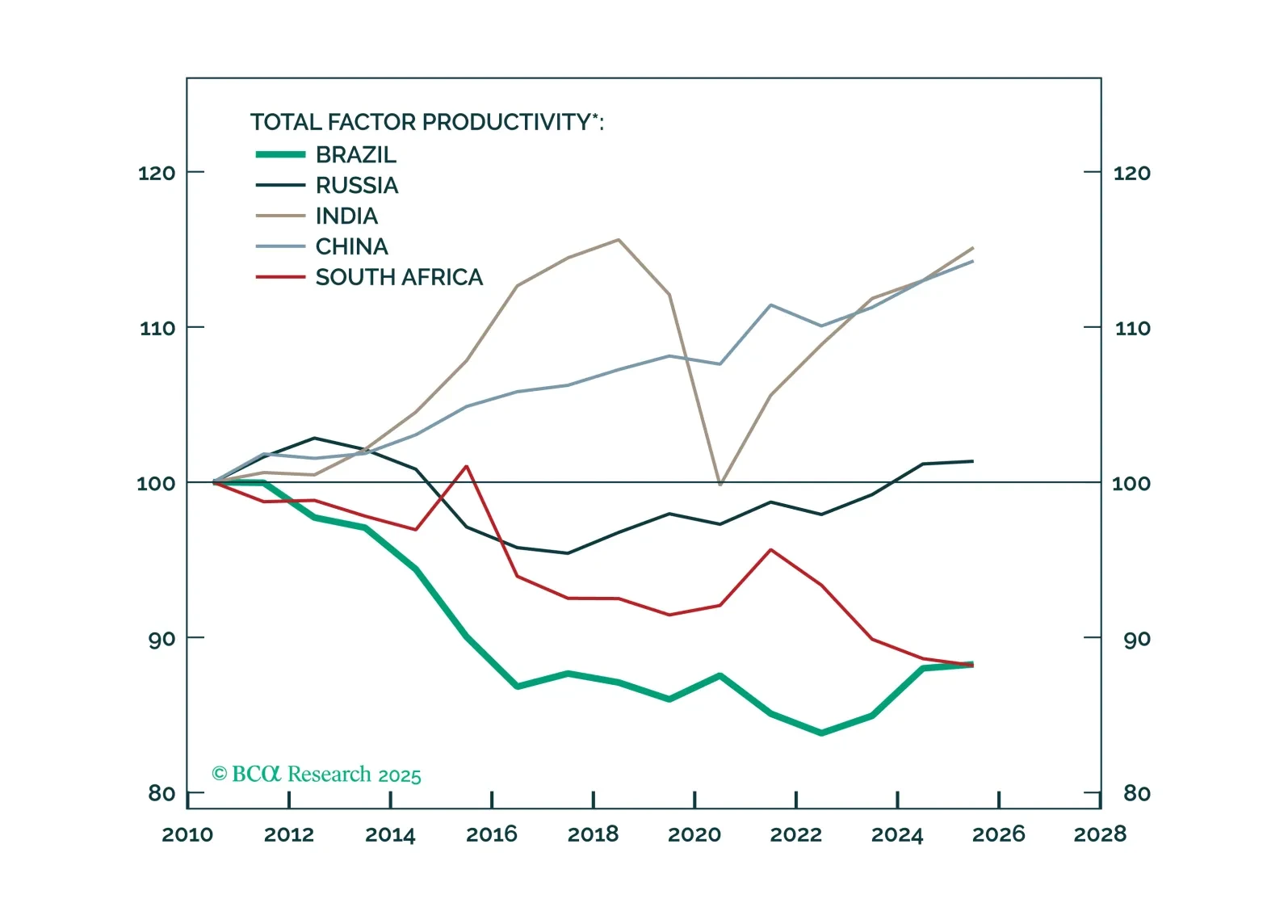

Brazil’s bleak macro outlook persists – rising debt, weak productivity, and political inertia. With 2026 elections looming, genuine reform seems unlikely, though Argentina’s bold turnaround could pressure Brasília to rethink its cycle of governability over growth.